Debt Levels Under Control

2016-09-22ChinamountingdebtwonleadtocrisisbutcorporatedebtneedsaddressingByJiJing

China's mounting debt won't lead to a crisis, but corporate debt needs addressing By Ji Jing

Debt Levels Under Control

China's mounting debt won't lead to a crisis, but corporate debt needs addressing By Ji Jing

Rising debt levels are prompting concerns over a possible debt crisis, with some believing it will pose risks to the global economy. How serious is China's debt issue?

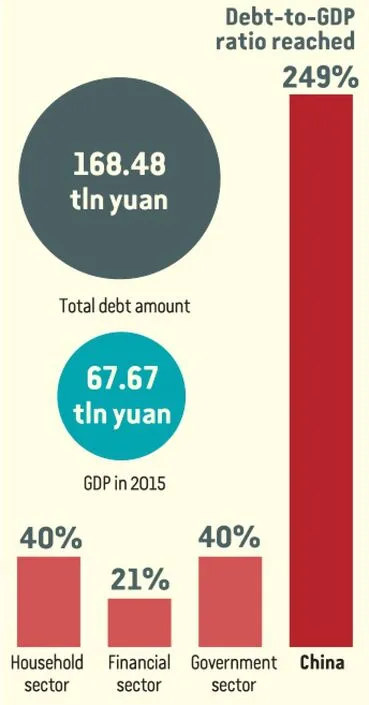

By the end of 2015, China's total debt had amounted to 168.48 trillion yuan($25.3 trillion). The debt-to-GDP ratio had reached 249 percent, Li Yang, an academician at the Chinese Academy of Social Sciences and Chairman of the National Institution for Finance and Development,revealed at a press conference on June 15.

The debt-to-GDP ratios of China's household, fnancial and government sectors had reached 40, 21 and 40 percent, respectively,by the end of last year, according to Li. “Such debt levels are not high globally, and they are controllable,” he said.

More specifically, the government debt level of 40 percent was lower than the upper sustainable debt limit of 60 percent set out by the EU's Maastricht Treaty as well as the debt levels of many major market economies and developing countries.

In contrast, Japan's government debt-to-GDP ratio exceeds 200 percent; the United States and France have government debt of over 120 percent, while government debt in Germany and Brazil hovers around 80 and 100 percent, respectively.

As for local government debt, which has triggered widespread anxiety, Li said that a local government's ability to repay its debt depends on its debt-to-GDP ratio, with a ratio below 100 percent indicating the ability to cover the debt. Since local government debt stood at 89.2 percent last year, the current debt level is manageable.

An urban rail transit project under construction in Kunming, southwest China's Yunnan Province, on April 18

Crisis unlikely

Though, the debt issues of Chinese enterprises deserve increased attention. “China's non-fnancial corporate sector has the most prominent debt problems, with a debt ratio of 131 percentby the end of last year, with state-owned enterprises (SOEs) accounting for a large proportion of the debt,” explained Li.

Sun Xuegong, Deputy Director of the Fiscal and Financial Department of the National Development and Reform Commission (NDRC), explained that Chinese enterprises' high debt levels are caused by their financing structure. As China's capital market is underdeveloped, domestic enterprises primarily rely on indirect financing,such as bank loans for funding, rather than on direct fnancing through stock markets.

The high leverage rate of enterprises will increase debt default risks, in turn increasing the quantity of non-performing bank loans. However, given the sound fnancial situation of China's commercial banks, the debt default risks of enterprises are unlikely to affect the stability of the country's banking sector.

Li said China has adequate assets to cushion the impact of debt risks, therefore the possibility of a debt crisis occurring is slim. China's sovereign assets amounted to 227.3 trillion yuan ($34 trillion), sovereign debts stood at 124 trillion yuan ($18.6 trillion), and the net asset value was 103.3 trillion yuan ($15.5 trillion)in 2014.

Meanwhile, China's high savings rate has provided a solid foundation for debt sustainability. “Debt problems in European countries could easily lead to social unrest because they have little, or even no savings;for instance, the savings rate of Greece is negative,” Li noted.

However, China has a savings rate of around 50 percent. Every year, an amount similar to this is transformed into corporate investment through bank loans. Thus, the signifcant majority of China's debt occurs within its own territory and can be solved domestically and independently, while foreign debt accounts for a mere 3 percent of the total debt.

In addition, China's government debt is used for investment. In proportion to the huge debt, China's local governments possess a large amount of premium assets which have future debt repayment guarantees and greatly reduce the possibility of a debt crisis,” said Li.

Deleveraging efforts

Although China's debt risks are mostly under control at present, there is a possibility they will continue to accumulate and expand. If left unrestrained, the debt increase will harm the economy, according to Sun.

The Central Government has attached tremendous importance to the problem and put forward the task of deleveraging at the end of last year. Deleveraging is the reduction of the debt ratio in the economy at the macro-level or the reduction within an economic sector, such as the corporate sector, at the micro-level.

Sun suggested that in order to deleverage,the government should remain committed to stable economic growth in order to prevent this falling out of the reasonable range. Without a stable macroeconomic situation, the financial performances of enterprises will deteriorate and the leverage rate will rise.

The key to deleveraging is to step up supply-side structural reform. Such measures include reforming SOEs, mergers and acquisitions, closing “zombie enterprises,” cutting overcapacity, and reducing costs and taxes to improve the proftability of enterprises and their ability to cover debts.

Likewise, capital market reform should be accelerated in order to establish a multi-layered capital market and increase the proportion of direct fnancing for enterprises. Since corporate debt is much higher than that of government and households, transferring this to the other two sectors is regarded as an effective way of deleveraging by experts.

Wang Shengbang, Deputy Director of the Prudential Regulation Bureau of the China Banking Regulatory Commission, cited the example of the United States to illustrate this point. Since the 2008 global fnancial crisis, the United States has not reduced its overall leverage rate, but has only transferred the fnancial and household debt to the government.

Wang explained that through mixed ownership reform among SOEs, those enterprises could issue shares to individuals,thereby transferring corporate debt to the household sector.

The Central Government is also mulling over using debt-for-equity swaps to deleverage. Sun said the upcoming round of swaps should follow market rules and be carried out in accordance with the law. Also, “zombie companies”and companies with bad credit records will be excluded from the process.

Risk prevention

Wang believes that local governments still have maneuver room in regard to their debt levels. China's budget deficit increased from 2.4 percent in 2015 to 3 percent this year. However,the government should observe the law when incurring debts. According to the revised Budget Law enacted on January 1 last year, local governments can only accumulate debt by issuing bonds.

To prevent local government debt from spiraling out of control, the Ministry of Finance(MOF) capped local debt at a maximum of 16 trillion yuan ($2.4 trillion) last year. This was approved by the National People's Congress,China's top legislature.

Existing local government debt is being transferred into bonds. “This is in line with the new Budget Law, which prescribes that bond issuance is the only legitimate form of local government debt. The transfer has also reduced the risks of local debt,” said Wang Kebing, Deputy Director of the MOF's Budget Department.

Moreover, risk prevention mechanisms have been introduced by governments in 31 provinces, municipalities and autonomous regions to cope with the potential risks of local debt, according to Wang Kebing.

As for industries plagued with overcapacity such as the coal and steel sectors, which are grievously affected by the downward trend, economic restructuring and transformation is vital to solving their debt problems. For instance, the NDRC has recently unveiled plans to transform heavy industrial bases in northeast China to make former industrial cities in the region less reliant on heavy industries. ■

China's Debt Ratios(By the end of 2015)

Copyedited by Dominic James Madar

Comments to jijing@bjreview.com