AIIB: Integrating New and Old Orders

2016-09-22ZhangJingwei

OPINION

AIIB: Integrating New and Old Orders

The headquarters of the Asian Infrastructure Investment Bank in Beijing

In the wake of Brexit, global stock and exchange markets have been on tenterhooks. However, negative effects are not likely to expand, and economic globalization will not be disrupted or reversed.

At a session held during the World Economic Forum's Annual Meeting of the New Champions 2016, Jin Liqun, President of the Asian Infrastructure Investment Bank (AIIB), suggested that the AIIB should expand, as 20 more countries are set to join during the second half of this year, bringing the total to roughly 90 members.

There are differing views on the AIIB across the world. Some countries believe that it's a challenger to the old order, and the United States and Japan initially rejected it before adopting a wait-and-see attitude. Some others deem it a useful supplement to the global economic order.

The expansion of the AIIB is testimony to its unique role in global economic governance. In the era following the 2008 global fnancial crisis,the mechanism is necessary and has managed to play a role distinct from those of the World Bank and the Asian Development Bank.

In an age when almost all major economies are obsessed with loosening and tightening monetary policy and are pinning hopes on currency wars and trade protectionism, panic and anxiety arising from isolationism will cause more danger to global markets, as proven by Brexit.

Countries of the world need to closely cooperate with each other, and economic integration is the recipe to break the new pattern of mediocrity. When the old globalization and management mechanisms fail to work,the AIIB can immediately provide new, efficient solutions.

The expansion of AIIB mirrors the appeal for global economic integration and a new world balance. Moreover, the governing institutions of the AIIB take on the integration of the old and new orders. On the one hand, the AIIB has not only drawn on the experience of the World Bank and the Asian Development Bank, but has also outstripped the two in the effciency of its decision making. On the other hand, it has Chinese characteristics and reflects the demand in emerging markets.

It's unnecessary to avoid mentioning the leading role China has played in its establishment. Without that, the AIIB wouldn't have been founded. AIIB is closely linked with the China-proposed Belt and Road Initiative, and the country is the bank's largest funder. Beyond that, exporting production capacity and capital is in line with its ongoing supply-side reform.

In the post-crisis era, emerging markets urgently need to improve infrastructure construction, which will lay the foundation for another round of stable growth. This can't be realized without sufficient capital. This is more vital when energy and resource prices are foundering at low levels, with countries in central and west Asia needing to get rid of their dependence on energy and resource exports by undergoing industrial structural reform.

Even for the developed world, left crippled by the fnancial crisis, the demand for restructuring is evident. From the United States to Europe, developed countries hope to reinvigorate their manufacturing industry and jostle for a leading role in Industry 4.0. Therefore, in their eyes, a capital and industrial transformation is also of prime signifcance.

The AIIB and the Belt and Road Initiative are constructive for both China and the entire world, and the two are interwoven. In such a context, economies in Asia and Europe will strengthen cooperative relations and seek mutual benefits in economy and trade, free from political entanglements and geopolitical alignment. In fact, many member states of the AIIB are located along the routes of the Belt and Road.

The AIIB has approved the first batch of loan projects, which encompass energy, transport and urban development in Bangladesh,Indonesia, Pakistan and Tajikistan, with a total volume reaching $509 million. Of them,three are co-funded by the World Bank, Asian Development Bank and the European Bank for Reconstruction and Development. The AIIB's loan projects are consistent with production capacity projects of the Belt and Road Initiative. In addition, the AIIB is not an isolated mechanism but maintains coordinated links with other global governance institutions.

Joining the AIIB is lucrative. For developing countries in need of capital and production capacity projects, the inflow of these amidst market turbulence can improve economic foundations and even spur development in leaps and bounds. Around the globe, especially across Asia and Europe, industrial upgrading and economic development do not just enhance the economy, but also can help solve contradictions in other spheres.

The expansion of the AIIB and implementation of the Belt and Road Initiative can catalyze the building of a new type of economic and trade partnership, which chimes with the requirements of the post-crisis era. ■

This is an edited excerpt of an article written by Zhang Jingwei, a guest researcher at the Chongyang Institute for Financial Studies at Renmin University of China, and published in National Business Daily Copyedited by Dominic James Madar Comments to yushujun@bjreview.com

NUMBERS

($1=6.6 yuan)

$1.36 tln

The value of China's outstanding foreign debt by the end of March

86.4 tln yuan

The total value of goods carried by logistics companies in the frst fve months, up 6.1 percent year on year

$42 mln

Money earned by Viet Nam from exporting litchi to China up to the end of June

7.8%

Year-on-year growth of China's lottery sales in May

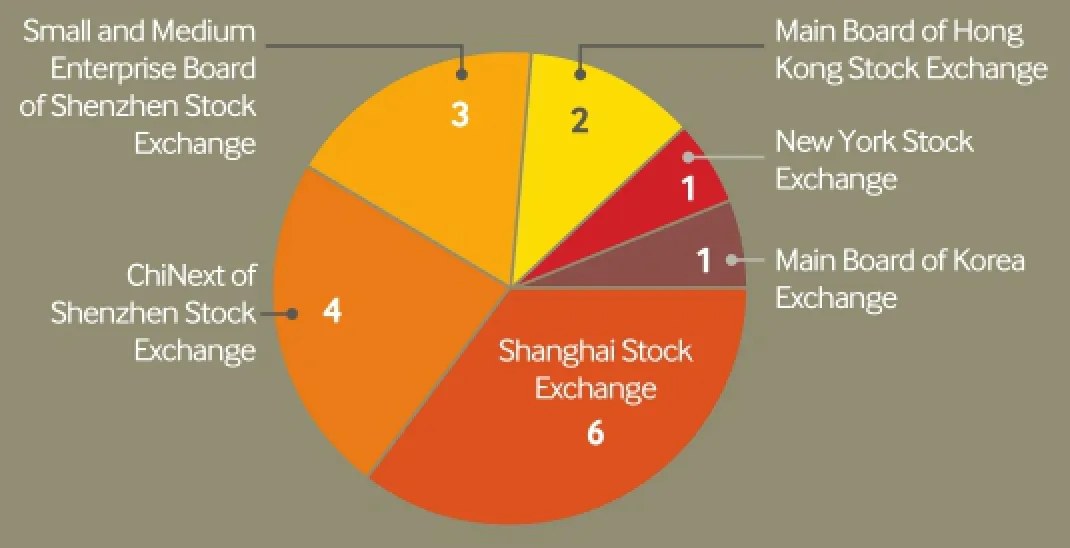

Chinese Companies' IPOs by Market Jun

Financing Amount of Chinese Companies' IPOs by Market Jun (Total: $2.39 bln)

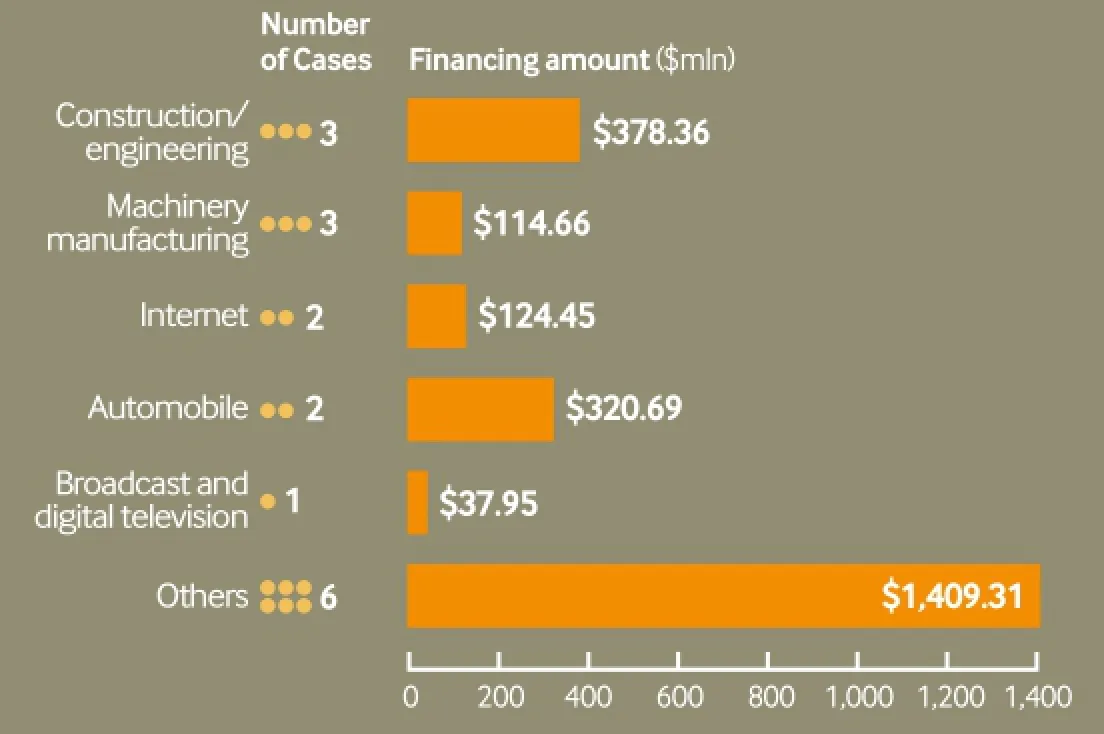

Chinese Companies' IPOs by Industry Jun

318.28 tons

Gold consumed in China in the frst quarter,a year-on-year decrease of 3.91 percent

340 mln yuan

Money paid by Chinese HeSteel to acquire the steel mill in the Serbian city of Smederevo on June 30

31

The number of private equity or venture capital investments in the renewable energy and clean technology industry in China in the frst quarter, a year-on-year increase of 106.7 percent

$1.5 bln

The value of a fve-year loan that the Industrial and Commercial Bank of China agreed to provide to Saudi Electricity Co.