China,Strong Advocate of Global Economic Governance Reforms

2015-07-09ByLIGANG

By+LI+GANG

AS globalization deepens, inter-state interconnections and interdependence draw closer together. No single country can prosper in isolation. There is consequently global consensus on the need to enhance cooperation on global economic governance, and to deal with the problems of insufficient representation of developing countries, imbalanced governing organizations, and low efficiency.

Humankind must now address the critical issues that affect everyone. They include the financial crisis and reconfiguration of the international trade system, climate change and the crucial call for environmental protection, public health and energy/resource security, food safety, anti-terrorism, and trafficking in humans and drugs. Their resolution is beyond the capacity of any single country.

Existing Problems in Global Economic Governance

A major flaw in the current global economic governance structure is that of under representation of developing countries in international economic organizations such as the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD). The current global governance structure and relevant rules were designed predominantly by developed countries over the past half century. They do not fit the new situation apparent in the strong growth of developing countries and emerging economies.

The effective resolution of many major global issues is impossible without such countries involvement. IMF data show that the U.S., whose GDP accounts for 16.45 percent – according to the 2013 world total — has 16.75 percent of voting rights in the IMF and 15.13 percent of voting rights in the IBRD. Similarly, other developed countries have voting powers in major international economic organizations proportionate to their economic aggregate.

The situation is different for the developing world. For instance, China, with a GDP representing 15.84 percent of the world total in 2013, has a mere 3.81 percent of voting rights in the IMF, less than Japan, Germany, France, and the U.K., whose economic aggregate is behind Chinas. The same is true for India and Brazil (see Chart 1).

What is more, the IMF focuses its macro-economic monitoring on developing countries, and takes little account of their developed peers. Global economic governance with the West at the helm advocates the Washington Consensus which, based on neoliberalism theories, underscores free economy and marketization, and globalization of trade, invest-ment, and finance. The latest financial crisis exposes defects in the current international financial system and inadequacies in global economic governance.endprint

There are multiple international currencies in todays global economy that function internationally, but an irrational structure allows the U.S. dollar to dominate and so weaken other currencies (see Graph 1). This imbalance has negative impact on the world economy.

In response to the 2008 financial crisis, the U.S., in its own interest, unilaterally rolled out the quantitative easing (QE) policy to stimulate its domestic economy, and withdrew from it in the wake of its economic recovery. The turbulence in the financial market caused by the Federal Reserves introduction of and exit from QE highlighted the internal flaws of current global monetary governance.

To address this problem we have two options: one is to adopt a single currency worldwide; the other is to give non-U.S. dollar currencies more clout and greater say. But it will take considerable time to achieve either. A more realistic approach would be to set up a binding mechanism within the current governance structure that upgrades IMF independence and its supervision of global monetary and financial affairs, meanwhile increasing the proportion of voting rights of developing countries in the organization.

Existing global economic governance organizations such as the IMF, WTO, and IBRD are all hampered by redundant procedures and low efficiency. This results in agonizing delays in efforts to find solutions to pressing issues. By the time one appears, the situation has often changed. The stalled Doha round of world trade talks, the sudden outbreak and swift spread of the financial crisis, the lack of consensus on capital supervision, resurgence of trade protectionism, and the flooding of international liquidity under excessive QE… all highlight the need to reform the global economic governance system amid challenges from a new international environment and the lingering financial crisis.

The global crisis triggered by the U.S. subprime lending crisis alerted us to the fact that ethical risk in the capital market is now a global issue. The absence of international coordination among financial organizations means that latent capital market risks can easily spill over into the real economy and onward to the world economy, causing big problems. Better international coordination calls also for reconfiguration and reforms to the global economic governance system.

Chinas Proposals for and Contributions to Global Economic Governance Reformsendprint

China is a strong advocate of global economic governance reforms. It advances the G20 institutionalization process with the goal of building the group into a leading platform for global eco- nomic governance. So far the recovery of the world economy is still halting, and performances by world leading economies vary, making coordination of macro-economic policies even more difficult. The G20 is now at the critical stage of transiting from a crisis response mechanism to a long-term management mechanism. This demands breakthroughs in institution and capacity building.

A founding member of the group, China spearheads the construction of global governance centered on the G20, having raised around 15 percent of the approximately 1,000 reform proposals from all member states. At the Brisbane Summit, Chinese President Xi Jinping urged the G20 to focus its future endeavors on three missions – innovating growth patterns, building an open world economy, and improving global economic governance.

To break the U.S. dollar monopoly, China also advocates reforms to international financial organizations and reserve currency diversification, and establishment of an international monetary system conducive to healthy development of the world economy.

Over past years, internationalization of the Chinese currency, the Renminbi, has forged full steam ahead. The RMB Internationalization Index, created by Renmin University of China, rose to 1.96 percent in the second quarter of 2014, compared with 0.92 percent in early 2013. A 2014 HSBC survey shows that as many as 58 percent of HK firms use RMB in their cross-border businesses, so leading other offshore RMB markets. This figure is 38 percent for Taiwan companies, 26 percent in France, and 23 percent in Germany. As it is more globally used, the RMB functions as both a settlement and investment currency, and as a reserve currency.

The HSBC survey found that 32 percent of companies interviewed had launched RMB capital management, and used letters of credit in RMB and RMB financing services. Of them, 19 percent were expanding inter-company crossborder RMB lending operations. But the fact is that internationalization of the Chinese currency is still at the nascent stage, and global transactions are largely confined to its offshore markets.

China is also a staunch supporter of free trade, and opposes any form of trade protectionism. While adamantly advancing reforms to the international trade system, China is exploring new paths for regional economic cooperation.endprint

Since its accession to the WTO in 2001, China has conscientiously performed its duty as a member, making notable efforts as regards tariff cuts and exemptions, open markets, and legislative improvement. Since the Doha round slid into a stalemate, China has pushed forward and participated in regional economic cooperation. Building free trade areas (FTA) is regarded as a critical route to this end.

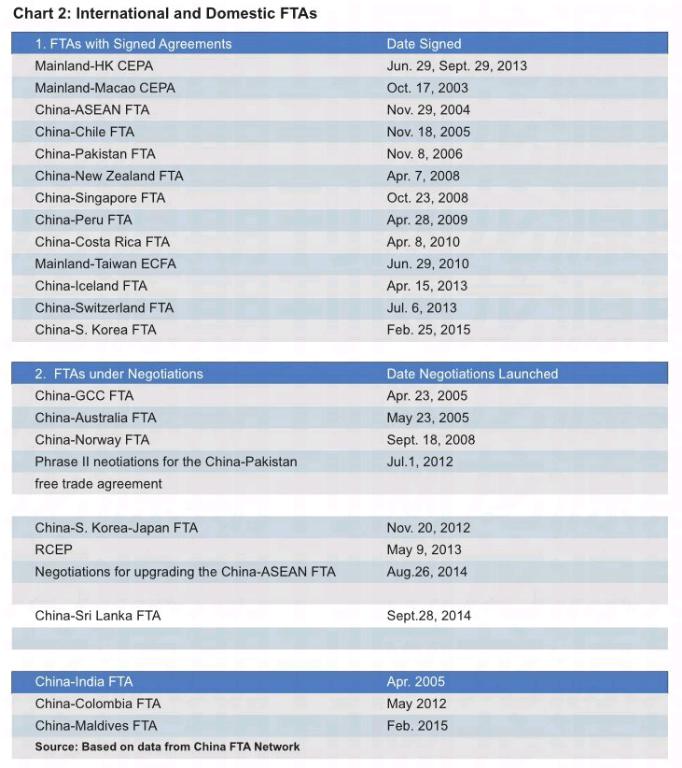

So far China has signed 13 free trade agreements that involve 20 countries and regions. Of them, three are domestic FTAs – the Closer Economic Partnership Arrangement (CEPA) between Chinas mainland and Hong Kong and between Chinas mainland and Macao, and the Economic Cooperation Framework Agreement (ECFA) between Chinas mainland and Taiwan. Five are with other developing countries — Pakistan, Chile, Peru, Costa Rica, and South Korea, and another four with developed countries — New Zealand, Singapore, Iceland, and Switzerland. That with ASEAN is by far the only multilateral free trade pact China has accomplished. All but one (with South Korea) of the 13 free trade agreements already sealed have been enacted.

China is also amid negotiations for eight more free trade deals — respectively with South Korea, the Gulf Cooperation Council, Australia, Norway, and Sri Lanka, for the Regional Comprehensive Economic Partnership (RCEP), phrase II negotiations for the ChinaPakistan free trade agreement, and negotiations for upgrading the ChinaASEAN FTA.

In addition, China completed in 2007 the joint feasibility study of a Regional Trading Arrangement (RTA) with India, and started feasibility research on FTAs with Colombia in 2012 and Sri Lanka in 2013 (See Chart 2). These efforts have significantly boosted trade and two-way investment between China and its trade partners, contributed to mutual-benefit and win-win economic cooperation, and fueled economic cooperation and integration in East Asia.

China is also working to advance regional economic cooperation to the largest extent possible through multilateral cooperative platforms. Thanks to its efforts the 22nd APEC Economic Leaders Meeting, convened last November in Beijing, agreed to launch the Free Trade Area of the Asia Pacific (FTAAP) process, and endorsed a roadmap for it. This marked a groundbreaking step towards creating an open Asia-Pacific economic pattern.

China has proposed the Belt and Road Initiatives, which are expected to stimulate international economic growth and regional economic cooperation, and have far-reaching impact on global economic governance patterns.endprint