Making It Simple

2015-05-21ByJiJing

By+Ji+Jing

Robert Parkinson, founder and CEO of RMG Selection, a China-focused international recruitment and human resources consultancy company, recently applied for an ICP (Internet content provider) license for his company and it took him less than a month. When he carried out the same process for another website five or six years ago, the whole process took more than two months, Parkinson recalled.

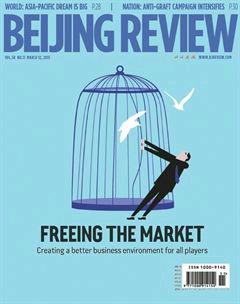

The Chinese Governments drive to streamline administration and delegate power to lower levels has made it much more convenient for foreign companies to do business in China.

“Things have become a little bit easier. The reform has encouraged smaller and medium- sized companies to enter the market because it becomes quicker to establish an enterprise within China,” Parkinson said.

Simplified procedures

Jens-Peter Otto who had worked in China for six years as a PricewaterhouseCoopers partner, providing consultancy for German companies setting up branches in China, also welcomed the simplified administrative procedures. He was especially impressed with the abolishment of the capital verification report.

In the past, all companies, including foreigninvested entities in China, needed such reports verifying their paid-in capital upon initial establishment of a company or when there was a change in capital or shareholders. Reports had to be issued by certified public accounting firms.

The Third Plenary Session of the 18th Central Committee of the Communist Party of China terminated the practice in order to simplify approval procedures.

“Although we would earn money because we usually prepare this capital verification report, we welcome this change that has been an additional burden for companies,” Otto said.

The minimum of 30,000 yuan ($4,900) registered capital requirement for starting a limited liability company was removed in 2013.

“Many approval procedures have been abolished, which has saved money and made it easier for foreigners to start a company. As a consequence, many of our member companies are showing a willingness to invest in China,”said Robert Sun, President of the AmericanChinese CEO Society.

Broadened access

In addition to measures of streamlining administration, the negative-list approach first tested in the Shanghai Free Trade Zone (FTZ) has also made it easier for foreign companies to start businesses in China.

Under the negative-list approach, foreign investors will need to have their projects and companies approved only when the investment is on the negative list, which specifies areas prohibited or restricted for overseas investors.

China has been using the Catalogue for the Guidance of Foreign Investment to manage foreign investment. The catalogue lists three categories of industries for foreign investment: encouraged, restricted and prohibited. All foreign investments should be conducted following the catalogue and are subject to an approval process.

However, the negative-list approach has given foreign investors a higher degree of freedom as they only need to go through a registration process when the industries they invest in are not on the list, which can shorten the time to obtain a license to as little as four days.

“The negative-list model conforms to the international norm and the ongoing reform of streamlining administration in China,” said Shen Danyang, spokesman of the Ministry of Commerce.

“The difficulty people have found in the past in doing business is that the country gave us a very ambiguous business climate. No one was quite sure what the rules were. The government changed or had to change the rules very rapidly, leaving no time for administrators, lawyers and professionals to catch up,” Parkinson said.

“What the government is trying to do with the negative-list approach and the whole concept of the Shanghai FTZ is to make it easier for people to know what is allowed and what isnt,”he added.

Adapting to changes

Although foreign companies are enjoying more convenience while doing business in China, the gradual abortion of the special national treatment and the rising labor and land costs in the country are causing some concerns among the foreign community.

In order to attract foreign investment at the beginning of the reform and opening- up drive in the late 1970s, the Chinese Government has offered foreign firms special national treatment, exemplified by a lower tax rate or tax exemption and cheap land rent fees.

“These preferential treatments have been growing increasingly incompatible with the demand for fair competition of the market economy and imminent change,” said Kuang xianming, Director of the Center for Economic Transition under the Hainan-based China Institute for Reform and Development.

“As the special treatment is being phased out, foreign companies will be subject to more uniform supervision, fairer treatment and more transparent rules,” Kuang added.

“China is becoming less and less attractive to foreign companies as a workshop or manufacturing base, because countries like India, viet Nam, and Indonesia are able to offer labor more cheaply,” said Parkinson.

However, he thinks that this should not be a question of concern because the key to Chinas sustained economic growth is to spur domestic consumption.

“Once foreign investment is introduced to the service sector, there will be more competition between domestic and foreign companies in the industry, which will inevitably lower prices and encourage spending,” said Parkinson

He also pointed out that Shanghai FTZs practice of opening up more service sectors to foreign investment will attract Western countries like the United Kingdom, which are service-based, to further export their services to China.