Relation between Rural Financial Development and Rural Economic Grow th:A Case Study of Yunnan Province

2015-02-06LeiXULijiaHU

Lei XU,Lijia HU

College of Economics and Management,Southwest Forestry University,Kunming 650224,China

1 Introduction

Since the reform and opening-up,China's economy keeps developing at high speed and residents' income is constantly increasing.However,as a large agricultural country,per capita income of farmers grows slow mainly because rural economy fails to realize considerable development.Compared with the past,the function of financial development in marketecono my environment is becoming more and more important,while rural economic growth and increase of farmers' income can not do without support of rural finance.With issue of state policies for strengthening and favoring rural areas,there have been a series of measures for promoting rural economic growth in the aspect of rural finance.For example,it develops policy banks with Agricultural Development Bank of China as major part and Agricultural Bank of China as auxiliary part,and local rural credit cooperatives as rural financial institutions.Besides,it also energetically develops village banks,farmers fund cooperatives,small amount credit companies,to satisfy fund demand of farmers for developing agriculture.However,it is necessary to study the relation between rural finance and rural economic growth.Yunnan Province is situated in southwest China,the traffic is inconvenient and resources are scarce.Besides,Yunnan is always a poor province in China.There are 73 poor counties in Yunnan,ranking the first place in the whole country.Therefore,it is of realistic significance to study the relation between rural finance and rural economy and promote rural economic development.

2 Current situations of researches

2.1 Domestic research situationsDomestic scholars have made extensive researches on the relation between rural finance and rural economy.Based on VAR(Vector Auto regression)model and co-integration analysis,Yao Yaojun and He Pichan made an empirical analysis on the relation between financial development and economic growth of rural areas in 1978-2002 using Granger causality test method.They found that rural financial development is Granger cause of rural economic growth,while rural economic growth is not Granger cause of rural financial development[1].Qian Shuitu and Xu Jiayang held that agricultural development and increase of farmers'income need powerful support of rural finance such as agricultural credit in the condition of modern market economy[2].Zhang Jun believed that the function of financial service to economy is increasingly prominent,and will become in dispensible factor influencing rural economic development in future,and thus it is required tomake innovation in rural finance to provide better financial service[3].Using the error correction model(ECM),Wang Danmade an empirical study on the interactive relation between rural financial development and agricultural economic growth of Anhui Province in 1991-2005.Empirical study results indicate that there is long-term balance relation in between.In the causal relation,rural financial development contributes to agricultural economic growth[4].

2.2 Foreign research situationsMany foreign scholars have made some researches and exploration in the relation between financial development and economic development.They focus on the relation between financial development and economic growth at macro level,while pay little attention to the relation between rural financial development and rural economic growth.Hugh Patrick[5]first introduced a method for analyzing the relation between financial development and economic growth and proposed two financial development models,namely,supply-leading and demand-following models.The study of Goldsmith[6]indicated that there is positive correlation between financial development and economic growth.

3 Model design

3.1 Econometric modelWe built VAR econometric model using data of rural financial development and rural economy of Yunnan Province in 1995-2010 and made analysis.VAR model is based on statistical data.All variables in a VAR are treated symmetrically in a structural sense.Each variable has an equation explaining its evolution based on its own lags and the lags of the other model variables.VAR modeling does not need as much knowledge about the forces influencing a variable as do structural models with simultaneous equations:the only prior knowledge required is a list of variables which can be hypothesized to affect each other inter-temporally.Traditional econometric models are based on economic theories,such as separately evaluating relation between two dependent variables using simultaneous equations.In comparison,VAR model takes every endogenous variable in the system as function of lagged value of all endogenous variables,so as to analyze the relation between dependent variables and obtain more reliable conclusion.

3.2 Indicator selection

3.2.1 Indicator of rural financial development of Yunnan Province.Ronald I.Mckinnon[7]proposed of measuring total financial assets of a country using the money stock(M2).Smith used the ratio of total financial assets to GDP to measure financial development level of a country.With reference to these and according to availability of data of Yunnan Province,we total agricultural deposit amount(NYCX)and agricultural loan amount(NYDK)of Yunnan Province,as well as investment of rural fixed assets of Yunnan Province(GDZC)to denote indicators of rural financial development in Yunnan Province,as shown in Fig.1.

3.2.2 Indicator of rural economic development of Yunnan Province.Rural economic development mainly refers to increase of farmers' income.Thus,we took per capita income(RJSR)of Yunnan Province as rural economic development indicator,as shown in Fig.2.

3.3 Data descriptionConsidering influence of long time and change of policies,we adopted related statistical data after the year of1995.All indicators were collected and arranged according toChina Statistical Yearbook,Almanac of China's Finance and Banking,China Rural Statistical Yearbook,and websites of national and local statistics bureaus.We used Eviews software to conduct processing and test of related data.

3.4 Study methodsIf the mean value function of a time series changes with the time,this series is a non-stationary time series.For most economic data related to rural areas of Yunnan Province we obtained,the time series composed by most data are non-stationary.If directly making regression to this time series,there will the problem of spurious regression(pseudo-regression).To avoid the problem of spurious regression,we firstly used ADF unit root test to judge whether variables are stationary.If the variable is non-stationary,it is necessary to test whether the variable is single co-integrated,and make difference processing to make it become stationary series.Next,we made co-integration test to determine long term relation between variables.Co-integration analysis needs Granger causality test.Thus,on the basis of co-integration test,we tested Granger causality to make further analysis of relation between variables.

4 Empirical test and results

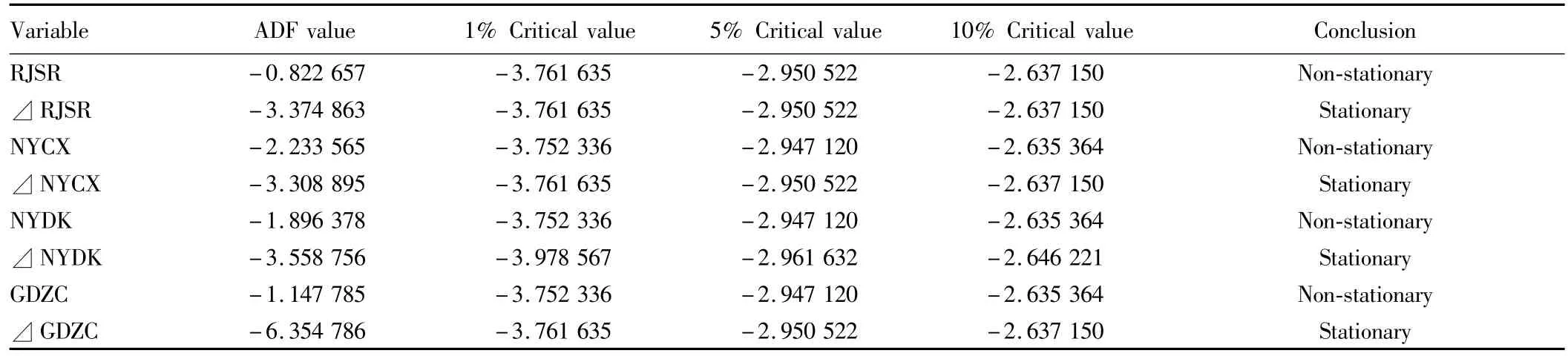

4.1 Panel unit root testThe unit root test is used to test stationarity of time series,to avoid the problem of spurious regression.Common unit root test method is ADF(augmented Dickey-Fuller)test.If a time series contains unit root,this time series is non-stationary.In this study,with the aid of Eviews 6.0 software,we made unit root test of per capita income,agricultural deposit,agricultural loan,and investment of fixed assets in rural areas of Yunnan Province.The results are listed in Table 1.

Test results show that time series of variables are non-stationary.In other words,after the first order difference processing,the series are stationary at the level of first order difference,indicating that the original series is a first order single co-integrated series.

4.2 Panel co-integration testThe co-integration test is a method for judging the long-term relation between explanatory variables and explained variable through the co-integration equation on the basis of solving the problem of spurious regression.From ADF unit root test,we know that through first order difference of variables selected for rural areas of Yunnan Province,we obtained stationary time series and eliminated the problem of spurious regression.Also,from ADF test,it can be known that although the originally selected indicators are not stationary series,they are first order single co-integrated series.Therefore,it is able to test where there is co-integration relation.The co-integration test generally includes Engle-Granger(EG)two-step method and JJ test.EG two-step method is based on residual error of regression and can be used to test stationarity of residual error through building OLS model;JJ test is based on regression coefficient.In this study,we adopted EG two-step method to conduct co-integration test.

Table 1 Results of the unit root test

Firstly,to overcome heteroscedasticity of data,we took natural log of data and established the following regression equation:

lnRJSRt=α+βlnNYCXt+γlnNYCKt+ωlnGDZCt+εt

Through estimation,we obtained the residual error series et

Secondly,we tested stationarity of e”t.If it is stationary,both explanatory and explained variables are co-integrated.Otherwise,they are not co-integrated.Then,we carried out unit root test for et,as shown in Table 2.

Table 2 Results of the et unit root testNull Hypothesis:ET has a unit rootExogenous:NoneLag Length:0(Automatic based on SIC)

From Table2,we can see that the test result of et is stationary at5%level.Therefore,the time series after first order difference processing is co-integrated for a long term.

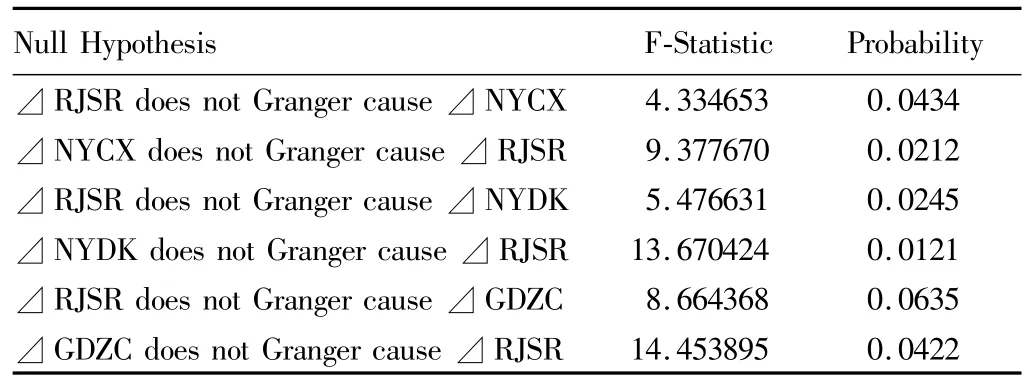

4.3 Granger causality testThrough difference processing,the above indicators are stationary and have long-term co-integration relation.Then,we carried out Granger causality test for these variables.Test results are listed in Table 3.

Table 3 Granger causality test

From the test results,we know that at 10%level,we can not exclude⊿RJSR is Granger cause of⊿ NYCX,neither can exclude⊿NYCX is Granger cause of⊿RJSR.Other selected indicators are similar.Therefore,rural financial development can promote rural economic growth,and rural economic growth also can promote rural financial development.

5 Conclusions and policy recommendations

Through empirical analysis of the relation between rural financial development and rural economic growth of Yunnan Province,we concluded that both are mutually promoted.Therefore,in order to further bring into play promotion of rural financial development to rural economic growth and lift the guiding function of developing rural economy to rural financial development,we came up with following recommendations.

5.1 Deepening financial system reform of Yunnan Province and promoting site distribution of traditional financial institutions in rural areasThrough this study,we found that rural financial development is always an essential factor influencing rural economic development.Therefore,it is recommended to promote reform of rural financial system in Yunnan Province,optimize allocation of rural financial resources,establish and improve rural financial system,energetically develop rural financial institutions with agricultural banks as guidance,rural credit cooperatives as main force,and rural financial cooperative organizations as auxiliary entities,and improve the convenience of farmers in obtaining agricultural production funds.

5.2 Adjusting industrial structure of rural economy of Yunnan Province and boosting rural economyYunnan Province has the largest number of poor counties in the whole country.Rural economy falls behind and fails to develop quickly.Major reasons for this include traditional agriculture is the major part of agriculture,rural economy develops slowly.In this situation,it is recommended to greatly develop rural economy of Yunnan Province,adjust rural industrial structure,and develop new rural economy under the premise of ensuring development of traditional rural economy.For example,it is recommended to guide rural farmers to centralize funds to develop rural large-scale economy,plant cash crops,to obtain economic benefits and famous brand benefits,so as to boost rural economy.

5.3 Guiding development of new financial institutions under the premise of guaranteeing development of traditional financial institutionsOur study results indicate that there is a long-term co-integration relation between rural finance and rural economy of Yunnan Province.Therefore,government should issue pertinent policies to promote rural financial development,especially development of rural informal financial institutions,and carry out proper supervision.In this way,it is expected to promote rural economic development.In the past,farmers obtain funds mainly from normal financial institutions like banks.The amount and convenience of available funds are limited and impede farmers' obtaining agricultural production funds and consequently restricts agricultural economic growth.Therefore,it is recommended to properly develop informal financial institutions,such as rural private financing and fund raising,and properly supervise operation and development of funds,to facilitate agricultural production of farmers,invigorate rural financial development,promote rural economic development,and so as to guide development of rural finance.

[1]YAO YJ.Rural financial development and economic growth in China:An empirical analysis[J].Economic Science,2004,(5):24-31.(in Chinese).

[2]QIAN ST,XU JY.Study on the relationship between China rural credit and farmers’income-Based on the empirical analysis of panel cointegration and error correction model[J].Financial Theory and Practice,2011,(11):16-23.(in Chinese).

[3]ZHANG J.Savings differences and the meet of borrowing need—Analysis on farmers’financial activities of an export-oriented economy village[J].China Rural Survey,2000(3):12-21.(in Chinese).

[4]WANG D,ZHANG Y.Empirical analysis on the relationship between financial development and agricultural growth in Anhui Province[J].Journal of Financial Research,2006(11):177-182.(in Chinese).

[5]HUGH T PATRICK.Financial development and economic growth in underdeveloped countries[J].Economic Development and Cultural Change,1966,14(2):174-189.

[6]GOLD SMITH R.Financial structure and economic development[M].New haven:Yale University Press,2010.

[7]MAIJN.The currency and capital of economic development[M].Shanghai:Shanghai Sanlian Bookstore Press,1988.(in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Empirical Study on Formation Path of Fam ily Farms in Different Environments from the Perspective of ANT

- An Empirical Analysis of the Factors Influencing the Cooperative Relationship between Broiler Processing Enterprises and Broiler Raisers

- Prediction of Coal Consumption in China Based on the Partial Linear M odel

- How to Develop Rubber Production in Xishuangbanna Dai Autonomous Prefecture?

- A Study of Regional Brand Positioning Strategy for Linhai Orange Based on Soft Laddering

- Evaluation of Arable Land Reserve Resources and Analysis of Restrictive Factors:A Case Study of Hangjin Banner in Inner Mongolia