A Mixed Bunch

2014-10-23ByWangJun

By+Wang+Jun

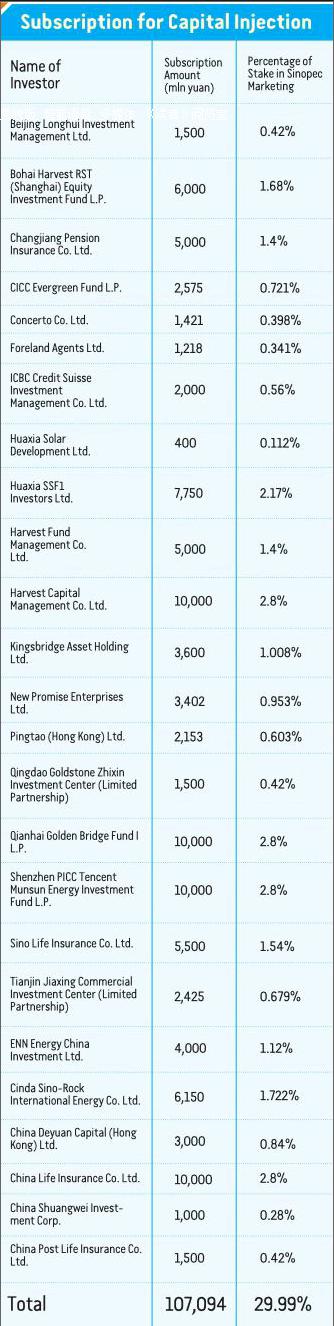

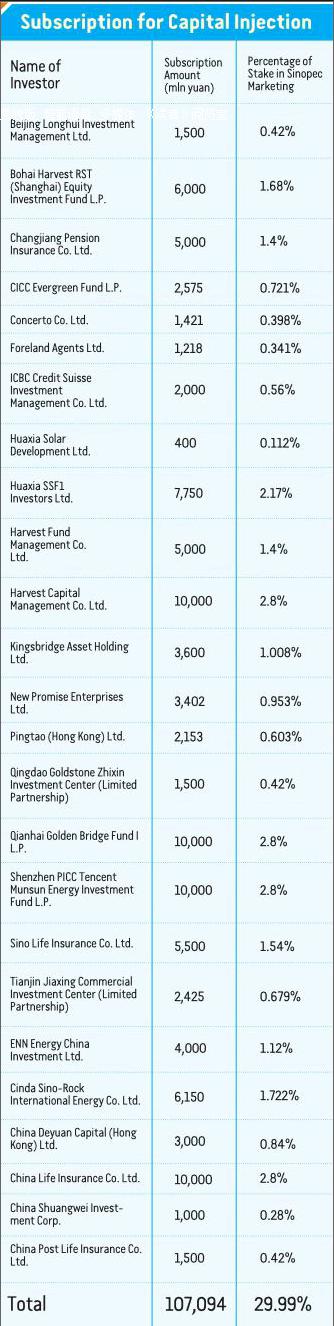

China Petroleum and Chemical Corp.(Sinopec), the countrys largest petroleum refiner and oil product manufacturer, announced on September 12 that its wholly owned subsidiary Sinopec Marketing Co. has entered into a capital injection agreement with 25 domestic and foreign investors.

Pursuant to this deal, the investors will subscribe for a total 29.99-percent shareholding interest in Sinopec Marketing Co. for an aggregate amount of 107.09 billion yuan ($17.41 billion). Sinopec will hold the remaining 70.01 percent of the shares, according to the oil refiner.

Upon completion of the capital injection, the registered capital of Sinopec Marketing Co. will increase from 20 billion yuan ($3.25 billion) to 28.57 billion yuan ($4.65 billion).

According to Lu Dapeng, a spokesman for Sinopec, this represents the worlds largest corporate acquisition so far this year. “The reorganization has formed a mixed equity structure consisting of state and private entities,” said Lu.

The chosen few

The reorganization represents yet another milestone for Sinopec following its announcement in February of its decision to initiate the introduction of outside capital and the completion in April of the restructuring of its marketing division.

ye Huiqing, chief accountant of Sinopec Marketing, said that these 25 investors have been selected via the taking into consideration of their quotes, industrial interaction and the amount of shares they intended to subscribe for.

According to the Sinopec announcement, the capital injection was administered with impartiality, fairness, openness and transparency. The company conducted multiple rounds of selection and competitive negotiation, allowing potential investors to evaluate Sinopec Marketing independently and to submit non-binding and binding offers based on the process.

For the purposes of the selection process, Sinopec and Sinopec Marketing jointly established an independent evaluation committee comprising independent directors, external supervisors and internal and external experts to conduct review and screening of the potential investors.

The committee considered the offering price and the proposed investment amount of each potential investor and gave priority to strategic investors, domestic investors, and investors who can provide benefits to the general public.

Among the 25 investors, nine are strategic industrial investors, investing a total of 32.69 billion yuan ($5.32 billion) and accounting for 30.5 percent of the investment. Twelve investors are Chinese companies, who will invest a total of 59 billion yuan ($9.59 billion), accounting for 55.1 percent of the total investment.

The four companies whose participation is held to be potentially beneficial to the public will invest 32 billion yuan ($5.2 billion), accounting for 29.9 percent of the total investment. Of the 25 companies, 11 are private companies, investing 38.29 billion yuan ($6.23 billion), accounting for 35.8 percent of the investment.

Lu thinks the above investors can derive benefits from at least three areas: obtaining a platform for more resources, receiving stable investment returns and realizing rapid business growth by combining with the existent brand, sales networks and clients of Sinopec.

Most of the nine strategic investors have participated by establishing or controlling investment management companies and fund management companies. For instance, Concerto Co. Ltd., Foreland Agents Ltd. and Shenzhen PICC Tencent Munsun Energy Investment Fund L.P. are propped up by wellknown enterprises RT Mart, Haier and Tencent, respectively.

Chai Zhiming, Deputy General Manager of Sinopec Marketing, said the company will cooperate with the nine strategic investors to expand into new businesses including convenience stores, auto services, online-to-offline (O2O) services, financial services, environmental protection products and advertising. Its gas stations will be built into “lifestyle stations,” designed to meet customers everyday needs.

Sinopec will cooperate with RT Mart in convenience stores, join forces with Tencent in mobile payment, media promotion, O2O business, maps and navigation services, user loyalty programs and big data applications, and collaborate with Haier in interactive marketing, logistics and oil sale.

According to a press release from the company, Sinopec Marketing aims to provide comprehensive and integrated services in order to build the trust of consumers and satisfy the needs of the general public in its new incarnation as a lifestyle service provider.

An example

Wu Ruchuan, President of China Beijing Equity Exchange, said the mixed ownership reform can be realized in three ways: transferring ownership of part of state-owned properties to private capital, introducing private investors and establishing new companies. He claimed introducing private investors should represent the first choice for mixed ownership reform in the future.

Previously, some state-owned enterprises(SOEs) in Shanghai and Guangdong Province commenced pilot mixed ownership reforms, but the central SOEs in industries related to economic lifelines failed to make any significant breakthroughs in this respect.

In this instance, however, Sinopec has embarked on its course of mixed ownership reform in a manner that enjoys the broad support of industrial insiders.

“Mixed ownership reform represents only a means, but not the end. In the future we will strive to further improve our corporate governance structure,” said Lu.

This is also a measure necessary for protecting the interests of investors. According to a Sinopec press release, upon completion of the transaction, Sinopec will work with its investment partners to improve Sinopec Marketings corporate governance mechanisms guided by the principles of professionalism and market-orientation.

A diversified board of directors is to be established, consisting of three representative

directors from private capital, three indepen

dent directors and one director who is an employee of Sinopec, in addition to four directors designated by Sinopec Corp.

Although Sinopec controls 70 percent of the stake in Sinopec Marketing, non-Sinopec representatives hold the majority of the board of directors.

A remuneration and appraisal committee, a risk and strategy committee and an audit committee will also be established under the board of directors in accordance with the applicable laws and regulations.

Sinopec will also facilitate Sinopec Marketing in optimizing its management structure and establishing a specific performance appraisal system in order to develop a marketoriented, contract-guided and position-based human resources management mechanism, a market-oriented compensation system and a long-term incentive-based mechanism, according to a Sinopec press release.

Zhao Chen, an analyst of the oil and gas industries with Orient Securities Co. Ltd., said that the end goal of Sinopecs introduction of private investors is to improve its corporate governance structure and build the company into a competitive one, which is similar to the aims of the reform of state-owned banks.

“years ago, by introducing foreign strategic investors, Chinese banks individually established a modern corporate governance structure and improved their asset management, bringing about considerable returns for their investors,”said Zhao.

But compared with the conditions encountered years ago, Chinas market environment has been remarkably improved, laying better foundations for the mixed ownership reform. Most of the investors Sinopec have introduced are domestically based, which can better protect the national interest.

“Sinopec is considered to have provided a model for the new round of mixed ownership reform for SOEs,” said Zhao, who stated the companys method of introducing investors can be duplicated, which is of great overall significance to the reform of SOEs.

“If SOEs and private investors can cooperate effectively, this round of SOE reform may bring benefits even greater than those created by the previous reform of the banking industry,”Zhao said.