Reorganization for Revival

2014-08-14

A round of reorganization of the Chinese dairy industry supported by the government of China is progressing steadily. The Chinese dairy enterprises are going to get the support in technology upgrade, taxation and finance.

On June 13, the State Council published the Plan of Promoting the Mergers and Reorganization of Enterprises of Baby Formula, which was co-developed by the Ministry of Industry and Information Technologies (MIIT) and other governmental departments. In this new policy, the administration body of the dairy industry established the goal and method of pushing the mergers and reorganization of dairy enterprises in China.

This measure is one of the packages the Chinese government launched for the intensive integration of the dairy industry in one year. At the end of May, the examination of enterprisesqualification of producing milk powder, which is said to be the strictest one in the history, drove out 51 unqualified enterprises. Last year, the National Development and Reform Commission of China also launched an investigation into the vertical price monopolization of dairy enterprises.

These new measures took place against the background that the top leaders of China already issued several instructions to the development of dairy industry. In May 2013, Chinas premier Li Keqiang stated the requirements of intensifying the efforts into the quality and safety of baby formulas in a regular meeting of the State Council. After the melamine scandal in 2008, the Chinese governments of all levels began to apply strict control over the baby formula enterprises. However, most of the Chinese parents in China are willing to buy foreign brands via various channels.

The Chinese government has made its goal and maneuvers clear. With the strict requirements, the small enterprises with lesser technologies to keep the quality and safety are eliminated. On the other hand, the strong support to big companies can give them a larger access to the resources and market.

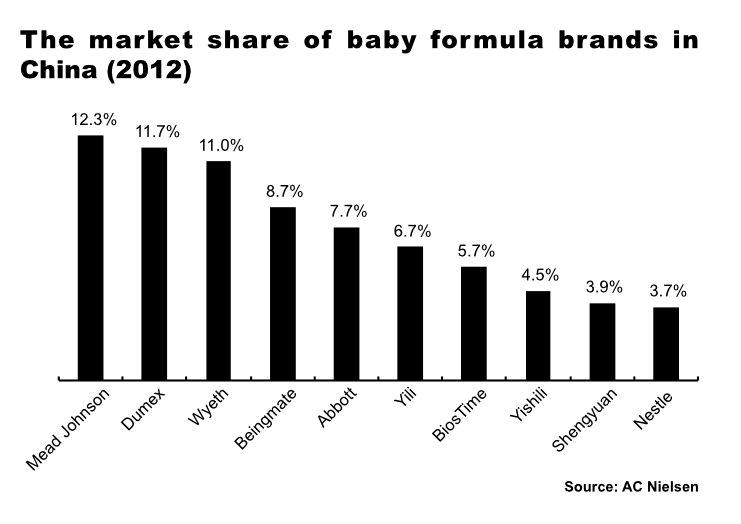

The combination of the “rod” and“carrot” represents an ambitious goal of the Chinese government for the baby formula industry: by the end of 2018, China is going to have 3-5 big dairy enterprises with the annual sales of over 5 billion yuan and the top 10 domestic enterprises in that industry should take 80% of the market. In that long-term vision, domestic brands are expected to defeat Wyeth, Mead Johnson, Dumex and Abbott, which are foreign brands that have been ruling the Chinese baby formula market for years.endprint

Presently, these foreign brands take half of the domestic market, but before the melamine event in 2008, their market share was not higher than 30%.

80% Market Share in Five Years

In the plan of reorganization, the Chinese government implemented a series of policies for the revival of domestic baby formula industry under the guidance of the government, including the encouragement to the producers to build their own dairy farms. However, these efforts are not rewarded with the public confidence in Chinese domestic dairy enterprises.

The first draft of the reorganization plan came out in October 2013. After being reported to the State Council, the plan was modified several times. On June 13, Gao Fu, second chief inspector of the Consumer Goods Department at the MIIT, made a thorough introduction to the goals of reorganization. The first phase ends in 2015, with the goal of having developed 10 big baby formula enterprises with the annual sales of 2 billion yuan and 65% of the market taken by these top 10 domestic enterprises.

The MIIT thinks it not difficult to reach the goal, because there had already been six baby formula producers with the annual sales of over 2 billion yuan and the top 10 domestic enterprises had already taken 45% of the market by the end of 2013. In addition, the examination of producers qualifications in May reduced the number of domestic baby formula enterprises from 120 to 82, which further enhanced the industrial concentration.

The second goal, as mentioned above, is a long-term goal to develop 3-5 enterprises with the annual sales of over 5 million and have 80% of the market taken by top 10 domestic brands by the end of 2018.

Gao Fu called this goal an “anticipatory goal”. He said: “we set up this goal with the consideration of two aspects. One of them is the anticipation for the situation after the improvement in the requirements of the industry. When the higher requirements for industrial policy and production qualification come out, some of the enterprises are likely to be forced to embark on the way of reconstruction or even driven out of the market.

Gao Fu admitted that the goal for the period of 2015-2018 is hard to be realized, but the government will try its best to improve the industrial concentration by 5% year by year.

The enterprises that want to survive or even benefit from this round of reorganization must have these three conditions. Firstly, they need secured milk source as the dairy enterprises are going to be required to use the raw milk from their own dairy farms as the main ingredients. Secondly, they need advanced production technologies, which enablethem to detect the defects, control the key links, standardize the production and keep the food safety. Thirdly, they need high-quality products, reasonable debt structure and great profit margins.endprint

Support from Central Government

The enterprises that meet these three conditions, which are hard to be finished in consideration of the current situation, will receive great rewards from the government.

According to Gao Fu, the administrative department will simplify the process of examination and approval, give out the discounts in the tax payment, enhance the financial investment and subsidies and issue favorable land policies to accelerate the process of mergers and reorganization.

Concretely, the enterprises that can meet the three aforementioned conditions will pay less contract tax, land value-added tax and stamp tax. They will receive the rewards in cash from the central government if they replace the old and outdated production facilities with the new ones to improve the efficiency and quality. The Chinese government is also planning to offer financial support to the baby formula enterprises, especially big ones, if they finish mergers and reorganization. The securities companies and asset management companies are also encouraged to provide financial support for baby formula enterprises with multiple fundraising platforms. The capital market is expected to exert its influence as well. The qualified enterprises are allowed to raise funds for mergers and reorganization through the issuance of stock options, corporate bonds and convertible bonds.

Several banks have responded to this call. Two banks have promised the 60-billion-yuan financial support for the reorganization of Chinese dairy enterprises. One of them is National Development Bank. It has signed a cooperative agreement with the MIIT, tentatively promising to support the industrial development with 30 billion yuan. Minsheng Bank is also preparing to provide the cash of 30 billion yuan as the support for the development of dairy enterprises.

Actually, before the issuance of the favorable policies, there are several enterprises having got the financial and technological support. For example, Sanyuan Dairy, a state-owned enterprise in Beijing, got the financial support of 10 million yuan from the Beijing government in the first half of 2014. The money was said to be used to support the research into the ingredients of breast milk. Previously, Sanyuan Dairy was ordered to integrate the assets of Sanlu, which went bankrupt after the melamine event. This had undermined its profit margin.

In the recent year, the MIIT also worked with the Association of Dairy Enterprises to endorse 20 milk powder brands in three times. Among the 20 brands, Nestlé is the only foreign brand, but it also uses the local source of raw milk. Others are domestic brands, including the nation-known brands like Mengniu, Yili, Yashi and regional brands like Longdan and Baiyue.endprint

Price Is Still the Problem

It has been a year since the draft of the reorganization of the baby formula industry came out. In the past year, there were a lot of cases of mergers and reorganization. Now, the Chinese government began to throw more efforts in advancing the reform. However, can these measures ensure and boost the voluntary integration among the enterprises?

For this, Gao Fu has made it clear that the MIIT, or other governmental departments, would not intervene in the market and influence the decisionmaking of enterprises.

“The enterprises will join in the mergers and reorganization voluntarily. There is no mandatory matchmaking by the government through administrative orders and maneuvers. The market will play the pivotal role in the allocation of resources,” he said. “The government will be focused on creating the environment good for the development by removing the unreasonable regulations that could stop the mergers and reorganization of enterprises, enhancing the supervision and providing more support in finance, taxation and land policies.

Song Kungang, emeritus president of the Industrial Association of Dairy Products, encouraged the enterprises to take the opportunity: “Some enterprises previously tried in the mergers and reorganizations, but some problems remain unresolved. For example, the enterprise that merged the other one needs to be responsible for the employees of its target and pay the debts or taxes the target owed. This adds the difficulties in the integration and reorganization of the assets. This time, the government has removed the problems for us. This is good news.”

Actually, the new policy about reorganizing the baby formula industry and the re-accreditation of the production license are among the strict measures of the Chinese government, which has helped improve the quality of domestic baby formula products, as no problems were found through the spot checks from last year. However, the consumers are still unsatisfactory with the market. One of the main problems lies with the price – the baby formula product are more costly in China than similar ones in foreign countries.

Jiang Yujun, deputy director of the National Dairy Engineering Technology Research Center, said: “We recently collected the information about prices of baby formula products in China and foreign countries. We found that the price of dairy products in Europe is usually one third or one half of that in China. This means that the cost of producing and selling baby formula is still too high in China.”endprint