The Rising Empire of Renminbi

2014-08-14

The trip of Chinas premier Li Keqiang to the UK is quite fruitful. Dozens of governmental and business agreements were reached between the two countries, involving finance, technology, education, energy, high-speed railway and infrastructure construction. The total value was higher than US$30 billion.

Quoting Chinese media, the journey Premier Li Keqiang has improved the relation between China and the UK to a newhigh level, and means win-win results for both China and the UK.

“The deepening bond between China and the UK is evangelic for both countries, as well as the world,” reported Chinese official media Xinhua News Agency. The Independence also reported that the journey of Li Keqiang to the UK is good for both countries, as China needs the UK and the UK China. “The clear and mutually beneficial economic structure constitutes the basis for the China-UK relations,” reported the British newspaper.

Both the Chinese and British media listed the financial cooperation between China and the UK at the top of the achievements Li Keqiang made during this journey. The most impressive financial cooperation dealt this time was none other than the agreement of direct trading between Chinas Renminbi and the British pound.

Bonding Yuan with Pound

“Let the financial cooperation precede the China-UK cooperation,” said Li Keqiang when he was delivering a speech to the Chinese and British business representatives during his visit to the British National History Museum.

Before that, he and British Prime Minister David Cameron were present in a small roundtable meeting with IMF president Christine Lagarde, World Banks president Jim Yong Kim, OECDs secretary-general Angel Gurria, president of Chinas central bank Zhou Xiaochuan.

Also in that meeting, an important agreement was reached: with the authorization of Peoples Bank of China (central bank), the Foreign Exchange Trading Center of China announced the initiation of direct trading between yuan and pound in the inter-bank foreign exchange market.

Almost at the same time, Construction Bank of China (CBC), which is one of the top five commercial banks in this country, announced that it had been appointed by the central bank as the clearing bank for the Renminbi business in London. An insider from CBC said that the bank had already built a worldwide yuan clearing network with London as its center. It also set up three clearing teams in Beijing, London and New York, through which it formed the offshore yuan clearing service that is available across different time zones.endprint

“This is the first time Chinas central bank chose a clearing bank for Renminbi deals in foreign countries outside Asia. This is of great significance for the promotion of the economic and trade relations between China and the UK, as well as the one between China and Europe,” said Mark Boleat, chairman of the Policy and Resources Committee of the City of London when he answered Chinas media.

The journey of Li Keqiang to the UK this June was a conclusion for the long-term negotiation between China and the UK in the direct trading between the two countriescurrencies. Early on April 1, the central bank of China and Bank of England signed a memorandum of cooperation about setting up the yuan clearing institution in London.

George Osborne, Financial Minister of the UK, said that “Great Britain is quite lucky to have this agreement of yuan-pound direct trading agreement reached this time”. He also believes that it is an important step for the UK to become the center of Renminbi in the West.

Truth to be told, it is not “luck” that has made London host the first yuan clearing bank outside of Asia. As one of the most important international financial centers in the world, London is always an important market for the international spread and use for any currency. This city has been contending with other European cities, such as Frankfurt, and non-European cities like Hong Kong and Singapore for the Renminbi offshore center. According to the latest report from the City of London, it has been three years since the City of London began the plan of setting up the yuan business. The agreement about the direct trading between yuan and pound is undoubtedly the best reward for their efforts as it ensures the leading place of London as the offshore Renminbi center in the western world.

“London has been keeping its leading place in the global Renminbi offshore center,” said Boleat. Two thirds of the Renminbi payment outside of mainland China and Hong Kong happened in London, according to Osborne.

Then, why is London so interested in and committed to becoming the offshore Renminbi center? Apart from the closer political bond, the agreement also allows the UK to directly benefit from the non-stop economic development of China. Steve Barrow, the currency research chief with Standard Bank, said that there would not be too many benefits at first, since it is an “evolutionary” deal instead of a “revolutionary” one.endprint

However, this does not reduce the enthusiasm of British for that deal. Standard Chartered forecasts that China is going to take more than 20% of the global exports market by 2020, which will undoubtedly improve the importance of Renminbi. George Osborne said that the biggest benefits of the direct trading between yuan and pound for the UK were the increasing number of jobs and improving appeal for the foreign investment.

“To connect British enterprises with the extraordinary economic growth is an important part of our economic plan,” said Osborne. “This will bring about the employment and investment opportunities to London.”

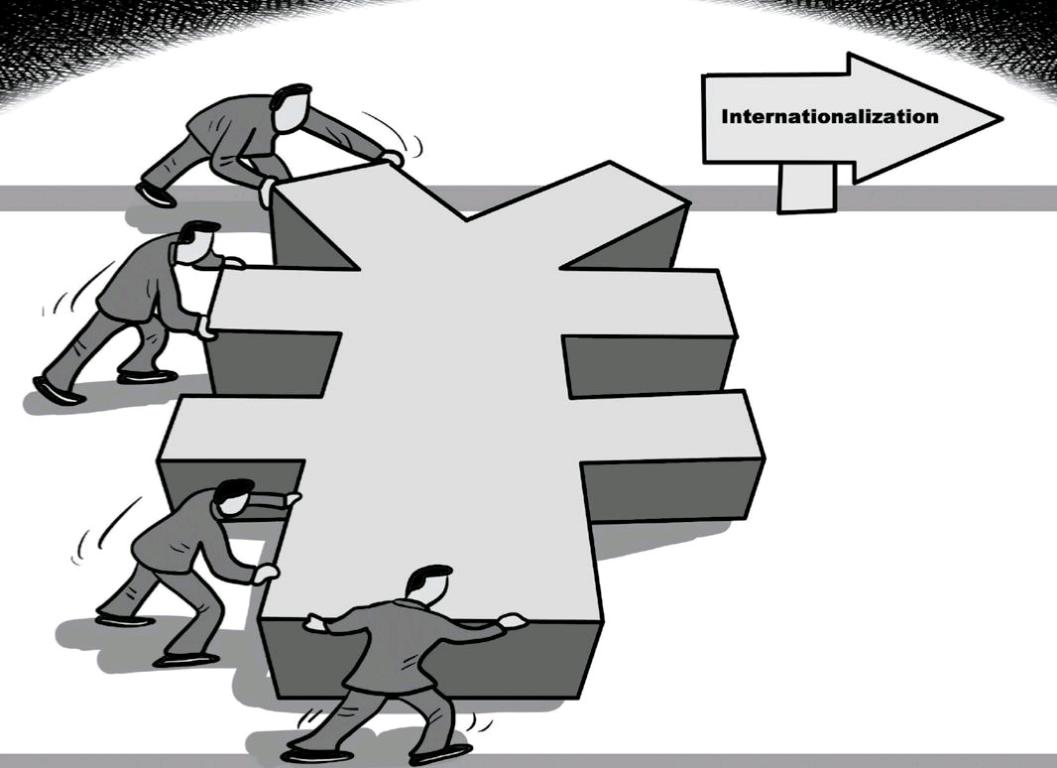

The Internationalization of Renminbi

It is beyond question that London and the UK could benefit greatly from the direct trading between yuan and pound. Then, as the announcement stressing the “winwin result”, what could China get from the agreement?

A look into Chinese medias reports could reveal that the Chinese are as excited as, if not more than, the British. Nearly all financial, economic and political newspapers or other publications gave priority to this matter. They all spared no efforts in detailing the benefits of the agreement for China.

It is widely believed that the direct trading between yuan and pound could save the cost of Chinese investors when they invest in London. Previously, the Renminbi needs to be exchanged into the U.S. dollar before being exchanged into the pound. Without the part involving the U.S. dollar, the Chinese investors could no longer need to bear the extra cost occurring in the yuan-USD-pound process. The benefits are also enjoyed by the Chinese enterprises which export their products to the UK since they now can settle the trades directly with Chinese yuan.

“The decreasing trade cost could increase the bilateral trade between China and the UK, which would further balance the Chinese market, reduce or eradicate the potential risks of the Chinese economy,” said Simon Derrick, chief researcher of foreign exchange with Bank of New York Mellon.

In addition, the direct bonding between yuan and pound can make the formation system of Renminbi exchange rate more transparent, which is good for the flexible exchange rate system between yuan and pound and also provides a great example for the trading between pond and other currencies.

Moreover, to have Renminbi bond with one of the most established currencies in the world is undoubtedly a good thing for Renminbi to improve its international importance. This is what the Chinese government keeps working for – the internationalization of Renminbi.endprint

The said internationalization means that the Chinese government wants Renminbi to be able to used for trade settlement, crossborder payment and other economic deals like the U.S. dollar. It is an ambitious goal, but the Chinese government has been doing well so far. Prior to that, Renminbi could be directly exchanged into the US dollar, Japanese yen, Australian dollar, New Zealand dollar, ruble and ringgit. Now the British pound is in the camp as well, meaning that Renminbi can be directly traded with other major currencies in the world apart from euro and Swiss franc.

Chinas efforts to push its own currency to the international market are to build an international currency market that matches its economic power. Presently, China is the second largest economy in the world, but Renminbi is the only currency that cannot be used for the foreign exchange reservation among the currencies of top five economies in the world. This could not only be a shame to the second largest economy in the world, but also a threat to the stability of Chinese economy.

In the past few years, China has always been criticized for its excess reliance over the U.S. dollar in its foreign exchange reservation. In addition, the international financial crisis in those years has crumbled the international currency system. And the U.S. quantitative easing has brought unlimited impact over the worlds economy. These facts have made China, as well as the world, realize that the current international currency system dominated by the U.S. dollar might not be as stable as ever before. It is time to change this, and China, the second largest economy next to the U.S., is expected to play an important role in that matter.

Chinas desperation and efforts to push the internationalization have seen good re- sults. According to the report from Society for Worldwide Interbank Financial Telecommunications (SWIFT) in May, the Renminbi once again found its way into the list of Top 10 global payment currencies after four straight months success. It is now the seventh largest international payment currency in the world, a great jump from the bottom of the list two years ago.

The newly-built connection of Renminbi with pound and London is widely believed to accelerate the internationalization of Renminbi and can fuel the fear of Americans that the US-dollar-dominated Bretton Woods System might collapse one day. In recent years, the trend of “getting rid of U.S. dollars” is raging in the world. The proportion of U.S. dollars in the international for- eign exchange reservation has dropped from 55% ten years ago to 33% now. The rise of Renminbi, which is providing more choices for the world when it comes to the reservation currency, is undoubtedly a threat to the U.S. dollar.endprint

However, the Chinese government keeps stressing that Renminbi has the ambition, but no power at this moment, to take the leading role of the U.S. dollar. This could be considered to be a humble attitude, yet it is true – presently, Renmini only takes 2% of the global payment settlement despite its seventh place. This means it is still a long way for Renminbi to go before the real establishment of the empire.

Thats the ultimate goal of the Chinese government, but are the governments efforts enough for this goal? Robert Mundell, the “father of euros”, said that the UK never meant to push the pound to be an international currency; neither did the U.S. Apparently, the Nobel laureate deemed it unnecessary for the Chinese government to take political or economic measures to promote the internationalization of Renminbi.

“Whats really standing in the way of yuans internationalization? Sadly, its China itself,” reported Economist. “The simplest way to push the currency to the world is the trade deficit. However, Beijing does not ever think of this, at least at this moment.” endprint

endprint