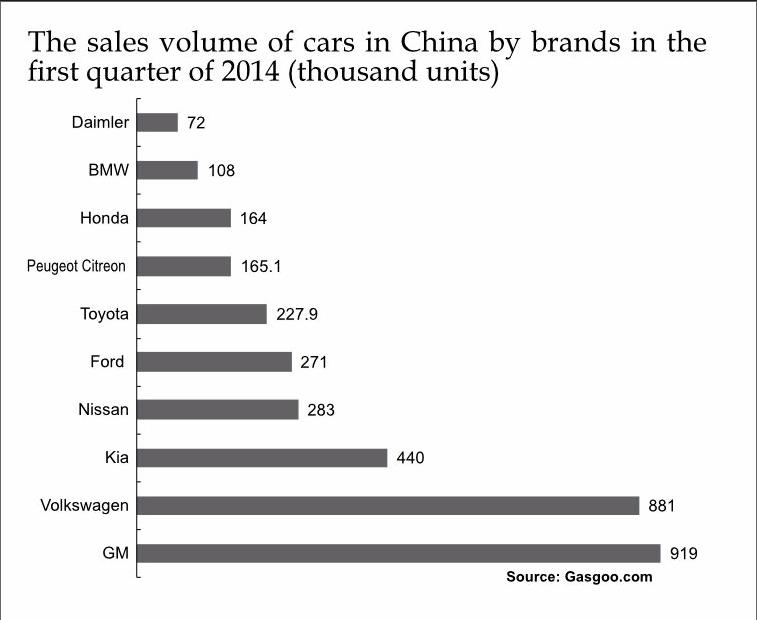

One of every five new cars sold in China belongs to German brands

2014-08-14

In the first three months of 2014, the German automakers had the sales higher than the same period in past few years. Though the strong euro had taken away billions of their revenues, the German automakers still saw the increase in both the turnover and profits. This was mainly attributed to their Chinese clients.

According to Wirtschaftswoche, the German auto companies realized the 17% increase in the sales in China in the first quarter of 2014, while the Chinese auto market only grew at 9%. As a result, the German auto companies saw their market share in China increase by 21.8%, which is a historical high level.

It was reported that the sale of German automotives was less satisfactory in the U.S. than in China. In the first quarter of 2014, the German automakers saw its sale in the U.S. increase by 1% and its market share dropped to 7.9%.

Volkswagen is still the most profitable auto-making company in the first quarter of 2014, like it was a year ago. Volkswagens sales amount reached 47.8 billion euros. It was followed by Toyota. Due to the depression of the Japanese yen, the operating revenue of this Japanese automaker increased by 13% to 46.3 billion euros.

The top three automakers in terms of sales volume were Toyota, GM and Volkswagen, as they respectively sold 2.6 million, 2.4 million and 2.3 million units.

It is reported that the European market had a slight increase and the Chinese market continued to show a good outlook which ensured that German automakers are going to create new records in the year of 2014. This is the conclusion Earnest & Young made based on the analysis of the financial data of the 16 largest auto manufacturers in the world.

Though Volkswagen kept its championship in terms of turnover, Toyota ranked the first in terms of the profits(3.1 billion euros). However, the figure dropped 26%. In comparison, the profits of Volkswagen increased to 2.9 billion euros, up 22%. Daimler saw the largest increase in profits as it soared 95% to 1.8 billion euros, increasing its ranking in the list of profitability from seventh place to the fourth place. BMW kept the third place as it earned the profits of 2.1 billion euros in the first quarter of 2014.

In recent years, the German auto brands had a dramatic increase in the sale. From 2009 to 2013, the sales volume of German automakers increased from 1.6 million to 3.7 million units. In the same period, the size of Chinese auto market only increased by 74%. The market share of German cars increased from 15.1% in 2009 to 21.8% in the first quarter of 2014, meaning one of every five cars sold in China comes from the German brand.

Chengdu, Guangzhou and Ningbo as the most livable cities in China

Asian Development Bank (ADB) announced on June 13 that it made a ranking for the livability of 33 cities in China based on a serial index developed with the assistnace of technologies. The data mainly comes from a survey in 2011.

The ranking made by ADB is mainly based on the scores of cities in the water and air pollution, solid waste, noise, ecology, family livability (including water, gas supply and green land area), environment management and the livability of entire environment.

As the research has found out, the cities in South China and coastal areas are more livable compared with the ones in the northern, western and northwestern parts of this country – these areas are more developed.

According to the data from 2011, Chengdu has the highest comprehensive livability score in China. It is followed by Guangzhou, Ningbo and Changsha.

Beijing ranks the middle in the list while Shanghai is among the rear part. The last three places are respectively taken by Lanzhou, Harbin and Taiyuan.

The research team of ADB almost started from scratch to work out the livability index through consulting with Chinas Ministry of Environmental Protection. They defined all the factors and indices and worked out the concept of livability. They also developed proper research methodologies.

Sergei Popov, a senior environmental expert with ADB, said: “We chose the 33 cities based on the availability of the data, which came from their statistical reports and communiqués of environmental protection.”

This index could also point to the concrete problems in different sectors. For example, the poor water environment in Shenzhen is caused by its poor quality of surface water, while the poor quality is caused by the indisposed waste water.

Apart from the comprehensive index, the project also made in-depth investigations into six cities of Beijing, Guangzhou, Lanzhou, Shanghai, Shenyang and Wuhan, since their historical data is still available. The investigation found that Guangzhous livability improved the most– 45.4% – among all cities, while Lanzhou has the lowest improvement (17.9%).

Popov said: “The comparison between the data of different cities could measure the efforts of government into the improvement of environmental livability and living conditions. It will also provide scientific and reliable data for the government to take actions.”

World Bank: hard landing of Chinas economy will impact Asia

On October 10, the World Bank published the latest Global Economic Prospect, in which it lowered the expected growth rate of global economy to 2.8%. The report stressed that if the rebalancing of Chinese economy went through hand landing, the impact will be extended to most of Asian countries.

Previously, the World Bank expected the global economic growth rate to be 3.2% this year. The drop was a result of the dim outlook of the U.S., China and other BRICS countries. The World Bank once expected a 3.4% economic growth rate in 2015, which was not changed this time.

The accelerated recovery of developed countries will boost the rebound of the global economy. Thats why the World Bank estimated a 3.4% and 3.5% economic growth rate in the world in 2015 an 2016 respectively.

Meanwhile, the faster recovery of the high-income economies will provide the main driving force for the developing countries. The high-income economies are expected to bring about the additional demand of US$6.3 trillion yuan in the world in the next three years, apparently higher than the US$3.9 trillion they contributed in the past three years.

Presently, the global economy is mainly haunted by the terrible weather in the U.S., the Ukrainian crisis, the rebalancing of China, the political disputes in some middle-income economies, the slow progress in structural reform and the limitation in production capacity. These factors have rendered the developing countries annual economic growth rate lower than 5% for three straight years.

China, the most attention-worthy developing country, lowered its expected growth rate from 7.7% to 7.6%. The report from World Bank stressed that the economic expectancy of China depends on the result of its economic rebalancing. It the hard landing happens, the impact will be extended to the entire Asia. The World Bank forecasts that this year is to be a disappointing year for the economic growth of developing countries as their average growth rate will drop from 5.3% to 4.8%.

The World Bank listed three major risks Chinas economy is going to face in the future in its Briefing of Chinese Economy published on June 6. Firstly, if the local government debts go through de-leverage in a disorderly manner, the investment growth will be greatly slowed. Secondly, if the property industry and others meet the problem in fundraising, the economic activities might be much less frequent. Thirdly, if developed countries recovery is weakened, the rebound of exportation might not come true.

Wu Zhuojin, chief economist of the China Department at the World Bank, said: “There is going to be no smooth way of re-balancing in China. It reflects the contradictions between the structural need and the recent demand regulation.

But the temporary economic slowdown brought by the structural changes might not be bad news. “In the middle term, these measures could improve the quality of Chinas economic growth, making it more inclusive and sustainable,” said Karlis Smits, a senior economist with the World Bank.

Chinese investors eye foreign property market

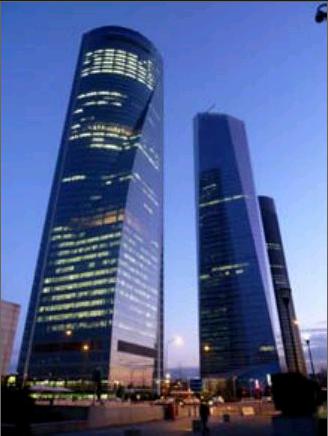

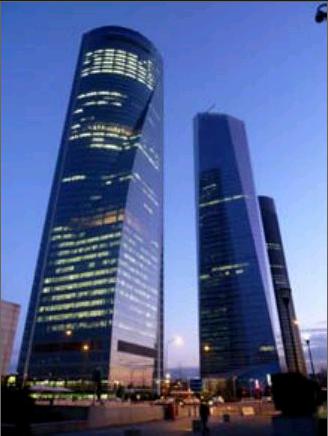

The lingering depression in Chinas property market has forced many Chinese property companies to make overseas investment. At the beginning of this year, Greenland, Wanda and Country Garden totally threw 53 billion yuan into the property projects in London and Australia. In mid-June, Wanda spent 265 million euros acquiring Torre Espacio, the landmark building in Madrid.

Jones Lang LaSalles research report showed that Chinese property developers were also actively seeking the opportunities of overseas investment to deal with the slowdown of the economic growth and property development in China. In 2013, the Chinese property developers invest US$7.6 billion in total in the overseas market, up 124% year on year. In 2011 and 2012, the figure was respectively US$2.9 billion and US$3.3 billion.

In 2014, the overseas investment Chinese property companies made kept soaring. In the first quarter of 2014, the Chinese institutional investors input in the overseas property projects increased by 80% year on year. The British, American and Australian enterprises are the most favorable for Chinese investors.

Xia Yangyang, director of the China Region of Jones Lang LaSalle, said that the Chinese institutional investors, which have enough money, will keep their enthusiasm in the overseas property projects. The total investment into overseas property projects from China is expected to surpass US$10 billion in 2014.

When the Chinese property developers are actively investing in the overseas market, the foreign property projects are also looking for ways to get more Chinese capital to boost local economic development. Some of foreign companies even chose to work with Chinese companies in the property development.

In mid-June, a delegation led by Charlie Cornish, CEO Of Manchester Airport Group, visited Beijing, Tianjin, Shanghai and Shenzhen to introduce the Chinese migrant investors about the investment opportunities in the Manchester Airport City, the said largest reconstruction project in the UK.

Last October, Beijing Construction Engineering Group Co., Ltd became the partner of Manchester Airport City. It was given 20% of the projects stocks and will work with British architecture company Carillion and Greater Manchester Pension Fund to develop this project. The total investment amounted to 800 million pounds and a 5-millionsquare-foot commercial area is going to be built around the Manchester airport.

Xing Yan, General manager of the International Construction Department at Beijing Construction Engineering Group, said that the Manchester Airport City was the largest project in the UK after London Olympic Games. The business pattern in the northwestern part of the UK will change thanks to the influence of the project.

“We choose this project in Manchester because of low risks in the UK. Though the return on investment might not be high, the return is available and sustainable for a long while. Meanwhile, we hope to expand ourselves in the British and European market with this project,” said Xing Yan.

China owns great potential in the gold market

While present in the Global Gold Summit in Vancouver on June 18, Song Xin, General Manager of China Gold Group, said that the gold market in China had great potentials.

During his speech in the event, Song Xin said that consumption volume of gold per capita is only one fifth of the average level in the world or one tenth of that in developed countries. Therefore, there is great potential in Chinas gold market.

According to him, though the output of gold of China was the largest in the world in the past seven years, it is far from the demand of Chinese consumers. According to the statistical data, the consumption volume of gold increased by 41% last year to 1176 tons in 2013, much larger than the 428-ton output of this country. This also made China surpass India as the largest consumer of gold in the world.

Song Xin said that the young consumers of China spend more money on gold. In his opinion, this trend will ensure the continuous growth of the gold industry with the increasingly vigorous investment and consumption. The industrial structure will be better and the Chinese gold market is going to make more contributions to the world.