OPINION Sustained Yuan Appreciation Unlikely

2014-03-18

Recently, the continued depreciation of the yuan has aroused extensive attention. Some think it was the result of intervention by the Peoples Bank of China, the countrys central bank, to pour cold water on expectations of renminbi appreciation. If its true, the central bank has set out to make preparations for prospective exchange rate reform.

According to the report on the implementation of monetary policies in the fourth quarter of 2013, the central bank would further improve the renminbi exchange rate formation mechanism by highlighting the role of the market in affecting exchange rates and enhancing the flexibility of the two-way movement of the exchange rate.

From the launch of the exchange rate reform to the end of 2013, the renminbi exchange rate against the U.S. dollar rose 35.7 percent, while Chinas consumer price index(CPI) grew at an annual average rate of 3.1 percent. In 2013, the renminbi exchange rate increased by 3 percent, three times as fast as that in 2012. The upward trend didnt come to an end until February 2014.

Theoretically speaking, when the renminbi appreciates, its purchasing power will be strengthened, and the cost of imports will be lowered, which would greatly benefit domestic consumers. However, this is far from the truth. In reality, the renminbi keeps depreciating in the domestic market.

Why does this happen? The divergence mirrors the distortion of renminbi exchange rates and probable human intervention. There are also significant errors in the statistics of renminbi purchasing power and consumer prices.

The above-mentioned two factors have combined to push the renminbi to appreciate externally and depreciate internally. This will encourage capital outflows or more specifically, wealth exports. As a result, China is forced to invest heavily in the overseas market. For instance, Chinas non-financial foreign direct investment hit $90.17 billion in 2013. In addition, hordes of Chinese have immigrated to other countries, which is a type of private foreign investment under the foreign exchange control.

Whats worth mentioning is that numerous Chinese enterprises have turned to the overseas market for survival. In 2013, among the BRICS countries, only China saw its real effective exchange rate boom, while the other four countries—Brazil, Russia, India and South Africa—witnessed depreciation.

Although Chinas trade surplus has continued to grow over the past few years, due to the renminbis appreciation, its manufacturing industry has become less and less attractive to foreign investors. Now, members of the Association of Southeast Asian Nations (ASEAN) have morphed into new destinations for Chinese enterprises. In fact, many Taiwanese businesses have moved part of their production lines from China to Southeast Asian countries like Viet Nam.endprint

Under such circumstances, it is urgent that exchange rates be exposed to market supply and demand, and that the flexibility of the two-way movement be intensified. Generally speaking, the renminbi will not maintain an upward trend in 2014.

Firstly, the unsteady nature of the global economic recovery and uncertainties brought by the U.S. withdrawal of quantitative easing are pushing the currencies of emerging countries to depreciate. Secondly, there are still risks of economic downturn in China. Thirdly, international capital may flee China because of the ongoing economic transformation and optimistic expectations for the U.S. and EU economies. Fourthly, Chinese enterprises have been severely affected by the renminbis appreciation, and its time to give them some breathing space. n

NUMBERS

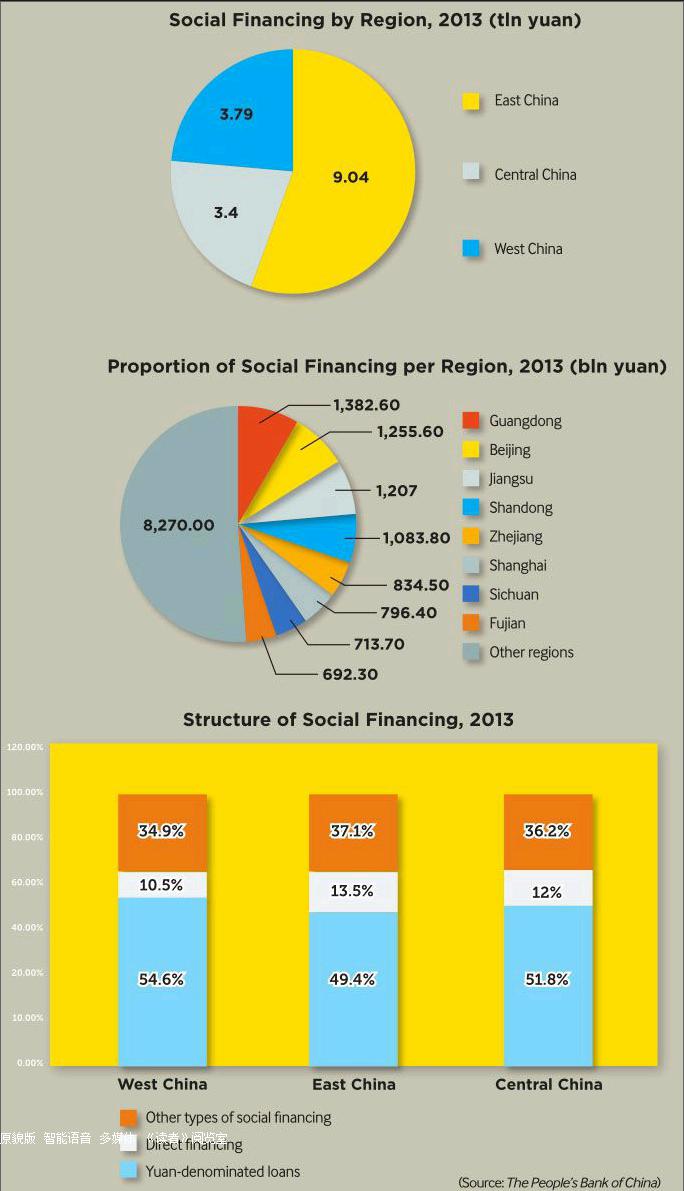

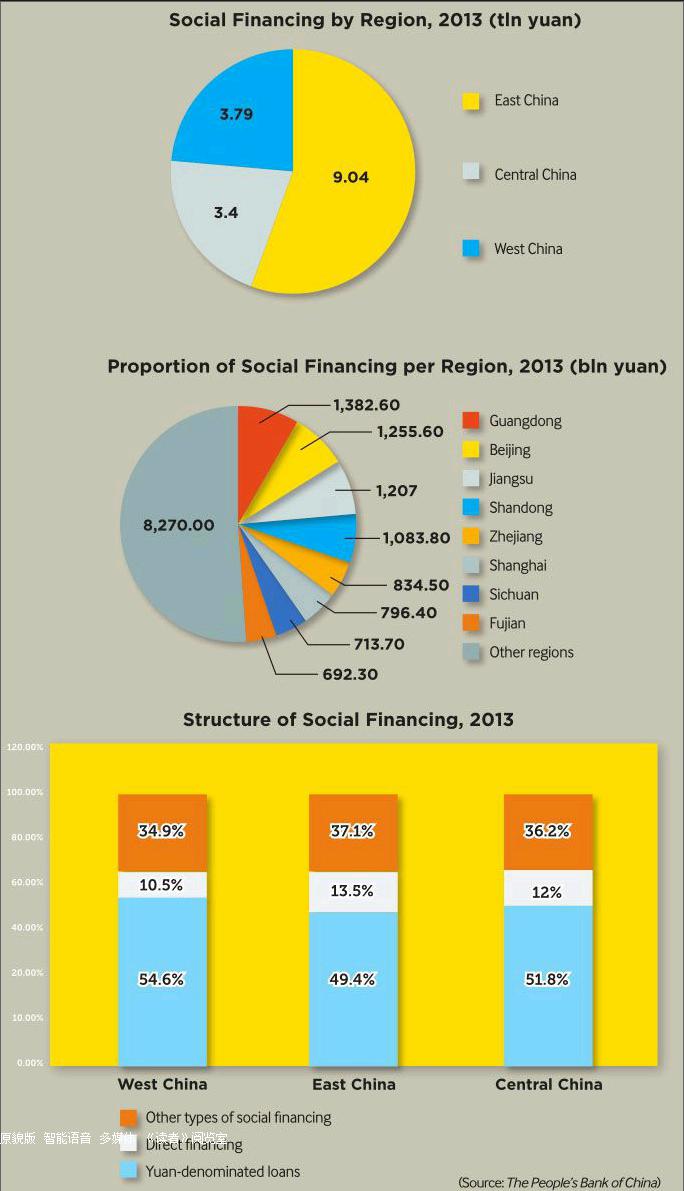

3.79 tln yuan

The size of social financing in west China in 2013

7.97 tln yuan

The total amount of social financing n 2013

13.5 %

The rate of direct financing against total social financing in east China in 2013

THE MARKETS

Offshore Yuan Bonds

The International Finance Corp. (IFC), a member of the World Bank Group, will issue yuandenominated bonds worth 1 billion yuan ($165 million) in London in March.

As IFC Vice President Hua Jingdong said, the move is aimed at increasing foreign investment in China.

It indicates a strong demand from international investors for offshore yuandenominated bonds, and will serve as an alternative source of renminbi funding for investment in China, he said.

China has been trying to introduce the yuan into the global market in an unprecedented fashion. It began to push the currency through cross-border trade settlement in June 2009.

Since that year, China has promoted the internationalization of the yuan by facilitating international trade and investment denominated and settled in renminbi, encouraging offshore yuan service centers to develop offshore yuan-denominated financial products, and encouraging central banks to hold the currency as part of their foreign exchange reserves.

A Probable IPO

Sina Weibo, Chinas version of Twitter, is planning a stock market listing in New York“relatively soon,” a source told Xinhua News Agency on February 25.

The initial public offering (IPO), which will look to raise about $500 million, is scheduled for the first half of the year, possibly in May.

For the fourth quarter of 2013, Weibos total revenues reached $71.4 million, up 151 percent year on year and 33.7 percent quarter on quarter, resulting in a profit of $3 million, according to Sina, one of the major Web portals in China.

The planned listing comes at a tricky time for Weibo, as microblogging is seemingly in decline because of competition from the more private mobile messaging apps like Tencent Holdings Ltd.s WeChat, or weixin, in China.endprint