Telecom Giant Under a Cloud

2014-03-18ByDengYaqing

By+Deng+Yaqing

One out of every three Chinese people is a mobile Internet user. Its huge population combined with its constantly ascending economic status spells an inspiring future for the smartphone sector, where Qualcomm Inc., a world leader in 3G, 4G and next-generation wireless technologies, dominates the market by producing high-quality chipsets. Yet, the company seems to have run into a stone wall as of late.

As early as last November, Chinas National Development and Reform Commission(NDRC), the countrys top economic planner, commenced an anti-monopoly probe into Qualcomms business in Beijing and Shanghai, on the basis of accusations of possible abuses of intellectual property rights.

The NDRC revealed that Chinese mobile phone vendors had to pay Qualcomm 1-6 percent of each mobile phones cost as a patent licensing fee, not counting chipset charges.

The investigation was first sparked by condemnation from the China Mobile Phone Alliance (CMPA) under the China Communication Industry Association, which claimed that Qualcomms business model had severely undermined Chinas mobile phone industry by overcharging its Chinese clients.

When patent holders charge exorbitant fees, there is nothing left for the Chinese mobile industry but manufacturing, said Wang Yanhui, Secretary General of CMPA, in an interview with China Central Television.

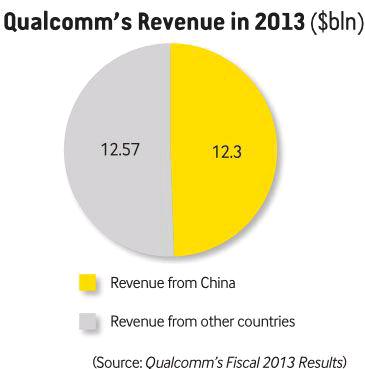

Established in 1985, Qualcomm is known for being the inventor of a digital wireless technology named Code Division Multiple Access (CDMA), the core component of some major 3G telecommunications standards such as Wideband Code Division Multiple Access. In 2013, Qualcomms revenue rose 30 percent to $24.87 billion, with$7.88 billion coming from patents.

The telecom giant, hitherto, has maintained the lions share of Chinas mobile phone chip market, and its client list includes most Chinese mobile phone makers, such as Lenovo Group Co. Ltd., telecom equipment producers Huawei Technologies Co. Ltd. and ZTE Corp.

Paying the price

Maintaining a market share of 30 percent in the international market, it is not the first time that Qualcomm has been involved in an antitrust dispute. As early as 2005, in response to accusations from Nokia and Ericsson on the over-pricing of patent licensing, the European Union had initiated an anti-monopoly investigation against the U.S. telecom magnate that went on to span four years.endprint

In 2006, South Korea launched similar probes into its business. Eventually, the Korea Fair Trade Commission confirmed the allegation that Qualcomm discriminately overcharged some of its clients and wrote out a check for roughly $252 million.

As a matter of fact, in 2009, some domestic mobile phone vendors accused Qualcomm of practicing unfair competition by abusing its advantageous market position, and asked to be treated according to the FRAND principle—fair, reasonable, and non-discriminatory terms. However, at that time, China had just enacted the Anti-Monopoly Law, and still lacked the experience and resources necessary to crack down on illegal market operation and behavior.

As Chinas Anti-Monopoly Law stipulates, fines can range from 1-10 percent of a companys revenue for the previous fiscal year. Given that Qualcomm registered sales of$12.3 billion in China in the fiscal year ended in September 2013, the fine could be as high as $1 billion.

Hu Gang, a lawyer for China ConsumersAssociation, believed Qualcomm was likely to have a heavy fine imposed on them, for the NDRC needs only to prove that Qualcomm earned profits through pricefixing tactics, and such evidence could be quite easily be gleaned and collected from contracts and emails.

Hu claimed the government should focus on creating an open and transparent trade environment to safeguard consumers Part suppliers like Qualcomm that are in the higher end of the industrial chain can substan tially affect product prices, he said.

.-

Its pricing pattern would undoubtedly place a stumbling block on Chinas road toward the 4G era. If it is established that the company engaged in monopoly behavior, Qualcomm may be forced to make some adjustments, meaning lower production costs for domestic mobile phone vendors, noted Xiang Ligang, CEO of a telecommunications portal website CCTime.

Self-dependence

As the proverb goes in the business world, top enterprises set the rules, second-class enterprises build up brands, and inferior ones earn a living by churning out products. In order to remove the obstacles on its 4G path, China needs to depend on itself by developing its own core technologies.

“Now, domestic manufacturers still cannot parallel their overseas rivals in chipset production. Except Huawei, 90 percent of domestic mobile phone makers have to rely on purchases from Qualcomm and MediaTek,” Song Yongjun, a chief consultant with Teler Telecom Consulting, told China Quality Daily.endprint