Is investment-cashflow sensitivity a good measure of financial constraints?

2011-06-27HualinWanKaiZhu

Hualin Wan,Kai Zhu

aSchool of Accounting and Finance,Shanghai Lixin University of Commerce,China

bSchool of Accounting,Shanghai University of Finance and Economics,China

Is investment-cashflow sensitivity a good measure of financial constraints?

Hualin Wana,*,Kai Zhub

aSchool of Accounting and Finance,Shanghai Lixin University of Commerce,China

bSchool of Accounting,Shanghai University of Finance and Economics,China

A R T I C L E I N F O

Article history:

2010

Accepted 22 July 2011

Available online

8 December 2011

JEL classification:

C5

H25

Investment-cashflow

sensitivity

Financial constraints

Tax reform

Since Fazzari et al.(1988),investment-cashflow sensitivity has been one of the most important indicators for testing and measuring the external financial constraints of corporations.This study analyzes the effect of changes in the relative cost of internal and external financing on investment decisions in response to tax changes.China’s 2004 VAT reform decreased companies’effective tax rates, leading to an increase in operating cashflow.This,in turn, reduced the internal cost of financing and the value of the tax shield and increased the cost of debt financing.This study shows that in the case of the VAT reform,investment-cashflow sensitivity increased significantly,whereas cash holdings-cashflow sensitivity and borrowing-slack sensitivity did not significantly change.We conclude that investment-cashflow sensitivity is not an effective measure of financial constraints under information asymmetry,butcash-cashflow sensitivity and borrowing-slack sensitivity may be useful alternatives.

Ⓒ2011 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong. Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

This paper investigates the internal validity of investment-cashflow sensitivity to measure financial constraints under information asymmetry,using the opportunity provided by the Value Added Tax(VAT)reform in China.Since Fazzari et al.(1988),investmentcashflow sensitivity has been one of the most important indicators used to measure financial constraints and one of the basic models used to test Myers and Majluf’s(1984)pecking order hypothesis.Fazzari et al.(1988)state that if there is no difference between the cost of internal and external financing,investment and financing is irrelevant.However,the presence of information asymmetry increases the relative cost of external financing.The higher the degree of information asymmetry,the greater the external financial constraints and investment will rely more on internal financing,i.e.,operating cashflow.Therefore, investment-cashflow sensitivity can be used to measure financial constraints under information asymmetry.

However,Poterba(1988),Cleary(1999),Erickson and Whited(2000),Kaplan and Zingales(1997,2000),Almeida et al.(2004),Alti(2003)and Bushman et al.(2008)have questioned the validity of this indicator from different perspectives.Based on an analytical model,Kaplan and Zingales(1997,2000)show that investment-cashflow sensitivity cannot effectively measure the cost of external financial constraints.Bushman et al. (2008)argue that the existing investment-cashflow sensitivity model actually reflects the correlation between investment in fixed assets and working capital.As a result,these authors have proposed competing indicators.

This study uses an exogenous event,VAT reform,to investigate the internal validity of investment-cashflow sensitivity as a measure of financial constraints.Internal validity is the ability of a research design to rule out other theories.The stronger the exclusiveness of the research design,the higher the internal validity.Although previous studies assume that a company’s operating cashflow is given,operating cashflow is affected by both the profitability of a company and the level of corporate taxes.Under tax reform,companies receive tax subsidies and their operating cashflow increases.If firms invest more and there is an increasing relationship between investment and operating cashflow,this obviously cannot be explained by changes in the company’s financial constraints under information asymmetry.Exogenous tax reform seldom changes the inherent information asymmetry between companies and capital markets,including financial constraints.It does,however, change the extent to which investment decisions depend on operating cashflows.If so, investment-cashflow sensitivity may not always reflect the status of information asymmetry-based external financial constraints,i.e.it is a measure with less internal validity.

The remainder of the paper is organized as follows.Section 2 reviews the existing literature.Section 3 presents our hypothesis development.Section 4 provides the sample selection and description of variables.Section 5 presents the empirical test results and analysis,and Section 6 concludes.

2.Literature review

In frictionless capital markets,there is no difference between internal and external financing costs,which implies that there is no relationship between investment and financing.It is also a basic assumption of Modigliani and Miller’s(1958)capital structure irrelevance theory.However,under asymmetric information(Akerlof,1970),external financing will cause adverse selection and reduce firm value.Therefore,companies have to give priority to internal financing,then to debt financing and finally to equity financing, which is called pecking order theory(Myers and Majluf,1984).

Pecking order theory and trade-off theory are two competing views on capital structure and many studies have focused on which theory has more explanatory power(Fama and French,2002;Shyam-Sunder and Myers,1999;Frank and Goyal,2000,2008).Other studies have tested the extended pecking order hypothesis,for example,the market reaction to SEOs(Smith,1986;Eckbo et al.,2006)and the financial constraints hypothesis(Smith, 1986;Eckbo et al.,2006).

In their seminal paper,Fazzari et al.(1988)argue that pecking order theory can explain companies’investment behavior when facing external financial constraints.Information asymmetry and agency costs increase the cost of external financing.To minimize the cost of capital,companies will prefer internal financing from their operating cashflow.When a company’s operating cashflow cannot meet its investment needs,the company will turn to external financing.Therefore,the higher the investment-cashflow sensitivity,the higher the implicit costs of external financing and the higher the financial constraints.Investment-cashflow sensitivity has been used as an important measure of financial constraints in finance and accounting research(Biddle and Hilar,2006;Beatty et al.,2007;Cleary et al., 2007;Lyandres,2007;Polk and Sapienza,2008;Pulvino and Tarhan,2006;McNichols and Stubben,2008).

Although the theory of financial constraints is widely accepted by scholars,there is considerable controversy about the validity of using investment-cashflow sensitivity as a proxy.Kaplan and Zingales(1997,2000)show that after controlling for growth opportunities,the relationship between investment and operating cashflow is uncertain.Bushman et al.(2008)argue that changes in operating cashflow and increased investment in fixed assets must be accompanied by an increase in working capital.Therefore,the investment-cashflow sensitivity may reflect,to a certain extent,the relationship between investment in fixed assets and working capital.This is a natural phenomenon arising from the expansion of a company’s investment and it cannot be used to explain the company’s cost of external financing.

Chinese scholars have conducted several studies to examine whether investmentcashflow sensitivity can be used to measure the financial constraints of listed companies in China,with inconsistent conclusions.Feng(1999)divide their sample into two groups according to the existence and non-existence of financial constraints,using the standard of whether the company is one of the 300 pivotal enterprises appointed by the State Economic and Trade Commission,one of the 212 companies organized under the main bank system’s support,or one of the 120 state pivotal enterprise groups.They investigate the effect of cashflow on investment levels in these samples and find that governmentsponsored enterprises are almost free from internal cashflow.Wei and Liu(2004)show that financial constraints and investment-cashflow sensitivity have a significant positive relationship.Guo and Ma(2009)find that compared with state-owned listed companies,private companies’investments have higher cashflow sensitivity and investmentcashflow sensitivity is greater during periods of low bank lending rates than during periods of high bank lending rates.On the contrary,Guo and He(2008)find that investment-cashflow sensitivity has a non-binding relationship with financial constraints,in a sample divided according to the level of state ownership,return on net assets and enterprise size.

Academics have also studied the factors affecting financial constraints.For example,Lian and Cheng(2007)find that companies with fewer financial constraints show a stronger investment-cashflow sensitivity and tend to over-invest.Whereas companies facing more serious financial constraints suffer from under-investment,with information asymmetry as the main cause of cash flow sensitivity.Wang et al.(2008)con firm that higher corporate financial constraints are linked to higher investment-cash flow sensitivity,but they find that asymmetric information theory cannot fully explain the relationship between financial constraints and investment-cash flow sensitivity.

These mixed findings are likely due to engoneneity problems and fail to take into account China’s tax system and its reforms,which could lead to measurement bias when using investment-cash flow sensitivity to measure financial constraints.Based on the results of our analytical model,we find that investment-cash flow sensitivity increases during the tax reform,which is indicative of increased financial constraints.We also compare this result to some other measurements of financial constraints to identify more robust measures.

3.Hypothesis development

3.1.Institutional background of VAT reform

To minimize endogeneity problems,we use China’s VAT reform pilot in 2004 and analyze its effect on investment-cashflow sensitivity.VAT has been the most important source of revenue,accounting for more than 35%of state tax revenues since 1994.From 1994 to 2008,production-based VAT,calculated as sales revenue minus the purchasing cost of raw materials was implemented in China.

In 2004,the Ministry of Finance and State Administration of Taxation issued‘‘Several Issues on Value-Added Tax Provisions in Northeast China’’(Tax[2004]No.156),allowing general taxpayers in six industries in Northeast China(including Heilongjiang,Jilin,and Liaoning Province)to recover input VAT on purchases of fixed assets.This was a pilot for changing from production-based VAT to consumption-based VAT(hereinafter abbreviated as the VAT pilot)beginning in July 2004.In 2005,the input tax deduction from fixed assets changed from an incremental deduction to a full deduction.In 2006,the pilot was expanded to Central and Western China.In January 2009,the VAT reform was implemented nationwide.

There are several advantages in studying the VAT pilot in China:(1)As a national policy, VAT is completely exogenous to corporate decision-making which avoids endogeneity issues.At the same time,it is unlikely to affect the information asymmetry between capital markets and companies,or at least will not lead to an increase in information asymmetry. (2)The pilot was implemented only in Northeast China,leaving companies in other regions still facing production-based VAT,providing a natural control sample.(3)Value-Added Tax should change neither the company’s investment spending nor its incometax rate,1Since the income tax reform in 2008,the change in the tax rate affects the company’s future pro fitability and external financing tax shield while changing the company’s cost of external financing.As this situation does not provide a clean experimental environment,we did not use the comprehensive VAT reform in 2009 as the research event in this study.The value-added tax reform in 2004 can better explore the relationships between the pilot sample companies and investment financing when the income tax remains unchanged.therefore the VAT reform should primarily affect operating cashflows in the current period,namely internal financing costs,without affecting external financing costs.2The VAT reform reduces future operating cash flows.Investors will decrease the expected future earnings of current investment,which leads to higher financing costs,but will also expect the return on investment of projects to change due to lower investment costs and higher revenue under the VAT reform.Therefore,these factors do not directly result in future expectation declines and higher external finance costs.In addition,the reduction in internal financing does not mean that financial constraints increase,particularly as the result of an increase in information asymmetry.As emphasized in the classical theory of financial constraints,it is information asymmetry that results in the cost difference between internal and external financing.Under the VAT reform,there is no reason to believe that an increase in investment-cash flow sensitivity is due to asymmetric information.Based on the above features,if there is a significant change in investment-cashflow under the VAT reform,it will challenge the internal validity of investment-cashflow sensitivity as proxy for financial constraints.3Tax subsidies may lead to increased pro fitability,and thus banks should be more willing to provide loans to businesses. Revitalization of the Northeast should then lead to companies having easier access to bank loans.These effects will result in a reduction in corporate financial constraints,but will not result in an increase in financial constraints based on the investmentcash flow model.Therefore,the effect of these factors is a‘‘bias against’’,and will not affect the conclusions of this study.The study is also based on previous research on the measurement of financial constraints.We examine the time-series variation of the dividend policy,asset-liability ratio and the average cash holdings in the pilot areas and non-pilot areas,and we do not find any systematic differences around the existence of the pilot in different regions.The descriptive evidence suggests that events that are exogenous to the VAT reform do not lead to an increase in financial constraints.

3.2.VAT and investment-cashflow sensitivity

As mentioned earlier,China implemented production-based VAT before the Value-Added Tax reform,and does not allow companies to recover input tax on the purchase of fixed assets from the output tax on products and services in the same period.Because China’s VAT is based on prices excluding tax,VAT is not part of current costs and is not reflected in the income statement,thus it will not affect income tax payable in the current period.Although firms are not allowed to recover the VAT on fixed assets,it can be included in the initial value of fixed assets.Thus,VAT will reduce income tax liability in the future period through depreciation,thereby reducing corporate income tax costs.Thus, under production-based VAT,product sales and VAT on raw materials will not affect the company’s operating profit and operating cashflow.Input VAT on the purchase of fixed assets does not affect the company’s procurement operating cashflow,but can increase future operating cashflow by increasing depreciation.

Under production-based VAT,the company’s operating cashflow after tax and the VAT due after making an investment can be expressed as follows:

where NI1represents net profit after tax;FC1represents the amount of depreciation of investments for each year of operation under production-based VAT;S is sales revenue; VC is raw material costs;and I is the amount of investment in fixed assets.The corporate income tax rate and VAT tax rate are expressed asτc,τv,respectively,assuming fixed assetinvestment is entirely from internal financing.Using straight-line depreciation,the depreciation period is N.Because sales(purchases)receive(pay)an equivalent output tax(input tax),VAT does not affect the company’s current operating cashflow.

Under the consumption-based VAT system,VAT input tax(hereinafter abbreviated as input tax)on the purchase of fixed assets can be recovered in the current period,which directly reduces the company’s current Value-Added Tax expenditure and increases the company’s current operating cashflow.At the same time,because VAT is not included in the initial value of fixed assets,this leads to a reduction in depreciation,directly increasing the company’s profitability and income tax expense during the period and reducing future operating cashflow.

Under consumption-based VAT,the company’s operating cashflow after tax and VAT on investment management can be expressed as

where NI2refers to net profit after tax,and FC2represents the amount of depreciation during each operating year after an investment is made under consumption-based VAT.

Clearly,compared with Eq.(1),VAT is not included in the depreciation of fixed assets, therefore the operating cashflow declines during the period under consumption-based VAT.The marginal decline is

However,under the consumption-based VAT system,VAT on fixed assets is deductible in the current period,which directly increases the operating cashflow of the current period:

The effect of the VAT reform on net operating cashflow is then

where R is the discount rate.The remaining variables are defined earlier.

Eq.(5)has two important implications:First,the VAT reform,in essence,reduces the cost of investment by way of tax subsidies,which has a positive effect.Second,the depreciation of fixed assets decreases after the VAT reform,thereby reducing future operating cashflows,which has a negative effect.As the income tax rate is always less than 1,the VAT reform can directly increase the companies’operating cashflows.This means that the VAT reform can directly increase companies’current operating cashflow.

3.3.Analysis of the effect of VAT transform on investment-cashflow sensitivity

To determine whether the VAT reform affects companies’investment-cashflow sensitivity,based on Kaplan and Zingales(1997),we set the investment objective function as

C refers to financial constraints,a convex function of investment,which means the first derivative is greater than 0 and the second derivative is greater than 0.F is the returnfunction of the investment,which is concave,thus the first derivative is greater than 0 and the second derivative is less than 0.E represents the amount of external financing,that is, I=E+W,where W is internal operating cashflow.K is the difference between the cost of external financing and internal financing.To maximize investment gains,F(I),the scale of investment I should be:

where the first and the second subscript refer to the first derivative and second derivative of I(and hereinafter).

The scale of the effect of internal financing capacity on investment can be obtained by the implicit functional derivative of Eq.(7):

Because C is a convex function and F is a concave function,investment and operating cash flow have a positive relationship in an incomplete market.

Clearly,if(9)>(8),the VAT reform will increase the company’s investment-cashflow sensitivity.Thus,this paper proposes the following research hypothesis:

Hypothesis.The VAT reform significantly increases companies’investment-cashflow sensitivity.

4.Sample selection and variable definitions

4.1.Sample and control sample selection

The sample is selected from A-share companies listed on China’s stock exchanges and data is extracted from the CCER database.To isolate the influence of the VAT reform,we refer to the methodology used by Aharony et al.(2000).The sample period is from 2001 to 2006.Enterprises in the three Northeastern provinces(Jilin,Liaoning,Heilongjiang)that meet the conditions are selected as the research sample,and enterprises that meet the conditions and are from other areas are selected as the control sample.We investigate whether investment-cashflow sensitivities increased significantly in listed companies from the three Northeast provinces following the VAT reform.

To ensure the validity of our conclusions,we exclude the following firm-year data:

(1)All companies in industries that were unaffected by the VAT reform.Because only certain industries enjoyed the benefits of the input-VAT deduction,non-related industries are not in our research scope and are thus eliminated.We refer to The Listed Company Industry Guidelines released in April 2001 by the China Securities Regulatory Commission for the VAT reform-related or non-related industry base.The VAT reform-related industries are divided according to the State Administration of Taxation [2004]156 date file,including equipment manufacturing,petrochemical,metallurgy, shipping manufacturing,ship and floating device manufacturing,automobile manufacturing,and agricultural product processing.Because the industry codes for some listed companies in the existing database are unclear,which may influence the accuracy of the conclusions,we also remove this data.5These industries are‘‘communication equipment,computer and other electronic equipment manufacturing’’,which does not affect the conclusions of this paper.Only the significance of the full sample regression is affected,whereas the divided sample regression results remain unchanged.

(2)Companies with missing firm-year data between 2001 and 2006.Excluding these companies ensures that all sample firms have observations before and after the VAT reform,and also balances the panel data to ensure the samples are fully comparable.We therefore rule out the possibility that the research conclusions result from differences in the samples before and after the VAT reforms.

Following the above selection process,our sample includes 2352 firm-year observations from 392 companies.A total of 228 firm-year observations from 38 companies are from the three Northeastern provinces and 2124 firm-year observations from 354 companies are from other locations.Table 1 shows the industry distribution of the samples.The equipment manufacturing industry is the largest sector,with 528 observations,and transportation and equipment manufacturing is the smallest,with 192 observations.Thus,the sample selected in our research is representative.

Table 1Sample distribution by industry.a

4.2.Variable definitions

4.2.1.Dependent variable

In the paper,we use‘‘cash payout in the acquisition and construction of fixed assets, intangible assets and other long-term assets’’divided by total assets at the beginning of each year as a measure of fixed asset investment,6In this paper,we also test a different method for measuring the scale of fixed asset investment.The conclusions do not change significantly.presented as lnv.After the VAT re-form,the investment variables do not include VAT in the Northeast area investment but VAT is included in the other areas.In the descriptive statistics,we also examine the investment in the Northeast multiplied by 1.17 to eliminate the effect of the inconsistency between the variables.We also use the above adjusted data in the regressions.

4.2.2.Main explanatory variables

We define enterprise operating cashflow as‘‘net operating cashflow+tax fee paid+tax returned from the government’’divided by total assets at the beginning of each year,7Tax payments and returns are not included in operating cashflow,because tax may be affected by the different tax rates and tax policies in different regions and also because tax is not controllable for the enterprise.The cashflow computed in this way is more comparable.In a robustness check,we also use the operating cashflow without adjusting tax as the independent variable, and the conclusions are unchanged.presented as Opcash.

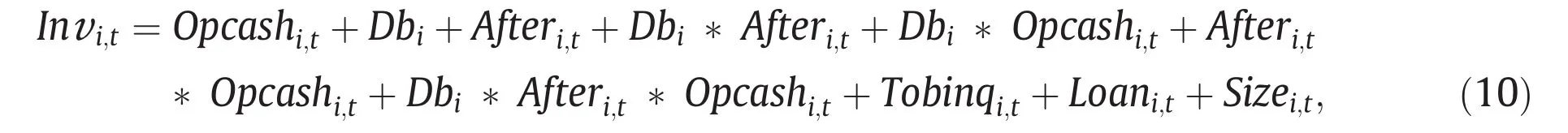

According to the theoretical analysis in this paper,the VAT reform should increase the operating cash flow in that period,and will also increase the investment and cash flow sensitivities.Thus,we expect the VAT reform to signi ficantly increase the investment-cashflow sensitivities in Northeast listed companies after 2004.In this paper we focus on whether investment-cash flow sensitivity is signi ficantly greater than 0 in the Northeast listed companies after 2004.We de fine‘‘After’’as a dummy variable that equals 1 for the years after 2004,and 0 otherwise.‘‘Db’’is a dummy variable that equals 1 if a firm is located in the Northeast,and 0 otherwise.We investigate whether the coef ficient of Db*After*Opcash is significantly greater than 0.

To ensure the completeness of the model,we also interact each pair of Opcash,Db and After.However,these interactions are not the focus of this study and we do not forecast the directions of these interactions.

4.2.3.Control variables

Based on previous studies,we include the following control variables:(1)Tobinq is used as the proxy for growth.The higher the growth,the greater the opportunities for investment and the more likely that firms are to invest in fixed assets.We expect Tobinq and investment to be positively related.(2)Size is measured as the logarithm of total assets at the beginning of the year,which is used to control for scale.(3)Loan equals companies’long-term liabilities(long-term loans plus bonds payable)divided by total assets at the beginning of each year.Myers(1977)insists that the stronger the debt constraint,the weaker the will to invest.According to the debt bonding theory,this variable should be negatively related to investment.However,because of the widespread soft budget constraints in China’s state-owned enterprises,it may be negatively correlated with investment.(4)New loans(Loanchg)are measured as the change in loans divided by total assets at the beginning of each year(loans=short-term borrowing+short-term bonds+-long-term debt due within 1 year+long-term loans+bonds payable).8When we compute company loans using only bank loans(long term loans+short term loans)and use it to calculate debt constraints(loan)and increased loans(Loanchg),the conclusions are unchanged.When a company’s investment increases,it usually increases loan financing at the same time,so we expect this variable and investment to be positively related.

4.2.4.Other variables

To further test related theories,we also use the following variables.(1)Cash holding (Cashchg):measured as the change in cash and cash equivalents divided by total assetsat the beginning of each year.(2)Financial slack(Deficit):Shyam-Sunder and Myers(1999) measure financial slack as‘‘dividend payment+capital expenditure+change in operating funds+long term loans due within 1 year-operating cashflow.’’However,they were interested in the influence of financial demands on long-term debt,whereas in this paper we are interested in the effect of internal financial demands on enterprise credit capacity. To better meet the requirements for testing financial constraint theory,we measure it as‘‘(dividend payment+capital expenditure+change in operating funds+long-term loans due within 1 year-operating cashflow)/total assets at the beginning of each year.’’Dividend payment is derived from‘‘cash dividends,distributed profits and interest payments’’in the cash-flow statement,capital expenditure is derived from‘‘cash payouts for the acquisition and construction of fixed assets,intangible assets and other long-term assets’’, change in operating funds is derived from‘‘decrease in inventory+decrease in operating receivables+increase in operating payables’’in the cash-flow statement,and operating cashflow is derived from‘‘net cashflow from operating activities’’in the cash-flow statement.

The main regression model is as follows:

where subscript i represents companies and subscript t represents years.

4.3.Descriptive statistics and correlation analysis

Table 2 presents the descriptive statistics.To avoid the possibility that extreme values may affect the conclusions,the continuous variables are winsorized at the 1%level.The investment ratio(Inv,investment divided by total assets at the beginning of each year, hereafter abbreviated as the proportion of investment)has a mean of 0.063,a median of 0.042 and a standard deviation of 0.066.The operating cashflow percentage(Opcash), the main explanatory variable,has an average of 0.062,a median of 0.057 and a standard deviation of 0.079.This highlights the considerable difference in investment and operating cashflow among the sample companies.

The average proportion of debt in relation to total assets(Loan)is 0.053,whereas the average change in debt(Loanchg)is 0.034,which indicates an increasing trend for company debt.The average of Deficit is 0.045,which demonstrates that most companies cannot satisfy their investment requirements from their own funds,thus they need to resort to outside funding.The average of Tobinq is 2.218 and the average of size is 9.209,from which it can be inferred that the average asset size is 1 billion yuan.

Table 2Descriptive statistics(based on 2352 observations).

Table 3Pearson correlation matrix.

Fig.1.Comparison of Pearson correlations using different measures.

Table 3 presents the Pearson correlation coefficient matrix,in which there is a signif icant positive relationship between operating cashflow(Opcash)and investment(Inv), and also between loan and operating cashflow(Opcash).This finding is consistent with the previous literature.The correlation between loan and investment proportion(Inv)is 0.18,and the correlation between company scale(Size)and investment proportion(Inv) is 0.11.The correlations are significant at the 1%level(two-tailed test).

If our hypothesis is correct,the improvement in financing ability due to the VAT reform will increase firm investment.But,the relationship between investment and operating cashflow in different areas will be significantly different.We therefore examine the investment and operating cashflow relationship in different areas before and after the VAT reform(Fig.1).The figure shows that the correlation between investment and operating cashflow increases from 12%to 40%for firms in the Northeast,a 28%increase,whereas it changes from 27%to 32%in the other areas,an increase of only 5%.9Spearman correlation coefficients also produce similar results.This shows thatthe correlation between investment and operating cash flow increased more signi ficantly in firms located in the Northeast than in firms in other areas.This is consistent with our hypothesis.However,the other two measures,cash holding-cash flow sensitivity and borrowing-slack sensitivity,show no signi ficant difference between firms in the Northeast and other areas before and after the VAT reforms.

5.Empirical results and analysis

5.1.Regression analysis

Regression analysis of investment-cashflow sensitivity is shown in Table 4.According to our hypothesis,investment-cashflow sensitivity should significantly increase following the VAT reform in the Northeast,which means the regression coefficient on Db*After* Opcash should be significantly positive.

In Table 4,regardless of whether loan is included or not,the coefficient on Db*After* Opcash is 0.162 and significant at the 10%level(two-tailed).This means that as operating cashflow increased by 1%,firm investment increased by 0.162%in Northeast listed firmsafter the VAT reform.This is equivalent to 326,000 yuan(the average investment is 2.01 million yuan),which we consider to be economically significant.Thus,it can be inferred that the VAT reform had a significant influence on investment-cashflow sensitivity in the Northeast,and overall the sensitivity increased following the VAT reform.This result is consistent with our hypothesis,which stated that the VAT reform would significantly increase the sensitivity of investment and operating cashflow.

Table 4Fixed effects regression of investment-cash flow sensitivity.

The coef ficients on the control variables in Table 4 are also consistent with previous findings.The coef ficient on Tobinq is signi ficantly positive,which means that the higher the growth potential,the more opportunities that are available for investment and the bigger the scale of the investment.The coef ficient on Size is signi ficantly negative,which means the bigger the company,the smaller the relative investment scale.The coef ficient on Loan is positive but not signi ficant,which is not consistent with the loan constraints theory,but provides support for the soft budget constraints theory.Since most of the listed companies are government owned,this non-significant result is not unexpected.

Under existing theory,cash holding-cashflow sensitivity is also used to measure financial constraints,as cash holding is considered a negative investment.The result of the VAT reform is to decrease firms’cash holdings.The model to test cash holding-cashflow sensitivity is as follows:

Table 5 shows the regression results of the cash holding-cashflow model.The coefficient on Db*After*Opcash is negative but not significant,which means that cash holdings in companies in the Northeast decreased following the VAT reform.This is consistent with a decrease in financial constraints,although the result is not significant.However,we note that this result is not consistent with the result presented in Table 4.We think cash holding is affected by many other factors besides investment,such as dividend distributions, loan repayments and so forth.The correlation between cash holding and cashflow is smaller than that between investment and operating cashflow.These results suggest that the cash-holding model is better than the investment-cashflow model for measuring financial constraints.

Based on the model used by Shyam-Sunder and Myers(1999),we also use borrowingslack sensitivity to measure financial constraints.When companies are facing financial slack,they may turn either to their own funds or to external financing.External financing is influenced more by information asymmetry and changes in external financing ability can better reflect the change in financial constraints.If changes in investment-cashflow sensitivity reflect changes in financial constraints,an increase in sensitivity in the Northeast after the VAT reform should be interpreted as an increase in financial constraints.In this way,the borrowing-slack model is consistent with theory,thus external funding should decrease because it is harder to obtain external finance.The model is as follows:

The regression in column 1 of Table 6 shows that financial constraints did not increase. The coefficient on Reform*After*Deficit is positive but not significant.The coefficient is 0.085 and the T value is 0.80,which is contrary to an increase in financial constraintsand is consistent with a decrease in financial constraints after the VAT reform.Theoretically,when internal operating cash flow increases it can be used to guarantee increases in loans.To further test whether the model above is consistent with the expectations of financial constraints theory,we partition the sample by financial slack(columns 2-3 in Table 6).Theoretically,if the VAT reform alters financial constraints,then the change in constraints should be stronger in companies with more financial slack.Therefore,we would expect the sub-sample with slack above 0 to show a signi ficant result,whereas the group with slack below 0 should not.However,from the results in columns 2 and 3, we find that financial constraints are not signi ficantly affected by the VAT reform,which is contrary to the result from the investment-cash flow model.

The above tests show that when the tax rate changes,investment-cash flow sensitivity may not be an effective way to measure financial constraints.On the one hand,tax reform does not increase external financial constraints,or at least does not make financial constraints stronger.However,the signi ficant increase in investment-cash flow sensitivity reported in the regression result is not consistent with the classic theory.On the other hand,under the same tax reform,the relationship between cash holding-cash flow andborrowing-slack does not significantly change.These findings suggest that in China’s institutional setting,the latter two models may be better measures of financial constraints.Of course,the above results are not sufficient to provide full support for this conclusion,and we believe it is an open question for future research.

Table 5Fixed effects regression of cash-cash flow sensitivity.

Table 6Fixed effects regression of borrowing-slack sensitivity.

5.2.Further discussion and robustness checks

Information asymmetry,agency costs and capital market ef ficiency are the three major pillars of financial theory.Fazzari et al.(1988)point out that the investment- financial constraints model is a development of the information asymmetry model in Myers and Majluf (1984).Kaplan and Zingales(1997)criticize the effectiveness of the investment-cash flow model to re flect financial constraints under information asymmetry,although there is no indication of the actual factors and the direction of the effect.

This paper provides support for the view of Kaplan and Zingales(1997).We also argue that enterprise tax subsidies do not increase the degree of information asymmetry between enterprises and banks,nor do they result in an increase in agency costs.Although tax subsidies boost corporate cash flow through increased investment,enterprise free cash flow does not increase and therefore does not lead to an increase in agency costs. At the same time,tax subsidies do not change the governance structure of the company and related agency costs.Therefore,the results cannot be attributed to either a change in agency costs or to information asymmetry,and therefore extend and strengthen the findings of Kaplan and Zingales(1997).

Is there a potential‘‘survivorship bias’’problem from using the balanced panel data analysis in our research?Because delisting of China-listed companies is rare,the difference in the sample of balanced and non-balanced data is mainly caused by the listing time and missing data,rather than‘‘survivorship bias’’.

We also use different variable definitions.For instance,we use‘‘cash payout for acquisition and construction of fixed assets,intangible assets and other long-term assets’’minus‘‘cash received from disposal of fixed assets,intangible assets and other long-term assets’’to proxy for investment.We use the sales growth rate to replace Tobinq as a proxy for growth opportunities,and use investment data without the tax adjustment to re-analyze the data.In all cases,the above conclusions still hold.

6.Conclusions

In this paper,we explore the internal validity of investment-cashflow sensitivity as a proxy for financial constraints from both a theoretical and an empirical perspective.Since Fazzari et al.(1988),investment-cashflow sensitivity has become an important measure of financial constraints and one of the basic models used to test Myers’and Majluf (1984)pecking order theory.However,the validity of this measure has been frequently questioned(Poterba,1988;Cleary,1999;Erickson and Whited,2000;Kaplan and Zingales, 1997,2000;Almeida et al.,2004;Alti,2003;Bushman et al.,2008).These scholars have also proposed alternative measures of financial constraints from different perspectives.

This paper discusses the validity of investment-cash flow sensitivity as a measure of financial constraints under an exogenous tax reform.Our findings suggest that the VAT reform resulted in corporate investment being more dependent on operating cash flow.In other words,although the investment-cash flow sensitivity increased signi ficantly,it is not explained by companies’ financial constraints,especially those arising from increased information asymmetry.For the company and the capital market,the tax rate change caused by the VAT reform was a relatively exogenous event and should neither increase the inherent information asymmetry between the company and capital markets,nor lead to financial constraints caused by information asymmetry.However,tax rate changes affect the degree to which investment depends on operating cashflows.Therefore,the investment-cashflow relationship may not always reflect firms’external financial constraints and it may not be an effective measure of financial constraints caused by information asymmetry.

In this paper,we compare the investment-cashflow sensitivity between listed firms in the Northeast and other areas following the VAT reform in Northeast China in 2004.Our results show that following the VAT reform,investment-cashflow sensitivity increased significantly in listed companies in the Northeast.However,the regressions of cash holding-cashflow and borrowing-slack sensitivities show that financial constraints in listed companies in the Northeast did not change significantly,and this is consistent with the theory that financial constraints did not increase.

This paper has important theoretical implications.Whether investment-cash flow sensitivity is an adequate measure of financial constraints is theoretically controversial,and its effectiveness in China needs further theoretical study and empirical testing.In this paper, we explore the issue from a tax perspective and the results show that investment-cashflow sensitivity is an inadequate measure,whereas the cash-cash flow model and borrowing-slack model are relatively more effective.The implications of this paper for Chineseresearchers is that in China’s newly emerging market,investment-cash flow sensitivity is unsuitable as a measure of financial constraints.China has experienced many tax reforms since the 1980s,which will affect investment-cash flow sensitivity without changing financial constraints.This study indicates that the cash holding-cash flow and borrowing-slack sensitivity models are relatively free from tax reform in fluence and thus are better measures than investment-cash flow sensitivity.

Acknowledgments

This article is sponsored by the National Natural Science Foundation of China(Grant Nos.71102013 and 70972060),the Ministry of Finance National Accounting Leader (Reserve)Personnel Training Plan,the Humanities and Social Sciences Youth Fund from the Ministry of Education(Grant No.10YJC790242),the Key Subject Construction Program of the Shanghai Education Commission(Grant No.J51701),the Key Scientific Research Innovation Program of the Shanghai Education Commission(Grant No.11ZS187),the‘‘Dawn’’Program of the Shanghai Education Commission(Grant No.10SG54)and the Shanghai Pujiang Program.It is also part of Shanghai University of Finance and Economics’‘‘211’’major project.The authors express their appreciation to the 4th symposium of the China Journal of Accounting Research and its participants,teachers of the Accounting and Corporate Governance Project Research Department in Shanghai Lixin University of Commerce,and to the editor and anonymous reviewers for their suggestions and comments.However,the authors are responsible for all errors in the paper.

Aharony,J.,Lee,C.W.,Wong,T.J.,2000.Financial packaging of IPO firms in China.Journal of Accounting Research 38,103-126.

Akerlof,G.A.,1970.The market for‘‘lemons’’:quality uncertainty and the market mechanism.The Quarterly Journal of Economics 84,488-500.

Almeida,H.,Campello,M.,Weisbach,M.,2004.The cashflow sensitivity of cash.Journal of Finance 59,1777-1804.

Alti,A.,2003.How sensitive is investment to Cashflow when financing is frictionless?Journal of Finance 58, 707-722.

Beatty,A.,Liao,S.,Weber,J.,2007.The Effect of Private Information and Monitoring on the Role of Accounting Quality in Investment Decisions.MIT Working Paper.

Biddle,G.,Hilar,G.,2006.Accounting quality and firm-level capital investment.The Accounting Review 81, 963-982.

Bushman,R.M.,Smith,A.J.,Zhang,F.,2008.Investment-Cashflow Sensitivities are Really Investment-Investment Sensitivities.Working Paper.

Cleary,S.,1999.The relationship between firm investment and financial status.Journal of Finance 673,692.

Cleary,S.,Povel,P.,Raith,M.,2007.The U-shaped Investment Curve:theory and Evidence.Journal of Financial and Quantitative Analysis 42,1-39.

Eckbo,B.E.,Masulis,R.,Norli,O.,2006.Security offerings.In:Eckbo,B.E.et al.(Eds.),Handbook of Corporate Finance,vol.1.Elsevier,North Holland,Chapter 6.

Erickson,T.,Whited,T.,2000.Measurement error and the relationship between investment and Q.Journal of Political Economy 108,1027-1057.

Fama,E.,French,K.R.,2002.Testing trade-off and pecking order predictions about dividends and debt.Review of Financial Studies 15,1-33.

Fazzari,S.,Hubbard,R.G.,Petersen,B.,1988.Financial constraints and corporate investment.Brookings Papers on Economic Activities 141,195.

Feng,Wei,1999.The internal cashflow and enterprise investment:evidence from the financial reports of listed companies in China.Economic Science 1.(in Chinese).

Frank,M.Z.,Goyal,V.K.,2000.Testing the pecking order theory of capital structure.Journal of Financial Economics 67,217-248.

Frank,M.Z.,Goyal,V.K.,2008.Trade-off and pecking order theories of debt.In:Eckbo,B.E.et al.(Eds.), Handbook of Corporate Finance,vol.2.Elsevier,North Holland,Chapter 12.

Guo,Jianqiang,He,QingSong,2008.Can investment-cashflow sensitivity reflect financial constraints? Empirical study based on Chinese background.Industry Economic Review 4(in Chinese).

Guo,Lihong,Ma,Wenjie,2009.Reinspection of financial constraints and enterprise investment-cashflow sensitivity:evidence from China listed companies.The World Economy 2.(in Chinese).

Kaplan,S.,Zingales,L.,1997.Do investment-cashflow sensitivities provide useful measures of financial constraints?Quarterly Journal of Economics 169,215.

Kaplan,S.,Zingales,L.,2000.Investment-cashflow sensitivities are not valid measures of financial constraints. Quarterly Journal of Economics 707,712.

Lian,Yujun,Cheng,Jian,2007.Investment-cashflow sensitivity:financial constraints or agency cost?Journal of Finance and Economics,2.(in Chinese).

Lyandres,E.,2007.Costly external financing,investment timing,and investment-cashflow sensitivity.Journal of Corporate Finance 13,959-980.

McNichols,M.F.,Stubben,S.R.,2008.Does Earnings Management Affect Firms’Investment Decisions?Working Paper.

Modigliani,F.,Miller,M.H.,1958.The cost of capital,corporate finance and the theory of investment.American Economic Review 48,261-297.

Myers,S.C.,1977.Determinants of corporate borrowing.Journal of Financial Economics 5,147-175.

Myers,S.,Majluf,N.,1984.Corporate financing and investment decisions when firms have information that investors do not have.Journal of Financial Economics 13,187-221.

Polk,C.,Sapienza,P.,2008.The stock market and corporate investment:a test of catering theory.Review of Financial Studies.

Poterba,J.M.,1988.Comment on‘Financial Constraints and Corporate Investment’.Brookings Paper on Economic Activity 1,200-204.

Pulvino,T.,Tarhan,V.,2006.Cashflow Sensitivities with Constraints.Working Paper.

Smith Jr.,C.W.,1986.Investment banking and the capital acquisition process.Journal of Financial Economics 15,3-29.

Shyam-Sunder,L.,Myers,S.C.,1999.Testing static tradeoff against pecking order models of capital structure. Journal of Financial Economics 51,219-244.

Wang,Qiang,Lin,Chen,Wu,Shinong,2008.Financial constraints,corporate governance and investmentcashflow sensitivity:empirical study based on chinese listed companies.Contemporary Finance& Economics 12(in Chinese).

Wei,Feng,Liu,Xing,2004.Influence of financial constraints and uncertainty on company investment behavior. Economic Science 2(in Chinese).

15 October

*Corresponding author.Address:School of Accounting and Finance Shanghai Lixin University of Commerce,No.2800,Wen Xiang Road,Songjiang District,Shanghai,China.

E-mail addresses:wanhualin@lixin.edu.cn,hualin.wan@gmail.com(H.Wan).