Do dividend tax cuts lead firms to increase dividends:Evidence from China

2011-06-27ChunFeiWangYunnanGuo

Chun Fei Wang,Yunnan Guo

aSchool of Accountancy,Central University of Finance and Economics,China

bChina Center for Economic Research,National School of Development, Peking University,China

Do dividend tax cuts lead firms to increase dividends:Evidence from China

Chun Fei Wanga,*,Yunnan Guob

aSchool of Accountancy,Central University of Finance and Economics,China

bChina Center for Economic Research,National School of Development, Peking University,China

A R T I C L E I N F O

Article history:

Accepted 14 June 2011

Available online

11 December 2011

JEL classification:

G32

G34

Dividend taxation is an important component of investors’taxes and has attracted the attention of policymakers and financial economists.However,the theory of dividends and the reform of dividend taxation remain a puzzle.This paper analyzes the effect of dividend taxation on firms’dividend policies.Using a natural experiment and differencein-difference estimation,we find that China’s dividend tax cut in 2005 led firms to increase their dividend payments. Companies with higher proportions of tradable individual shares or investment fund shares were more likely to increase their dividend payments.However,opportunistic behavior also exists,where companies with higher proportions of shares held by executives were also more likely to increase their dividend payments.These findings support the existence of a causal relationship between China’s taxcut and firms’increased dividend payments and imply that the reform of dividend taxation in 2005 achieved its goal.

Ⓒ2011 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong. Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

Dividend taxation is an important component of investors’taxes and has attracted the attention of policymakers and financial economists.Recently,many countries have begun to focus on capital market taxation reforms.In China,the State Council promulgated‘Some Opinions of the State Council on Promoting the Reform,Opening and Steady Growth of Capital Markets’(hereinafter referred to as the‘Nine Opinions’)in 2004,which stressed that tax policy in relation to capital markets should be refined to encourage public investment.On 13 June,2005,the Ministry of Finance and the State Administration of Taxation issued the document,‘Notice on Policies Relating to Individual Income Tax on Dividends and Bonuses’,which stated that taxes on individual investors’income from dividends and bonuses of listed companies should be levied in accordance with the current tax laws after temporarily deducting 50%of an individual’s taxable income.Therefore,since 13 June,2005,individual investors’dividend income has been taxed at a rate of 10%,rather than 20%.The objectives of the dividend tax cut were to increase the likelihood of companies making dividend payments,ease the conflict of interest between large and minority shareholders,protect the interests of minority shareholders and encourage public investment.As a result,this paper examines whether the lower dividend tax rate has led firms to increase their dividend payments.

There has been fierce theoretical debate over whether a reduction in the dividend tax rate would lead firms to increase their dividend payments.The main dispute is between the‘new theory’or‘tax capitalization view,’and the‘traditional view’of whether reductions in dividend tax rates affect the financial behavior of companies.Proponents of the‘traditional view’stress that if a company mainly relies on external equity financing then, under classical taxation,higher dividend taxation will tend to raise the cost of capital.As the capital gains tax rates on retained earnings are generally lower than dividend tax rates, shareholders may benefit from decreased dividend payments.Conversely,a decrease in dividend tax can limit the ability of firms to engage in inter-temporal tax arbitrage and may,therefore,lead companies to increase their dividend payments.The‘new theory’developed by King(1977)argues that in cases where companies mainly rely on retained earnings,mature companies are able to keep all of their profits to meet their equity financing needs and then distribute the remaining profits as dividends,even when there is double taxation.Dividend taxes will thus be irrelevant to the companies’dividend policies.In this case,a decline in dividend tax may not affect a company’s financial behavior and,thus, its dividend payout.

The results of recent empirical research in this area are not entirely consistent.Chetty and Emmanuel(2005)analyze the impact of the 2003 dividend tax cut in the United States on firms’payout behavior and find that,consistent with the‘traditional view’,the tax cut induced companies to increase their dividend payments and created the possibility for aninitial dividend payout.The same result is also found in Dhaliwal and Oliver(2007),Brown et al.(2007),and Blouin et al.(2004).Surveying 384 financial executives and conducting in-depth interviews,Brav et al.(2005)find that dividend tax is not a dominant concern for the majority of firms and,with respect to the 2003 dividend tax cut,only 28%of financial managers felt that it might increase their company’s dividend payout,while the other 70%of financial managers believed the decline in dividend tax might not or would not affect their dividend policy.In addition,La Porta et al.(2000)analyze the effects of dividend taxes around the world,but do not find any conclusive results.

Different theories have completely different views on the reform of dividend taxation policies.Recently,many countries have begun to focus on dividend tax reforms.A number of developed countries,including the United States,Britain and Germany,have adjusted their dividend tax rates.However,what is confusing is that the direction of the changes in dividend taxation has been different.Some countries,such as Britain and Germany,have increased their dividend tax rates,while others,such as the United States,have reduced their dividend tax rates.In the United States,the Jobs and Growth Tax Relief Reconciliation Act was enacted in 2003 by President Bush.One of the main provisions of the act was to reduce the tax on individual dividend income to 15%,instead of the top rate of 35%.However,the reforms in the United Kingdom and Germany were different.From 1973,shareholders in the United Kingdom were credited for a portion of the taxes they paid at the corporate level,through what is known as an imputation-style corporate tax system.However,in 1997,the amount deductible was reduced from 20%to 10%,thereby effectively increasing shareholders’dividend tax rates.This reform brought the UK tax system more into line with classical taxation.Similarly,Germany’s nearly 30 year old imputation-style corporate tax system,which was one of the lightest dividend tax systems in the world,was abolished in 2000,which also led to an increased dividend tax rate.

Therefore,whether declines in dividend tax rates lead firms to increase their dividend payments,which then eases the conflict of interest between large and small shareholders, is an important empirical question.However,little large sample empirical research has been conducted on this important issue in China.In a previous study based on a unique sample of 86 listed companies releasing A and B shares,Zhang(2007)finds that,consistent with the‘traditional view’,China’s dividend tax cut affected the price of equity capital.Because the dividend tax rate is higher than the capital income tax rate in China,investors expect a higher return from companies that make high dividend payments.Although Zhang’s(2007)research design is ingenious,the study has some deficiencies.Leaving aside the small sample size,there is a systematic difference between the A-share and B-share markets.In a study of the short-term market reaction to the dividend tax cut,Zeng and Zhang(2005)find that cumulative abnormal returns are positively correlated with dividend payments.They argue that,in China,dividend tax affects asset prices in line with the‘traditional view’.However,not all investors were beneficiaries of the dividend tax cut.For example,corporate shares were not subject to the reduced dividend tax rate.Zeng and Zhang(2005)fail to acknowledge this difference.This paper focuses on the causal relationship between the dividend tax cut and increased dividend payments,and evaluates the effects of China’s dividend taxation reform.

To examine this causal relationship and evaluate the reform of dividend taxation,this paper uses a sample of A-share listed companies between 2003 and 2007 for the empirical tests.In addition,a‘natural experiment’and difference-in-difference estimator methods are used to estimate the impact of the dividend tax cut on companies’dividend policies.We find that the 2005 dividend tax cut led firms to increase their dividend payments. Companies with higher proportions of tradable individual shares or investment fund shares were more likely to increase their dividend payments.However,opportunistic behavior was also detected,where companies with higher proportions of shares held by executives were more likely to increase their dividend payments.These findings support the existence of a causal relationship between dividend tax cuts and increased dividend payments and suggest that China’s reform of dividend taxation in 2005 achieved its goal.

2.Institutional background and hypotheses

2.1.Institutional background

In China,there is variation in the dividend taxes paid by different investors.Dividend taxation in China is based on a classical tax system,where the company and the individual are treated as separate entities and pay separate income taxes.The result is that income is taxed twice.In the Chinese stock market,only individual shareholders and funds pay dividend taxes.According to the Individual Income Tax Law of the People’s Republic of China, interest,dividends,bonuses,contingent income and other income are taxed at the rate of 20%.According to the‘‘Notice on the Tax Policies Relating to Mutual Funds’’(coded Cai Shui Zi[2002]No.128)issued by the Ministry of Finance and the State Administration of Taxation in 2002,investment funds are required to pay tax on income from dividends, bond interest and interest on savings at a rate of 20%.However,social security funds are tax-free.According to Article 26 of the Enterprise Income Tax policy,an enterprise’s following sources of income are tax-free:(a)dividends,bonuses and other equity investment gains generated between qualified resident enterprises;and(b)the dividends,bonuses and other equity investment gains that non-resident enterprises obtain from resident enterprises,where the non-resident enterprise has organs or establishments inside the territory of China and has actual connections with such organs or establishments.In these cases,the dividend income obtained from these enterprises is tax-free.

To promote the healthy and stable development of capital markets,the Nine Opinions state that the tax policy for capital markets should be refined to encourage public investment.Since 13 June,2005,individual dividend income has been taxed at a rate of 10%, rather than 20%.On 13 June,2005,the Ministry of Finance and the State Administration of Taxation issued a document coded Cai Shui[2005]No.102,which stated that the tax on individual investors’income from dividends and bonuses of listed companies should be levied in accordance with current tax laws after temporarily deducting 50%of an individual’s taxable income.On the same day,the Ministry of Finance and the State Administration of Taxation issued a document coded Cai Shui[2005]No.107,which stated that the income that investment funds receive from dividends and bonuses of listed companies should also be levied after temporarily deducting 50%of taxable income.

2.2.Hypotheses

As the objective of the 2005 tax reform was to encourage public investment,individual income tax payers received preferential policies.The policymakers were concerned whether individual shareholders would benefit from the reduction in dividend taxes and whether it would encourage companies with higher proportions of individual shares to increase their dividend payments.At the same time,financial economists were con-cerned whether the reduction in shareholders’dividend tax would lead to firms increasing their dividend payments and,in the context of China,whether‘new theory’is more powerful than the‘traditional view’.The answers to these basic propositions will provide a theoretical basis for the subsequent tax reform in capital markets in China.Therefore,we propose the following hypothesis:

Hypothesis 1.Following the reduction in the dividend tax rate,companies with higher proportions of individual shares increased their dividend payments.

Investment funds have also benefited from the dividend tax cut.Moreover,in recent years,funds have had an increasingly powerful influence on companies’financial policies. Therefore,companies with higher proportions of investment fund shares are more likely to increase their dividend payments.In addition,the executives of listed companies are individual income tax payers and the financial policymakers of their companies.Executives may also increase their companies’dividend payments for reasons of self-interest.Thus, we propose the following hypotheses:

Hypothesis 2.Following the reduction in the dividend tax rate,companies with higher proportions of investment fund shares were more likely to increase their dividend payments.

Hypothesis 3.Following the reduction in the dividend tax rate,companies with higher proportions of shares held by their top executives were more likely to increase their dividend payments.

3.Research design and sample selection

3.1.Research design

This paper uses the‘natural experiment’and difference-in-difference estimator methods to estimate the impact of the dividend tax cut on companies’dividend policies.Compared with similar policies abroad,the tax cut on 13 June,2005 was very clean,1The 2003 tax reform in the United States also included a capital gains tax cut.In addition,the 1986 dividend tax change in the United States comprised a package of tax reforms.because the code stated there was to be no change in other dividend tax provisions and there was also no change in other related taxes.2At the same time,the Ministry of Finance and the State Administration of Taxation issued a notice on the Issue Concerning the Tax Policies Relating to the Pilot Reform of Share-trading,document code Cai Shui[2005]No.103,which stated that the individual income tax on stock transfers occurring during the course of the pilot reform of share-trading,where a holder of nontradable shares gives consideration to a holder of tradable shares or cash,shall be temporarily exempt.We believe that this did not affect companies’normal dividend policies.In general,the tax cut affected companies with shares held by individuals,investment funds and executives,while companies with corporate holdings and social security fund holdings were not affected.We use the companies that were subject to the change in dividend tax as the treatment group,while the companies that were not affected by the dividend tax reform are the control group.We then compare the changes in companies’dividend policies before and after the dividend tax cut to estimate the effect of the tax cut on corporate dividend policies.This methodology uses the exogenous dividend tax change to estimate the time series and cross-sectional differences in companies’dividend policies.As the introduction of the tax cut is an unpredictable event,we assume that listedcompanies are randomly assigned to the treatment group and the control group.After the introduction of the policy,there are limited endogenous concerns about changes in the shareholdings of various groups.The exchange of executives’shares is subject to numerous restrictions and securities laws.Moreover,it can have a negative impact on the company.Exchange of investment fund shares and individual shares are affected by numerous factors,of which the reduction in dividend taxes is just one of many.We use the following model to estimate the impact of the dividend tax cut on companies’dividend policies.

The left-hand side variable,increase,is a dummy variable.If the dividend in that year is greater than in the prior year,the variable increase equals 1 and 0 otherwise.In addition, we specifically consider the effect of the regulation issued in May 2001,‘Administration of Offerings of New Shares by Listed Companies Procedures’,which focuses on cases where‘a company did not distribute any dividends or bonuses during the most recent 3 years and the board of directors failed to provide a reasonable explanation of the same’.Some companies made trivial dividend payouts to meet this provision.Accordingly,we revise the increase variable.Specifically,if the dividend payments in this year are more than those in the previous year,but the pre-tax dividend is less than 0.1 Yuan per share,the increase equals 0(the same study design also appears in Deng and Zeng(2005)and Wu et al. (2003)).Furthermore,a regulation issued in May 2006 stated that,‘Profits distributed accumulatively in the latest 3 years in cash or stocks shall be no less than 20%of annual distributive profits of the latest 3 years’.We also revise the increase variable to capture the effect of this regulation.3Administration of Offerings of New Shares by Listed Companies Procedures Article 8(e),issued on May 8,2006,states that the accumulative profits distributed in the last three years in cash or stocks shall be no less than 20%of annual distributive profits of the last 3 years.This was also amended on October 9,2008 to the accumulative profits distributed in the last 3 years in cash shall be no less than 30%of annual distributive profits of the last 3 years.Specifically,if the accumulative profits distributed in the latest 3 years in cash or stocks are more than 20%and less than 25%of the annual distributive profits of the latest 3 years,the increase equals 0.

The right-hand side variable,Tax,is also a dummy variable.We define the event date of the tax cut as the announcement date of the document coded Cai Shui Zi[2005]No.102.If a company’s dividend declaration date is after 13 June,2005,the variable Tax equals 1 and 0 otherwise.In China,the provisions for dividend payments do not change after thedeclaration date.Therefore,we use the dividend declaration date to determine the effect of the tax cut on a company’s dividend policy.

The explanatory variables of primary interest are Individual,which is measured by the percentage of shares held by the top 10 tradable individual shareholders;Fund,which is measured by the percentage of shares held by investment funds;and Director,which is measured by the percentage of shares held by executives.

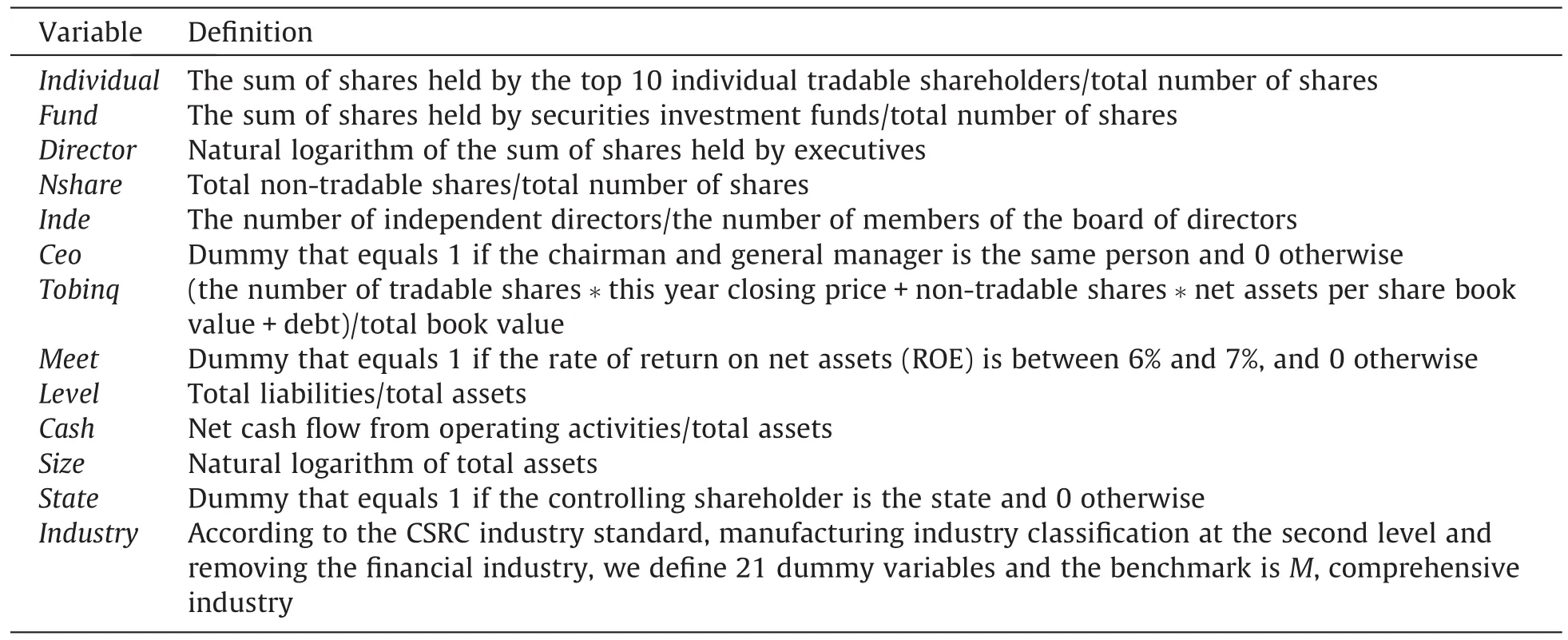

The control variables include the profitability of a company,company size,debt ratio and firm growth,which have important influences on dividend policies(Allen and Michaely,2003;Baker et al.,2001;Leithner and Zimmermann,1993;Kato and Loewensteinm, 1995;Li et al.,2006).In addition,we also include measures of corporate governance, the nature of the enterprise,and the chairman and general manager being the same person,which are likely to affect companies’dividend policies(Yuan and Su,2004).The definitions of the main variables are presented in Table 1.

Table 1De finitions of main variables.

Table 2Descriptive statistics.

?

Table 4Individual shareholders.

3.2.Sample selection

The sample comprises 4605 listed companies with A-shares in China’s stock market between 13 June,2003 and 13 June,2007 to test the effects of the dividend tax cut.4Because the 2006 dividends may have been allocated in 2007 and some companies also paid dividends in mid-2007,we use the date of the announcement of dividends to identify the specific dividend year.The selected companies must have been listed since 2003,which ensures 2 years before the dividend tax cut for paired comparison.In addition,we remove ST and PT companies, financial institutions and companies with missing variables.All financial indicators and equity structure data is obtained from the CSMAR database.Data on the securities investment fund shares and pro fits distributed accumulatively in cash or stocks in the last 3 years are from the Wind database,and dividend data is from the China Center for Economic Research (CCER)database.

4.Descriptive statistics

Table 2 presents descriptive statistics.We winsorized the top and bottom 1%of observations for all the continuous variables to reduce the impact of extreme observations.In Table 2,we find that 17.1%of companies increased their dividend payments and the proportion of shares held by the top 10 individual tradable shareholders is,on average,about 1%.The mean value of director is 6.187,the mean value of fund is 2.3%and the mean value of Nshare is 57%.The proportion of independent directors is,on average,about 34%.These results are consistent with the basic characteristics of A-share listed companies in China, indicating that sample selection bias is not a major concern.

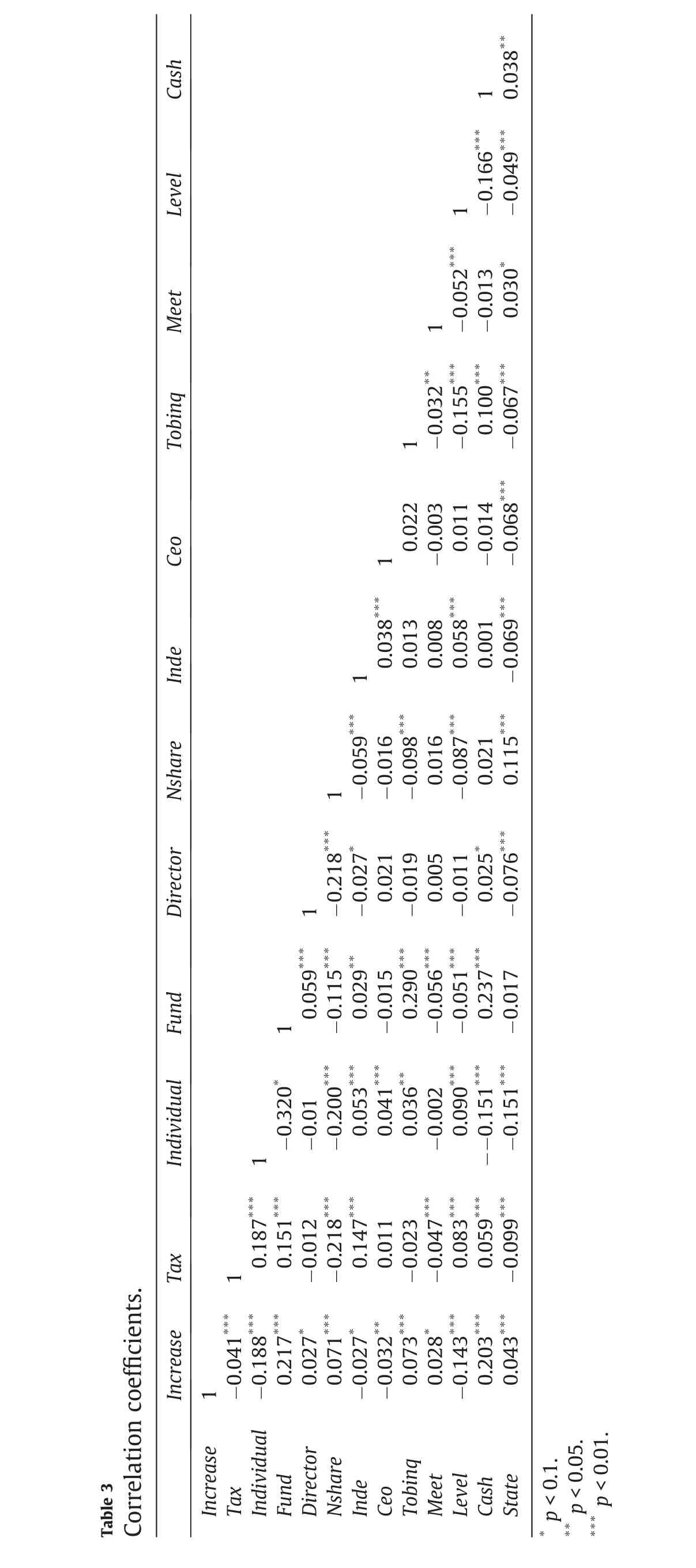

Table 3 presents the correlation coefficients.In Table 3,we find that the proportion of shares held by individual shareholders(individual)and the likelihood of an increase in dividend payments(increase)are highly negatively correlated(-0.188),which suggests thatthere is a serious conflict of interest between large shareholders and small shareholders.In addition,higher proportions of shares held by executives are positively related to increased dividend payments and companies with higher proportions of investment fund shares are positively related to increased dividend payments,indicating that both have an important effect on companies’dividend policies.

Table 5Investment funds.

Table 6Managerial ownership.

5.Empirical results

Tables 4-6 present the empirical results of Models(1)-(3),respectively.

Table 4 presents the results of Model(1).In columns(1)and(2)of Table 4,we find that the proportion of shares held by individual shareholders(individual)has a negative and significant relationship with increased dividend payments,-108.643(p=0.000)and -75.779(p=0.000),which indicates that there is an apparent conflict of interest between large shareholders and small shareholders.However,the coefficients of the interaction between the tax cut and individual shareholders in Table 4 columns(1)and(2),tax*individual,are positive and significant,53.998(p=0.001)and 48.674(p=0.001),thus indicating that following the dividend tax cut,the companies with higher proportions of shares held by individual shareholders were more likely to increase their dividend payments.Deng et al.(2007)argue that dividend payments represent the shared interests of large and small shareholders;therefore the dividend tax cut has alleviated the conflict of interest between the two classes of shareholders to some extent.

Table 5 presents the results of Model(2).Cash dividends are an important revenue source for securities investment funds.Especially during times of market downturn,securities investment funds prefer to invest in listed companies that offer cash dividends.We find the coef ficients of Fund in Table 5 columns(1)and(2)are positive and signi ficant, 11.454(p=0.000)and 9.554(p=0.000),which suggest that companies with higher proportions of shares held by investment funds are more likely to increase their dividend payments.Moreover,after the dividend tax cut,this increasing tendency is more obvious. Without including the other control variables,the coef ficient of Tax*Fund in Table 5 column(1)is positive and significant;while with all the control variables,the coefficient of Tax*Fund in Table 5 column(2)is also positive and significant.

Table 6 presents the results of Model(3).The coefficients of the interaction between the tax cut and shares held by executives in Table 6 columns(1)and(2),Tax*Director,are positive and significant,0.024 and 0.025,thus indicating the existence of opportunistic behavior arising from executives’self-interested motivation to increase dividend payments.

6.Robustness tests

A number of robustness checks were undertaken.First,the observation window was modi fied to(-2,3)years,i.e.between 13 June,2003 and 13 June,2008,5Because some indicators in the CSMAR database are obtained after 2003,the window of the robustness test is only(-2,3).but this does not alter the main conclusions.

Second,we ignore the effects of the regulations,‘Administration of Offerings of New Shares by Listed Companies Procedures’and‘Profits distributed accumulatively in the latest 3 years in cash or stocks shall be no less than 20%of annual distribu-tive profits of the latest 3 years’issued in May 2001 and the main conclusions do not change.

Third,during the sample period the shares held by funds increase year by year.Therefore,even without the dividend tax cut,companies with higher proportions of shares held by funds are also likely to have increased their dividend payments.We also consider this fact in a robustness test.As the number of shares held by funds changes little between 2004 and 2005,we use the 2004 and 2005 samples to re-estimate the results and find that all conclusions are still robust.

7.Conclusion

Dividend taxation is an important component of the taxes of individual investors and has attracted the attention of policymakers and financial economists.Recently,numerous countries have focused on capital market taxation reforms.However,what is confusing is that the dividend tax reforms in different countries have been in completely different directions.Some countries,such as Britain and Germany,have increased their dividend tax rates,while other countries,such as the United States,have decreased their dividend tax rates.Moreover,there are also different theoretical arguments concerning dividend taxes.The‘traditional view’argues that reduced dividend tax rates increase companies’dividend payments,while the‘new theory’states the contrary.

This paper investigates a causal relationship between the 2005 dividend tax cut in China and increased dividend payments,in order to evaluate China’s dividend taxation reforms. We use the natural experiment and difference-in-difference estimator methods to estimate the impact of the dividend tax cut on companies’dividend policies.We find that the 2005 dividend tax cut led firms to increase their dividend payments.Companies with higher proportions of tradable individual shares or investment fund shares were more likely to increase their dividend payouts.However,opportunistic behavior is also found to occur,where companies with higher proportions of shares held by executives were more likely to increase their dividend payments.These findings support a causal relationship between the tax cut and increased dividend payments and imply that the reform of dividend taxation in 2005 achieved its goal.However,due to this study’s short observation window,the long-term effects of the dividend tax cut still require further study.

Acknowledgements

The author is grateful to the China Journal of Accounting Research(CJAR)2010 summer research workshop and the insightful comments and suggestions from the anonymous reviewers and the editors.This work was supported by the MOE Project of Humanities and Social Sciences(08JA630007)and the National Natural Science Foundation of China (Approval No.71172029).

公立医院综合预算管理内部控制体系的实施,可以提高资源的优化配置,保障资产安全,提高经济效益。可以说,在深化医疗卫生改革的背景下,预算管理控制是公立医院不可或缺的一部分。预算管理控制系统需要全员参与。领导者必须更新管理理念,认识建立健全预算管理和控制体系的重要性,优化人力,物力和财力资源配置,支持公立医院预算控制,在单位内发挥良好的领导和指导作用,鼓励所有成员通过部门和部门参与预算控制的建设。员工合作营造良好的内部控制氛围,提高员工的风险防范水平。明确职责目标,相互制衡,实施企业,财政,医疗综合监督体系的管理流程,严格审批责任,在重大决策实施前全面开展示范工作,推进各种工作的合法化和合规性。

Allen,F.,Michaely,R.,2003.Handbook of the Economics of Finance,vol.1.pp.337-422.

Baker,H.K.,Powell,G.E.,Veit,E.T.,2001.Factors influencing dividend policy decisions of NASDAQ firms.The Financial Review 36,19-37.

Brav,A.,Graham,J.R.,Harvey,C.R.,Michael,R.,2005.Payout policy in the 21st century.Journal of Financial Economics 77,483-527.

Brown,J.R.,Liang,N.,Weisbenner,S.,2007.Executive financial incentives and payout policy:firm responses to the 2003 dividend tax cut.The Journal of Finance 4,1935-1965.

Blouin,J.,Jana,R.,Douglas,S.,2004.The Initial Impact of the 2003 Reduction in the Dividend Tax Rate.Working Paper.

Chetty,R.,Emmanuel,S.,2005.Dividend taxes and corporate behavior:evidence from the 2003 dividend tax cut.Quarterly Journal of Economics 120,791-833.

Deng,J.P.,Zeng,Y.,2005.Family ownership and dividend policy.Management World 7,139-147(in Chinese).

Deng,J.P.,Zeng,Y.,He,J.,2007.To share or to monopolize profits.Economic Research Journal 4,112-123(in Chinese).

Dhaliwal,K.,Oliver,Z.,2007.Did the 2003 tax act reduce the cost of equity capital.Journal of Accounting and Economics 43,121-150.

Kato,K.,Loewensteinm,U.,1995.The ex-dividend-day behavior of stock prices:the case of Japan.Review of Financial Studies 8,817-847.

King,M.A.,1977.Public Policy and the Corporation.Chapman and hall,London.

La Porta,R.,Lopez-de-Silanes,F.,Shleifer,A.,Vishny,R.W.,2000.Agency problems and dividend policies around the world.The Journal of Finance 1,1-33.

Leithner,S.,Zimmermann,H.,1993.Market value and aggregate dividends:a reappraisal of recent tests,and evidence from European markets.Swiss Journal of Economics and Statistics 29,99-122.

Li,L.,Wang,M.S.,Ji,Y.F.,2006.Dividends policy making and its factors.Journal of Financial Research 1,74-85 (in Chinese).

Petersen,M.A.,2008.Estimating standard errors in finance panel data sets:comparing approaches.Review of Financial Studies 22,435-480.

Wu,L.N.,Gao,Q.,Peng,Y.,2003.The research of the factors impacted on‘NON-Normal High Dividend’on China’s open companies.Economic Science 1,31-42(in Chinese).

Yuan,T.R.,Su,H.L.,2004.The empirical study on the influential factors on ultra-ability dividends payout of listed company.Accounting Research 10,63-70(in Chinese).

Zeng,Y.M.,Zhang,J.S.,2005.The impact of dividend tax cut on asset prices.Economic Science 6,84-94(in Chinese).

Zhang,J.S.,2007.Effects of Dividend Tax on Equity Asset Price.China Financial and Economic Publishing House (in Chinese).

8 April 2010

*Corresponding author.

E-mail address:wangchunfei@gsm.pku.edu.cn(C.F.Wang).

Dividend taxation

Dividend policy

Natural experiment