Do institutional investors have superior stock selection ability in China?

2011-06-24YihongDengYongxingXu

Yihong Deng*,Yongxing Xu

aThe School of Economics&Management,Tsinghua University,China

bThe Finance Department of Guangxi Zhuang Autonomous Region,China

Do institutional investors have superior stock selection ability in China?

Yihong Denga,*,Yongxing Xub

aThe School of Economics&Management,Tsinghua University,China

bThe Finance Department of Guangxi Zhuang Autonomous Region,China

A R T I C L E I N F O

Article history:

Accepted 28 March 2011

Available online 7 September 2011

JEL classification:

G14

G20

This paper uses unique data on the shareholdings of both institutional and individual investors to directly investigate whether institutional investors have better stock selection ability than individual investors in China.Controlling for other factors,we find that institutional investors increase(decrease)their shareholdings in stocks that subsequently exhibit positive(negative)short-and long-term cumulative abnormal returns.In contrast, individual investors decrease(increase)their shareholdings in stocks that subsequently exhibit positive(negative)short-and long-term cumulative abnormal returns.These findings indicate that institutional investors have superior stock selection ability in China.

Ⓒ2011 China Journal of Accounting Research.Founded by Sun Yat-sen University and City University of Hong Kong.Production and hosting by Elsevier B.V.All rights reserved.

1.Introduction

Institutional investors are playing an increasingly important role in global capital markets.In 2005,institutional investors held 65%of the equity in firms listed on the NYSE/AMEX,indicating a compound annual growth rate of 6.3%over the past 25 years(Agarwal,2005).In China,institutional investors held 44%of the tradable equity value in the stock market in July 2007, an increase of 25%since the end of 2004.To identify profitable investments,institutional investors incur large expenses on stock selection.As indicated by Kent et al.(1997),total costs in the mutual fund industry exceed$10 billion per year and more than half of these expenses are incurred in their stock selection efforts.However,the extent to which institutional investors’stock selection costs and efforts are transformed into superior stock selection remains an important and open research question for both practitioners and academic researchers.While there is already a large body of literature on this issue,the results have been mixed.Further research on this issue,particularly in the context of China,provides us with a greater understanding of investor behavior in the stock market.

A number of academic studies have examined the stock selection ability of mutual funds.Beginning with Jensen(1968), most academic studies have concluded that mutual funds do not have superior stock selection ability.Later studies have come to similar conclusions,including Chang and Lewellen(1984),Malkiel(1995)and Gruber(1996).Most recently,Fama and French(2010)find that the aggregate portfolio of actively managed US equity mutual funds is close to the marketportfolio,but the high costs of active management result in lower returns to investors.Their bootstrap simulations suggest that few funds produce benchmark-adjusted excess returns sufficient to cover their costs.However,the results of other studies,such as Grinblatt and Titman(1989),Lee and Rahman(1991),Grinblatt and Titman(1992),Hendricks et al.(1993), Goetzmann and Ibbotson(1994),Womack(1996),Bello and Janjigian(1997),Kent et al.(1997)and Chen et al.(2000),suggest that mutual funds in the US do have some stock selection ability.

More recently,studies have started investigating the trading of individual investors relative to institutional investors.San (2007)finds that individual investors are more likely to realize their profits by selling their holdings and their stock selection earned about 2%per month more than institutional investors in the late 1990s bubble.Kaniel et al.(2008)find that individual investors tend to buy stocks following a price decline in the previous month and sell following a price increase.They document positive excess returns in the month following intense buying by individual investors and negative excess returns after selling by individual investors.Because institutional investors are trading in the same markets as individual investors, these results suggest that individual investors are better at stock selection than institutional investors.

Although these studies have frequently provided important insights into US markets and US institutional investors,the applicability of these findings to other markets is questionable because of institutional and environmental differences between countries and regions.In fact,a number of researchers have been working on this issue.Kang and Stulz(1997)study stock ownership in Japanese firms by non-Japanese investors from 1975 to 1991.Their results suggest that foreign investors, mostly foreign institutional investors,have superior stock selection ability in Japan.Grinblatt and Keloharju(2000)find that foreign investors,mostly institutional investors,seem to outperform the portfolios of households in Finland.Seasholes (2000)finds that foreign institutional investors buy(sell)ahead of good(bad)earnings announcements in Taiwan,whereas local investors do the opposite.These findings suggest that institutional investors have superior stock selection ability in these markets.Other studies suggest that institutional investors do not have superior stock selection ability in other countries,such as Korea(Choe et al.,2001)and Turkey(Aragon et al.,2007).Taken together,the evidence indicates that institutional and environmental differences between markets are important.

Most of the above studies focus on the US market.They use indirect methods,Jensen’s alpha or a decomposition of Jensen’s alpha,or a Treynor-Mazuy model,a modified security market line approach first suggested by Treynor and Mazuy (1966)and later refined by Bhattacharya and Pfleiderer(1983),to examine the stock selection ability of institutional investors through analysis of their performance.The key is to decompose the excess performance of institutional investors into two sources:stock selection ability and timing ability.Bollen and Busse(2001)use daily tests that are more powerful than the previously used monthly tests to examine the timing ability of mutual funds and find that mutual funds may possess better timing ability than previously documented.San(2007)provides a possible explanation for the inferior performance of institutional investors,which are found to hold winners too long and miss-time momentum cycles.

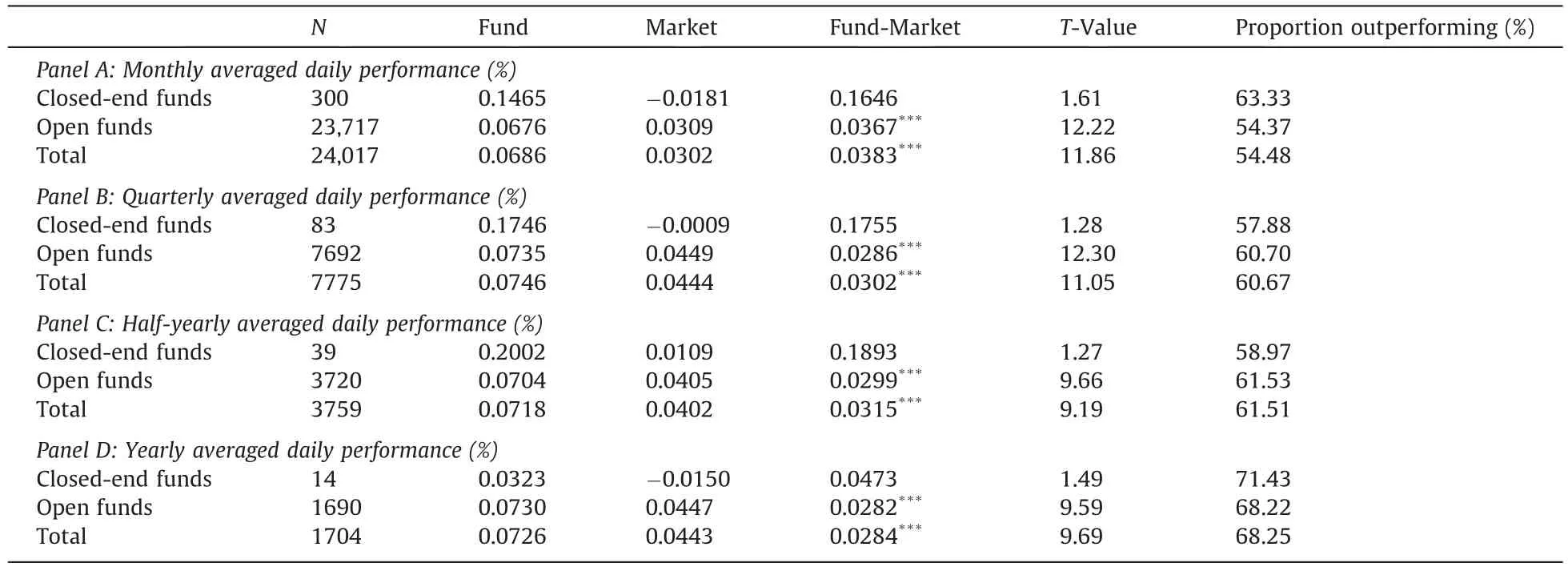

With its increasing economic scale and growing stock market,China is playing an increasingly significant role in global capital markets.In July 2009,the market value of stocks in China’s capital market reached US$3.2 trillion,ranking China second worldwide.However,the literature covering institutional investors in China is scarce.Table 1 compares the performance of mutual funds and the market index in China.It shows that more than 50%of both open funds and closed-end funds outperform the market index(net of management fees).However,closed-end funds insignificantly outperform the market,indi-cating that performance among them may vary significantly,with some extremely high returns and some extremely low returns.Open funds consistently outperform the market and they comprise more than half of the mutual fund industry in China.In total,the annualized data shows that mutual funds in China outperform the market by 0.0284%per day,1There may be a question as to why individuals do not invest all of their money in mutual funds given that they outperform the market index in China.This can be partly explained by behavioral considerations,such as people preferring to control their own money or that they ex ante expect that they can beat mutual funds because some mutual funds do underperform the market index ex post.The sometimes irrational trading behavior of mutual fund managers disclosed by the China Securities Regulatory Commission may also dent individuals’confidence in mutual funds.Moreover,some people in China regard investing in the stock market by themselves as an interesting form of entertainment.suggesting the huge effort that mutual funds put into research and stock selection is not a zero-sum game.Furthermore,Yu et al. (2009)investigate differences in the returns between institutional and individual investors and find that institutional investors outperform individual investors in China.However,they do not document the performance difference due to stock selection.

Table 1Performance comparison between mutual funds and the market index in China.This table reports the performance(net of fees)comparison between mutual funds and the market index in China from 2001 to 2010.Panel A,Panel B,Panel C and Panel D report the results based on monthly,quarterly,half-yearly and yearly averaged daily performance,respectively.

We use unique data on the shareholdings of both institutional and individual investors to directly investigate whether institutional investors have better stock selection ability than individuals in China.Based on the intuitive idea that institutional investors will be more likely to buy future winners and sell future losers than individual investors,we first sort stocks by future price performance into ten deciles and examine the difference between institutional and individual investor daily trading among deciles.The sorting evidence is consistent with our hypothesis that institutional investors have better stock selection ability than individual investors.We also regress institutional and individual investor daily trading on future stock performance while controlling for other factors,such as size and momentum effects.We find that institutional investors increase(decrease)their shareholdings in stocks that subsequently exhibit positive(negative)short-and long-term cumulative abnormal returns.In contrast,individual investors decrease(increase)their shareholdings in stocks that subsequently exhibit positive(negative)short-and long-term cumulative abnormal returns.These findings indicate that institutional investors have superior stock selection ability in China.

To our knowledge,this paper is the first to use daily trading data for institutional and individual investors to directly examine whether institutional investors have superior stock selection ability.We find that institutional investors have better stock selection ability than individual investors in China.The remainder of the paper is organized as follows.Section 2 reviews the extant literature and develops our research hypotheses.Section 3 describes our research design.The empirical results are provided in Section 4 and Section 5 concludes.

2.Literature review and hypotheses

2.1.Literature review

Trueman(1988)presents a theoretical model showing that the incentive for one type of institutional investor-managers of investment funds-to engage in noise trading arises because of the positive signal that the level of the manager’s trading provides about his or her ability to collect private information concerning current and potential investments.If the manager’s compensation is directly related to investors’perceptions of his or her ability,the manager will trade more frequently than is justified on the basis of his or her private information.This suggests that institutional investors are not necessarily rational investors with superior stock selection ability.

A number of empirical studies focus on mutual funds.Jensen(1968)was the first to evaluate the performance of mutual funds over the period 1945-1964 and documents evidence that mutual funds do not have significant stock selection ability. Similar results are found in subsequent research,such as Chang and Lewellen(1984),Malkiel(1995),Gruber(1996)and Kent et al.(1997).However,Grinblatt and Titman(1989)examined the 1975-1984 quarterly holdings of a sample of mutual funds and found that the risk-adjusted gross returns of some funds were significantly positive.Other research also suggests that mutual funds have some stock selection ability,such as Lee and Rahman(1991),Grinblatt and Titman(1992),Hendricks et al.(1993),Goetzmann and Ibbotson(1994),Womack(1996),Bello and Janjigian(1997),Kent et al.(1997)and Chen et al.(2000).Moreover,Chen et al.(2000)document evidence that funds with the best past performance have better stock-picking skills than funds with the worst past performance,suggesting that stock selection ability may differ among institutional investors.

Researchers have also examined the stock-picking ability of other types of institutional investors.Womack(1996)analyzes the new buy and sell recommendations of security analysts at major US brokerage firms and finds that analysts appear to have stock-picking ability.Metrick(1999)analyzes the equity-portfolio recommendations made by investment newsletters between July 1980 and December 1996 and finds no significant evidence of superior stock-picking ability for the overall sample of 153 newsletters,suggesting that investment newsletters in the US do not have superior stock selection ability.

Other studies have recently investigated trading by individual investors relative to institutional investors.San(2007)uses data on institutional holdings and trading volume for all NYSE and Nasdaq-NM stocks from 1986 to 2001 and examines whether trading by institutional investors is more profitable than trading by individual investors.He finds that individual investors realize superior gains by selling and that their trading was about 2%per month more profitable than institutional investors in the late 1990s bubble.He also provides a possible explanation for the inferior performance of institutional investors,as they tend to hold winners too long and miss-time momentum cycles.Kaniel et al.(2008)investigate the dynamic relation between net individual investor trading and short-horizon returns for a large cross-section of NYSE stocks.They findthat individual investors tend to buy stocks following declines in the previous month and sell following price increases.They also document positive excess returns in the month following intense buying by individual investors and negative excess returns after selling by individual investors.Because institutional investors are trading opponents of individual investors, institutional investors suffer from negative excess returns in the month following buying and positive excess returns after selling.These findings indicate that individual investors have better stock selection ability than institutional investors.

The above mentioned literature concentrates on institutional investors in the US,however,researchers are increasingly studying institutional investors in other markets.Kang and Stulz(1997)studied stock ownership in Japanese firms by non-Japanese investors from 1975 to 1991.They find that foreign investors,mostly foreign institutional investors,outperform domestic investors in Japan.Grinblatt and Keloharju(2000)conducted a simultaneous analysis of the investment behavior and performance of various investor types and find that foreign investors,mostly institutional investors,seem to outperform the portfoliosofhouseholds,even aftercontrolling forbehavioraldifferences showing thatforeign investors tend to be momentuminvestors and householdstend to be contrarians.Seasholes(2000)finds thatforeign institutionalinvestors buy(sell)ahead ofgood(bad)earnings announcements in Taiwan,whereas localinvestors do the opposite.Using trading data from Korea from December 1996 to November1998,Choe etal.(2001)find thatforeign investors,allof whomare institutionalinvestors,buy at significantly higher prices and sell at significantly lower prices than domestic individuals for medium and large trades.They also find that foreign institutional investors are at less of a disadvantage relative to domestic institutions than relative to domestic individuals.However,for large trades,the disadvantage of foreign institutional investors seems to persist.

Recently,Aragon et al.(2007)examined whether institutional investors have superior stock selection ability relative to individual investors in Turkey.They compared the portfolio returns of each investor group with a benchmark portfolio that has the same exposure to local market,size,and book-to-market factors and estimate the intercepts of the domestic market model to be 7.71%and 7.12%for individual investors and institutional investors,respectively,with the difference between these estimates statistically insignificant.They also use the‘‘benchmark-free’’measure developed by Grinblatt and Titman (1993)and estimate the annualized risk-adjusted returns as-0.08%and-0.45%for individual investor and institutional investor portfolios respectively,with the difference statistically insignificant.

In summary,the mixed results in the extant literature indicate that the extent to which institutional investors’stock selection costs and efforts are transformed into superior stock selection ability remains an open research question.Furthermore,the stock selection abilities of institutional investors also seem to differ across markets.

2.2.Hypothesis development

Assuming that institutional investors have better stock selection ability than individuals,they should be able to form a more accurate estimate of the intrinsic value of companies to better predict future stock price performance.Thus,institutional investors will buy stocks which they believe are going to be future winners and sell those which they predict to be future losers,which will be more accurate than individual investors’predictions.Furthermore,since individual investors are the trading counterparty of institutional investors,they are more likely to buy future losers and sell future winners. Therefore,our hypotheses are as follows:

H1:Changes in institutional investor ownership are positively correlated with subsequent abnormal returns.

H2:Changes in individual investor ownership are negatively correlated with subsequent abnormal returns.

3.Research design

3.1.Data and sample selection

Institutional and individual investor ownership data are drawn from Topview software,an official information source of daily ownership held by three different groups of investors provided by the Shanghai Stock Exchange(SSE).The data service is offered to investors at the price of over RMB 19,800 per year,which is hardly affordable to most individual investors in China.Topview classifies all investors in the stock market into three categories:institutions,individuals and non-professional legal persons.Institutional investors conceptually include mutual funds,qualified foreign institutional investors, insurance companies,social insurance funds and securities companies.2The Qualified Foreign Institutional Investor program is a Chinese program that was launched in 2002 to allow licensed foreign investors to buy and sell A stocks in China’s mainland stock exchanges(in Shanghai and Shenzhen).Chinese mainland stock exchanges were previously closed off to foreign investors due to China’s tight capital controls which restrict the movement of assets in-and-out of the country.As of February 2009,a total of 79 foreign institutional investors had been approved under the QFII program.Foreign access to China’s A stocks are still limited,with quotas placed under the QFII program amounting to US$30 billion.For each day from June 1st,2007 to December 31st,2008,Topview reports the total ownership held by each of the three groups of investors on each of the 849 stocks listed on the Shanghai Stock Exchange.Data on stock returns and control variables are drawn from the China Stock Market and Accounting Research(CSMAR)database.

Deng and Lee(2000) find that institutional investors never trade on certain stocks during the sample period,with small firm size as the main driver.We therefore delete 29 firms from the original sample because institutional investors nevertrade their stock.Finally,we delete those observations with missing data on changes in institutional ownership or subsequent abnormal returns.Table 2 describes the sample selection process and Table 3 breaks down the institutional and individual ownership data by year.

Table 3 illustrates that institutional investor shareholdings in the SSE average 13.84%,much lower than the 65%in the NYSE/AMEX(Agarwal,2005).Institutional investors increased their shareholdings in 2007 and decreased them in 2008, whereas individuals were net buyers during the whole period.Moreover,net daily changes in both institutional and individual ownership are small,averaging less than 0.01%.

3.2.Variable definitions

Change in ownership is measured as the daily ownership change between the measurement day and the previous trading day:

Subsequent abnormal returns are obtained by summing the daily abnormal returns(ARi,t+n)over the measurement window:

where ARi,t+nis calculated as the raw return of the stock minus the corresponding daily average-weighted return of the market portfolio of the stocks with institutional investor trading.

For the short-term window for measuring subsequent abnormal returns,we select the subsequent one day(N=1)and subsequent five days(N=5).We also choose the subsequent 30 days(N=30)and subsequent 120 days(N=120),because institutional investors in China change their stock portfolios relatively frequently during the year.Fig.1 illustrates the timeline and measurement of our dependent and explanatory variables.

Tests of the relationship between changes in institutional(individual)ownership and subsequent abnormal returns are conducted while controlling for contemporary and historical returns,prior changes in institutional(individual)ownership,beginning institutional(individual)ownership,firm size,year,weekday and industry effects.We define these variables as follows:

Table 2Sample selection criteria.This table describes the sample selection process.We delete stocks that no institutions had traded during the whole sample period and stock-day observations with missing data on changes in institutional and individual ownership or subsequent abnormal returns.

Table 3Descriptive statistics of ownership variables.This table describes the institutional and individual shareholding data.All the variables are winsorized at the top and bottom 1 percent of the final sample.

Fig.1.Timeline and measurement of main variables.

ARt=daily abnormal returns for the stock on the measurement day.

ARt-j=daily abnormal returns for the stock j days before the measurement day(j=1,2,3,4,5).

INSTCHt-j=daily change in institutional ownership j days before the measurement day(j=1,2,3,4,5).

INDICHt-j=daily change in individual ownership j days before the measurement day(j=1,2,3,4,5).

INSTt-1=institutional ownership at the end of the day before the measurement day.

INDIt-1=individual ownership at the end of the day before the measurement day.

SIZE=log of the market value of the firm’s equity at the end of the day before the measurement day.

Year=dummy vector indicating the year of the measurement day.

Weekday=dummy vector indicating the weekday of the measurement day.

Industry=dummy vector indicating the three-digit CSRC standard industry code for the firm.

Table 4 summarizes the variable definitions.

3.3.Research method

We first sort stocks by future price performance into ten deciles and examine the difference between institutional investor and individual investor daily trading among the deciles.The following two regressions form the basis of our cross-sectional tests:

Table 4Variable definitions.

Table 5Descriptive statistics of independent variables.This table reports the mean,median,standard deviation,minimum,maximum,and the number of observations (N)of the independent variables.All variables are defined as in Table 4.All the variables are winsorized at the top and bottom 1 percent of the final sample,and SIZE exhibited in the table is the market value of equity in units of Million RMB¥.

Fig.2.Subsequent stock performance and investor trading.

4.Empirical results

Table 5 reports the descriptive statistics of the independent variables for the total sample.It shows that stock performance in the sample is diversely distributed.Daily abnormal returns range from-6.44%to 9.20%and weekly(five trading day)cumulative abnormal returns range from-15.27%to 19.98%.From a long-term perspective,monthly(30 trading day) cumulative abnormal returns range from-34.01%to 44.68%and half-yearly(120 trading day)cumulative abnormal returns range from 62.03%to 72.77%.Firm size varies widely,with the market value of equity ranging from RMB 545.36 million to RMB 331,294.45 million.

4.1.Sorting evidence

Panel A of Fig.2 plots the average investor trading and short-term(five trading day)future performance of the 10 deciles sorted by future performance.Basically,it shows that institutional investors buy stocks with positive future abnormal returns and sell stocks with negative future abnormal returns.The higher(lower)the future performance ranking,the more institutional investors buy(sell).The opposite is true for individual investors.The average investor trading and long-term (120 trading days)future performance of the 10 deciles sorted by future performance is plotted in Panel B of Fig.2.It documents a similar trend to Panel A for the correlation between long-term subsequent stock performance and investor trading. In summary,Fig.2 illustrates that changes in institutional(individual)ownership are positively(negatively)correlated with subsequent abnormal returns.

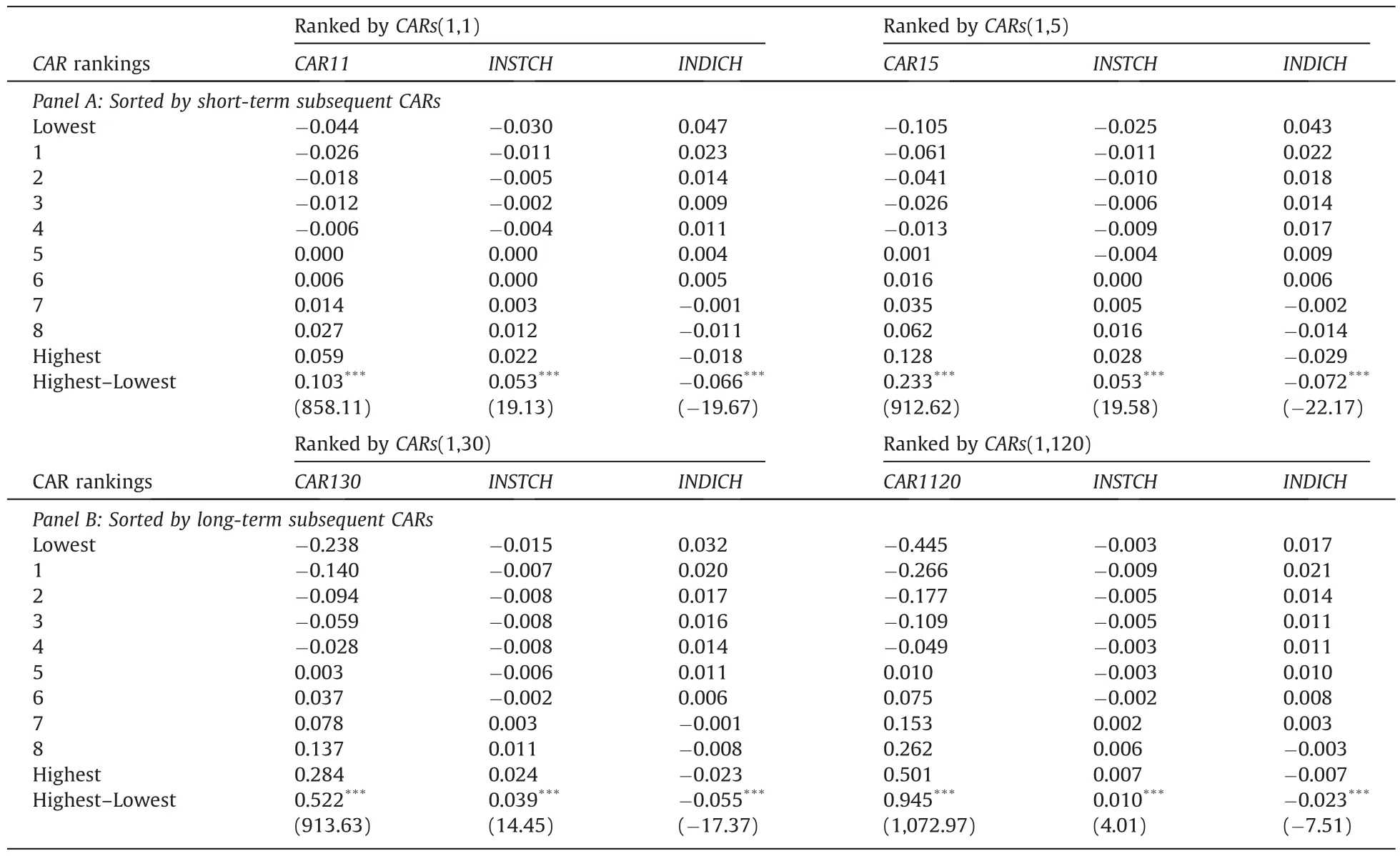

Table 6 reports the average daily change in institutional and individual ownership of each decile sorted by subsequent abnormal returns.Several patterns are worth noting.First,institutional investors sell stocks with low-ranked future abnor-mal returns and buy stocks with high-ranked future abnormal returns,with a statistically and economically significant difference.Second,the daily change in institutional ownership basically increases with the ranking of subsequent abnormal returns,whereas individual investor ownership decreases.These patterns hold regardless of whether they are measured in the short-term or long-term,and vice versa for individual investors.In summary,this initial evidence shows that institutional investors have better stock picking ability than individual investors.

Table 6Deciles of subsequent CARs.This table reports the ranking of stocks by both short-term and long-term subsequent CAR s.Stocks are ranked according to subsequent CAR s,sorted into decile,and the equally weighted average changes in institutional and individual ownership within each decile are reported.T-statistics are stated in parentheses.

Table 7Cross-sectional regression tests of changes in ownership on short-term future CAR s.This table reports the estimates from multivariate regressions of change in institutional ownership on short-term subsequent CAR s.Refer to Table 4 for variable definitions.T-statistics are stated in parentheses.

4.2.Regression tests on short-term subsequent abnormal returns

Table 7 reports the results of the cross-sectional regression tests of changes in institutional and individual ownership on short-term subsequent abnormal returns.Panel A shows that institutional investors increase(decrease)their shareholdings in stocks that subsequently exhibit positive(negative)short-term cumulative abnormal returns.In particular,institutional investor ownership increases(decreases)by 0.247%as subsequent one-day abnormal stock returns increase(decrease)by 1%.In addition,institutional investor ownership increases(decreases)by 0.187%as subsequent five-day cumulative abnormal returns increase(decrease)by 1%.Therefore,changes in institutional ownership are significantly positively related to short-term future abnormal returns,as Hypothesis 1 predicts.

Panel B illustrates that individual investors decrease(increase)their shareholdings in stocks that subsequently exhibit positive(negative)short-term cumulative abnormal returns.In particular,individual ownership decreases(increases)by 0.348%as subsequent one-day abnormal stock returns increase(decrease)by 1%.Furthermore,individual investor ownership decreases(increases)by 0.247%of the stock as subsequent five-day cumulative abnormal returns increase(decrease)by 1%.Thus,we find that changes in individual ownership are significantly negatively related to short-term future abnormal returns.

Table 7(continued)

4.3.Regression tests on long-term subsequent abnormal returns

Table 8 reports the cross-sectional regression results for changes in institutional and individual ownership on long-term subsequent abnormal returns.Panel A shows that institutional investors increase(decrease)their shareholdings in stocks that subsequently exhibit positive(negative)long-term cumulative abnormal returns.More specifically,institutional investor ownership increases(decreases)by 0.061%as subsequent 30-day cumulative abnormal returns increase(decrease)by 1%. In addition,institutional ownership increases(decreases)by 0.018%as subsequent 120-day abnormal stock returns increase (decrease)by 1%.This illustrates that change in institutional ownership is significantly positively related to long-term future performance,as Hypothesis 1 predicts.However,when we run the regression on changes in institutional ownership over the long window[30 and 120 day]abnormal returns,it turns out to be insignificant,suggesting that institutional investors shortsightedly focus on short-term returns more than long-term returns.

Panel B shows that individual investors decrease(increase)their shareholdings in stocks that subsequently exhibit positive(negative)long-term cumulative abnormal returns.In particular,individual investor ownership decreases(increases)by 0.084%as subsequent 30-day abnormal stock returns increase(decrease)by 1%.Furthermore,individual investor ownership decreases(increases)by 0.026%as subsequent 120-day cumulative abnormal returns increase(decrease)by 1%.Thus,we find that changes in individual ownership are significantly negatively related to long-term future abnormal returns.

4.4.Sensitivity analysis

Since institutions may prefer more risky stocks that lead to higher subsequent performance,we apply risk-adjusted abnormal returns calculated using the CAPM model as a robustness check.Beta is estimated on a daily basis for each stock, using the return data during the 60 trading days before the measurement date(no less than 20 trading days if there is

incomplete data)and our main results hold.3One referee also suggests that there may be reverse causality,because institutional trading may cause stock price movements or institutions may manipulate stock prices because of the significant amount of money they control.As we use daily data to test whether institutions have a superior ability to pick stocks in this paper,we believe that institutions’daily demand will only lead to contemporary stock price movements,but not in the subsequent period.If that were the case,institutions would just buy stocks and wait for the stock prices go up.That is,institutional ownership would become higher and higher.In our sample period from June 2007 to December 2008,however,institutional ownership decreased,as shown in Table 3.Therefore,the potential reverse causality problem is not severe in this paper.We also measure the subsequent abnormal returns after institutional investors buy or sell by longer or shorter windows,such as(+1,+2),(+1,+3)and(+1,+10)for short-term subsequent performance and(+1, +60),(+1,+90),(+1,+240),(+1,+360)and(+1,+480)for long-term subsequent performance.Our main results still hold.We also use total assets instead of market value to control for the firm size effect,which does not change our main results.

Table 8Cross-sectional regression tests of changes in ownership on long-term future CAR s.This table reports the estimates from multivariate regressions of change in institutional ownership on long-term subsequent CAR s.Refer to Table 4 for variable definitions.T-statistics are stated in parentheses.

5.Conclusions

In this paper,we use unique data on the shareholdings of both institutional and individual investors to directly investigate whether institutional investors have better stock selection ability than individual investors in China.Our methodology is based on the intuitive idea that if institutional investors are better at selecting stocks than individual investors,then institutional investors are more likely to buy future winners and sell future losers.Thus we first sort stocks by future price performance into ten deciles and examine the difference between institutional and individual investor daily trading among the deciles.The sorting evidence supports our hypothesis that institutional investors have better stock selection ability than individual investors.

We also regress institutional and individual investor daily trading on future stock performance while controlling for other factors,such as size and momentum effects.We find that institutional investors increase(decrease)their shareholdings in stocks that subsequently exhibit positive(negative)short-and long-term cumulative abnormal returns.In contrast,individual investors decrease(increase)their shareholdings in stocks that subsequently exhibit positive(negative)short-and longterm cumulative abnormal returns.These results indicate that institutional investors have superior stock selection ability in China.

The empirical results in this paper are not consistent with some of the research on institutional investors in the US market.This may suggest that institutional investors in China have more private information than those in the US.However,it is possible that they achieve their information advantage by illegal or unethical means,i.e.through unethical channels of inside information in a specific setting without effective regulation of insider trading.In fact,the Wall Street Journal reported on December 2,2010 that‘‘Several hedge funds under scrutiny in an insider-trading investigation made big bets on health-care stocks also being examined in the probe,according to a Wall Street Journal analysis.Hedge funds SAC Capital Advisors LP, Diamondback Capital Management LP,Jana Partners LLC and Balyasny Asset Management LP all increased their holdings in one or more of three health-care stocks during the quarters in which the companies announced mergers and the stock shot up in price,according to public filings.’’However,institutional investors have seldom been investigated and punished because of insider trading in China,although mutual fund star managers(such as Yawei Wang,etc.)often perfectly time their trading around valuable information disclosures(such as merger and acquisition announcements,etc.)and achieve superior performance.This suggests that China still has a long way to go in effectively regulating insider trading and improving its stock market mechanisms.

The above conclusions are subject to the caveat that we treat all institutional investors in China as the same due to the limited availability of detailed investor trading data.Chen et al.(2000)document evidence that stock selection abilitiesamong mutual funds vary significantly,suggesting that different institutional investors may vary in their stock selection abilities.Unfortunately,our data does not differentiate between different types of institutional investors.We leave this issue for future research with more detailed and complete data.

Acknowledgments

Yihong Deng is a doctoral candidate at Tsinghua University and Yongxing Xu is a postdoctoral researcher at Tsinghua University.We are grateful to Yuan Ding,RaffiIndjejikian,Jeong-Bon Kim,Jevons Chi-Wen Lee,Zhen Li,Jinghong Liang,James A. Ohlson,Liandong Zhang and other participants at the 4th Symposium of China Journal of Accounting Research at the Central University of Finance and Economics.We also thank Peikun Yu for collecting data on institutional trading positions.All remaining errors are our own.A China Scholarship Council Grant and accommodation provided by the University of Michigan to Yihong Deng are acknowledged.

Agarwal,P.,2005.Institutional Ownership and Stock Liquidity,Working Paper.Cornell University.

Aragon,G.O.,Bildik,R.,Yavuz,M.D.,2007.Do Institutional Investors Have an Information Advantage?Working Paper,Arizona State University.

Bello,Z.Y.,Janjigian,V.,1997.A reexamination of the market-timing and security-selection performance of mutual funds.Financial Analysts Journal 53,24-30.

Bhattacharya,S.,Pfleiderer,P.,1983.A Note on Performance Evaluation,Technical Report 714,Stanford University.

Bollen,N.P.B.,Busse,J.A.,2001.On the timing ability of mutual fund managers.Journal of Finance 56,1075-1094.

Chang,E.C.,Lewellen,W.G.,1984.Market timing and mutual fund investment performance.Journal of Business 57,57-72.

Chen,H.-L.,Jegadeesh,N.,Wermers,R.,2000.The value of active mutual fund management:an examination of the stockholdings and trades of fund managers.Journal of Financial and Quantitative Analysis 35,343-368.

Choe,H.,Chan,B.K.,Stulz,R.M.,2001.Do Domestic Investors have More Valuable Information about Individual Stocks than Foreign Investors?NBER Working Paper No.8073.

Deng,Y.,Lee,C.J.,2000.A Portrait of Institutional Traders in China,Working Paper.Tulane University.

Fama,E.F.,French,K.R.,2010.Luck versus skill in the cross-section of mutual fund returns.Journal of Finance 65,1915-1947.

Goetzmann,W.N.,Ibbotson,R.G.,1994.Do winners repeat:predicting mutual fund performance.Journal of Portfolio Management 20,9-18.

Grinblatt,M.,Keloharju,M.,2000.The investment behavior and performance of various investor types:a study of Finland’s unique data set.Journal of Financial Economics 55,43-68.

Grinblatt,M.,Titman,S.,1989.Portfolio performance evaluation:old issues and new insights.Review of Financial Studies 2,393-421.

Grinblatt,M.,Titman,S.,1992.The persistence of mutual fund performance.Journal of Finance 47,1977-1984.

Grinblatt,M.,Titman,S.,1993.Performance measurement without benchmarks:an examination of mutual fund returns.Journal of Business 60,97-112.

Gruber,M.J.,1996.Another puzzle:the growth in actively managed mutual funds.Journal of Finance 51,783-810.

Hendricks,D.,Patel,J.,Zeckhauser,R.,1993.Hot hands in mutual funds:short-run persistence of relative performance,1974-1988.Journal of Finance 48, 93-130.

Jensen,M.C.,1968.The performance of mutual funds in the period 1945-1964.Journal of Finance 23,389-416.

Kang,J.-K.,Stulz,R.M.,1997.Why is there a home bias?An analysis of foreign portfolio equity ownership in Japan.Journal of Financial Economics 46,2-28.

Kaniel,R.,Saar,G.,Titman,S.,2008.Individual investor trading and stock returns.Journal of Finance 63,273310.

Kent,D.,Grinblatt,M.,Titman,S.,Wermers,R.,1997.Measuring mutual fund performance with characteristic-based benchmarks.Journal of Finance 52, 1035-1058.

Lee,C.F.,Rahman,S.,1991.New evidence on timing and security selection skill of mutual funds.Journal of Portfolio Management 17,80-83.

Malkiel,B.G.,1995.Returns from investing in equity mutual funds 1971-1991.Journal of Finance 50,549-572.

Metrick,A.,1999.Performance evaluation with transactions data:the stock selection of investment newsletters.Journal of Finance 54,1743-1775.

San,G.,2007.Who gains more by trading-institutions or individuals?Working Paper,Tel-Aviv University.

Seasholes,M.,2000.Smart Foreign Traders in Emerging Markets,Working Paper.Harvard Business School,Cambridge,MA.

Treynor,J.L.,Mazuy,K.,1966.Can mutual funds outguess the market?Harvard Business Review 44,131-136.

Trueman,B.,1988.A theory of noise trading in securities markets.Journal of Finance 3,83-95.

Womack,K.L.,1996.Do brokerage analysts’recommendations have investment value?Journal of Finance 51,137-167.

Yu,P.,Lee,C.J.,Wang,Y.,2009.Do institutions outperform individual investors?China Finance Research 8,147-157.

18 October 2010

*Corresponding author.Tel.:+86 18776984959.

E-mail address:dengyh.03@sem.tsinghua.edu.cn(Y.Deng).

Institutional investors

Stock selection ability

Individual investors

杂志排行

China Journal of Accounting Research的其它文章

- Macroeconomic control,political costs and earnings management: Evidence from Chinese listed real estate companies

- Why are social network transactions important?Evidence based on the concentration of key suppliers and customers in China

- Do modified audit opinions have economic consequences?Empirical evidence based on financial constraints☆

- Corporate fraud and bank loans:Evidence from china