Poised for IPO

2010-09-12ByLIUYUNYUN

By LIU YUNYUN

Poised for IPO

By LIU YUNYUN

Financial uncertainties test the management expertise of Agricultural Bank of China before it becomes listed on China’s stock markets

Agricultural Bank of China Ltd. (ABC), the last of the “big four” state-owned commercial banks that is not listed, is expected to float its shares in both Hong Kong and the mainland stock markets later this year. It cleared a preliminary hearing with the China Securities Regulatory Commission (CSRC) on May 25.

Analysts estimated the bank will raise $26 billion-30 billion in total in the two markets by issuing no more than 53 billion shares, making it the largest initial public offering (IPO) so far this year.

ABC’s IPO is set to occur in a time of extreme uncertainties and market vulnerability due to recent global financial market turmoil. Internationally, the world economy has not been well healed as a sovereign debt crisis is dealing a heavy blow to European Union countries. On the domestic front, the benchmark Shanghai Composite Index nosedived to 2,555 points on May 20, the lowest level in the past 12 months, amid fears of accumulating banking risks.

Conundrum

ABC has more than 24,000 branches nationwide with more than 350 million customers. Though the second biggest in terms of assets among the “big four,” it has always been the weakest link among China’s state-owned commercial banks.

In the past, all state-owned banks made numerous “policy loans,” meaning the loans were issued based on government directives instead of for commercial reasons. ABC shouldered the most “policy loans” as it focused on lending to rural areas. To date, ABC has been the only state-owned bank that is devoted to agriculture, rural development and farmers—an appropriate set of actions given the bank’s name.

How to transform this policy-driven institution into a profit-seeking commercial lender has been a true challenge to ABC managers.

Experts feared the bank might have “too high moral standards” that could interfere with its actual proftability, which might be the biggest stumbling block for its listing.

ABC is striving to turn the previous burden into a competitive edge. Insiders from ABC, as reported by Caijing magazine, said the bank has extended the concept of “rural areas” by including county-level customers. As most of the loans to those clients are small, the risk of lending is adequately controlled. In addition, the loan-and-deposit interest rate difference of business relating to the rural areas is higher than that of urban business. In big cities, large companies are in a better position to bargain, and the lending interest rate is usually 10 percent lower than the benchmark rate. The case with small and medium companies is just the opposite—10 percent higher than the benchmark rate. As for ABC’s customers in rural areas, the rate is mostly 50 percent higher than the benchmark rate. Analysts believed the clearcut blue sea strategy will distinguish ABC from other banks.

Cash cow

ABC’s Vice President Pan Gongsheng said as of May 25 the national social security fund (SSF) had been the bank’s only strategic investor. People closer to the bank said it had no intention of inviting other strategic investors in the IPO. Ji Guoqiang, Director of the Equity Management Department of the National Council for the Social Security Fund, said the SSF has invested 15 billion yuan ($2.2 billion) in ABC in preparation for the IPO.

The SSF, established in 2000, has investments in all of the country’s largest listed state-owned commercial banks, including the Industrial and Commercial Bank of China (ICBC) and Bank of China (BOC). As of December 31, 2009, total assets under management of the SSF stood at 776.6 billion yuan ($113.7 billion). Last year, the fund weathered the global financial turbulence to achieve a rate of return at 16.1 percent of up to 84.9 billion yuan ($12.4 billion), according to the fund’s website announcement.

Unlike its domestic rivals, ABC may not look overseas for strategic investors. A number of foreign banks had the rare chance to buy into the major Chinese commercial banks in 2005 and 2006 ahead of their IPOs. In return, they pledged to teach their Chinese partners how to operate proftably and risk-free, and introduce advanced management expertise. But as the fnancial crisis swept through the world, many of them rushed to cash out of the Chinese equities to heal fnancial painsat home. Goldman Sachs, for example, in May 2009 sold a 0.9-percent interest in the ICBC for around $2 billion.

RURAL ORIENTED: Agriculture Bank of China is devoted to serving the country’s agriculture, rural areas and farmers. By the end of 2009, the bank’s rural-related loans totaled 1.2 trillion yuan ($176 billion)

This has raised suspicions over the need for an overseas strategic investor and many believe ABC may even open its door for domestic private companies. The State Council on May 13 announced a new policy that allowed private capital into the fnancial industry, including buying stakes at fnancial institutions.

Easy go

A number of domestic commercial banks are delaying their refnancing plans, which is believed to make way for ABC’s IPO.

At a press conference on May 20, Guo Shuqing, Chairman of China Construction Bank (CCB) said the bank is likely to postpone its refinancing plan until the end of 2010 or early 2011.

This move was widely believed to help stabilize stock market sentiment and clear the path for ABC to go public. Share prices of CCB on the Shanghai A-share market have been on a downturn as investors grow nervous about aggressive government tightening policies.

“We will carefully time the refinancing program in line with market conditions and still hope to raise around 75 billion yuan ($11 billion),” said Guo.

In another move, the Huaxia Bank Co. Ltd. has also recently delayed the announcement date for its refnancing plan.

In fact, top managers of ABC earlier this year hinted that its IPO will not be affected by the refnancing wave of other banks at all, said a recent report by the Shanghai Business Daily.

The regulators will arrange a reasonable timetable for fnancing of commercial banks, and the IPO of ABC is surely the most important, said Lu Zhengwei, chief economist at the Industrial Bank Co.

ABC’s Timeline

1999: The “big four” state-owned commercial banks—ICBC, CCB, BOC and ABC—spin off 1.4 trillion yuan ($200 billion) of non-performing assets to their corresponding asset management companies.

2004: ABC for the first time puts forward its shareholding reform plan.

September 2007: ABC starts a trial program in some provinces to strengthen financial services for “agriculture, rural areas and farmers.”

August 2008: ABC sets up a department providing fnancial services for“agriculture, rural areas and farmers” as part of its shareholding reform.

October 22, 2008: The State Council approves ABC’s shareholding reform plan.

November 6, 2008: Central Huijin Investment Co. Ltd. injects 130 billion yuan ($19 billion) into ABC, and ties as its largest shareholder with the Ministry of Finance.

January 9, 2009: ABC convenes its founding meeting in Beijing with a registered capital of 260 billion yuan ($38 billion).

February 2, 2009: Premier Wen Jiabao says the Central Government will inject 200 billion yuan ($29 billion) into ABC to help it prepare for the asset reorganization.

April 7, 2010: ABC kick starts the process of IPO, and 21 underwriters report their initial underwriting programs.

April 14, 2010: ABC says nine investment banks will help with its share issuance.

May 4, 2010: Reports hold that ABC files applications to list on the Shanghai Stock Exchange and Hong Kong Stock Exchange.

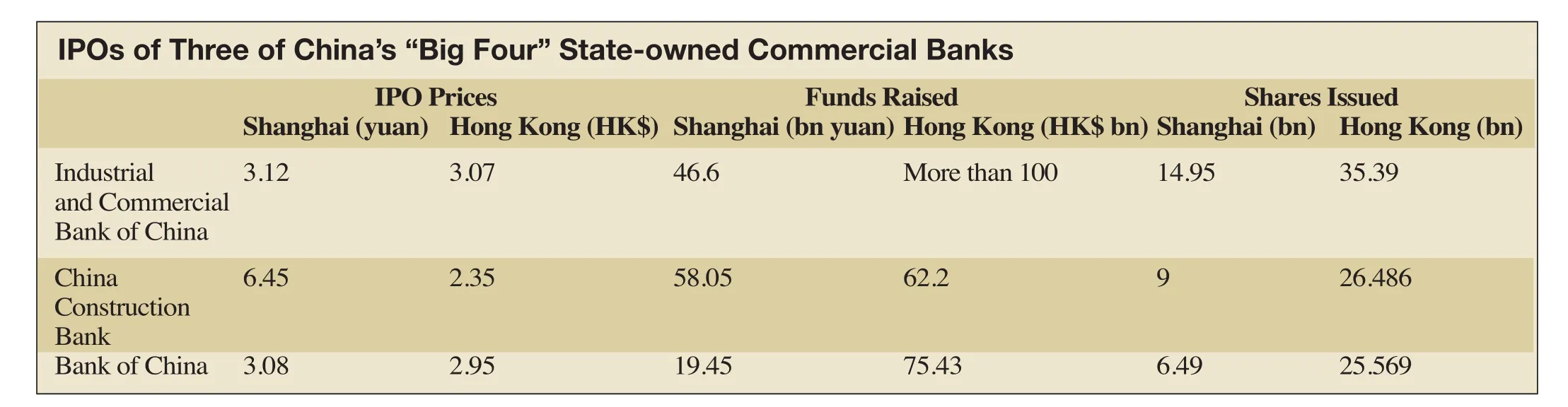

IPOs of Three of China’s “Big Four” State-owned Commercial Banks IPO Prices Funds Raised Shares Issued Shanghai (yuan) Hong Kong (HK$) Shanghai (bn yuan) Hong Kong (HK$ bn) Shanghai (bn) Hong Kong (bn) Industrial 3.12 3.07 46.6 More than 100 14.95 35.39 and Commercial Bank of China China 6.45 2.35 58.05 62.2 9 26.486 Construction Bank Bank of China 3.08 2.95 19.45 75.43 6.49 25.569