Shanghai Faces Three Challenges in Becoming Financial Center

2009-09-30

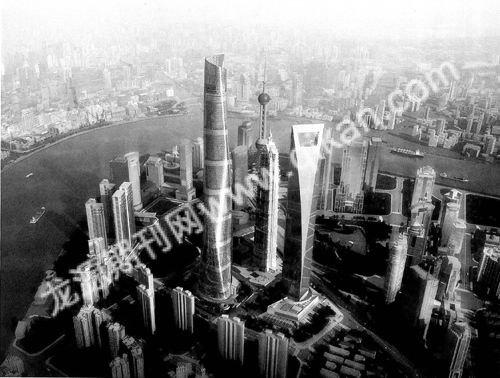

On May 16, 2009, the 2009 Lujiazui Forum was held in Shanghai. How to build Shanghai into an international financial center is the main topic of this forum.

This forum, named “the financial development and economic growth in the period of globalization”, has special meaning: the traditional western financial centers are seriously hit by the financial crisis while Chinas economy takes the lead in seeing recovery. In addition, China has already shown its will and determination to rebuild the international economic order. In that situation, to build Shanghai into an international financial center is at right time and right place. The start of this forum is undoubtedly a sign of Shanghais determination to become an international financial center.

What difficulties and challenges will Shanghai meet in becoming an international financial center? Lu Ting, an economist ofMerrill Lynch (Asian and Pacific Region), said: “Though building Shanghai into an international financial center can not be realized in a short time, Chinas economic growth rate, from the middle- and long-term view, is much higher than the western countries. It is one of the most advantageous factors for Shanghai to be an international financial center.”

One: Challenges from Other Cities

On May 15, the General Program of Shenzhen Comprehensive Supporting Reform was approved by the State Council of China. According to this program, Shenzhen plans to build five kinds of centers, which are global financial center, logistics center, trade center, innovation center and international cultural industry center.

On April 28, Beijings mayor Guo Jinlong said openly that Beijing is dedicating to becoming a financial center city with certain international influences; on April 20, Huang Qifan, standing Vice Mayor of Chongqing said that Chongqing is trying to be the financial center in the upstream areas of the Yangtze River; on April 18, Liaoning provincial government put forward the plan of building Shenyang into a financial center in Southeast China.

Liu Huangsong, Head of Economic Prosperity Research Office of Shanghai Academy of Social Science, said that Shanghai has the advantages other cities dont have: a comparatively consummate financial market system has been formed; Shanghai Stock Exchange has jumped in Top 10 in the world. The future exchange, gold exchange and inner-bank market are all well prepared. Whats more important is that Shanghai has already got a flock of financial talents after several years development and its internationalization level is higher than other cities.

Lu Ting said: “China has a large market, making it possible to have two or more regional financial centers.”

Two: Gap between Old Centers

The Britain-based Financial Times published the Latest Chart for Global Financial Center Index in March which shows that those well-established financial centers, though seriously hit by the financial crisis, still overpower Shanghai and Beijing. London still stands in the first place with 781 points. Following it are New York with 768 points and Singapore with 687 points. Hong Kong is ranked at No. 4 with 684 scores. No. 5 and No. 6 are two Swiss cities-Zurich and Geneva.

Tokyo falls from No. 7 to No. 15 and Sydney falls from the tenth place to the sixteenth. Shanghai and Beijing, however, doesnt benefit from the financial crisis in their ranks. Shanghai stands at the 35th place, one place lower than last chart. Beijing falls by 4 levels to No. 51. Taipei, Kuala Lumpur and Bangkok for the first time enter the chart, respectively ranking at No. 41, No. 45 and No. 50.

Therefore, it is a long way for Shanghai to become an international financial center like London and New York. According to Liu Huangsong, Shanghai is in the initial stage of building an international financial center. It is forecasted that it will reach the middle stage in 2020. “By then, Shanghais stock market will have certain scale. Those foreign companies will also be listed. The foreign exchange market will also have larger influence in Asia. It will possess the ability to impact the global steel and oil prices. The settlement of Renminbi will also be done in Shanghai.”

Liu Songhuang said: “In spite of this, Shanghai cant reach the level of London and New York in 2020. But it may jump in the list of Top 10 global financial centers.”

Third: Restrictions from Policies

Previously, some experts pointed out that Shanghai has to face two hurdles during its construction of international financial center: the first hurdle is that the headquarters of macro adjustment department, financial supervision department and some major commercial banks are set up in Beijing; the second hurdle is t that the Renminbi can not be exchanged freely at this time.

“Those two restrictions do exist. No changes will be seen in a short time. But this doesnt mean that Shanghai cant get any achievements,” said Liu Huangsong. Presently, what Shanghai primarily needs to do is to increase its market strength and market competitive power, including developing new financial products and introducing warrants and stock index futures.

“Apart from the focus on reform of marketization, administration measures should be adopted as supports,” said Liu Huangsong. In his opinion, Shanghai should actively asks for the support from the State Council and central government to set up, for example, the headquarters of China Banking Regulatory Commission, China Securities Regulatory Commission and China Insurance Regulatory Commission in Shanghai.

Hai Jiming, chief economist of China International Capital Corporation, said that the globalization of Renminbi shall satisfy two conditions: one is basic condition and the other one is policy. The basic condition has already been available. However, there is no policy allowing Renminbi to be exchanged freely. Its influence upon the world is not enough. Therefore, the internationalization of Renminbi should be pushed forward.