Research on Innovation-Driven Expansion of Regional OFDI:New Evidence From a Business Environment Perspective

2024-02-28DuanLonglongandLiQingyi

Duan Longlong and Li Qingyi

Sichuan University

Abstract: This paper investigates the impact of provincial innovation-driven efficiency on the expansion of regional Outward Foreign Direct Investment (OFDI) flows within the context of China’s economy during the period 2011 to 2020 by measuring the innovation-driven efficiency and business environment index using the DEA-Malmquist index and the combined CRITIC weighting method from the new perspective of business environment improvement.The findings reveal that: (a) There is an inverted U-shaped relationship between provincial innovation-driven efficiency and regional OFDI flows.This increase in innovation-driven efficiency can promote OFDI expansion of the region by improving its business environment.(b) The improvement of the business environments plays a significant intermediary and synergistic role in OFDI expansion driven by improved innovation efficiency.(c) The study of regional heterogeneity suggests that the central region enjoys the longest window period in terms of innovation-driven OFDI expansion,followed by the eastern region while the western region has the shortest window period.The improvement of the business environment in the western region is more effective in driving regional OFDI expansion.This conclusion remained true after the robustness test.In conclusion,this paper offers a few policy recommendations that can help Chinese capital of various kinds go global more effectively.

Keywords: innovation as a driver,innovation efficiency,OFDI expansion,business environment

China will continue to promote high-standard opening up to improve the level and quality of trade and investment cooperation.This signifies that China has officially advanced a broader agenda of opening up across more areas and in greater depth.As one of the major vehicles to promote high-standard opening up,outward foreign direct investment (OFDI) is of gforemost importance regarding China’s ability to enhance its international competitiveness and integrate into the global economic system.Over the past 40 years since the reform and opening up in 1978,China has witnessed a surge in OFDI.According to the2022 Statistical Bulletin ofChina’s Outward Foreign Direct Investment,China’s OFDI reached an impressive US$163.12 billion in 2022,securing its position as the world’s second-largest contributor to global outward investment.However,due to the adverse influence of the global economic downturn,China’s OFDI experienced a steady decline from 2017 to 2019,culminating in negative growth,which was the first ever since China began reporting its OFDI statistical data.Amidst the complicated external environment,how to expand opening-up and promote the implementation of the going global strategy in the new era of high-quality development becomes a pressing issue that demands immediate attention and thoughtful deliberation.

When Chinese enterprises embark on the journey of international expansion,their innovation capability becomes a crucial determinant in gaining competitive advantages within the global market.The fifth plenary session of the 19th Communist Party of China (CPC) Central Committee in 2020 emphasized the need for China to promote innovation-driven high-level opening up.Since then,China has intensified the practical implementation of its innovation-driven development strategy,effectively facilitating the shift from a factor-driven and investment-driven economic growth model to an innovation-driven model.This transition has injected new momentum into China’s highlevel opening up.Given that the OFDI level is affected by both technological innovation and the institutional environment,it becomes imperative for the government to provide timely guidance and regulation to ensure proper oversight of enterprises’ OFDI behaviors.Notably,following the 18th National Congress of the Communist Party of China (CPC),a considerable number of policies and measures have been introduced,with a focus on fostering innovation-driven development.However,it remains uncertain whether these measures have genuinely facilitated the successful international expansion of Chinese enterprises.In particular,amidst the ongoing improvement of the business environment,there is a theoretical controversy over the issue of whether changes in innovation-driven efficiency and the business environment can interact in a coordinated manner to jointly promote the expansion of China’s OFDI scale.The clarification of the mechanism of how innovation-driven efficiency and the business environment affect the scale of regional OFDI and their relationships holds considerable theoretical and practical significance in realizing China’s strategic objective of high-level opening up in the new era which calls for high-quality development through a new development pattern.

Literature Review

How Does Technological Innovation Affect OFDI Expansion

A majority of scholars consider technological innovation a motive behind OFDI when coming to the relationship between innovation and OFDI.In terms of the motives behind OFDI,the academic community widely agreed that market seeking,resource seeking,efficiency seeking,and technology seeking were the four predominant determinants of OFDI (Lecraw,1984).Technology-seeking OFDI aimed to assist a country’s enterprises in closing the technological gap with the host country by accessing advanced technology and research resources (Yao,2016),to upgrade their technology and optimize their industrial structure (Zhu & Li,2022).Strategic asset-seeking was also a motive behind OFDI (Amighini et al.,2013).In recent years,there has been a notable rise in the proportion of technology-seeking OFDI within China’s OFDI landscape,gradually displacing natural resourceseeking OFDI (Wong et al.,2022).The implementation of an innovation-driven strategy could facilitate the technological advancements and innovation of enterprises by leveraging the reverse technology spillover effect of OFDI,consequently exerting an indirect influence on enterprises’ OFDI behavior (Driffield & Love,2003).

However,the existing academic literature on the direct impact of technological innovation on OFDI is limited.Within the current body of literature,there are three predominant viewpoints.The first viewpoint asserted that technological innovation and increased innovation efficiency could promote OFDI.R&D-driven technological innovation enabled enterprises to expand their presence in foreign markets by leveraging their distinctive technological advantages while overcoming the inherent disadvantages they faced as external entities (Kafouros & Buckely,2008).As a result,an increased investment in R&D by enterprises corresponded to a proportional rise in their demand and scale of OFDI activities (Peng,2020).The second viewpoint asserted that technological innovation inhibited the OFDI of a region.Several notable studies in the existing body of literature revealed that the enhancement of innovation capability within enterprises diminished their motivation to pursue advanced foreign technologies through investments.(Zhou & Li,2022).Transnational research indicated that the technological innovation carried out by developing countries might weaken the technological leadership traditionally enjoyed by developed countries.Consequently,some developed countries responded by intensifying investment review mechanisms and imposing restrictions on cross-border acquisitions,where necessary.These measures could have an adverse impact on the OFDI behavior of enterprises in developing countries.(Huang,2017).The third viewpoint asserted that the impact of technological innovation on OFDI was not significant.This could potentially be attributed to an overemphasis on the role of technological innovation (Andreff,2002).The impact of innovation on the OFDI behavior of the home country’s enterprises varied depending on the enterprises’ ownership structure.As such,technological innovation policies might exert a substantial impact on state-owned enterprises,while having limited effects on local state-owned enterprises and private enterprises (Zhao,2021).

Relationship Between Business Environment and OFDI Expansion

A good business environment was essential for ensuring the stability of the economy,facilitating the effective implementation of policies,and fostering the sustainable operations of enterprises.It was an important component of a nation’s economic soft power (Jiang et al.,2022).However,the existing literature presented divergent perspectives regarding the impact of the business environment on China’s OFDI.Some scholars argued that improving the business environment can effectively promote OFDI by streamlining administrative procedures and relaxing capital controls (Luo,2010).Simultaneously,a law-based and facilitative business environment could also reinforce the home country’s specific advantages and drive its enterprises to engage in OFDI (Xue & Shuai,2019).Other scholars hold that because different elements within the business environment system had different impacts on OFDI,the impact of the business environment on OFDI seemed to be neutral.Specifically,the implementation of credit market-oriented reforms,supportive tax policies,and streamlined approval procedures were instrumental in driving a region to engage in OFDI.Yet,the reinforcement of intellectual property protection noticeably inhibited enterprises’ OFDI in the initial stage of their internationalization (Jiang & Wang,2014).Similarly,studies have found that non-financial policy measures such as information support,the streamlining of administrative procedures,and strengthened diplomatic protection contribute to enhancing the performance of OFDI carried out by Chinese enterprises by facilitating efficiency improvements and reducing operational costs.However,financial support could not be directly translated into enterprises’ competitive advantage.At the same time,the improvement of the business environment could potentially lead to a crowding-out effect(Qi & Guan,2017),resulting in the effective reduction of tax burdens for enterprises and improved supply efficiency of public goods.This could attract some enterprises to return to their home country,“weakening” their OFDI activities (Lin,2020).

An examination of the existing body of literature identified several notable research gaps.First,a majority of the existing literature predominantly focused on exploring the influence of OFDI reverse technology spillovers on regional innovation capabilities.However,there was a paucity of studies that specifically investigated how the technological innovation of enterprises or regions directly impacted OFDI.Second,current domestic and foreign literature pertaining to the impact of a business environment on OFDI largely analyzed this relationship from the perspective of the host country,with a dearth of literature that examines the impact of OFDI from the standpoint of the home country.Third,no study to date has investigated the joint impact of technological innovation and business environments on OFDI.Therefore,there is a growing urgency to examine whether efficiency enhancements driven by innovation can augment the quality of China’s OFDI by improving the business environments.The marginal contribution of this paper lies in the following two aspects:First,it considers technological innovation efficiency,an indication of innovation-driven strategy as a pivotal influencing factor in China’s OFDI,exploring the theoretical feasibility of innovation-driven efficiency promoting the expansion of OFDI.It provides a new avenue for studying the reverse effects of innovation-driven efficiency on OFDI.Second,it has established a comparable and traceable business environment index based on China’s business environment.Building upon this index,it examines the mechanism and actual results of the synergy between innovation-driven efficiency and business environment improvements for the expansion of OFDI.It provides empirical support to the proposal of expanding OFDI through government regulation and the market.

Research Design

Theoretical Framework and Hypothesis

According to the endogenous growth theory,the disparity in economic development across regions is predominantly determined by the disparity in their technological progress and innovative capability.Conventional theories on foreign direct investment,such as the monopolistic advantage theory and the eclectic theory of international production,focus on the ownership advantage,location advantage,and internalization advantage enjoyed by multinational corporations (MNCs).During the innovation output process,technological innovation reinforces the ownership advantages of enterprises and enhances their capability to engage in international investments,representing a critical prerequisite for enterprises to engage in OFDI.The development trajectory of OFDI indicates that it not only reflects MNCs’ competitive advantage but also can serve as an innovation input channel to obtain advanced technology and facilitate technological innovation.According to the diffusion of innovation theory,technology-seeking OFDI employs investment as a tool to absorb advanced technologies through technology transfer and spillover from the host country.This is an important motive for enterprises to carry out OFDI.Therefore,the OFDI level of an enterprise is the synergy of both innovation input and output.

The theory of investment-inducing factors argues that,in addition to direct-inducing factors such as technological innovation,indirect-inducing factors such as the business environment also play a significant role in promoting OFDI.As the organic combination of various policies,the business environment exerts its influence on OFDI through two distinct mechanisms: institutional incentives and institutional avoidance.The former refers to the governmental introduction of incentive policies aimed at fostering a cordial and clean relationship between government and business and offering preferential treatment in terms of financing and taxation to enterprises.This can improve the business environment and mitigate institutional transaction costs,thereby affecting the flow of enterprises’ funds.The latter relates to the inclination of enterprises to opt for OFDI as a means of evading restrictive policies or legislation arising from institutional constraints and the deterioration of the business environment.Therefore,the business environment can serve as both a catalyst for enterprises to gain comparative advantages and as a motivator for enterprises to escape from institutional constraints.

Technological innovation can also facilitate industrial structure transformations,enhance social services and infrastructure systems,and influence the innovation environment.Consequently,it effectively enhances the business environment and indirectly affects enterprises’ OFDI behavior.Specifically,regional innovation-driven performance exerts a direct impact on enterprises’ OFDI through the synergy of innovative input and output.Industrial agglomeration during the urbanization process engenders knowledge spillover and the concentration of innovative elements,ultimately augmenting the density of innovative input.As a result,the innovative input drives enterprises to engage in OFDI by bolstering their pursuit of technology.The upsurge in innovative input leads to an increased level of innovation output,thereby creating favorable conditions for OFDI by strengthening enterprises’ ownership advantages.The business environment exerts its influence on OFDI via institutional incentives and institutional escapism.In terms of institutional incentives,improvements in the business environment result in reduced institutional transaction costs,decreased government rentseeking behavior,and increased potential for international investment to return to the home country or to enhance the willingness and capability to engage in OFDI.In terms of institutional escapism,the deterioration of the business environment can weaken enterprises’ advantages in OFDI or drive them to engage in OFDI to escape institutional constraints.Moreover,technological innovation can lead to new technologies and facilitate the expansion of new industrial chains,consequently facilitating the optimization and upgrading of the industrial structure.The shift in industrial structure towards service sectors,such as finance and information,has led to the diversification of financing channels available for enterprises and the enhancement of the social credit system.This transformation has also contributed to the further improvement of regional business environments,thereby establishing an additional theoretical framework.As a result,the following hypotheses have to be tested:

H1: The relationship between the increase of regional innovation-driven efficiency and local OFDI expansion may be nonlinear.

H2: The improvement of the business environments may drive a region to expand OFDI.

H3: Regional innovation-driven efficiency exerts its influence on local OFDI expansion by altering the local business environments.

Definition of Variables

Based on the established theoretical framework and hypotheses,this study examined the impact of technological innovation and business environments on OFDI and explored the potential intermediary effects of government-led business environment improvements on the OFDI activities of enterprises.In the new era,China’s economy is characterized by uneven and inadequate development across regions.Given this regional heterogeneity,the present study has examined the OFDI activities across China’s 31 provincial-level administrations (provinces,autonomous regions,and municipalities directly under the central government) using panel data models from econometrics.The time series selected spans the period from 2011 to 2020.According to empirical experience,the panel data models were set to have a fixed coefficient and varying intercepts.Before modeling,it was necessary to accurately measure and define each variable.

Core Explanatory Variable: OFDI.

Currently,there are two commonly used methods to collect statistics for OFDI,namely measurements based on the flow and measurements based on the stock.Various criteria exist for the selection of indicators to measure provincial OFDI.One approach involved the direct use of OFDI flows or stocks for calculation (Sun & Zhang,2022; Yin & Zhu,2017).Another approach considered the ratio of OFDI flow or stock to each region’s GDP (Li & Wang,2016).Lastly,some studies employed per capita OFDI as an indicator (Liao et al.,2020).Within the dynamic context,the authors believed that the flow of OFDI provides a more direct reflection of the evolving trend of OFDI in the present period.What’s more,the per capita OFDI data mitigates the impact of population size on OFDI.Therefore,this study employed non-financial per capita OFDI flow data from each province as a core explanatory variable and converted OFDI measured in USD into OFDI measured in RMB using exchange rates from the respective years.

Core Independent Variable: Regional Innovation-Driven Performance (TE).

There are many ways to measure regional innovation-driven performance,including the single indicator method,multi-indicator method,and input-output efficiency-based method.Within the context of the single indicator method,innovation performance is assessed through a specific index that can reflect innovation output,such as the quantity of patents,revenue generated from new products,and the number of scientific and technical journal articles.However,it is difficult to fully reflect the comprehensive implementation effect of a regional innovation-driven development strategy.The multi-indicator method takes innovation input into account and assesses the innovation performance based on both innovation input and output.The efficiency method used the ratio of innovation input to innovation output as an indicator to measure innovation performance,providing insights into the allocation and utilization of innovation resources.This method provided a more accurate depiction of a region’s innovation capability (Xu et al.,2022).In this paper,innovation-driven efficiency is used to measure regional innovation performance.

Some scholars employed the data envelopment analysis (DEA) method to measure regional innovation efficiency.This approach uses mathematical programming and statistical data to determine the decision-making units (DMUs) on the boundary.Subsequently,efficiency calculation is performed by assessing the deviation degree of other DMUs from this boundary,avoiding subjective parameter settings.However,the conventional DEA method based on CCR and BBC models,fails to effectively compare the dynamic change trends among regions at different periods.Hence,it is not suitable for panel data analysis.This study has built a DEA-Malmquist model by integrating the DEA method with the Malmquist index method to empirically measure the changes in innovation performance across China’s 31 provincial-level administrations from 2011 to 2020.

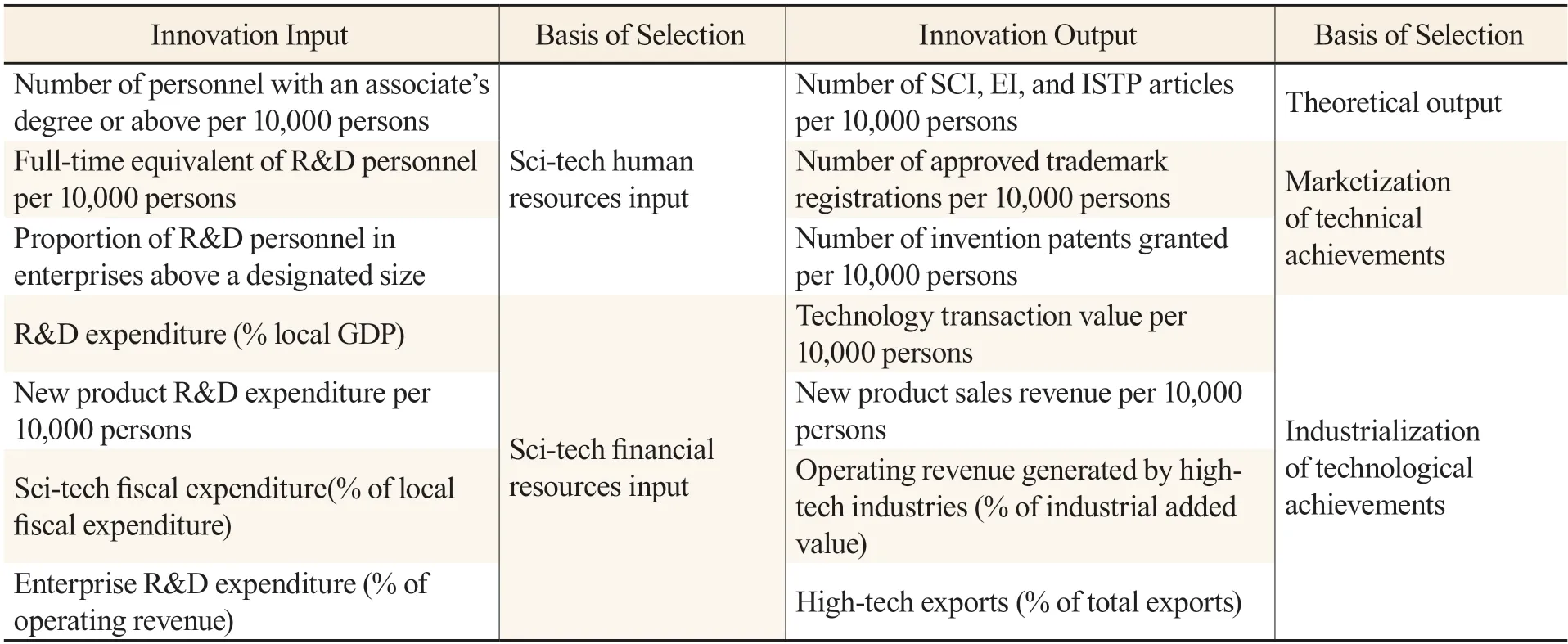

This paper constructed an input-output index system to measure regional innovation-driven efficiency.Building on the measurement method proposed by Xu (2022),this paper divided innovation input into sci-tech human resources input and sci-tech financial resources input.To assess sci-tech human resources input,three indicators were selected,which collectively depicted the number and quality of personnel engaged in scientific and technological work within a region.These indicators included the number of individuals with an associate degree or above per 10,000 persons,the full-time equivalent (FTE) of research and development (R&D) personnel per 10,000 persons,and the proportion of R&D personnel in enterprises above a designated size.To assess sci-tech financial resources input,four indicators were employed,which were the new product development cost per 10,000 persons,R&D expenditure (% of regional GDP),sci-tech fiscal expenditure (% of local fiscal expenditure),and enterprise R&D expenditure (% of operating revenue).These indicators reflected the quantity and intensity of regional investments in the sci-tech field.This paper divided innovation output into theoretical output and technological achievements.To ensure the quality of theoretical innovation,the number of SCI,EI,and ISTP articles per 10,000 persons was selected as an indicator to effectively measure the theoretical output of a region.As technological achievements might or might not be translated into economic benefits,further division was necessary.Hence,technological achievements were categorized into marketed ones and industrialized groups.The number of registered trademarks per 10,000 persons and the number of patents granted for inventions per 10,000 persons were used to measure the potential economic benefits that could be derived from technological achievements through marketization.Four indicators were used to represent technological achievements that had been successfully transformed into economic benefits.These indicators were technology transaction value per 10,000 persons,new product sales revenue per 10,000 persons,operating revenue generated by high-tech industries (% of industrial added value),and high-tech exports (% of total exports).

The above innovation input and output index system is a combination of indicators to measure each DMU.The input-oriented DEA-Malmquist index model was used to calculate the provincial innovation-driven efficiency index one by one.The selected input and output indicators are shown in Table 1:

Table 1 Input and Output Indicators for Innovation-Driven Efficiency Calculation

CoreIndependent Variable: Business Environment Index (BEI).

Numerous studies have been conducted to assess the business environment.The World Bank’s Ease of Doing Business Index,which covers 10 topics,is widely used by the academic community.The Ease of Doing Business Index,introduced in 2003 and continuing to serve its function,is scientific in nature and provides a clear direction for China’s continuous improvement of its business environment.However,the index has some limitations.First,the topics it covers are limited.Second,the data collected referred to businesses in the economy’s largest cities (Beijing and Shanghai in China’s case) and might not represent regulations in other locations of the economy (Liu et al.,2020).Given the limitations of the World Bank’s index and the diversity of China’s social development,it was of particular importance to establish a provincial business environment evaluation index with Chinese characteristics (Yang et al.,2020).

With reference to the World Bank’s reports and international good practices,a provincial business environment evaluation index system with Chinese characteristics was developed for this paper.This system encompassed the five major reform areas①The five key areas to implement reforms include the protection of market entities,enhancement of the market environment,improvement of government services,strengthening of regulation and enforcement,and legal assurances.China proposed in the Regulations on Improving Business Environment released in 2019 and the National Commission of Reform and Development’s requirements for establishing a high-quality and internationally comparable business environment evaluation index system.This system covered 7 primary indicators and 11 secondary indicators.The primary indicators were the market environment,policy environment,taxation environment,financial environment,credit environment,infrastructure environment,and ecological environment.Each indicator was assigned a weight and when combined,they formed the business environment index(BEI).

This paper adopted the objective weighting method of CRITIC to ensure the objective assessment of each indicator.Compared with the other two objective weighting methods,the standard deviation method,and the entropy weight method,the CRITIC method has significant advantages because it takes the data volatility and data correlation between the indicators into account.The core of the CRITIC method lies in contrast intensity (data volatility) and conflict evaluation (data correlation).The contrast intensity is expressed by standard deviation.A larger standard deviation indicates greater volatility and higher weight.The conflict evaluation is expressed by the correlation coefficient.A greater correlation coefficient indicates less conflict and lower weight.The CRITIC weights of provincial business environment indicators were calculated with the SPSSAU software (Table 2).Therefore,BEIs of China’s 31 provincial-level administrations from 2011 to 2020 have been obtained.

Table 2 Provincial Business Environment Indicators and Weights

Definition of Control Variables.

In addition to the above core variables,this paper also selected some control variables,including (a)GDP per capita.GDP per capita had a positive role in promoting OFDI,and economically developed regions had a higher level of OFDI (Ma & Xue,2022).(b) Opening-up level (OPEN,FDI flows (%of GDP)).FDI could improve the quality and capability of enterprises’ OFDI through technology spillover and resource allocations (Fu & Lin,2021).(c) Urbanization level (UR,urban population (%of total population)).Urbanization could promote the accumulation of intangible assets such as the industrial cluster effect,cost efficiency advantages,and tangible assets such as financial support and human resources support.Both had a positive impact on OFDI (Wang & Mao,2020).(d) Ownership structure (OS,ratio of total assets of SOEs to total assets of private enterprises).The diversification of OFDI entities led to the rapid growth of OFDI (Gong & Li,2016).(e) Industrial structure (IS,the ratio of secondary and tertiary industries to primary industry).The industrial structure had a direct impact on the scale and growth rate of OFDI.There was a bilateral causal relationship existing between the industrial structure and OFDI (Zhang & Tang,2019).The data sources of the above variables can be found in theChina Statistical Yearbook for Regional Economyand theChina Statistical Yearbook forMacroeconomyover the years.

Model Selection and Preliminary Analysis

To establish econometric models,it was essential to conduct hypothesis tests to examine the relationships between variables.Following the basic methods and steps of econometric modeling,it is advisable to commence with the drawing of scatter plots.The regional innovation-driven performance(TE) and business environment index (BEI) mentioned above were used as the horizontal axis while the log of regional OFDI flows as the vertical axis.The linear fitting results of the scatter plot showed that within the context of China,TE and OFDI exhibited an inverted U-shaped relationship,and a positive correlation was observed between BEI and OFDI within the sample period.To delve deeper into the underlying mechanism of how TE and BEI affect OFDI,more comprehensive panel data models are required to conduct parameter estimation.Prior to conducting parameter estimations,it is crucial to execute unit root tests on the pertinent variables,thereby mitigating the occurrence of pseudo-regression issues.This precautionary measure ensures the accuracy and validity of the subsequent parameter estimation process.Currently,the econometric community offers various methods for conducting unit root tests on panel data.The commonly used method is to conduct a joint diagnosis using the Levin-Lin-Chu test (LLC test),the ADF-Fisher test,and the PP-Fisher test.Specifically,if two out of the three methods yield significant results during the significance test,it is safe to conclude that a series meets the stationarity criterion.The results of the panel unit root tests for each variable series are shown in Table 3.

Table 3 Panel Unit Root Test Results of Each Variable Series

The diagnostic results in Table 4 revealed that the test results of the explanatory variable of BEI and the control variables of CGDP and IS were non-stationary while the remaining variables fulfilled the criteria for stationarity.To facilitate subsequent estimations,a transformation must be applied to the nonstationary series.The transformation techniques commonly used include differencing,logarithm transformation,and exponential smoothing.Logarithm transformation was employed in this paper.Tests were conducted after the transformation and the series were found to satisfy the conditions of stationarity.Ultimately,all stationary series were incorporated into the quantitative regression model for estimation.

Table 4 Static Panel FGLS Estimation for Static Panel Data of the Impact of Innovation-driven Efficiency and Business Environment on Regional OFDI (national samples)

Now,the panel data models established are as follows:

Where,LnOFDIitis the OFDI level of the province in the year oft;LnBEIit×TEitthe interaction term of the business environment and innovation-driven efficiency ofiprovince in the year ofi;Controlita series of control variables,including logarithm of economic growth (lnCGDP),opening up level (OPEN),urbanization (UR),ownership structure (OS),industrial structure (lnIS);μit,ηit,andγitstochastic disturbance terms,which comply with independent homoskedasticity assumptions in nature.According to the distribution of the numbers of individuals and time series of the provincial panel data models,it is reasonable to choose models with a fixed coefficient and varying intercepts.

Empirical Analysis

Benchmark Regression

On a national scale,this paper first estimated how innovation-driven efficiency and business environments affect regional OFDI under static conditions.In addition to the three relationship assumptions defined by the panel models above,there may also be a correlation between innovationdriven efficiency and the business environments.Moreover,the existence of some control variables leads to multicollinearity in the models.To eliminate the effects of multicollinearity and heteroscedasticity,stepwise regression and White robust standard errors were introduced for corrections.At the same time,this paper performed fixed-effects and random-effects regressions on the panel data and used the Hausman test to determine whether to use the fixed-effects model or the random-effects model.Table 4 shows the estimation results of the static panel models using the software Eviews11.0.

Models 1 and 2 show the regression results of the impact of regional innovation-driven efficiency on OFDI,model 3 shows the regression results of the impact of regional business environments on OFDI,and models 4,5,and 6 show the regression results including the interaction between innovation-driven efficiency and business environments.It can be seen from the estimation results of the above static panel model that: (a) There was a significant inverted U-shaped relationship between regional innovation-driven efficiency and OFDI.The critical value of innovation-driven efficiency at the deflection point was about 1.06.In other words,innovation-driven efficiency can promote OFDI growth at the initial stage of the innovation-driven strategy and restrain enterprises’OFDI once it exceeds the critical value.The average innovation-driven efficiency of China in 2019 indicated that China was currently in the initial phase of this inverted U curve.This observation implied that enhancing innovation-driven efficiency during this stage could significantly stimulate enterprises to carry out OFDI activities.(b) From the perspective of the direct effect of the business environments,the regression coefficient was significantly positive,indicating that improving the business environments could promote OFDI.At the same time,when comparing the impacts of innovation-driven efficiency and the business environment on OFDI,it was observed that the business environment coefficient exhibited a larger absolute value.This suggested that improving the business environment had a more pronounced impact on enterprises’ OFDI activities.(c) From the perspective of the synergistic effect of the business environment on the relationship between innovation-driven efficiency and OFDI,there was a significant negative correlation between the interaction term of the business environments and innovation-driven efficiency and the OFDI.This suggested that as the business environment continued to improve,the advancements in innovation capabilities would inhibit enterprises’ OFDI behavior.The business environment reinforced the inverted U-shaped relationship between regional innovation-driven performance and OFDI.When the business environment improved and innovation-driven efficiency reached a certain level,it would attract outward investments to backflow to the home country and the inflow of foreign direct investment.(d) From the perspective of the effects of the control variables,the regression coefficients of economic growth,opening up,urbanization,and ownership structure were significantly positive,which was highly consistent with the previous hypothesis.However,the regression coefficient of the industrial structure was significantly negative,failing to meet the proposed expectations.This outcome could be attributed to the presence of multicollinearity and the concentration of China’s OFDI in labor-intensive and low value-added sectors,in particular the mining industry and traditional service sectors.In recent years,China’s industrial structure upgrading primarily happened in emerging industries and services.However,the OFDI from these emerging sectors remained relatively low,resulting in a negative correlation between industrial structure upgrading and OFDI.

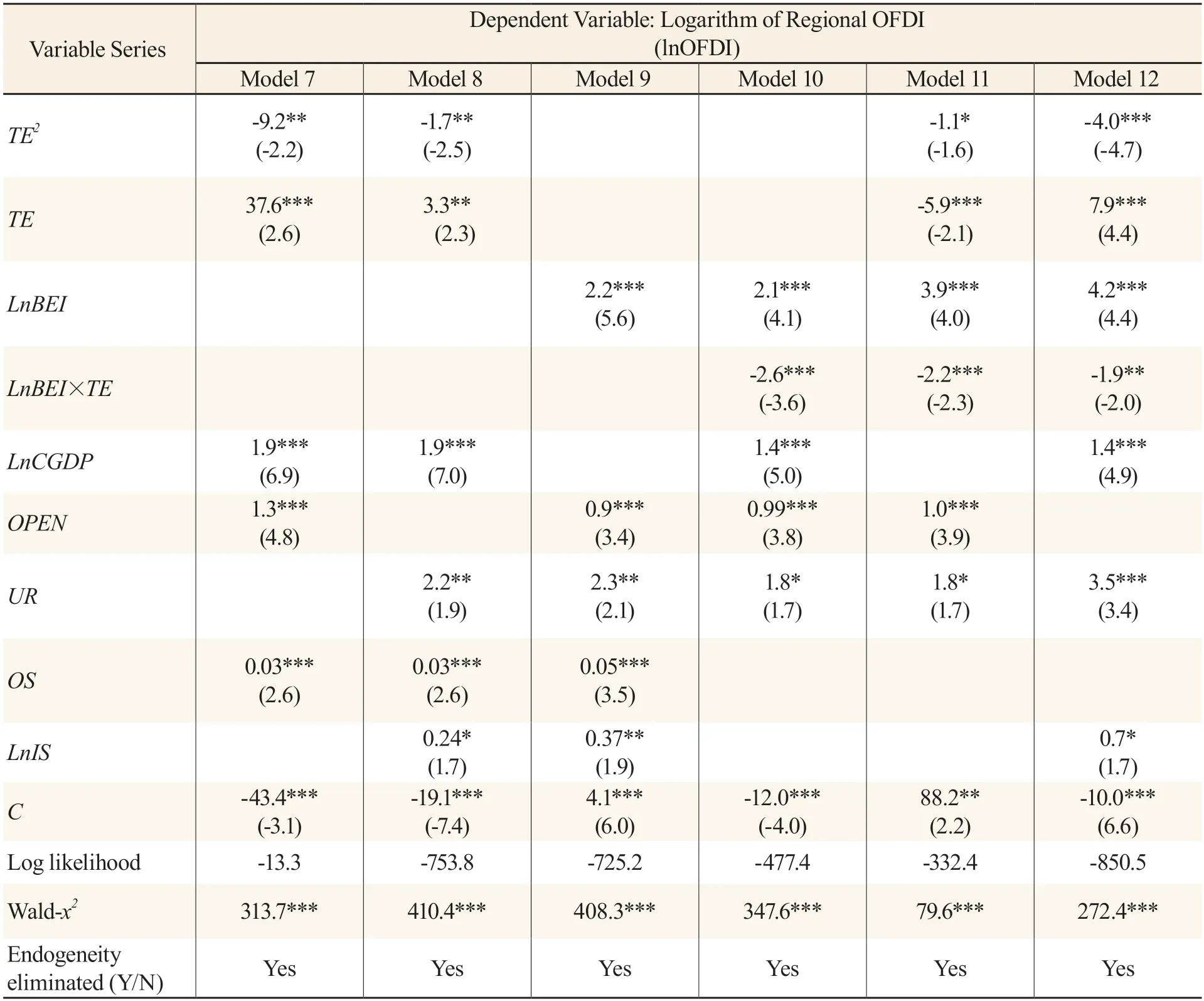

Elimination of Endogeneity and Consideration of Regional Heterogeneity

Due to the uneven and inadequate economic development across regions in China,it is difficult to reflect the regional heterogeneity of the impact of innovation and business environment on OFDI when national samples are used.Therefore,it is necessary to explore the impact from a geographical perspective in order to provide a comprehensive understanding of how the business environment and innovation-driven efficiency impact regional OFDI flows.To this end,the national samples were divided into three subgroups①Eastern region: Beijing,Tianjin,and Shanghai municipalities,Hebei,Shandong,Jiangsu,Zhejiang,Guangdong,Hainan,Fujian,Liaoning,Heilongjiang,and Jilin provinces; Western region: Chongqing municipality,Sichuan,Shaanxi,Yunnan,Guizhou,Gansu,and Qinghai provinces,Guangxi Zhuang,Ningxia Hui,Xizang,Xinjiang Uygur ,and Inner Mongolia autonomous regions; Central region: Shanxi,Henan,Anhui,Hubei,Jiangxi,and Hunan provinces.,which were the eastern region,the central region,and the western region,following China’s division of economic regions.Considering the possible endogeneity in national samples,the latest version of the panel data model,the extended regression model (ERM)was used for parameter re-estimation.A major advantage to differentiating this model from the general average estimation models is that it can eliminate the endogeneity of dependent variables and parameter bias resulting from sample pooling and truncation to the maximum extent.It uses the maximum likelihood estimation method and Heckman’s two-step estimation method to estimate new parameters.It is applicable to econometric models where a large sample size and a small sample size coexist.ERM estimations were repeated on the panel data of the three regions using STATA15.0.The final estimation results are shown in Table 5 and Table 6.

Table 5 ERM Estimation for Panel Data of the Impact of Innovation-Driven Efficiency and Business Environment on Regional OFDI Flows (national samples)

Table 6 ERM Estimation for Panel Data of the Impact of Innovation-Driven Efficiency and Business Environment on Regional OFDI Flows (regional samples)

Table 5 first presents the parameter re-estimation results of the panel data of national samples using ERM.Stepwise regression was applied to different groups to minimize the impact of multicollinearity.The findings could be summarized as follows: (a) When prioritizing the impact of innovation-driven efficiency on OFDI,the empirical results after the elimination of endogeneity reaffirmed the conclusion that there was an inverted U-shaped relationship between innovation-driven efficiency on OFDI as observed in the foregoing static models.Considering the magnitude of the parameters,the computed critical value indicated that China was still positioned in the initial phase where innovation-driven efficiency led to the expansion of OFDI.This finding demonstrated that there was a prolonged period of dividend effect for China’s international circulation which focuses on substantially promoting OFDI through innovation.(b) An examination of the impact of the regional business environment on OFDI showed that business environment improvement could significantly promote OFDI.This facilitating effect was further amplified when the endogeneity was eliminated.(c) An observation of the interaction term between the business environment and innovation-driven efficiency indicated that the business environment exerts an obvious negative synergy in the process of innovation-driven efficiency promoting OFDI.A close examination of the interaction term coefficient revealed that while the interaction term did not alter the positive role of increased innovation efficiency and improved business environment in promoting OFDI expansion on the national scale,it did offer ample policy leeway to the coordinated implementation of innovation-driven strategies and the building of law-based business environment.(d) In addition to industrial structure,economic growth,opening up,urbanization,and ownership structures were passively correlated to OFDI flows.When the endogeneity of industrial structure was eliminated,it exhibited a positive correlation with regional OFDI flow,which was consistent with the expectations.This indicated that the results of the static models were indeed affected by the endogeneity between variables to some extent,leading to biased or invalid parameter estimation.When the parameters were corrected by the ERM,all control variables conformed to the theoretical hypothesis,guaranteeing the validity and reliability of the models.

To delve deeper,the national samples were divided into three heterogeneous regions: eastern,central,and western regions to examine the impacts of innovation-driven efficiency and business environment on regional OFDI flows.The parameter estimation results are shown in Table 6.

Table 6 shows the results of parameter re-estimation using multiple models,with subsamples reconstructed for the three regions.A lateral comparison of the variables revealed that: (a) A significant inverted U-shaped relationship between innovation-driven efficiency and OFDI was found in all regions.A further examination of the critical point on this curve revealed that the central region demonstrated the longest period during which innovation-driven efficiency promotes OFDI,followed by the eastern region.In contrast,the western region had the shortest window period.Within the study period,all three regions were in the phase where innovation-driven efficiency promotes OFDI.(b) Improvements in the business environment were found to facilitate OFDI expansion in all three regions.Delving deeper into the coefficient analysis,the eastern region had the largest coefficient,followed by the western region,while the central region exhibited the smallest coefficient.When considering the interaction between the business environment and innovation-driven efficiency,the synergy between them varied across regions.In the western region,both factors had the least negative impact on OFDI expansion,followed by the eastern region.However,the central region experienced the greatest negative impact.Furthermore,the margin coefficient of the interaction term indicated that the coordination and interaction of innovation-driven efficiency and the business environment had no bearing on their positive role in promoting OFDI expansion.Therefore,adopting a coordinated approach could provide a solid foundation for OFDI expansion.(c) An observation of the parametric performance of the control variables in the three regions revealed contrasting results.Opening up inhibited OFDI in the western region,whereas in the eastern and central regions,opening up had the opposite effect.In the central region,the relationship between the industrial structure and OFDI expansion was not found to be significant.These phenomena could be attributed to the developmental disparities between the central and western regions and the eastern region.Due to the later implementation of opening up policies in the western region,there was room for improvement in terms of scientific and technological capabilities,the completeness of the industrial chain,and the resilience of market entities to fierce competition.That’s why the western region took a prudent attitude toward OFDI during the initial stage of opening up.

Robustness Estimation

In the previous sections,this paper has extensively explored the relationship between innovationdriven efficiency and regional OFDI expansion.However,the OFDI flow itself is a complex variable,and the impact of innovation-driven efficiency on regional OFDI follows a dynamic and gradual process.Therefore,it is necessary to consider the influence of intertemporal factors.Additionally,when estimating model parameters,the use of only one evaluation method may introduce selective bias.To address these concerns and ensure the accuracy of parameter estimation,it is necessary to conduct robustness tests on the previous parameter estimations.

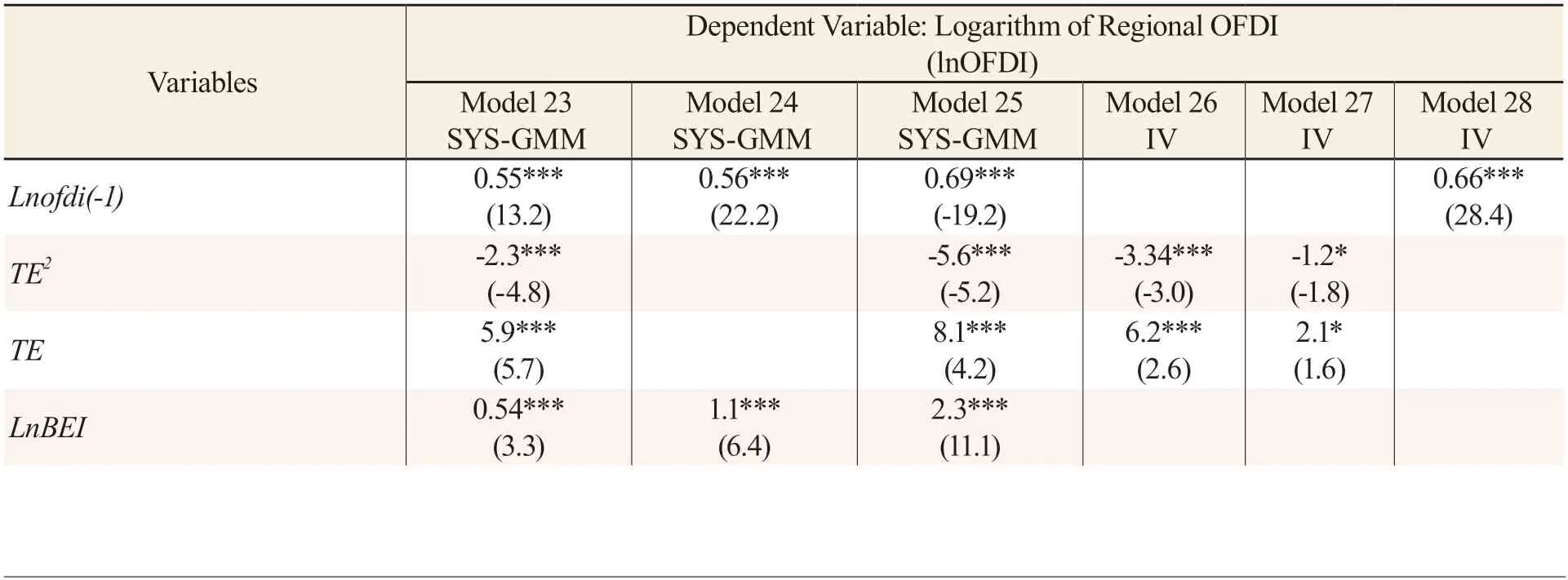

Robustness Test

The methods commonly used to conduct a robustness test include the instrumental variable (IV)method,sample replacement method,and model transformation method.In the context of this study,both the IV method and the model transformation method could be used for parameter re-estimation.For the first method,the parameter estimates obtained were compared after the re-estimation.For the second method,it allowed better observation on the reliability of parameters.To meet the needs of this study,a combination of the two methods was employed.The System Generalized Method of Moments (SYS-GMM) technique for dynamic panel data was employed to diagnose the signs of the existing parameters and assess the presence of an intertemporal lag effect in the process of innovation-driven efficiency affecting OFDI expansion.For the IV method,the average nighttime lights (NL) data was used to replace the existing provincial business environment index ,so as to check the validity of the parameters①For this paper,the Version 4 DMSP-OLS nighttime lights time series,monthly NPP/VIIRS data,and EVI data are used.The provincial average night time light intensity grid value was obtained after data pre-processing,correction,and fusion.This indicator can be used as a high-quality instrumental variable related to OFDI..Two kinds of estimation were performed using SPSSAU and STATA15.0.The robustness test results are shown in Table 7.

Table 7 Robustness Test of the Impact of Innovation-Driven Efficiency on Regional OFDI Expansion (SYS-GMM and IV methods)

In Table 7,models 23 to 25 present the SYS-GMM estimation results.In this estimation method,an autoregressive (AR) process was employed to determine the order of lag,while the Sargan test was used to evaluate the robustness of the estimation results.The Sargan test assessed the extent of endogeneity elimination,with a value closer to 1 indicating a more thorough elimination of endogeneity.Models 26 to 28 present the regression results obtained through the IV method.In this estimation method,the Hausman test was used to determine whether to employ fixed effects or random effects models.When the empirical test results were taken into account,the authors found that: (a) The SYS-GMM estimation first confirmed that within the context of China,the expansion of regional OFDI was characterized by path dependence.The results also provided strong support for the previous findings that there was an inverted U-shaped relationship between innovation-driven efficiency and regional OFDI and that improving the business environment had a positive impact on promoting OFDI expansion.The results of other control variables also aligned with the conclusions drawn from the extended regression model,indicating overall robustness in parameter estimation.(b) The empirical results of the robustness test using the IV method indicated that when replacing the business environment with the modified provincial average nighttime light data,the inverted U-shaped relationship between innovation-driven efficiency and regional OFDI was still significant.At the same time,regions with an elevated level of nighttime lights also had a stronger ability to expand their OFDI.Further estimation of the lagging effect of regional OFDI indicated that OFDI expansion had intertemporal characteristics at the 1st-order level.So far,all core issues have been properly addressed and hypothesis testing has been effectively validated.

Test of Intermediary Transmission Mechanism

Based on the statistical tests conducted above,the direct impact of provincial innovationdriven efficiency on regional OFDI expansion has been largely identified and quantified.However,when examined from the theoretical framework perspective,innovation-driven efficiency can also exert an indirect impact on regional OFDI expansion by facilitating improvements in the business environment.Therefore,it is necessary to test this intermediary transmission mechanism.Panel simultaneous equation models and the two-stage least squares method identified through key equations are necessary to diagnose the presence and magnitude of the intermediary transmission mechanism.The panel simultaneous equation models are as follows:

① This paper uses the scatter plot to diagnose the model of innovation-driven efficiency and regional business environment index.The diagnosis results show an inverted U-shaped relationship between the two factors.Therefore,a secondary model is used in this paper.

Models (4) and (5) are the simultaneous equations of the business environment as an intermediary transmission variable.Model (5) is a just-identified equation and model (4) is an equation to be estimated.According to the order conditions of simultaneous equation estimation and identification,the two-stage least squares method (2SLS) can be used to estimate the parameters of the equations.The parameter results estimated by STATA15.0 are shown in Table 8.

Table 8 Simultaneous Equations Model Estimation Results of the Impact of Innovation-Driven Efficiency on Regional OFDI Expansion (national samples)

In Table 8,grouped regression was conducted to perform parameter re-estimation.Additionally,the Hausman test was performed on different models to determine the appropriate model estimation.The results of the parameter estimation in Table 8 revealed several key findings: (a) Business environment did have a significant intermediary effect in the process of innovation-driven efficiency promoting the expansion of regional OFDI.Moreover,this intermediary effect was much more eminent than the marginal contribution resulting from the direct impact of the business environment on OFDI expansion.These results suggested that the increase in innovation-driven efficiency could promote OFDI both directly and indirectly.(b) The parameter estimations of all control variables mentioned above were proven to be reliable and robust.Economic growth,opening up,urbanization,industrial structure upgrading,and a rise in the share of public ownership all could promote OFDI expansion.These findings aligned well with the underlying theoretical framework previously presented.

Conclusions and Policy Implications

This paper delves into how improvements in provincial innovation-driven efficiency affect OFDI expansion within the context of business environment improvement.It effectively addresses the existing controversy over the role of innovation as a driver for promoting OFDI expansion based on China’s OFDI developments over the years.The following conclusions are drawn:

(a) Within the context of China,there is an inverted U-shaped relationship between provincial innovation efficiency and regional OFDI levels.This observation deviates from the predominant viewpoint within existing literature.This relationship persists not only on a national scale but also at the regional level.Further investigation into the critical point unveils that,both at the national and regional levels,the promotion of OFDI through increasing innovation efficiency will enjoy preferential policy support in the near future.(b) Building a law-based and facilitative business environment can serve as an institutional accelerator,enabling innovation to effectively propel OFDI expansion.The business environment plays a dual role in promoting OFDI.First,it reduces transaction costs associated with OFDI and facilitates expansion through institutional incentives.Second,the business environment can be integrated into innovation-driven efficiency,exerting an indirect impact on OFDI behavior.Notably,in circumstances where innovation efficiency declines,the business environment can mitigate the negative effects of this decline and partially flatten regional OFDI fluctuations.(c)The provincial OFDI shows evident path dependence,a phenomenon that remains steadfast even after conducting robustness tests by substituting instrumental variables.This enduring trend suggests that fluctuations in China’s provincial OFDI align with the ratchet effect hypothesis,characterized by intertemporal lag.(d) The empirical test results of other control variables show that economic growth,intensified urbanization,increased openness,industrial structure upgrading,and the continual expansion of public ownership are all found to have a significant positive impact on the expansion of regional OFDI after the endogeneity issues are eliminated.

Based on the aforementioned conclusions,the authors offer the following policy recommendations:

(a) The central government should issue guidelines to help provincial-level administrations speed up their efforts in improving their respective 2035 action plans for innovation-driven strategies in the new era,and incorporate the major institutional factor of consolidating and deepening business environment building into the innovation-driven strategy.The currentOutlines on National Strategyfor Innovation Driven Developmentand associated action plans have not adequately incorporated institutional innovation elements,such as the business environment.This omission significantly hampers the effectiveness of the business environment in promoting OFDI in a coordinated manner.Furthermore,it impedes the establishment of a mechanism for promoting high-level international circulation through domestic circulation.Therefore,it is necessary to improve the national toplevel planning for innovation-driven strategies in the new era across the board to build China into a modern economic powerhouse.At the same time,efforts should be made to drive all provinciallevel administrations to issue their respective action guidelines in due time based on their respective condition.

(b) It is crucial to precisely identify the roles assumed by the three regions in promoting OFDI expansion to avoid the introduction of one-size-fits-all OFDI innovation policies.High-level OFDI innovation pilot zones for the new era can be set up in the eastern and western regions to explore differentiated models and pathways that can help domestic enterprises expand globally.The western region,with its vast expansiveness,can offer a sizable market for innovations in the central and eastern regions.While continuing to promote the implementation of local innovation-driven strategies,the western region should actively embrace the transfer of the industrial chain and supply chain from the central and eastern regions.The central government should encourage and guide competitive enterprises from the central and eastern regions to establish branches in the western region.

(c) Efforts should be made to expedite the development of comprehensive catalogs delineating advantageous OFDI industries at both national and regional levels.An OFDI white list system should be established,adhering to the principle of asymmetric advantages.Furthermore,channels should be created to facilitate the connection between FDI technology spillovers and OFDI reverse technology spillovers.Policy frameworks aligned with local comparative technological advantages should be established.More fiscal,taxation,and financial support should be provided to specific enterprises and industries.Building on these endeavors,the government should speed up the establishment of institutional opening-up principles and core standards.

杂志排行

Contemporary Social Sciences的其它文章

- A Brief Introduction to Sichuan Academy of Social Sciences

- Research on the Legal Framework of Content Regulations for Network Platforms

- Reflections and Improvements on China’s Asset-Backed Securities Information Disclosure System

- The Innovative Expression of Traditional Chinese Cultural Archetypes in Animated Films: Establishing a Reliable,Admirable,and Respectable Image of China

- On the Praxis-Oriented Semiotic Aesthetics in Eastern European Marxism

- Research on Pathways of How Digital Transformation Affects the Business Performance of MEEC Enterprises in Chengdu