Development Status and Analysis of Supply and Demand Structure of Lithium Carbonate Market in China

2024-01-17

China is a big manufacturer country in terms of lithium carbonate,where the production of lithium carbonate has been growing steadily.The production grew from 78000 tons in 2016 to 350000 tons in 2022,presenting a compound annual growth rate of 28%.In addition,in lithium carbonate industry,the distribution of manufacturing region and enterprises are relatively centralized,resulting in a relatively high industrial concentration.Downstream lithium carbonate products can be divided into conventional industrial products and lithium batteries.The application of lithium carbonate in lithium battery products more concentrates in cathode material.In recent years,as new energy market develops,the demands for lithium carbonate (as principal raw material for power battery) are also significantly increasing.This article is going to make in-depth analysis on development status and fundamentals of lithium carbonate market in China.

1.Raw material and industrial pattern of the production of lithium carbonate in China

(1) Relatively high concentration in domestic market

Boosted by new energy policies,the production of lithium carbonate in domestic market has been growing steadily in recent years,growing from 78000 tons in 2016 to 350000 tons in 2022,presenting a compound annual growth rate of 28%.From the perspective of the production of lithium carbonate,the distribution of lithium carbonate production region and enterprises are relatively centralized,resulting in relatively high concentration.

From the perspective of raw material for lithium carbonate products,the principal sources in the production of lithium carbonate cover smelting,purification and recycling.Currently,the volume of recycling market in China is rather small,and the production of lithium carbonate mainly relies on smelting.Commonly used smelting raw materials incorporate spodumene,lepidolite and salt lake brine.In 2022,lithium carbonate products contained 123000 tons of spodumene products,96000 tons of lepidolite products and 68000 tons of salt lake products,respectively accounting for 35.1%,27.5% and 19.4%.

The principal characteristics of spodumene are high content of lithium and less content of impurity substances,and spodumene is mainly used to manufacture battery-grade lithium carbonate.Lepidolite is relatively low in grade,containing less lithium than spodumene.Besides,lepidolite is rubidium-cesium associated ore,which means it contains more impurity substances.Lepidolite is commonly used to manufacture industry-grade lithium carbonate.Salt lake also has the problem of lithium content and impurity substance content.Particularly,in our country,lithium resource endowment is higher than normal magnesium lithium ratio.Most salt lake products are industry-grade lithium carbonate,and they just can be used to manufacture battery-grade lithium carbonate after further purification.

From the perspective of manufacturing region of lithium carbonate,principal manufacturing regions distribute along resource regions,overlapping with the distribution of upstream smelting enterprises.Principal lithium carbonate manufacturing provinces are Jiangxi,Sichuan and Qinghai,totally accounting for 77%.The three provinces are where lithium mine resources concentrate.Among them,Jiangxi is the province boasting the biggest lepidolite resources in China,where Nanshi Lithium and Ganfeng Lithium are based.The commonly used raw materials are lepidolite and imported spodumene;Sichuan is the province boasting the biggest pyroxene resources,where big lithium salt manufacturers are based,such as Tianqi Lithium;Qinghai is the province boasting the biggest salt lake brine resources,where Lake Lithium and Minmetals Salt Lake (leading domestic lithium carbonate manufacturers engaged in salt lake raw material) are based.

From the perspective of the distribution of lithium carbonate manufacturing enterprises,there are totally 50-60 manufacturing enterprises in upstream part,which means the concentration ratio is high.In 2022,TOP 10 lithium carbonate enterprises manufactured 200000 tons of lithium carbonate totally,accounting for 57% of total production nationwide,shaping a pattern that is relatively concentrated.Among them,Nanshi Lithium boasted the biggest production in 2022,i.e.33000 tons,accounting for 9%.Up till now,there is no absolute monopoly in the industry.

From the perspective of the distribution of lithium carbonate products,battery-grade carbon and industry-grade carbon are relatively even in production distribution.Among them,the production of battery-grade lithium carbonate is relatively bigger,i.e.180000 tons in total in 2022,accounting for 51%nationwide;industry-grade production was 170000 tons,accounting for 49%.

(2) Seasonal production cycle

The production cycle of lithium carbonate is seasonal,mainly influenced by seasonal freezing of salt lake and regular maintenance of corporate equipment.However,overall capacity of lithium carbonate is relatively stable,and seasonal production suspending or supply suspending is not likely to occur;production fluctuation during busy season and slack season will not greatly influence demand and supply situation periodically.

According to previous experiences,in January to February each year,the production of salt lake in China falls by 30%-40%,due to the freezing of Qinghai salt lake,regular maintenance of corporate equipment and Spring Festival holidays.After March,as temperature climbs,the production of lithium carbonate also rises swiftly,and peaks in June.Entering Sep,the production of lithium carbonate falls a bit due to power restriction and production restriction for summer,and the production still remains high until December.

(3) Relatively long upstream capacity cycle

The mining process chain in upstream part of lithium resource is relatively long.The development of new mines and salt lake requires prospecting,scientific research and approval of mining rights before the construction of plants and capacity climbing.Approving procedures differ as for different resource types and different countries,and the procedure duration required is an uncertainty.For example,most Qinghai-Tibet salt lakes lie in environmentally fragile regions,which leads to bigger difficulties in getting mining rights of new mining area due to higher requirements of environmental protection.Our country requires mining right renewal for expansion of current mining areas or transformation of mines to lithium ore production,but approval conditions are relatively loose.Since the beginning of 2022,for the purpose of guaranteeing lithium resources for domestic market,related departments have accelerated approval procedures for the exploration of lithium resources.In terms of plant construction and capacity climbing,generally speaking,the construction of spodumene and lepidolite smelting plant requires 2-3 years;capacity climbing to design capacity requires 1-2 years;the construction of salt lake lithium extraction plant requires 5-7 years.Comparatively speaking,the expansion of downstream cathode material enterprises requires only 6-10 months.Incompatible upstream and downstream capacity cycles will probably lead to periodic imbalance between supply and demand.

2.Overview of demands for lithium carbonate in domestic market and downstream products

(1) Description on market

As new energy market emerges,demands for lithium carbonate (principal raw material for power batteries) are also rising greatly.In 2022,consumption of lithium carbonate in China was 505000 tons,up by 405% compared to the figure in 2016.Boasting the most advanced lithium battery industry chain in the world,China is the principal region for the production and sales of lithium carbonate,covering 90%of lithium iron phosphate cathode material,lithium manganese cathode material,lithium cobaltate cathode material,electrolyte and over 50% ternary cathode material.Currently,China accounts for about 80% of total lithium carbonate consumption worldwide.

As for downstream part of lithium carbonate,firstly,it is directly related to new energy end market,which is still in the upgoing trend.The sales of NEV rose from 500000 vehicles in 2016 to 6900000 vehicles in 2022,with the increase of over 10 times.This boosted the installation of power battery from 28.2GWh in 2016 to 294.1GWh in 2022.Secondly,energy storage battery also enjoys a bright prospect in growth in the future.With the development of new energy power generation+energy storage,energy storage battery will hopefully become the new consumption pillar of lithium carbonate in the future.According to the issuing of Guiding Opinions on Accelerating the Development of New Type of Energy Storage in 2021,our country will accelerate the construction of electrochemical energy storage and promote the mode of new energy power generation+energy storage,with the purpose of achieving the transformation of new type of energy storage market from commercialization to scale development by 2025.

(2) Regional distribution

From the perspective of consumption regional structure of lithium carbonate,downstream demands are more dispersed,not quite overlapping with upstream production regions while quite overlapping with the distribution of cathode material market.Principal domestic provinces that consume lithium carbonate are Jiangsu,Hunan,Fujian,Guangdong and Hubei.The five provinces consumed 208000 tons in 2022,accounting for 41% of domestic total;Jiangsu,ranking the 1st,accounted for 10%.

Lithium carbonate consuming enterprises are also distributed in a dispersed manner.Principal consumption regions mainly are the provinces where battery cathode material enterprises are intensively located.Representative Jiangsu enterprises are ternary cathode material and lithium iron phosphate material enterprises,such as EASPRING,Changzhou Lithium Source,Reshine New Material;representative Hunan enterprises are lithium iron phosphate and ternary cathode material enterprises,such as Yuneng New Energy,RT-HITECH,Hunan Shenghua,Changyuan Lico,Hunan Shanshan and Reshine New Material;in Fujian,Guangdong and Hubei,representative enterprises are Xiamen Tungsten,Dynanonic,Changzhou Lithium Source (BTR),BRUNP,Hubei Wanrun and other lithium iron phosphate and ternary cathode enterprises.Downstream enterprise consumption concentration is relatively low.There are 20-30 lithium iron phosphate material enterprises and 30-40 medium-and-low nickel ternary material enterprises,and CR12 accounts for 47%,presenting strong long tail effect.Top 3 consumption enterprises,Yuneng New Energy,Dynanonic,and Xiamen Tungsten respectively accounted for 8%,7% and 6%.

(3) Product application

Downstream lithium carbonate products can be divided into conventional industry products and lithium batteries.In lithium battery products,lithium carbonate is more applied in cathode material.In downstream lithium carbonate consumption in 2022,conventional industry products only accounted for 7%,and the proportion of lithium battery was 93%.Among it,81% was cathode material and 7% was electrolyte.Main target application fields of lithium battery are new energy vehicle,consumer electronics and energy storage and so on.Conventional lithium carbonate application fields incorporate glass-ceramic,medicine and lubricating grease and so on.

In recent years,a significant increase could be seen in the sales of NEV in China.Due to fact that lithium carbonate is the principal raw material for power batteries,NEV sector has become the biggest consumption in downstream part of lithium carbonate industry chain,and has become the most influential factor for price.The proportion of NEV in downstream part of lithium carbonate industry rise from 27% in 2016 to 60% in 2022.NEV occupied 69% in the increased consumption of lithium carbonate from 2016 to 2022.We can see that energy storage industry is developing swiftly and shows great potential.However,in the short run,demands for lithium carbonate are still determined by new energy power batteries to a large extent.

Prevailing battery cathode materials are divided into lithium iron phosphate,ternary materials (further incorporating medium-and-low nickel and high-nickel ternary),lithium cobaltate and lithium manganate.Lithium iron phosphate is mainly applied to NEV power batteries and energy storage batteries;ternary materials are mainly applied to NEV power batteries;lithium cobaltate is mainly applied to consumer electronics batteries;lithium manganate is mainly applied to two-wheeled electric vehicle power batteries.In 2022,domestic demands for the above four cathode materials totally was 409000 tons,including 246000 tons of lithium iron phosphate and 115000 tons of ternary materials (as the two most leading technical routes currently in NEV power batteries),respectively occupying 49% and 23%.

Currently,NEV power battery technical routes center on lithium iron phosphate power batteries and ternary material power batteries.In 2022,in power battery installation in our country,the installation of lithium iron phosphate power battery was 183.8GWh,and that of ternary materials was 110.4GWh,respectively accounting for 62% and 38%.In history,with the development of NEV power battery technologies,the two technologies rose alternately in terms of proportion.In recent years,as blade batteries and CTP Kirin batteries develop,the proportion of lithium iron phosphate further increases.

With regards to lithium battery energy storage,lithium iron phosphate battery outperforms ternary battery in terms of safety stability,cycle life and full cycle cost.Energy storage battery industry is in its early stage of development,and is developing fast.According to data,installation of energy storage battery in our country in 2022 exceeded 100GWh,presenting a YOY increase of 130%.In the future,as policy objectives are gradually being realized and lithium iron phosphate is gradually becoming the leading technology in energy storage batteries,energy storage will hopefully develop into the new demand pillar for lithium carbonate.

品牌管理是在管理机制、组织机制上落实品牌战略,并使品牌战略在既定的轨道上推进。其内容主要是品牌的创立、推广、维护和评估。

With regards to consumer electronics battery,lithium cobaltate is the first generation of commercialized lithium battery cathode material.Mainly applied to small consumer electronics such as mobile phones and computers,lithium cobaltate also is an important role in downstream consumption of lithium carbonate.In recent years,market scale of conventional consumer electronics products such as computers and mobile phones maintain stable.As novel consumer electronics products keep being invented,the market is raising more requirements on cost performance of batteries.As lithium iron phosphate battery and lithium manganate battery have lower unit cost,the proportion of their application in electronics market is progressively rising.

With regards to two-wheeled vehicles,in 2019,New National Standards came into force,which promotes the upsurge of lithium battery application in two-wheeled vehicles.In 2022,the sales of electric two-wheeled vehicles in our country exceeded 50 million vehicles,presenting a YOY increase of 15%.As consumers raise higher requirements on performance and endurance of electric two-wheeled vehicles,electric two-wheeled vehicles will gradually substitute lithium batteries that have higher energy density for lead-acid batteries.In 2022,penetration rate of lithium battery two-wheeled vehicles was 25%,YOY up by 1.6 percent points.As new buying behaviors such as shared mobility,on-demand delivery and retail distribution are getting more popularized,electric two-wheeled vehicle market scale is growing.However,the demands from electric two-wheeled vehicle for lithium batteries still are not playing an important role.Additionally,the energy density of sodium-ion batteries is similar to that of lithium iron phosphate and lithium manganate,and it has an edge relying on relatively low comprehensive cost.

With regards to conventional fields,lithium carbonate is mainly applied in ceramics,glass,grease,medicine,alloy and polymer and so on.Among them,glass and ceramics account for 43%,and grease accounts for 26%.In 2022,the consumption of lithium carbonate in conventional fields was 33000 tons,accounting for around 7% of total lithium carbonate consumption.When being used in glass and ceramics as additive,lithium carbonate helps to enhance Corrosion Resistance in glass and enhance hardness of ceramics.As demands for glass and ceramics as daily necessities have become saturated,point of growth mainly lies in special ceramics materials.

Lithium-base grease,working as thickener,helps to improve product performance.It is widely used in industry fields but the growth tends to level off.Lithium is also used in conventional industry fields such as air-conditioner manufacturing and primary aluminum production.When applied in medical field,lithium carbonate helps to treat maniac depression.It demonstrates excellent therapeutic effect in treating bipolar affective disorder featuring alternating episodes of mania and depression;also it has a preventive effect in recurrent depression.

The 3rd Version of Nonferrous Metal Industry Innovation Forum on the Integration of Industry and Finance Convening Grandly

In mid-October,the 3rd version of nonferrous metal industry innovation forum on the integration of industry and finance was convened grandly in Beijing.The conference is devoted to implementing the deployments made in the “14th Five-Year Plan” on the integration of industry and finance;further guiding financial resources to providing better support and service for key fields in non-ferrous industry;improving ecological chain and supply chain connecting industry development and financial service;constructing an integrated platform incorporating industrial financial institutions and non-ferrous real economy.

The conference was organized by China Nonferrous Metals Industry Association,undertaken by China Nonferrous Metals magazine,supported by Shanghai Futures Exchange,specially coordinated by Chongqing Weiqiao Finance Factoring,CHINALCO and Beijing Golden Antimony Industry.More than 100 guests attended the conference,coming from non-ferrous metal enterprises nationwide,supply chain finance companies,futures and securities companies,fund companies and trade logistics companies.

Duan Debing,Vice President and Secretary General of China Nonferrous Metals Industry Association,Zhou Jun,Director,North Market Service Center,Shanghai Futures Exchange,Zhu Nan,General Manager of Chongqing Weiqiao Finance Factoring and other distinguished guests attended the conference and delivered opening speeches.

China non-ferrous metal industry has been in connection with finance since long ago.As early as in the beginning of 1990s,capital connected non-ferrous metal industry through futures market.After over 30 years of industry-finance integration and futures-spot interaction development,China non-ferrous industry has become one of the industries boasting highest marketization,fastest adaptability to international market changes and strongest responding to international market shocks.Delivery amount of non-ferrous metal futures accounts for nearly 40%of total amount of futures in our country.Copper,aluminum and zinc rank TOP 3 in comprehensive evaluation for commodity futures function in China.

According to Duan Debing in his speech,industry-finance integration is an irresistable trend that has a brilliant future.He put forth three suggestions as for industry-finance integration.

Firstly,to stop industry-finance integration being distracted from its intended purpose.Industrial financial institutions ought to stay true to the mission of serving the real economy;to give full play to the special role of financial capital in resource allocation,risk mitigation,policy transmission and expectation management,i.e.guiding more financial resources to key fields and weakness of our industry,and quenching the thirst of enterprises with financial“flowing water”;to make great efforts in developing inclusive finance,green finance and science and technology innovation finance,and to enable enterprises to get quality development.

Secondly,industry-finance integration ought to keep pace with the times.Industry-finance integration is going to play a more and more important role in future industrial development.Enterprises need to be a good learner all the time so as to cultivate a group of inter-disciplinary talents good at both industry and capital;to get in-depth understanding of the rules of multi-level capital market;to flexibly operate various financial derivatives tools,thus providing consolidated support for corporate development.

Thirdly,to enhance bottom-line thinking.To stay high alert to illegal opportunistic behavior in the name of industry-finance integration;to be alert to possible occurrence of market risks,industry risks and connected transaction.Physical industry ought to work with financial institutions to construct effective prevention and monitoring mechanism to prevent risks in time and to avoid risk resonance during the integration.

According to Zhou Jun,under the great support from related ministries and commissions and industry associations,Shanghai Futures Exchange has been continuously optimizing contract rules;to make intensified efforts in product listing and contract optimization,enhancing the supervision on futures market and improving market service quality and efficiency;to deepen efforts in market service and make contributions to the stable operation of our non-ferrous industry.Next step,Shanghai Futures Exchange will actively rise to all kinds of market risks and challenges,continuously enhance front-line supervision ability,keep promoting market reform and innovation,and provide support for non-ferrous industry to get quality development and improve efficiency.Firstly,to make intensified efforts to improve supervision efficiency,to stablize expectation and hold the bottom line.Secondly,to use registration mechanism of futures listing as a turning point to improve metal type sequence and make intensified efforts to construct quality product system.Thirdly,to encourage industry customers to get engaged and stablize industry chain and supply chain.

According to Zhu Nan,Weiqiao has been dedicated to providing all-round financial service for non-ferrous metal industry.Through in-depth integration of finance and industry,Weiqiao is promoting the development and innovation of industry.Zhu Nan believes that non-ferrous industry is facing challenges in terms of market,energy and environment.Meanwhile,new technologies and new modes are emerging and bringing new opportunities for the industry.In such context,only through in-depth industry-finance integration can non-ferrous metal industry better develop;only through joint efforts of enterprises can the whole industry get development in sustainable way.

The conference invited multiple financial experts to deliver speeches.In the first part,Zhang Yingying,Deputy Director of Innnovation Business Department of COFCO QIDEFENG Trading,Huang Zhe,Assets Management Director of Chongqing Weiqiao Finance Factoring Co.,Ltd.,Zhao Dawei,Deputy General Manager of CHINALCO Innovation Development Equity Investment Fund Management(Beijing) Co.,Ltd.,Fang Long,General Manager of Global Mandatory Carbon Market Department of Sinochem Energy High-Tech Carbon Assets Operation Co.,Ltd.,shared their points of view from the perspective of cases of nonferrous metal enterprises utilizing derivatives,addressing pain points in cooperation between industries and financial institutions,industrial funds brightening the development of non-ferrous metals,and carbon emissions trading and the use of carbon financial tools.In the second part,Huang Yue,Deputy General Manager of CHINALCO Commercial Factoring Co.,Ltd.,Wu Gang,Executive Director and General Manager of CNMC Golden Bright Insurance Broker Co.,Ltd.,Lan Hai,Director of Capital Operation Department of Tianjin North China Geological Exploration Bureau,Shi Heqing,Manager of Precious Metals Department of Beijing Antaike Information Co.,Ltd.,Fan Rui,Non-ferrous Analysis Responsible Person of Guoyuan Futures,Liu Weishi,Deputy General Manager of Beijing Sunline International Logistics Group,delivered special reports from the perspective of integrated solution for non-ferrous supply chain financial products,“go global” non-ferrous enterprises insurance guidance,fundraising in the geological exploration industry to promote mining exploration and development,analysis of the financial development situation and industry trends of the non-ferrous gold industry,risk prevention and control tools for non-ferrous industry,status quo and prospect of metal logistics supply chain in Southeast Africa under the “One Belt and One Road” initiative.

The State Council: To Enhance Supportability for Strategic Mineral Resources such as Rare Earth

In mid-October,the State Council printed and issued Opinions on Promoting High Quality Development of Inner Mongolia and Striving to Write a New Chapter of Chinese Path to Modernization (referred to as Opinions in short),which puts forth that we need to enhance the exploration and utilization of strategic resources such as rare earth.To support Inner Mongolia’s systematic prospecting evaluation,protective development,high-quality utilization and standardized management of strategic mineral resources;to enhance supportability for strategic mineral resources such as rare earth,iron,nickel,copper,tungsten,tin,molybdenum,gold,fluorite,crystalline graphite,lithium,uranium,helium;to accelerate developing high-purity rare earth metals,high-performance rare earth permanent magnet and high-performance polishing material and other high-end rare earth functional materials;to expand the application of rare earth catalytic materials in steel,cement,glass,auto and thermal power;to support Baotou Rare Earth Products Exchange in constructing rare earth product transaction center in conformity with legal provisions that is oriented to the whole country;to develop Baotou into the biggest rare earth new material base nationwide and the leading rare earth application base worldwide.

Ministry of Natural Resources Making Intensified Efforts in Selling Lithium Ore Block

In order to go all out to promote a new round of strategic action for mining breakthrough,to promote lithium resource exploration and development,reserves and production increase,and to advance quality development of lithium battery new energy industry,Ministry of Natural Resources is actively advancing the selling of lithium ore block to expand supply of lithium ore source and satisfy market demands.Currently,20 lithium ore blocks in Xinjiang,Sichuan,Jiangxi and Yunnan are actively preparing for selling.Subsequently,we will continuously enrich block sources through exploration targets and submission by province-level natural resource management departments and incorporate them into selling schemes.In recent years,great breakthroughs have been made in the prospecting of rare metals such as lithium ore in metallogenetic belts including Western Sichuan,the Kunlun Mountains,Alkin,Mufu Mountain and Himalaya,which leads to significant increase in lithium ore reserves.According to the statistics of mineral resource reserves nationwide,in 2021,lithium ore reserves (lithium oxide equivalent) was 4046800 tons,and the figure was 6352700 tons in 2022,presenting a YOY increase of 57%.Meanwhile,spodumene ore and lepidolite ore are widely distributed in our country,and we have more than 1500 salt lakes.It is feasible to further enhance lithium ore prospecting through making intensified efforts in selling lithium ore block;part of our certified lithium ores have not been prospected adequately,so more efforts ought to be made for further geological exploration,and there are significant potentials in lithium ore reserves increase.

The Mining Rights of Two Lithium Mines in Sichuan Struck a Deal at a High Price

According to the information from Sichuan Provincial Public Resource Trading Platform,on August,13th,the prospecting auction of Jiada Lithium Mine in Ma’erkang City of Sichuan ended.The auction struck a deal at the price of RMB 4.206 billion,presenting the appreciation rate of 1317 times.On August,11th,the prospecting right of North Lijiagou Lithium Mine in Jinchuan County of Sichuan struck a deal at the price of RMB 1.01 billion,with the starting price of RMB 570000 and the number of quotations of 3412 times,presenting the appreciation rate of 1771.23 times.According to analysts,the skyrocketing price emerged once again while lithium price is falling indicates the fact that lithium resources are still scarce.In particular,Sichuan is rich in quality lithium resources that many companies are willing to buy at a high price.Meanwhile,in the first half of the year,due to the fluctuation of the price of lithium carbonate and the instability of the supply of lithium mine,lithium mine companies are competing with each other even more fiercely.Companies in the industry chain are fighting for upstream lithium resource so as to stabilize manufacturing cost.

182 Geological Prospecting Fund Projects Are Deployed This Year in Inner Mongolia

Inner Mongolia Government Information Office convened Press Conference Exclusively on Inner Mongolia Department of Natural Resources.In terms of improving resource guaranteeing ability and spending intensified efforts in constructing the base of important national energy and strategic resources,the conference puts forth the following: making deployments of 182 geological prospecting fund projects,making investment of RMB 350 million,including: firstly,25000 strategic mineral investigationand research projects,strategic mineral prospecting projects in key survey areas,prospecting areas,and mineralization potential areas throughout the region,and coalbed methane and geothermal energy projects.The construction of these projects kicked off in this May.Meanwhile,the government is actively making special prospecting in Obo of Baiyun,so as to provide support for the construction of Baotou rare earth new material base and rare earth application base.Secondly,to enhance the management on energy resource exploitation.To carry out differentiated control policies for mineral types.To preferentially exploit iron-rich,copper and gold and quality non-metallic minerals,and carry out overall control on the reserves of rare earth and tungsten ore.Thirdly,to advance efficient utilization of mineral resources.To consolidate annual sampling inspection proportion of prospecting and mining publicity information about mining right holder based on the principle of “randomly selecting inspection objects,randomly selecting law enforcement inspectors,released to the society”,so as to modify and improve construction plan for green mines in Autonomous Region.

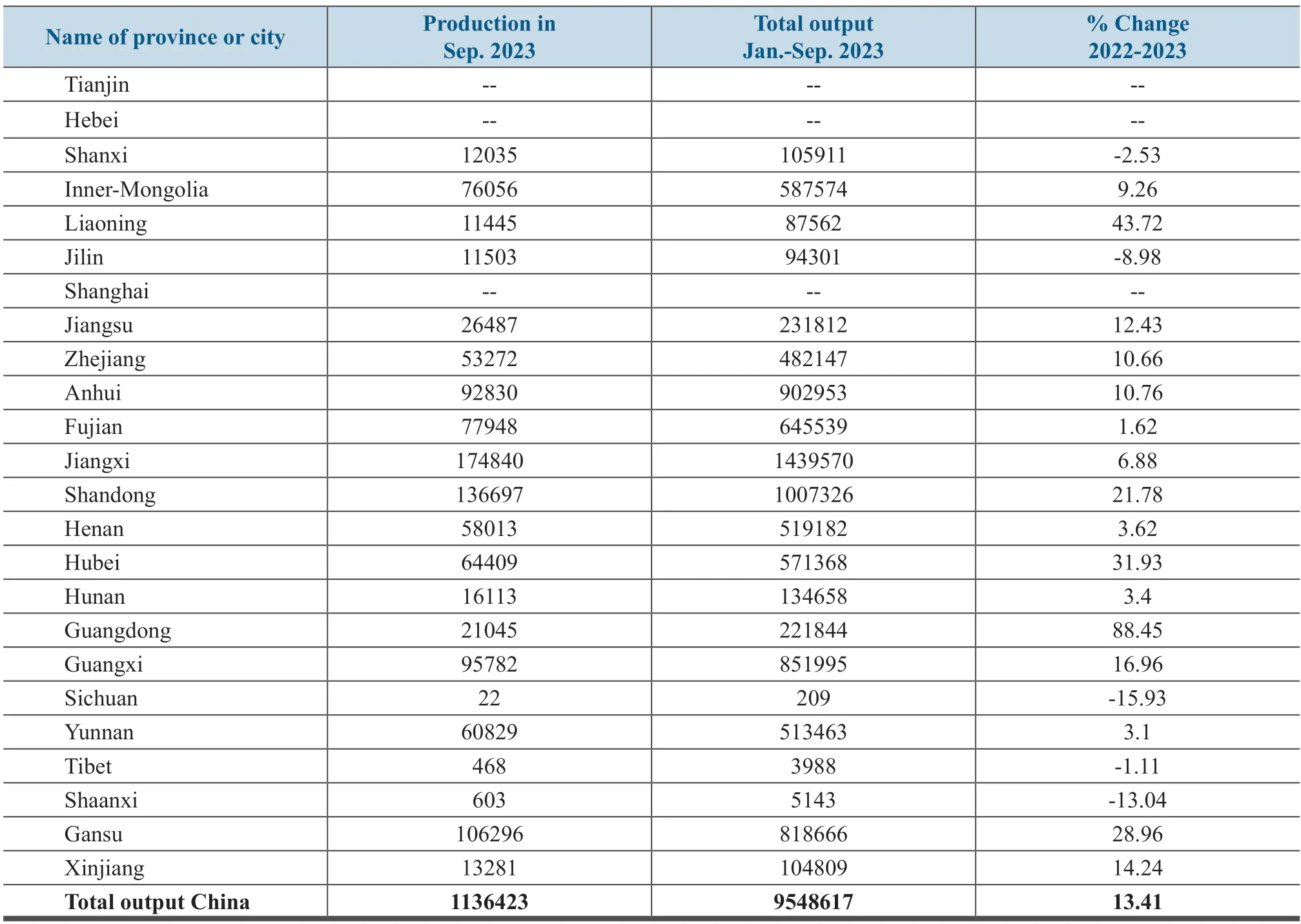

Refined Copper Production by Province or City in 2023 Unit: metric ton

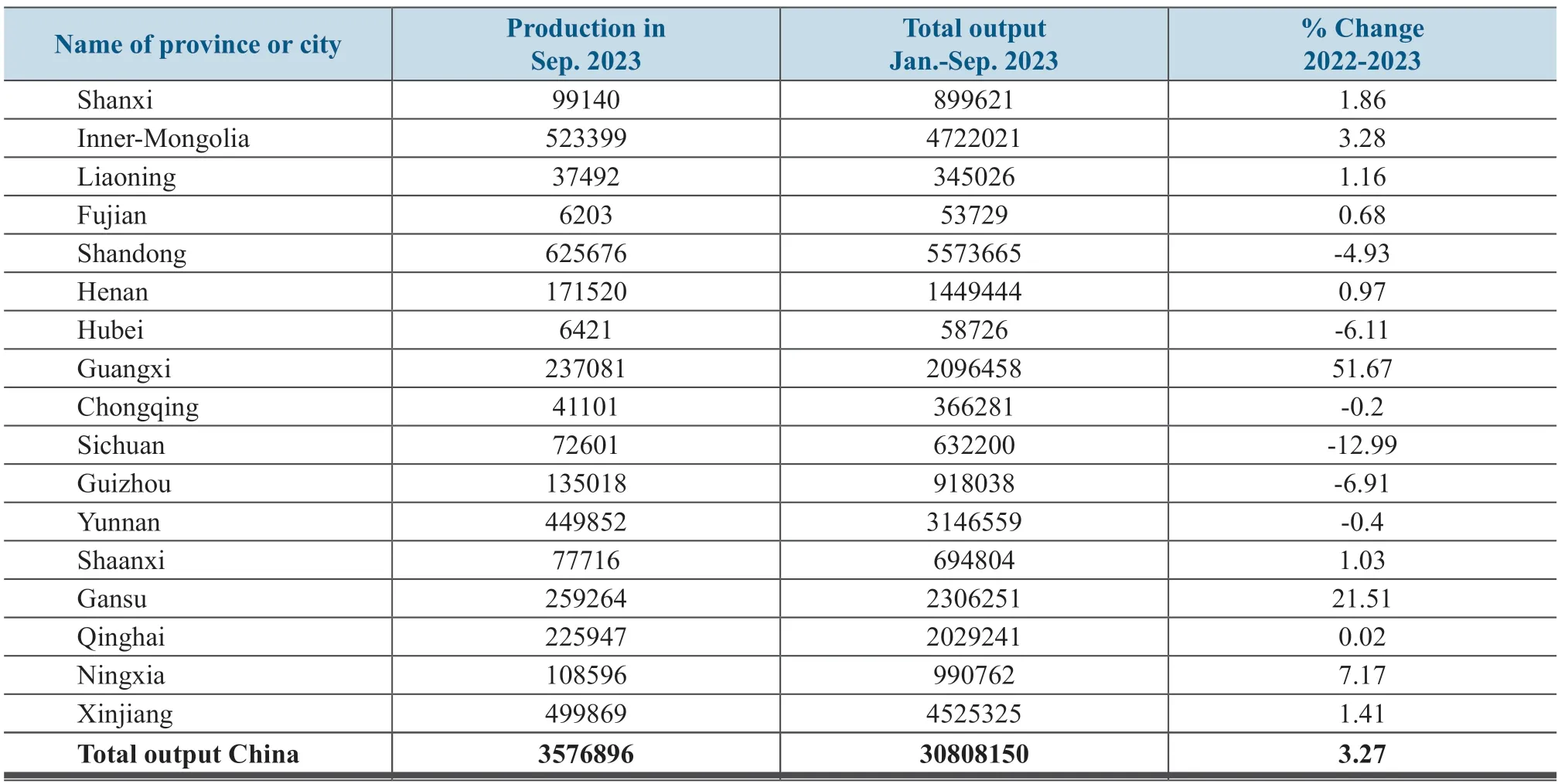

Aluminum Production by Province or City in 2023 Unit: metric ton

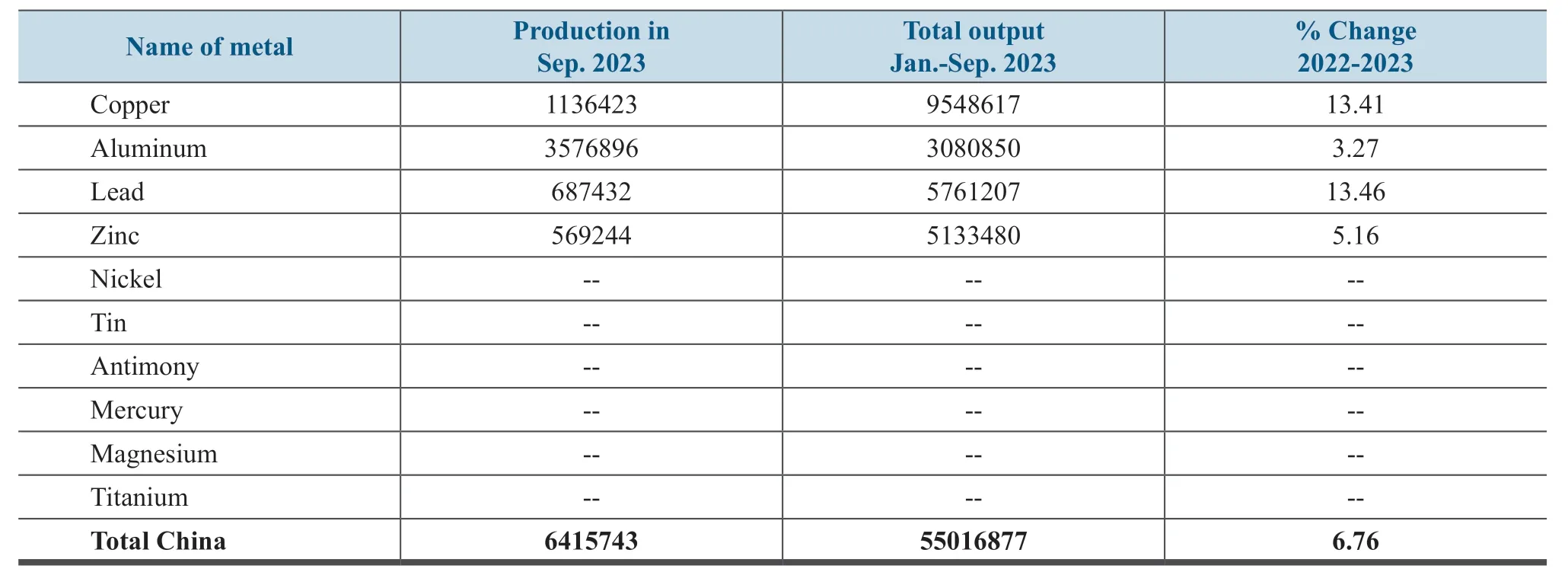

Production of the Ten Major Nonferrous Metals in 2023Unit: metric ton

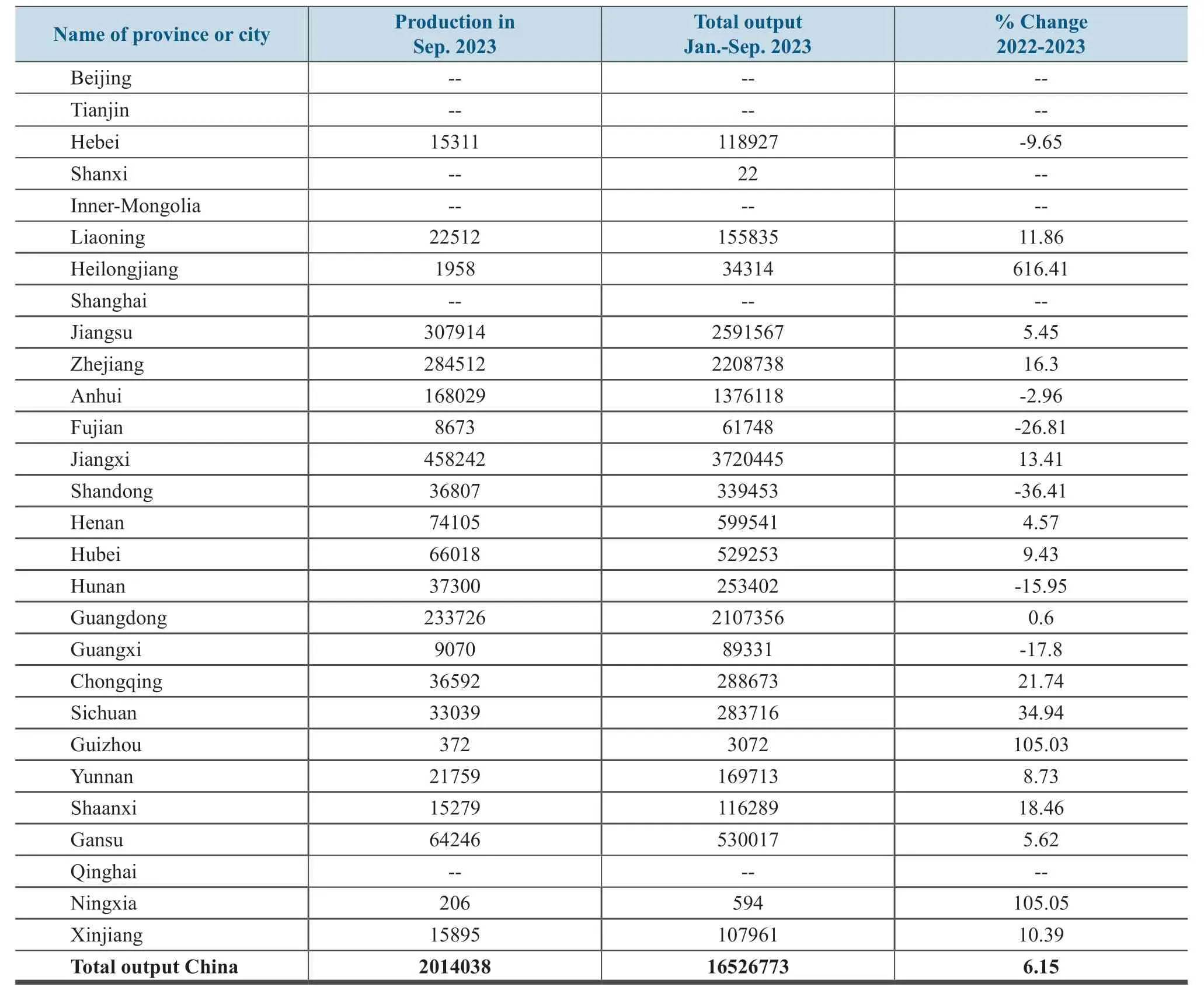

Fabricated Copper Production by Province or City in 2023 Unit: metric ton

Lead Production by Province or City in 2023Unit: metric ton

Alumina Production by Province in 2023Unit: metric ton

Yield of Ten Major Types of Nonferrous Metals By Region

Zinc Production by Province in 2023 Unit: metric ton