Research on the Effect of R&D lnvestment lntensity and Sales Expense on the Performance of Biomedical Enterprises

2023-12-23WangLifeiJiaZhengWuDongmingXinghua

Wang Lifei,Jia Zheng,Wu Dongming,Xinghua*

(1.School of Business Administration,Shenyang Pharmaceutical University,Shenyang 110016,China;2.School of Business Administration,Tangshan Vocational and Technical College,Tangshan 063300,China)

Abstract Objective To explore the influence of new drug R&D investment and sales expense on the performance of biomedical enterprises.Methods The financial statements of 76 listed biomedical enterprises for 5 consecutive years were selected,and the data were modeled to study the effect of R&D investment and sales expense on the performance of biomedical enterprises by using financial indicators as tools and statistical methods of multiple linear regression.Results and Conclusion Under the premise that the weak related factors such as enterprise scale,life cycle and asset-liability ratio are set as unrelated variables,the R&D investment intensity of biomedical enterprises is negatively correlated with the current performance,which also shows that the R&D of biomedical enterprises has the characteristics of high risk.Besides,the influence of early R&D investment is delayed.However,the sales expense of leading biomedical enterprises with large scales have higher proportion.Meanwhile the greater sales expense of the same enterprise in different periods,the better the enterprise performance is.Biomedical enterprises should consider their own development stage to develop more patented drugs.Besides,they must formulate plans for allocating reasonable sales personnel and cost expense to ensure that enterprises can obtain better benefits.

Keywords: biomedical enterprise;enterprise performance;R&D expenditure;sales expense

1 Introduction

According to the latest National Bureau of Statistics,in the past decade,the total R&D expenditure in China increased from 86.87 billion yuan in 2011 to 278.64 billion yuan in 2021.The increase of R&D investment reflects China’s emphasis on scientific and technological innovation,which is the foundation of economic development.The biomedical industry is highly dependent on continuous innovation and development.In recent years,the National Development and Reform Commission,the State Council and other departments have clearly pointed out that the biomedical industry should be taken as a national key innovation industry.With the introduction of support policies,more and more biomedical enterprises have intensified the investment in the scientific research under the guidance of the government,which injects new vitality into the development of enterprises.

New drug R&D is a risky business.Despite the great risks,many large biomedical enterprises are involved in new drug R&D because it is essential for their survival.Besides,patients also need new drugs to treat diseases.Therefore,the development and successful registration and marketing of new drugs has become urgent for the survival of the pharmaceutical industry today.With the implementation of product patents in China,the status of the pharmaceutical industry in China has changed significantly in recent years,and more and more enterprises have increased their R&D investment.The source of R&D funds and the maintenance of the capital chain become the focus of enterprises.Therefore,the disposable funds owned by biomedical enterprises will promote or limit the sustainable development of enterprises.

The goal of each biomedical enterprise is to maximize return on investment (ROI),which means to increase enterprise sales and earn considerable profits for the maintenance and sustainable development of enterprises.Meanwhile,the goal of drug marketing is to meet the needs of customers and obtain profits,which is highly consistent in purpose.Therefore,as the direct driving factor for enterprises to obtain profits,the attention of enterprises is very critical.Since drug sales are different from the sales of other business types,the marketing personnel of pharmaceutical enterprises must understand the real needs,wishes,and attitudes of customers towards products and services.Enterprises need to spend more on training on-site personnel,which enables the sales department to sell products to different customers.Therefore,pharmaceutical enterprises need to pay attention to the marketing and make more investment in understanding the needs and expectations of customers.

At present,no matter from the perspective of the total volume or proportion of R&D investment amount,the investment intensity of China’s biomedical industry is lower than that of biomedical enterprises in developed countries.What is worse,some China’s biomedical enterprises abandon the R&D and focus on the production of generic drugs to obtain the greatest benefit in a short time.However,some experts in the industry pointed out that the enterprises lacking innovation would have insufficient motivation in the later stage of sustainable development,which hindered the further development of enterprises.Only gaining something in the R&D innovation and correctly playing the role of sales can they promote the growth of enterprise performance.In this paper,76 biomedical enterprises listed on Shenzhen Stock Exchange and Shanghai Stock Exchange from 2015 to 2019 are taken as the samples to study the relationship between the R&D investment-revenue ratio,sales expenserevenue ratio and the net interest rate of shareholders by using multiple linear regression analysis.By controlling the relevant variables,the correlation between the performance of enterprises,investment and sales expense is studied,and a conclusion is drawn.Then,some suggestions are put forward for the capital investment in the production and operation activities of enterprises.

2 Literature review

2.1 Literature review of the impact of R&D investment on enterprise performance

There are many literatures on the impact of R&D investment and new drug innovation in the biomedical industry on enterprise performance,and the scope of research is also wide.Scholars have focused on the influencing factors of R&D and the relationship between R&D investment and enterprise value.For example,whether the biomedical industry should increase the intensity of R&D investment,enterprises need to consider a variety of conditions,external factors such as macro-environment,policy support,government subsidies and tax incentives,and internal factors including capital structure and asset-liability ratio.For different biomedical enterprises,both future sustainable development and the stability of the current capital chain are important,so the selection of R&D investment strategy is affected by many factors.

Due to the particularity of the biomedical industry,most scholars believe that pharmaceutical enterprises have high R&D investment,low capitalization,low success rate of new drugs and long return on investment cycle,which results in the confusion of scholars on the impact of R&D investment on enterprise performance indicators.Cao Xiaomei (2016)[1]selected 59 representative pharmaceutical listed enterprises in A-shares of Shanghai and Shenzhen exchanges to make a regression analysis on the R&D investment and financial index establishment model of enterprises.She used the least squares method to make an empirical study on the investment and financial index.She found that the R&D investment funds of biomedical enterprises could improve the current performance of enterprises.Besides,the coefficient analysis of regression function showed that although the R&D expenditure had no significant effect on Tobin Q,the lag period in the split time had a significant effect on the performance of enterprises,showing a positive correlation between the two,and there would be a significant weakening effect in the subsequent stage.Zhong Yangmei,et al.(2018)[2]believed that intangible assets in biomedical enterprises accounted for a high proportion.Therefore,they studied the effect of R&D expenditure on the profit of pharmaceutical enterprises.Then,they concluded that there was a significant positive correlation between R&D expenditure and net profit of enterprises.Yu Yan (2014)[3]selected enterprise on GEM to make an empirical study.He concluded that there was a significant negative relationship between R&D expenditure and financial performance.Hao Cailian(2020)[4]made an empirical study which showed that the R&D investment of biomedical enterprises could positively promote the sustainable development of enterprises.Besides,the increase of the investment in R&D funds was helpful for the long-term development of enterprises.However,the number and proportion of R&D personnel of enterprises had no effect on the growth of enterprises,indicating that enterprises should reasonably arrange the number of R&D personnel and strictly assess high-level R&D personnel.Excessive R&D personnel cannot create better performance of enterprises,but it will cause more management costs that further reduce the profit of enterprises.

2.2 Literature review of the effect of sales expenses on enterprise performance

The sales expense will directly affect the current enterprise performance.But some research results show that different scholars have not formed a consistent conclusion.Feng Rentao,et al.(2013)[5]studied the effect of sales expenses of pharmaceutical enterprises on the value of enterprises and current business performance,then they concluded that there was a positive correlation between the two.Bao Miaomiao (2014)[6]applied the statistical quantitative analysis method to empirically study the effect of advertising expenses of pharmaceutical enterprises on profit and obtained the positive correlation between the two.However,there would be an inverted U-shaped trend,which meant there was an inflection point in the impact coefficient,and the effect of sales expenses on profit before this point showed an increasing trend.When it was greater than the sales expense at this point,the effect of sales expenses on profit would decrease,so the reasonable sales expense would have an optimal solution to maximize the benefits.Huang Xiaobo,et al.(2018)[7]concluded that the sales expense rate in this year had a significant negative correlation with the financial performance of the enterprise in that year after making an empirical study,and the previous sales expense rate had no effect on the performance of the enterprise in this year.Yan Bin (2020)[8]concluded that there was a significant negative correlation between the sales expense rate and the financial performance of enterprises using an empirical study.Then,he demonstrated that with the premise of unchanged control variables,the corresponding return on equity would decrease by 0.27% after 1% increase in the sales expense rate.

2.3 Comment of the literatures

Based on the above literature analysis,it can be seen that there is no consistent conclusion on the relationship between enterprise performance and R&D investment and sales expense.Besides,the conclusions drawn will be different according to various samples selected by the authors.From the multi-faceted analysis,scholars believe that when R&D investment is intensified,enterprise performance will be better.However,sales expense will make enterprise performance worse.Yet,some scholars hold the opposite point of view.In addition,some scholars believe that R&D investment,sales expense and enterprise performance have a significant correlation,and they are the most obvious factors impact on enterprise performance.In this paper,we use the financial data of biomedical enterprises as a sample,apply linear regression model to construct the equation between the two and enterprise performance and analyze the relationship between them.

3 Empirical studies

3.1 Study hypotheses

At present,different scholars have different views on the impact of R&D expenditure and sales expenses on enterprise performance,and the following research assumptions are made based on the query and collation of data.

3.1.1 Effect of R&D expenditure on enterprise performance

The operation of biomedical enterprises mainly relies on the sales of drugs.The patented technology and drugs mastered by enterprises are the core competitiveness.Innovation is the fundamental source for the development of enterprises,and R&D is the direct path to produce innovation results.However,the R&D investment of enterprises should balance risks and benefits.Blind investment can lead to the loss of enterprise funds due to R&D failure.The data in the sample shows that the pharmaceutical enterprises in the leading position often have a large proportion of intangible assets,which means that they have more patent rights,occupying the demand market and achieving more profits.At the same time,although some enterprises have a large R&D investment,they do not obtain a higher profits.By calculating the capitalization proportion of R&D investment,we can find that the conversion rate of R&D investment is low because most capital investment are processed,which does not become the assets of enterprises.At present,most scholars believe that R&D investment has a positive impact on the profits of enterprises,but there is a certain lag period in the impact,which can be reflected in the financial indicators beyond the late stage of R&D.

Based on the above research results,this paper puts forward the hypothesis that there is a significant negative correlation between the R&D investment ratio and the net interest rate of shareholders in the current period.

3.1.2 Effect of sales expenses on enterprise performance

The best way for pharmaceutical enterprises to maximize return on investment is earn considerable profits by increasing sales to achieve sustainable development.The goal of drug marketing is to obtain profits by meeting the needs of customers,so the expense of enterprises in the sales will be directly related to the benefits in that year.At present,pharmaceutical enterprises pay more attention to marketing,which also provides impetus to promote enterprise performance.However,while management makes high sales expense strategy,there will also be waste phenomenon.With the reform of the twoinvoice system of the government and the introduction of the “4+7” drug centralized procurement system in recent years,the waste of expenditure in the sales is well limited,enterprises pay more attention to the rationality of sales expense,spending more funds for the development,management and maintenance of the market,strictly controlling the funds in the advertising and business publicity,which in turn achieve better profits.

Based on the above research,this paper puts forward the hypothesis that there is a significant positive correlation between the sales expense ratio and the net interest rate of shareholders in the current period.

Both R&D investment and sales expense of enterprises are continuous and dynamic,which will be restricted by time lag.In this paper,linear model does not consider the time factor,and the life cycle stage and size of enterprises are taken as unrelated variables and random error variables.

3.2 Selection of data and samples

In this paper,the listed enterprises in the biomedical industry are selected,and the financial statements are derived from the data released by Sina Financial Network.A total of 76 enterprises with large scale in the industry are selected as the sample data from 2015 to 2019,of which the individuals with missing data in several years are removed.Finally,a total of 382 samples are obtained.The R&D investment ratio,sales expense ratio,net interest rate of shareholders,the total assets of enterprises and enterprise asset-liability ratio are calculated respectively.

3.3 Model building

Based on the above assumptions,a linear regression equation is established between the independent and dependent variables as follows.

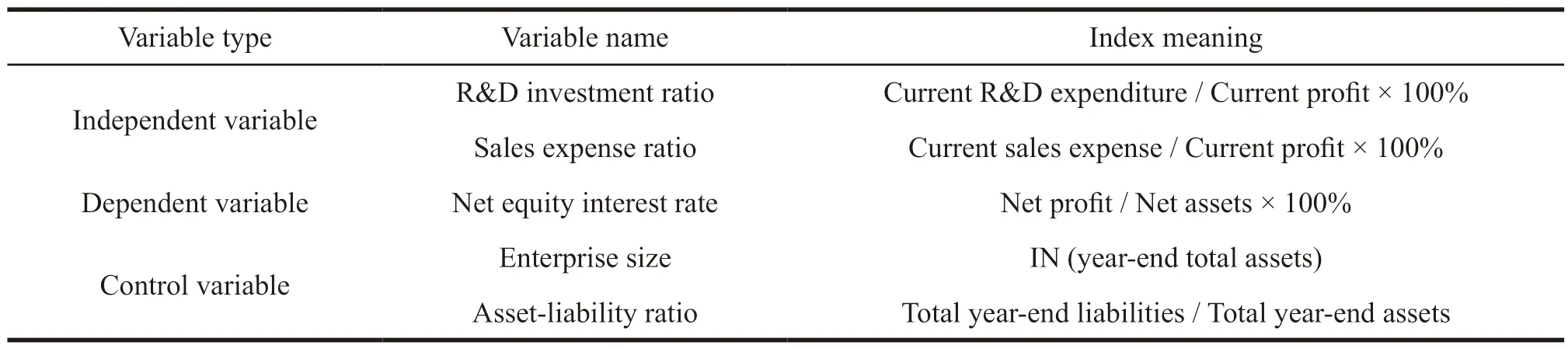

Among them,the subscriptitindicates the financial index value of thei-th enterprise in the yeart,and ROE indicates the net interest rate of shareholders’ equity,which is used to show the ratio of net profit of thei-th enterprise in the yeartto the average owner’s equity.RDII indicates the proportion of R&D investment of the enterprise in the current year to gross profit.SALE indicates the proportion of sales expense of the enterprise in the current year to gross profit.SCALE is a measure of enterprise size,which is expressed by the total assets of the enterprise and is considered as a control variable in this model.DTAR indicates the asset-liability ratio of the enterprise,which is used by the enterprise to measure the proportion of funds from creditors among the funds required in the production and operation of the enterprise and is taken as a control variable in this model.εis a random error variable in the formula,as shown in Table 1.

Table 1 Main indicators and their meanings

3.4 Analysis of empirical results

3.4.1 Descriptive statistics

The data in 382 samples were statistically analyzed descriptively by SPSS 25,and the statistical results are shown in Table 2.

Table 2 Descriptive statistics analysis

It can be seen from the results that among the 382 samples selected by the biomedical enterprise,the minimum R&D investment ratio is 0.001%,while the maximum value reaches 65.99%,with the standard deviation of 8.40%.The large standard deviation of R&D investment ratio of biomedical enterprises indicates that the difference of R&D investment intensity is large,which may be caused by the difference of enterprise scales.Besides,the difference of R&D investment intensity might be caused by the different stages of enterprise life cycle.Secondly,the mean R&D investment ratio is 5.87%.The current study suggests that any pharmaceutical enterprise can maintain normal development when R&D expenditure reaches 2%,but it has a better market competitiveness only when it reaches 5%.Statistics show that the biomedical enterprises with an average value of 5.87% have a large R&D expenditure and core competitiveness.Thirdly,the minimum ration of sales expense is 0.002%,the maximum ration is 100.00%,and the mean value is 24.12%.The data statistics show that both the maximum value and the mean value are at a higher level.Fourth,the average net interest rate of shareholders is 11.12%,which is at a higher profit level in all industries.

In summary,it can be concluded that the R&D expenditure,sales expenses and net interest rate of shareholders of biomedical listed enterprises in China are at a high level between 2015 and 2019,and all enterprises attach high importance to the investment in R&D and sales.

3.4.2 Correlation analysis

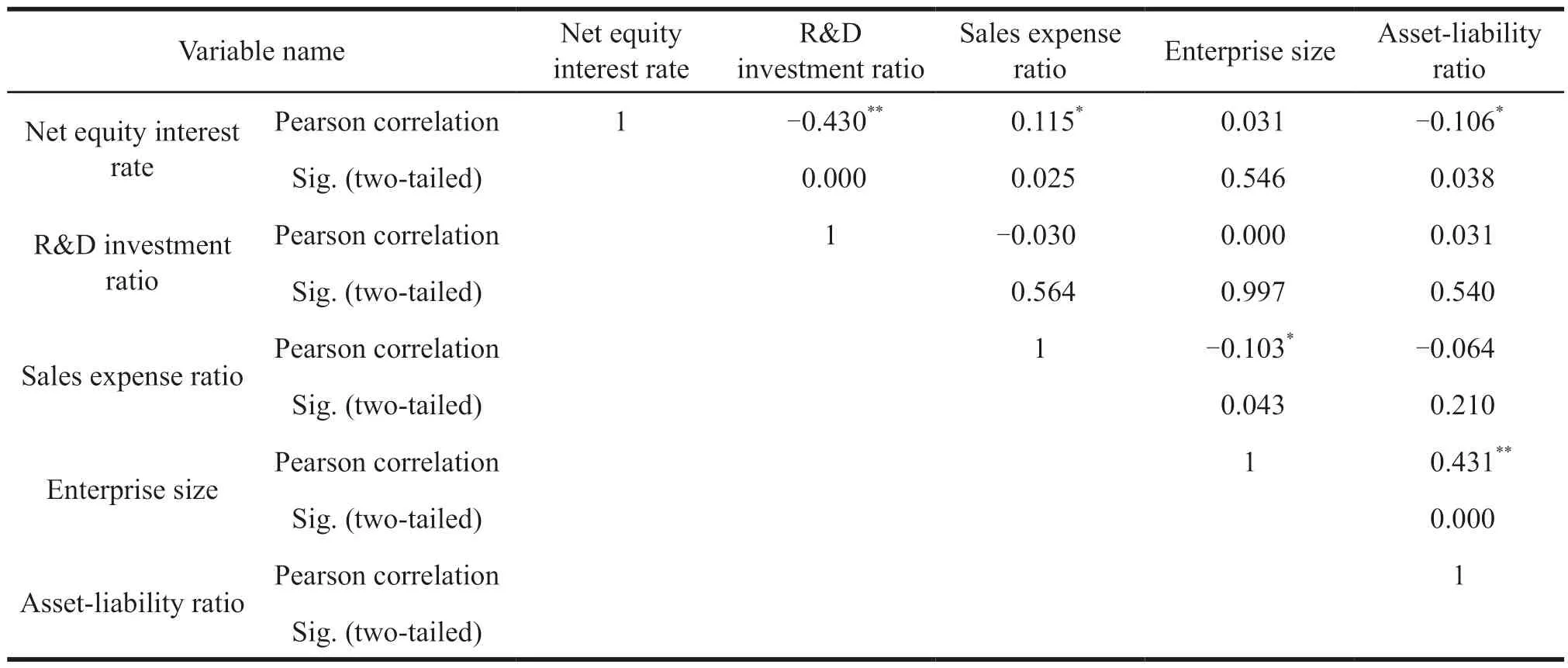

The data in the samples were analyzed by SPSS 25 for correlation,and the results are shown in Table 3.

Table 3 Correlation coefficient between main indicators and significance

Through the statistical results of SPSS 25 correlation,it can be seen that the correlation coefficient between R&D investment ratio and the net interest rate of shareholders is -0.430,and the significance test is passed,indicating that there is a significant correlation between the two.Therefore,it verifies hypothesis 1: R&D investment ratio is significantly negatively correlated with the net interest rate of shareholders of enterprises in the current period.The correlation coefficient between the sales expense ratio and the net interest rate of shareholders is 0.115,and the significance test is passed,which shows that there is a significant positive correlation between the two.Therefore,it verifies hypothesis 2:There is a significant positive correlation between the sales expense ratio and the net interest rate of shareholders of the enterprise in the current period.

3.4.3 Multiple linear regression analysis

Multiple linear regression analysis of the data by SPSS 25 showed the following results in Table 4 and Table 5.

Table 4 Significance of linear regression equation

Table 5 Regression coefficient of variables

In the multiple linear regression analysis of the data by SPSS 25,Table 4 shows that the linear equation has a significant correlation due to itsFvalue of 25.076 and its significance is 0.000.The tolerance and variance inflation factor VIF can explain the collinear relationship between variables in collinearity test.When the tolerance in statistical results is less than 0.1 or the variance inflation factor is greater than 10,it means that there is obvious multicollinearity between R&D investment ratio,sales expense ratio,enterprise size,asset-liability ratio,and net interest rate of shareholders.Therefore,this regression equation cannot linearly reflect the relationship between independent variables and dependent variables.Table 5 displays that the tolerances in the collinearity statistics are all between 0.8 and 1,and the VIF coefficients between different variables are between 1.0 and 1.2,which are much less than 10,so there is no multicollinearity between the variables.The adjustedR2value of the equation was 0.202,indicating that the linear equation explained 20.20% of the relationship between variables.Bof R&D investment intensity is -0.510,while the significance is 0.000,so there is a significant negative correlation between R&D investment intensity and return on equity.Meanwhile,B of sales expense is 0.060,the significance is 0.024,so there is a significant positive correlation between sales expense and return on equity.

4 Conclusion and suggestions

4.1 Main conclusion

Firstly,biomedical enterprises take new drug R&D as the core competitiveness.From the selected samples,although the overall level of absolute amount of R&D investment and sales expense is high,there is great difference among various enterprises.The correlation coefficient in the linear regression model in this paper also shows that there is a significant correlation between R&D investment,sales expense and the net interest rate of shareholders of enterprises.

Secondly,the empirical research shows that there is a significant negative correlation between the R&D investment ratio and enterprise performance,but the samples with a large R&D investment ratio are mostly leading enterprises in the industry,with better performance in new drug R&D and patented drugs.The negative relationship between R&D investment and the performance of enterprises in the current period is due to the lag in the benefit of R&D expenditure.It means the current R&D investment only acts on a certain link in R&D that can produce a large benefit after the drug R&D is successful and approved for marketing.

Thirdly,the empirical results show that there is a significant positive correlation between the sales expense ratio and enterprise performance,indicating that the sales of drugs by pharmaceutical enterprises is a direct source of enterprise performance.The largescale enterprises with more patents will invest more in the sales,and the enterprise performance will also be better.But the model shows that the coefficient B value of SALE in the equation is small,indicating that there is an unreasonable part of the sales expenses of biomedical enterprises.

4.2 Suggestions

Firstly,the development of biomedical enterprises is based on the continuous successful innovation and production of new drugs.No matter whether they are used as treatment or prevention,R&D must ensure the market demand,which can guarantee the products to obtain sales and profits proportional to the investment.Therefore,the selection of appropriate R&D strategy is an important management activity of enterprises.Therefore,enterprises need to strictly control the management of advance,in-process and afterwards results of R&D in combination with their industrial status and the actual situation of internal capital,arranging budget investment reasonably and improving the capitalization level,maximizing the negative impact of fund outflow on the performance,and improving the competitiveness to have a sustainable development.

Secondly,because the R&D investment of enterprises in the model has a negative correlation with the net interest rate of shareholders of enterprises,the conclusion is also in line with the intuitive perception of management on business data.If only short-term interests are considered and corresponding R&D investment plans are formulated conservatively,it will affect the long-term competitiveness of enterprises,and ultimately cause R&D and innovation capacity in China’s enterprises to lag far behind compared with developed countries.It is obviously not conducive to the healthy development of the industry.In view of the current situation,the government should give play to the regulatory role of “tangible hands” in the market,improving the patent protection system,strengthening the protection period and intensity of innovative products developed by enterprises,and giving subsidies and honorary rewards to high-quality products.In addition,it should intensify support in terms of policies,subsidizing enterprises,and allowing enterprises to invest manpower and material resources to focus on R&D and innovation.

Thirdly,drug development aims to meet the needs of people who do not have access to appropriate therapeutic agents to prevent various diseases.Under the premise of market demand,the marketing should solve the matching problem between drug R&D and market demand,which also helps biomedical enterprises obtain profits.The research results show that,within the allowable range,improving the sales expenses of enterprises can positively promote the performance of enterprises.Therefore,it is necessary to increase the capital investment of sales departments,which can maintain the sales channels,strengthen the knowledge training of sales personnel and improve the sales incentive mechanism of enterprises.In addition,it is vital to build new sales channels to attract more customers.The upstream and downstream highquality enterprises can cooperate to establish win-win partnerships so that they will invest the sales expenses in the projects that have the greatest impact on the performance of enterprises.

Fourthly,the R&D and the sales are two crucial links for the survival and development of biomedical enterprises,and they are closely related.On the one hand,the capital arrangement of enterprises may limit the investment of the two.On the other hand,the R&D investment will be more conducive to the long-term development of enterprises because of its delayed benefits,which is necessary for the sustainable growth of enterprises.However,the sales expense is directly conducive to the enterprise performance,so the formulation of budget planning becomes a key strategy of enterprises.For enterprises with a certain scale,it is necessary to reasonably arrange the investment ratio between R&D investment and the sales expense,which can ensure the long-term development of enterprises.

杂志排行

亚洲社会药学杂志的其它文章

- Research on Incentive Policies for Chinese Innovative Drug R&D -Taking Innovative Anti-tumor Drugs as an Example

- Research on the Impact of Independent R&D and Collaborative Innovation on Economic Performance in China’s pharmaceutical Industry

- The Status Quo and Enlightenment of the Foreign Extended Clinical Trial System

- Foreign Experience and Enlightenment of Reimbursement Management of Multi-indication Drugs

- Study on Public Health Behavior against the Background of COVID-19 Pandemic -Based on Bandura Reciprocal Determinism

- Current Situation and Prospect of the Application of Real-World Evidence in Health Care