From Lab to Market: The Rising Recombinant Collagen in the Cosmetic Industry

2023-12-17RitaBao

Rita Bao

ChemLinked,REACH24H Consulting Group,China

1 Introduction to recombinant collagen

1.1 What recombinant collagen is?

In the cosmetics industry,innovation is largely driven by breakthroughs in ingredients.Historically,many brands have achieved significant success by harnessing the potential of exclusive ingredients.Examples include Pro-Xylane for L’Oréal,nicotinamide for Olay,etc.Currently,recombinant collagen is the rising star in the cosmetics industry.Collagen widely exists in tissues such as skin,bones,and muscles.Its supportive,reparative,and protective properties make it a vital substance in maintaining skin elasticity and moisture.As Dr.J.Brandt—the father of collagen,stated,the skin aging process is the process of collagen breakdown and loss.Therefore,how to supplement the continuous loss of collagen has long been a focus of dermatological research.

Collagen products available in the market can be categorized into animal-derived collagen and recombinant collagen based on extraction methods.Animal-derived collagen is extracted from animal tissues,while recombinant collagen is produced through genetic engineering techniques.The latter option offers several advantages,including superior performance,greater flexibility,and enhanced safety.Additionally,recombinant collagen has a higher denaturation temperature,exceeding 72 °C,compared to animal-derived collagen which typically denatures at around 40 °C.This higher denaturation temperature simplifies transportation and storage.While animalderived collagen currently holds the majority of the market share,recombinant collagen is rapidly gaining ground due to the significant advancementsin synthetic biology in recent years (Table 1).

1.2 Categories of recombinant collagen

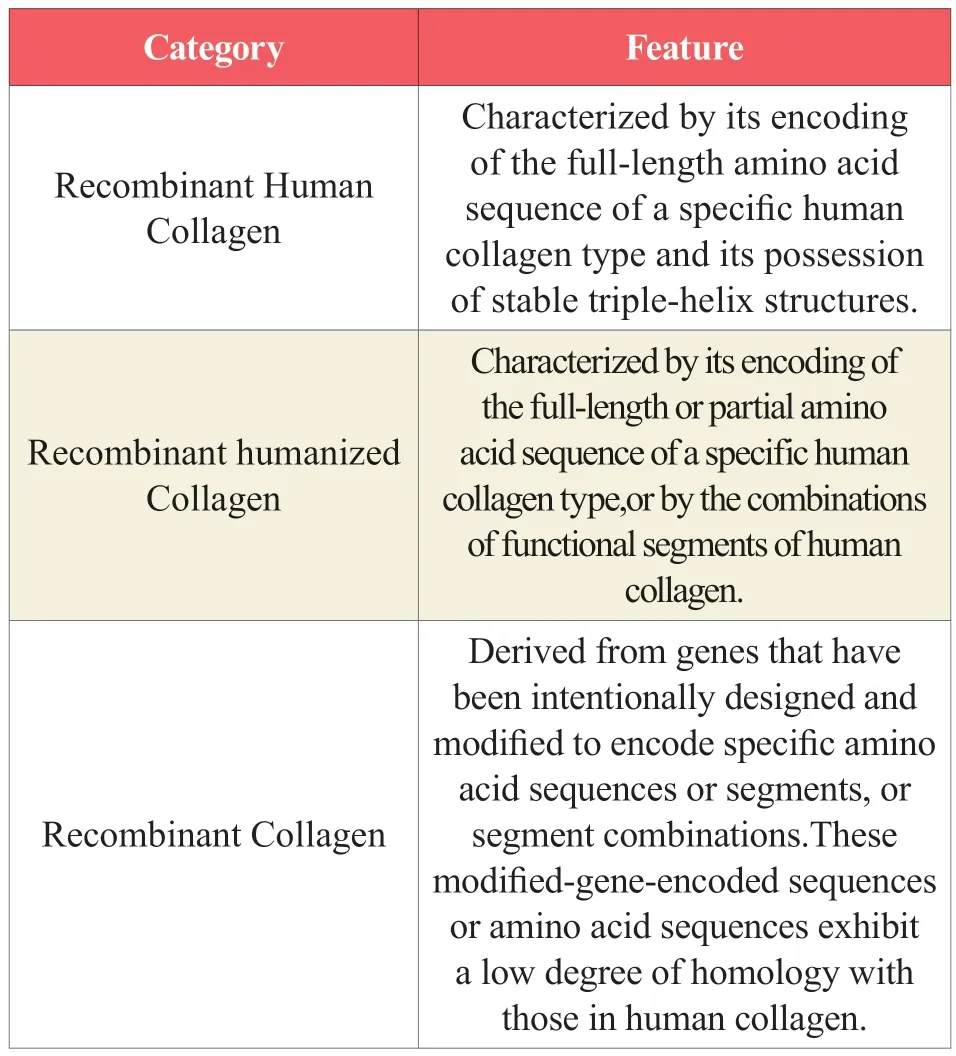

According to the Guidelines for Naming Recombinant Collagen Biomaterials,recombinant collagen can be categorized into three groups:recombinant human collagen,recombinant humanized collagen,and recombinant collagen.Recombinant human collagen exhibits a structure identical to that of human collagen.But there are currently no recombinant human collagen products available in the market.Recombinant humanized collagen features amino acid sequences that match specific functional regions of human collagen,resulting in exceptional biocompatibility.In contrast,recombinant collagen has a relatively low degree of homology to human collagen(Table 2).

Table 2.Different categories of recombinant collagen

2 Recombinant collagen market and applications

2.1 Market size of recombinant collagen

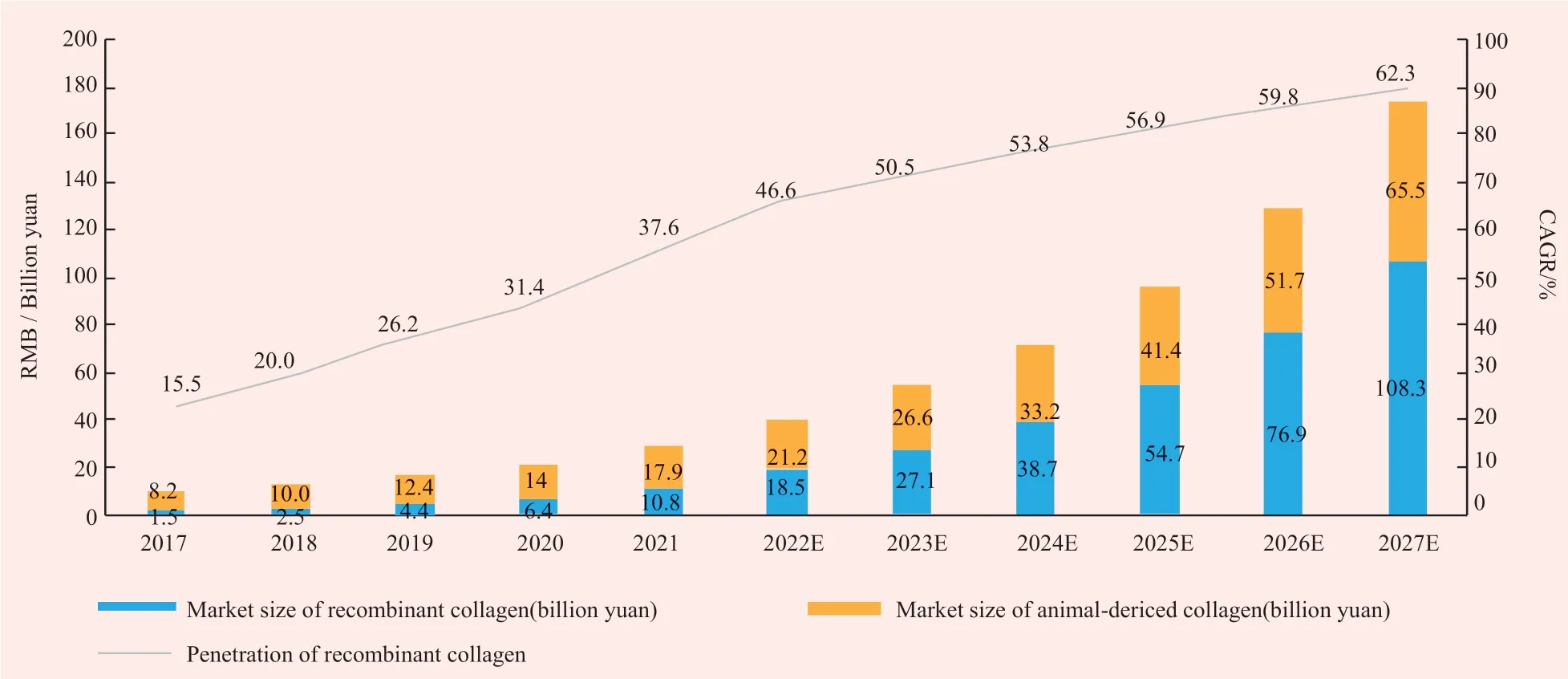

As recombinant collagen production and commercialization receive increasing attention,the prospect is promising.According to Frost &Sullivan,the market size of recombinant collagen has witnessed substantial growth,surging from 1.5 billion yuan in 2017 to 10.8 billion yuan in 2021,with a compound annual growth rate (CAGR) of 63.8%.Itis expected to reach 108.3 billion yuan in 2027,with a CAGR of 42.4% from 2022 to 2027.Notably,the penetration rate of recombinant collagen products in the entire collagen market has increased from 15.5%in 2017 to 37.6% in 2021,and is expected to furtherincrease to 62.3% in 2027 (Figure 1).

Figure 1. Market size of recombinant collagen and animal-derived collagen

2.2 Applications of recombinant collagen

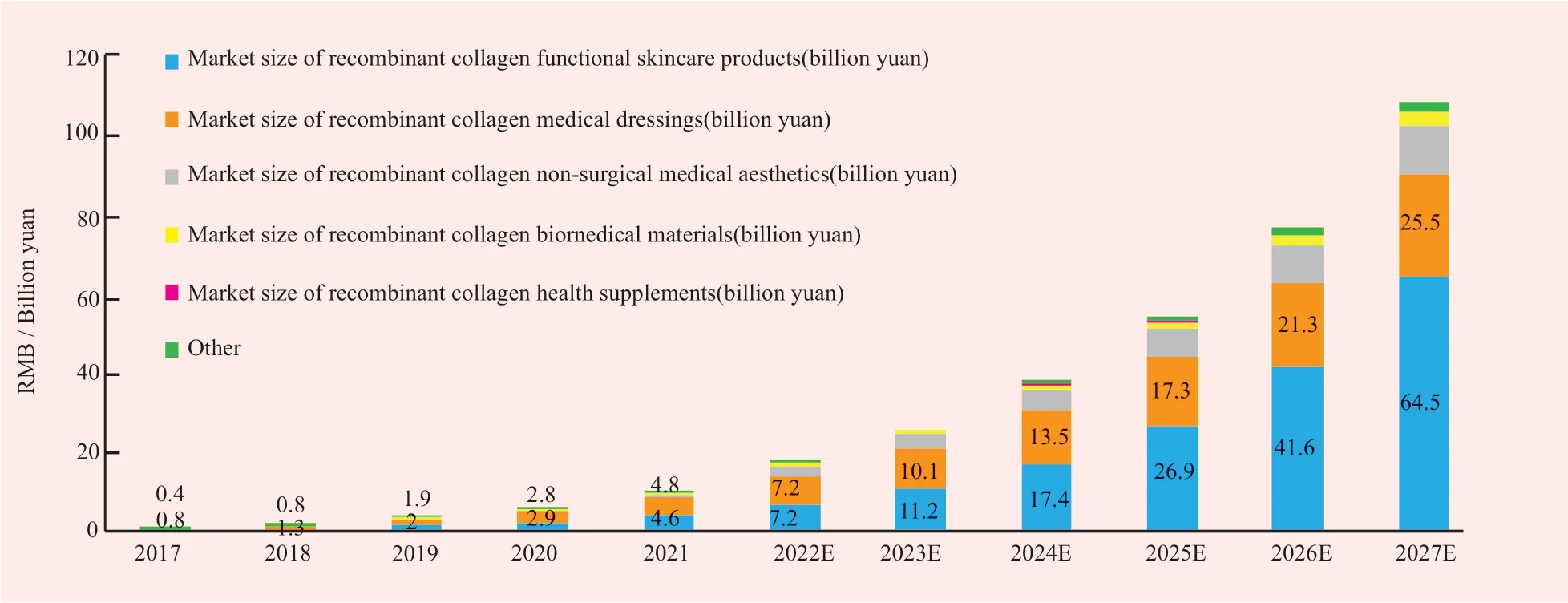

The applications of recombinant collagen span across various fields,covering professional skincare(including functional skincare and medical dressing),non-surgical medical aesthetics,biomedical materials,health supplements,etc.Among these,functional skincare and medical dressing stand out as the primary application areas.In 2021,functional skincare and medical dressing accounted for 42.6% and 44.4% in all types of applications of recombinant collagen (Figure 2).

Figure 2. Applications of recombinant collagen

Delving into the field of functional skincare,China saw its market reach 30.8 billion yuan in 2021,with a CAGR of 23.4% from 2017 to 2021.The market is expected to reach 211.8 billion yuan by 2027,with a CAGR of 38.8% from 2022 to 2027.Within this market,recombinant collagen based functional skincare products had a scale of 4.6 billion yuan in 2021,with a CAGR of 54.9% over the same period.This segment is projected to surge to 64.5 billion yuan by 2027,growing at a CAGR of 55.0%from 2022 to 2027.The market penetration rate of recombinant collagen based functional skincare products is anticipated to rise from 14.9% in 2021 to 30.5% in 2027 (Figure 3).

Figure 3. Functional skincare market size and recombinant collagen segment

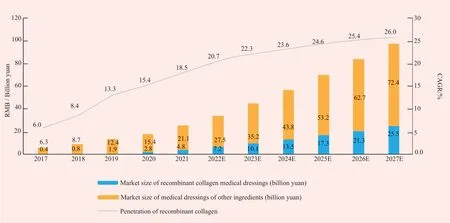

In the medical dressing field,the market hit 25.9 billion yuan in 2021 with a CAGR of 40.2% from 2017 to 2021,representing a rapid growth trend.The market is expected to expand to 97.9 billion yuan by 2027,growing at a CAGR of 23.1% from 2022 to 2027.Within the market,recombinant collagen based medical dressings accounted for 4.8 billion yuan,with a penetration rate of 18.5% in 2021,and a CAGR of 86.1% from 2017 to 2021.From 2022 to 2027,this segment is expected to continue growing at a CAGR of 28.8%,and leading to an improved penetration rate of 26.0% in 2027 (Figure 4).

Figure 4. Medical dressing market size and recombinant collagen segment

2.3 Competitive landscape

Currently,China is at the forefront of research,manufacturing,and industrialization of recombinant collagen worldwide.As the pioneer in the industry,Giant Biogene is one of the largest recombinant collagen manufacturers worldwide with extensive libraries of recombinant collagen.Additionally,it is world's first enterprise to achieve mass production of recombinant collagen skincare products.After Giant Biogene made its debut on the HKEX in November 2022,it has earned the title of China’s first Recombinant Collagen stock.Following the footsteps of Giant Biogene,enterprises such as Jinbo Biopharmaceutical and Trautec Medical Technology have entered the market and built their early-mover advantages.Jinbo has developed a new recombinant Type III humanized collagen ingredient—MicoreCol.III,with a small molecular weight of only 3 kDa,which can penetrate the skin at a rate of 33% in 4 h and up to 86% in 12 h.Moreover,Jinbo’s exclusiveinnovation—Recombinant Type III Humanized Collagen Freeze-Dried Fiber,is the first recombinant collagen product with class III medical device certification in China approved for injectable cosmetic treatment.Noteworthy,Jinbo also went public in July 2023.Trautec is the only biotechnology enterprise that has successfully realized the industrial production of recombinant type XVII humanized collagen which has obtained the INCI name.Furthermore,Trautec has secured investment from Shiseido,facilitating their technological innovation and product research and development.

As the recombinant collagen field continues to gain momentum,an increasing number of enterprises,such as Bloomage Biotech,Marubi,Wuzhong Pharmaceutical,and others,have rapidly entered the sector.They have done so through self-research projects,purchase of patented technologies,as well as mergers and acquisitions (Table 3).

Table 3.Major players in China’s recombinant collagen industry

When examining the competitive landscapein the recombinant collagen cosmetics sector,it’s apparent that both upstream raw material suppliers and downstream beauty companies are strategicallyinvesting in this field by introducing their own product lines.Recombinant collagen based skincare products primarily focus on barrier repair and anti-aging effects due to recombinant collagen’s biological properties,including providing structural support,promoting hemostasis and cell adhesion,stimulating cell regeneration and proliferation,repairing damaged skin barriers,and supplying nutrition for aging and problematic skin.

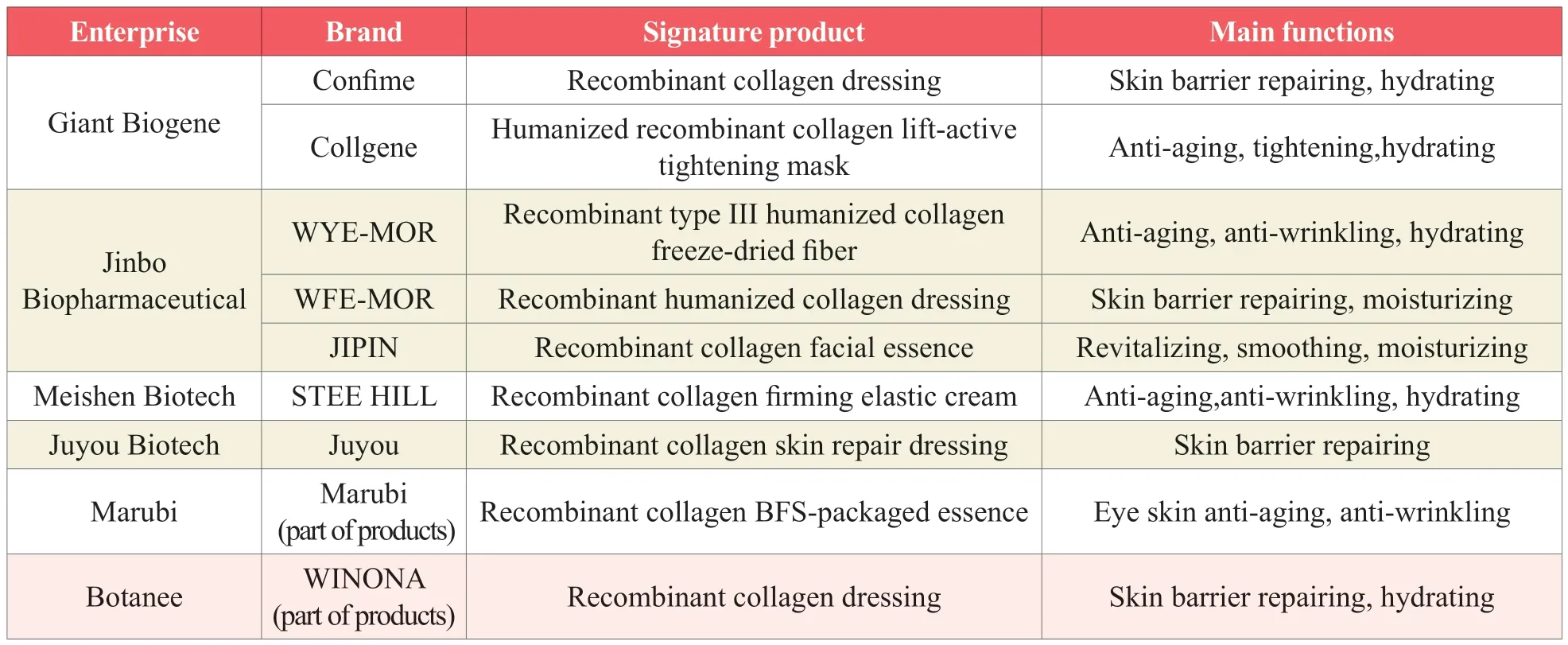

Examples include the popular brand Confime and Collgene under Giant Biogene,as well as new recombinant collagen products launched by leading Chinese functional skincare brands such as Marubiand Winona.Particularly,Confime has established a strong presence in the recombinant collagen based skincare category.According to Giant Biogeneinterim financial report of 2023,Confime’s revenue was 1.23 billion yuan in H1 2023,with a YoYincrease of 101%,accounting for 76.4% of Giant Biogene’s total revenue(Table 4).

Table 4.Major Chinese brands in the recombinant collagen cosmetics sector

2.4 Development potential

In addition to its primary applicationsin functional skincare and medical dressings,recombinant collagen’s applications in the following areas are also noteworthy:

2.4.1 Non-surgical medical aesthetics

Non-surgical medical aesthetics,specificallyinjectable cosmetic treatments,have becomeincreasingly popular as a means to enhance one's appearance.Collagen,compared to other ingredients,offers naturalness,strong adhesion,and a whitening effect,making it a highly suitable bioactive ingredient for injectable cosmetic treatments.However,in the past,the high cost and safety concerns associated with collagen injection products limited their use ininjectable cosmetic treatments.A significant turning point occurred in 2021 when Jinbo Biopharmaceutical developed the recombinant type III humanized collagen freeze-dried fiber under the brand WYEMOR.In 2022,this product generated an impressive revenue of 113.5 million yuan,representing a remarkable YoY growth of 310% and accounting for 29.06% of the company’s total revenue.Additionally,it's noteworthy that in August 2023,Jinbo’s second injectable recombinant collagen product was approved for market access.With continuous technological advancements,recombinant collagen will be applied to more scenarios in injectable cosmetic treatments.

2.4.2 Scalp care

As consumers’ personal care needs becomeincreasingly refined,scalp health issues are garnering more attention than ever before.Consequently,high-efficacy ingredients have also become the focus of scalp care products.Currently,Trautec has demonstrated the effectiveness of recombinant XVII collagen in repairing skin tissue and promoting hair growth through in vitro cell and animal experiments.Additionally,Jland Biotech has also launched a new material—Anti-Hair Loss and Scalp Nourishing Transdermal Recombinant Collagen,which claims to effectively permeate the basal layer of the scalp,providing anti-hair loss,hair care,and scalp anti-aging effects.

2.4.3 Oral beauty

As the beauty economy evolves,the concept of“internal and external beauty” has gained popularity,leading to a growing demand for oral beauty supplements.Collagen is a trendy choice among consumers who seek to combat aging through dietary supplementation.Today,China’s oral beauty market has evolved from the collagen era 1.0 to the collagen peptide era 2.0,where products are featured with better efficacy due to higher absorption rates.With the advancement of recombinant collagen technology,there is substantial market potential for collagen supplements with even higher absorption rates and enhanced solubility.

3 Regulatory compliance

To guide the healthy,standardized,and regulated development of recombinant collagen industry,the Chinese government has enacted a series ofindustry standards and policies that specify naming conventions,product supervision,and quality control requirements for recombinant collagen biomaterials.In March 2021,National Medical Products Administration (NMPA) released the Guidelines for Naming Recombinant Collagen Biomaterials,establishing standardized nomenclature for recombinant collagen biomaterials.Subsequently,in April of the same year,the Principles for Classifying Recombinant Collagen Medical Products was released to strengthen the supervision and management of recombinant collagen medical products.In January 2022,the NMPA released the Recombinant Collagen Industry Standard (YY/T 1849-2022),which officially came into effect in August 2022.This standard,jointly drafted by multiple professional research institutions and industry-leading players,stipulates requirements for the industry covering eight aspects including definition,quality control,testing methods,stability,biological evaluation,packaging,transportation,and storage.Furthermore,the Recombinant Humanized Collagen Industry Standard was released in January 2023 and enforced in July 2023,with the aim of promoting the orderly development of recombinant humanized collagen.All in all,these regulatory policies are expected to facilitate the healthy development of the recombinant collagen industry.

杂志排行

China Detergent & Cosmetics的其它文章

- The Haircare Efficacy Research of Prinsepia Utilis Oil

- Study on the Effect and Mechanism of Green Plum Citron Double Strain Fermentation Filtrate on Skin Barrier

- In Vivo Study of a Natural Whitening Agent

- In Vitro Study on the Soothing and Oil Control Efficacy of P-Hydroxyacetophenone

- The 3rd Summit Forum on Amino Acid Surfactant was Held

- The 2023 (12th) National Sulfonation/Ethoxylation Technology and Market Seminar was Held