Demand for industrial textiles in the domestic and abroad markets declines in H1 of 2023

2023-09-18EditedbyZhaoXinhua

Edited by Zhao Xinhua

In the first half of 2023, the global economy is in a fragile recovery, and while growth prospects have improved, they remain highly uncertain; the domestic economy has picked up, but the foundation for sustained economic recovery is still not solid.China’s industrial textile industry continues to be in the adjustment period after the explosive growth in demand for pandemic prevention materials and then the steep decline, the release of substantial investment in production capacity impacts the supply and demand system, and competition in related fields intensifies; other fields outside the industry chain of pandemic prevention supplies have maintained relatively stable development.Since the outbreak of the pandemic in 2020, the industrial value-added of China’s industrial textile industry has significantly oscillated.The growth rate of industrial value-added reached a historical high in 2020, fell rapidly in 2021, began to recover after 2022, reached the highest point in the first half of 2022, and then slowed down,and entered the decline range again since 2023.

According to the survey conducted by the Association on sample enterprises, the prosperity index of the industrial textile industry in the first half of 2023 was 51.7, which was in the micro prosperity range, down 3.3 from the first quarter of 2023 and up 4.8 from the same period in 2022, far lower than the indicator before 2021.

Market demand and production

According to the CNITA’s survey of member enterprises, 45.9% and 39.2%of the surveyed enterprises said that the domestic and international market demand in the first half of 2023 had declined to varying degrees, and the domestic and international market demand index was 37.8 and 46.1, respectively, compared with the first quarter (42.9 and 50.0), down 5.1 and 3.9.In terms of fields,the domestic market of textiles for transportation and textiles for reinforcement continued to recover, and the domestic market demand index was above the threshold separating contraction from expansion; in terms of international orders,the international market demand index of nonwovens, protective and safety textiles, filtration and separation textiles is above the threshold separating contraction from expansion, among which, the demand for nonwovens in overseas markets is significantly warmer than the first quarter.

In terms of orders in hand, 32.2% of the surveyed enterprises have a relatively stable and continuous source of orders or orders in hand can support production for more than three months, while 28.3% of the surveyed enterprises can only support production within one month.According to the size of the enterprise, the orders in hand of large enterprises are more stable and sufficient to support longer production; most of the orders in hand of small and medium-sized enterprises can only support production within a month or even within half a month.

Despite the decline in market demand,the industry’s capacity utilization rate has remained stable.According to the Association's survey, the average capacity utilization rate of the industry in the first half of 2023 reached 71.7%, an increase of 0.7 percentage points from the first quarter,of which the proportion of enterprises with capacity utilization rate of more than 70%increased by 3.8 percentage points from the first quarter.

According to the National Bureau of Statistics, the output of nonwovens of enterprises above designated size from January to June 2023 fell by 2.2% year-on-year, and the decline continued to narrow after the first quarter; the production of cord fabric increased by 2.8% year-on-year, reversing the long-term trend of decline.

Economic benefits

According to the National Bureau of Statistics, from January to June 2023, the total operating income and profit of enterprises above designated size of the industrial textile industry fell by 7.6% and 41.5%year-on-year, respectively, and the profit margin was 2.9%, down 1.7 percentage points year-on-year.

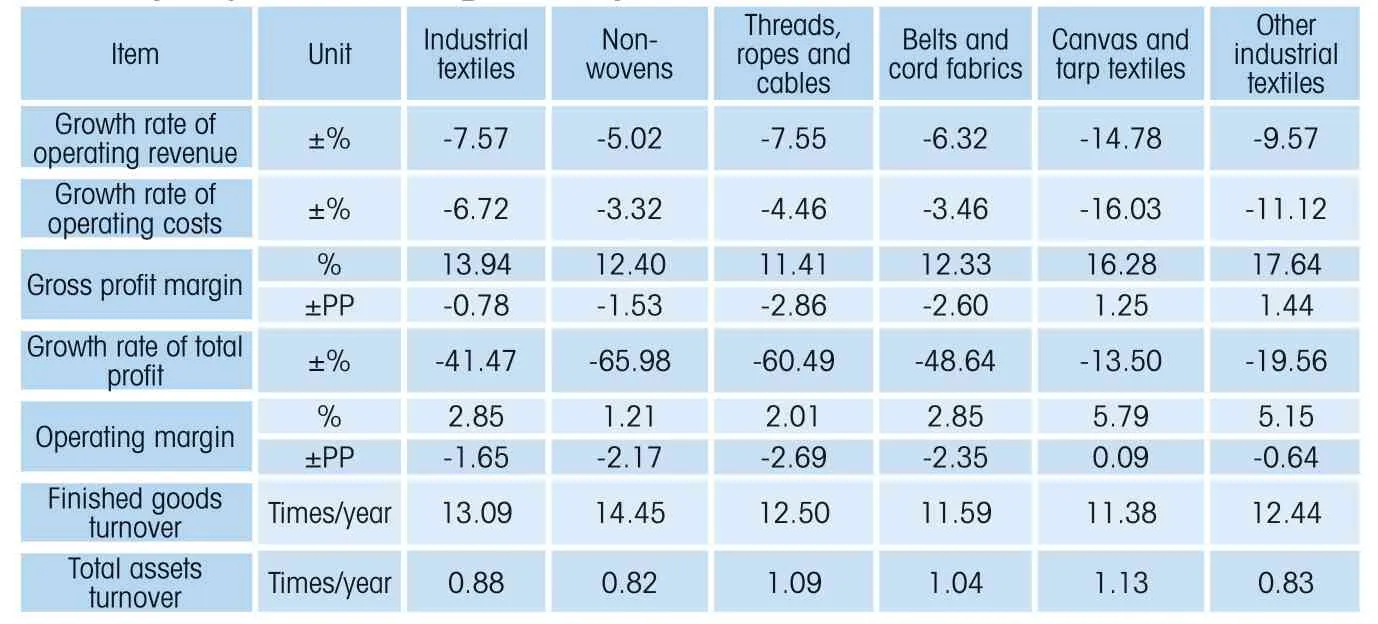

From January to June, the total operating income and profit of nonwovens enterprises above designated size fell by 5%and 66% respectively, and the profit margin was only 1.2%, down 2.2 percentage points year-on-year, which is at the lowest level in history.The total operating income and profit of enterprises above designated size of threads, ropes and cables decreased by 7.6% and 60.5% respectively year-onyear, and the profit margin was 2%, down 2.7 percentage points year-on-year; the total operating income and profit of enterprises above designated size of textile belts and cord fabric decreased by 6.3% and 48.6%, respectively, and the profit margin was 2.9%, down 2.4 percentage points;the operating income and total profit of enterprises above designated size of canvas and tarp textiles decreased by 14.8%and 13.5% respectively, but the gross profit margin increased by 1.25 percentage points and the profit margin was 5.8%;the total operating income and profit of other industrial textile enterprises above designated size including filtration and geotextile decreased by 9.6% and 19.6% respectively, but the gross profit margin increased by 1.44 percentage points to 17.6%, which is the highest level in the industry, and the profit margin remained above 5%, reaching 5.2% (Table 1).

Table 1 Main economic indicators of industry operation from January to June 2023(enterprises above designated size)

According to the questionnaire, 30% of the enterprises said that their income had increased in the first half of the year to varying degrees, and 23% of the enterprises said that their profits had increased.Since 2023, the profit situation of the industry has declined sharply, mainly due to the intensified market competition leading to the continued decline in the price of finished goods, the Association’s survey shows that the price index of finished goods in the first half of the industry is only 32.6, compared with the end of 2022 and the first quarter of 2023, respectively, down 6.1 and 12.0.

International trade

According to China Customs, from January to June 2023, the export of China’s industrial textile industry (customs 8-digit HS code statistics) was 20.07 billion US dollars, down 12.5% year-on-year, and the decline has deepened; the imports of China’s industrial textile industry (customs 8-digit HS code statistics) were 2.6 billion US dollars, down 17.3% yearon-year.

In the first half of 2023, exports of key products of the industry (chapters 56 and 59)to major trading partners all declined to varying degrees,but exports to Russia increased significantly by 50.1%;Asia is the largest export market for China’s industrial textiles, and the United States is still the second largest single export market for China’s industrial textiles.

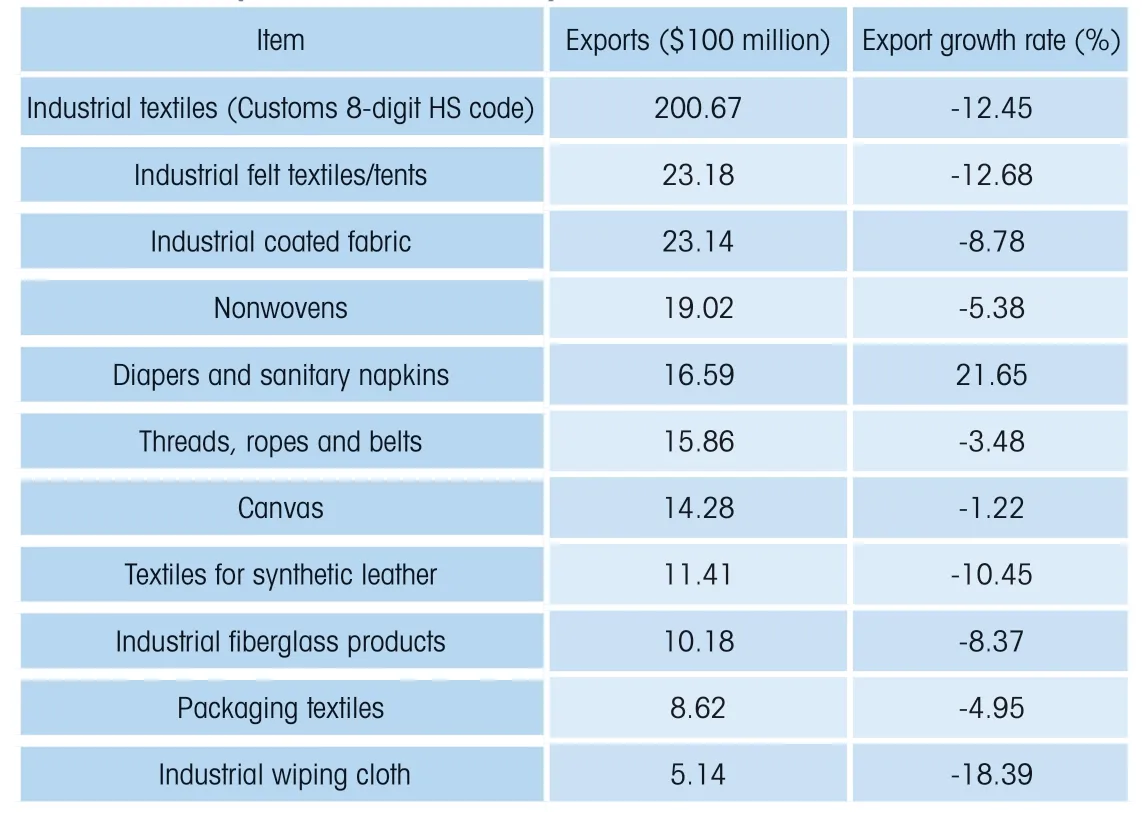

From the main export products, industrial felt textiles/tents, industrial coated fabrics and nonwovens are the industry’s top three export products, exports fell 12.7%, 8.8%and 5.4%, respectively, but from the quantity point of view,exports of nonwovens was 622,000 tons, an increase of 1.9%; the exports of diapers and sanitary napkins reached 1.66 billion US dollars, up 21.7% year-on-year; the decline in exports of threads, ropes and belts, textiles for synthetic leather, industrial fiberglass products and packaging textiles has deepened to varying degrees(Table 2).

Table 2 The export of industrial textile industry and main products from January to June 2023

Despite the overall decline in exports, exports of some higher-technology market segments maintained a high growth rate, such as airbag exports of 430 million US dollars, an increase of 14.2%; industrial felt and blanket textiles exports of 210 million US dollars, an increase of 8.3%; the export of reinforcement textiles was 110 million US dollars, up 6.5% year-on-year; filtration and separation textiles were exported to 110 million US dollars, up 13.2%year-on-year.These reflect the positive results achieved by the industry in technological innovation, product development and market expansion in recent years.

Annual development forecast

At present, the various operating indicators of China’s industrial textile industry are at a historical low.The demand for pandemic prevention materials such as masks and protective clothing has plummeted, driving the production, domestic and export sales and profits of the entire industrial chain to fall sharply.Meanwhile,the excessively fast expansion of nonwovens production capacity has had a great impact on the smooth operation of the industry, but the impact of these factors is gradually weakening.Although the fields related to nonpandemic prevention materials face some common difficulties, the operation quality and efficiency are still in a reasonable range.In the long term,the fundamentals of the industry have not changed, and companies remain cautiously optimistic about future expectations, and are still willing to invest in advanced production capacity, digitalization, and green development.In the second half of 2023, with the implementation of various active national policies and the weakening of the pandemic factors, it is expected that the industry situation will improve, and the decline of the main economic indicators will narrow, but it will not change the trend of low operation.

杂志排行

China Textile的其它文章

- ITMF: Business situation remains negative but improves for the first time since November 2021

- Create a digital avatar, everyone is a designer!

- How do top garment manufacturers develop energy-efficient and high-speed processes?

- Turnover of textile and apparel specialized market achieves recovery growth in H1 of 2023

- 33.82 million tons man-made fiber produced in the first half of 2023

- Benefits of China’s home textile industry increase YoY in H1 of 2023