Impact of Sharp Fluctuations of Live Pig Prices on Financial Capacity of Pig Breeding Enterprises: An Analysis Based on the Data of Listed Enterprises from 2018 to 2021

2023-08-30QiXUERuihanLIShufenLI

Qi XUE, Ruihan LI, Shufen LI

1. International Education College, Henan Agricultural University, Zhengzhou 450046, China; 2. College of Economics and Management, Henan Agricultural University, Zhengzhou 450002, China

Abstract Based on the general equilibrium theory of microeconomics, this study first analyzed the causes of sharp fluctuations in live pig prices, and then explored the financial capabilities of enterprises during the sharp fluctuations of live pig prices by using the financial data of 4 typical top listed enterprises from 2018 to 2021. By comparing the changes in the capabilities of enterprises, the impact of price on the financial capability of enterprises and differences were identified. The research results showed that the price of live pigs played a decisive role in enterprise profits, and there were huge differences in the fluctuation period. In the sharp increase period of price, price temptation is easy to cause enterprises to over-invest, resulting in excessive growth of enterprise assets, and increasing the business risk of enterprises. Based on the above conclusions, some policy suggestions were put forward to promote the stable development of industry from the three levels of enterprises, industries and government departments.

Key words Live pig price, Price fluctuation, Pig breeding enterprise, Financial capacity

1 Introduction

Since the reform and opening up, pork, as an important basic guarantee for China’s food safety strategy, has achieved remarkable results in domestic industrial development, and pork production has been growing constantly[1]. Pork is the largest livestock and poultry consumer goods in China[2], and it is also a single commodity with a large weight in the CPI basket[3]. In recent years, the sharp rise and fall of pork prices in China generally follows the law of "pig cycle", which essentially is the realistic result of the game between supply and demand of live pigs, but the sharp fluctuation of its price has a dramatic impact on the consumption of urban residents and rural residents in China. Since 2006, China has completed four "pig cycles" (July 2006 to April 2010, May 2010 to March 2015, April 2015 to May 2018, and June 2018 to date), and each cycle spans about 3-4 years. The current "pig cycle" is jointly affected by the African swine fever and the COVID-19 pandemic, with greater price fluctuation and longer duration[4]. In addition, with the development of the internet, the food safety incidents caused by live pig disease and the transmission of information will cause consumer panic among mass consumers and lead to a decline in consumer confidence, which will further affect the normal economic life[5]. Cyclical changes in pork prices have a significant substantive impact on various capabilities and profits of live pig enterprises. The No.1 documents in 2019, 2020, and 2021 deployed the prevention and control of pig epidemic and the stabilization of pork supply as important work, and the pig production gradually recovered. But the pig prices around the country reversed again in 2021, and the "pig cycle" issue appeared again. The No.1 central document in 2022 clearly put forward "long-term support policies to stabilize pig production and prevent sharp fluctuations in production", and the newly released No.1 central document in 2023 emphasized "protecting the basic production capacity of live pigs and perfecting the long-term mechanism for the stable and orderly development of pig industry", making ensuring stability a top priority in the development of pig industry.

Various industrial chain links of pig breeding also affect the price of live pigs. The supply side of pig breeding is most closely related to the fluctuation of pig prices. The epidemic situation of pigs will increase the morbidity and mortality of pigs, which has certain negative effects on sale[6]. From the perspective of the fluctuation law of pig prices, live pig prices run in the states of sharp fluctuation and gentle fluctuation, and changes frequently[1]. Ning Youliangetal.[7]made an in-depth analysis of the price transmission mechanism of China’s live pig industry chain and drew a conclusion that the price of live pig industry chain influences each other. Song Mengfei[8]made an empirical analysis using VAR model and found that there was a long-term stable equilibrium relationship between pig prices and pig supply in China. The cyclical fluctuation of live pig prices is attributed to the factors that cause the change in supply[9]. The pig supply side is mainly affected by diseases[10], piglet prices[11], feed prices[12],etc.From the perspective of pig breeding enterprises, the pig industry in China is moving towards large-scale, intensification and modernization[13]. The fluctuation of live pig prices will have a certain feedback on the daily operation of enterprises, and further have an increasing impact on the amount of livestock on hand and for slaughter and production income of live pigs[14]. Therefore, it can restrain the excessive expansion of enterprises and promote the common development of breeding individuals by guiding dispersed farmers to set up professional cooperatives and share resources and risks at this stage[15].

To sum up, the analysis and study of the impact of pig price fluctuations on various financial capabilities of pig breeding enterprises is conducive to helping the government guide the moderate concentration of industries, prevent the monopoly behavior of pig leading enterprises on pig prices, and protect the overall profit of all enterprises on the supply side. Furthermore, it will guide pig enterprises to grasp the overall law of "pig cycle" from the micro perspective, timely control the amount of livestock on hand and for slaughter, and reduce the impact of "pig cycle" on the operation of pig enterprises. There have been some studies on the cyclical changes of pig price fluctuation in domestic literature, but studies on its actual correlation with the operation capacity of breeding and production enterprises and the impact on the orderly operation of enterprises are still insufficient. By analyzing the causes of pig price fluctuation and its impact on the financial indicators of top listed enterprises, as well as the reasons for the differences between enterprises, this paper aims to promote enterprises to enhance social responsibility, strengthen the overall situation awareness, and establish a long-term concept. Furthermore, it has an important theoretical significance and practical value for realizing the ultimate goal of ensuring supply and stabilizing price by making better use of the linking role of industry associations and the restrictive role of market regulatory policies, guiding enterprises to actively maintain the stability of market supply, maintaining the smooth operation of market trading transactions, and advocating multi-party coordination.

2 Cause analysis of sharp fluctuation of live pig prices

In the absence of external factors, the market price of live pigs runs relatively stable, and price fluctuations often occur when there is an external shock, especially animal disease. After the outbreak of swine plague and swine erysipelas in 2009, foot-and-mouth disease in 2011 and 2012, African swine fever broke out in large scale in 2018, all of which are closely related to the soaring price of live pigs. From the market performance of pork prices, the growth rate of pork prices was as high as 171.58% from August 2018 to August 2020, and the continuous high operation of pork prices caused unprecedented price risks in the pork market, which seriously affected the quality of people’s livelihood and industrial safety. Behind the sharp rise and fall of pork prices is mainly the sharp rise and fall of pig prices, so how did the rise and fall in the price of live pigs come about?

The main reason for the fluctuation of live pig prices is the imbalance between supply and demand in the live pig market. When the pig market is affected by the epidemic, the decrease in the supply of pigs causes the imbalance between supply and demand in the pig market, and the price of live pigs gradually rises with varying impact degrees of the epidemic. When the price of live pigs rises to a certain extent, pig farmers who are sensitive to the market will recognize in advance that the price will continue to rise in the future, reduce the amount of slaughtering live pigs or temporarily do not slaughter, and wait for price stability before selling, in order to obtain higher profits. Other farmers will follow pioneer farmers, and make the decision of less or no slaughtering temporarily. The existence of learning effects leads to the communal behavior of delaying or no slaughtering, which further aggravates or even worsens the phenomenon of low supply of live pigs in the market. Pork is a commodity with less elasticity in price demand, and its demand will not increase with the decrease of prices, so prices will further accelerate their rise in the short term, forming a situation of soaring market prices of live pigs.

According to the price fluctuation law of "pig cycle", there will inevitably be a sharp decline after a sharp rise, and the soaring price of live pigs has brought huge profits to farmers in the short term. The nature of capital is to obtain a high return on investment, and the risk seekers will still choose to enter the pig industry even if there is a risk. Incumbent enterprises will choose to expand the scale of breeding, increase the amount of livestock on hand, in order to obtain more returns. After the release of new production capacity, the market appears oversupply situation, resulting in gradually declining price of live pigs, and the breeding industry will enter the situation of meager profit when the price has fallen to a certain extent. At this time, pig farmers of market sensitivity judge that prices will continue to fall, and they are eager to sell pigs to avoid large losses when the price is too low, in order to ensure the maximum interest. Other farmers have followed suit and sold in advance, and the communal behavior of pig farmers has exacerbated the oversupply of pigs in the market. Similarly, because the elasticity of pork price demand is small, the demand will not increase with the decline of prices, thus the price will decline sharply in the short term, resulting in a situation of price collapse in the market.

3 Analysis of the impact of live pig price fluctuations on the financial ability of enterprises

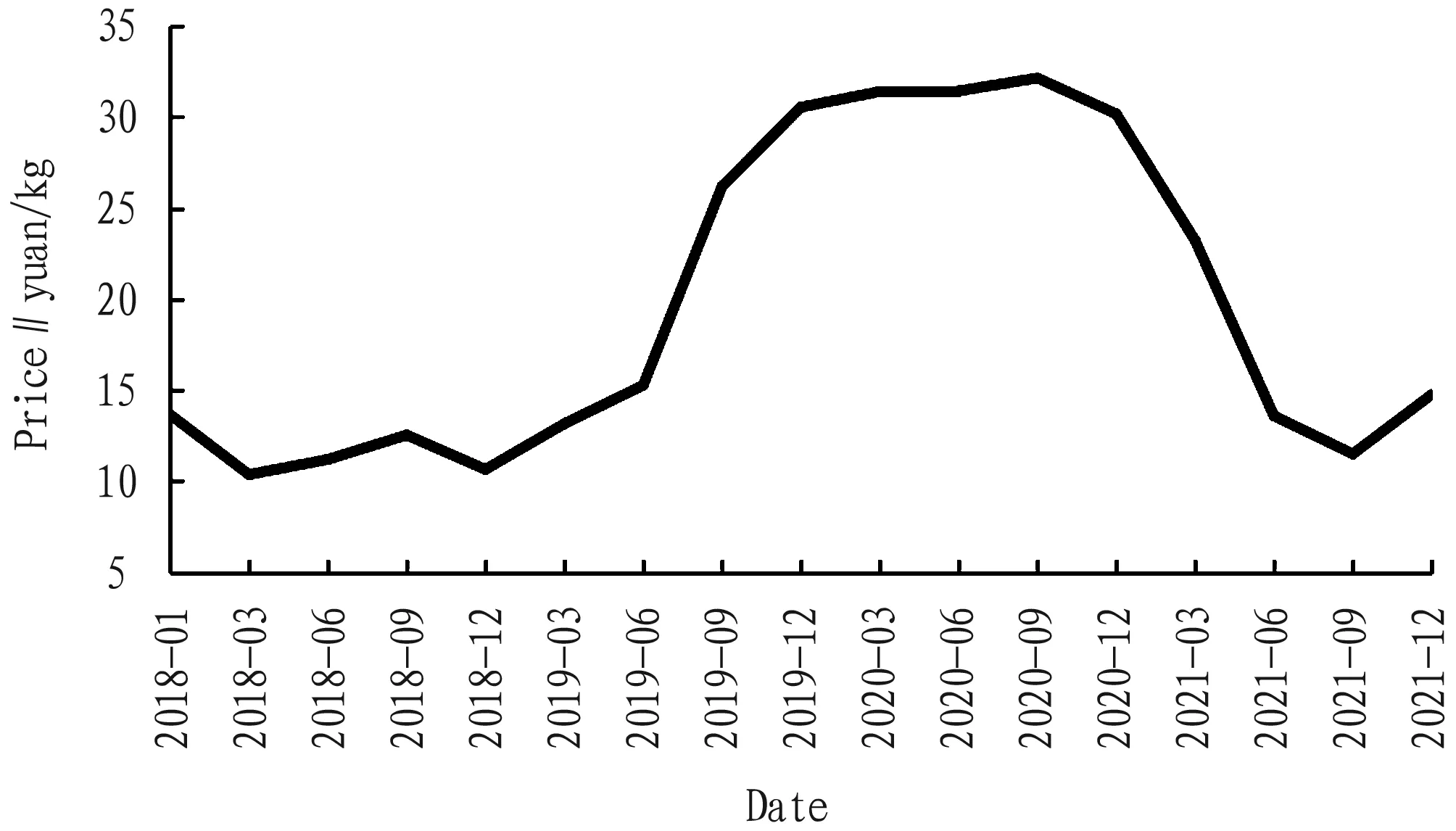

From the above analysis of the causes, it can be seen that the price of live pigs will rise and fall sharply under the impact of uncertain factors, and then cause the sharp rise and fall of pork prices. The trend of pork prices was plotted based on the pork prices from 2018 to 2021 (Fig.1). On the whole, the pork prices fluctuated wildly. It fluctuated around 13 yuan/kg from January 2018 to March 2019, started to rise suddenly and sharply in June 2019 when the price of pork was 15.26 yuan/kg, and reached a peak of 32.12 yuan/kg in September 2020. At the end of 2019 and throughout 2020, the pork price was above 30 yuan/kg, and in December 2020, the pork price began to plummet again, falling from 30.15 yuan/kg to about 13 yuan/kg. From the data of 4 years, a complete pig cycle had been formed.

Fig.1 Trend of pork prices from 2018 to 2021

From the profit sensitivity of related factors in the cost-volume-profit analysis of management accounting, it can be seen that price is the most sensitive to profit. Therefore, pork prices will have a greater impact on the profits of enterprises in both links of pig breeding or meat processing. Taking the leading enterprises in the pig breeding industry as an example, this paper analyzed the effect of price fluctuations on the profitability, development ability, operation ability and solvency of the leading enterprises, in order to fully understand the impact of sharp price fluctuation on pig breeding enterprises.

3.1 Impact of price fluctuations on profitabilityAnalysis of profitability is an important part of financial ability analysis of enterprises, and it is also an important basis for evaluating the management level of enterprises. The higher the gross profit margin, the stronger the profitability of the enterprise. Net profit margin on sales refers to the proportion of net profit of enterprises in the operating revenue, which can evaluate the ability of enterprises to earn profits from sales. The higher the return on assets, the better the asset utilization effect of the enterprise, the more profits created by the use of limited assets, and the stronger the profitability.

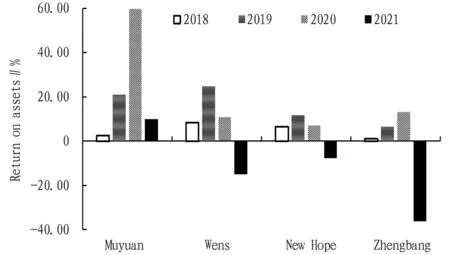

Figs.2-4 showed the relevant data of the profitability of 4 listed enterprises from 2018 to 2021. Combined with Fig.1, it can be seen that with the continuous rise of pork prices, the earnings rate of the enterprises also kept increasing. The end of 2019 and 2020 were the periods with the highest pork prices, and the profit margins of the 4 enterprises in 2019 and 2020 were also the highest in 4 years. From the perspective of gross profit margin and net profit margin on sales, the profitability of the 4 enterprises showed a trend of first rising and then declining. The higher the pork price, the higher the earnings rate of enterprises. Since pork prices began to plummet in December 2020, the profitability of the 4 enterprises dropped dramatically. The gross profit margins of Wens Foodstuff and Zhengbang Science and Technology in 2021 even reached -8.32% and -25.18%, and Muyuan and New Hope could still make profits. The net profit margins on sales of Wens Foodstuff and Zhengbang Science and Technology in 2021 were -20.86% and -40.10%, showing serious losses. Although the net profit margin on sales of New Hope was also negative, the situation was better than the previous two.

Fig.2 Comparison of net profit margin on sales of pig breeding enterprises from 2018 to 2021

Fig.3 Comparison of gross profit margin of pig breeding enterprises from 2018 to 2021

Fig.4 Comparison of return on assets of pig breeding enterprises from 2018 to 2021

From the perspective of return on assets, the 4 enterprises also showed a trend of first rising and then decreasing, and the return on assets of the 4 enterprises was also the highest in 4 years when the pork price was the highest. In September 2020, pork prices began to plummet, and the net interest rates on assets of Wens Foodstuff, New Hope, and Zhengbang Science and Technology in 2021 dropped to -15.28%, -7.85%, and -36.12%, indicating that the asset utilization effect of enterprises first increased and then decreased. In short, the price of live pigs plays an important role in the profits of enterprises, and the profits in the period of high prices are much higher than that in the period of low prices. Meantime, the high price period is easy to promote the high growth of enterprise assets, which increases the business risk of enterprises.

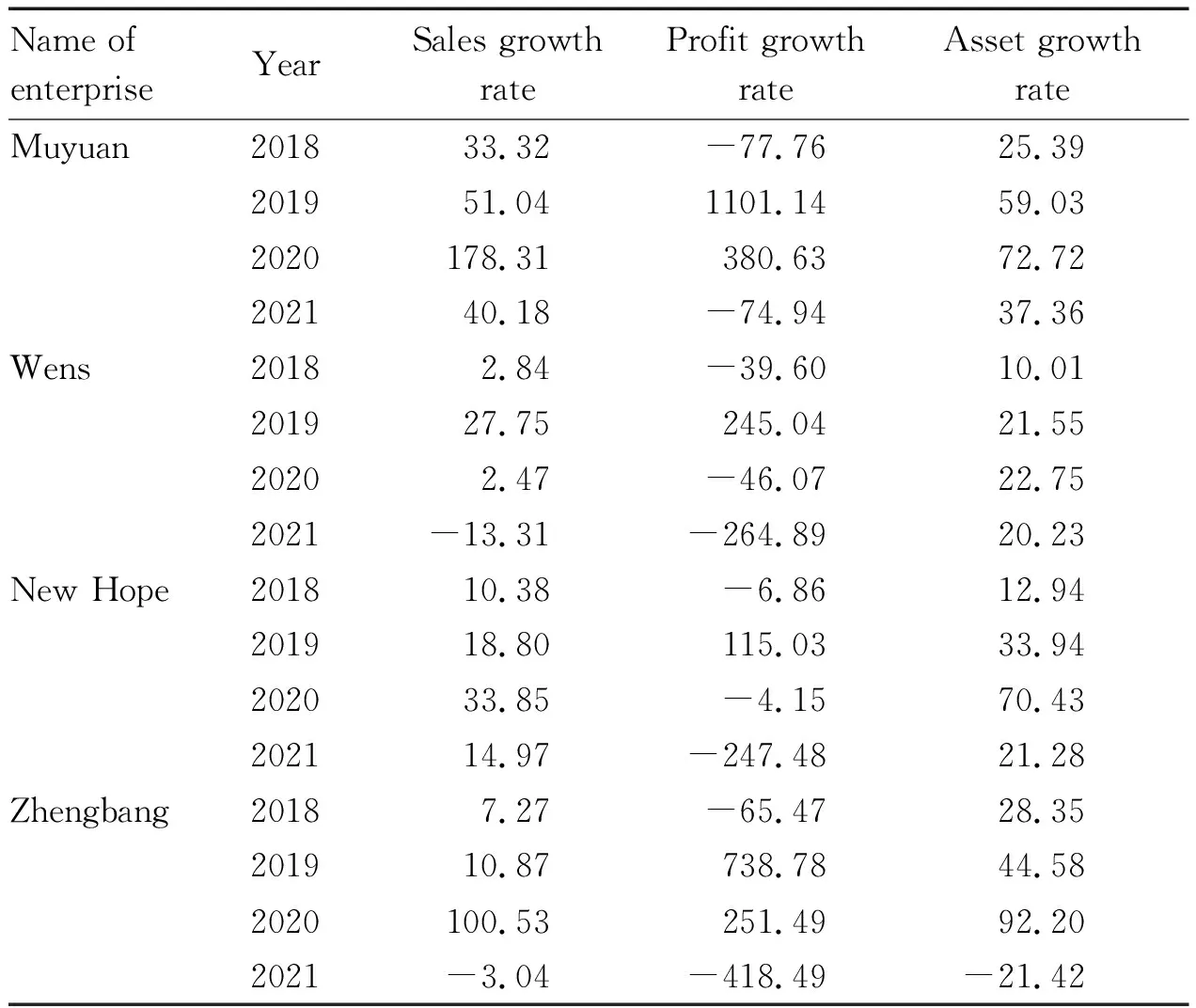

3.2 Impact of price fluctuations on development abilityDevelopment ability refers to the growth ability shown by enterprises in the process of engaging in business activities. As shown in Table 1, the sales volume of the 4 listed enterprises had experienced a process from slow growth to gradual decline, while Wens Foodstuff and Zhengbang Science and Technology in 2021 showed negative growth, with sales growth rates of -13.31% and -3.04%, respectively. In terms of profit growth, the sales growth rates of Muyuan Food were -77.76%, 1101.14%, 380.63% and -74.94% from 2018 to 2021, and the profit fluctuated greatly in the 4 years. The profits of the other three enterprises also fluctuated to different degrees, with negative profit growth rate in 2021, indicating that enterprises had unstable growth and average development ability. From the perspective of asset growth, the assets of the 4 enterprises showed a growth trend first, and reached the fastest growth in 2020. In 2021, the asset growth gradually slowed down, and the assets of Zhengbang Science and Technology even decreased, showing weak enterprise competitiveness. Overall, the development capacity of the 4 enterprises showed a trend of first strengthening and then weakening, and reached the weakest period of development ability in 2021.

Table 1 Comparison of development capacity of pig breeding enterprises from 2018 to 2021 %

3.3 Impact of price fluctuations on operation capacityThe turnover and cashability ability of accounts receivable can directly reflect the speed of the enterprise’s account collection. The stronger the enterprise’s asset operation capacity is, the higher the asset management level is. The higher the current assets turnover ratio of the enterprise, the more efficient the working capital, the stronger the profitability of the enterprise, and the better the use of funds. The higher the turnover ratio of fixed assets, the higher the utilization efficiency of fixed assets, the more reasonable the structure layout, and the stronger the ability to use fixed assets. On the contrary, it means that enterprises invest too much in fixed assets, but assets and equipment are not fully utilized.

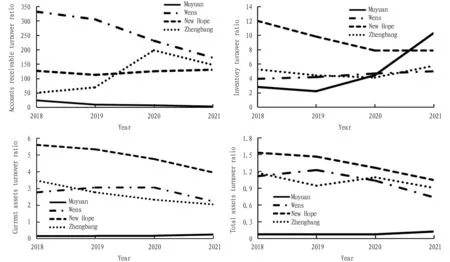

Fig.5 shows the data related to the operating capacity of the 4 listed enterprises from 2018 to 2021. From the perspective of the turnover of accounts receivable, the accounts receivable turnover ratio of Muyuan Food decreased year by year, and the collection time gradually became longer, indicating that the enterprise had poor operation capacity and low management level. The remaining three enterprises had better operation capacity, with higher realization speed and management efficiency of accounts receivable. From the perspective of inventory turnover, the turnover speed of Muyuan Food and Zhengbang Science and Technology first slowed down and then accelerated, indicating that their inventory management was constantly improving and optimizing. In the 4 years, the inventory turnover speed of Wens Group had been accelerating, while that of New Hope gradually slowed down. From the perspective of asset turnover, the asset turnover speed of Muyuan Food was constantly getting faster, and that of Wens Food first accelerated and then slowed down, while that of New Hope and Zhengbang Science and Technology gradually slowed down.

Fig.5 Comparison of operation capacity of pig breeding enterprises from 2018 to 2021

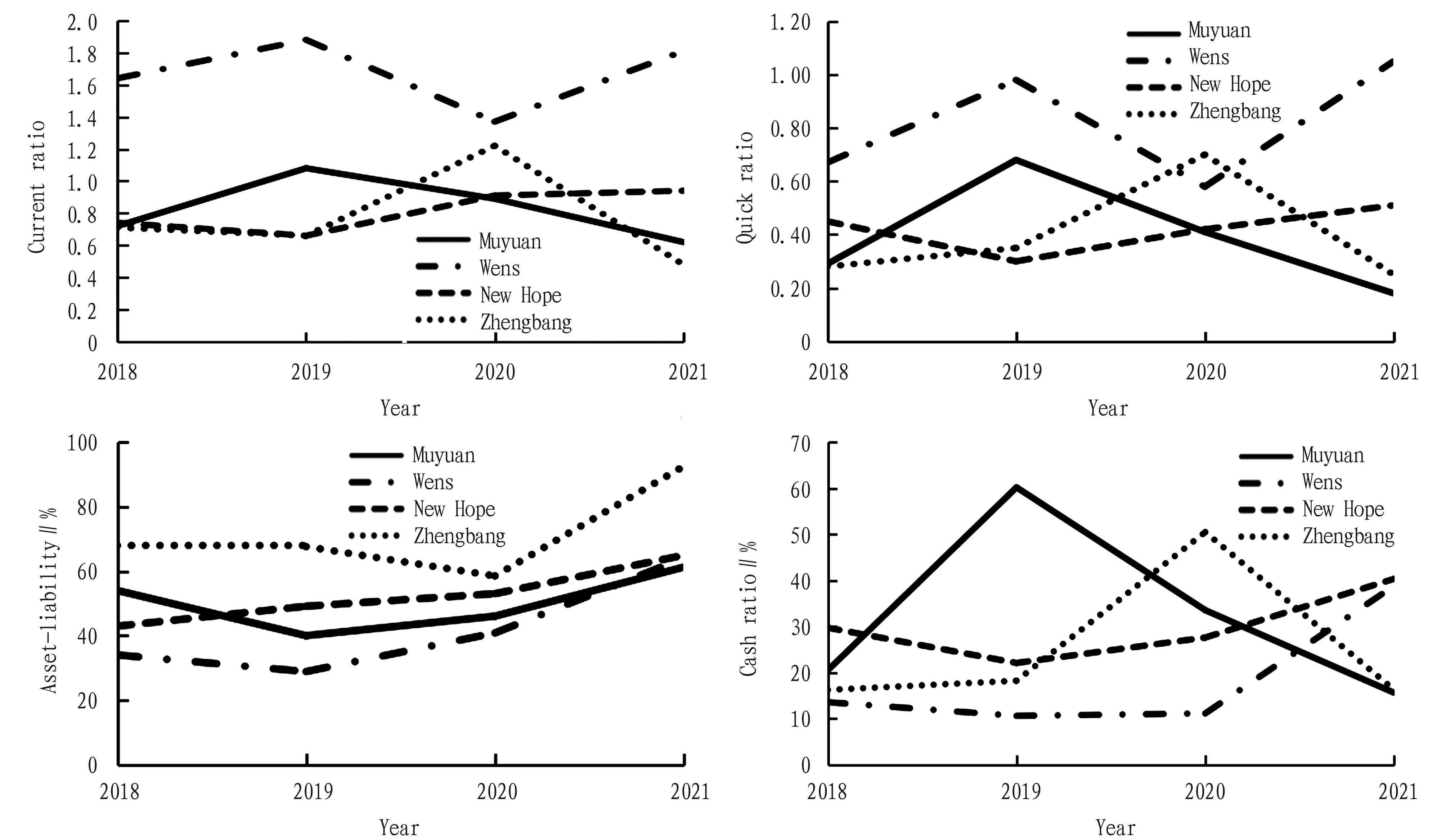

3.4 Impact of price fluctuations on solvencyThe solvency of an enterprise is a measure of the ability of the enterprise to repay its debts as they mature. The current ratio reflects the ability of an enterprise’s current assets to repay its current liabilities. When the value is about 2, it indicates that the current assets are about twice the current liabilities and the solvency is good. Quick ratio refers to the ability of an enterprise to realize its current assets. It is better when the value is about 1, which means that for every 1 yuan of current liabilities, there is 1 yuan of current assets that can be immediately realized for debt repayment. The asset-liability ratio indicates the proportion of liabilities in total assets of enterprises, and about 50% indicates that enterprises can effectively weigh the ratio of liabilities and assets while using financial leverage to carry out operation with borrowed capital.

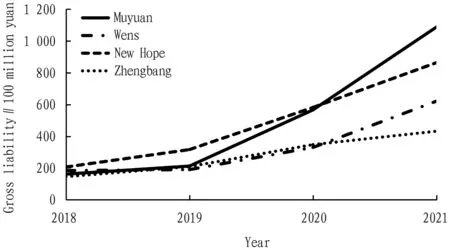

Fig.6 shows the data related to the solvency of the 4 listed enterprises from 2018 to 2021. The fluctuation of live pig prices reduced the solvency of the 4 enterprises. First, the long-term solvency was observed. Since 2019, the asset-liability ratio of the 4 enterprises all begun to rise. In 2021, the asset-liability ratios of Muyuan, Wens and New Hope reached more than 60%, close to the international warning line of 70%. The asset-liability ratio of Zhengbang had always been the highest among the 4 enterprises in the 4 years, and although the index slightly declined during the period, it still maintained a high proportion, and even rose to 92.06% in 2021, which was at risk of insolvency and near bankruptcy. Although the liability ratio of New Hope increased year by year, from 42.98% in 2018 to 64.98% in 2021, it had small fluctuation and was close to the ideal value, indicating that the enterprise had good management ability, good profitability and cash flow status, and guaranteed solvency. The liability ratio of both Muyuan and Wens showed a trend of decreasing first and then increasing, and the liability ratio of Muyuan always fluctuated near the ideal value, while that of Wens was relatively low in the early stage. In the case of no debt repayment crisis, enterprises should expand production scale through appropriate debt operation, open up a larger market and obtain higher profits. In 2021, the liability ratio reached 64.10%, indicating that the enterprise changed its management strategy and operated with financial leverage. Combined with Fig.7, it can be seen that the expansion of production scale through financing during the period of rising pork prices and the sharp decline in profits during the period of falling pork prices promoted the increase of liabilities of the 4 enterprises to a certain extent, resulting in greater financial pressure and poor solvency of the enterprises.

Fig.6 Comparison of solvency of pig breeding enterprises from 2018 to 2021

Fig.7 Comparison of gross liabilities of pig breeding enterprises from 2018 to 2021

Second, the current liabilities were investigated. The current ratios of Wens Group in the 4 years were 1.64, 1.88, 1.37 and 1.81, respectively, which were the closest to the ideal value of current ratio. The other three enterprises had low current ratios, indicating that the enterprises had poor ability to repay current liabilities. From the point of view of quick ratio, the quick ratios of the 4 enterprises were lower than the ideal value, and that of Wens Group remained the closest to the ideal value. The cash ratio index, which can best reflect the strength of an enterprise’s short-term solvency, was further surveyed. At the end of 2020, when pig prices began to plummet, the cash ratios of Wens and New Hope began to increase, indicating that the short-term solvency of the enterprises was enhanced, whereas the cash ratios of Muyuan and Zhengbang decreased accordingly, and the enterprises were short of cash and faced a crisis that its debts could not be repaid. In short, the decline in solvency means an increase in financial risk and a decrease in liquidity, which is likely to cause a series of problems such as the rise in financing costs.

Through the analysis of the 4 enterprises, it can be seen that the fluctuations of live pig prices to different degrees will affect the profits and liabilities of enterprises, and further affect the financial capabilities of enterprises. In the rapid increase period of live pig prices, the profits of the 4 enterprises increased significantly, and the assets of the corresponding period also increased. In December 2020, the price of live pigs began to fall, the 4 enterprises showed a cliff-like decline in profits, and even negative profit growth. However, due to the differences in business models among enterprises, there are also differences in financial capacity in the same business period and business environment. The integrated farming model implemented by Muyuan and New Hope has more advantages in disease prevention and control. Compared with the farming model of "company+farmer", their industrial chain is longer, with more profitable links, and they are more flexible in coping with the price fluctuations of live pigs. At the same time, it can implement the management of the whole industrial chain, promote green production methods, and obtain additional profits while ensuring the quality of pigs and the safety and quality of products. The profitability and anti-risk ability of Muyuan and New Hope are significantly stronger than those of Wens and Zhengbang who carry out the "company+farmer" model, thus integrated farming model is a breeding model that pig breeding enterprises should learn and promote.

4 Conclusions and policy suggestions

4.1 ConclusionsThe study found that live pig prices are sensitive to changes in enterprise profits. In the high price period of live pigs, the profits of enterprises also show a substantial increase, which is much higher than that in the low price period of live pigs. Some enterprises blindly expand when the price is high; when prices start to go down, the large-scale investment leads to increased financial risk, resulting in a risk of near-bankruptcy. Meantime, the rise in the price of live pigs has also brought about the high growth of enterprise assets. For enterprises, the increase in assets is a good thing, which can enhance the credit capacity of enterprises, but it will also increase the business risk of enterprises. In the same environment, it is also affected by large fluctuations in the price of live pigs, and due to different business models adopted by enterprises, it will also have an impact on the business effect. Muyuan and New Hope adopted the "integrated" farming model, and they were still able to make profits and their sales volume increased slightly even when the price of pigs plummeted, However, the profits of Wens and Zhengbang had a cliff-like drop when the price suddenly dropped, and their sales volume also showed negative growth.

4.2 Policy suggestionsSince the sharp fluctuation of pig prices is closely related to the communal behavior of pig farmers’ production decisions, and the sharp rise and fall of prices not only affect the short-term profits and long-term investment of enterprises, but also lead to sharp fluctuations in long-term profits, the rise and fall of company value and even increased business risks. Based on the above research conclusions, this paper puts forward the following suggestions.

4.2.1Enterprise level. Pig breeding enterprises should avoid convergence behavior, avoid exacerbating the shortage or excess supply of pigs in the market and promoting sharp price fluctuations. Head breeding enterprises should actively assume social responsibilities, take a long-term view, and establish an overall concept. When there is a phenomenon of short supply in the market, they should actively play a demonstration role by ensuring the normal supply of pork and stabilizing the price of live pigs. When the market supply exceeds demand, the inventory structure should be adjusted promptly to stabilize the market supply, and enterprises should not take the lead in selling live pigs, which will trigger panic sales and plunging prices. At the same time, large-scale breeding enterprises should not use their own advantages to seize market resources too much, invest too much to expand the scale of enterprise operation, enhance monopoly power, and force small-scale breeding farmers to withdraw from the market, but should share and promote the excellent experience of pig breeding, strengthen support for small and medium-sized free-range farmers, and give play to the unique advantages of large enterprises and small farmers, thus forming a reasonable industrial chain division of labor, and jointly promoting the sustainable development of the pig industry.

4.2.2Industry level. Industry associations should play a good role as a link between enterprises, and guide enterprises to develop in an orderly manner and refrain from blind expansion or excessive investment by releasing industry information promptly and accurately, and evaluating market trends objectively and impartially. In the critical periods, industry associations should guide enterprises to stabilize prices, and do not engage in market speculation. Industry associations should serve as a bridge between the government and enterprises, being a good adviser for policy formulation and industry development planning. They must make policies more precise, scientific and effective, take multiple measures simultaneously to maintain industrial safety and stabilize industrial development, and do a good job in preventing short-term regulation and long-term development of price fluctuations.

4.2.3Government level. The government should do a good job in policy support, regulation improvement and industrial planning, and provide different types of guidance and differentiated support according to the situation of enterprises; pay more attention to and help small-scale farmers, and increase subsidies and the promotion of pig insurance to help them resist risks; focus on supporting large-scale enterprises to enhance the ability of scientific and technological innovation, and promote the improvement of total factor productivity of large-scale enterprises; improve the ability of enterprises to prevent and control pig diseases, guide the stable development and orderly expansion of enterprises, and implement vertical integrated development. Moreover, the government should improve the relevant laws and regulations system, crack down on behaviors that disrupt market order, and resolutely maintain the stable development of the live pig market. Modern scientific and technological means can be used to constantly improve the pig price monitoring mechanism, and data collection of the pig industry across the country should be well done to achieve real-time monitoring of people’s supply and demand for pigs, striving to control the future price trend. When a crisis comes, corresponding coping strategies should be adopted promptly to reduce the impact on society.

杂志排行

Asian Agricultural Research的其它文章

- Construction of the "Three-integration" Rolling Development Mode in the Urban-rural Fringe from the Perspective of Thematic Business Engine: A Case Study of "Zhucheng Dinosaur Eco-city" in Shandong Province

- Relationship between Rural Industry Revitalization and Land Resource Utilization and Its Practice in Ganning Town, Wanzhou District of Chongqing

- Pollination Effects of Pear Trees by Honeybee and Its Influencing Factors

- Intellectual Property Protection and High-Quality Development of Xinjiang Melons under the Big Food Concept

- Age Structure and Change Trend of Tobacco Farmers: A Case Study of Shashi Town, Liuyang City, Hunan Province

- Influence of Family Financial Conditions on the Choice of Family Parenting Style: An Empirical Study Based on CEPS Data