Comparative Analysis of Rice Export Competitiveness in Heilongjiang Province of China Based on Index Method

2023-07-31MinLUYafeiGUO

Min LU, Yafei GUO

1. Buchang Xixian Economic Research Institute, Xi’an 712046, China; 2. Shaanxi Institute of International Trade &Commerce, Xi’an 712046, China; 3. Universiti Teknologi Mara, Negeri Selangor 40450, Malaysia; 4. Shaanxi Provincial Environmental Monitoring Center, Xi’an 710054, China

Abstract Based on the analysis of rice planting and export development in Heilongjiang Province in 2013-2021, this paper comprehensively used three export competitiveness analysis methods, namely, trade competitiveness index, revealed comparative advantage (RCA) analysis and international market share analysis, to compare the four major rice exporters in the world and the three major rice export provinces and cities in China. Besides, it evaluated the rice export competitiveness of Heilongjiang Province from multiple perspectives. It analyzed the reasons for low competitiveness in terms of export product structure, export market structure, production and processing technology, and brand building. Finally, it is recommended to clarify the positioning of rice export quality and take more measures to ensure product quality; improve the level of industrialization of rice production and processing, and extend the rice industry chain; develop diversified rice export markets and improve export flexibility; adhere to the principle of "opening the door and going out", expand the international popularity of high-quality brands, so as to enhance the rice export competitiveness of Heilongjiang Province.

Key words Rice, Export competitiveness, Trade competitiveness index, Revealed comparative advantage (RCA) analysis, International market share analysis

1 Introduction

Food security is an eternal issue directly concerning human survival and development. In recent years, conflicts, climate change and economic crises have brought unprecedented pressure on global food security[1], and large populous countries must have control over their own food supply. Rice, as one of the most important food crops, feeds nearly one third of the world population. The stable supply of rice has a far-reaching impact on the world food security system. Due to the spatial imbalance of rice production and consumption in the world, rice trade has become the main way for countries to adjust and supplement the balance between supply and demand[2]. At present, the rice trade in the international market can be divided into three categories according to the quality, from high to low, namely, japonica rice, high quality indica rice and medium and low quality indica rice. The rice export volume of Heilongjiang Province only ranks the top 4 in China, but it is the largest continuous production area of commercial japonica rice in the world, and its japonica rice production has the absolute advantages of high commercialization rate and low cost[3]. Taking Heilongjiang Province as the research object, we comprehensively used three export competitiveness analysis methods, namely, trade competitiveness index, revealed comparative advantage (RCA) analysis and international market share analysis to compare the four major rice exporters in the world and the three major rice export provinces and cities in China. We obtained main factors for weak rice export competitiveness of Heilongjiang Province, and came up with recommendations, which are of great practical significance to ensure national food security.

Regarding the research on rice export trade, scholars at home and abroad have made extensive studies, which can be summarized into two aspects: quantification of export competitiveness and food security, pattern and impact. (i) The study on measurement of rice export competitiveness: There are two main methods to measure export competitiveness: index method and model method. The RCA proposed by Balassa[4]has a far-reaching impact on the theory of intra-industry trade. Li Ying selected trade competitiveness index[5], and Lang Yuqi adopted trade competitiveness index, RCA and international market share to measure rice export competitiveness[3]; Ma Huilian, LI, and Juháse used a constant market share (CMS) model, Yang Yueyuan and Huang Zhiming used a modified CMS model, and Xiao Li and Zhou Yongji used gray correlation analysis to analyze the export competitiveness of agricultural products[6-10]. (ii) The study on food security, pattern and impact issues. Shao Zhongzhongetal.[11]believed that India has enhanced its geographic influence through rice export trade; Lu Mengkeetal.[12]found that the safety of rice export structure is the highest in China’s grain import and export. Zhou Mozhuetal.[2]found that China, along with India, Thailand, the United States, Vietnam, and Pakistan, are the core nodes of the global rice trade network, and recommended that China should increase the complexity of the rice trade network to ensure safety.

From the above analysis, we can see that the existing research mainly focuses on the measurement of the competitiveness of rice export trade and the analysis of food security. However, there are few papers that study rice export competitiveness from the perspective of food security, and use the export competitiveness index to calculate and compare and analyze from the international and domestic vertical and horizontal perspectives. In view of this, based on the qualitative analysis of the current situation of rice cultivation and export in Heilongjiang Province, we used the IMS, TC, and RCA indexes to evaluate the position of Heilongjiang Province’s rice exports in the international market, analyze the factors restricting export competitiveness, and came up with pertinent recommendations for improvement from the theoretical aspect.

2 Current development status of rice exports in Heilongjiang Province

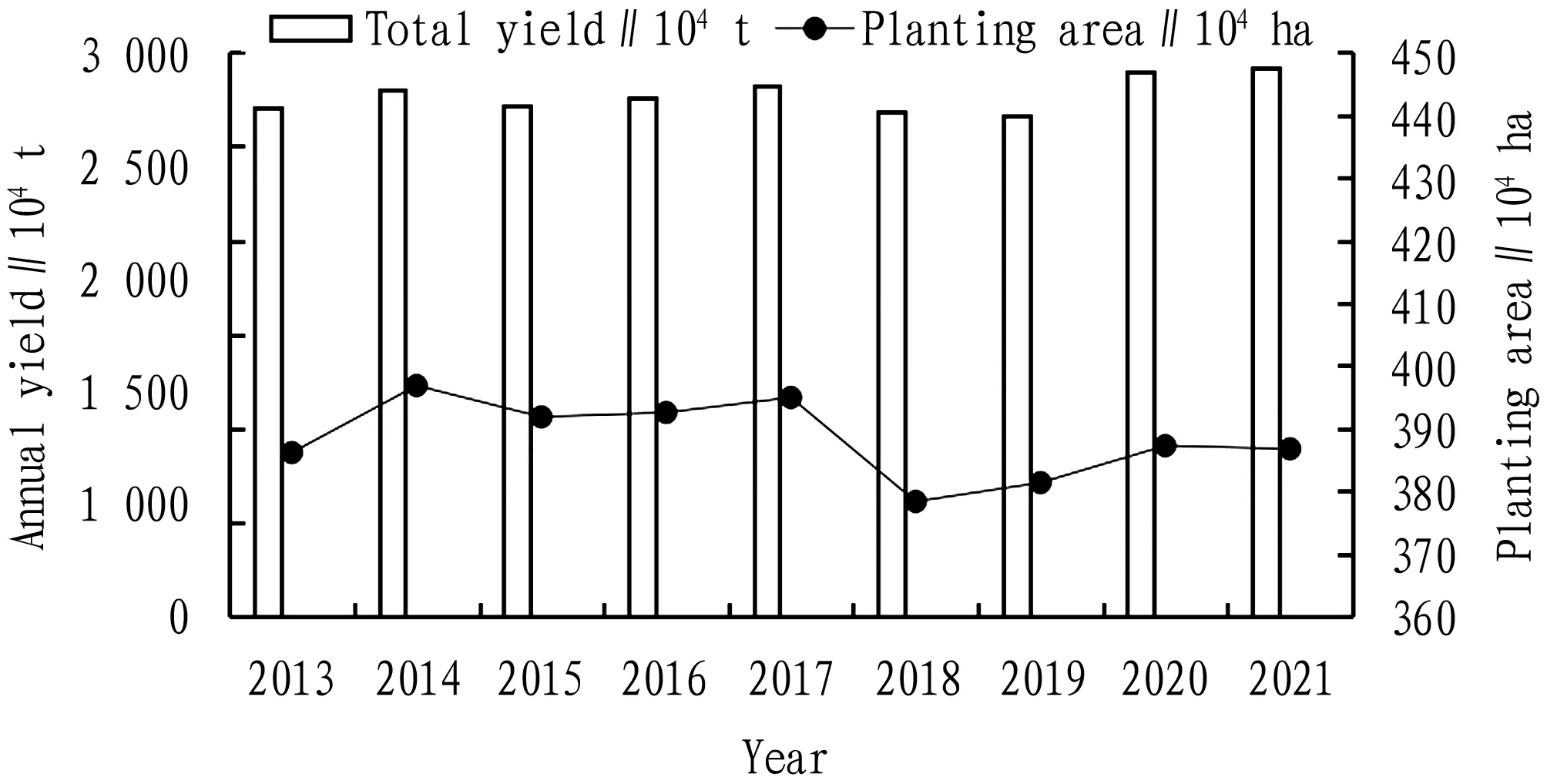

2.1StableplantingareaandyieldandsignificantimprovementinqualityHeilongjiang Province has the most suitable black soil for rice cultivation, the best irrigation water source and sufficient sunshine. Besides, it has a long temperature accumulation time and a large temperature difference between day and night. It is one of the main producers of high-quality japonica rice in China. The breeding of new rice varieties and the rapidly growing market demand for high-quality rice have formed a synergy between supply and demand to promote the steady increase in rice planting area and yield in Heilongjiang Province, and it has also laid a good foundation for the export of high-quality rice. In 2013-2021, the rice planting area in Heilongjiang Province was in the range of 3.78 million to 3.96 million ha, and the annual yield was 26.635 million to 29.137 million t, both of which showed a stable increase trend (Fig.1). While the production has steadily increased, Heilongjiang Province also paid attention to the improvement of quality. In 2020, "Jinhe" rice products from Qiqihar City, Heilongjiang Province participated in the Monde Selection on behalf of Chinese rice and won the Global Gold Medal honor. Before Jinhe, no rice brand in the world had won this award, including the industry-famous Japanese rice and Thai rice[8].

Data source: Statistical Yearbook of Heilongjiang Province.Fig.1 Trends in rice cultivation and production in Heilongjiang Province in 2013-2021

2.2Mainlymeetingdomesticdemand,withlowexportproportionAlthough the rice yield of Heilongjiang Province is high, it is still mainly to meet domestic demand. In terms of the proportion of exports, it fell continuously from 0.17% in 2013 to 0.04% in 2016, and then steadily recovered, rising slightly, until 2021 it increased to 50% of the year 2013. These indicate that the export proportion of rice in Heilongjiang Province has not yet recovered, and the core sales area is still the domestic market (Fig.2).

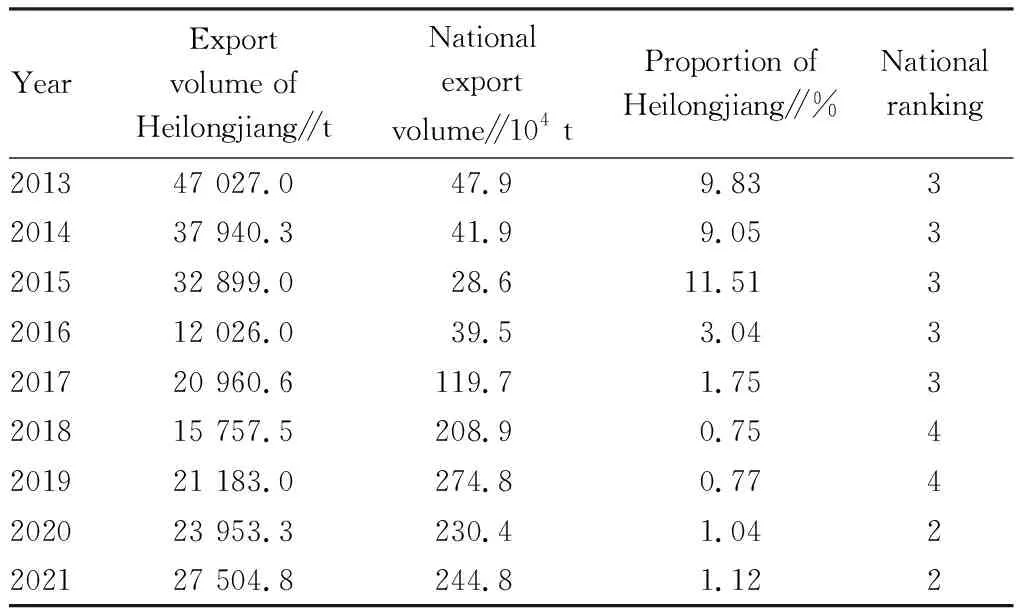

2.3Exportvolumeproportioninthewholecountrychangingfromdeclinetorise,andpositionofriceexportprovincebecomingstableDue to the impact of green trade barriers and technical trade barriers, Heilongjiang Province’s rice exports declined continuously from 2013 to 2016[9](Table 1). The significant increase in exports in 2017 was possibly due to the opening up of new rice exporters and the introduction of the minimum purchase price policy for rice that year. In 2018-2021, the export volume dropped again and then recovered rapidly, and the national share also increased.

Table 1 Rice export volume and national share and ranking of Heilongjiang Province in 2013-2021

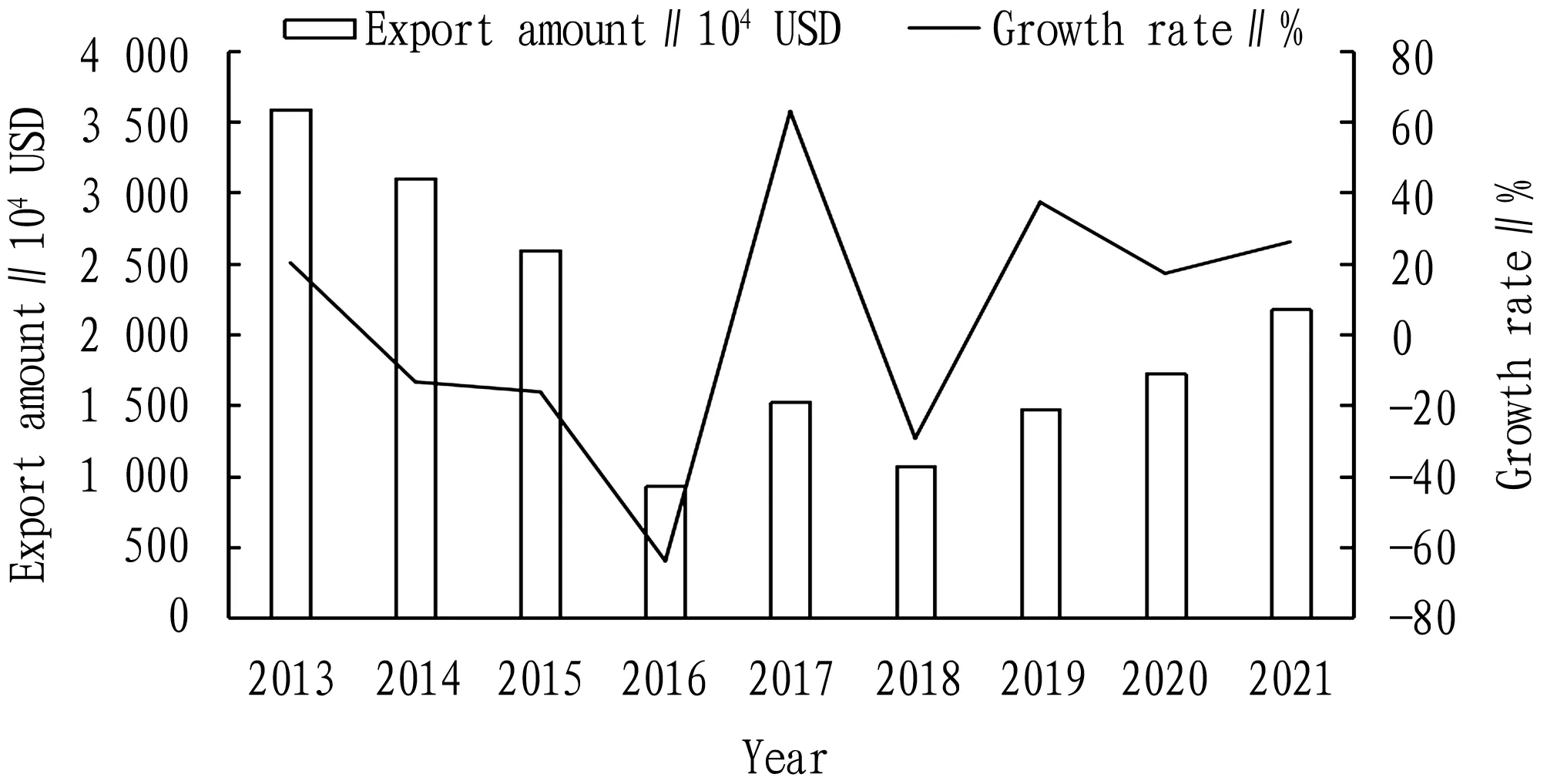

2.4OverallgrowthtrendofHeilongjiangProvince’sriceexportamountAs shown in Fig.3, since 2014, due to the sluggish domestic and international economic situation, Heilongjiang Province’s rice export amount has declined, and the decline has gradually increased, bottoming out in 2016, with a decline of as much as 64%. In 2017, with the moderate recovery of the world economy and the steady improvement of the domestic economy, Heilongjiang Province’s foreign trade imports and exports increased strongly[10]. In addition to the state attaching great importance to agricultural exports, the rice export amount bottomed out, reversing three consecutive years of decline, increasing to 15.213 million USD, an increase of 62.8% year-on-year. Although it dropped again after that, it recovered quickly. Because the export amount base was too small, the export amount would still be less than 2/3 of 2013 until 2021.

Data source: Monthly Statistical Report on China’s Agricultural Exports.Fig.3 Rice export amount and growth trend of Heilongjiang Province in 2013-2021

2.5RiceexportmarketofHeilongjiangProvinceisbecomingmorediversifiedIn the early stages, the rice export targets of Heilongjiang Province were mainly concentrated in the underdeveloped African countries represented by Cted’ Ivoire. In recent years, benefited from the government’s encouragement of foreign trade, the rice exports of Heilongjiang Province have not only increased to Russia, but also expanded to Japan, South Korea and Mongolia, and the export market has become more diversified. On the whole, although the rice-exporting countries (regions) of Heilongjiang Province have increased, they are still too concentrated and lack telescopic flexibility[11].

3 Analysis of rice export competitiveness of Heilongjiang Province

In order to comprehensively and objectively analyze the rice export competitiveness of Heilongjiang Province, we selected Thailand, Vietnam, India and Pakistan, which have relatively developed rice industries and are at the core nodes of the global rice trade network, as the objects of international comparison, selected Beijing and the three northeast provinces, which have ranked first in China for rice exports for many years, as the domestic comparison objects, and selected three indicators: the international market share trade competitiveness index and the demonstrative comparative advantage index to analyze the level of rice export competitiveness in Heilongjiang Province in a multi-dimensional manner.

3.1Internationalmarketshare(IMS)analysisThe international trade market share is the international market share (IMS), also known as the export market share. It refers to the proportion of a country’s products in the world total exports. It is usually used to compare the competitive advantages of specific commodities between different countries and regions.

IMS=Xi/Xiw

(1)

whereXirepresents the total export amount of productiof the country (region),Xiwdenotes the total world (national) exports of producti. IMS can represent the overall export competitiveness of a country (region) and is the most direct and powerful embodiment of the export competitiveness of a country (region).

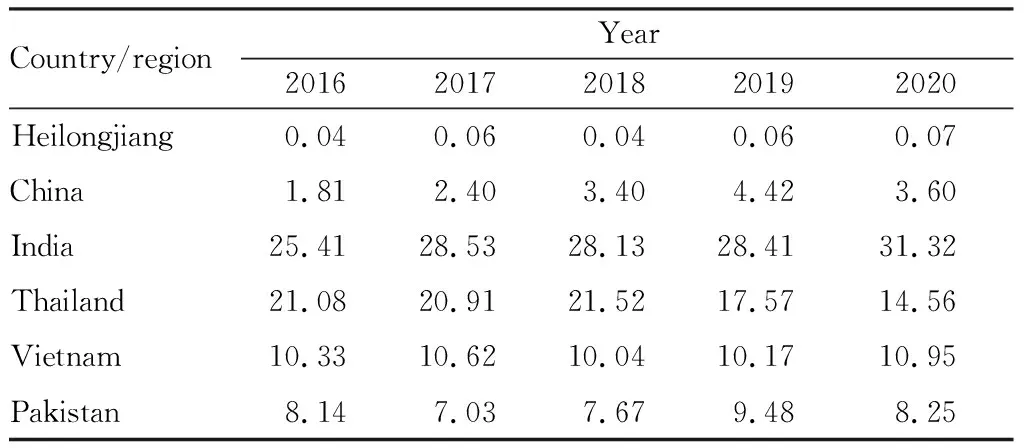

3.1.1International comparison. As shown in Table 2, the IMS shows that Heilongjiang Province and even China’s rice exports have a very limited IMS. The highest international market share of China’s rice exports was less than 4.5%, and China is a typical large rice producer rather than a large exporter. In horizontal comparison, India, which ranked second in the world in rice production, has surpassed Thailand in terms of export market share and has grown rapidly. Its share was close to 1/3 of the world, and its export competitiveness is the strongest, which is closely related to its natural advantages of growing rice and its strategy of mainly relying on agriculture in exchange for foreign exchange. Meanwhile, the IMS of Thailand’s rice exports has shown a significant downward trend, declining by about 1/3 in five years, while Vietnam and Pakistan, which ranked third and fourth, are relatively stable. These indicate that at this stage, China’s IMS of rice was not comparable to that of the four countries, and there is a lot of room for improvement.

Table 2 International comparison of the IMS of rice in Heilongjiang Province %

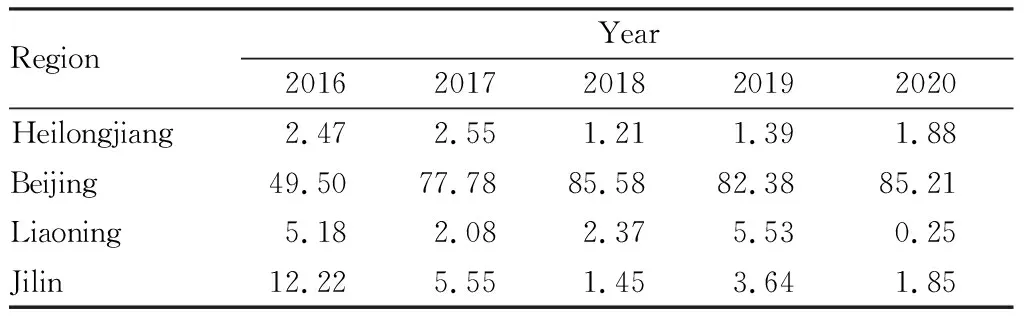

3.1.2Domestic comparison. We used the proportion of the rice export amount of the four domestic provinces (cities) in the national rice export amount to calculate its international market share. As shown in Table 3, in 2016-2020, compared with the same period in the three provinces (cities), Heilongjiang Province’s rice export market share ranked second, with a maximum of only 2.55% and its export competitiveness was not among the top among the three eastern provinces, let alone comparable to Beijing. For an individual region, the international market share of rice in Heilongjiang Province as a whole was on a downward trend, and the market share of rice exports in the three eastern provinces has declined significantly, while the market share of rice exports in Beijing has grown rapidly, reaching a maximum of 85.58%, indicating that compared with the main domestic rice-exporting provinces and cities, the international market share of Heilongjiang Province’s rice exports was not high, and the international market competitiveness was weak.

Table 3 Domestic comparison of the IMS of rice in Heilongjiang Province %

3.2Analysisoftradecompetitiveness(TC)indexIn fact, whether it is China or Heilongjiang Province, rice trade belongs to intra-industry trade, it has both exports and imports, so there are obvious accounting defects in IMS indicators. The trade competitiveness (TC) Index, also known as trade competitive advantage index and trade balance index. It is to assess the export competitiveness of a certain product in a country or region by accounting for the ratio of the net export of a certain product to the total import and export of a certain product in a certain country or region, and analyzing the mutual trade of a certain product in the international market.

TC= (Xij-Mij)/(Xij+Mij)

(2)

whereXijis the export of productjfrom country (region)i,Mijdenotes the import of productjof country (region)i, (Xij-Mij) is the net export of country (region)i, (Xij+Mij) is the total imports and exports of country (region)i. If TC is above or below -1, it means that the country’s export products have a weak competitive advantage; if it is close to 1, it shows that the product has a strong advantage in the international market competition and can be regarded as one of the main commodities exported by this country. TC takes 0 as the critical value, and the value is between (-1, 1). If TC is greater than 0, it means that the productjof country (region)iis a net export product, and if it is less than 0, it means that it is a net import product. If TC is close to 1, it means that the productjdoes not have an export competitive advantage at all; if it is close to 1, the product has a strong advantage in the international market competition and can be regarded as one of the main commodities exported by this country.

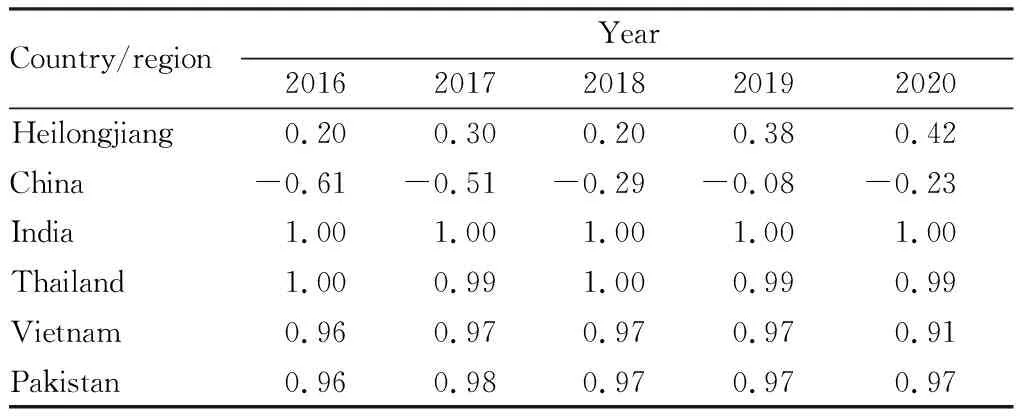

3.2.1International comparison. We used the difference between rice exports and imports from the five countries as a proportion of the total rice imports and exports to calculate. As shown in Table 4, in 2016-2020, China’s overall rice trade competitiveness lagged far behind that of India, Thailand, Vietnam and Pakistan. It has been negative for five consecutive years, and imports have exceeded exports. Although the competitiveness index was negative, it has risen slightly overall, indicating that the weakness of export competition has been alleviated. Different the national situation, Heilongjiang Province’s rice trade competitiveness index was positive and gradually increasing, indicating that Heilongjiang Province’s rice exports were greater than imports at this stage, and its trade competitiveness has improved significantly. Comparison indicates that although Heilongjiang Province’s rice export competitiveness cannot be compared with that of the four rice powerhouse countries, its natural rice planting advantages, the country’s No.1 production advantage, and the quality advantage of the world gold award is gradually being transformed into an export competitive advantage, which can be used as the main export product of the region.

Table 4 International comparison of Heilongjiang Province’s rice TC index

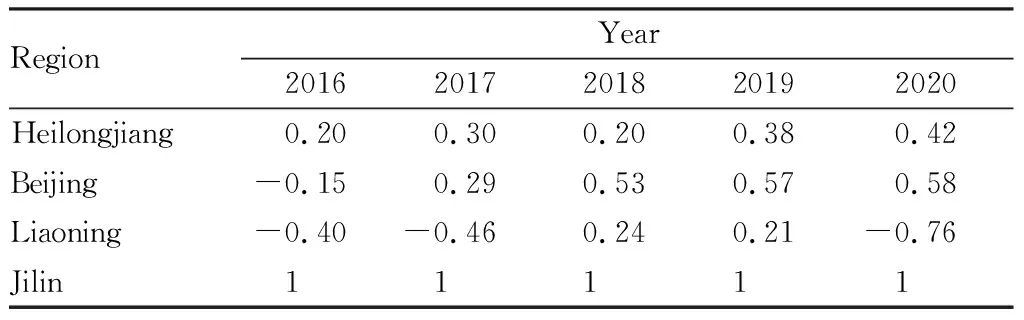

3.2.2Domestic comparison. We used the difference between rice exports and imports in the four provinces and cities to calculate the proportion of total rice imports and exports. As indicated in Table 5, Heilongjiang Province ranked third in the country in the rice TC and had a high export competitive advantage. In horizontal comparison, Jilin Province ranked first and had the strongest export competitiveness, so rice can be used as its absolute export advantage product. Beijing ranked second, and the rice TC showed slight upward trend, which was close to 0.6. Liaoning Province’s rice TC index had a large fluctuation range, with a TC index of -0.76 in 2020, which has a significant competitive disadvantage. Trade competitiveness reflects the status of rice exports, and Heilongjiang ranks in the middle reaches compared with the other three provinces (cities).

Table 5 Domestic comparison of Heilongjiang Province rice TC index

3.3RCAanalysisRCA, first proposed by the American economist Balassa in 1965, was to measure the ratio between the export amount of a product in a certain country in the calculation period to the proportion of total exports and the global export amount of a product to the world total export amount, and then judge the level of competitive advantage of the product. If the RCA is lower than 0.8, it means that the product does not have an export competitive advantage; if the RCA is in the range of 0.80-1.25, it means that the product has a general competitive advantage in export; in addition, once RCA is in the range of 1.25-2.5, or even greater than 2.5, then the international competitive advantage of the product is very obvious and strong.

RCAij=(Xij/Xit)+(Xwj/Xwt)

(3)

whereXijis the export of productjfrom country (region)i,Xitrepresents the total export value of country (region)iin the periodt,Xwjrepresents the export value of the world export productj,Xwtdenotes the total export value of the world during the periodt. In order to clearly show the competitive export advantages of rice in various regions relative to other grains, we used the total export value of grain to replace the total export value.

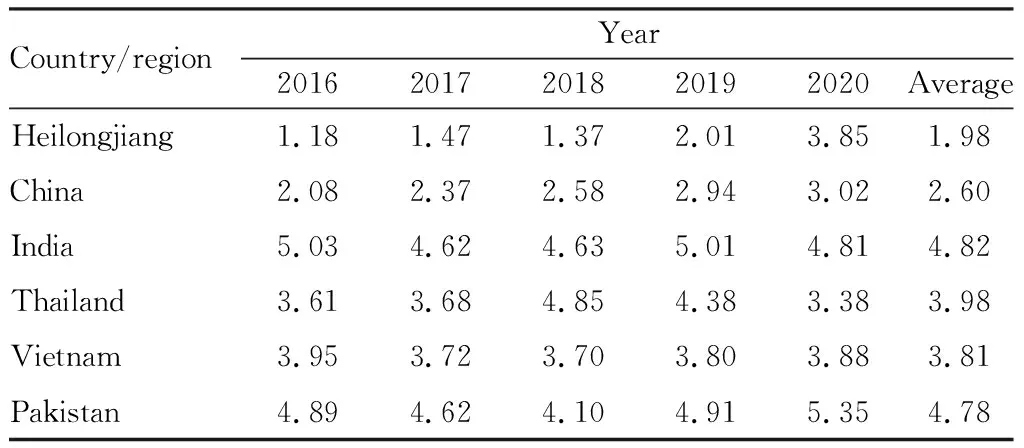

3.3.1International comparison. We used the ratio of rice export amount to grain export amount of the five countries to account for the proportion of the world rice export amount to the world grain export amount. As shown in Table 6, in 2016-2020, the RCA values of Heilongjiang Province and China as a whole have increased, especially the average RCA in Heilongjiang Province was as low as 1.98, but the growth was rapid, reaching 3.85 in 2020. The overall average RCA of China was 2.6, and the comparative advantage of rice exports was obvious, but the horizontal comparison was not prominent. For example, the RCA index of rice in India and Pakistan was around 4.8 every year, indicating that they have a strong competitive advantage in the international market and Pakistan has great potential. The average RCA of rice in Thailand and Vietnam was in the range of 3.8-4.0, indicating that the international market competitiveness of rice products in the two countries was also very prominent. Comparing the four countries, it can be seen that the rice competitive advantage of Heilongjiang Province was not prominent and its international competitiveness was not strong.

Table 6 International comparison of rice RCA in Heilongjiang Province

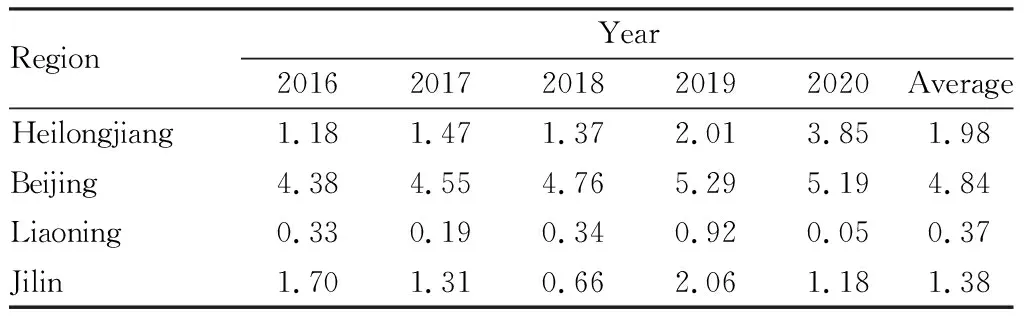

3.3.2Domestic comparison. We used the proportion of the ratio of rice export amount to grain export amount in 4 provinces to calculate the ratio of the world rice export amount to the world grain export amount. As shown in Table 7, compared with the other three provinces (cities) in the same period, the average RCA of Heilongjiang Province was 1.98 and ranked second, and its export competitive advantage was significant. From the perspective of an individual region, Beijing had the most prominent comparative advantage, the RCA index was stable, and it far exceeded the national average of 2.6, far ahead of other provinces. The RCA index of Liaoning Province and Jilin Province fluctuated greatly, and the overall trend was slightly downward. Comparison indicates that Heilongjiang Province had obvious advantages in rice export competitiveness.

Table 7 Domestic comparison of rice RCA in Heilongjiang Province

Although the results of the rice competitiveness level in Heilongjiang Province measured by the above three methods are slightly different, the overall results are basically the same. In international comparisons, IMS, TC and RCA all show that the rice export competitiveness of Heilongjiang Province ranks low in the international market and cannot be compared with the other four countries. In the domestic comparison, the IMS index shows that the rice IMS of Heilongjiang Province is comparable to that of Jilin Province, but there is a huge gap with Beijing; the TC index shows that Jilin Province has the strongest export competitiveness, and Heilongjiang Province ranks third; the RCA index shows that although Heilongjiang Province’s rice is not as good as Beijing, it surpasses Jilin Province and Liaoning Province. It shows that to enhance the rice competitiveness of Heilongjiang Province, India, Thailand, Pakistan, and Vietnam must be compared internationally, while Beijing and Jilin Province must be compared domestically to learn from each other’s strengths.

4 Analysis of constraints on the competitiveness of rice exports in Heilongjiang Province

4.1Riceexportsaremainlyprimaryproducts,andexportincomeislimitedAs one of the world three largest exporters of japonica rice, China mainly exports japonica rice to Japan and South Korea. Japanese, Korean, and Thai rice are all representatives of high quality. With the economic development of various countries and the improvement of consumer living standards, the international market will inevitably increase the demand for high-quality rice. The statistical data indicate that the proportion of rice and unpolished rice exports in Heilongjiang Province increased from 4.76% in 2001 to 38.89% in 2015[3]. Rice exports accounted for a relatively high proportion of primary products, which restricted the growth of export amount.

4.2Riceproductionandprocessingresearchanddevelopmentarelaggingbehind,andtheindustrialchainextensionisinsufficientCompared with Japan and South Korea, which can transform the absolute disadvantage of small farmland area and low food self-sufficiency rate into the absolute advantage of the world leading rice production and processing technology, China is lagging behind in rice production and processing research and development, and the technology and equipment for the processing of new rice products mainly rely on the introduction from Japan[5]. At present, China’s rice processing enterprises generally attach importance to the fineness of rice processing, but they do not have a deep understanding and insufficient attention to the nutrition of rice, the staple food of rice, and the extension of the rice food industry chain[17]. The level of rice processing is extensive, and the development and utilization of rice processing by-products is low. In the long run, this will lay hidden dangers for foreign deep-processed rice products to attack the northeast market.

4.3Thericeexportmarketistooconcentrated,whichisnotconducivetoavoidingtradefrictionsThe rice exports of Heilongjiang Province are mainly concentrated in Russia, Japan, South Korea and other neighboring countries, making its rice export market limited, and it is difficult to broaden a wide range of export channels for a while, which is not conducive to avoiding trade frictions and is vulnerable to the domestic economic fluctuations of importing countries and the impact of agricultural product trade protection measures. If the rice demand market structure of these countries changes one day, Heilongjiang Province will be difficult to cope with, thus the rice export market structure must be adjusted and optimized as soon as possible.

4.4Thericebrandisscatteredanddisorderly,andtheworldreputationisnothighIn the process of economic globalization, the importance of brands is self-evident. On the one hand, because the agricultural product market is gradually becoming a fully competitive market, China generally does not pay enough attention to agricultural product brands. On the other hand, rice is a necessity of life, and distributors also lack sufficient attention to the rice brand. In contrast, agricultural associations, enterprise groups, and multinational companies monopolize most of the markets for the cultivation and sale of agricultural products in Japan and South Korea. In recent years, Heilongjiang Province has cultivated famous and excellent brands such as "Jinhe", "Jinfu Qiaodayuan", "47° North Latitude Liushuixiang", and "Tiangu Yudao", but the problems of scattered and disorderly brands still exist, and the brand promotion is insufficient and the popularity is not high.

5 Recommendations for enhancing the competitiveness of rice exports in Heilongjiang Province

5.1Takingmultiplemeasurestoensureproductquality

With the strong scientific research support of institutions of higher learning, agricultural research institutes, rice associations,etc., Heilongjiang Province has cultivated high-quality rice varieties such as "Wuyou Rice No.4", "Jiyuanxiang No.1", and "Songjing 83". In addition to the cold black soil, the green and organic rice planting environment and the promotion of standardized production technology, it can be said that the quality of exported rice is guaranteed from the source. Heilongjiang Province should first determine the quality positioning of rice export. High-quality rice with high-price positioning should be selected, and consumer groups should be positioned as high-end customers. Second, it is necessary to actively support and support the establishment of agricultural associations and rice industry groups, give full play to their capital and scale advantages, purchase seeds in a unified manner, and plant large-scale, standardized and unified sales. Third, it is recommended to establish a quality supervision system for green and organic rice production, and the government should set up specialized agencies to conduct food quality evaluation and residue testing of rice in the main production areas to guide and supervise rice production and ensure high-quality rice production.

5.2Improvingthelevelofindustrializationofriceproductionandprocessing,andextendingthericeindustrialchainThe processing of export rice should not only focus on "fine" processing, but also jump out of the positioning of rice staple food, make breakthroughs in "deep" processing, and increase its added value. Rice production and processing enterprises can establish a relatively complete rice industrial chain. From the upstream production and processing stage, rice husk is used to generate electricity, and the rice husk ash after power generation can be processed into activated carbon, silica, polysilicon,etc.The crushed rice produced and processed in the middle streams can be used to produce rice noodles, rice noodles and other products. The by-product rice bran can be used to process and produce rice bran oil. It can also extract fatty acids, glutamate, ferulic acid,etc., from the by-product of rice oil and rice bran meal. Downstream enterprises sell rice and can produce high-tech products such as germ powder and rice protein[18]. In addition, it also needs the promotion of governments at all levels and the support of the technical force of scientific research institutes to form a joint force with rice processing enterprises to enhance the competitiveness of rice exports.

5.3DevelopingdiversifiedriceexportmarketsandimprovingexportflexibilityIn the world, there are only three countries that can export japonica rice: China, the United States, and Australia, while the countries (regions) that import japonica rice are mainly Japan, South Korea, North Korea, Russia, Taiwan, Romania, the Czech Republic, Poland, Hungary, and several countries in the European Union[5]. In terms of market development, it is necessary to consolidate the existing major trading partnerships between Russia, Japan and South Korea, and to implement an all-round diversification policy. Focusing on the international rice consumer market, Heilongjiang Province needs to focus on developing China Taiwan and EU countries such as Romania, Poland, and the Czech Republic, and actively promote trade ties with various countries and regions, reduce the concentration of the international market, improve export flexibility, and truly internationalize and globalize Heilongjiang’s rice exports.

5.4Adheringtotheprincipleof"openingthedoorandgoingout"toexpandtheinternationalpopularityofhigh-qualitybrandsIn a market economy, if rice is to gradually expand the market, it must have a "well-known and trustworthy" commodity brand. In recent years, relevant departments and enterprises in Heilongjiang Province have not only implemented the strategy of "going global" and actively participating in international food expositions and tastings to promote Heilongjiang rice, but also held international green food industry expositions and "Rice Festivals" through "Opening the door", and have made remarkable achievements. In future, it is necessary to seize the opportunity and actively participate in product promotion activities around the world to expand its brand influence. In addition, it is recommended to analyze the rice quality characteristics such as color, grain type and flavor according to the natural area of Heilongjiang Province, and form several excellent quality brands as soon as possible in accordance with the international gold award quality to improve export competitiveness.

6 Conclusions

In this study, taking the evaluation of rice export competitiveness of Heilongjiang Province as the research object, using the international market share index, trade competitiveness index and RCA analysis methods, we analyzed the rice export competitiveness of Heilongjiang Province from different perspectives, and reached the conclusion that Heilongjiang Province still has no obvious export competitive advantage. The reasons that restrict the competitiveness of Heilongjiang Province’s rice exports include: rice exports are mainly primary products, and export income is limited; production and processing research and development are lagging behind, and the industrial chain is not extended enough; the export market is too concentrated, which is not conducive to avoiding trade friction; the brand is scattered, disorderly, and the world reputation is not high. It is recommended that Heilongjiang Province should learn from India, Thailand, Pakistan and Vietnam internationally, and Beijing and Jilin Province domestically, take the road of high-quality development, focusing on high-quality positioning, industrial development, diversified export markets, and expanding the international brand awareness. In future, the research should focus on the key links of japonica rice cultivation, sales, quality improvement and brand building, drawing on the experience of Japanese rice industry cultivation and brand building, and exploring the path of rice industrialization development, quality improvement and brand building in Heilongjiang Province.

杂志排行

Asian Agricultural Research的其它文章

- Exploration on the Path of Whole-region Comprehensive Land Consolidation under the Background of Rural Revitalization

- Geographical Indication Intellectual Property Protection and Regional Public Brand Construction of Rape Industry in China

- Influencing Factors of Cultivation and Improvement of College Students’ Innovation and Entrepreneurship Ability under the New Normal

- Effects of Different Proportions of Controlled Release Urea and Ordinary Urea on Peanut Yield

- Selection of Greenhouse Zucchini Varieties and High-Quality, High-Yield and High-Efficiency Cultivation Techniques

- Growth and Antimony Bioconcentration Characteristics of Wild Ramie (Boehmeria nivea) under Sb Stress in Different Valence States