On the Industrial Division and Coordinated Development in the Guangdong-Hong Kong-Macao Greater Bay Area

2023-01-04LiSusuDuYixuanandJiaoPing

Li Susu, Du Yixuan, and Jiao Ping*

Guangdong University of Finance & Economics

Abstract: The Guangdong-Hong Kong-Macao Greater Bay Area is a young but vigorous international city cluster with a complete industrial system and is taking the lead in China’s economic development. This paper analyzes the economic and industrial development of the Guangdong-Hong Kong-Macao Greater Bay Area and measures the industrial agglomeration index and homogeneity index among different cities in the area. After our analysis,we found that the cities in the area showed apparent differences in their economic development levels. Therefore, this paper suggests improving the competitiveness of the Greater Bay Area through systematic division and collaboration of industries, further achieving rational industrial structure and high-quality economic development.

Keywords: Guangdong-Hong Kong-Macao Greater Bay Area, industrial division,industrial collaboration

TheReport on the Work of the Goνernment (2017)clearly stated the development plan of building a city cluster in the Guangdong-Hong Kong-Macao Greater Bay Area. Since then, the building of the Greater Bay Area has become a key subject for both the government and the academic community. TheOutline Deνelopment Plan for the Guangdong-Hong Kong-Macao Greater Bay Areaissued in 2019 proposed new requirements for the development of the city cluster in the Greater Bay Area. The Greater Bay Area plays a significant and strategic role in exploring a new model for China’s economic development and leading China’s overall economic development. The development of the Greater Bay Area will break the administrative division of cities in the area, facilitate the cross-regional flow of resources, promote industrial division and collaboration, and provide a better external market environment, thus improving the economic operational efficiency of the whole area.

Guangdong, as a global manufacturing center, is the window and base of China’s foreign trade. The clear industrial division and coordinated development in the Greater Bay Area will inject impetus into Guangdong’s overall growth. It will also have profound influence and significance for the province in deepening reform, realizing the goal of“Standing in the Forefront of China in Four Aspects,”①It refers to standing at the forefront of China in building institutions and mechanisms for high-quality economic development, building a modern economic system, creating a new pattern of opening up on all fronts, and building a social governance model based on collaboration, participation, and common interests.promoting the Belt and Road Initiative, and implementing the functional area developmental strategy of Guangdong featuring “one core, one belt, and one area.”②Here “one core” refers to the Pearl River Delta Areas; “one belt” refers to the Coastal Economic Belt; “one area” refers to the Ecological Development Area in North Guangdong.This study further enriches and improves the theoretical system for the development of the Greater Bay Area, analyzes the existing problems facing each region in its industrial development, and provides corresponding suggestions for future research on the coordinated development of regional industries. It is of significant and practical value for the industrial collaboration and economic development of the Greater Bay Area, as well as other city clusters in China.

Literature Review

The Greater Bay Area boasts favorable conditions for industrial collaboration owing to the distinctive geographical advantages, broad economic hinterland, developed urban agglomeration, convenient transportation and logistics, and industries with complementary advantages. Currently, much research has been done on the development of the Greater Bay Area. Chen Zhao and Zhang Jiaxin (2020) examined the current situation of the coordinated development of industries in the area, arguing that the area has initially formed an industrial system with a large scale and complete structure by speeding up the replacement of old growth drivers with new ones and optimizing its industrial structure. A “center+ periphery” model was also developed featuring multiple centers represented by Shenzhen and Zhuhai, which have achieved the best agglomeration effects in the area. Meanwhile, some researchers explored the weaknesses in industrial collaboration in the area. According to research by Xiang Xiaomei and Yang Juan (2018)and that by Zhu Hongwei and Wang Qi (2019), industrial cooperation in the Greater Bay Area lacked a mechanism for multi-dimensional and cross-regional collaboration and unfinished integration and extension of the industrial chain.

Regarding the research on the industrial division and coordinated development mechanism of the Greater Bay Area, Sui Wenjuan (2018) believed that giving full play to the leading role of the government and core cities was helpful in promoting the industrial restructuring of the Greater Bay Area. Xiang Xiaomei and Yang Juan (2018)pointed out that each city should make full use of its unique geographical advantages and resource endowments to form a sound cooperation mechanism to achieve coordinated development of industries and create a win-win situation. Zhang Haimei and Chen Duoduo (2018) proposed to build a long-term cooperation mechanism for the development of manufacturing and service industries in Guangdong province, the Hong Kong Special Administrative Region, and the Macao Special Administrative Region to diversify the regional industrial cooperation and strengthen the government’s role in promoting the transformation and upgrading of manufacturing industries in the Pearl River Delta Area.

In terms of promoting industrial upgrading and coordinated development, Yang Xinrong et al. (2017) argued that it would be wise to leverage the advantages of Hong Kong and Macao to deepen the opening-up of the Greater Bay Area. Sui Wenjuan (2018)suggested building a long-term mechanism for sustainable cooperation among cities to realize the dual synergy of industries and cities in the area. Xiang Xiaomei et al. (2018)thought that the Greater Bay Area should rationalize the industrial division and build a mechanism for the integration of industrial chains to achieve industrial collaboration,featuring such modes as inter-industry divisions, intra-industry divisions, divisions in industrial chains, and comprehensive integration of industries. Li Renke (2019) believed that to promote complementary advantages among industries and their coordinated development, it would be good to further refine the vertical divisions in industries and speed up the industrial restructuring by leveraging the leading roles of the core cities.Thus, making better use of the coordination role of the government to innovate the institutional mechanisms of the Greater Bay Area. Zhang Yu et al. (2019) proposed to leverage the advantages of technology, R&D, manufacturing, and logistics to optimize the division and cooperation modes of the supply chains and the industrial chains.

The existing literature has provided a reference for this paper, but there are also some shortcomings: First, there are many normative and predictive research results, but fewer studies are based on empirical analysis; Second, there are many studies on the current situation of industrial collaboration, but few studies on specific collaboration mechanisms;Third, systematic and constructive suggestions on the coordinated development of industries are scarce. This paper intends to make corresponding improvements for the above-mentioned problems.

Economic and Industrial Development of the Greater Bay Area

The Greater Bay Area consists of Guangzhou, Shenzhen, Zhuhai, Foshan, Huizhou,Dongguan, Zhongshan, Jiangmen, and Zhaoqing in the Pearl River Delta Area (the cities in Pearl River Delta [PRD] cities), as well as the Hong Kong Special Administrative Region (HKSAR) and the Macao Special Administrative Region (Macao SAR). In 2020,the combined population of the Greater Bay Area reached 72.6492 million, and the GDP exceeded RMB 11.62 trillion, accounting for 11.61 percent of the GDP of China (RMB 99.94 trillion). Considering the timeliness and availability of the data, we mainly adopted the relevant data from 2018 and 2019 for analysis.

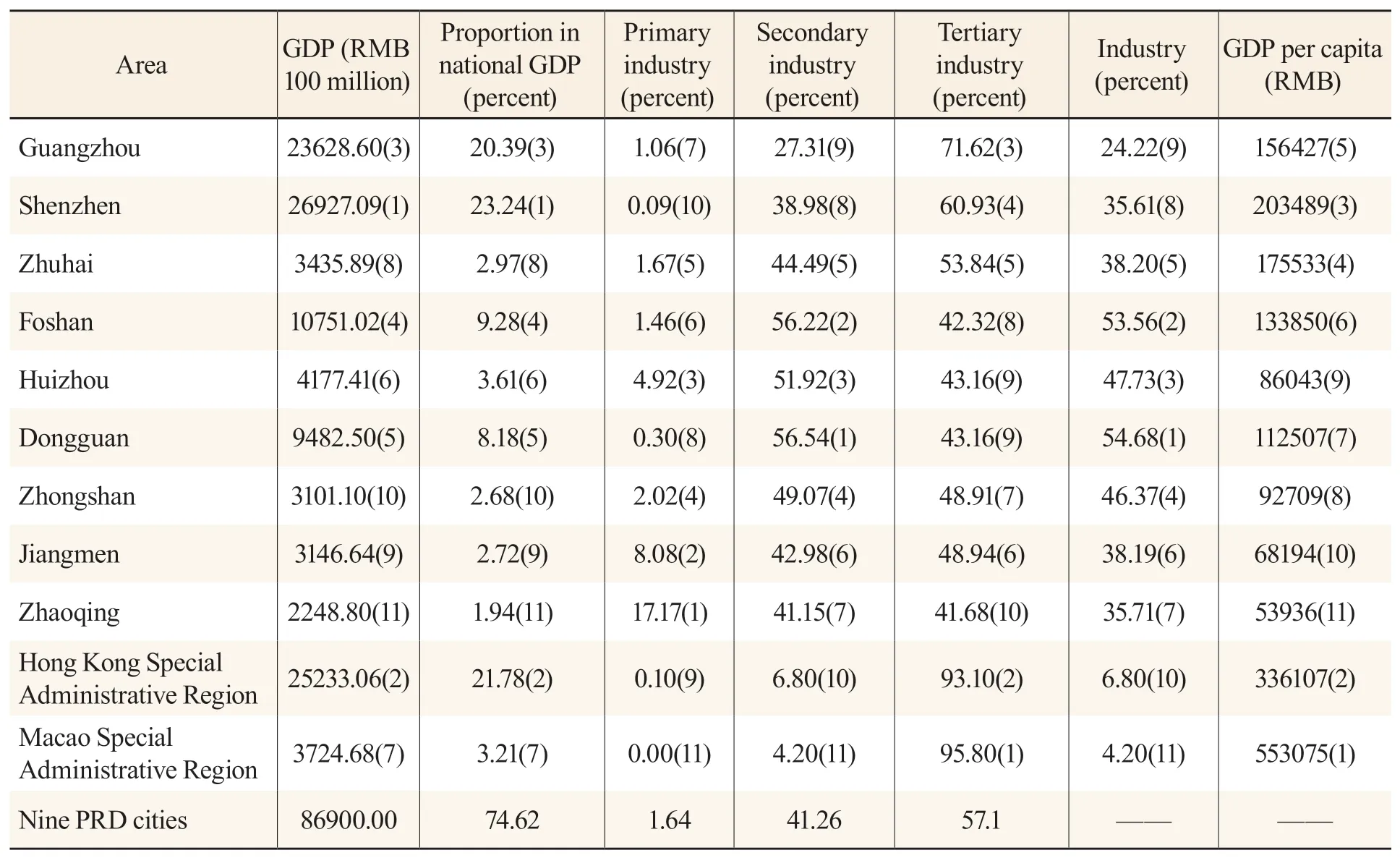

Differences in Economic Development among Cities in the Greater Bay Area

There are significant differences in economic development among cities in the Greater Bay Area. As is shown in Table 1, Shenzhen, Hong Kong, and Guangzhou are in the first echelon with the strongest economic strength. Foshan and Dongguan are in the second echelon with moderate economic strength. Huizhou, Macao, Zhuhai, Jiangmen,Zhongshan, and Zhaoqing are in the third echelon. From 2008 to 2017, Hong Kong ranked first in terms of GDP, followed by Guangzhou and Shenzhen with rapid growth.Shenzhen’s GDP surpassed that of Guangzhou in 2017 and surpassed Hong Kong for the first time in 2018, ranking first in the Greater Bay Area. In 2019, the combined GDP of Shenzhen, Hong Kong, and Guangzhou accounted for more than half (65.41 percent)of the Greater Bay Area. Foshan and Dongguan, with their strong manufacturing basis,ranked fourth and fifth, accounting for 9.28 percent and 8.18 percent of the area’s GDP,respectively. Zhuhai, Huizhou, Zhongshan, Jiangmen, and Macao lagged behind in terms of GDP proportion, being 2.97 percent, 3.61 percent, 2.68 percent, 2.72 percent, and 3.21 percent, respectively. Zhaoqing’s GDP accounted for less than two percent of the area’s GDP, ranking 11th. In terms of GDP per capita, Hong Kong and Macao were much higher than the nine PRD cities. Macao’s GDP per capita reached RMB 553,075, the highest in the area. The population of Hong Kong was less than two thirds of that of Shenzhen and about half of that of Guangzhou. However, the GDP per capita of Shenzhen was about two thirds of (0.605) that of Hong Kong, and Guangzhou was 0.465, about half that of Hong Kong. The GDP per capita of Shenzhen, Zhuhai, Guangzhou, Foshan, and Dongguan ranked at the middle and upper level of the Greater Bay Area, while that of Jiangmen and Zhaoqing was lower than the average of China (RMB 70,800).

Table 1 GDP and Industrial Composition of Areas in the Greater Bay Area in 2019 (percent)

Industrial Development Status of Cities in the Greater Bay Area

According to Table 1, in terms of the relative proportion of the three industries in each area, Hong Kong and Macao were dominated by the tertiary industry, accounting for more than 90 percent. In 2019, the ratio of three industries in the nine PRD cities was 1.64:41.26: 57.1. In terms of the internal situation of the city cluster, Guangzhou, Shenzhen, and Zhuhai showed a typical proportion of three industries with the tertiary industry ranking first followed by the secondary and primary industries; Zhaoqing and Zhongshan showed little difference in the proportion of secondary and tertiary industries; while the proportion of the primary industry in Zhaoqing was much higher than other cities in the Greater Bay Area, accounting for 17.17 percent. Except for Guangzhou and Shenzhen, the proportion of secondary industries in the other seven cities was higher than the average of Guangdong province (40.5 percent), with industry remaining the main driver of the economy.

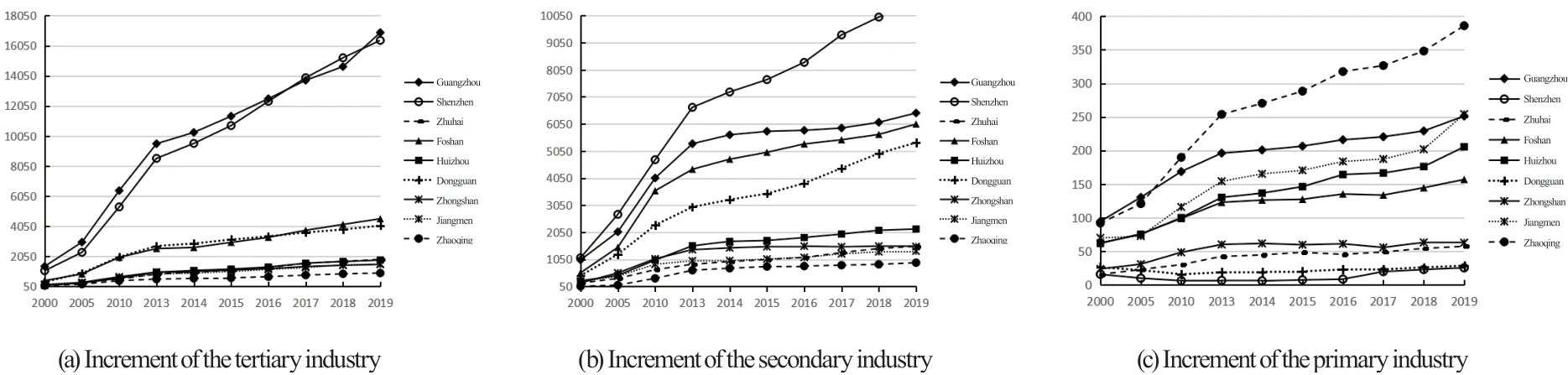

In the absolute increment of the three industries in each city, similar conclusions can also be drawn. It can be seen from Figure 1 (a) that the increment of the tertiary industry in Guangzhou and Shenzhen was much higher than that in the other seven cities whose economic development was dominated by scientific and technological innovation and had entered the advanced stage of industrialization. As shown in Figure 1 (b), Shenzhen,Guangzhou, Foshan, and Dongguan saw a steady increment in the secondary industry,ranking among the top four over the past decade with a fast growth rate. Foshan and Dongguan were in the advanced stage of industrialization and were constantly improving their manufacturing innovation capability to catch up with Guangzhou and Shenzhen; As shown in Table 1 and Figure 1 (c), the industrial structure of Zhaoqing, Jiangmen, and Huizhou was in the middle and advanced stage of industrialization and registered a high increment in the primary industry, but their industrial structure relatively lagged behind and need further optimization and upgrading.

Figure 1. Increment of Three Industries in the nine PRD Cities

From the proportion of the three industries of 11 cities in the Greater Bay Area, we found that Hong Kong and Macao, had absolute advantages in the service industry. In fact, Hong Kong is dominated by the financial industry, which features high added value and low employment, as well as the tourism and logistics industries with low added value and high employment. Macao features a single industrial structure, whose industrial structure needs to be further diversified. The nine PRD cities, as important manufacturing development bases in the Greater Bay Area, have a high proportion of secondary industries, with a complete and advanced manufacturing industry. The differences in the development of the three industries among the 11 cities in the Greater Bay Area provide the basic conditions for the industries in the area to complement each other.

Measurement and Analysis of the Industrial Division and Coordinated Development Index

The data on regional GDP, GDP per capita, and three industries of the nine PRD cities presented in this paper comes from theGuangdong Statistical Yearbook, and the data on the total output value of industrial enterprises and the number of employees in different industries in each city comes from theGuangdong Statistical Yearbook of Industry. The data related to Hong Kong and Macao mainly comes from theChina Statistical Yearbook,Hong Kong Annual Digest of Statistics, andMacao Yearbook of Statistics.

Measurement Index

Industrial Agglomeration Index/Industrial Specialization Index

The industrial agglomeration index refers to the ratio between the proportion of the output value ofjindustry in the total output value ofiCity and that of the output value of thejindustry in the total production value of the whole region. According to the practices of Liu Zhuo (2012) and Sui Wenjuan et al. (2018), we used the industrial agglomeration index to describe and measure the degree of agglomeration or specialization of regional industries, which represents the specialization degree or competitive edges of regional industries. The calculation formula is:

whereeijrefers to the number of employees, total output value or the increment ofjindustry iniCity;eirefers to the total number of employees or regional GDP of all industries iniCity;Eiis the total number of employees, industrial increment, or total industrial output value of the whole region;Erefers to the total number of employees and regional GDP of all industries in the whole region. The higher the value ofLQij, the higher the specialization degree ofjindustry iniCity, indicating a higher competitive edge in the region. IfLQij>1, it indicates that the specialization degree ofjindustry inicity is higher than the regional average, with a large production scale and obvious competitive edges, and the industrial competitiveness is leading in the region; IfLQij<1,it indicates that the specialization degree ofjindustry iniCity is lower than the regional average, with a small production scale and weak industrial competitiveness; IfLQij>1.5,it can be inferred that the degree of agglomeration or specialization of this industry in the city is very high.

Industrial Homogeneity Index

With reference to the measurement method of Krugman (1991), we used the industrial homogeneity index to measure the differences and homogeneity of industrial structures among regions and identify their industrial competition relationship, that is, to measure the regional industrial division by the differences in industrial structures. The industrial homogeneity index is calculated by summing the absolute value of the differences in the proportion of industries between two cities. The calculation formula is:

where,PijandPikrespectively represent the increment ofiindustry, ini, kcities;PjandPkrespectively represent the sum of the increment of all industries ini, kcities.According to experience, the value of the industrial homogeneity index varies between 0 and 2. IfGSIij=0, it indicates that the industrial structure ofiCity andjCity is the same;ifGSIij=2, it indicates that the industrial structure ofiCity andjCity is completely different. The smaller the industry homogeneity index is, the more similar the industrial structure between regions, and there may be problems such as industry homogeneity and repeated construction; otherwise, the greater the industry isomorphism index is, the greater the difference in industry structure between cities, and the less the homogeneity is, the more the complementary will be.

Analysis of Industrial Specialization in the City Cluster of the Greater Bay Area

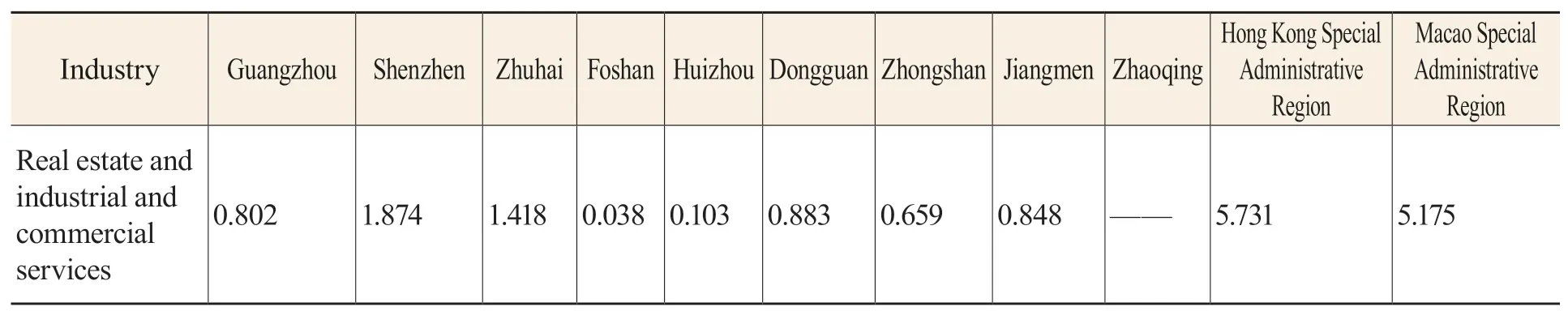

We measured the regional agglomeration index of each industry in 11 areas in the Greater Bay Area in 2018 by using statistical data and Formula (1), to determine the regional specialization degree of each industry in the area. The specific results are shown in Table 2.

Table 2 Specialization Index of the City Cluster in the Greater Bay Area by Industry in 2018

Note. In view of the availability of relevant data in the Hong Kong Special Administrative Region and the Macao Special Administrative Region, the data in this table is measured by the number of employees in different industries. The data on the number of employees in Zhaoqing’s service industry was not available.

In general, some cities in the Greater Bay Area showed a high specialization degree in certain industries (industrial agglomeration indexLQij>1). For example, Hong Kong and Macao registered a high industrial agglomeration index in industries, such as wholesale and retail, transportation, warehousing, and postal services, finance, leasing and business services, real estate, and industrial and commercial services, indicating that the two regions enjoyed a higher specialization degree in these four industries, especially in finance, leasing and business services/real estate, and industrial and commercial services.The nine PRD cities varied greatly in industrial agglomeration degree. Guangzhou,Zhuhai, Huizhou, Jiangmen, and Zhaoqing registered a high agglomeration degree in agriculture, forestry, animal husbandry, and fishery, with Zhaoqing ranking first (2.798),Guangzhou registering a relatively low value (1.005), and Shenzhen having the lowest value (0.109); In terms of manufacturing industry, Dongguan ranked first in the Greater Bay Area (1.837). Shenzhen, Foshan, and Zhongshan registered a value higher than 1, and Zhaoqing had the lowest value (0.145); Guangzhou, Shenzhen, and Foshan ranked high in the industrial agglomeration of the wholesale and retail industries; Guangzhou and Shenzhen had a higher industrial agglomeration index in transportation, warehousing, and postal services; Shenzhen, Zhuhai, and Foshan showed a higher industrial agglomeration index in the financial industry; Guangzhou and Shenzhen performed well in the industrial agglomeration of the leasing and business services/real estate and industrial and commercial services. In general, this was consistent with the analysis of the proportion of the three industries in each city of the Greater Bay Area, as shown in Table 1 above,signifying that the area registered a high specialization degree in the leading industries.

Analysis of Industrial Specialization of the Manufacturing Industry in the Nine PRD Cities

According to the analysis of the overall level of industrial specialization in the Greater Bay Area, Dongguan, Shenzhen, Foshan, and Zhongshan registered a relatively high agglomeration index in the manufacturing industry. The manufacturing industry, with its huge system, was the main carrier of technological innovation in a country or region.It generated and spread technological innovations. It will exert a spillover effect on other industries and play a critical role in determining the economic development capacity of a country or region. Therefore, it is necessary to examine the agglomeration degree and specialization level of the segmented industries in the manufacturing industry of the nine PRD cities to provide a reference for industrial transformation and upgrading and coordinated development in the area. We calculated the agglomeration index of the manufacturing industry in the nine PRD cities in 2018 based on Formula (1). The results are shown in Table 3.

Table 3 Agglomeration Index of the Manufacturing Industry in the nine PRD Cities in 2018

As shown in Table 3, Guangzhou, Foshan, Dongguan, Jiangmen, and Zhaoqing are competitive in the tobacco, alcohol, and food processing industry, with Jiangmen ranking first in the agglomeration index (3.510); Foshan, Dongguan, Zhongshan, Jiangmen, and Zhaoqing have a competitive advantage in the textile, leather, and footwear industry, with Foshan topping the agglomeration index (1.877).

Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen, and Zhaoqing boast a high agglomeration index in the wood processing and furniture manufacturing industry,with Zhaoqing being the highest (3.027). Foshan, Dongguan, Zhongshan, Jiangmen,and Zhaoqing show a high agglomeration index in the paper-making, printing,cultural, and sporting goods manufacturing industry. This is mainly determined by the resource endowment and long-established industrial base of the cities.Guangzhou, Zhuhai, Foshan, Huizhou, Zhongshan, Jiangmen, and Zhaoqing have a higher agglomeration index for the petrochemical industry, with Huizhou being the highest. This is mainly attributed to the convenient maritime transportation conditions and the petrochemical industrial bases in the city represented by ExxonMobil and the Huizhou Oil Refining Company. The adjacent core cities with high energy consumption, such as Shenzhen and Guangzhou, have a huge demand for energy. Guangzhou, as one of the largest first-tier cities in China,has obvious advantages in the petrochemical industry due to its high petroleum consumption and strong international competitiveness brought by petrochemical industrial bases that integrate refining and chemical operations represented by the Sinopec Guangzhou Branch. Guangzhou, Shenzhen, Zhuhai, Zhongshan, and Zhaoqing show a higher agglomeration index in the pharmaceutical industry,with Zhuhai being the highest (3.107), followed by Guangzhou (1.686). Zhuhai is endowed with abundant marine biological resources, which is a unique advantage for biomedical research. The establishment of the Traditional Chinese Medicine Science and Technology Industrial Park of Cooperation between Guangdong and Macao (the GMTCM Park) in the Hengqin New Area of Zhuhai City has created sound synergy effects. The planning of biomedical industrial parks in the High-Tech Zone has greatly promoted the development of the pharmaceutical industry in Guangzhou. Foshan, Jiangmen, and Zhaoqing have a competitive advantage in the mineral product, metal product manufacturing, and the metallurgical industry.Zhaoqing has the highest agglomeration index (3.766), followed by Foshan (2.284);Guangzhou, Foshan, Dongguan, Zhongshan, and Jiangmen have obvious advantages in the general equipment manufacturing industry, with Foshan ranking first in the agglomeration index (1.336); The special equipment manufacturing industry is agglomerated in Shenzhen, Zhuhai, and Foshan, with Foshan being the highest(1.405). Foshan has been promoting the agglomeration of the general and special equipment manufacturing industries by relying on industrial parks, specialized towns, and characteristic industrial bases. The Foshan National High-Tech Industrial Development Zone, which features Chancheng Park, Nanhai Park (Nanhai Economic Development Zone, Guangdong High-Tech Service Zone for Financial Institutions,and Nanhai Industrial Park), Shunde Park, Gaoming Park, and Sanshui Park,see continuous improvement in the industrial agglomeration of the equipment manufacturing industry. The automobile manufacturing industry is mainly located in Guangzhou, with an agglomeration index of 4.336. Guangzhou has gathered four major automobile manufacturers: GAC, Nissan, Honda, and Toyota, bringing obvious advantages for the city to develop the automobile industry. In recent years, Guangzhou has been laying out industrial chains such as automobile parts manufacturing and has witnessed remarkable development in the new alternative energy vehicle industry.The equipment manufacturing for railway, vessel, aerospace, and other transportation modes is mainly located in Guangzhou, Zhuhai, and Jiangmen, of which the industrial agglomeration index of Jiangmen is 6.156, followed by Guangzhou with 2.206. Rail transit is becoming an important driver for the rapid development of the equipment manufacturing industry in Jiangmen. The Guangdong Rail Transit Industrial Park in Yinzhou Lake, Xinhui District, Jiangmen Municipality has developed into the largest rail transit industrial base with the most suppliers in Guangdong province. In 2010, CRRC Guangdong Co., Ltd. was the first to settle in the Guangdong Rail Transit Industrial Park in Jiangmen Municipality, attracting more than ten supplier companies to settle in the industrial park. The electric machinery and equipment manufacturing industry is concentrated in Zhuhai, Foshan, and Zhongshan, with the highest agglomeration index in Zhongshan (2.058), which is an important machinery manufacturing and processing base in the Pearl River Delta Area. Shenzhen, Huizhou, and Dongguan have a higher agglomeration index in the computer, communication, and other electronic equipment manufacturing industry. The instrument manufacturing industries is concentrated in Shenzhen, Zhuhai, Dongguan, and Zhongshan, with Zhuhai ranking the highest (2.035),followed by Shenzhen (1.502). The cities in the Pearl River Delta City Cluster have their advantages and characteristics in the manufacturing industry, with strong complementary advantages and a sound foundation for cooperation.

Analysis of Industrial Homogeneity of the Manufacturing Industry in the Nine PRD Cities

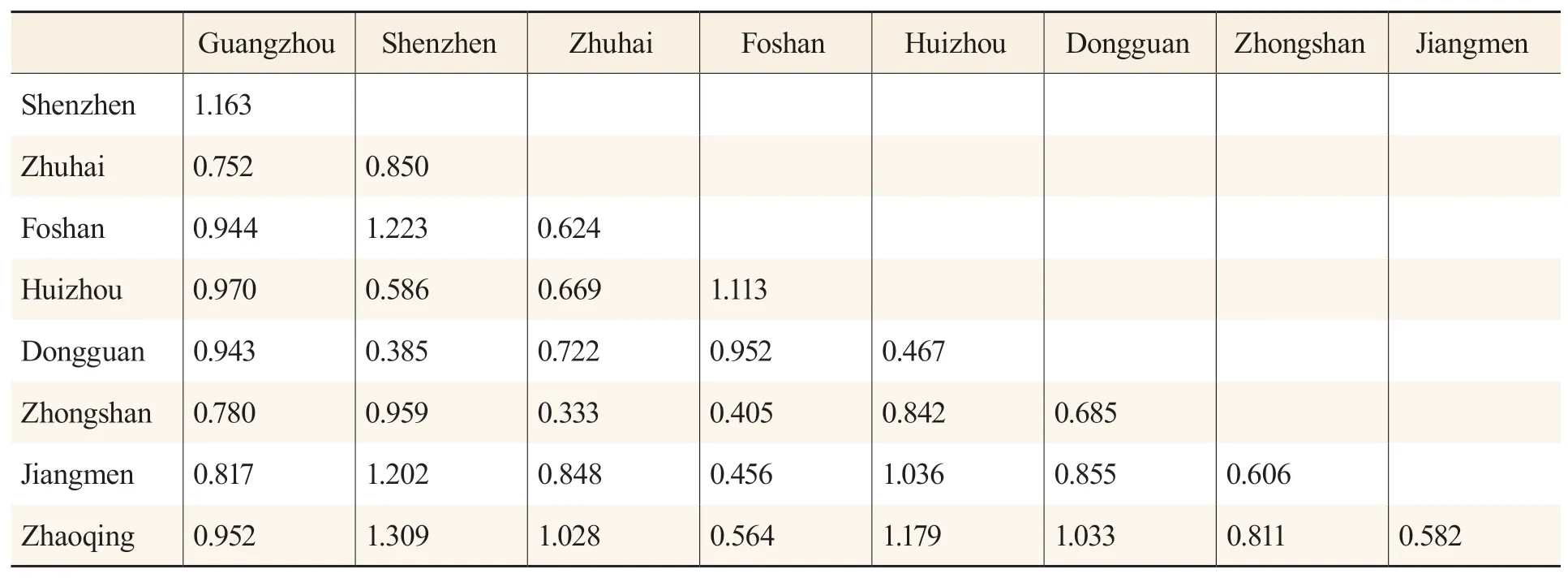

We measured the homogeneity index of the manufacturing industry in the nine PRD cities based on statistics and Formula (2), to further explore the differences in the industrial structure among cities in the area. The results are shown in Table 4.

Table 4 Homogeneity Index of the Manufacturing Industry in the nine PRD Cities in 2018

Calculated by cities, the average homogeneity index of the manufacturing index in the nine PRD cities is 0.847. Combining this with the agglomeration index of the manufacturing industry in each city, we found some fields to be improved. industrial homogeneity is more common in the Shenzhen-Dongguan-Huizhou, Guangzhou-Foshan-Zhaoqing, and Zhuhai-Zhongshan-Jiangmen city clusters. The homogeneity index is 0.385 between Shenzhen and Dongguan, 0.333 between Zhuhai and Zhongshan,0.405 between Foshan and Zhongshan, 0.456 between Foshan and Jiangmen, 0.564 between Foshan and Zhaoqing, 0.467 between Huizhou and Dongguan, 0.685 between Dongguan and Zhongshan, and 0.606 between Zhongshan and Jiangmen. These cities are geographically adjacent and culturally connected. On the one hand, they can form a relatively complete industrial chain through complementary advantages, while on the other hand, repeated investment may appear. Second, regions that are geographically separated or located far away from each other see significant differences in industrial structures, with a higher homogeneity index, for example, 1.163 between Shenzhen and Guangzhou, 1.223 between Shenzhen and Foshan, 1.202 between Shenzhen and Jiangmen, 1.309 between Shenzhen and Zhaoqing, 1.028 between Zhuhai and Zhaoqing, 1.113 between Foshan and Huizhou, 1.036 between Huizhou and Jiangmen,1.179 between Huizhou and Zhaoqing, 1.179 between Dongguan and Zhaoqing, and 1.033 between Dongguan and Zhaoqing. The industrial development pattern in these cities is fragmented, and the level of collaboration is lower. Third, These cities have many similar pillar industries, and the division of labor is not clear. For example,Foshan, Dongguan, Jiangmen, Zhongshan, and Zhaoqing all make the traditional textile industry their pillar industry, the same case with the petrochemical industry in Guangzhou, Zhuhai, and Huizhou, and with the electronic manufacturing industry in all the nine FRD cities. The phenomenon of homogeneous competition is prominent.Fourth, some cities boast several pillar industries but lack unique advantages. The pillar industries are isolated from each other.

Industrial Divisions and Cooperation Mechanisms in the Greater Bay Area and the Suggestions

Paths for Industrial Collaboration and Coordinated Development in the Great Bay Area

The key path is making differentiated positioning and regional industrial divisionsbuilding platforms and promoting industrial agglomeration-creating industrial alliances and building whole industrial chains. Following this path, the cities can comprehensively promote the formation, integration, and coordinated development of their intercity industrial chains, and advance the establishment of a new development pattern in the area featuring the coordinated, differentiated, and collaborative development of Guangdong,Hong Kong, and Macao. They should also support and cooperate with each other based on their own industrial advantages and development orientations to build industries with regional characteristics while expanding and strengthening their competitive and leading industries. In a bid to agglomerate high-end industries and build supporting platforms,the area should create a complete chain for the commercialization of scientific and technological achievements by building five major platforms for knowledge innovation,industrial technology R&D, innovation element trading, science and technology intermediary services, and commercialization of achievements while keeping in line with the international standards.

Industrial Divisions and Cooperation Mechanisms in the Greater Bay Area

The key to the coordinated development of industries in the Greater Bay Area lies in promoting the integrated development of a modern service industry, an advanced manufacturing industry, and related emerging industries. The goal is to build a modern industrial system with a benefit-sharing value chain and a development pattern featuring the coordinated development of multiple central cities, promoting the factor mobility between the PRD areas, and creating a unified market with sound interactions between internal and external resources. Two principles should be followed when carrying out the industrial divisions. First, the complete upstream and downstream supply chains and industrial ecosystems of the nine PRD cities should be fully leveraged to create market space for the development of the service industry in Hong Kong and Macao. At the same time, the Greater Bay Area shall use the powerful and world-class modern manufacturingoriented service industry in Hong Kong and Macao to guarantee the transformation and upgrading of the manufacturing industry in the Pearl River Delta Area. Second, it shall divide the city cluster according to the main targeted functions, strong industries, and future development directions of the cities in the Greater Bay Area, to build an integrated spatial linkage between the core cities and node cities, and rationally distribute the upstream and downstream industrial chains based on the specialized functions of each city. In this regard, it is necessary to further rationalize the regional industrial planning and establish a unified market for the coordinated and differentiated development of the area by considering the industrial development situation of the Greater Bay Area and the national requirements for the layout of key industries, thus promoting the mobility of factors and reducing transaction costs. Meanwhile, efforts shall also be made to cultivate more large enterprises with an output value of above 100 billion by efficiently promoting industrial agglomeration and improving the industrial supporting capability. This will help improve regional industrial divisions and industrial supporting capabilities, form a regional market to boost the demands of enterprises on the supply side and demand side,provide a sound business environment for the development and expansion of enterprises in the area, and enhance the overall competitiveness of the Greater Bay Area.

Suggestions on Promoting Industrial Collaboration and Coordinated Development in the Great Bay Area

First, top-level design. (a) A coordination center for the construction of a regional city cluster should be established by focusing on the top-level design, holding joint conferences, and building a market-oriented development pattern tailored for the area which engages all market players, features multifaceted governance and complementary advantages, and benefits all. It shall coordinate policies in the Greater Bay Area by fully considering the functional orientations of the area so that all regions can give full play to their comparative advantages and optimize their overall industrial layout for differentiated development. Such moves will ensure the integrated and balanced development of the area, minimize repeated construction and vicious competition,improve the service efficiency of infrastructure facilities, and optimize the allocation of comprehensive resources; (b) Each region should implement a top-down management mode for comprehensive coordination reflecting both authority and execution according to the functional orientation of each region in the top-level design, and establish a reasonable city hierarchy system and industrial divisions and cooperation mechanisms. It should also build several economic circles in the Greater Bay Area where the industrial agglomeration belt, urban system, and population mobility circle are well matched. Each economic circle should be configured with a diversified city and several specialized cities, to form an industrial cluster in the Greater Bay Area and achieve the complementary advantages of well-coordinated industries.

Second, industrial collaboration. (a) It is necessary to develop competitive industries according to the local conditions of each city, build multiple centers in the Greater Bay Area, and properly deal with the relationships between central cities and peripheral ones.Efforts shall also be made to build a sound industrial development model and optimize the layout of regional spatial functions; (b) It shall deepen the industrial cooperation systems, and enhance the agglomeration effects and catalytic roles of the core cities to form an enabling industrial gradient. The area should relocate some industries from large cities to small and medium-sized cities, facilitate the formation of specialized industrial clusters in the surrounding regions, and create industrial chains, technology promotion chains, and market segmentation chains with complete systems and orderly cooperation in the city clusters. (c) It shall accelerate the transformation and upgrading of traditional industries and improve the efficiency of industrial development. Priority should be given to fostering industrial clusters with a focus on high-end manufacturing and modern service industries, optimizing cooperation in supply and industrial chains, and promoting the Greater Bay Area to move toward the medium-to-high end of the global industrial chain. (d) It shall improve the industrial collaboration and innovation system in the Greater Bay Area, comprehensively realize the integration and innovation of industrial divisions and industrial chains, develop cross-industry collaborative mechanisms, cocreate new business forms and models, and advance the two-way upgrading and expansion of domestic and international markets. It should follow national policies such as the Belt and Road Initiative, dual circulation, and new infrastructure, and actively develop and promote the deep integration of the domestic markets and international markets.

Third, policy support. The government should actively provide guidance and services, establish comprehensive service institutions, cultivate industrial collaboration and innovation subjects, create a favorable business environment, and lay a solid foundation for the incubation and innovation of enterprises. (a) It shall build an industrial collaboration and innovation platform, and establish effective connections between R&D institutions and the technology transfer service institutions of the enterprises to accelerate the commercialization of R&D achievements; (b) It shall establish an information consulting center to promote information sharing in the Greater Bay Area, and build a batch of learning-oriented enterprises and develop new intelligent products online and offline by keeping abreast with the updated technologies in the industry; (c) It shall attract excellent financial venture capital institutions at home and abroad to participate in the investment and construction of the area by leveraging investment promotion platforms and scientific and technological innovation capabilities in the supply chains. A strong human resources intermediary service system shall also be established to appropriately and rapidly match the talents with the posts provided in the Greater Bay Area and make timely adjustments, match the talents with the most suitable positions, and assist innovative enterprises in selecting business partners and efficient teams; (d) At the same time, it shall further improve and optimize such supporting services as legal consulting,finance, taxation, and others, and protect intellectual property rights. Every enterprise,platform, employee, and even everyone living in the Greater Bay Area engaging in every node of the technological information platforms, business network systems, and intelligent manufacturing supply chains should make every effort to accumulate and nurture innovation elements and promote the interactions, gatherings, and sharing of such innovation elements. In this way, all links of research, industry, finance, and innovation will be integrated, which will improve the innovation efficiency and capability of each region, and drive the high-quality economic development of the Greater Bay Area.