Corporate governance in generating companies of the Russian electric power industry in the context of ESG agenda

2022-11-04GalinaSheveleva

Galina I.Sheveleva

Melentiev Energy Systems Institute of Siberian Branch of the Russian Academy of Sciences,130 Lermontov St.,Irkutsk 664033,Russia

Abstract: To address the issues of investment appeal in the Russian electric power industry,this study analyzes the dynamics of corporate governance,including permanent redistribution of property and compliance with the Russian Corporate Governance Code,in wholesale and territorial-generating companies.The increasing concentration of property in the hands of the state and its implications for investors are also noted.This study reveals the violations of essential principles,and the substantial differences in corporate governance practices,in the best-and worst-performing companies.Additional standards for better corporate governance practices to benefit the investors in the context of the current Environmental,Social,and corporate Governance (ESG) agenda are proposed.This study provides a new insight at the development of corporate governance in Russian power generating companies through property redistribution and compliance with corporate governance principles.

Keywords: Corporate governance,Russian power generating companies,ESG agenda.

Nomenclature

AFEP-Association française des entreprises privées

ATS-Administrator of Trading System of Wholesale

Electricity and Capacity Market

CHPP-Combined Heat and Power plant

CJSC-Closed Joint-Stock Company

ES-Energy System

ESG-Environmental,Social,and corporate Governance

FEMC-Far Eastern Management Company

FGC UES-Federal Grid Company Unified Energy System(electrical networks with voltages above 220 kV)

GEO-General Manager

G-factors-Corporate governance factors

GRI-Global Reporting Initiative Standards

HCGE-High Committee on Corporate Governance

IDGC-Interregional Distribution Grid Companies(electrical networks with voltage below 220 kV)

JSC-Joint-Stock Company

LLC-Limited Liability Company

MEDEF-Mouvement des entreprises de France

OJSC-Open Joint-Stock Company

PJSC-Public Joint-Stock Company

RAO UES of Russia-Russian Joint Stock Company

Unified Energy System

SO-System Operator (UES Dispatching Unit)

TGC-Territorial Generating Company

TCFD-Recommendations of the Task Force on Climaterelated Financial Disclosures

WGC-Wholesale Generating Company

0 Introduction

Private stock market investments are relevant for the development of the Russian electric power industry.This is largely because of the increasing popularity of stock markets among young investors.They seek to form a diversified investment portfolio of several dozen securities,thereby imposing higher standards on joint stock companies to ensure efficient use of the funds raised.The most popular method of potential investment screening is to evaluate corporate governance compliance with the standards of the current ESG agenda.A key role in this agenda is likely to be played by corporate governance (component G),whose implementation primarily depends on compliance with the other components (E and S).

This study aims to identify new strategies for the development of corporate governance in wholesale and territorial generating companies (WGC and TGC) in the electric power industry (hereafter referred to as generating companies) under the current ESG agenda.This study was conducted during the initial stage of the new scientific project.Therefore,a large amount of analytical material,including the analysis of the data from developing countries facing similar issues,are taken into consideration.

The main objectives of the study are:

· To identify “bottlenecks” faced by generating companies to comply with the standards of the world’s best practices of corporate governance.

· To identify those responsible for non-compliance in the management structure and the degree of interest of generating companies in the observance of these standards.

· To propose updated corporate governance standards in the context of modern ESG agenda.

· To formulate the priority areas for development including the restructuring of corporate governance bodies responsible for its effectiveness,given the ownershipspecific characteristics.

The G-factors were recommended by the Bank of Russia.They were primarily related to the ownership structure and the principles of the Russian Corporate Governance Code (hereafter the Code),based on basic international principles and its observance[1-2].

The implementation of the principles of the Code was analyzed using the methodology recommended by the Bank of Russia to domestic companies for reports “On Compliance with the Principles and Recommendations of the Corporate Governance Code” (Letter of the Bank of Russia No.IN-06-52/8 of 17.02.2016)[3].Generating companies that published such reports were studied.The analysis followed the criteria for assessing compliance with the principles of the Code (Code criteria).

The data used were obtained from the official websites of generating companies,the information agency Bigpower News,the Unified State Register of Legal Entities,Bank of Russia,Russian Union of Industrialists and Entrepreneurs,National Council on Corporate Governance,corporate governance of advanced domestic companies,Russian Institute of Directors,corporate governance code of listed companies in AFEP-MEDEF (France),research findings,and other information sources.

Ownership structures and adoption of international corporate governance principles are equally problematic in Russia and developing countries,characterized by their relatively weak institutional environment.The negative impact of high ownership concentration and inappropriate behavior of board members are evident in various developing countries.However,when the principles of best corporate practices are followed,the company’s value and other performance aspects will increase[4-5].The structure of the board of directors affects the performance of companies differently.Gender diversity has a mixed effect on company value.As this effects increases[6],gender diversity negatively correlates with company value[7-8].However,there is a positive but relatively weak relationship between gender diversity and company value[9].The effectiveness of female executive directors are notable[9-10].Overall,positive impacts of gender diversity on directorial boards were assessed.As legal and regulatory violations decrease,monitoring is strengthened thereby,risk decline[11-12].Moreover,corporate frauds,including that in related-party transactions,decreases[13-14].The importance of the number of female directors is also analyzed[15].Independent directors show low performances because of their high dependence on large business owners[16-19].There are a few studies which deal with strengthening of board decision-making frameworks[20-21]and internal governance mechanisms[22].

This study identifies the factors affecting corporate governance and analyzes the dynamics of permanent ownership redistribution in generating companies after the liquidation of Russia’s RAO UES (2009),relative to its current structure (2020).Ownership of these companies are highly concentrated in the hands of the major shareholders:the state,private Russian owners,and foreign owners.Compliance of the generating companies with the 2019-2020 Code criteria recommended by the Bank of Russia,was evaluated.The study identified the criteria in which the companies are least compliant,and the persons responsible for it (from the board of directors).Unsatisfactory performance of the board of directors with respect to corporate governance compliance is also addressed.A formalist approach to the compliance with international “soft law” is further noted.To reduce the knowledge gap in these areas,this study proposes the additional criteria,from the Corporate Governance Code and the current ESG agenda,that were not previously included in the methodology provided by the Bank of Russia.The possible improvements in corporate governance are presented differently,with proposed structural optimization of the board of directors based on data from their regular and informal evaluations.

1 Corporate governance factors

The corporate governance factors in the ESG agenda are summarized in this section.The G-factors recommended by the Bank of Russia are as follows[23-24]:

· Capital structure and existence of a controlling person.

· Arrangements and practices of general shareholder meetings.

· Ensuring the rights of shareholders

· Structure and composition of management bodies and their work.

· Remuneration system of management bodies regarding its balance.

· Organization of risk management,internal control,and internal audit.

· Organization of information disclosure.

· Procedures for managing conflicts of interest.

· Mechanisms and measures to combat corruption and fraud.

· Practice of following the principles and recommendations specified in the Corporate Governance Code.

The above listed G-factors are not new to the Russian companies.In essence,they indicate the ownership structure,corporate governance principles in the Code,and practices of compliance with them.

The corporate governance principles were developed based on international best practices by considering the domestic features (2014).The European Bank for Reconstruction and Development,the Organization for Economic Cooperation and Development,the Moscow Exchange,the Federal Property Management Agency,the Ministry of Economic Development of Russia,and Russian and international companies providing corporate governance services participated in the development of these principles.The principles of the Code recommended by the Bank of Russia for reports on compliance with the principles and recommendations of the corporate governance code are listed below[3].

· All shareholders should have an equal and fair opportunity to participate in the company’s management and profits (efficient and reliable consideration of their rights to shares).

· The board of directors should perform effectively(professionalism,efficiency,and accountability to shareholders).

· There should be efficient interaction between the corporate secretary and shareholders.The secretary’s actions should be coordinated,to protect the rights and interests of both parties.

· There should be a policy for the remuneration of key executives,which will ensure the attraction,motivation,retention,and similarity in long-term financial interests among the shareholders.

· There should be an efficient risk management and internal control system.

· The relevance,completeness,and reliability of the disclosed information must be provided.The principles of non-burdensomeness and equal access for shareholders to this information are to be observed.

· The rights and interests of shareholders should be observed in the significant corporate actions.

2 Redistribution of property

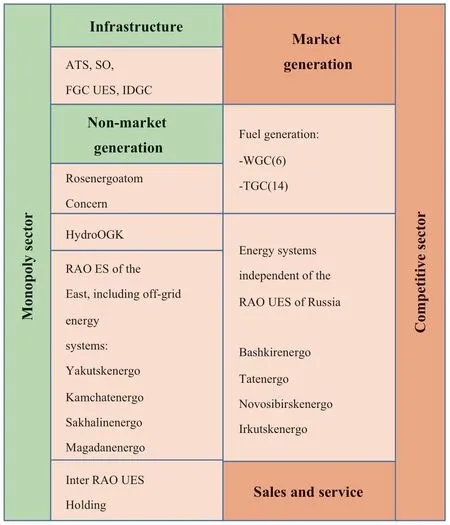

Restructuring of the Russian electric power industry led to the liquidation of Russia’s RAO UES (2008).The power generation assets of the thermal power industry were privatized with the establishment of large wholesale and territorial generation companies.Six WGCs and 14 TGCs were founded based on the extra-territorial principle and the territorial principle,respectively.Monopoly sectors (power transmission,distribution,and operational supervisory control) were separated from the potentially competitive sectors (power generation,sales,repair,and maintenance).The structure of the Russian electric power industry after the liquidation of the RAO UES is shown in Fig.1.

According to Fig.1,the state still controls the monopoly sectors and some strategically important generation assets:hydro and nuclear power,RAO Energy Systems of East OJSC,and Inter-RAO UES Holding OJSC.

Fig.1 Structure of the electric power industry

Competitive sectors were taken over by private owners.Bashkirenergo OJSC,Novosibirskenergo OJSC,Tatenergo OJSC and Irkutskenergo OJSC,which were not owned by RAO UES of Russia and recognized as not reformed,changed their ownership as well.

After the liquidation of the RAO UES of Russia,some of the generation assets in the competitive sectors in the Russian power industry (WGC-1 OJSC,TGC-1 OJSC,WGC-5 OJSC,TGC-3 OJSC,WGC-6 OJSC,and TGC-14 OJSC) were privatized by state companies (RusHydro PJSC,FGC UES OJSC,Russian Railways OJSC,and Gazprom OJSC).These data are taken from the 2009 annual reports of the above companies.Major foreign owners of Russian-generating companies are: German E.ON (WGC-4 OJSC),Italian Enel (WGC-5 OJSC),and Finnish Fortum(TGC-10 OJSC) The first offshore foreign companies were: Jamica Limited (TGC-6 OJSC),Integrated Energy Systems Limited (TGK-5 OJSC,TGK-6 OJSC,and TGK-7 OJSC),and Primagate Trading Limited (TGC-6 OJSC).A significant proportion of generation assets in the Russian power industry (WGC-3 OJSC,TGC-2 OJSC,TGC-4 OJSC,TGC-5 OJSC,TGC-6 OJSC,TGC-7 OJSC,TGC-8 OJSC,TGC-9 OJSC,TGC-12 OJSC,and TGC-13 OJSC)were taken over by Russian private owners.

The new structure of the main shareholders of Russiangenerating companies at the end of 2020 is shown below.These data correspond to the information from the 2020 annual reports of the above companies and the quarterly reports of RusHydro PJSC and Fortum PJSC for Q2 2021[29-30].

The number of TGCs and WGCs decreased after liquidation of the RAO UES of Russia.This consolidation was caused by the acquisition of the generation assets of WGC-1 OJSC,WGC-3 OJSC,and TGC-11 JSC by Inter-RAO UES PJSC,and the merger with Bashkirenergo OJSC.The TGC-12 OJSC and TGC-13 OJSC were merged into the Siberian Generating Company Group.The TGC-5 OJSC,TGC-6 OJSC,and TGC-9 OJSC were merged into TGC-7 OJSC (Volzhskaya TGC) and then renamed as T Plus PJSC (2015).The WGC-6 OJSC was undertaken by the Gazprom Energoholding LLC.

As a result of the permanent redistribution of property,the state increased its share of ownership in the generation assets of the Russian electric power industry.First,it was done by merging the above-mentioned generation assets with state-owned companies Inter RAO UES PJSC and Gazprom Energoholding LLC,and finally,by increasing the share of state participation in the shareholder equity of individual generating companies.

Foreign owners increased their shares in the generating companies.Towards the end of 2020,Unipro PJSC had up to 83.7% shares while Fortum PJSC had up to 98.3%shares.

Private Russian entrepreneurs also increased their ownership concentration in generating companies.V.Alekperov (LUKOIL PJSC) received the full generation assets of the Southern Generation Company,TGC-8 OJSC.A.Melnichenko merged Kuzbassenergo JSC (former TGC-12 JSC) and Yenisei TGC (former JSC TGC-13 OJSC) into the Siberian Generating Company.V.Vekselberg established a new generating company,T Plus PJSC,by combining the assets of TGC-5 OJSC,TGC-6 OJSC,TGC-7 OJSC,and TGC-9 OJSC.L.Lebedev (TGC-2 OJSC) and M.Prokhorov (Quadra PJSC) increased the shares through the structures affiliated and controlled by them.The structures affiliated with L.Lebedev,namely KORES INVEST LLC,Janan Holdings Limited,Raltaka Enterprises Ltd.,Litim Trading Limited,and Debt Agency LLC,were the main shareholders of TGC-2 OJSC (59.8 % of the shares of these companies were transferred to the trust management of SOVLINK LLC in 2020).M.Prokhorov controlled the main shareholders of Quadra PJSC-Group ONEXIM LLC and BusinessINFORM LLC.

The unreformed companies Irkutskenergo OJSC and Novosibirskenergo OJSC were taken over by private Russian entrepreneurs.The Irkutskenergo OJSC was acquired by O.Deripaska (EuroSibEnergo OJSC).Novosibirskenergo OJSC was taken over by M.Abyzov(RU-COM Group),and later by A.Melnichenko (Siberian Generating Company).Tatenergo OJSC is now owned by the Republic of Tatarstan.A new generating company,TGC-16 OJSC,privately owned by TAIF Group,was established with the generation assets of Kazan CHPP-3 and Nizhnekamsk CHPP,which were acquired from Tatenergo JSC.

The redistribution of ownership among Russiangenerating companies is ongoing.According to Big Electric Power News,M.Prokhorov’s ONEXIM Group sold 82.47%of Quadra’s shares to Rusatom Infrastructure Solutions JSC(a division of Rosatom State Corporation) in December 2021.Finland's Fortum intends to buy Unipro PJSC[31].The main shareholders of TGC-14 PJSC,(Energosbyt,(controlled by Russian Railways OJSC: 39.8%),the units of the non-state pension fund Blagosostoyanie(RWM Capital Management Company CJSC: 24.5%,and Trinfiko Management Company CJSC: 23.0%) sold their shares to the Far Eastern Management Company.As a result,the stake of this Management company in the shareholder equity,including transactions with other shareholders of TGC-14 PJSC,exceeded 92.2%,[32].The Far Eastern Management Company JSC is affiliated with D.Pumpyansky’s Sinara Group.This group deals with mechanical engineering,development,financial assets,agricultural and energy businesses,and is a major supplier to the Russian Railways[33].According to a Big Electric Power News report,Inter RAO UES PJSC has plans to buy new generation assets including coal-fired power plants.The German energy company Uniper continues to sell Unipro’s electricity generation assets in Russia.

continue

With permanent redistribution of ownership,the state had the largest increase in the shares of installed electric capacity in wholesale and territorial-generating companies.In 2019,it increased to 63.9%.Whereas,the shares of foreign and private owners decreased to 22.5% and 13.6%of the total shares,respectively[27].Further redistribution of ownership could increase the state-owned installed electric capacity of WGCs and TGCs to 70%.In that case,the state ownership in the Russian electric power sector will surpass the pre-reform level.

The ownership structure of generating companies largely determines and affects their corporate governance practices and compliance with the code criteria.

3 Practice of adopting the principles and recommendations of the Code

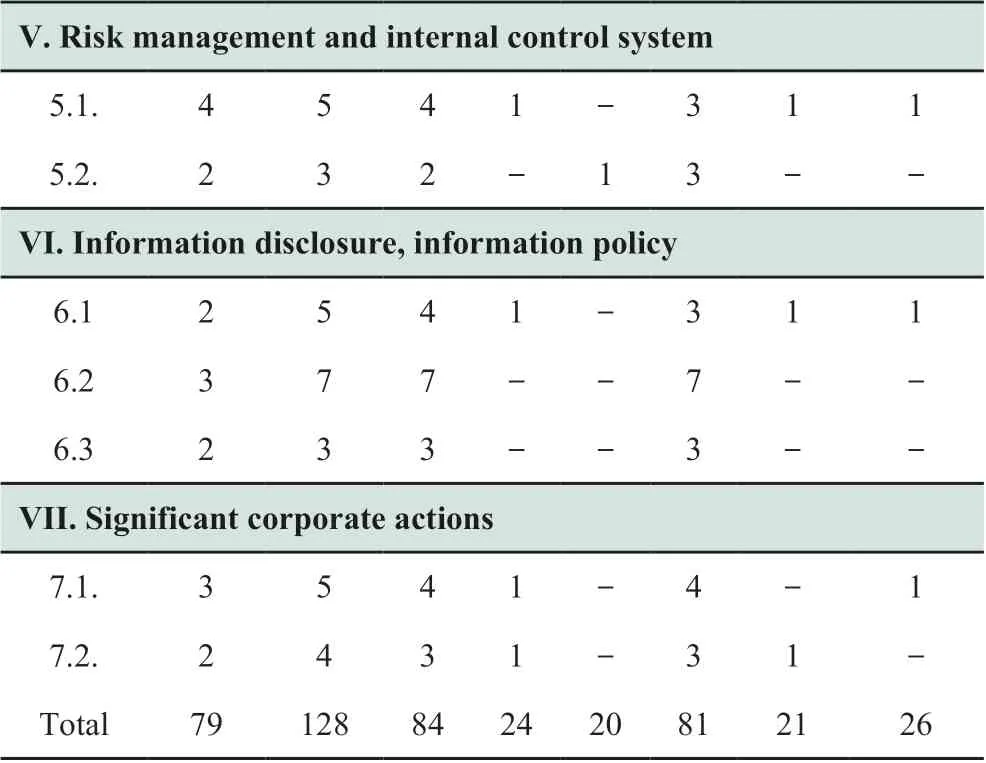

The practice of adopting the principles and recommendations of the Code in generating companies was investigated using data from the corresponding reports,over the period 2016-2020.They are available on the official websites and annual reports of these companies.Generating companies with shares admitted to organized trading were considered.The principles of the Code are presented in Table 1.

The 7 sections in the table contain 24 additional subsections with 79 principles numbered in three-digits(“1.1.1.” or “1.2.3.,” etc.),and 128 criteria for evaluating compliance with these principles,as recommended by the Bank of Russia.Each of the criterion has its own compliance status,namely: “complied with,” “partially complied with,” and “not complied with.”

3.1 Compliance with the Code criteria

An analysis of the compliance of corporate governance practices in generating companies was performed using the code criteria[34-51].The analysis results over fhe period 2019-2020 were obtained for each generating company included in the study.The analysis of Unipro PJSC is detailed in Table 1 as an example.

Table 1 Compliance of Unipro PJSC with the code criteria

The total number of Code criteria “complied with,”“partially complied with,” and “not complied with” by generating companies (as a percentage) are shown in Fig.2.

According to Fig.2,over the period of 2019-2020,there are significant differences among the generating companies in meeting the Code criteria.In 2019,the Russian companies with state participation-Inter RAO PJSC,and RusHydro PJSC,-and the Italian Enel Russia PJSC,and the German Unipro PJSC showed the highest compliance.They observed 96.9%,96.1%,and 93.8%,79.7% of the 128 Code criteria,respectively.Privately owned TGC-2 PJSC and Quadra PJSC closed this list,complying with 62.5% and 59.4% of the Code criteria,respectively.When considering the “not observed” compliance status,Quadra PJSC performed poorly.

Fig.2 Generating companies’ compliance with the Code criteria (%)

In 2020,Enel Russia PJSC,Inter RAO PJSC,RusHydro PJSC,and Unipro PJSC retained their high percentages of compliance with the Code criteria-96.9%,95.3%,95.3%,and 82.0%,respectively.The undeniably worst-scoring companies in terms of their compliance status were still TGC-2 PJSC (26.6%) and Quadra PJSC (24.2%).

In 2020,generating companies demonstrated varied changes (both decrease and increase) in their compliance with the Code criteria,relative to 2019.These changes were characteristic to both the best-and worst-scoring companies.Enel Russia PJSC,Unipro PJSC,and Quadra PJSC increased the number of Code criteria that they “complied with” while decreasing the “partially complied with”criteria.However,Enel Russia PJSC reduced the number of criteria “not complied with,” while their number slightly increased in Unipro PJSC and Quadra PJSC.The TGC-2 PJSC showed a relatively worse compliance percentage in 2020,when compared with its performance in 2019 and the other generating companies.In TGC-2 PJSC,the number of the Code criteria that were “complied with” and “partially complied with” decreased by 13.3% and 0.8%,respectively.Whereas,the criteria that were “not complied with”increased by 7.2%

The criteria in Sections I,II,III,and VIII of the Code were found to be the least fulfilled by the generating companies,in the period 2019-2020.These criteria concern virtually all sections in the Code.

If the generating company fails to follow any of the Code’s recommendations,an explanation must be provided (“comply or explain”).“Comply or explain” is an element or norm in the so-called international “soft law,”recommended for countries with relatively weak legal and regulatory frameworks[2].

3.2 Compliance with international “soft law”

Explanations of a company’s corporate governance strategy must be clear,relevant,thorough,and justified.They should correspond to the specific situation in which it functions.These explanations must include convincing evidence to justify deviations from the prescribed norms.The actions required to meet the relevant Code criteria and the possible alternative actions of the company should be described.If a company plans to adopt a particular recommendation of the Code in the future despite a temporary deviation,the time required for possible compliance should be clearly stated[52].However,the aim of these stipulations is not to make the companies mandatorily fulfill the Code criteria under threat of delisting but to oblige them to give public notice on the reasons for such non-compliance[53].Listed Russian companies are required to include such explanations in their reports on“Compliance with the Principles and Recommendations of the Corporate Governance Code”.

An analysis of generating companies’ compliance with the “soft law” in the year 2019 was conducted.Explanations for their non-compliance with the Code criteria were considered.A formalist approach was also evaluated.The explanations still lack the following points recommended by the Bank of Russia:

· A description of the circumstances and reasons for not following the Code

· A convincing and comprehensible analysis of the specific reasons for non-compliance with the Code

· A planned timeline for bringing the corporate governance practices into compliance with the Code criteria.

Below are some examples of the most common and revealing explanations for non-compliance with the Code criteria.They satisfy the formalist approach to compliance with the “soft law.” These explanations can be divided into two categories.

The first category includes “not foreseen,not conducted,not considered,not defined,not applicable,etc.”

The second category includes “the company plans to consider the inclusion,conduct,apply,etc.,” without specifying the time of execution.

Examples of such explanations for noncompliance with principles 7.1.1.,7.1.2.,7.2.2,which falls under “Significant Corporate Actions” (Section VII) of the Code are given below.

7.1.1.: The list of transactions or other actions related to significant corporate procedures,and the criteria for their determination,is “undefined.”

7.1.2.: There is “no” procedure for independent directors to declare their position,prior to the approval of significant corporate procedures.

7.2.2.: The “company plans” to consider the possibility of including an extended list of grounds,according to which the members of the Board of Directors and other persons stipulated by law are referred to those interested in its transactions,in the internal documents.

No less formal were the explanations provided for noncompliance with the principles of Section VI of the Code(information disclosure and information policy).

Some of the examples provided are “...the information policy was approved before the development of the Code and does not take into account the recommendations introduced,” “...the information policy was developed and approved,however,in the reporting period,issues related to its observance were not considered due to compliance with the company’s internal documents.” However,an additional analysis of the internal documents of generating companies that gave such explanations shows that these companies did not update their “Regulations on Information Policy.” In particular,the information policy was approved by Quadra PJSC (2006),TGC-2 PJSC (2006),TGC-1 PJSC (2008),and WGC-2 PJSC (2009),long before the adoption of the Code (2014).

Example of a formalist explanation for failure to meet the principles 2.4.3.and 2.5.1.in the Code,under “Board of Directors” (Section II) is given below.

“...There is no objective possibility of influencing the election of the board of directors.” In fact,the formation of the board of directors and the appointment of its chairman take place based on the recommendation from the main shareholders.In particular,89% of the members in the board of directors in Quadra PJSC was elected based on the recommendations of M.Prokhorov.

A change in the existing practice of this company can be expected only if there is a change in the shareholder equity structure or in the main shareholder’s approach to the formation of the board of directors.

The formalist approach to the compliance with the code criteria is,to a certain extent,a characteristic of stateowned companies.Following the results in 2019,RusHydro PJSC reported on compliance with the code criteria.However,regarding the violation of these requirements,85% of the members in the board of directors were found to be affiliated with the state.Chekunkov A.O.declared that an independent director was associated with the main shareholder,the state[54].

France established the HCGE,in the field of compliance with the norms of international “soft law”.The main objective of this committee is to oversee the implementation of the recommendations of the Corporate Governance Code,including the monitoring of companies’ reports on its compliance.The HCGE has no punitive or judicial powers.The existence of the HCGE and its constant monitoring are effective tools for preventing violations of the principles stipulated in the Code[52].

The generating companies' failure to meet the Code criteria and their formal explanations,at the very least,indicated the failure of the board of directors in fulfilling their basic responsibilities.After all,the board of directors should

· guarantee the rights and equal conditions of shareholders;

· ensure the update of internal documents;

· determine the company’s policy on remuneration through control over its implementation,while making necessary adjustments to it;

· determine the approaches and principles for organizing the risk management and internal control system,and manage the performance and compliance of the current system with these principles;

· ensure the development and observance of the information policy;the timeliness,transparency,and completeness of the disclosed information;its equal accessibility,and ease for shareholders;

· monitor corporate governance practices and play an important role in significant corporate actions.

The non-fulfillment of their duties by the board of directors may be owing to the ownership structure.It has little effect on the duties of board members;however,it does affect their ability to fulfill them.From a legal standpoint,every shareholder of the generating company is an owner.However real power belongs to the main shareholders.There is an actual parity of power between the owners of the controlling block and top management.

In this regard,the opinion of the organizer and head of the Russian Institute of Directors (I.Belikov) is authoritative.He has extensive experience in working on the board of directors of more than 20 foreign and Russian companies of various statuses (public and non-public) and capital structures (private and with state participation).According to I.Belikov,controlling shareholders strive to maintain the full control over their companies in the face of significant non-market risks and relatively weak legal and judicial protection.They work closely with top management to influence strategy development and decision-making.Controlling shareholders independently appoint and dismiss general directors,and often top managers.They set key objectives for them and determine the forms and amounts of remuneration.Boards of directors are formal participants in these relations and often just observers[55].

4 Development of corporate governance

The development of corporate governance in generating companies is most likely managed by ESG agenda.ESG factors are seen as effective tools in managing non-financial risks,to achieve long-term competitive advantages for companies[56].

Corporate Governance Codes in various countries have been updated to better articulate the corporate governance objectives in the context of ESG agenda.The revisions were newly adopted by the UK,Italy,Austria,Denmark,and Mexico in 2018;by Germany,Belgium,and Saudi Arabia in 2019;and by France in 2020.The key emphasis of these revisions were primarily focused on improving the mechanisms of interaction between the boards of directors and shareholders,achieving gender equality on boards,strengthening oversight over the adopted remuneration policy of top management,and environmental and social aspects[57].

The Bank of Russia developed an updated methodology to formulate the reports on “Compliance with the Principles and Recommendations of the Corporate Governance Code” (Letter of the Bank of Russia No.IN-06-28/102 of 27.12.2021)[58].The analysis of the proposed Code criteria and their comparison with the previous version of the Code revealed the following changes:

· The criteria are more clearly stated.

· The wording is expanded.

· Criteria are redistributed.

· New criteria are introduced,including those in the context of the ESG agenda.

In particular,the new Code criteria in the context of the ESG agenda are as follows:

6.1.1.: Consideration of the effectiveness of information interaction with the persons concerned by the board and the revision of the company's information policy.

5.2.2.: Evaluation of corporate governance practices,including stakeholder interaction procedures.

6.2.2.: Availability of a non-financial report containing information about ESG factors.

Based on the results of the research conducted on the implementation of ESG principles in the corporate governance of advanced domestic companies[59],the following criteria were proposed to evaluate the compliance[27]:

· The ESG system is built into the overall corporate governance system.

· The ESG policy is designed,its goals and objectives are formulated,and the main principles of the company’s activities in the ESG field are developed based on the opinions of a wide range of stakeholders.

· The powers of the ESG committee established under the board of directors are identified.They include the consideration and coordination of ESG agenda issues,interaction with management and external stakeholders on these issues,and control over the company’s work in the ESG field.

· ESG issues are regularly addressed at meetings of the board of directors.

· ESG information is disclosed in accordance with international reporting standards,GRI.

· The reliability of ESG information is verified by an independent auditor.

· ESG-KPIs are developed and tied to the remuneration of the company’s top management.

· ESG issues are included in the risk management system.

· Update of the company’s internal documents is in line with the ESG agenda.

The proposed criteria for evaluating the companies’compliance with ESG principles are very similar to the Bank of Russia’s recommendations for boards of directors with respect to ESG factors.The Bank of Russia developed recommendations for ESG factor disclosures based on the international standards of TCFD and GRI.These recommendations were produced as a methodological resource for companies interested in disclosing information about ESG factors.They pay special attention to non-financial information and the principles of its disclosure[24].

New approaches to establish boards of directors in generating companies is necessary.A top-of-the-agenda in the context of ESG-driven development is to optimize and improve the performance of boards.In this regard,the introduction of widespread evaluation of board of directors in corporate practices is considered.According to Leblanc and Gillies,everyone who contemplates becoming board members and company directors should accept that the evaluation of their performance will necessarily be held on a regular basis;the time when the board members and board reported to no one,is coming to an end[21].Such an evaluation is important for the sustainable long-term development of companies and the increase in shareholder value[60].With a formalized procedure for the regular evaluation of board of directors,one can strengthen the confidence of investors and other stakeholders in generating companies.Evaluation should not be a mere formality.Its results must be considered when establishing the future board of directors,formulating their development programs,and when updating internal documents.

The evaluation of boards of directors is a relatively new tool and has not become widespread among Russian companies.The Bank of Russia has developed recommendations for the annual self-evaluation of the performance of boards of directors.Self-evaluation is necessary to build a well-balanced structure of the board of directors and to determine their ability to make independent judgments and motivated decisions.The Bank of Russia recommended that several aspects of board self-evaluation should be considered,including:

· Organizational and structural aspects (composition and structure,competencies,distribution,and delegation of authority within the board of directors).

· Functional aspects (the proper performance of the board and its individual members,procedures,and practices for addressing significant issues).

· Behavioral aspects (personal and behavioral qualities of board members,including cooperation,complex problemsolving skills,ability to adapt to changing conditions,and openness to new suggestions)[61].

A preliminary list of questions was created to survey the board members on each of these aspects.

The competencies and behavioral characteristics of the board members of generating companies are particularly relevant for further research in this area.Personal and behavioral qualities,including cooperation,complex problem-solving skills,and the ability to adapt to changing conditions,were never assessed.In this regard,Canadian scholars R.Leblanc and J.Gillies developed an interesting approach to evaluate the performance of board members.In their view,competence,behavioral traits,and compatibility of board members are key in this evaluation.They reached this conclusion based on the data collected over a five-year period by observing in-person board meetings of private companies,public enterprises,and nonprofit organizations.Board members were classified according to behavioral characteristics,and the interactions between groups with different sets of characteristics were analyzed.The professional and personal characteristics of the board members that lead to better performance,were identified.

The positive dynamics of corporate governance development framework in the context of the ESG agenda at Unipro PJSC,Enel Russia PJSC,Inter Rao PJSC,and RusHydro PJSC was analyzed.Most of the internal documents were updated between 2020-2021.New documents were developed,including the Regulations on Assessment of Performance of the Board of Directors and its Committees (RusHydro PJSC),Sustainable Development Policy and Compliance Policy (Inter RAO PJSC),Global Compliance Program (Enel Russia PJSC),Sustainable Development Policy (Inter RAO PJSC),and Compliancerelated Policy (Unipro PJSC).Unipro PJSC started the implementation of UN Global Compact Principles in 2008.The company published and submitted its sustainable development report voluntarily to the National Register of Corporate Non-Financial Reports[62].

5 Conclusion

This study indicates a permanent redistribution of ownership in Russian-generating companies after the liquidation of the RAO UES and a further increase in the ownership concentration of such companies.The increase in ownership concentration diminished the role of board of directors and led to a formalist attitude toward compliance with the Code criteria.Many of these companies continue to treat corporate governance practices as a burden to ensure their publicity,rather than as a possibility to capital-raising opportunities and long-term development.

There is a positive trend in the development of corporate governance in the context of Russia’s ESG agenda.The study has shown new recommendations from the Bank of Russia on the disclosure of non-financial information,the consideration of ESG factors by the board of directors,and the reports on “Compliance with the Principles and Recommendations of the Corporate Governance Code.” The leading generating companies have updated their internal documents by developing new ones.

The new recommendations of the Bank of Russia and the proposed criteria for assessing companies’ compliance with ESG principles can strengthen the internal management mechanisms to compensate for the inefficiency of law enforcement in the country and thereby ensure investors’confidence and security.The widespread introduction of board evaluations and the non-formalist approach to such implementations in corporate practices are necessary for board of directors to function properly.Most importantly,this balance is required in terms of competencies and behavioral traits that are crucial in making effective decisions.

Acknowledgements

This research was conducted under the State Assignment Project (No.FWEU-2021-0001) of the Fundamental Research Program of the Russian Federation 2021-2030.

The author thanks the anonymous reviewers for their valuable comments that helped improve the manuscript.

Declaration of competing interests

We declare that we have no conflict of interest.

杂志排行

Global Energy Interconnection的其它文章

- Optimal dispatching method for integrated energy system based on robust economic model predictive control considering source-load power interval prediction

- Synergies of carbon neutrality,air pollution control,and health improvement—a case study of China Energy Interconnection scenario

- Caspian Energy Ring: Prospective vision

- Medium-term scheduling of operating states in electric power systems

- The scoping study of Kazakhstan-China-Republic of Korea power interconnection

- Reliability and sensitivity analysis of loop-designed security and stability control system in interconnected power systems