Chinese Economy:Growing Under Pressure

2022-06-22ByQiuHui

By Qiu Hui

China’s GDP grew steadily by 4.8 percent year on year in the first quarter of 2022 despite numerous challenges

Oceanic container ships docked at Shanghai Port,February 2,2022.(VCG)

Macroeconomic statistics from China’s National Bureau of Statistics (NBS)released on April 18 showed that the country’s economy continued to recover in the first quarter and that the operation of the economy was generally stable.

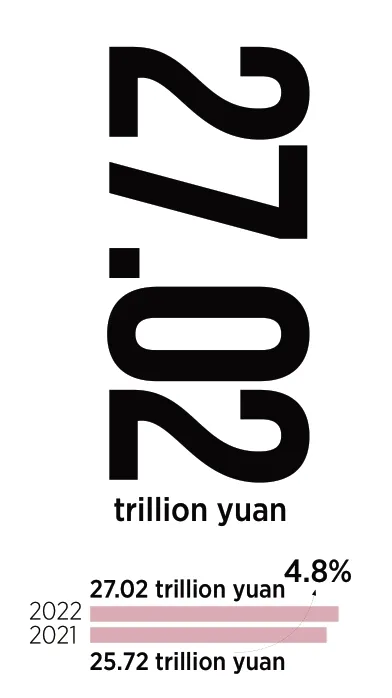

According to preliminary calculations,China’s GDP in the first quarter reached 27.02 trillion yuan (US$4.15 trillion).Calculated at constant prices,it grew by 4.8 percent over the first quarter of 2021 and 1.3 percent over the fourth quarter of 2021.NBS spokesperson Fu Linghui said at a press conference of the State Council Information Office (SCIO) that China’s economy continued to recover and develop in the first quarter,operating within a reasonable range in general.Fu also stressed that it should be recognized that the increasingly complex and uncertain environment at home and abroad has led to many difficulties and challenges for economic development.

“In general,our country can effectively respond to various risks and challenges thanks to a complete industrial system,super large-scale markets,dividends of reform and opening-up,and strong economic governance capacity,”said Fu.“From a full-year perspective,our economy is expected to maintain momentum of recovery and development.”

Negative Growth of Consumption

In March,sporadic COVID-19 outbreaks occurred in many parts of China,which had a negative impact on travel and consumption by residents.Specifically,total retail sales of automobiles fell by 7.5 percent,catering by 16.4 percent,and gold,silver,and jewelry by 17.9 percent year on year.

Pan Helin,co-director and researcher at the Digital Economy and Financial Innovation Research Center of Zhejiang University’s International Union Business School,said that because of lockdowns,the current overall consumer market is weak.The pandemic is having an impact on domestic demand from both ends of the chain.

“On the demand side,people are traveling less because of the lockdowns,lowering desire for consumption and need for non-essential goods,”said Pan.“On the supply side,the supply chain gets interrupted in lockdown areas with Shanghai at the core,which has inevitably affected the growth of demand.The future recovery of the consumer market depends on the control of the pandemic.”

Xu Hongcai,deputy director of economic policy at the China Association of Policy Science,is optimistic about economic recovery.In his view,despite negative factors affecting global demand,China has maintained a strong momentum in both domestic and external demand.Still,the Chinese government has taken necessary measures“to maintain stable growth and ensure employment.”Xu predicted that if the COVID-19 pandemic comes under effective control in the near future,the economy will gradually regain higher ground,and the annual GDP growth target of 5.5 percent will be achieved.

According to preliminary calculations,China’s GDP in the first quarter reached27.02 trillion yuan(US$4.15 trillion).Calculated at constant prices,it grew by4.8 percentover the first quarter of 2021 and 1.3 percentover the fourth quarter of 2021.

In March,sporadic COVID-19 outbreaks occurred in many parts of China,which had a negative impact on travel and consumption by residents.Specifically,total retail sales of automobiles fell by7.5 percent,catering by16.4 percent,and gold,silver,and jewelry by17.9 percentyear on year.

Other experts in the industry believe that the continuing uncertainty with the COVID-19 pandemic is increasing the downward pressure on the economy to the point that individual incomes are unlikely to grow,which will add more“barriers”to the growth of consumption.

On this matter,Fu Linghui said that when the pandemic gradually comes under control,relevant policies to ensure employment will be implemented and residents’consumption capacity will improve.The measures that the government has taken will be conducive to sustained consumption growth.For example,the government has actively promoted consumption of new energy vehicles,green and smart home appliances,and other consumer staples as well as integration of online and offline consumption,new business forms and models of consumption,and improvements in the rural consumer markets in terms of both quantity and quality.

Slower Industrial Growth

The resurgence of the pandemic in China brought production in many factories to a halt.Automobile production was severely affected.GAC,Dongfeng-Nissan,Xiaopeng,and other car manufacturers stopped production completely due to interruptions in the supply chain of parts.

Statistics show that in the first quarter of this year,the total value added of industrial enterprises above designated size grew by 6.5 percent year on year,and industrial production maintained rapid growth.However,in March,the total value added of industrial enterprises above designated size grew by only 5 percent year on year and 0.39 percent month on month.The slower growth made it more difficult for industrial production and operation.

The official microblog of China News Service cited Chen Shihua,deputy secretarygeneral of the China Association of Automobile Manufacturers and director of the China Automobile Industry Economic and Technical Information Research Institute,as predicting that in May,most Chinese car manufacturers would likely be forced to stop production.“The continued suspension of spare parts production in Shanghai,Jilin,and some other parts of the country will inevitably have a negative impact on China’s car industry,”he said.

“Cure the ‘disease’ before boosting economic growth is the best option,”said Pan Helin.When the pandemic is under effective control,implementation of supportive monetary and fiscal policies will boost the economy and enable enterprises to resume production quickly.He stressed that future economic development is closely related to the pandemic situation.When the pandemic is under control,lockdowns will no longer be necessary.Demand will naturally recover and the economy will resume robustly.

Downward Pressure on Real Estate

Statistics show that from January to March this year,China’s investment in real estate development was 2.78 trillion yuan (US$427.69 billion),up by 0.7 percent year on year.The growth rate fell by 3 percentage points from that in the first two months.

Yan Yuejin,research director of the Think Tank Center of the E-House Research Institute,thinks that the current growth rate of investment in real estate development is lower than 5 percent and closer to zero.The figure is a little too cold.The real estate market faced greater pressure in the first quarter,according to Yan,including delayed effects of some existing policies,weak confidence of housing enterprises and home buyers,and sporadic outbreaks of the pandemic.

Statistics show that the sales area of commercial housing from January to March was 310.46 million square meters,a drop of 13.8 percent year on year.Yan predicts this drop will continue into the foreseeable future.“Sales of commercial housing in March fell by more than 40 percent in many cities around the country,dragging down the data for the whole country,”he said.“The numbers evidence that the incentive policies from the fourth quarter of last year were not entirely effective.Market recovery is facing resistance.”

At the SCIO press conference,Fu Linghui said that easing of restrictions on the number of properties each resident is allowed to own and lowering of the threshold to use the housing provident fund will eventually help turn around falling commercial real estate sales.Improvement of the long-term real estate mechanism to meet residents’ demands for housing will also ease the downward trend in the sales of commercial housing.

Yan Yuejin suggested that in the second quarter,participants in the real estate market should actively promote recovery of the market by seeking to prevent pressure from unstable expectations caused by the excessively rapid decline in housing prices.