A Big Surge is Seen Once Again in Lithium and Cobalt Market

2022-05-19

1.The trend of raw material price

(1)Lithium

IThe price of lithium carbonate and lithium hydroxide has been ascending since mid-November,with divergent trends of growth shown.On December,15,spot price of SMM lithium carbonate was RMB 232000/ton,up by 18.1% on a MOM basis;spot price of lithium hydroxide was RMB 191000/ton,up by 2.4% on a MOM basis.Price of lithium carbonate is RMB 40000/ton higher than that of lithium hydroxide.

The big surge in the price of lithium carbonate is mainly the result of two reasons.Firstly,US House of Representatives approved Build Back Better bill on November,19th,which aims to improve NEV tax credits,in the hope of fully activating growth potential of US market.This bill also greatly boosted expectation for growth of demands from terminal consumption market,which drove a rapid surge in the price of lithium carbonate.Secondly,cathode material manufacturers whose capacity has been greatly expanded were making intensified efforts to stock up before the coming of Spring Festival,while the production of Qinghai salt lake was declining,which resulted in more obvious imbalance between supply and demand.

The comparative lagging-behind in the growth of lithium hydroxide is mainly owing to the concerns about the growth of ternary materials.For one thing,there is a sustained recovery in domestic lithium iron phosphate market,and the proportion of cumulative installed capacity of lithium iron phosphate exceeded that of cumulative installed capacity of ternary batteries.For another,in October,sales volume of NEV in Europe,the key market of ternary batteries,presented a MOM decrease of 18.7% and a YOY increase of just 26%;meanwhile,lithium iron phosphate is penetrating into European market with great efforts,and this has cast a cloud over the growth of ternary material.Due to the pressure of cost,lithium iron phosphate is probably going to play an overwhelming role for a long time in the future,until the solid ternary battery greatly improves its safety and energy density,and reduces its unit cost.

Look ahead,in the short run,the price of lithium is going to stay in rising trend,and the pattern of lithium carbonate outperforming lithium hydroxide will continue.Look into next year,the slowdown in the growth in Europe,the second largest terminal market,is creating hidden worries;especially given the fact that the base quota of this year is relatively high,the overall growth in global terminal market next year is likely to significantly slow down.Moreover,excessive high price of lithium will also lead to the rise in NEV cost and rapid increase in resource supply.It is estimated that lithium market will rise to high position and then ease back,but stay in relatively high position on the whole.

(2)Cobalt

The price of cobalt continues to rise since mid-November.On December,15th,the price of electrolytic cobalt was RMB 482500/ton,presenting a MOM increase of 16.7%;the price of cobalt sulfate was RMB 98500/ton,presenting a MOM increase of 7.1%.

Over the past one year,cobalt market has had far weaker performance than lithium market,mainly resulting from the factor that sustained recovery of lithium iron phosphate is squeezing the room for ternary materials.According to data from China Battery Union,the production of lithium iron phosphate batteries has exceeded that of ternary batteries for consecutive 7 months,and the installed capacity of lithium iron phosphate batteries has exceeded that of ternary batteries for consecutive 5 months.The proportion of cumulative installed capacity of lithium iron phosphate exceeded that of cumulative installed capacity of ternary batteries in November.

However,a big surge is seen in cobalt this month,mainly resulting from the discovery and fast spreading of Omicron,a new variant of Covid-19 virus,in Africa since November,25th.As Africa is an important area in the route by which Democratic Republic of the Congo ships cobalt raw material,it is estimated that the market will run short of cobalt resource,thus leading to a rise in cobalt price.

Look ahead,as the spreading of Omicron extended to Democratic Republic of the Congo,the concerns about supply side are getting intensified,which will hopefully lead to a sustained strong momentum in cobalt market.Look into next year,with the restarting of Mutanda by the end of this year,and the capacity release of other projects in the middle of next year,it is expected that the relation between supply and demand will be alleviated next year.Cobalt market will probably rise first and then decline next year.

(3)Nickel

Nickel market continuous to vibrate at higher level since mid-November,and rose and eased back in the short run.On December,15th,the price of electrolytic nickel was RMB 145300/ton,down by 1.2% on a MOM basis.The price of nickel sulfate(nickel sulfate hexahydrate)was RMB 37750/ton,down by 1.9% on a MOM basis.

On December,9th,Qingshan Industry Co.,Ltd.made an announcement in its official account that the Company officially succeeded in manufacturing high nickel matte molten iron on December,8th.The shoe finally dropped.However,currently from the view of the market trend,the news brought a shock to the market that is far weaker than that in March.A very important reason is that Qingshan Industry has had a too slow progress to reaching design capacity in high nickel matte compared to the plan in the first place(the delivery of the first batch was scheduled for the end of October).This leads to the estimation that the growth of the subsequent supply will not be very significant.

Look ahead,driven by NEV power battery industry,the demand for battery nickel is worth expecting overall.However,Qingshan Group’s design capacity reaching progress and delivery progress of high nickel matte are still under observation,and the design capacity reaching progress of BHP Billiton’s KWinana nickel refinery is also under observation.As a result,it is estimated that the game is going to get fierce,and the market is going to face the pressure of decline overall.

2.Production and sales data tracking

(1)Sales volume of NEV rose by 121.1% on a YOY basis in November in China

According to the data released by CAAM,in November,2021,production and sales of our NEV was respectively 457000 vehicles and 450000 vehicles,continuing to break records,up by 127.8% and 121.1% on a YOY basis,and up by 15.1% and 15.1% on a MOM basis,staying in robust growing trend.By category,production and sales of BEV was respectively 372000 vehicles and 361000 vehicles,up by 1.2 times and 1.1 times on a YOY basis;production and sales of PHEV was respectively 85000 vehicles and 89000 vehicles,up by 1.6 times and 1.7 times on a YOY basis;production and sales of fuel cell vehicles was 212 vehicles and 147 vehicles,down by 26.4% and 49.3% on a YOY basis.By purpose,passenger vehicles have occupied a predominant position,and commercial vehicles have occupied just 5.1%.

In November,market penetration rate of NEV in was 17.8%,and market penetration rate of passenger NEV was 19.5%,up by over 1 percent point compared to the previous month.From January to November,production and sales of NEV was 3023000 vehicles and 2990000 vehicles,both up by 1.7 times on a YOY basis.Cumulative sales penetration from January to November rose to 12.7%.It is estimated that production and sales of NEV the whole year will exceed 3500000 vehicles.

(2)Installed capacity of power battery went up by 96.2% on a YOY basis in November in China.Lithium iron phosphate accounted for 55.8%

According to the data released by China Automotive Power Battery Industry Innovation Alliance,in November,2021,the production and installed capacity of power batteries in China was respectively 28.2GWh and 20.8GWh,respectively up by 121.8% and 96.2% on a YOY basis;respectively up by 12.4% and 35.1% on a MOM basis.Among them,the production and installed capacity of ternary batteries was respectively 10.4GWh and 9.2GWh,respectively up by 2.6%and 57.7% on a YOY basis,and respectively up by 12.9% and 32.5% on a MOM basis,presenting a rise in the growth for consecutive 3 months;the production and installed capacity of lithium iron phosphate was respectively 17.8GWh and 11.6GWh,respectively up by 229.2% and 145.3%,and respectively up by 12% and 37.2% on a MOM basis.The installation of ternary batteries in November reached 44.2%,down by 1.2 percent points on a MOM basis,while the installation of lithium iron phosphate batteries reached 55.8%.

From the perspective of cumulative number,the production and installed capacity of our power batteries from January to November,was respectively 188.1GWH and 128.3GWH,up by 175.5% and 153.1% on a YOY basis.Among them,the installed capacity of ternary batteries and lithium iron phosphate batteries was respectively 63.3GWH and 64.8GWH,up by 92.5% and 270.3%on a YOY basis,and respectively accounting for 49.3% and 50.5%.

Overall speaking,driven by the significant increase in production and sales of NEV,the installed capacity of power batteries also had been enjoying a big YOY increase for consecutive 16 months,maintaining a robust growth.By structure,lithium iron phosphate had exceeded ternary batteries for consecutive 5 months in terms of single-month installed capacity,giving rise to the result that the proportion of cumulative installed lithium iron phosphate capacity exceeded that of cumulative installed ternary battery capacity for the first time this year.Relatively lower cost of lithium iron phosphate is a big appeal for all big auto companies to actively apply lithium iron phosphate batteries to improve cost competitiveness of vehicles.Tesla has made itself clear that it will apply lithium iron phosphate batteries for 2/3 of its vehicles in the future.BYD will apply lithium iron phosphate blade batteries for all collections of its vehicles.It is hopeful that lithium iron phosphate batteries will maintain a rising momentum before solid batteries truly give play to their strengths.

(3)The production of our cathode material went up by 77.1% on a YOY basis in November

According to the statistics of SMM,in November,2021,the production of cathode material was about 108000 tons in our country,up by 77.1% on a YOY basis.To be more specific,the production of ternary material was about 42800 tons,up by 51%on a YOY basis and up by 10% on a MOM basis;the production of lithium iron phosphate was about 52000 tons,up by 176% on a YOY basis and up by 14.4% on a MOM basis;the production of lithium cobalt oxides was about 7600 tons,up by 7% on a YOY basis and up by 10% on a MOM basis;the production of lithium manganate was about 5900 tons,down by 14% on a YOY basis and up by 1%on a MOM basis.

From the perspective of cumulative number,in our country,the production of cathode material from January to November was about 878000 tons,up by 69.9% on a YOY basis.To be more specific,cumulative production of ternary material was 374000 tons,up by 101.2% on a YOY basis;cumulative production of lithium iron phosphate material was 346000 tons,up by 129.2% on a YOY basis;cumulative production of lithium cobalt oxides was about 78500 tons,up by 19.0%on a YOY basis;cumulative production of lithium manganate was 79700 tons,up by 60.4% on a YOY basis.

In terms of lithium material,according to the statistics of SMM,in November,2021,in our country,the production of lithium carbonate was 20400 tons,up by 38% on a YOY basis;the production of lithium hydroxide was 17000 tons,up by 44% on a YOY basis.From the perspective of cumulative number,from January to November,in our country,cumulative production of lithium carbonate was 202000 tons,up by 34.5% on a YOY basis;cumulative production of lithium hydroxide was 159000 tons,up by 57.4% on a YOY basis.

In terms of cobalt material,according to the statistics of SMM,in November,2021,in our country,the production of cobalt sulfate was 5659 MMTs,up by 46% on a YOY basis;the production of cobaltosic oxide was 7260 tons,up by 4% on a YOY basis.From the perspective of cumulative number,from January to November,in our country,cumulative production of cobalt sulfate 53600 MMTs,up by 50.3% on a YOY basis;cumulative production of cobaltosic oxide was 48700 tons,up by 14.8% on a YOY basis.

(4)Sales of NEV globally went up by 70% on a YOY basis in October

According to the statistics of EV Sales,sales of passenger NEV worldwide reached 589000 vehicles in October,up by 70% on a YOY basis and down by 14% on a MOM basis.Single-month NEV market penetration rate was 8.8%.

From the perspective of principal market distribution,in October,in China,sales of passenger NEV was 366000 vehicles,up by 147.3% on a YOY basis;sales of passenger NEV in Europe was 184800 vehicles,up by 26% a YOY basis and declining a bit on a MOM basis;sales in US was about 55000 vehicles,up by 68% on a YOY basis.Sales in Europe and America continued to decline due to the shortage of chip and pandemic worldwide,especially in European market,where the overall sales declined by 29% that month.This has hindered the growth of NEV sales to a great extent.

From the perspective of cumulative number,from January to November,sales of passenger NEV was 4811000 vehicles worldwide,up by 127%on a YOY basis.Global NEV market penetration rate from January to November was 7.2%.By proportion in three major markets,from January to November,sales of passenger NEV in China was 2398000 vehicles,taking up 49.8% of global NEV market;sales in Europe was 1761000 vehicles,taking up 36.6% of global market;sales in US was 491000 vehicles(data of Marklines),taking up 10.2% globally.

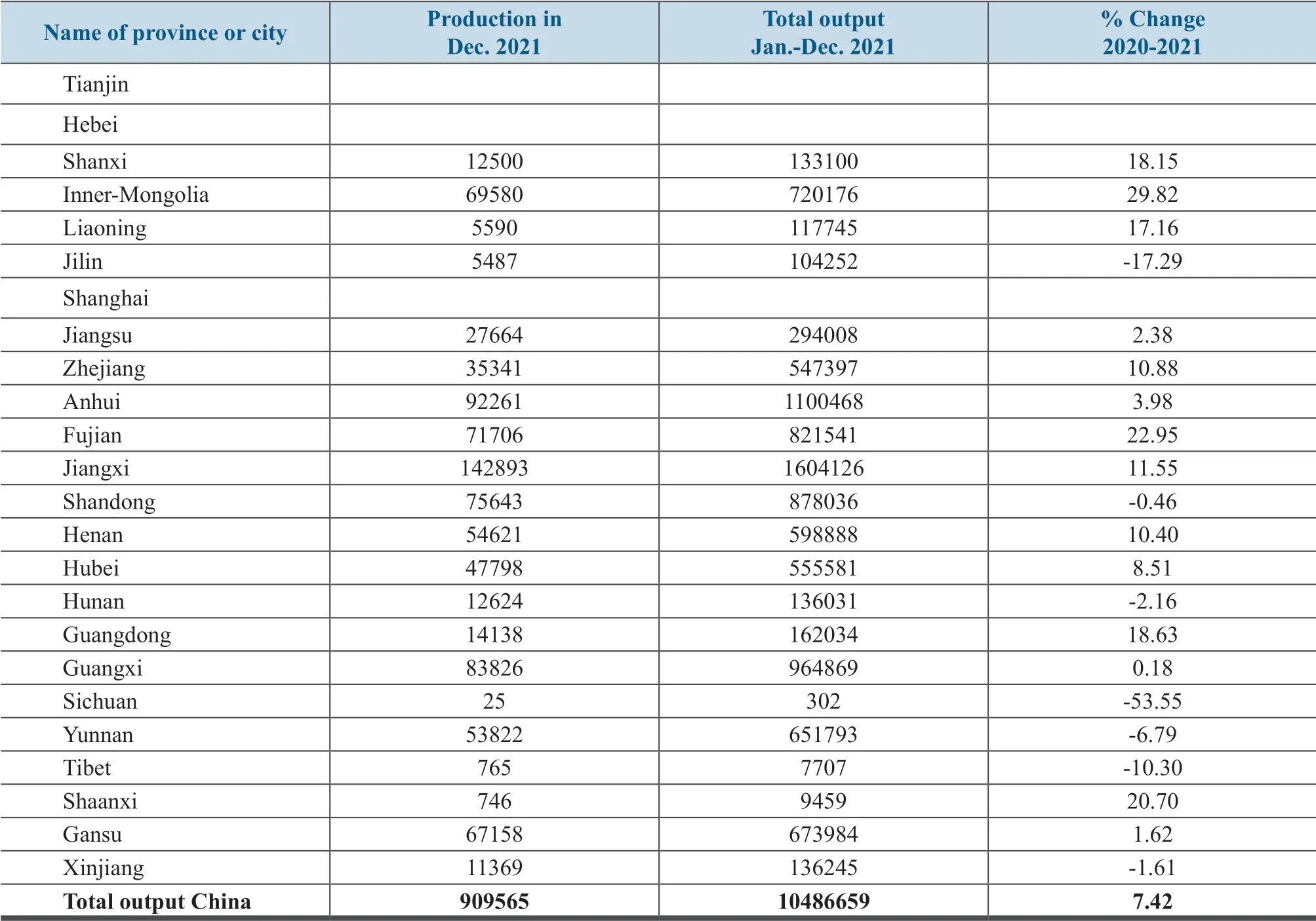

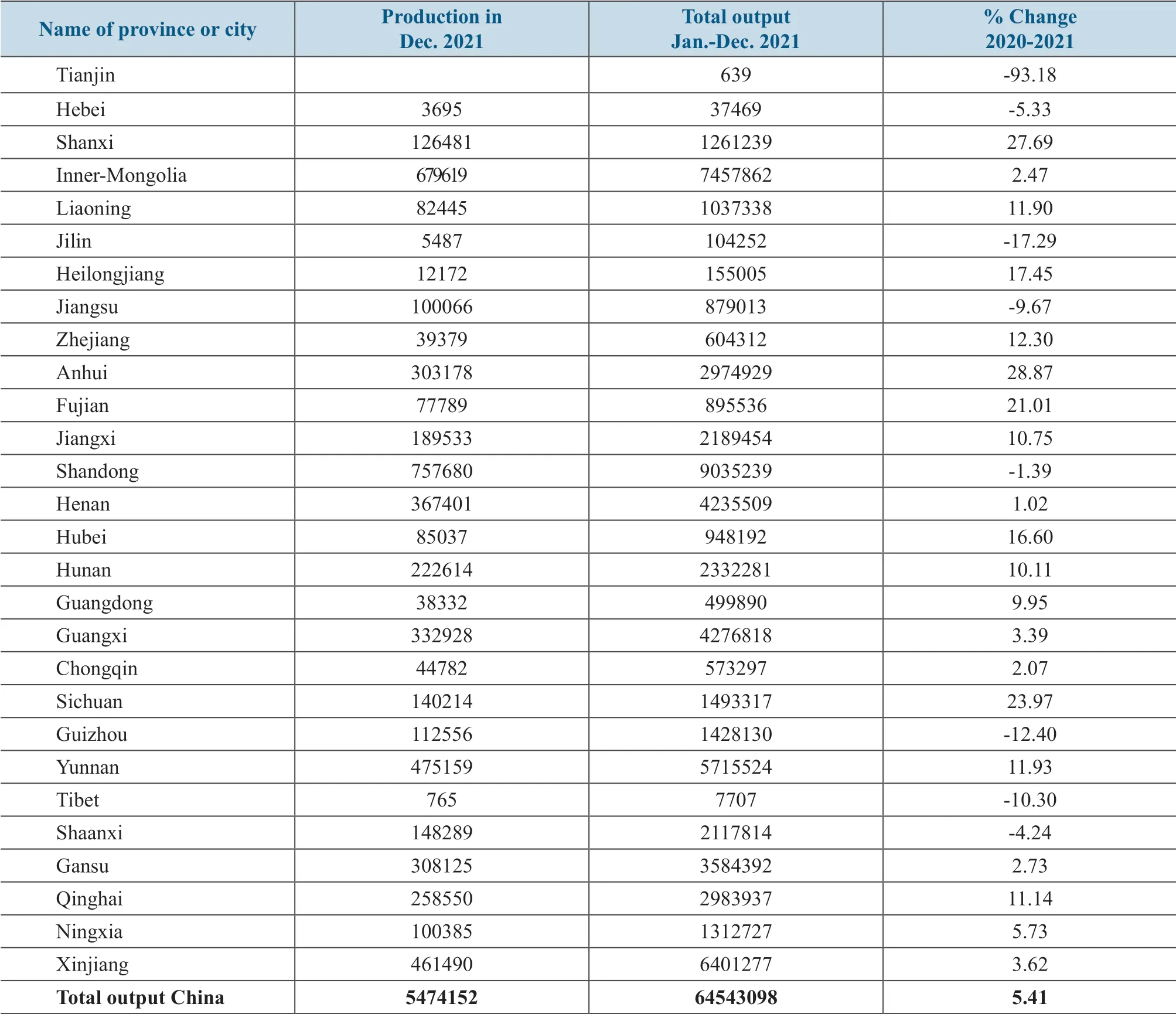

Refined Copper Production by Province or City in 2021Unit:metric ton

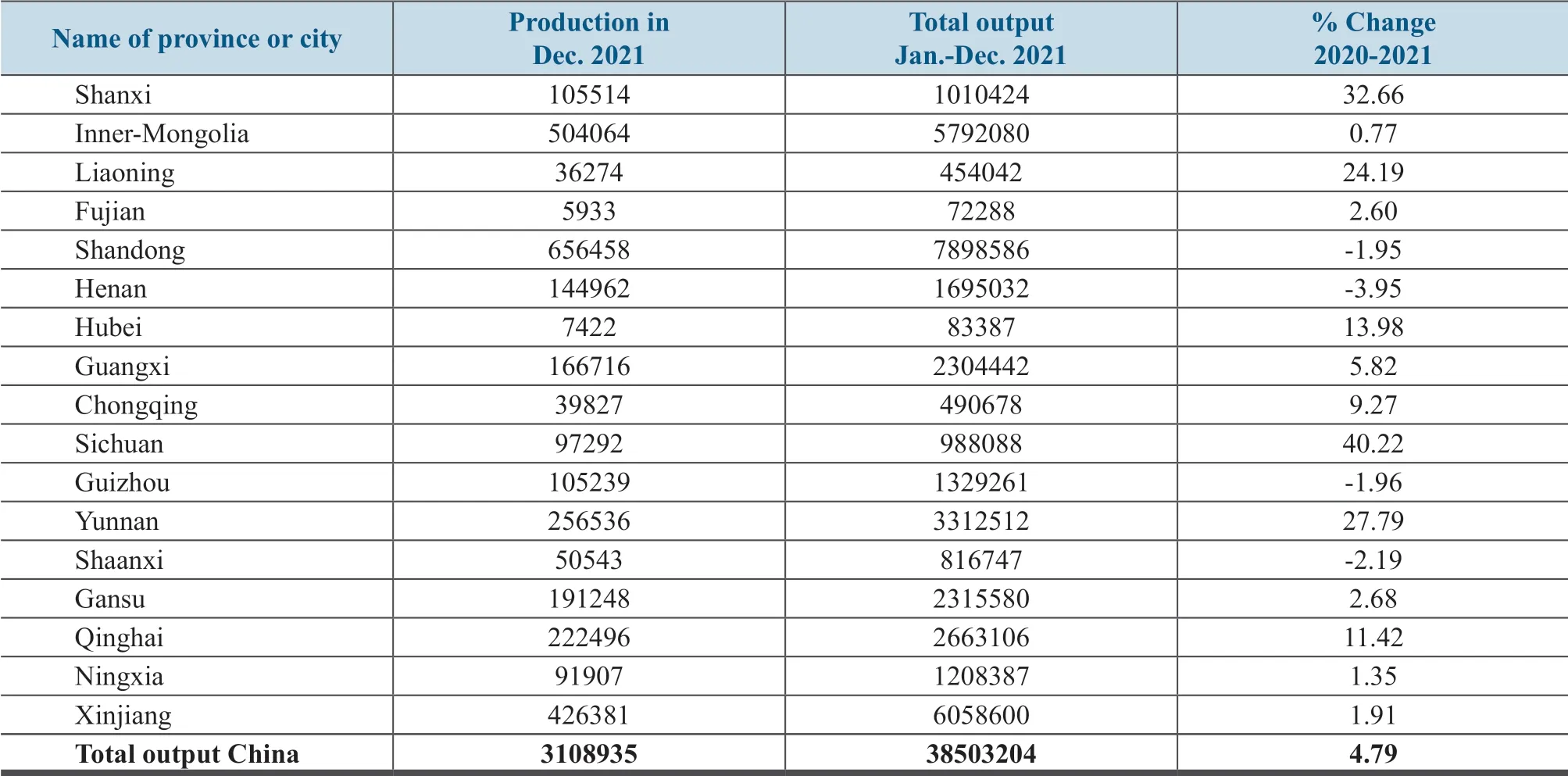

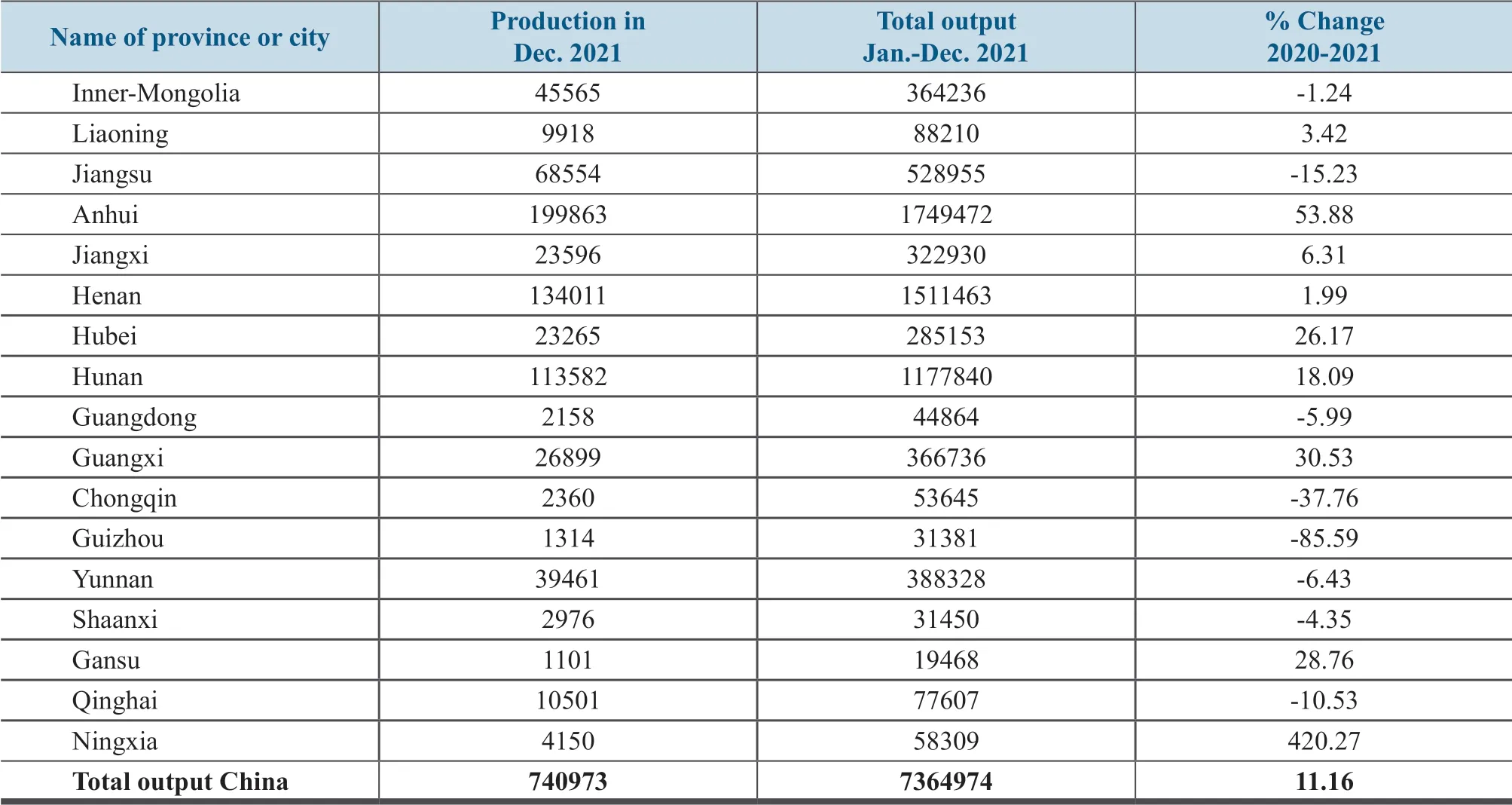

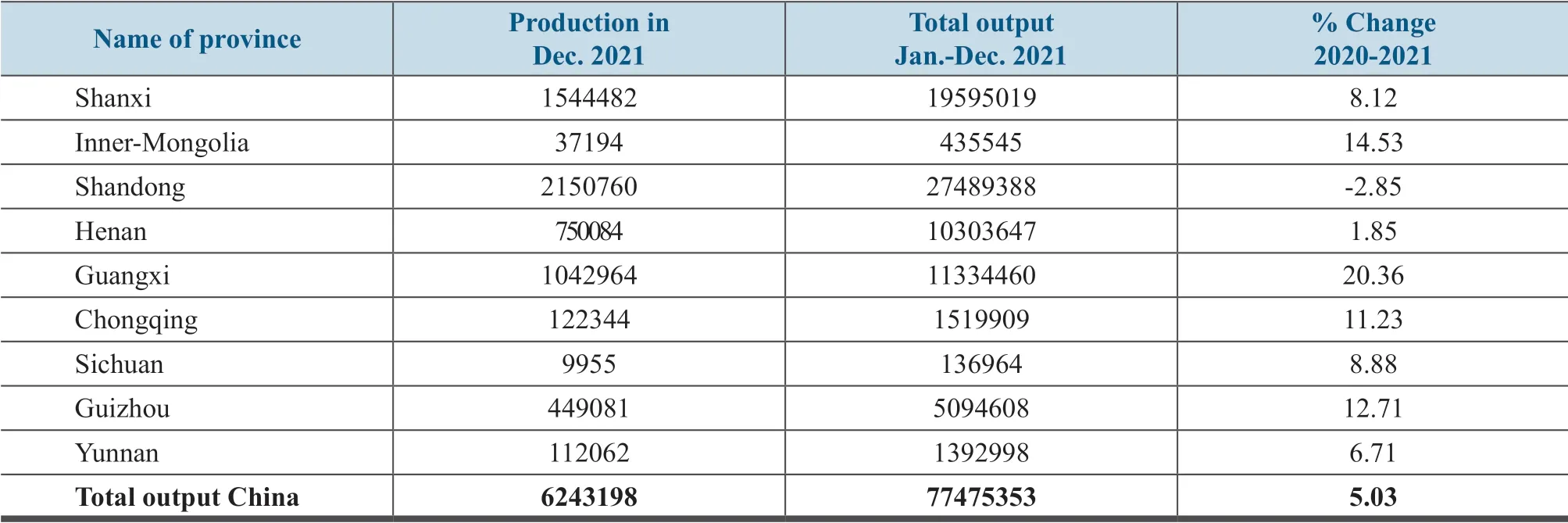

Aluminium Production by Province or City in 2021Unit:metric ton

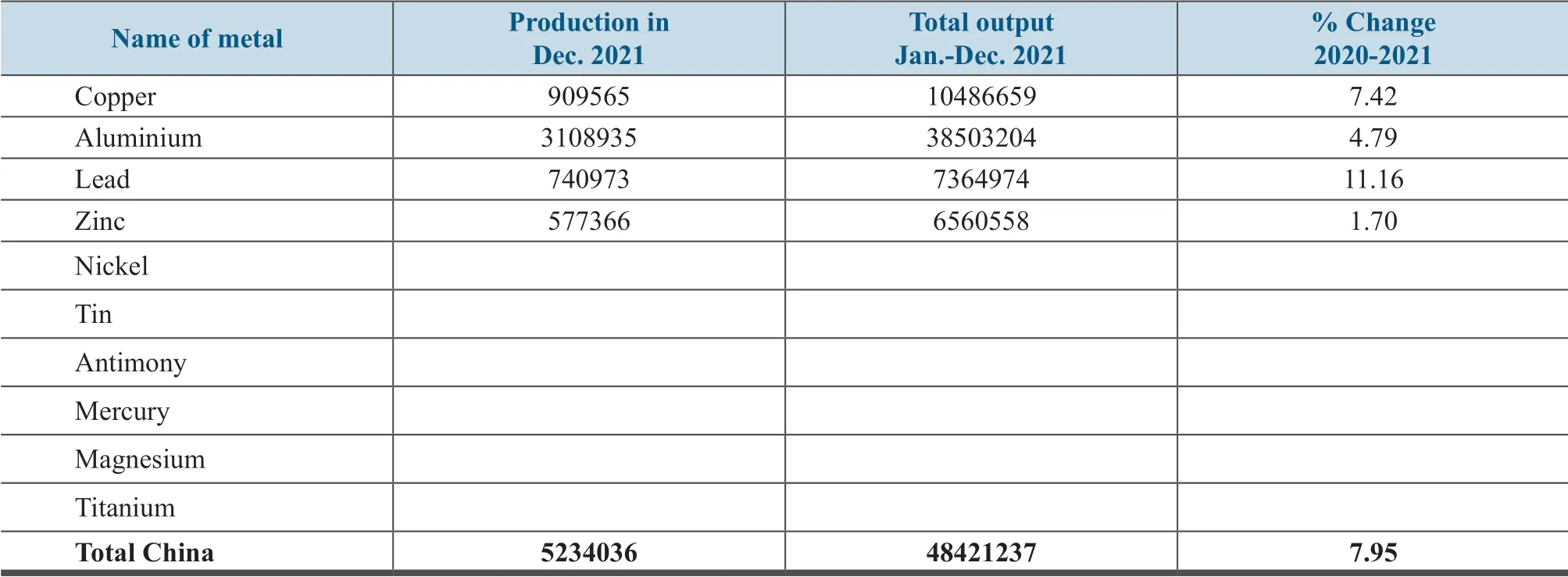

Production of the Ten Major Nonferrous Metals in 2021Unit:metric ton

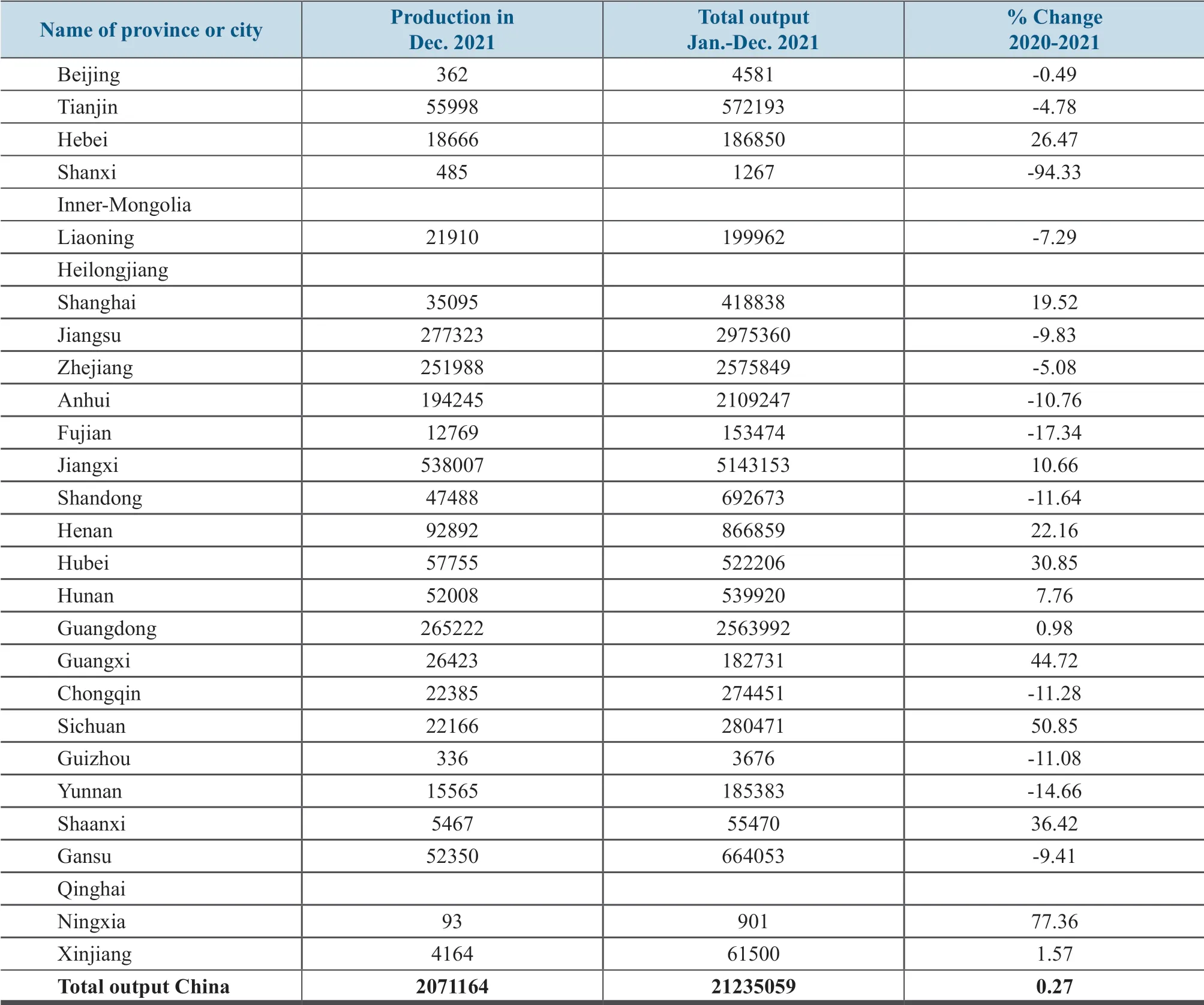

Fabricated Copper Production by Province or City in 2021Unit:metric ton

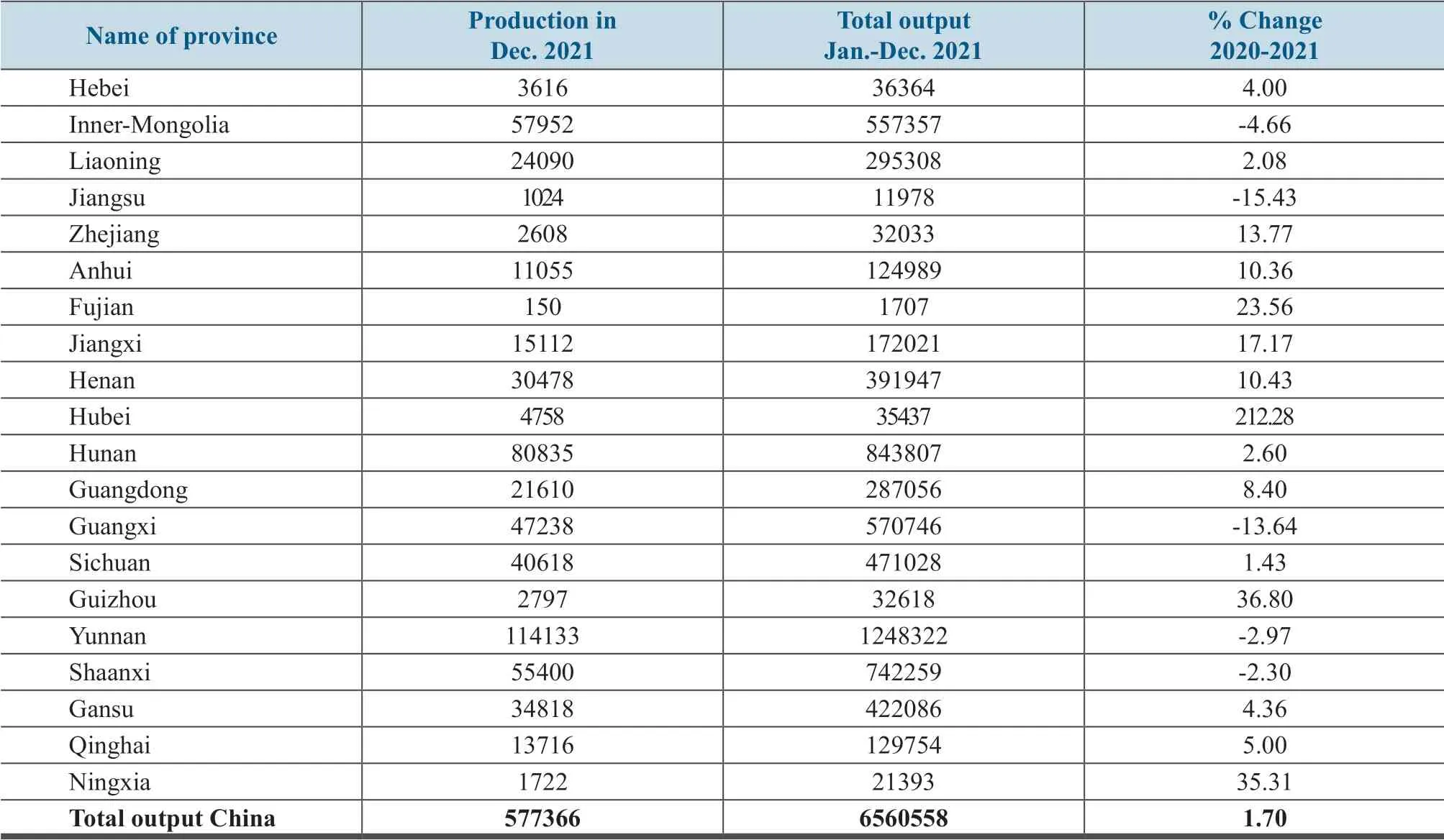

Lead Production by Province or City in 2021Unit:metric ton

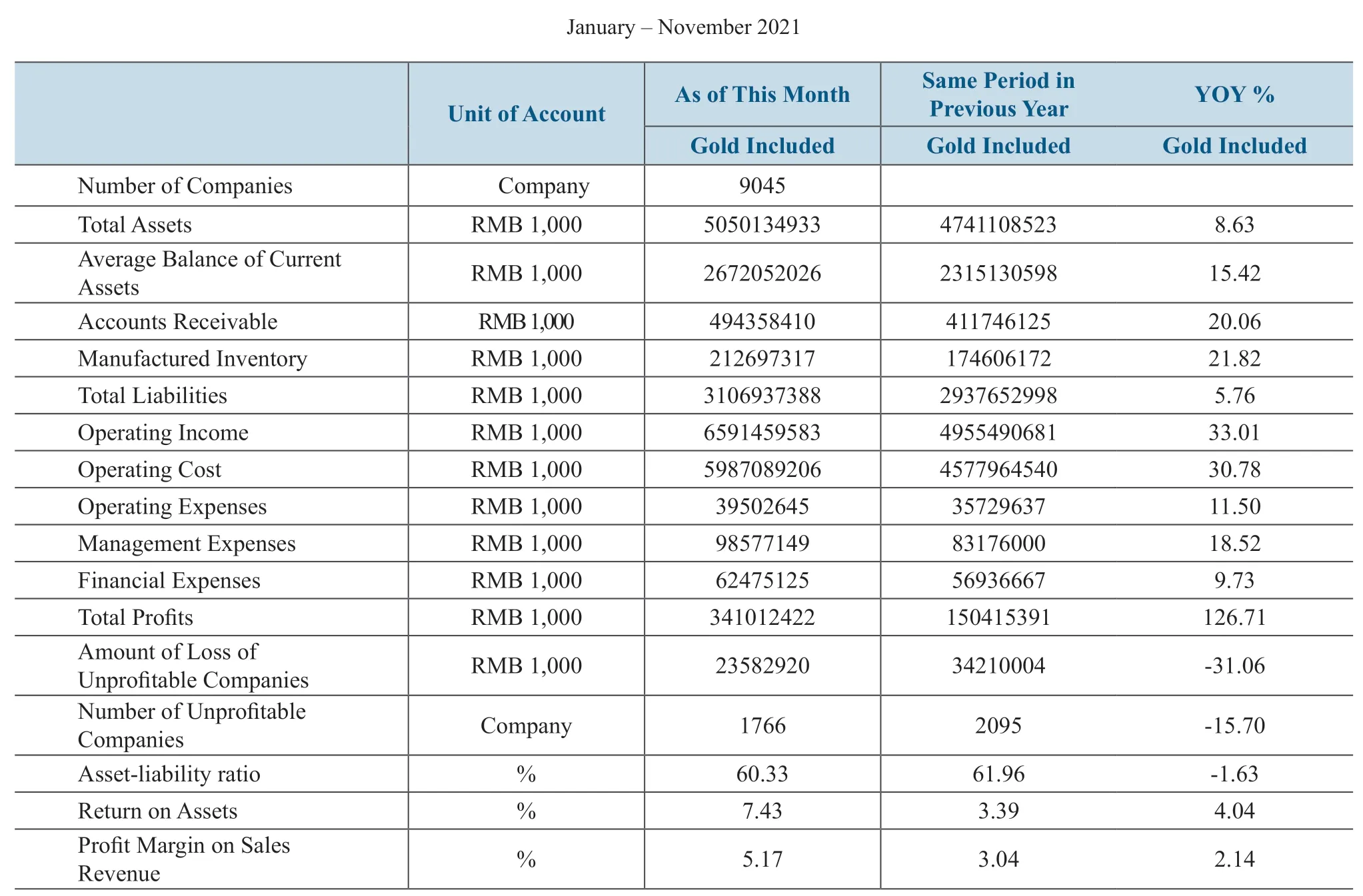

Key Financial Indicators of Non-ferrous Companies Above Designated Size

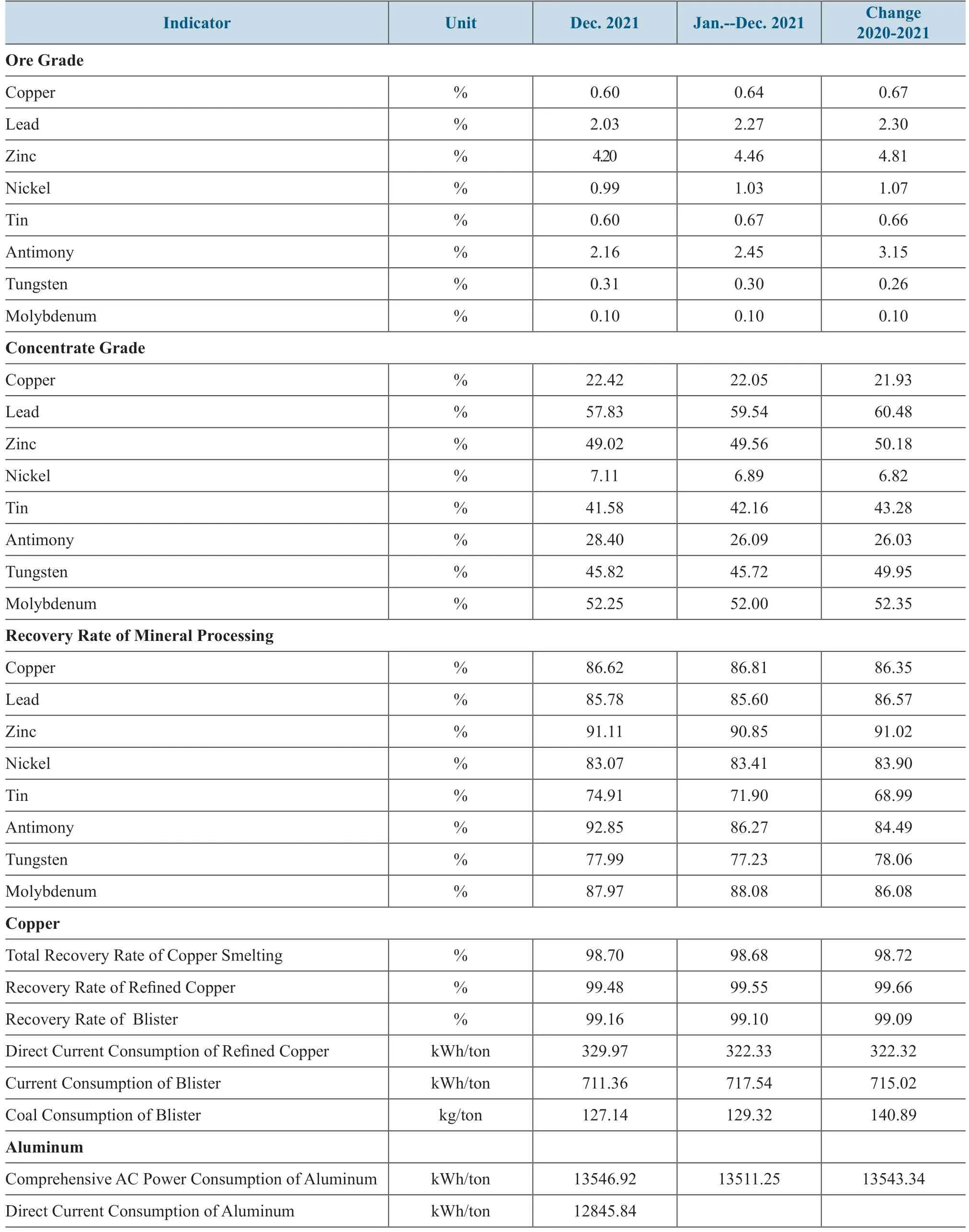

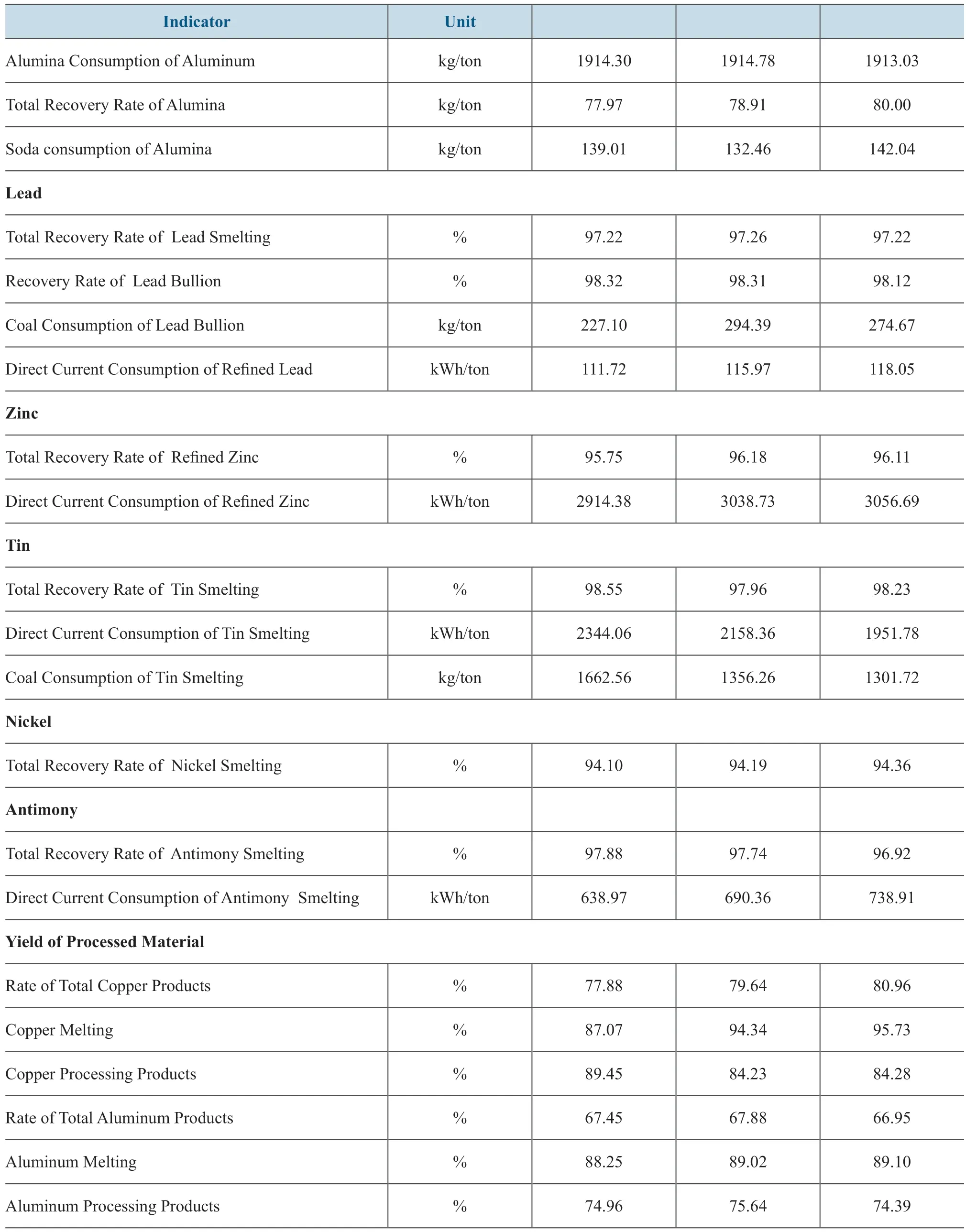

Technical and Economic Indicators of Major Enterprise

Continued from the previous page

Alumina Production by Province in 2021Unit:metric ton

Yield of Ten Major Types of Nonferrous Metals By Region

Zinc Production by Province in 2021Unit:metric ton