Financial Knowledge, Capability to Guard Against Risks, and Rural Households’ Selection of Financial Assets: An Empirical Study Based on Rural Households in China

2022-04-29WangYangandHuangLan

Wang Yang, and Huang Lan*

Chengdu University of Information Technology

Abstract: Based on rural household data collected in two rounds of the China Household Finance Survey (CHFS) in 2015 and 2017, respectively, this paper presents the likely impact of financial literacy and capability against risks on the breadth and depth of participation by rural households in risky financial markets.After instrumental variables are used to solve endogenous problems, we find that a good command of financial knowledge and a higher risk management level could significantly increase the probability and proportion of rural households investing in risky financial assets.A mechanism analysis further reveals that financial knowledge motivates rural households to engage in financial investments by helping them evaluate their capability to guard against risks.After multiple dimensions of indicators are employed to measure financial knowledge, the estimated results remain stable.In view of this, we have put forward some policy suggestions to increase the property income of rural households and promote the rural financial market.

Keywords: rural households; financial knowledge; risk management; financial assets

Introduction

Rural households in China have been finding it difficult to purchase financial products due to a lack of opportunities to invest in financial assets and limited access to modern financial services in rural areas.This has not only deprived rural households of the chance to obtain property income (Li Tao et al., 2010), but also further widened the urban-rural income gap (Wen Tao et al.,2005).Chinese households have been investing an excessive proportion of their wealth in real estate and deposits, while investments in financial risk assets have been steady at a low level.On top of this,the percentage of rural households purchasing stocks and funds in the risky financial markets has been much lower than that of their counterparts in urban areas (Dong Xiaolin et al., 2017; Fei Shulan,2017).This has been corroborated by data (as shown in Table 1) collected in four rounds of the CHFS in 2011, 2013, 2015, and 2017.For example, in 2017, the stock market participation rate was 9 percent among urban and rural households in China.Specifically, 13 percent of urban households chose to invest in the stock market, while the figure for rural households stood at only 0.57 percent.The fund market participation rate was 3.09 percent in China.Only 0.17 percent of rural households participated in the fund market, far lower than that of urban households (4.46 percent).

The single investment structure of rural households in China hinders not only the healthy development of the rural economy, but also the growth of their assets.To alleviate the difficulties of rural residents in participating in the financial markets and improve the rural financial service system from a macro perspective, the government has ramped up its efforts to invest more financial resources on the supply side (Zhang Longyao et al., 2013; Wang Shuguang, 2014).For example, in 2019, the People’s Bank of China (PBC), the China Banking and Insurance Regulatory Committee(CBIRC), the China Securities Regulatory Commission (CSRC), the Ministry of Finance (MOF),and the Ministry of Agriculture and Rural Affairs (MOA) jointly released the Guidelines on Finance Serving Rural Vitalization (hereinafter referred to as the Guidelines).①The document specifies that it is necessary to improve the financial services system for rural vitalization and guide relevant① In the CHFS conducted in 2017, when asked “Why doesn’t your family have a stock account? Respondents gave the following reasons: a.A lack of knowledge about stock trading b.Difficulties in opening an account/unable to open an account c.Excessive risks in stock trading d.Limited capital e.No interests f.Others.” According to the statistics of respondents, we can obtain the proportion of rural households giving up investment in the stock market due to a lack of knowledge about stock trading.financial institutions to empower rural communities.Finally, this document will contribute to a reasonable allocation of financial resources between rural and urban areas and an equal distribution of financial resources across these two areas.Although many policies and measures have led to some achievements, progress in empowering rural communities through financial services depends not only on the scale of capital investments on the supply side but also on the efficiency of rural households in utilizing such financial services on the demand side.Financial investment is a complex process for many households, as it takes a huge amount of time and energy to search for relevant information and analyze it before making a decision.Financial knowledge, which plays a vital role in screening and analyzing information, determines the success or failure of a financial investment to a considerable extent (Noctor et al., 1992; Song Quanyun et al., 2020).Therefore, it was important to strengthen the scale of capital investments in rural areas at a macro-level.However, this did not mean we could neglect the need to enhance the financial knowledge of rural households and improve their ability to allocate financial resources (Wang Dingxiang et al., 2013).Of note, to participate in the risky financial markets, investors must have a decent level of high financial literacy and be able to evaluate risks and returns of financial assets independently.This could enable them to identify financial products that suit their circumstances (Yin Zhichao & Qiu Hua, 2019).Investors who lack the necessary financial knowledge were prone to cognitive and behavioral biases, thereby limiting the breadth and depth of their participation in the financial markets (Rooij et al., 2011; Zhang Longyao et al., 2021).

Unfortunately, rural residents in China generally have limited financial literacy, resulting in their limited understanding and inadequate mastery of financial knowledge.In November 2018, the China Foundation for Development of Financial Education issued the firstSample Survey Report on Financial Literacy of Rural Residents in China.The report showed that rural households had limited access to financial knowledge or financial training, and most of them had only limited mastery of basic financial literacy.The 2017 CHFS also found that the lack of financial knowledge was the main reason rural households refused to participate in risky financial markets such as the stock market and fund market.Specifically, 75.46 percent of rural households did not①participate in the stock market because they had no knowledge about stock trading.A total of 65.52 percent of rural households gave up investing②In the CHFS conducted in 2017, when asked “Why didn’t your family buy a fund?” Respondents gave the following answers: a.A lack of knowledge about fund.b.Difficulties in opening an account/unable to open an account c.High fund risks d.Low returns from funds e.Limited capital 6.No time/interests f.Others.” According to the statistics of respondents, we can obtain the percentage of rural households giving up investment in the fund market due to a lack of knowledge about fund.in the fund market and over 70 percent rejected the idea of purchasing financialproducts for similar reasons.①In the CHFS conducted in 2017, when asked “Why didn’t your family buy any financial products?, respondents responded as follows: a.A lack of knowledge about financial products b.Complexities in buying financial products/unable to buy financial products c.Excessive risks in financial products d.Low returns from financial products; Limited capital e.No interests/time f.Others”.According to the statistics of respondents, we can know the percentage of rural households giving up investment in financial products due to a lack of knowledge about such products.This fact has also suggested that rural households need to improve their command of financial knowledge, and that the spread of financial knowledge in rural areas has the potential to create positive dividends.

As increasing government emphasis has been focused on agriculture, rural areas, and farmers,and a series of inclusive financial measures have been implemented, a boost has been given to the economy and financial markets in rural areas.This has created a diversified range of financial assets for rural households.As the income of rural households continues rising, there are three questions that need to be answered: (a) What is the impact of financial knowledge on rural households’ financial investment behavior? (b) Can the breadth and depth of rural households’ participation in the financial markets be improved? (c) What is the mechanism to achieve this purpose? At present, there is a limited amount of literature on these topics.Therefore, it is of great practical significance to study the relationships between financial knowledge and financial investments of rural households and the possible mechanisms that may impact their investment behaviors.This will not only help shed light on the deep-seated reasons inhibiting financial investment behaviors of rural households but also provide some basis for decision-making departments in formulating relevant policies.Rural households can expect to increase their property income by improving their financial investment abilities.

In view of this, we utilize data from two rounds of the CHFS conducted in 2015 and 2017 to study how financial knowledge is affecting rural households’ participation in the financial markets and their selection of financial assets, and to reveal the possible mechanisms.The main contributions of this paper include: (a) Much of the existing literature focuses on studying financial asset selection behaviors of urban households but ignores factors affecting the financial investments of rural households.This paper attempts to make up for this omission by looking at the financial knowledge level of rural households; (b) The mechanism analysis of this paper finds that financial knowledge has an effect on rural households’ decisions on financial asset investments by affecting their subjective and objective capabilities against risks; (c) In this paper, the lagged variable of financial knowledge and the corresponding instrumental variable are selected from the sample of rural households in the CHFS studies conducted in 2015 and 2017 to deal with the endogenous problems caused by reverse causality and omitted variables.In this way, the endogenous bias is overcome to the greatest extent,rendering the empirical results more credible; (d) This paper constructs indicators with multiple dimensions to measure the level of rural households’ financial knowledge, enabling conclusions to be more robust.

Literature Review and Research Hypotheses

Influence of Financial Knowledge on Rural Households’ Selection of Financial Assets

Financial investing is a complex decision-making process that should be underpinned by financial knowledge.Foreign studies have found that financial knowledge had a significant impact on savings,credit, and investments of households (Lusardi & Mitchell, 2014).Investors who did not understand the basic economic and financial concepts and lacked basic financial calculation skills faced a higher risk of investment failure and tended to give up investments (Hastings & Tejada-Ashton,2008).Poorer and less financially literate households were prone to make more investment mistakes(Calvet et al., 2009) and were more vulnerable to wealth reduction.Financially educated households tended to save more and were less indebted than those who could not calculate installment interest rates correctly (Bernheim & Garrett, 2003), and financially literate households were accumulating wealth faster (Stango & Zinman, 2009).In addition, households who mastered professional financial knowledge were generally more willing to participate in the stock market.With more advantages in the stock market, they held a higher proportion of risky assets (Rooij et al., 2011).

Most domestic studies on financial knowledge centered on micro-level benefits of financial knowledge and their impact on the participation of urban households in the financial markets (Zhang Longyao et al., 2021).However, there were few studies dedicated to the impact of financial knowledge on the financial investment behaviors of rural households and the potential mechanism.Yin Zhichao et al.(2014) used the data of the 2013 CHFS and found that an increase in financial knowledge and investment experience would encourage households to participate in the financial market and hold a higher proportion of risky financial assets.Shan Depeng (2019) studied the impact of financial literacy on urban poverty in China in accordance with the data from CFPS.He found that improving financial literacy through financial education was an important approach to reducing urban poverty.Financial knowledge could also have a positive effect on entrepreneurial decision-making and performance (Yin Zhichao et al., 2015; Sun Guanglin et al., 2019).A better command of financial knowledge could also help rural households gain access to formal credit and ease credit restrictions(Wu Yu et al., 2016).Guo Yan et al.(2020) discovered that improving financial knowledge played a greater role than the construction of hardware facilities, such as information equipment, in developing rural financial markets.

Most of the existing domestic and international studies have confirmed that financial knowledge,as a bridge between financial resources and financial investment practices, is a crucial factor affecting the financial investment of urban households.However, most rural residents in China, beset with a traditional mindset, are unconscious of the importance of financial management and lack financial knowledge.These two factors represent a bottleneck restricting their participation in the financial markets.We can speculate that a higher financial literacy level of rural households will not only help to expand channels for rural households to borrow money but also alleviate financing constraints infinancial investments.Moreover, better financial literacy would upgrade the ability of households to manage risks, thereby expanding the depth and breadth of their participation in the financial markets.Therefore, we bring forward the following hypotheses:

H1: Financial knowledge can expand the breadth of rural households’ participation in financial markets.

H2: Financial knowledge can expand the depth of rural households’ participation in financial markets.

The Mechanism of Financial Knowledge Influencing Rural Households’ Selection of Financial Assets

Households were more exposed to risks when they used risky financial markets to manage their wealth.For example, most investors were excluded from mastering the investment techniques for risky financial assets such as stocks as these assets called for some basic financial knowledge and a certain level of risk tolerance (Wang Xin, 2015).To adapt to the risky and volatile financial markets,investors in the financial markets, most of which are common households and individuals, must consider how to identify risks before investment and manage risks after investment.Some families may be more unwilling to participate in the financial market for the purpose of avoiding risks (Guiso& Paiella, 2008; Li Tao, 2009).The poorer ability of rural households to handle risks, the less likely they are to participate in risky financial markets, and the less they will choose to invest in risky financial products.Thus, our third hypothesis (H3): The breadth and depth of rural households’participation in risky financial markets can be expanded by helping them evaluate their capability against risks and strengthening their ability to handle risks.

Theoretically, financial knowledge can exert an effect on rural households’ investments in financial assets by helping them evaluate their subjective capability against risks and strengthening the objective capability of dealing with risks.Meanwhile, a good mastery of financial knowledge helps rural households better understand elements of financial markets and products, such as returns and risks, thus reducing uncertainties when they make investments.Rural households with a better command of financial knowledge are more likely to select products with higher risks, because they are more confident in their capability to deal with risks.Attitudes toward risks have a close bearing on people’s financial investment decisions, and financial knowledge will contribute to a better evaluation of their capability to withstand risks and thus allow them to make risky financial asset investments.

In addition, whether rural households could participate in the financial market is determined on the one hand by the inherent risks of financial assets, and on the other hand, by their risk management ability after an investment is made.Generally speaking, the greater the risk of financial assets, the higher the probability of investment failure.If rural households are not able to manage their own risks, they may be forced to give up investment when faced with investment opportunities that come with higher risks and higher returns.However, higher financial literacy can help rural households deal with risks in ways that are more cost-effective and efficient.As a result, if lossesare incurred, they can have enough means to smooth consumption, minimize the negative impacts,and expand investment channels.For example, rural households can purchase commercial insurance in the insurance market to prepare for risks after an investment is made.This move could upgrade their risk management capabilities (Urrea & Maldonado, 2011), thereby forming a relationship chain that covers financial knowledge, the capability to withstand risks, and investments in risky financial assets.Our fourth hypothesis then is (H4): Financial knowledge can encourage rural households to buy financial assets by raising their subjective and objective capabilities against risks.

Data Source, Model Setting, and Variable Selection

Data Sources

The data in this paper is derived from the third and fourth round of the CHFS conducted in 2015 and 2017 by the Survey and Research Center for CHFS, Southwestern University of Finance and Economics.In these two rounds, a three-stage, stratified, proportional to population size (PPS)sampling method was used to collect micro-financial information from Chinese households and provide high-quality micro-data for studying financial issues of Chinese households by means of scientific sampling, modern survey techniques, and survey management methods.Among them, the 2015 CHFS collected micro-data of more than 37,289 households from 1,396 villages (communities)in 351 counties (cities or districts) of 29 provinces (autonomous regions or municipalities).Among these, 11,654 households came from rural areas.①In this paper, only a household whose householder has been registered as a rural resident shall be regarded as a rural household.The 2017 CHFS collected micro-data from more than 40,011 households from 1,417 villages (communities) in②Among the provinces (municipalities) covered in CHFS, 11 came from the east of China, namely Beijing, Tianjin, Hebei, Shanghai, Liaoning, Jiangsu,Zhejiang, Fujian, Shandong, Guangdong, and Hainan; 8 came from the central region of China, including Shanxi, Jilin, Heilongjiang, Anhui, Jiangxi, Henan,Hubei, anbd Hunan; 10 came from the west of China, including Inner Mongolia Autonomous Region, Guangxi, Chongqing, Sichuan, Guizhou, Yunnan,Shaanxi, Gansu, Ningxia Hui Autonomous Region, and Qinghai.353 counties (cities or districts) of 29 provinces (autonomous regions or municipalities).Among these, 12,732 households came from rural areas.

These two rounds of CHFS collected detailed information on the demographics, assets and liabilities, insurance and security, income and expenditure, financial market participation, and financial knowledge of rural households in our sample.Specifically, a total of 10,085 rural households included in the 2015 CHFS were followed up in the 2017 CHFS.This accounted for 86.5 percent③In 2017, a total of 26,824 households in the 2015 CHFS were followed up, representing 71.9 percent of the total number.Among them, 16,739 urban households were followed, making up 65.3 percent of all urban households in 2015.of the total number of rural households in 2015, providing an excellent amount of data for this study.Among these households, the top 1 percent of households with the highest family income and net assets and the bottom 1 percent with lowest income and assets are phased out; households whose householder was less than 18 years old at the time and those with a missing control variable are alsoedited out.Finally, 9,680 households were left in the sample.

Model Setting

Probit model and tobit model.

We measure the breadth of rural households’ participation in the financial markets by determining whether rural households hold risky financial assets.Since this dependent variable is a two-valued variable, the probit model is used for empirical analysis.

In the formula above,Yiis a dummy variable that signifies whether rural households participate in risky financial markets.If the variable equals 1, it means the rural household has participated in the financial market; if the variable equals 0, it suggests the household has not participated in the financial market.FLirepresents financial knowledge, the core variable in this paper.Ximeans the control variable, covering characteristics of families, householders, and provinces;μisymbolizes the random errorμi~N(0,σ2).α, β, γ,is a coefficient estimate vector.We give special attention toβ∧, the estimated value of the coefficientβ.Ifβ∧is significantly positive, it means that financial knowledge can promote participation by rural households in the financial market.

In this paper, we use the proportion of risky financial assets in the total amount of financial assets held by rural households to measure the depth of their participation in the financial market.Since the proportion of risky assets in financial assets held by rural households is a type of truncated data, the tobit model is used for empirical analysis.

In this formula,Yiis a variable representing the financial asset investment of rural households,measured by the proportion of risky financial assets;yi*means rural households with its proportion of risky financial assets falling between (0, 1).The meanings of other variables are consistent with those for the probit model.

Ivprobit model and ivtobit model.

The amount of financial knowledge in model (1) and model (2) may be ascribed to endogenous causes.On the one hand, it is up to rural households to decide whether to learn financial knowledge,meaning that their decisions might be affected by unobservable factors (such as local customs, culture,and social and historical reasons).These affect not only rural households’ decisions to learn financial knowledge, but also their selection of financial assets.On the other hand, there may be reverse causality between financial knowledge and rural households’ participation in the financial markets,as they do not necessarily invest in financial assets only after they have acquired some financialknowledge.They are more likely to learn and accumulate financial knowledge as they delve deeper into the financial markets, and this reverse causality may lead to simultaneity bias and cause rural households to overestimate the impact of financial knowledge.Finally, there may be some deviations in the measurement of financial literacy indicators, and the answers provided by households in the sample to financial knowledge-related questions may be inaccurate or based on guesswork.To overcome the impact of the above endogenous problems and identify the causal relationship between financial knowledge and financial investment of rural households, financial knowledge variables are constructed according to data from the 2015 CHFS, and instrumental variables are selected to be estimated by ivprobit and ivtobit models.

Drawing on the ideas of Yin Zhichao et al.(2014), we select the average education level of respondents’ parents as the instrumental variable after different instrumental variables are tested.①A question was included into three rounds of CHFS conducted in 2013, 2015, and 2017: “What is the education level of your parents?” For this question,the respondents had to choose one of the following answers: a.Haven’t received any form of education b.Elementary school c.Junior Secondary School d.Senior Secondary School e.Technical secondary school/vocational high school f.Junior college/higher vocational college g.Bachelor’s Degree h.Master’s degree 9.Doctoral degree.According to answers of respondents, we can identify the educational level of their parents.In the 2013 CHFS, all households gave their answers to this question.However, in the 2015 CHFS and 2017 CHFS, these households were not followed up and only new households answered this question.As a result, when constructing instrumental variables, we had to regard the educational level of the parents of respondents in the 2103 CHFS as the educational level of those who were not followed up in the 2015 CHFS and 2017 CHFS.The effectiveness of the instrumental variables selected for our analysis is reflected in two aspects:First of all, parents are the earliest teachers of children, and family is also where one is exposed to financial knowledge.More well-educated parents can provide their children with earlier and easier access to financial knowledge.This sort of education will allow their children to gain a deeper understanding of financial concepts, such as interest rate calculations, inflation impacts,and risk-return relationships.Therefore, there is a correlation between the average education level of the respondents’ parents and the financial knowledge level of the respondents themselves.Second,financial transactions are subject to the decisions of financial market participants.The educational level of their parents will not affect the financial investment behaviors of respondents directly, but indirectly by exerting an effect on financial literacy of their children.In the following section, the normative econometric test we use to determine the effectiveness of our instrumental variables is discussed.

Variable Selection

Explained variable.

According to the financial asset information collected by the 2017 CHFS, the existing research methods (Yin Zhichao et al., 2014; Wang Yang, 2019) should continue to be used to divide financial assets into risky financial assets and risk-free financial assets.The former includes stocks, funds,financial bonds, corporate bonds, financial derivatives, financial products, foreign reserves, and gold.The latter includes cash, cash in stock accounts, government bonds, demand deposits, and fixed-term deposits.The breadth of rural households’ participation in the financial market is measured by a proxy indicator that represents whether rural households hold risky financial assets.If they hold risky financial assets, the indicator equals to 1.Otherwise, the value is 0.The depth of participation in the financial market is measured by a proxy indicator that indicates the proportion of risky financial assets in the total amount of financial assets held by rural households.

Financial knowledge indicator.

In light of the practices of existing literature, the financial knowledge level of rural households is measured by their ability to calculate interest rates, understand inflation, and identify risks.Specifically, in the 2015 CHFS, a question was devised to test their ability to calculate interest rates: If you deposit RMB100 in a fixed deposit scheme for five years, how much principal plus interest can you receive under an annual interest rate of four percent after five years? The possible answers are: a.Less than RMB120; b.RMB120; c.More than RMB120; d.Unable to calculate it.If the answer is “b.RMB120,” the respondent is considered to have given a correct answer.If the answer is “a.Less than RMB120” or “c.More than RMB120,” the respondent is believed to have provided an incorrect answer.A respondent who chose “d.Unable to calculate it” is seen as unable to calculate interest.

The question designed to evaluate the understanding of inflation is: If you deposit RMB100 in a bank for one year, how much worth of products can you buy with this RMB100 under an annual interest rate of five percent and inflation rate of three percent one year later? The potential answers include: a.More than a year ago; b.The same as a year ago; c.Less than a year ago; d.Unable to calculate it.If the answer is a.More than a year ago, the respondent is considered to have given a correct answer.If the answer is “b.The same as a year ago, or c.Less than a year ago,” the respondent is believed to have provided an incorrect answer.A respondent who chose “d.Unable to calculate it”is seen as unable to calculate inflation rates.

The question for evaluating the ability to identify risks is: Which one do you think is riskier,stocks or funds? The options are: a.Stocks; b.Funds; c.Haven’t heard of stocks; d.Haven’t heard of funds; e.Haven’t heard of both.If the answer is “a.Stocks,” the respondent is considered to have given a correct answer.If the answer is “b.Funds,” the respondent is believed to have provided an incorrect answer.If the answer is “c.Haven’t heard of stocks” or “d.Haven’t heard of fund” or “e.Haven’t heard of both,” the respondent is considered to have no idea what stocks or funds are.

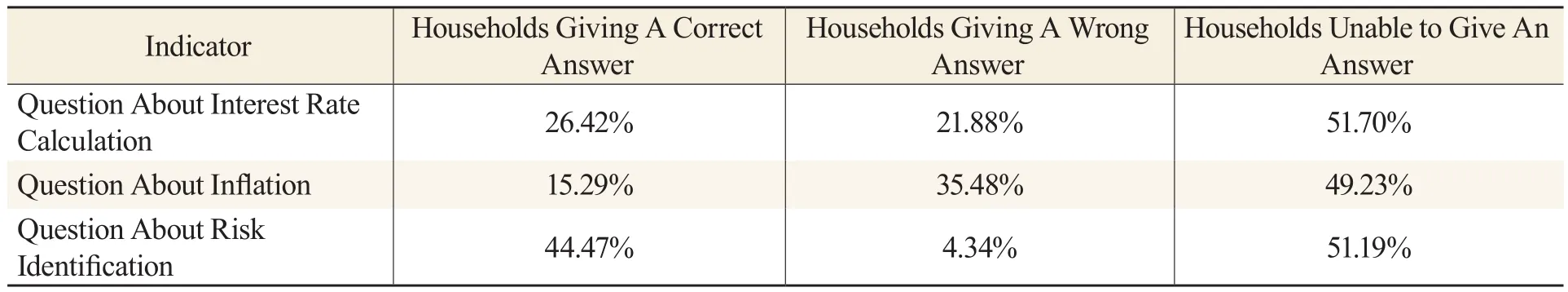

Table 2 provides descriptive statistics about the above three questions devised to evaluate the command of financial knowledge by rural households.These three questions differ from each other in terms of accuracy of answers given by rural households.Unfortunately, only a small percentage of rural households are able to give correct answers.Specifically, only 15 percent correctly answer the question about inflation, while the figure for the question about the interest rate is 26 percent.Only 44 percent (still less than half) of rural households are capable of identifying risks.On top of these, a total of 51.7 percent, 49.23 percent, and 51.19 percent of rural families know nothing about interest rates,inflation, and risks, which is staggering.

Table 3 gives a description of the number of correctly-answered questions.As shown in the Table, only 2.01 percent of all households give correct answers to all three questions and these households only answer an average of 0.54 questions correctly.One particular note is that 47 percent of all rural families have no idea about these three questions of financial knowledge.The descriptive results of Table 2 and Table 3 indicate that rural families lack basic understanding of basic financial knowledge, a phenomenon that will inevitably have a bad influence on their financial investment behaviors.

Table 2 Descriptive Statistics of the Performance of Rural Households in Answering Questions about Financial Literacy

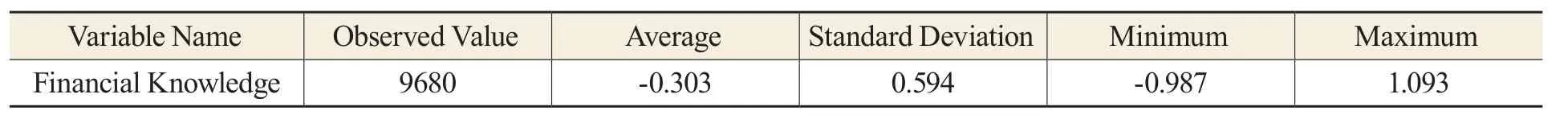

With reference to existing literature (Agarwal S.et al.2010; Lusardi A.et al., 2010; Rooij et al.,2011; lusardi and mitchell, 2010; Yin Zhichao, 2014), the method of factor analysis is first employed to build financial knowledge indicators in this paper.Two virtual variables are defined according to rural households’ answers of financial knowledge on each question.The first virtual variable is designed to signify whether the question had been correctly answered.If the answer is correct, the variable equals 1; otherwise it is 0.The second virtual variable is devised to represent whether the question had been answered directly (no matter the answer is correct or wrong).①The respondents could only give three different types of answers to each question: a correct answer; a wrong answer; unable to give an answer.These three answers suggest a declining financial knowledge level.For example, rural households who gave a wrong answer have better financial literacy than those unable to give an answer.If only a virtual variable representing whether an answer is correct or wrong is involved, the financial knowledge level of rural households who gave a wrong answer would be mistakenly deemed equivalent to that of those unable to give an answer.This will give rise to deviations in the measurements of financial knowledge indicators.If the question is directly answered, it equals 1; otherwise it is 0.Maximum likelihood method was used to conduct factor analysis on the six virtual variables arising from these three questions.②Results of Kaiser-Meyer-Olkin (KMO) test reveal that factor analysis is appropriate for this study.Considering that the characteristic value should be equal to or more than 1, one factor is retained.Due to length limitation, results of KMO test and factor analysis are not listed.Table 4 provides descriptive statistical results of the financial knowledge level of rural households obtained through the factor analysis.

Table 4 Factor Analysis Results

Additionally, in the subsequent robustness test for this paper, two indicators signifying the number of questions correctly answered by rural households①The corresponding question in questionnaire is: How much are you concerned about the economy and financial information? a.Deeply concerned; b.Very concerned; c.Concerned; d.A little concerned; e.Never concerned.Each of these options are given a value, namely 4, 3, 2, 1 and 0 respectively.and their attention to financial knowledge will be employed to re-measure the level of financial knowledge, and conduct robustness test on the estimated results.

Capability against risks.

For our study, the capabilities of rural households against risks are measured from both subjective and objective perspectives.Subjective capability against risks is measured in view of a question about attitudes of the interviewed families towards subjective risks in the 2015 CHFS.This question is: If you have an asset, which one of the following types of investment projects will you choose? These projects include: a.Investment projects with the highest risks and highest returns; b.Investment projects with slightly higher risk and slightly higher returns; c.Investment projects with average risks and average returns; d.Investment projects with slightly lower risks and slightly lower returns;e.Unwilling to take any risks.If a rural household chooses “d.Investment projects with slightly lower risks and slightly lower returns” or “e.Unwilling to take any risks,” the value for its subjective capability against risk shall be 0; if its answer is “c.Investment projects with average risks and average returns,” the value shall be “a.If a rural household chooses 1.Investment projects with the highest risks” and highest returns or “b.Investment projects with slightly higher risks and slightly higher returns,” the value for its subjective capability against risk shall be “b.A higher value means greater subjective capability against risks.”

With respect to objective capability against risks, indicators for objective risk management abilities of rural households are established in view of a question about the pension scheme of the interviewed families②Since the above questions were not retained in the 2017 CHFS, and the pension schemes of the households remain relatively stable, there were no significant changes between the two rounds of CHFS in 2015 and 2017.Therefore, the pension schemes for households in the 2015 CHFS are used for households followed up in 2017.in the 2015 CHFS with reference to the methods of Yin Zhichao et al.(2020).Specifically, the rural households are asked, “Do you have a pension plan,” and there are two options for this question: a.Yes; b.No.For families with pension schemes, they would be asked for more details of their plan.There are seven options for this question: a.Personal savings and investment; b.Child support; c.Social endowment insurance; d.Retirement pension; e.Commercial endowment insurance; f.Support from spouse or relatives; g.Other methods.If a household does not have a pension scheme, the value for its objective capability against risk is 0.If it chooses “b.Child support;d.Retirement pension; f.Support from spouse or relatives, or g.Other methods, it is deemed to have aweak capability against risks and the value would be a.If a household selects “a.Personal savings and investment, c.Social endowment insurance, or e.Commercial endowment insurance,” it is believed to have a strong capability against risks and the value would be b.

Other Control Variables

Control variables are selected according to the characteristics of different households,householders, and provinces.

Household characteristic variable.

Total household income includes income from agricultural production and operation, wage,property income, and transfer income.Household net asset means the total household assets minus household liabilities and household financial assets.To determine whether a household had any industrial and commercial business, a question is designed in the 2017 CHFS: Is your household now engaged in any industrial and commercial businesses, including self-employed and leasing businesses,transportation projects, online stores, and enterprises? If a respondent answers yes, the value for his/her net assets is 1; otherwise it is 0.If the respondent has a house, the value for homeownership is 1;otherwise, it is 0.In addition, the number of all immediate siblings of the householder and his spouse is used to measure the social network of the household.Family scale means the number of people living together in a rural household according to the CHFS definition of family members.

Householder characteristic variable.

The age of the householder is obtained by subtracting the year of birth of the householder given in CHFS data from 2017.Considering the nonlinear effect of age on the householders’ credit behavior,the square of the age of the householder is added to the regression model.There are nine levels for the education of householders in the CHFS: a.Haven’t received any form of education; b.Elementary school; c.Junior Secondary School; d.Senior Secondary School; e.Technical secondary school/vocational high school; f.Junior College/higher vocational college; g.Bachelor’s Degree; h.Master’s degree; i.Doctoral degree.The years of education corresponding to these options are 0, 6, 9, 12,13, 15, 16, 19 and 22 years, respectively.The question in CHFS to measure the health status of the householder is: “How is your health compared to your peers? There are five corresponding options for this question: a.Very good; b.Good; c.Average; d.Poor; e.Very Poor.If a householder chooses a and b, the dummy variable for physical health is 1, and if he/she chose c, d, or e, the value is 0.If the householder is male, the value for gender is 1; otherwise, the value is 0.If householder is married, the value for marriage status is 1; otherwise, it is 0.

Provincial dummy variables.

Provinces in China differ greatly from each other in terms of socioeconomic status, financial market conditions, culture, and customs.Considering this regional heterogeneity, a provincial dummy variable is constructed to control for external environmental factors that affect rural households’participation in the financial markets.

Table 5 provides a description of the descriptive statistics of the variables.As shown in thetable, the percentage of rural households participating in the financial markets is only 13 percent,and the proportion of risky financial assets in total financial assets held by rural households is only 6.68 percent.Only six percent of rural households believe that they have a strong ability to resist risks, and only eight percent of rural households are confident in their ability to cope with risks.This shows that both the breadth and depth of rural households’ participation in the financial market are inadequate, and their subjective and objective capabilities against risks generally prove to be insufficient.The average value for financial knowledge of rural households obtained through factor analysis is -0.3, the minimum value is -0.99, and the maximum value is 1.09.There are obvious differences in the level of financial knowledge among different rural households.In our sample, eight percent of rural households choose to start their own business in the industrial and commercial sectors; these rural households have four family members on average; the average age of householders is 57 years old, indicating that the population is aging in rural areas.The householders have received only a seven-year education on average, equal to the education level of Junior Secondary School, meaning that most of them are not well-educated.Also, more than a quarter of the householders are in poor health.

Table 5 Descriptive Statistics of Variables

Empirical Analysis

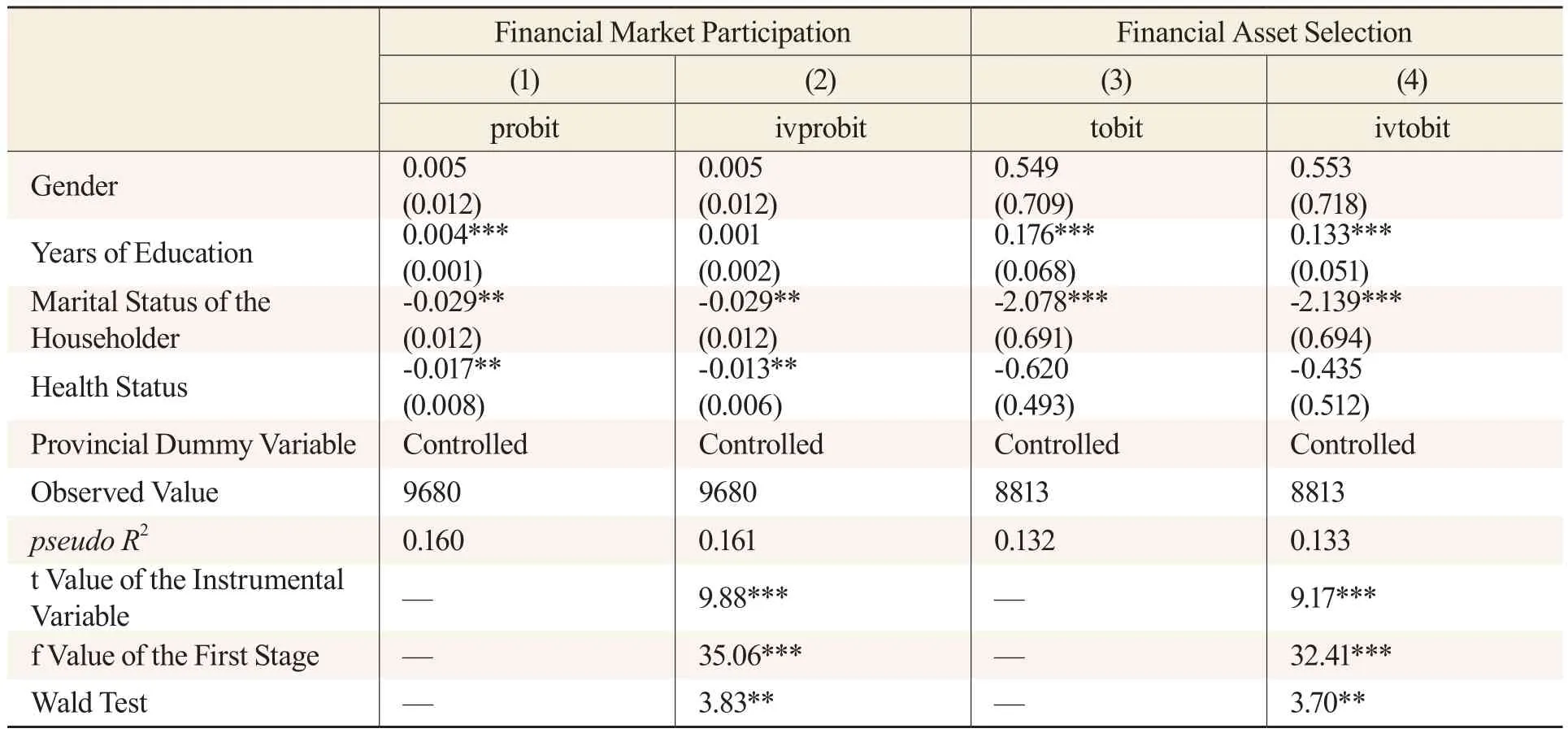

Financial Knowledge and Participation in the Financial Markets

Regarding financial market participation, and financial asset selection, we first examine whether financial knowledge significantly affects rural households’ willingness to participate in financial markets according to previous definitions of financial knowledge, financial market participation,and financial asset selection.Column (l) in Table 6 is the estimated results of the probit model.After household characteristic variables, the householder characteristic variable, and the provincial dummy variables are controlled for, we find that financial knowledge has a significant positive impact on rural households’ willingness to participate in the financial markets, generating a marginal effect of 0.016,which is statistically significant at the one percent significance level.

In addition, both household income and household net assets have a significant positive effect on rural households’ participation in the financial markets, as increased income and assets enable them to pay the fixed costs of financial investments, and they are thus more willing to participate in the financial markets (He Wei & Wang Xiaohua, 2021).Being a self-employed business owner will have an effect on reducing the probability of participating in the financial markets.This generates a marginal effect of -0.054, and the effect is statistically significant at the 1 percent significance level.On the one hand, rural households who are self-employed business owners were already facing high risks, and they would therefore reduce their investments in the financial markets (Healton &Lucas; Yin Zhichao et al., 2014).On the other hand, they also faced more credit constraints that inhibited their ability to invest in financial assets, further reducing their willingness to participate in financial markets (Constantinides et al., 2002).Home ownership would reduce the probability of rural household’s participating in the financial market, which was consistent with the conclusion in the literature that home ownership will “crowd out” investments in risky assets (Cocco, 2005; Wu Weixing & Qi Tianxiang, 2007).The scale of social networks, which is the number of brothers and sisters, would promote rural households’ participation in risky financial markets.In a traditional and isolated “rural society,” social networks can act as insurance that could improve households’capability against risks, thus contributing to their participation in financial markets (Yang Hong &Zhang Ke, 2021).Households with more family members would be less likely to invest in financial markets, as they must cope with a larger family expenditure.Therefore, they may face greater financial constraints on financial asset investments, thereby reducing their willingness to participate in financial markets (Wang Yang, 2019).

The age of the householder is in a nonlinear relationship with financial market participation because increased age will first increase and then diminish the possibility of rural households participating in the stock market.The marginal effect of years of education is 0.004, having a positive impact on financial market participation at the one percent significance level.Better-educated rural households may find it easier to learn and master financial investment knowledge.This could encourage them to participate in financial investments (Vissing -Jorgensen, 2002).Rural households are more likely to participate in the financial markets, while those with the householder married and with a member in bad health are more reluctant to participate in the financial markets.The gender of the householder has no significant effect on financial market participation.

Of particular note, estimated results in Column (1) of Table 6 might be affected by endogenous bias, and there might be bias in the estimated coefficient for financial knowledge.To solve this problem, the average education level of respondents’ parents is used as an instrumental variable of financial knowledge to conduct estimations in two stages.Column (2) is the estimated result of the ivprobit model after the instrumental variable is added.In the Wald test, the hypothesis that “financial knowledge” is an exogenous variable at the 5 percent significance level is rejected.In the first-stage estimation, the t value of the instrumental variable is 9.88.The value of the F-statistics is 35.06, greater than the critical value of 16.38 at the 10 percent bias level (Stock & Yogo, 2005).This indicates that there is no weak instrumental variable.In view of the above explanations of the exogenous problems of the instrumental variable, we believe that it is effective to select the average educational level of parents as the instrumental variable of financial knowledge in this paper.

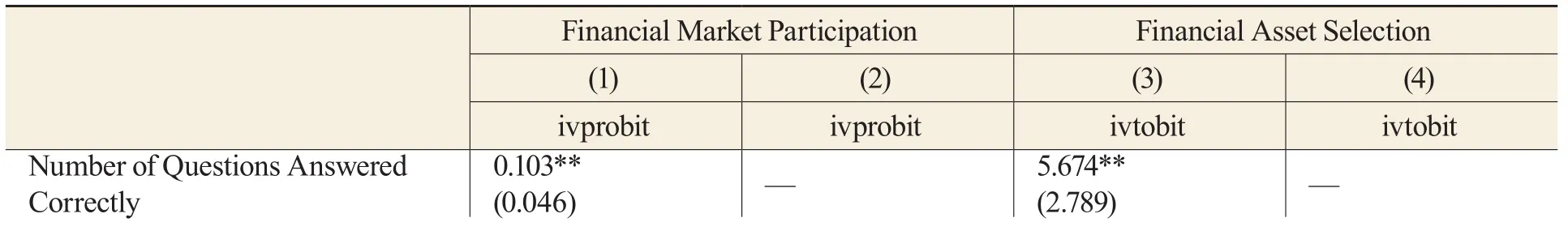

Table 6 The Impact of Financial Literacy on Financial Market Participation and Financial Asset Selection by Rural Households

The estimated results in column (2) show that the marginal effect of financial knowledge is 0.121,statistically significant at the 5 percent level.The estimated results of other variables are consistent with those in column (1).After the endogenous problem is taken into consideration, estimated results in the latter two stages further demonstrate that improvements in financial knowledge can increase the probability of rural households participating in risky financial markets.This verifies hypothesis H1.

Note: *, **, and *** indicate statistical significance at the 10%, 5%, and 1% significance level, respectively.These coefficients represent marginal effects.Inside the brackets are the clustered heteroskedastic-robust standard errors.

Financial Knowledge and Rural Households’ Selection of Financial Assets

In the benchmark regression model in column (3) of Table 6, endogenous problems are not considered.The proportion of risky financial assets is regressed on financial knowledge according to the tobit model.After endogenous problems of financial knowledge are considered in column (4),the ivtobit model is used to estimate results in two stages.The hypothesis that “financial knowledge”is an exogenous variable is rejected in the Wald test at the 5 percent significance level, indicating that there are endogenous problems resulting from financial knowledge.Therefore, there is an endogenous bias in the benchmark regression results in column (3).In the first-stage estimation, the t value of the instrumental variable is 9.17.The value of the F-statistics is 32.41, greater than the critical value of 16.38 at the 10 percent bias level (Stock & Yogo, 2005).This indicates that there is no weak instrumental variable.

The estimated results of the ivtobit model in column (4) prove that the marginal effect of financial knowledge is 6.670, statistically significant at the 5 percent significance level.This finding shows that rural households with a better command of financial knowledge will change the structure of their financial assets by purchasing more risky financial products.Therefore, hypothesis H2 is verified.

In addition, increased income and assets will allow rural households to invest more in risky financial assets.Home ownership and being self-employed business owners will leave rural households with less money to invest in risky financial assets, while an expanded social network will serve to raise the proportion of their investment in risky financial assets.The influence of the age of the householder also displays a non-linear relationship, and more well-educated rural households tend to invest more in risky assets.

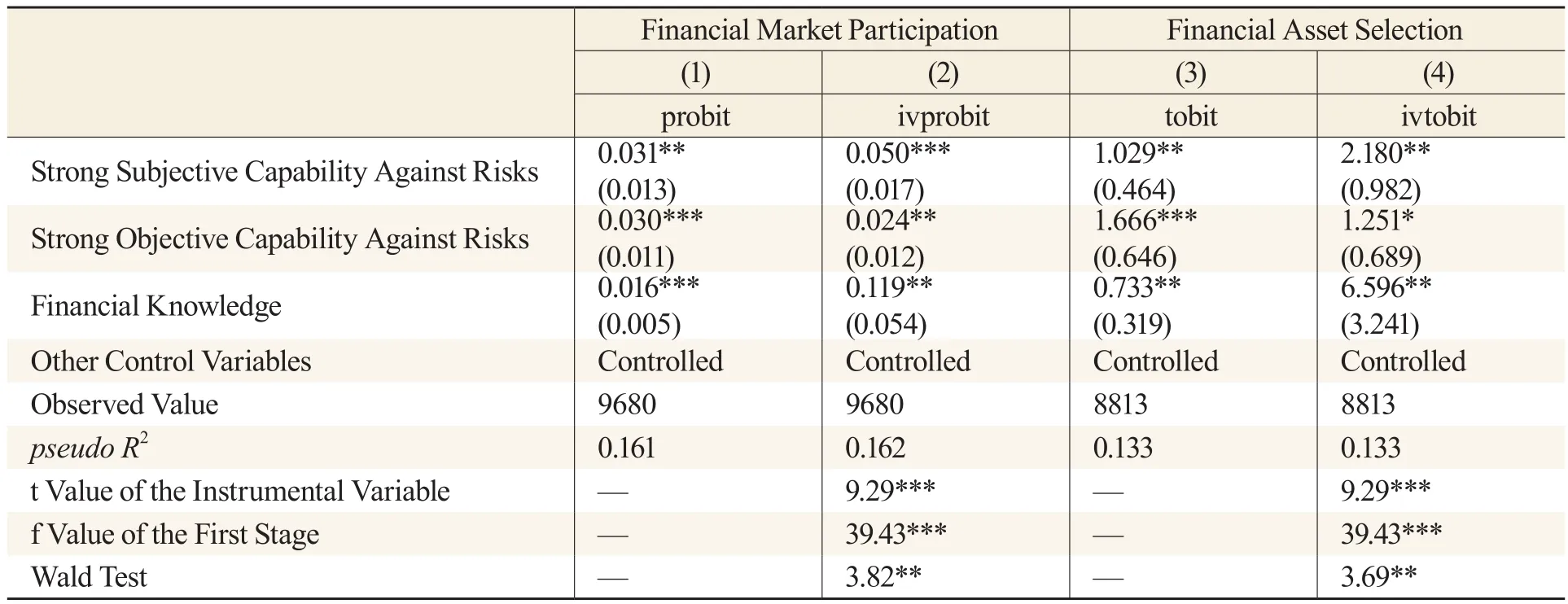

The Impact of Capability Against Risks on Financial Market Participation and Financial Asset Selection by Rural Households

Columns (1) and (2) in Table 7 report the effects of subjective and objective capabilities against risks on the breadth of participation by rural families in financial markets, respectively.Specifically,column (1) contains the estimated results of the probit model.Given the possible endogenous problems of financial knowledge, column (2) gives the estimated results of the ivprobit model in two stages.The results of the endogeneity test reveal that financial knowledge will lead to endogenous problems, and there are endogenous biases in the estimated results in column (1).As a result, the results in column(2) are reliable.For column (2), when the impact of financial knowledge is controlled for, we find that the marginal effect of subjective capability against risks is 0.03, a figure statistically significant at the 5 percent level.The marginal effect of the objective capability against risks is 0.05, statistically significant at the 1 percent level.Thus, stronger subjective and objective capabilities against risks can also motivate rural households to participate in risky financial markets.

Columns (3) and (4) in Table 7 report the effects of subjective and objective capabilities against risks on the depth of participation by rural families in the financial markets, respectively.Column (3)contains the estimated results of the tobit model.The estimated results of the ivtobit model in column (4)show that financial knowledge also has endogenous problems.This means that the results of column(4) are more credible.As for column (4), after the impact of financial knowledge is controlled for,enhanced subjective capabilities against risks can encourage rural households to hold risky financial assets.

According to the estimated results in Table 7, we conclude that increased subjective and objective capabilities against risks can expand the breadth and depth of rural households’ participation in risky financial markets.Therefore, Hypothesis H3 is validated.

Table 7 The Impact of Capabilities against Risks on Financial Markets Participation and Financial Asset Selection by Rural Households

Analysis of Impact Mechanisms

Table 8 tests whether financial knowledge can affect rural households’ financial investment decisions by influencing their subjective and objective capabilities against risks.The estimated results reveal that improved financial knowledge levels of rural households will lead to stronger subjective and objective abilities against risks.This relationship suggests that financial literacy can expand the breadth and depth of rural households’ participation in the financial markets by changing their subjective and objective capabilities against risks.As a result, Hypothesis H4 proves to be true.

Table 8 Analysis of Impact Mechanisms

Robustness Test

To examine the robustness of the empirical results in this paper, indicators for the financial knowledge levels of rural households need to be re-measured.To this end, we first use the number of correctly answered financial knowledge questions to measure the comprehensive financial knowledge levels of rural households.Rural households to give more correct answers are more efficient in comprehensively applying financial knowledge.Second, we measure the level of financial knowledge by looking at how much attention the interviewed households have been paying to economic and financial information, as rural households more concerned with such information generally have easier access to financial knowledge.

Table 9 shows the results of the robustness test conducted by re-estimating the above models according to the two newly defined financial knowledge indicators.As demonstrated in columns (1) - (2), higher comprehensive and general financial knowledge levels will significantly improve the willingness of rural households to participate in financial markets.Columns (3) - (4) also suggest that a higher financial knowledge level can significantly increase the proportion of rural households’ investments in risky financial assets, whether the proxy variable is the attention paid to financial information or the number of financial knowledge questions correctly answered.

Table 10 describes the robustness test on the impact of capabilities against risks on the breadth and depth of rural households’ financial market participation.The estimated results in columns (1) - (4)indicate that regardless of the level of financial knowledge, both subjective and objective capabilities against risks are important factors affecting rural households’ willingness to participate in financial markets and their selection of financial assets.Rural households with higher subjective and objective capabilities against risks are more likely to participate in the financial markets and tend to invest a larger percentage of their wealth in risky financial assets.

Table 11 illustrates the robustness test of the impact mechanism.Columns (1) and (3) correspond to estimated results of comprehensive financial knowledge.As they accumulate more comprehensive financial knowledge, farmers can better evaluate their capabilities against risks and handle risks more efficiently.Columns (2) and (4) are estimated results of general financial knowledge, and they imply that financial knowledge can enhance rural households’ subjective and objective capabilities against risks at the same time.

Table 9 Robustness Test-Financial Literacy

Table 10 Robustness Test-Capability Against Risks

Table 11 Robustness Test-Impact Mechanism

The empirical results of our analysis confirm that rural households with higher levels of financial knowledge and rural households with stronger capability against risks are more willing to participate in risky financial markets and invest more in risky financial assets, whether the estimated results are based on financial knowledge indicators in factor analysis or comprehensive and general financial knowledge indicators.The mechanisms analysis also reveal that financial knowledge can affect the breadth and depth of rural households’ participation in the financial markets by exerting an effect on their subjective and objective capabilities against risks.

Note: *, **, and *** indicate the impact is statistically significant at the 10%, 5%, and 1% significance level, respectively.These coefficients represent marginal effects.Inside the brackets are the cluster-heteroskedastic-robust standard errors.

Research Conclusions and Policy Implications

Based on the data on rural households collected in two rounds of the China Household Finance Survey, in 2015 and 2017, we study the impact of financial literacy and capacity against risks on participation by rural households in risky financial markets and their selection of financial assets.To offset the effects of estimation bias arising from endogenous problems of financial knowledge, we use a two-stage instrumental variable method to estimate results based on the ivprobit model and the ivtobit model.

We find that financial knowledge and capability against risks are the two key factors in understanding the financial asset selection behaviors of rural households.The more financial knowledge they have and the stronger their ability to guard against risks, the more likely they are toparticipate in financial markets and the more they will invest in risky financial assets.Our mechanism analysis further shows that higher financial knowledge levels can help rural households evaluate their capabilities against risks and ramp up their ability to deal with risks, thus indirectly expanding the breadth and depth of participation in financial markets.We discover that after multiple dimensions of indicators are employed to measure financial knowledge, the estimated results remain stable.In addition, increased household income and wealth, and a larger social network help rural households to participate and invest in the financial markets.By comparison, factors, such as home ownership,being a self-employed business owner, and increasing family size, will “squeeze” the breadth and depth of rural households’ participation in the financial markets.The education level and health status of householders have a significant positive effect on financial investments.Age shows a nonlinear relationship with financial investments, which increases first and then decreases as the age of the householders’ increases.

Based on the above conclusions, we believe that the lack of financial knowledge is a “stumbling block” restricting rural households from participating in financial markets and investing in risky financial assets.An inadequate command of financial knowledge is also a bottleneck hampering the growth of their property income.In rural areas, most rural families are poorly educated, and they generally have little access to financial knowledge.This leads them to misunderstand and resist financial products.According to the 2017 CHFS data, 75.46 percent of rural households did not participate in the stock market because of “a lack of knowledge about stock trading,” and 65.52 percent of rural households did not enter the fund market because of “a lack of knowledge about funds.” After mastering basic financial knowledge, rural households are likely to change their current financial investment decisions.

Therefore, when formulating policies and measures to boost the enthusiasm of rural households to engage in the financial markets, emphasis should be put not only on financial hardware infrastructure,but also on enhancing the financial literacy of rural households.There are a few ways to achieve this purpose.First, relevant government departments should dispatch personnel to spread financial knowledge in rural areas, and help rural households better understand financial knowledge by organizing outreach and online courses and free training sessions.Second, financial institutions can also regularly visit rural households to train target families in financial investments.This would allow financial institutions to interact with rural households and determine their personalized financial needs.Third, information technologies and new self-media platforms such as WeChat and Weibo can be harnessed to expand channels for rural households to acquire financial knowledge, and regularly feed simple and practical popular financial knowledge or financial cases to rural households to nurture their interests in increasing their financial knowledge.Finally, apart from disseminating financial knowledge, rural households should also be encouraged to put what they have learned into use.For this purpose, rural communities and financial institutions can offer corresponding opportunities and scenarios to help put the financial knowledge rural households have learned into practice, and thus assist them in transforming financial knowledge into intrinsic financial literacy.These efforts will motivate rural households to invest in financial markets on the demand side, thus preserving or increasing their wealth and raising their property income.

杂志排行

Contemporary Social Sciences的其它文章

- A Preliminary Study of Embedded Supervision Thoughts: Based on a Distributed Financial System

- Research on Big Data Platform Design in the Context of Digital Agriculture: Case Study of the Peony Industry in Heze City, China

- Research on the Impact of Venture Risk Tolerance on R&D Investments:Based on Entrepreneur Ability

- The Historical Fiction Based on True Stories: An Analysis of the Menghui Gushu by Huang Jianhua with the Aid of Historical Records and Archaeological Objects of Art

- The Belt and Road Initiative: Multilingual Opportunities and Linguistic Challenges for Guangxi, China

- The Land of Shu: Where Tang Poetry Rose and Fell