Modelling Insurance Losses with a New Family of Heavy-Tailed Distributions

2021-12-14MuhammadArifDostMuhammadKhanSaimaKhanKhosaMuhammadAamirAdnanAslamZubairAhmadandWeiGao

Muhammad Arif,Dost Muhammad Khan,Saima Khan Khosa,Muhammad Aamir,Adnan Aslam,Zubair Ahmad and Wei Gao

1Department of Statistics,Abdul Wali Khan University,Mardan,23200,Pakistan

2Department of Statistics,Bahauddin Zakariya University,Multan,60800,Pakistan

3Department of Natural Sciences and Humanities,University of Engineering and Technology,Lahore,54000,Pakistan

4Department of Statistics,Yazd University,Yazd,89175-741,Iran

5School of Information Science and Technology,Yunnan Normal University,Kunming,650500,China

Abstract:The actuaries always look for heavy-tailed distributions to model data relevant to business and actuarial risk issues.In this article,we introduce a new class of heavy-tailed distributions useful for modeling data in financial sciences.A specific sub-model form of our suggested family,named as a new extended heavy-tailed Weibull distribution is examined in detail.Some basic characterizations,including quantile function and raw moments have been derived.The estimates of the unknown parameters of the new model are obtained via the maximum likelihood estimation method.To judge the performance of the maximum likelihood estimators,a simulation analysis is performed in detail.Furthermore,some important actuarial measures such as value at risk and tail value at risk are also computed.A simulation study based on these actuarial measures is conducted to exhibit empirically that the proposed model is heavy-tailed.The usefulness of the proposed family is illustrated by means of an application to a heavy-tailed insurance loss data set.The practical application shows that the proposed model is more flexible and efficient than the other six competing models including(i)the two-parameter models Weibull,Lomax and Burr-XII distributions(ii)the three-parameter distributions Marshall-Olkin Weibull and exponentiated Weibull distributions,and(iii)a well-known four-parameter Kumaraswamy Weibull distribution.

Keywords:Weibull distribution;actuarial measures;heavy-tailed distributions;estimations;insurance losses

1 Introduction

Modelling insurance risk data using a heavy tailed distribution has obtained more importance and interest for actuaries.Mostly the Insurance risk data sets are positively skewed,more peaked than mesokurtic,unimodal and owns thick right tail;for detail,we refer to[1–3].To obtain the estimates of business risk for insurance risk data sets,the heavy tailed distributions are very effective and suitable and gives more good fit to the data than the other models,see[4–6].Heavy-tailed distributions have plays a major role and have great importance in the actuarial sciences offering the best description of the claim size distributions;see[7,8].

Realising the significance of these types of data modelling,researchers have shown a great interest in proposing new statistical models appropriate for modelling such data.A few of such models used for modelling insurance risk data and risk returns are Weibull,Pareto,Lognormal and gamma distributions,see for detail[9].However,there are very few probability models in the literature which has the capability to model data with the aforesaid features,therefore,it is necessary to propose new models to fit the insurance risk data,financial returns;for more detail we refer the interested readers to[10–17].

Studying the above literature,we are inspired to develop more dynamic probability models that are flexible in data fittings.Henceforth,in this article,our main objective is to suggest a new family of heavy-tailed(for short,NEFHT)models for modelling heavy tailed data.Several characterizations of the NEFHT distributions will be discussed here.Our research focuses on the special sub case of the NEFHT distributions,named as,a new heavy-tailed Weibull(NEHTW)distribution.Moreover,the most widely used maximum likelihood method of estimation is taken into conderation for estimation of the unknown model parameters.Furthermore,value at risk(VaR)and tail value at risk(TVaR)also computed.At last,we are concentrating our contemplations on the conclusions obtained from the NEHTW distribution fitted to insurance data.

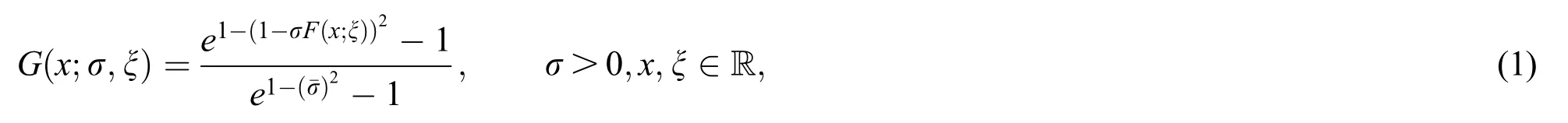

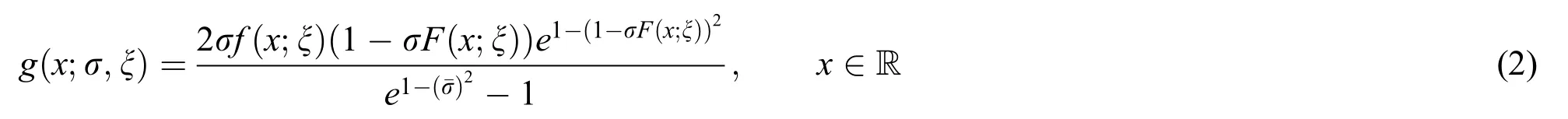

The cumulative distribution function(cdf)of the NEFHT distributed random variable sayX,is follows:

Henceforth,representingX~NEFHT (x;σ,ξ)a random variable having density function given in Eq.(2).

The main objective of the present work is to develop and examine the proposed family in order to get new models appropriate for modelling financial data sets.Its key advantage is that it offers more flexibility to the resulting models by inserting just one extra parameter instead of including two or three parameters as appeared in other methods.Based on the NEFHT family of distributions,we introduce a three-parameter NEHTW model and give a comprehensive description of some of its mathematical properties so that it will attract the wider applications in insurance sciences and other related areas of research.

The rest of this article is structured in the different sections illustrated as:In Section 2,we have incorporated the NEHTW model and several plots displayed for its density.Section 3 contains mathematical properties including quantile function and moments.Section 4 focuses on the estimation and simulation studies of the recently recommended family.Actuarial measures VaR and TVaR of the NEHTW model are derived and based on these measures,a simulation study is conducted in Section 5.Section 6 offers insurance data modeling,While the Section 7 presented the final conclusion of the paper.

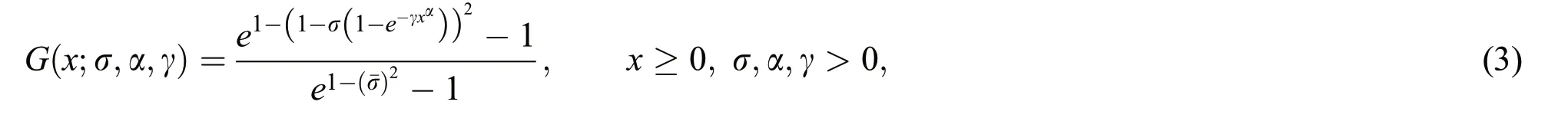

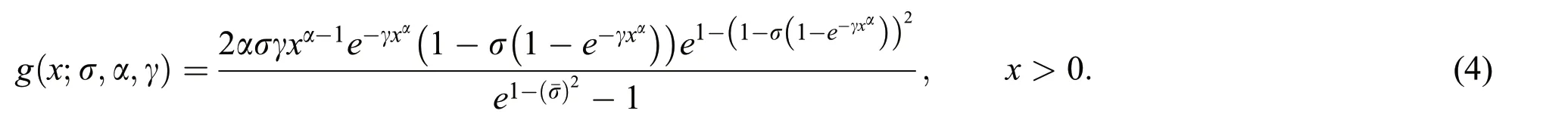

2 A Special Sub-Case

This portion of the article presents a particualr sub case of NEHT family by using the cdf of Weibull distribution with scale and shape parameters γ and α,respectively.The expressions for the cdf and pdf of the Weibull model is given byFx;(ξ)=1-e-γxα,x>0,ξ >0,andf x;(ξ)=αγxα-1e-γxα,respectively.Where ξ= α,(γ).The NEHTW model’s cdf is provided by the following expression.

with density function

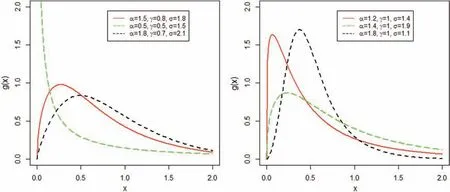

The pdf plots of the NEHTW model for selected parameter values are presented in Fig.1.

Figure 1:The NEHTW model pdf for specified values of the parameters

3 The Mathematical Properties

This section presents some important characterizations of the NEFHT family.

3.1 The Quantile Function

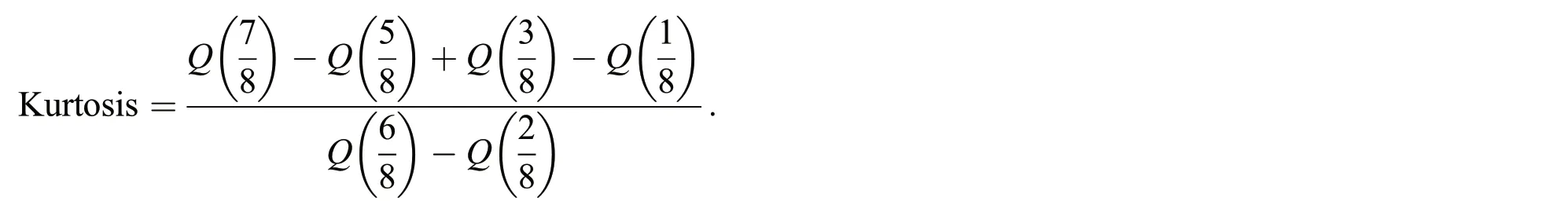

Quantile function is extensively utilized for collecting samples from a specific model.The quantile function of X,represented byQ(u),whereX~NEFHT,is exhibited by the expression given by Eq.(5)as

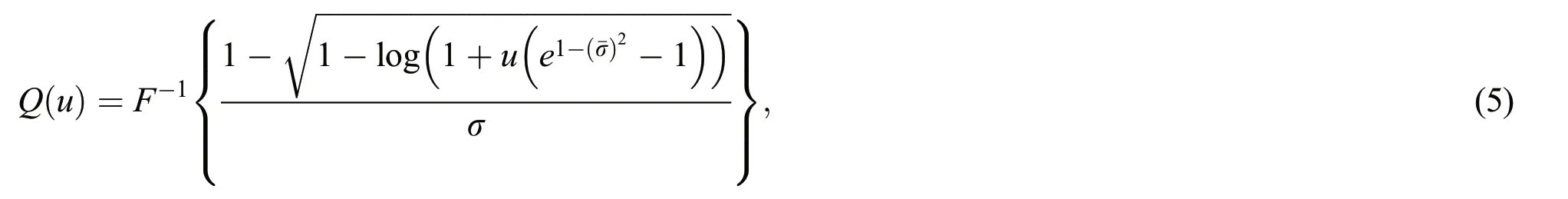

whereu∈(0,1).The quantile function is used to measure the effect of the shape parameters on the skewness and kurtosis.Henceforth,via using Eq.(5),we obtained the expressions for skewness and kurtosis.The formulas for skewness and kurtosis are presented by the following expressions.

and the Moor’s kurtosis is

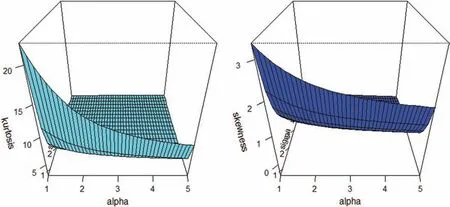

Usually,these measures are slightly influenced by the extreme observations.For γ=1 and different values of α and σ graphs for the skewness,mean,variance and kurtosis of the proposed model are sketched in Figs.2 and 3.

Figure 2:Graphs for the mean and variance of the NEHTW model

Figure 3:Plots for the skewness and kurtosis of the NEHTW model

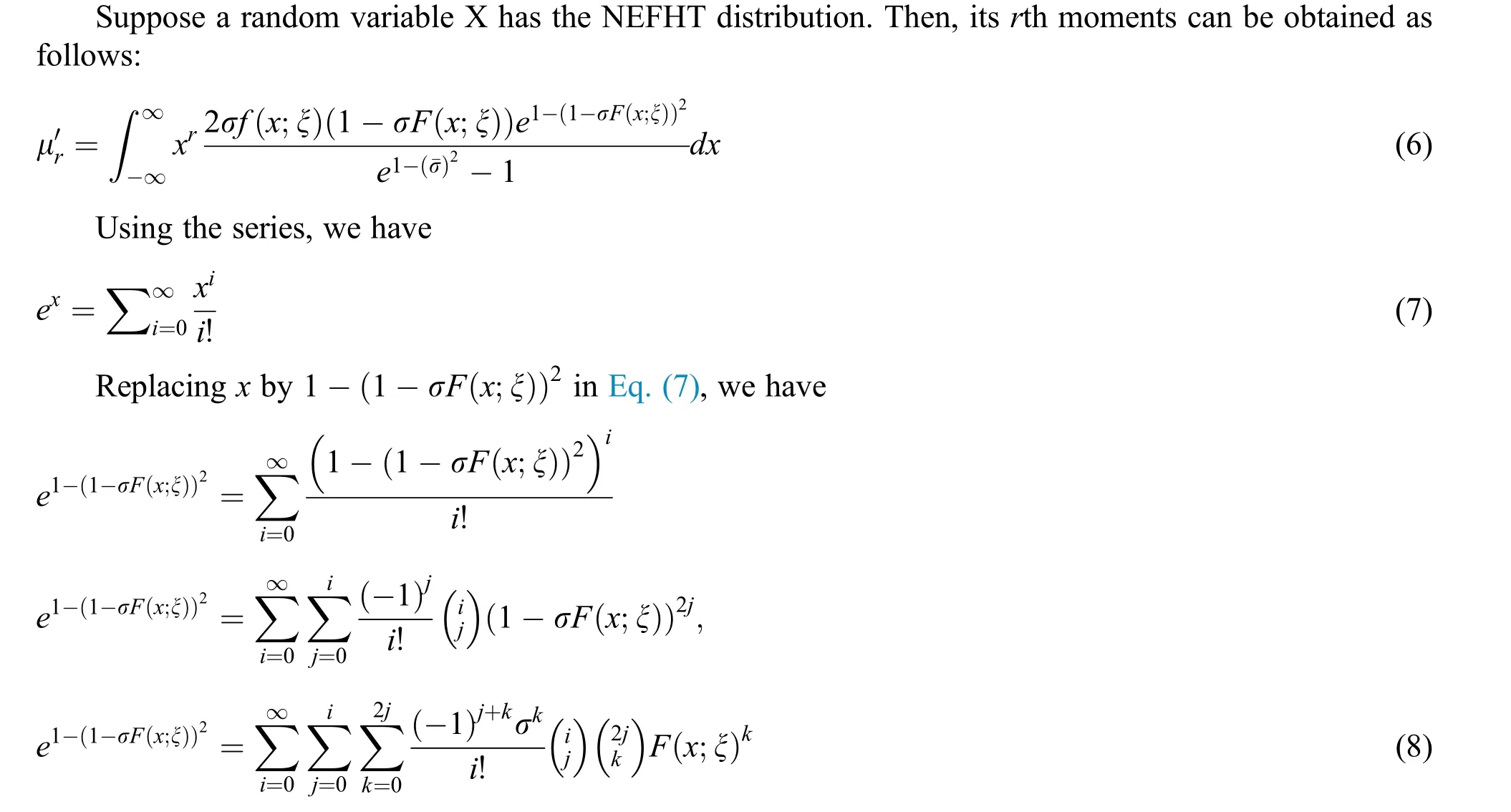

3.2 The Moments

4 Estimation of Paramters and Monte Carlo Simulation

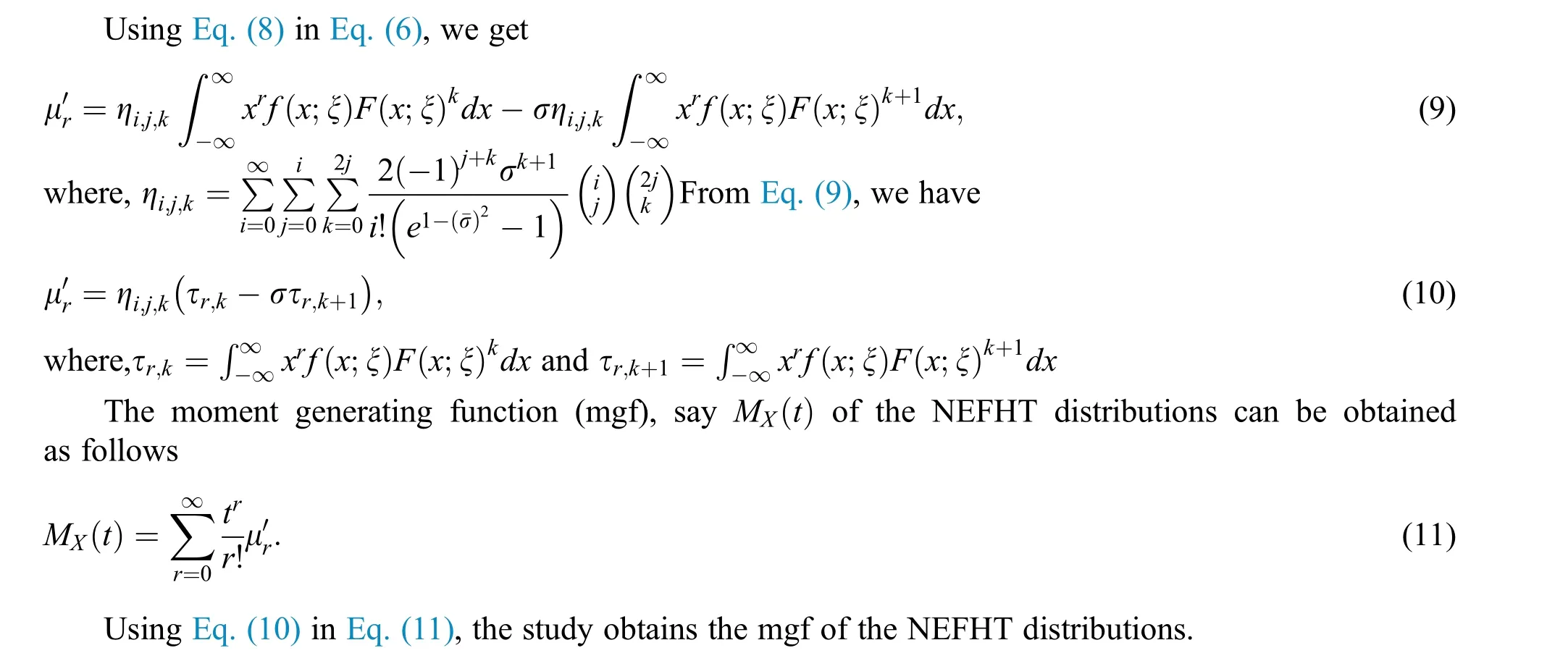

The following sub-section provides a well-known approach for estimation of unknown model parameters,named as maximum likelihood method estimation.Moreover,for assessing the nature of the maximum likelihood estimators(MLEs),a comprehensive analysis is performed.

4.1 Parameter Estimation

4.2 The Monte Carlo Simulation Study

In this portion,a comprehensive Monte Carlo simulation analysis is considered for assessing the performance of the ML estimates.The simulation study is conducted using the NEHTW distribution.The generation of random numbers is successfully performed using the inverse cdf procedure from the NEHTW model through R software.The major steps taken while performing simulation study are given below:

●We produced different samples of sizesn= 25,50,…,1000 from the proposed model.

●MLEs of the parameters are derived.

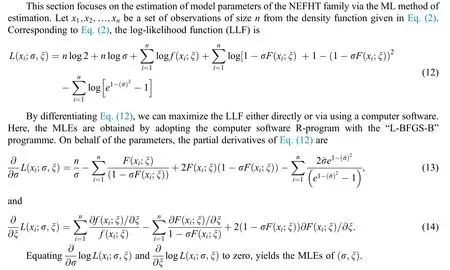

●MSEs and biases are calculated as

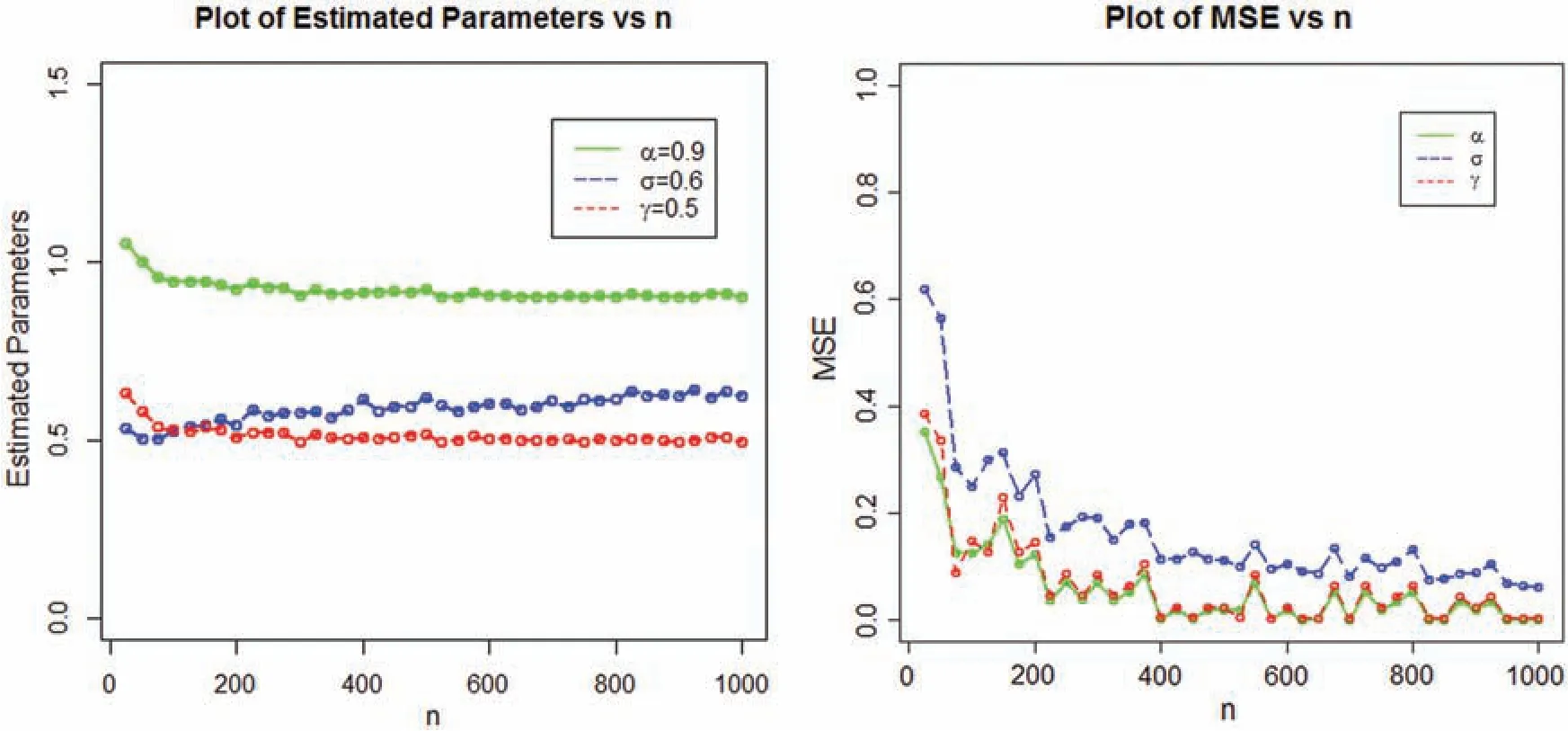

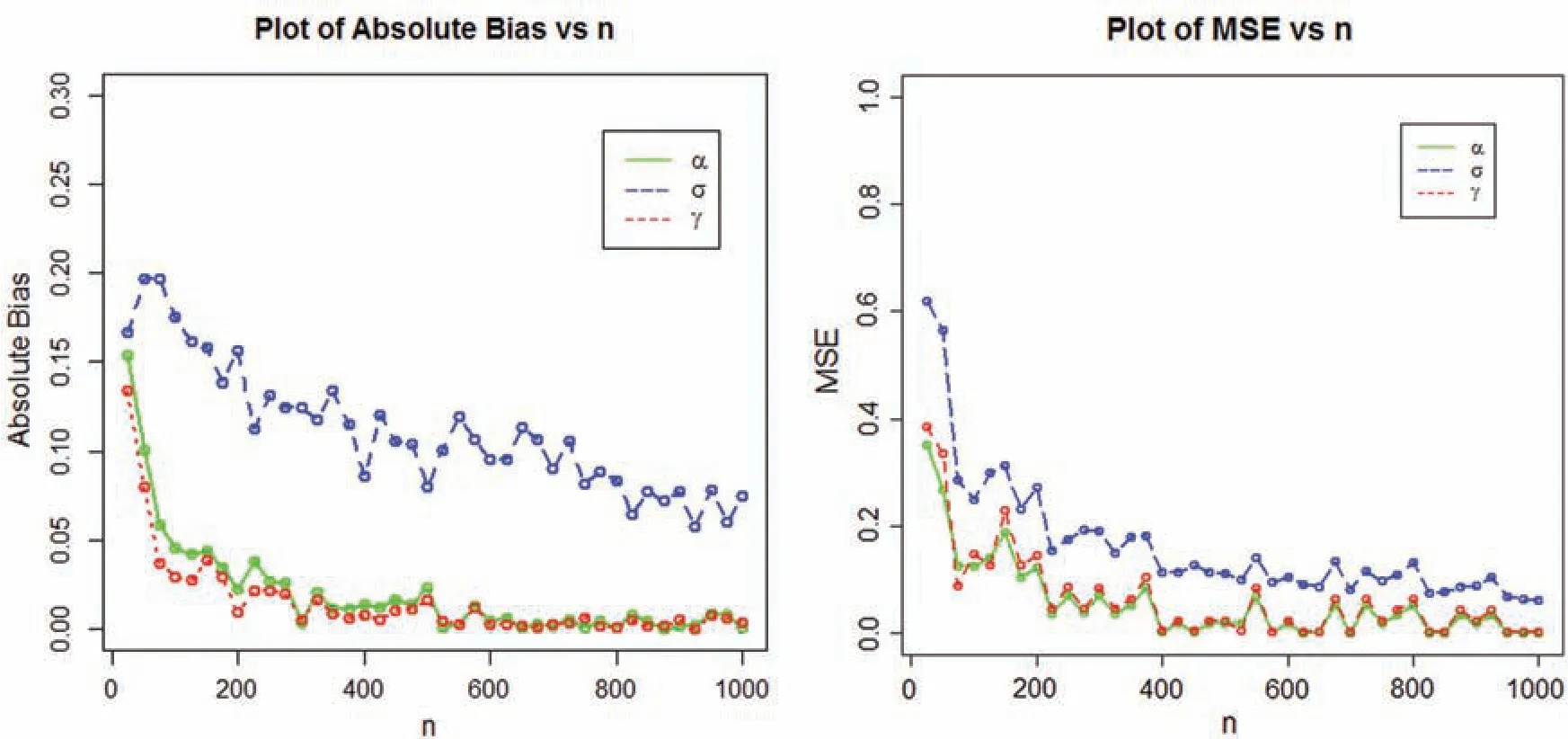

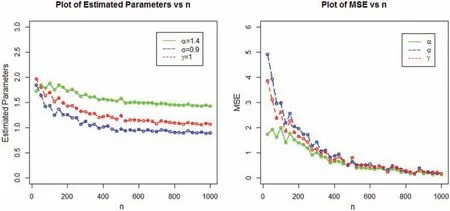

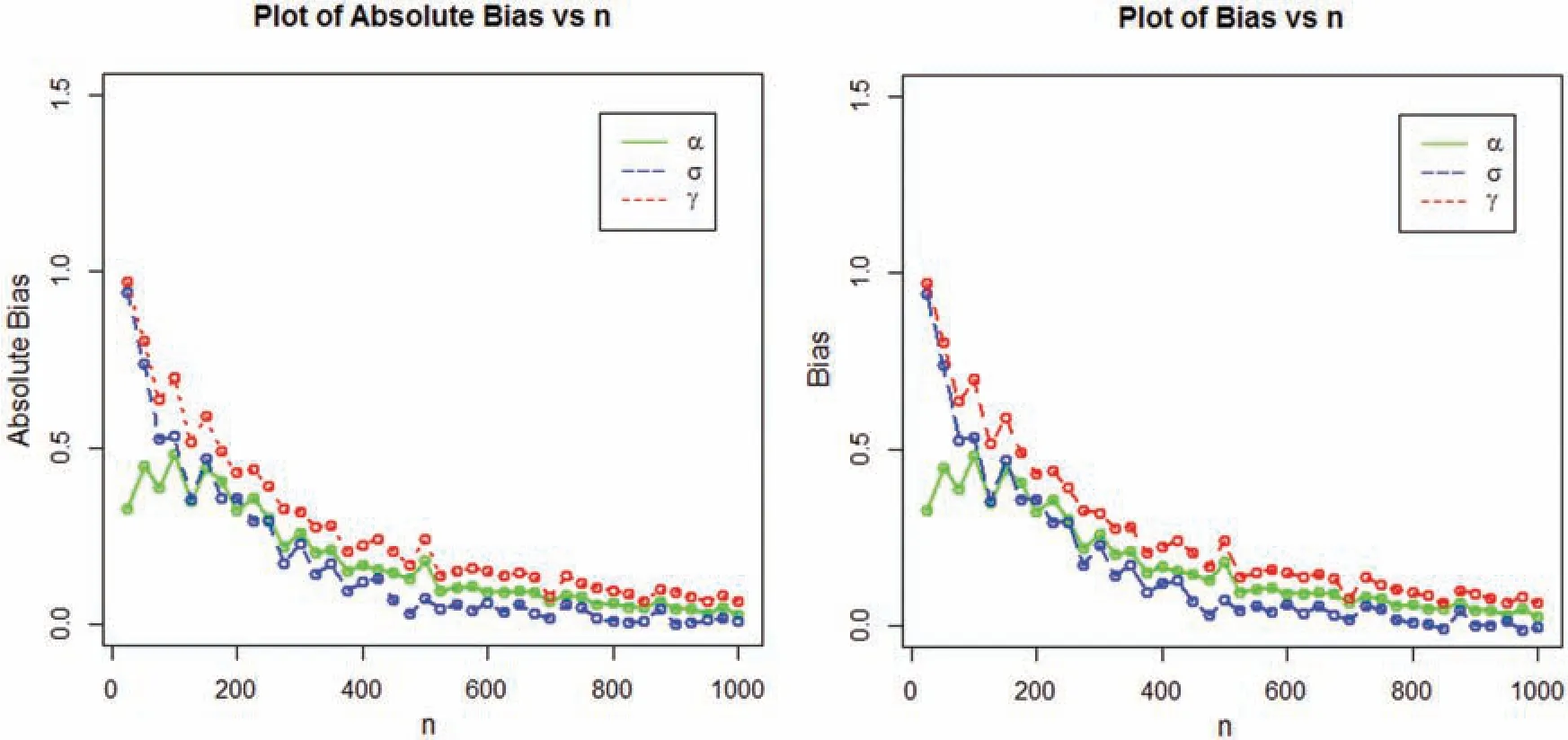

The numerical results of the simulation study are displayed in Figs.4–7.

5 The Actuarial Measures

One of the major role of financial science organizations is to determine the market loss.This portion contains the computation of some essential risk measures named as,VaR and TVaR for suggested model,which plays a key role in portfolio optimisation under the unpredictable situations.

5.1 The Value at Risk

The VaR is most widely considered by the professionals with in the field of insurance and finance to determine risk factor.The measure VaR is mostly specified with 90,95 and 99% of the confidence level,representing the risk probability equal or greater than X percent of the time.The VaR measure ofXis theqthquantile of its cdf.IfXhas the density function provided in Eq.(2),then

Figure 4:Estimated parameters and the MSEs of NEHTW distribution for α=0.9,σ=0.6 and γ=0.5

Figure 5:Graphical display of the absolute biases and MSE of the NEHTW distribution for α=0.9,σ=0.6 and γ=0.5

5.2 The Tail Value at Risk

The TVaR is an essential technique used for the computation of the estimated value of the risk provided that an event turned out beyond a determined significance level has occurred.LetXbe NEFHT distributioned random variable,then,the TVaR for the variable X can be determined as

Figure 6:Plots of the estimated parameters and the MSEs of NEHTW distribution for α=1.4,σ=0.9 and γ=1

Figure 7:Graphical presentation of the absolute bias and bias for NEHTW distribution using α=1.4,σ=0.9 and γ=1

Using Eq.(2)in Eq.(16),we have

5.3 The Numeric Risk Measures

We presented a computational analysis of these risk measures using two parameter Weibull and proposed models for various combination of parameters values with in this section.This process is carried out as:

●From the Weibull and NEHTW models,random samples of sizes n =100 and 150 are obtained.

●The parameters are estimated via the MLE approach.

●The process is replicated 1000 times to acquire the numerical figures for VaR and TVaR for comparing the competitive models.

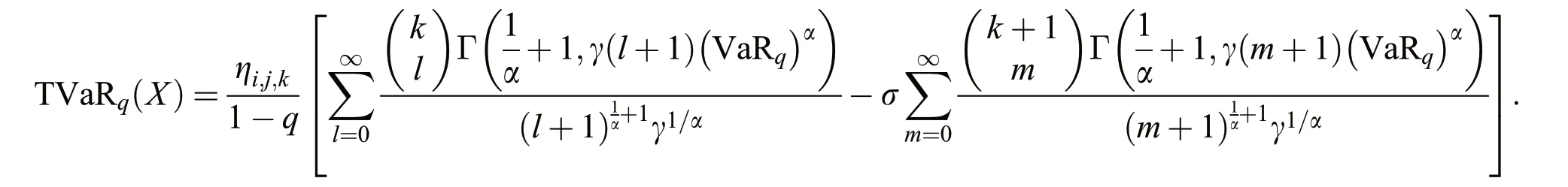

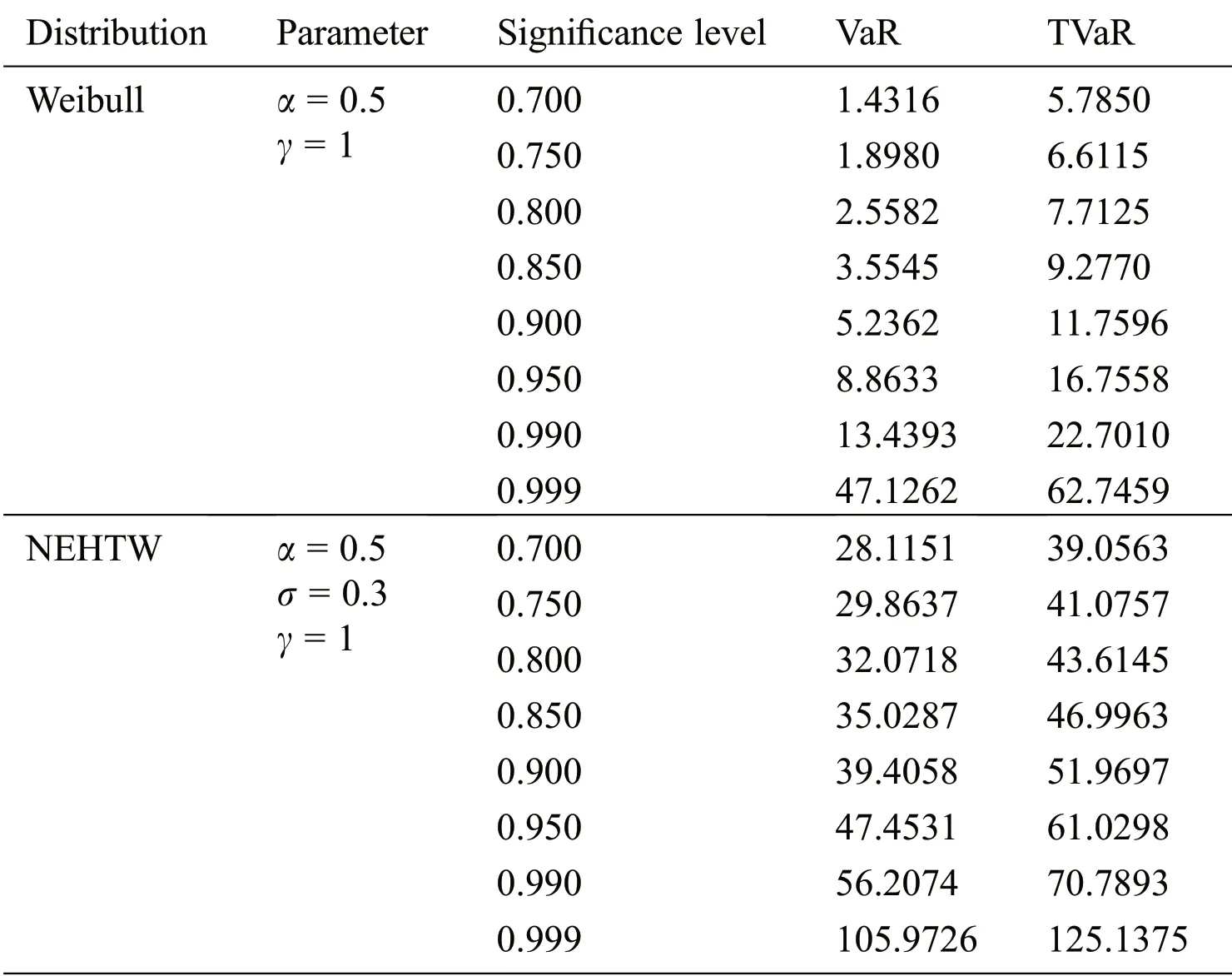

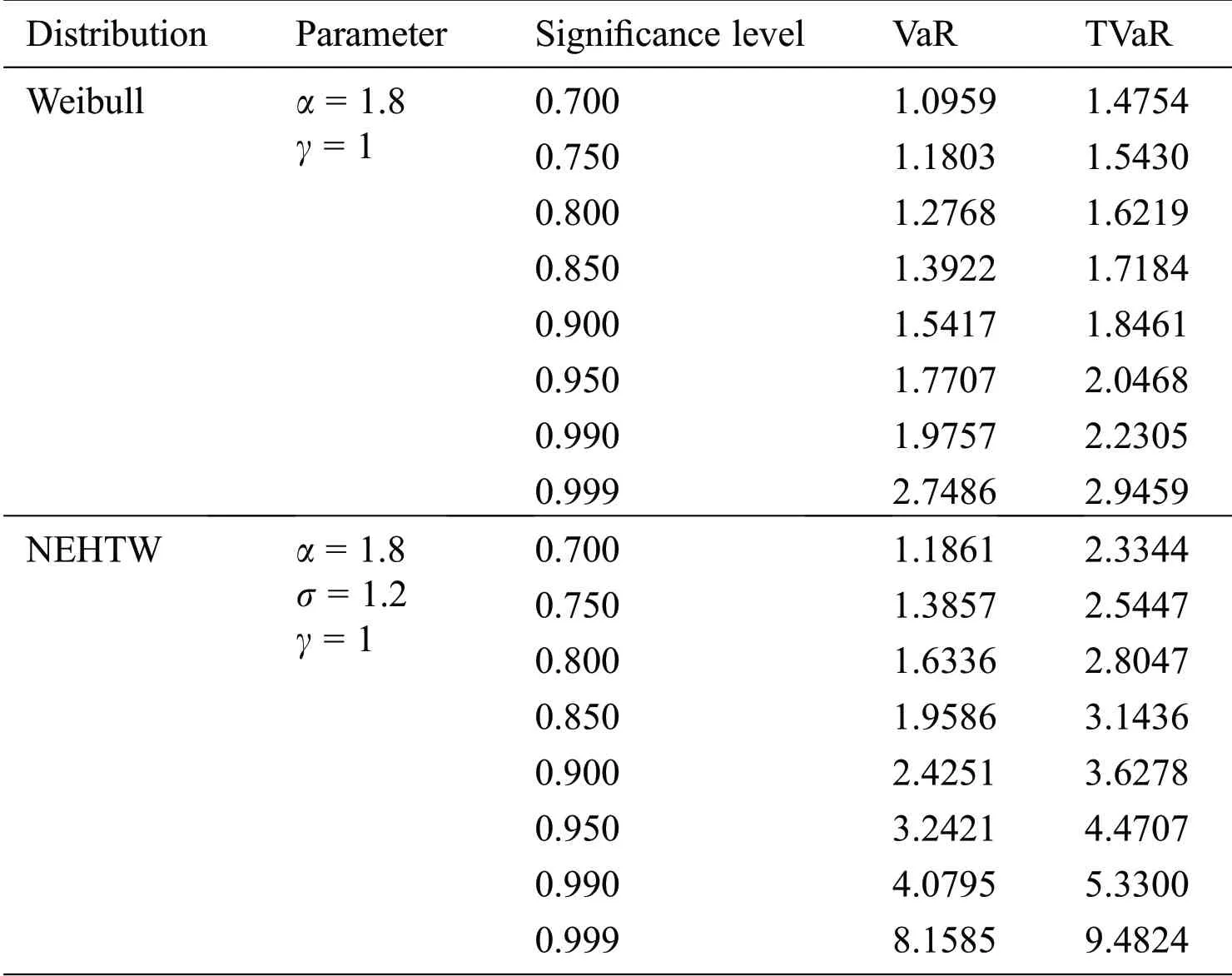

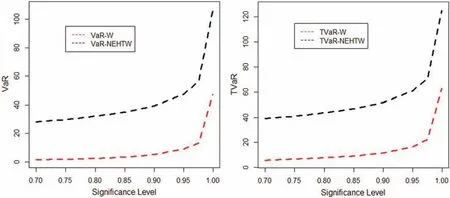

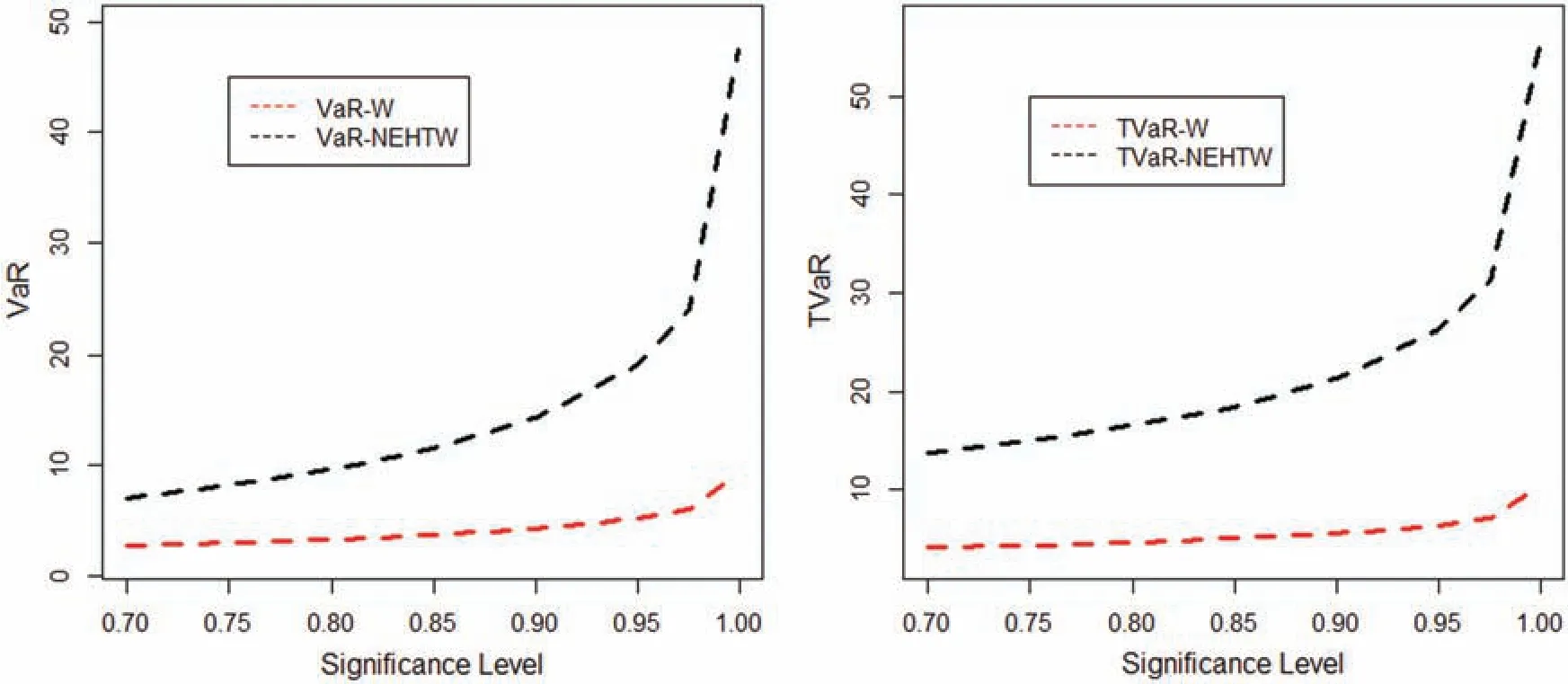

The TVaR and TVaR measures are reported in Tabs.1 and 2.In the support of Tabs.1 and 2,the graphs of the VaR and TVaR utilizing the proposed and Weibull models are sketched Figs.8 and 9,respectively.

Table 1:The simulated results for the VaR and the TVaR for n=100

The comprehensive simulation study is conducted for suggested and Weibull model.A model is considered to be a heavy tailed,if the risk assessment values are higher.The results given in Tab.1 and 2 exhibits,that the computed risk figures of the suggested model are higher than the standard Weibull distribution.The graphical display of the simulation results is portrayed in Figs.8 and 9,expressing the suggested model as more heavy tailed than the Weibull distribution.

Table 2:The simulated results of the VaR and the TVaR for n= 150

Figure 8:The graphical display of the results given in Tab.1

6 Applications

The heavy tailed models are prominently used for measuring the risk values of the data.We have considered an insurance loss data,in order to assess the performance of the proposed model.Moreover,the study provides simplified calculations of the actuarial measurements while using the existing data set for the Weibull and NEHTW models.

Figure 9:The graphical display of the results provided in Tab.2

6.1 Application to the Vehicle Insurance Loss Data

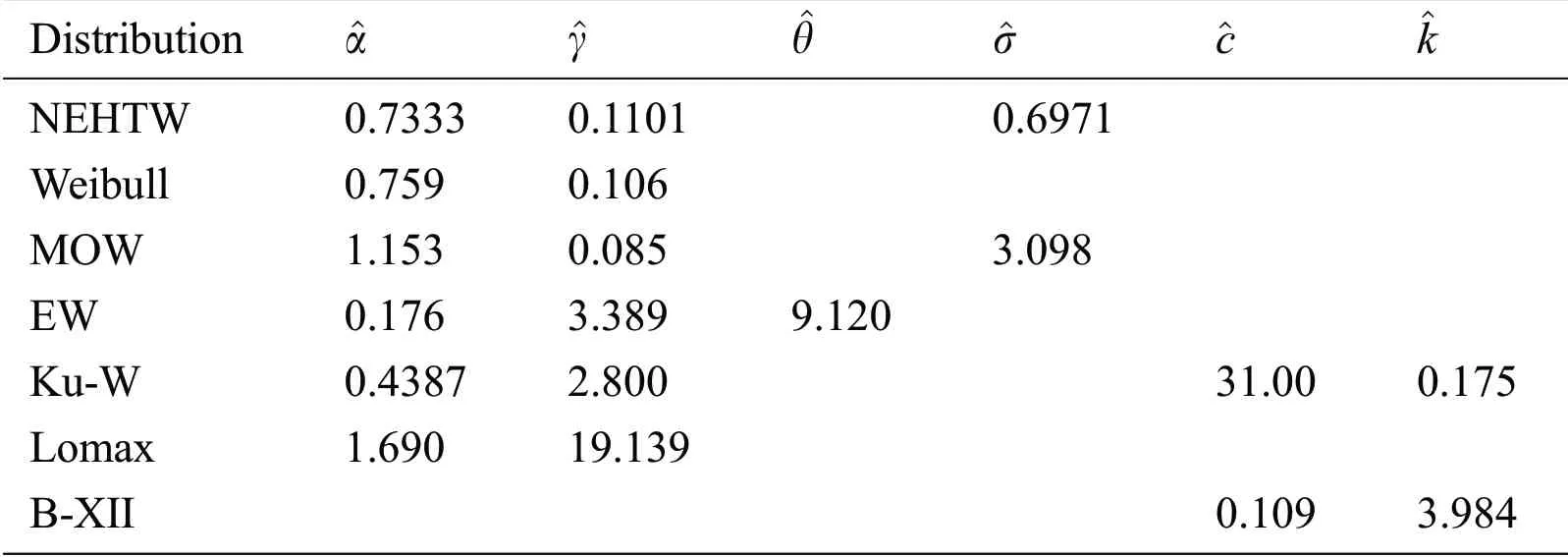

The link given in this subsection,provides the insurance loss data available at http://www.businessandeconomics.mq.edu.au/our_departments/Applied_Finance_and_Actuarial_Studies/research/books/GLMsforInsuranceData/data_sets.To determine the better fit of our suggested model,we have compared our proposed model with other recognized famous distributions.The competing distributions contains the Weibull,Exponentiated Weibull(EW),Kumaraswamy Weibull(Ku-W),Marshall-Olkin Weibull(MOW),Lomax and Burr–XII(BX-II)models.

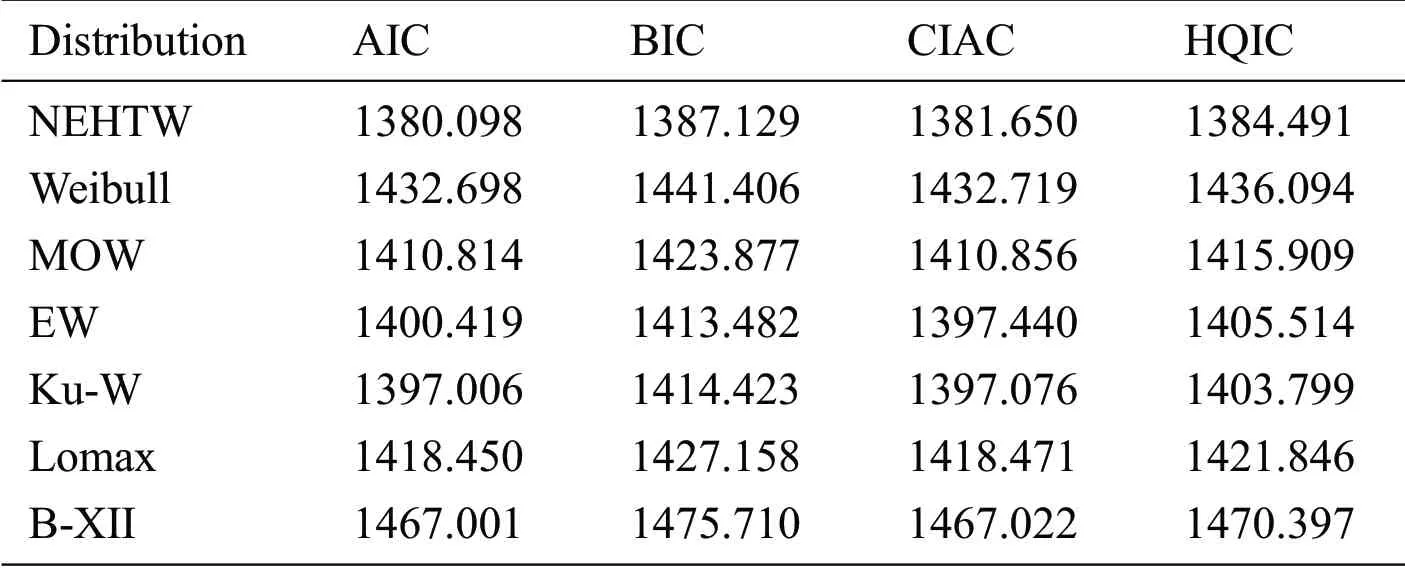

The maximum likelihood estimates of the model parameters are presented in Tab.3.Whereas the model adequacy is evaluated by the well-known measures such as Hannan-Quinn information criterion(HQIC),Akaike information criterion(AIC),Bayesian information criterion(BIC)and Consistent Akaike Information Criterion(CAIC).The results of these measures are presented in Tab.4.

Table 3:The ML estimates of the NEHTW and other compared distributions

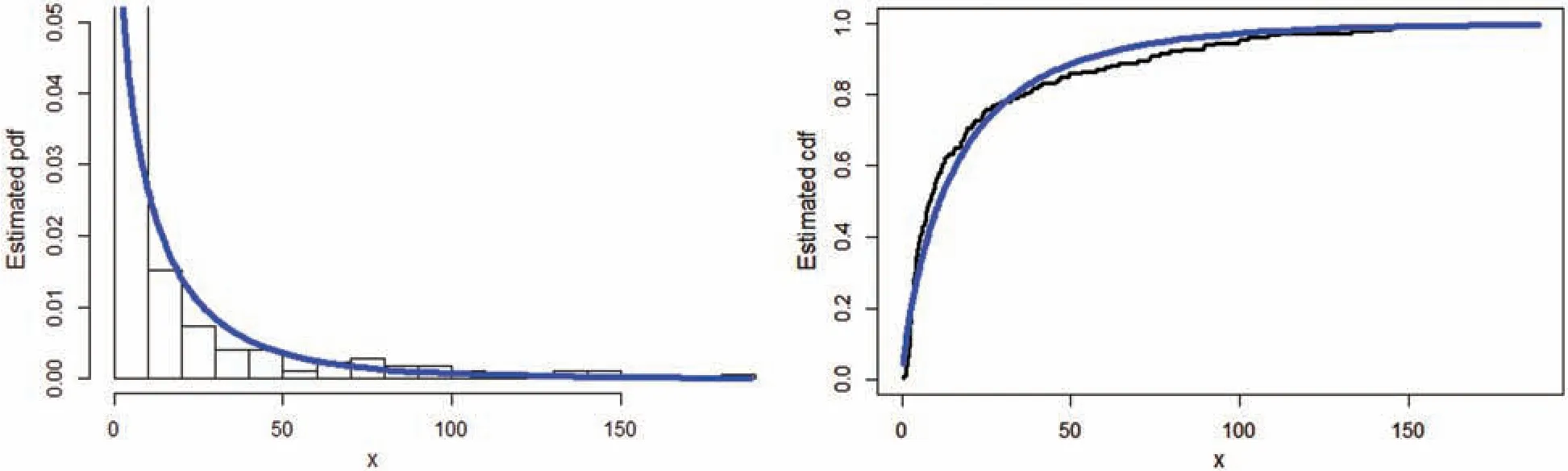

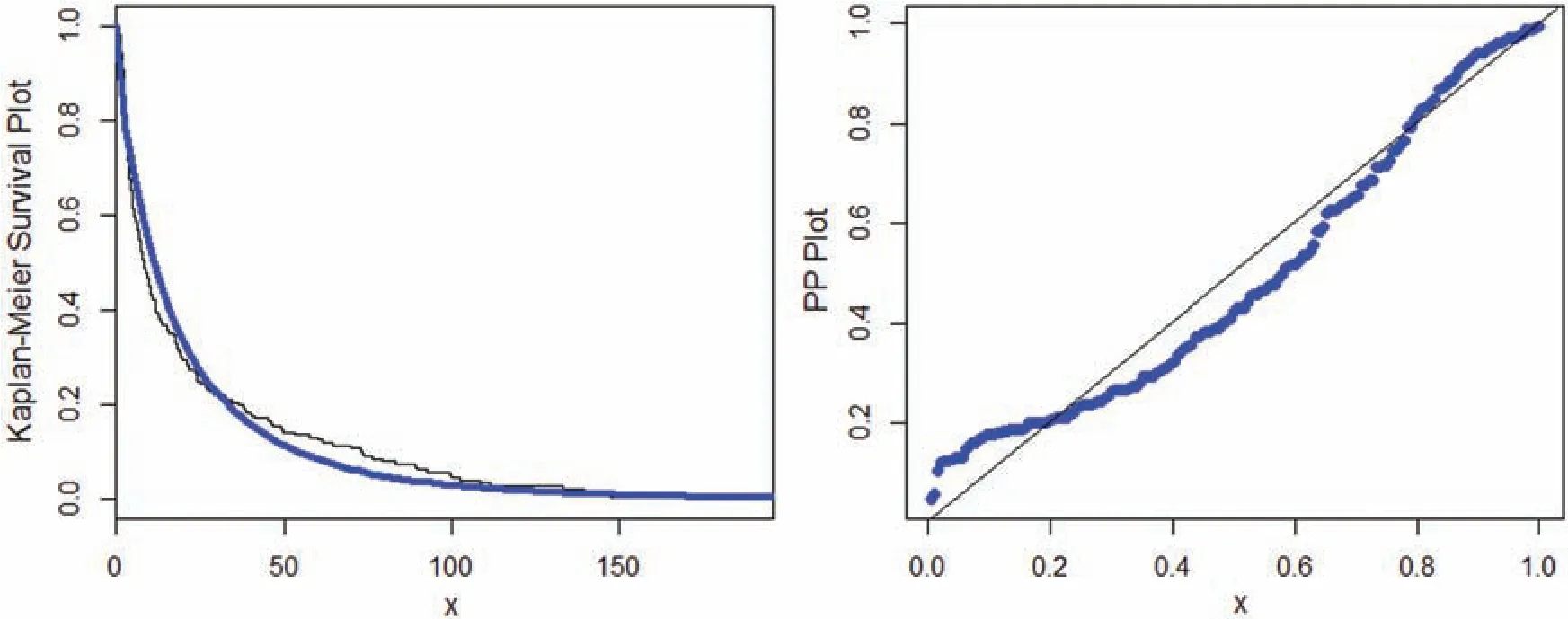

The researchers always interested in a smaller values resulted by the aforesaid measures.Tab.4 offers the final results of these measures,which illustrates that our suggested NEHTW model delivers a superior fit than the other competent models.Furthermore,using the insurance loss data,the fitted plots of the cdf,pdf,Kaplan Meier and probability-probability(PP)plots of the NEHTW models are presented in Figs.10 and 11 respectively.

Table 4:Computational analysis of the NEHTW and six competing models

Figure 10:The estimated pdf together with the cdf of the NEHTW distribution

Figure 11:Sketch of the Kaplan Meier and PP plots for the NEHTW model

6.2 Calculation of Actuarial Measures Using Insurance Data

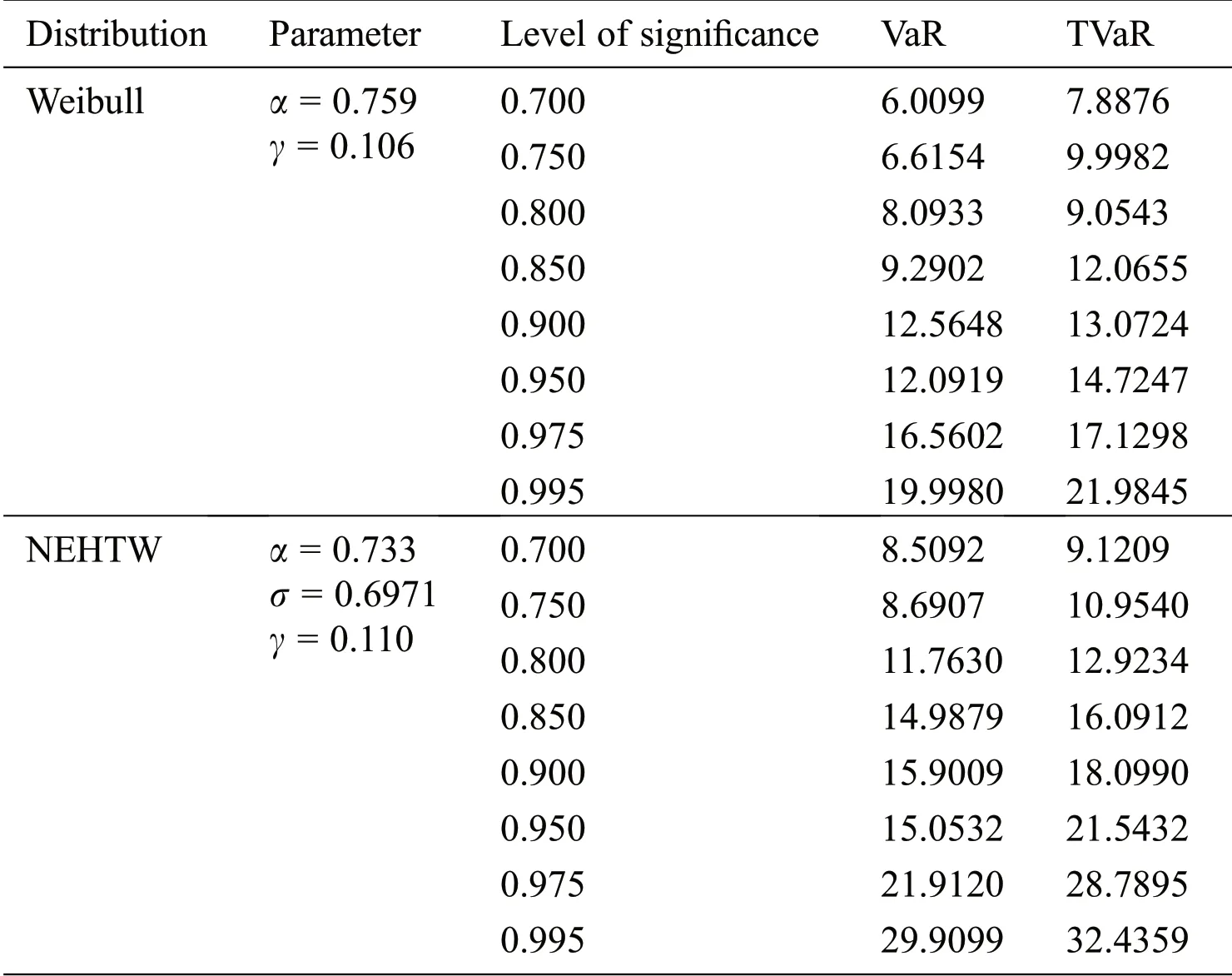

Here we have considered an insurance data set already used in Section 6.1,in order to compute the numerical values of VaR and TVaR and to compare the Weibull and NEHTW distribtuions.The obtained results of the VaR and TVaR,while considering different intervals of significance levels are illustrated in Tab.5.

Table 5:The actuarial measures using vehicle insurance loss data

From the above discussion,it is clearly shown that while modelling data,as the risk value of a model increases,the model becomes heavier tailed.From the calculated values given in Tab.5,it is the evident that the NEHTW model possess more longer tail than the existing Weibull model,which gives the testimony of the NEHTW as a strong candidate model for modelling insurance data sets.

7 Conclusion

In this article,we have provided the most flexible and prominent family,named as,new extended family of heavy tailed distributions.A specific three parameter form of the NEFHT class of distributions,named as,NEHTW distribution is studied,which has the capability to model heavy tailed data sets.Various basic statistical characterization have been studied.The estimates of the unknown model parameters are estimated via the most widely used ML method.A detailed evaluation of the of the simulation study is done to investigate the efficiency of the estimators.Moreover,the significance of the NEHTW model is illustrated via a practical application of the insurance loss data set.The practical application demonstrates that the NEHTW model is a prominent alternate model for modelling insurance losses.We expect that the new techniques will motivate the researchers for applications in actuarial sciences and many more different fields of research.

Funding Statement:The author(s)received no specific funding for this study.

Conflicts of Interest:The authors declare that they have no conflicts of interest to report regarding the present study.

杂志排行

Computers Materials&Continua的其它文章

- Design of Authoring Tool for Static and Dynamic Projection Mapping

- Detecting Lumbar Implant and Diagnosing Scoliosis from Vietnamese X-Ray Imaging Using the Pre-Trained API Models and Transfer Learning

- Design of a Compact Monopole Antenna for UWB Applications

- A Smart Wellness Service Platform and Its Practical Implementation

- Fingerprint-Based Millimeter-Wave Beam Selection for Interference Mitigation in Beamspace Multi-User MIMO Communications

- Multilayer Self-Defense System to Protect Enterprise Cloud