A Study on the "Quality" and "Quantity" of Financial Ecology in Henan Province

2021-08-24QiHUANG

Qi HUANG

Zhengzhou Central Sub-branch, the People’s Bank of China, Zhengzhou 450000, China

Abstract In order to promote the economic and financial development of Henan Province, this paper constructs the financial ecological system of Henan Province, evaluates the "quantity" of Henan financial ecology by entropy method-TOPSIS method, and evaluates the "quality" of Henan financial ecology by DEA-Malmquist method.It is found that the "quantity" of financial ecology in Henan Province shows the early advantage, but the power of late advantage is insufficient, and the "quality" of financial ecology in Henan Province is improved obviously, but it only depends on the technological progress, showing a lack of sustained momentum.Based on this, this paper puts forward some suggestions on promoting the development of digital finance, creating a good credit environment and actively preparing for the establishment of a diversified financial system, so as to improve the quality of financial ecology in Henan Province.

Key words Henan Province, Financial ecological quality, Entropy method-TOPSIS method, DEA-Malmquis method

1 Introduction

Socialism with Chinese characteristics has entered a new era, China’s economic development has also entered a new era, and the economy has changed from the stage of rapid growth to the stage of high-quality development.To achieve high-quality economic development and promote the high-quality development of the real economy, we must have the support of high-quality finance.Henan Province, as a main area in the development of the Central Plains Economic Zone in China, is lacking in power for economic development.According to the statistics of the National Bureau of Statistics, the per capita GDP of China in 2020 was 72 000 yuan, while the per capita GDP of Henan Province was only 55 400 yuan.The reasons for the differences in the level of economic development are varied, among which the difference in the financial industry is a shortcoming in the economic development.Financial ecology is the body, air, soil and moisture of financial development, and it is the core factor that determines financial development.In order to promote the economic and financial development of Henan Province, this paper reveals its advantages and disadvantages through a comprehensive analysis of the financial ecological development of Henan Province, and uses the optimization of financial ecology to promote the all-round economic and financial development of Henan Province and improve the quality of financial development, and support the construction of modern economic system in Henan Province.

2 Construction of index system and research methods

2.1 Construction of index system

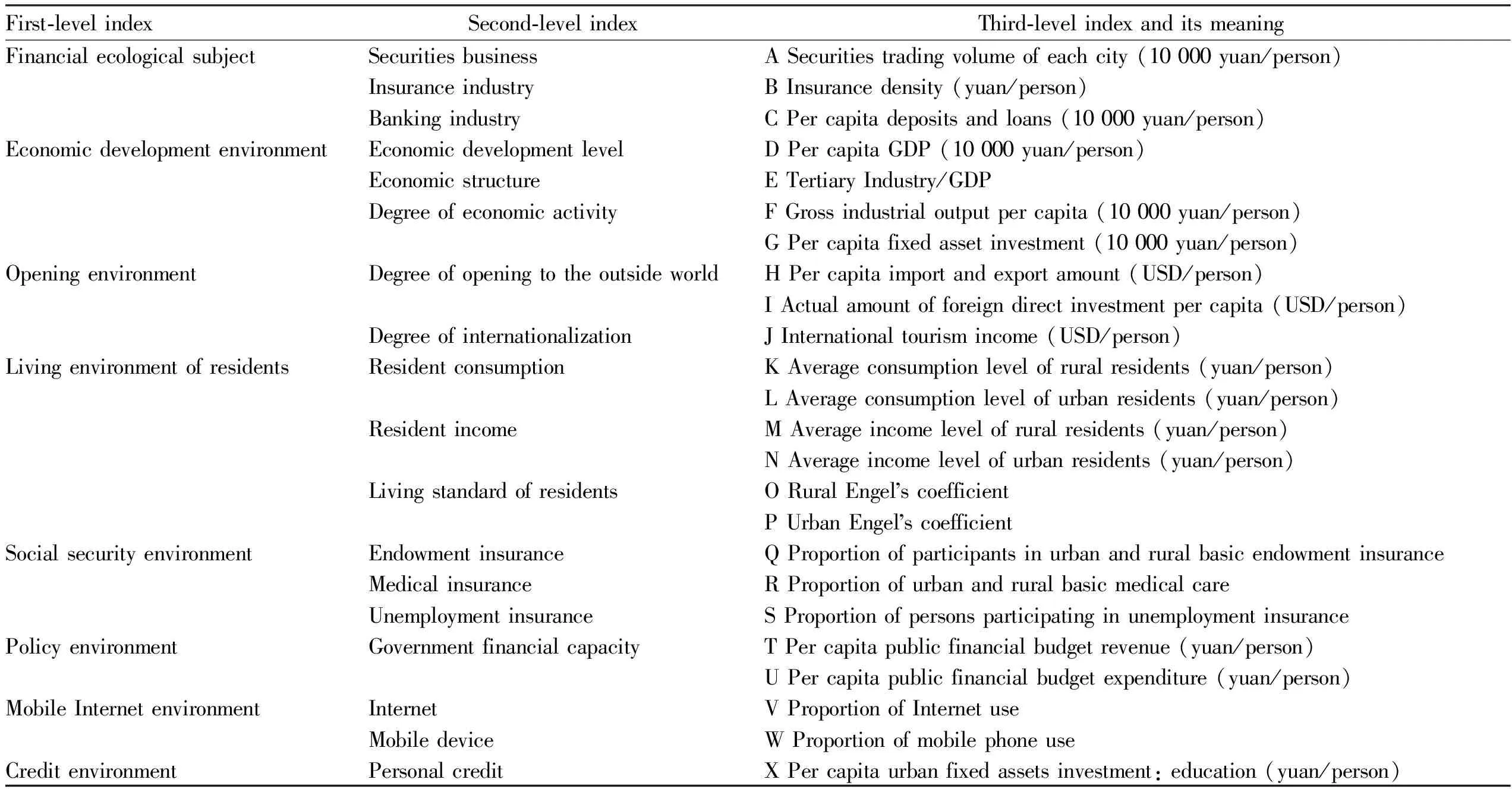

The joint influence of many complex factors determines the multi-level of the financial ecosystem and the diversity of its input-output indexes, so it is necessary to consider the comprehensiveness of index selection.Drawing lessons fromthe

Evaluation

of

Urban

Financial

Ecological

Environment

in

China

and related research results, this paper divides the financial ecosystem into two subsystems: financial ecological subject and financial ecological environment.At the same time, the two subsystems are divided into eight criteria, and the financial ecosystem index system is established after further expansion and improvement(Table 1).

Table 1 Index system of financial ecosystem

2.2 Data sources

Due to the relatively high requirements for the application of entropy method, TOPSIS method and DEA method, this paper collects the evaluation index data from multiple angles and multiple channels, and adopts a more scientific data processing method to ensure the authenticity of the data.The data of Jiyuan City are not completely statistically collected, so this paper mainly selects the data of 17 cities in Henan Province from 2011 to 2015 as samples to measure the financial ecological environment in multiple dimensions.The data come from the National Bureau of Statistics,Henan

Statistical

Yearbook

,Henan

Financial

Yearbook

and Wind database.2.3 Research methods

2.3.1

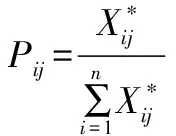

Measurement method of financial ecological index in Henan Province——entropy method-TOPSIS method.In the first step, the weight coefficient of the index is determined by entropy method, and the specific steps are as follows:(i)Calculate the proportion of the index value(P

)of evaluated objecti

underj

evaluation indexes:

(1)

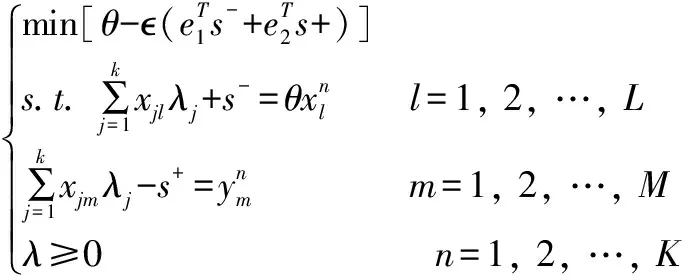

The normalized matrix of the data is:P

={P

}.(ii)Calculate the entropy value corresponding to indexj

:

(2)

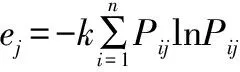

(iii)Calculate the information utility value of indexj

(for indexj

, if the information utility value of the index is larger, it means that the greater the evaluation function of the index is, the smaller the corresponding entropy value is).The importance value(d

)is defined:d

=1-e

(3)

(iv)Determine the entropy weight(weight)of indexj

:

(4)

InW

, the entropy weight(weight)of indexj

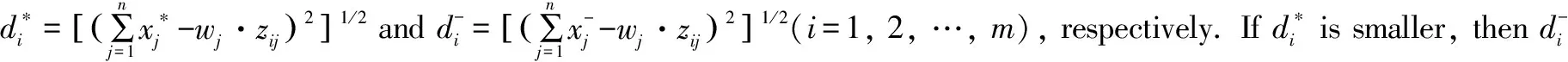

is determined by the importance value of the index.If the information utility value of the index is larger, the importance of the relevant evaluation is greater, and the weight is also greater.In the second step, on the basis of determining the weight, the TOPSIS method is used to measure China’s multi-dimensional poverty, the specific steps are as follows:

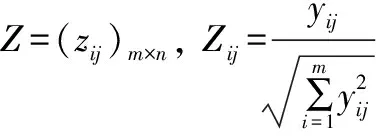

(i)In the process of multi-objective decision-making, the dimensions and ranges of each index are different, and the actual situation of the index can not be reflected in the decision-making, so it is necessary to normalize the decision matrix, that is, dimensionless processing.

The normal matrix is obtained:

(5)

(ii)Weighted normal matrix:X

=(x

)×=[w

·z

]×.

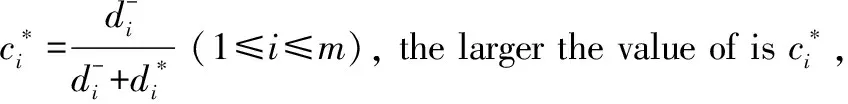

2.3.2

Measurement method of financial ecological efficiency in Henan Province—DEA(Data Envelopment Analysis)method.DEA decomposes efficiency into scale efficiency and pure technical efficiency by using DEA technology, so using DEA method, TFP growth can be divided into three parts: technological progress(TP), scale efficiency(SE)and pure technical efficiency(PTE).It is one of the most commonly used nonparametric frontier efficiency analysis methods.At present, it has become a research method of input-output efficiency, which is neck and neck with the traditional econometric methods.DEA is used to evaluate the resource allocation efficiency of multi-input and multi-output decision-making units.In this paper, the decision-making unit is the city, and there areL

kinds of input indexes andM

kinds of output indexes to evaluate the financial ecological efficiency ofK

cities.x

represents the input of the first kind of financial ecological environment resources in cityj

, andy

represents the output of financial ecological subjectm

in cityj

.The DEA model for cityn

(n

=1, 2, …,K

)with constant returns to scale is as follows:

(6)

t

to periodt

+1 is as follows:

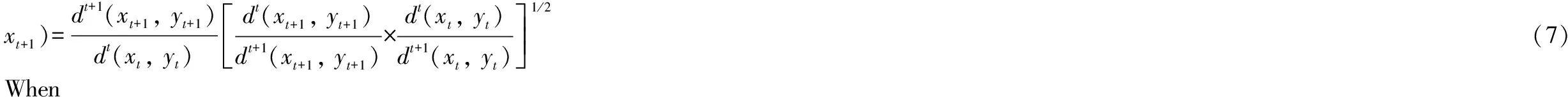

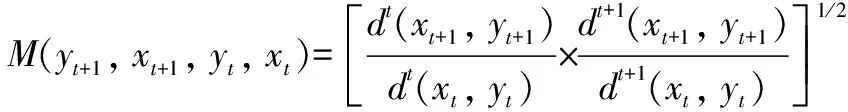

Formula(7)can be decomposed into:

(8)

Formula(8)indicates that the reasons for the change of productivity can be divided into technological change and technical efficiency change, and the rate of change of technical efficiency can be divided into the rate of change of pure technical efficiency and the rate of change of scale efficiency.

3 Measurement of Henan financial ecological index

3.1 Measurement of Henan financial ecological index based on entropy method-TOPSIS method

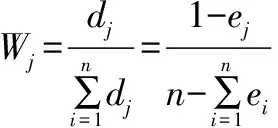

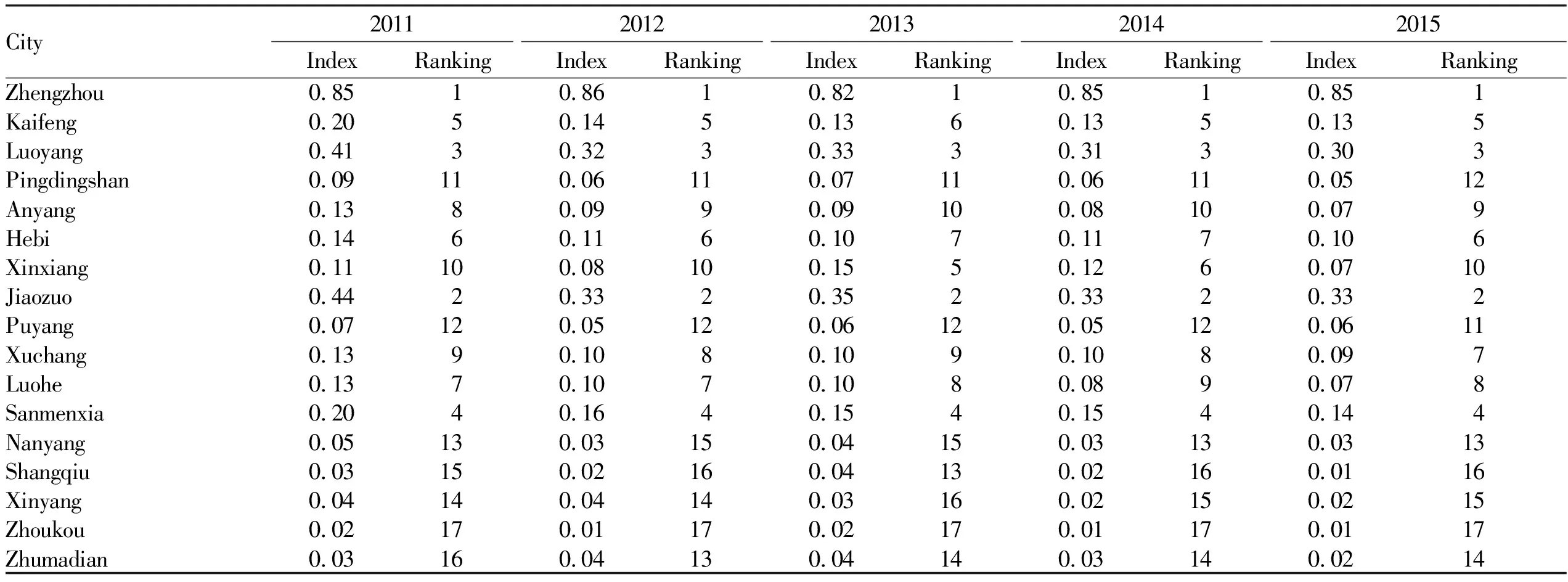

According to the measurement index system of Henan financial ecological index constructed above, the entropy method is used to determine the weight coefficient of each index, and using the TOPSIS method, the financial ecological measurement model based on entropy method-TOPSIS method is established to calculate the financial ecological index of various cities in Henan Province(Table 2).

Table 2 Financial ecological index(Ci)of cities in Henan Province based on entropy method-TOPSIS method

It can be seen from Table 2 that the ranking of financial ecological index of Henan cities remained basically stable from 2011 to 2015.The top five cities in terms of financial ecological environment are Zhengzhou City, Jiaozuo City, Luoyang City, Sanmenxia City and Kaifeng City, respectively.The top three cities in terms of financial ecological environment are Zhoukou City, Shangqiu City and Xinyang City.The level of financial ecological environment in Xinxiang City improved significantly from 2013 to 2014, but decreased significantly in 2015.It shows that the overall pattern of the financial ecological environment of various cities in Henan Province is stable, there is no obvious structural improvement, and the late-developing areas are lacking in late-developing advantage.

3.2 Development trend of financial ecology in various cities of Henan Province

As can be seen from Table 2, the financial ecological index of various cities in Henan Province showed an overall downward trend from 2011 to 2015, not only in the areas at the bottom of the ranking, but also in the areas at the top and in the middle of the ranking.The preliminary results show that the development of financial ecological environment in various regions of Henan Province has become worse in the past five years.In the top six regions, except Zhengzhou City with financial ecological index basically maintained at about 0.85, the financial ecological index of Jiaozuo City dropped sharply from 0.44 in 2011 to 0.33 in 2012, and remained at 0.33 in 2015.The financial ecological index of Luoyang City dropped sharply from 0.41 in 2011 to 0.32 in 2012, and remained at 0.3 in 2015.The financial ecological index of Kaifeng City dropped sharply from 0.2 in 2011 to 0.14 in 2012, and remained at 0.13 in 2015.The financial ecological index of Sanmenxia City gradually increased from 0.2 in 2011 to 0.14 in 2015.The financial ecological index of Hebi City gradually increased from 0.14 in 2011 to 0.1 in 2015.

Among the middle six regions, the financial ecological index of Xuchang City, Luohe City, Anyang City and Pingdingshan City showed a downward trend from 2011 to 2015, except that the financial ecological index of Xinxiang City showed an inverted U-shaped trend.The financial ecological index of Puyang City remained basically unchanged in the 5 years, maintaining at about 0.06.

Among the bottom five regions, the financial ecological index of Zhumadian City, Shangqiu City and Zhoukou City showed an inverted U-shaped trend from 2011 to 2015, indicating that the financial ecological environment of these areas improved in 2013, but there was insufficient motivation for improvement, and it fell back to the initial level in 2015.The financial ecological index of Nanyang City and Xinyang City showed a gradual downward trend in the past 5 years.

4 Measurement of financial ecological efficiency in Henan Province

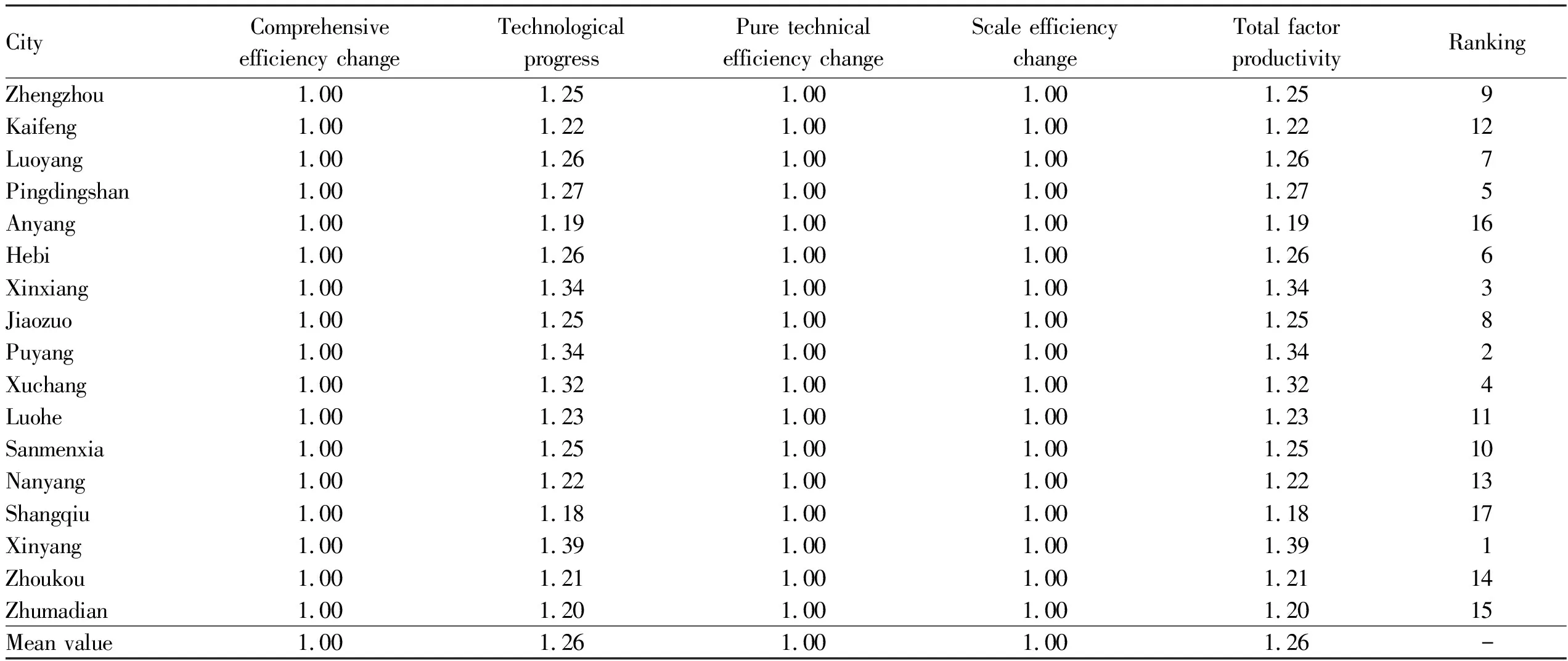

4.1 Measurement of financial ecological efficiency in Henan Province based on DEA-Malmquist method

By measuring Henan financial ecological index, we can fully reflect the advantages and disadvantages of Henan financial ecological environment in terms of "quantity".Starting from "efficiency", this paper intends to comprehensively reflect the advantages and disadvantages of Henan financial ecological environment from the perspective of "quality".The combination of "quantity" and "quality" and comparative study can help to find the driving force of financial ecological optimization.In this paper, the DEA method is used to measure the financial ecological efficiency, and the financial ecological environment is regarded as the input index, which is finally divided into seven aspects: economic development environment, opening environment, residents’ living environment, social security environment, policy environment, mobile Internet environment and credit environment.The output index is the main body of financial ecology, which is defined by three indexes: bank, securities and insurance.In this paper, the input indexm

=21, the output indexn

=3, and the number of decision-making unitsk

=17.Before using the DEA method to measure the financial ecological efficiency, the normalized data are weighted and summed step by step, and the weight is determined by the entropy method.The financial ecological efficiency of Henan cities is measured and decomposed by DEA-Malmquist method, and the results are shown in Table 3.

Table 3 The average index of financial total factor ecological efficiency and decomposition in cities of Henan Province

As can be seen from Table 3, the changes of pure technical efficiency and scale efficiency of 17 cities in Henan Province are all 1, indicating that the comprehensive efficiency of financial ecology in Henan was not improved from 2011 to 2015.The financial total factor ecological efficiency is greater than 1, which is determined by technological progress, indicating that the financial total factor ecological efficiency in Henan Province significantly improved from 2011 to 2015, and technological progress is the only driver.

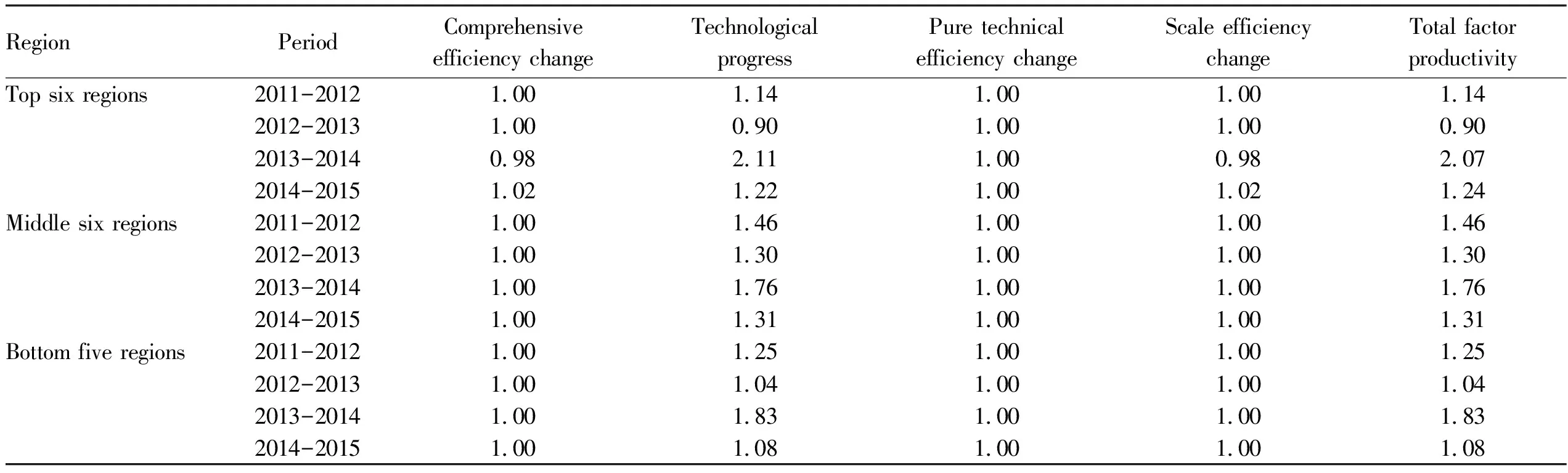

Table 4 Regional dynamic trend of financial total factor ecological efficiency in Henan Province from 2011 to 2015

4.2 Regional dynamic trend of financial total factor ecological efficiency in Henan Province

Examining the changing trend of financial total factor ecological efficiency in Henan from a regional perspective is not only helpful in judging the dynamic evolution of efficiency, but also conducive to the comparative study of the changing trend of financial total factor ecological efficiency in the top six, the middle six and the bottom five regions in terms of the financial ecological index.As can be seen from Table 4, the change of financial total factor ecological efficiency in the top six and the bottom five regions in terms of the financial ecological index fluctuated obviously, and the efficiency change significantly improved from 2013 to 2014, but the instantaneous efficiency change fell back to the initial level from 2014 to 2015, even lower than the initial level.The change of regional financial total factor ecological efficiency of the middle six regions in terms of the financial ecological index was relatively stable, and the overall level of efficiency change was higher than that of the top six and the bottom five regions.The financial ecological optimization power of these six cities is relatively strong.The change level of financial total factor ecological efficiency in the bottom five regions is low, which may also be the reason why the financial ecological index of these five cities is not high.

5 Conclusions and policy recommendations

5.1 Conclusions

5.1.1

The first-mover advantage is shown in Henan financial ecology at the level of "quantity", but the power of late-development advantage is insufficient.The overall pattern of financial ecology in Henan Province is stable, there is no obvious structural improvement, and the late-developing areas with relatively poor financial ecology are lacking in late-developing advantage.As far as the dynamic development trend is concerned, the financial ecology of various cities in Henan Province showed an overall downward trend in the past five years, and the financial ecology in some regions showed an inverted U-shaped development trend in the past five years.In other words, in the five years, the development of financial ecological environment in various regions of Henan Province tended to become worse, and the power of financial ecological optimization in late-developing areas is insufficient.5.1.2

The Henan financial ecology has improved obviously at the level of "quality", but it only depends on technological progress, lacking momentum.Although Henan financial total factor ecological efficiency has been continuously improved, it is obviously insufficient to rely on technological progress to improve financial total factor ecological efficiency.Therefore, we should continue to maintain the efficiency improvement brought about by technological progress, and at the same time, promote the comprehensive efficiency and comprehensively improve the total factor ecological efficiency of Henan finance through pure technical efficiency improvement or scale efficiency improvement.At the level of "quantity", the financial ecological index of various regions of Henan Province showed a downward trend from 2011 to 2015, and the overall situation of financial ecology showed a trend of deterioration.At the level of "quality", the financial total factor ecological efficiency in Henan showed a fluctuating upward trend from 2011 to 2015, and the financial ecological efficiency improved obviously.However, it only depends on technological progress, and there is an obvious lack of motivation for efficiency improvement.Therefore, Henan’s financial ecological optimization should continue to maintain and it is necessary to promote the growth of efficiency; at the same time, it is more important to solve the problem of declining financial ecological index.

5.2 Policy recommendations

5.2.1

Vigorously promoting the development of digital finance.The development of digital finance will be the core path of Henan financial ecological optimization.On the one hand, the emergence of new financial forms of Internet finance will bring new opportunities to the financial industry of Henan Province.It is necessary to carry out international settlement, offshore finance and e-commerce innovations in Zhengzhou Airport Economic Comprehensive Experimental Zone, and to create a rapid gathering and development trend of emerging industries such as intelligent equipment, new energy, e-commerce, and modern logistics.On the other hand, digital finance has unique advantages in serving "agriculture, rural areas and farmers", vulnerable groups, remote areas and so on.Compared with traditional commercial banks, the core advantage of digital finance is that it can effectively use big data, cloud computing and other technologies to obtain user information, identify risks, reduce costs, and continue to provide affordable financial services for vulnerable groups.The deep integration of digital technologies such as the Internet, information and communications with the financial industry provides new ideas for financial development by expanding the boundaries of financial services, improving the efficiency of financial services, reducing the cost of financial services, and solving the information asymmetry in the financial market, so as to expand the depth and breadth of financial development.Therefore, the construction of mobile Internet infrastructure should be strengthened to lay a solid foundation for the development of digital finance.It is necessary to strengthen the development and application of digital technology and deeply promote digital technology in the financial field.It is necessary to strengthen the publicity of digital finance and gradually disseminate the knowledge of digital finance to the broad masses of the people.5.2.2

Creating a good credit environment.In terms of top-level design, information means such as big data, cloud computing and the Internet of things should be used, and state ministries should take the lead in establishing a national unified social credit code system and credit information sharing and exchange platform.It is necessary to integrate the enterprise data and information held by government departments and relevant industries, clarify the main role of the credit system construction of the industry, standardize the credit rating of the industry, avoid repeated evaluation, and lighten the burden on enterprises.It is necessary to establish a mutual recognition system for the results of industry credit evaluation, gradually establish and improve the social credit information system and enterprise credit information disclosure mechanism, and form enterprise credit files covering enterprise business administration, financial credit, tax payment, social security contributions, contract performance, product quality, tendering and bidding, service commitments, safety and environmental protection, and other credit information.It is necessary to interconnect the credit information of the banking, industrial and commercial, judicial, taxation, environmental protection, social security, construction, railway, aviation departments.It is necessary to provide credit information sharing, inquiry, analysis and statistical analysis for enterprises and the public in accordance with the relevant laws and regulations and confidentiality agreement, and establish a joint credit reward and punishment mechanism across regions and industries.It is necessary to increase the disclosure and exposure of untrustworthy acts, improve the records of untrustworthy acts, form a deterrent and binding force, and truly and as soon as possible create a social atmosphere of "honor for those who keep faith, worry for those who fail to keep faith, and shame for those who break faith" so that those who keep their promises will benefit everywhere, and those who break their promises will be unable to move an inch.杂志排行

Asian Agricultural Research的其它文章

- Realization Path for Inclusive Finance to Support Rural Revitalization in Poverty-stricken Areas

- Competitiveness and Complementarity of Cocoon Silk Trade between China and Southeast Asia

- Analysis of Topographic Heterogeneity in the Sanjiangyuan

- New Insights of Neuromedin B and Its Receptor NMBR Involvement in Immunity

- Evaluation on Uncertainty of Detection Results of Aerobic Plate Count

- Analysis of Factors Influencing Residents’ Satisfaction with Pairing Aid Policy in Xinjiang: Based on the Data from Three Prefectures in Southern Xinjiang