Cash Injection Boosts The Real Economy

2021-07-27ByLeAn

By Le An

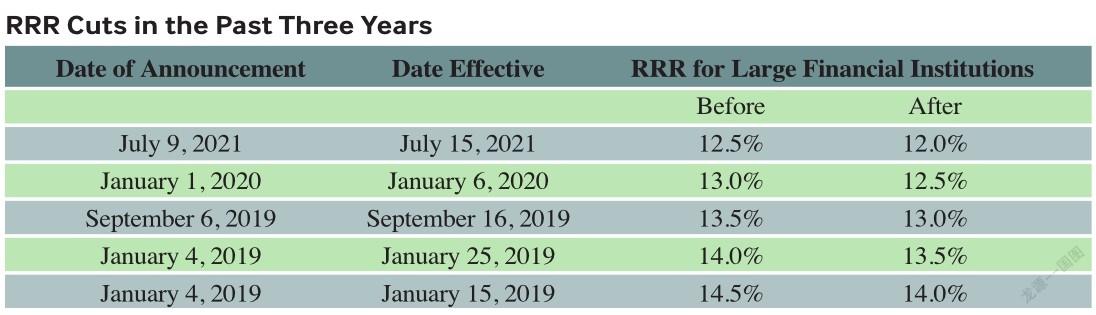

The cash amount that should be reserved for Chinese financial institutions, or the reserve requirement ratio (RRR), was lowered by 50 basis points starting July 15, excluding those that have already held the ratio at a low level of 5 percent. The measure, part of the financial sectors efforts to support the real economy, would release about 1 trillion yuan ($154.24 billion) in long-term liquidity, the Peoples Bank of China (PBC), the central bank, said.

After the reduction, the weighted average RRR for financial institutions stands at 8.9 percent.

Chinas economic growth has maintained stable momentum despite the COVID-19 epidemic, improving 12.7 percent year on year in the first half of 2021. Against this backdrop, the RRR cut has sparked heated debate. Does the move mean China is shifting away from a prudent monetary policy?

Why now?

The decision was made in compliance with the outcome of an executive meeting of the State Council on July 7. According to that meeting, China must firmly shore up its real economy, especially in support of the micro, small and medium-sized enterprises (MSMEs). To that end, the government will adopt monetary tools, such as cuts in the RRR for commercial lenders, with such measures expected to mitigate the impact of commodity price hikes since the beginning of this year on affected companies. Subsequently, the country will refrain from mass stimulus, maintain stability of the monetary policy and enhance its effectiveness.

Over the past year, commodity price hikes have impacted midstream manufacturing and downstream consumer goods industries worldwide. Many Chinese enterprises, due to the rising cost of raw materials, faced difficulties in maintaining profitability.

The PBC said the move is intended to optimize the capital structure of financial institutions and improve their services to reinforce the real economy. By cutting the RRR, more capital will be channeled into the market. It will then further buffer the impact of commodity price hikes on downstream industries and MSMEs, allowing for them to take advantage of the cheaper financing to hedge against the growing raw material costs.

The latest RRR cut is well-timed. It clearly demonstrates that policymakers have been fully aware of the downside risks to economic growth and are implementing customized precautions.