Luoyang Molybdenum Made Significant Increase in Performance in The First Half

2021-05-19

Luoyang Molybdenum released its semi annual report indicating that during report period,driven by the fact that there was a significant rise in the price of cobalt,copper,molybdenum,tungsten and phosphorus,and the fact that there was a rise in base metal business scale,the Company’s main business income,cost and gross profit presented a significant rise on a YOY basis.In the report period,the Company realized main business income of RMB 84.561 billion,up by RMB 38.004 billion (or 81.63%) on a YOY basis;net profit attributable to shareholders of listed company being RMB 2.409 billion,up by 139% on a YOY basis;total EBITDA being RMB 7.1 billion,up by 120% on a YOY basis;gross profit of main business being RMB 8.976 billion,up by RMB 8.326 billion (or 1,280.92%) on a YOY basis.

In report period,the Company steadily advanced its key projects and gave play to its endogenous growth potentials.The Company’s key project of production efficiency increasing in Democratic Republic of the Congo (Project 10K) and gold mine production expanding project in Australia have both been put into operation.In the meantime,feasibility research was completed for TFM mixed copper and cobalt mine and the latter is in steady progress.KFM mixed copper and cobalt mine is waiting for its feasibility research that is under active analysis.

Multiple measures are being taken to upgrade operation and the effects of cost decreasing and benefit increasing are being furthered.Production and operation cost in various sectors of the Company has been reduced by RMB over 360 million on a same-caliber and YOY basis.Specifically,copper-cobalt sector of Democratic Republic of the Congo saw a reduction of RMB 30 million in production and operation cash cost.

Mines and trade sector are effectively coordinating and trade sector is growing continuously.Mine sector and trade sector further integrate.IXM is giving full play to its anti-risk capability and realized outstanding performance,i.e.net profit attributable to parent company being RMB 369 million.

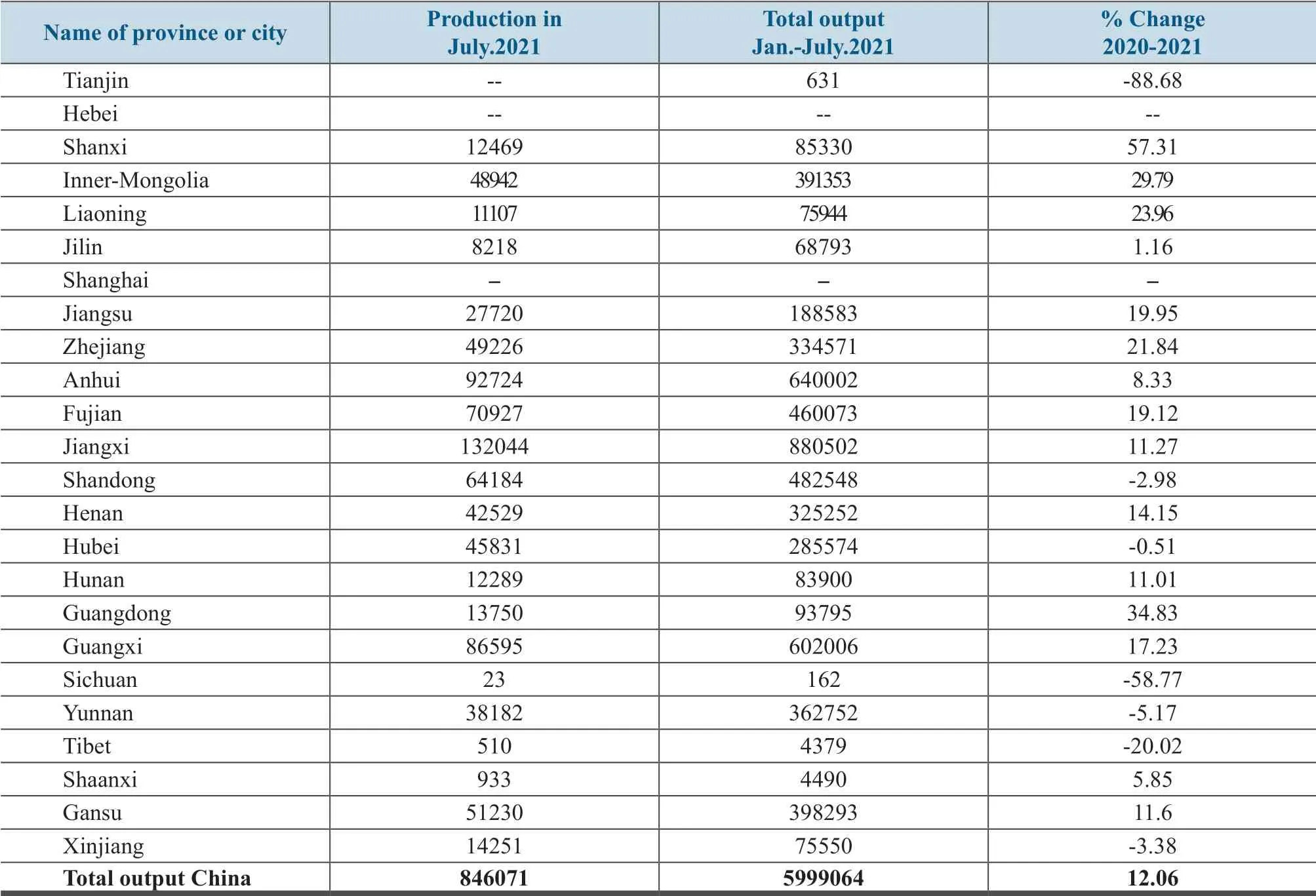

Tin Production by Province or City in 2021 Unit:metric ton

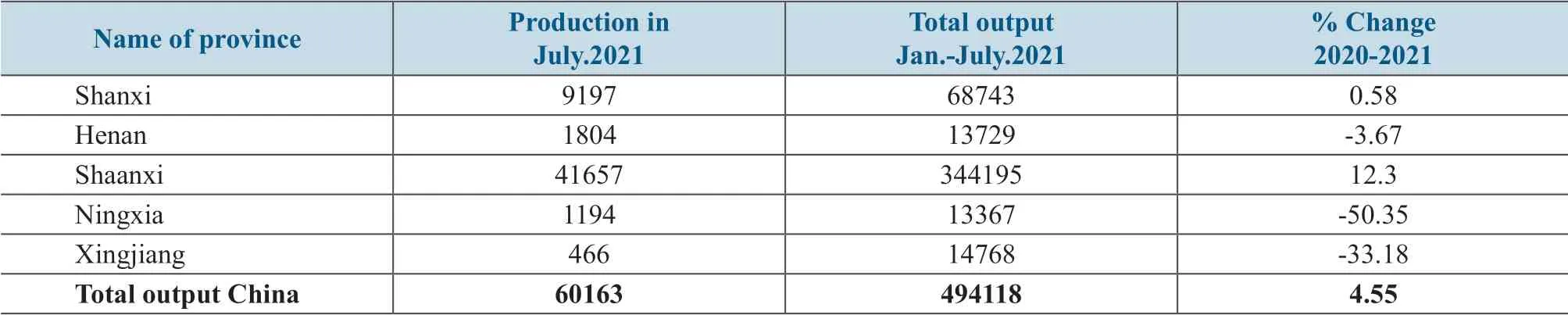

Magnesium Production by Province in 2021 Unit:metric ton

Refined Copper Production by Province or City in 2021 Unit:metric ton

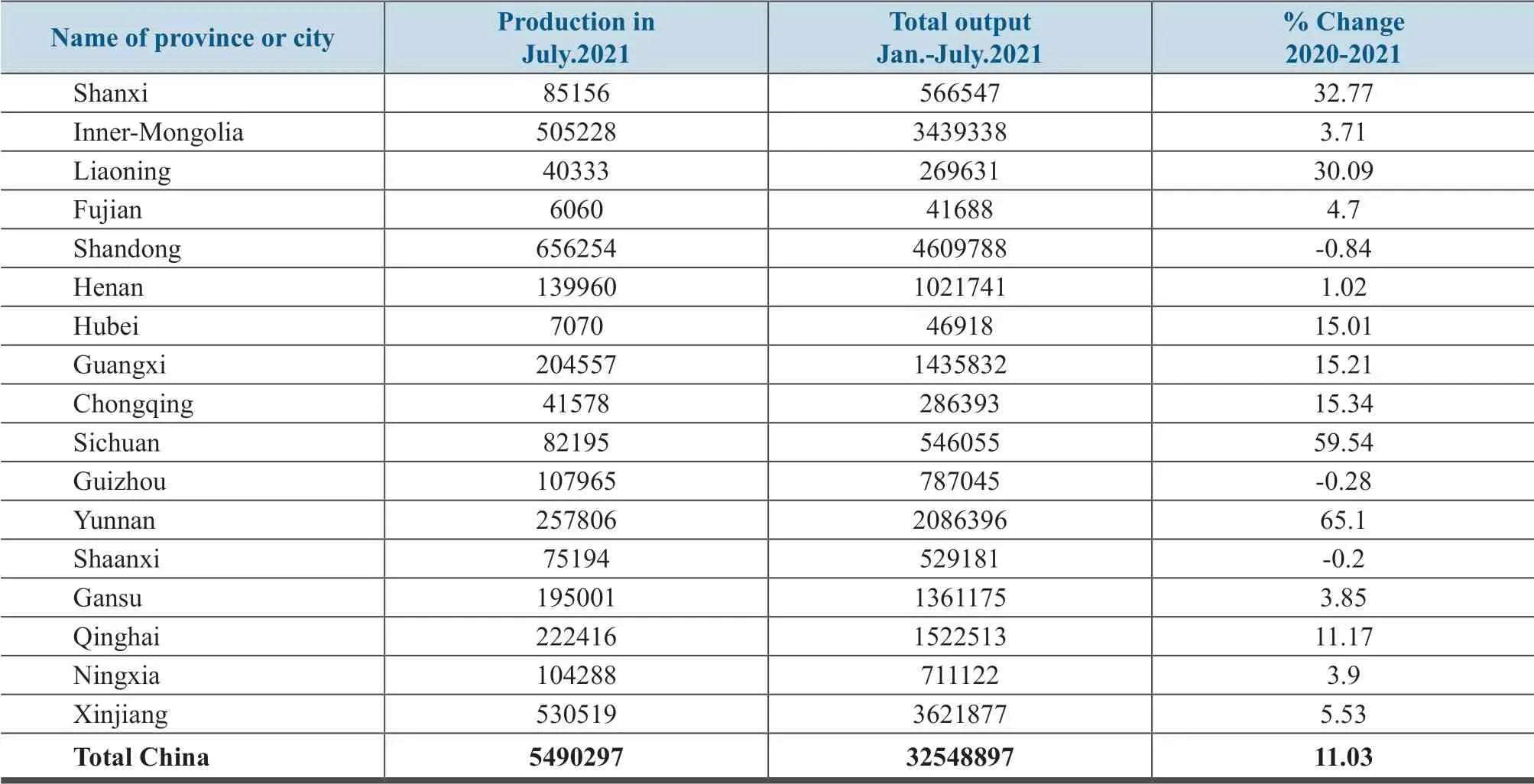

Aluminium Production by Province or City in 2021 Unit:metric ton

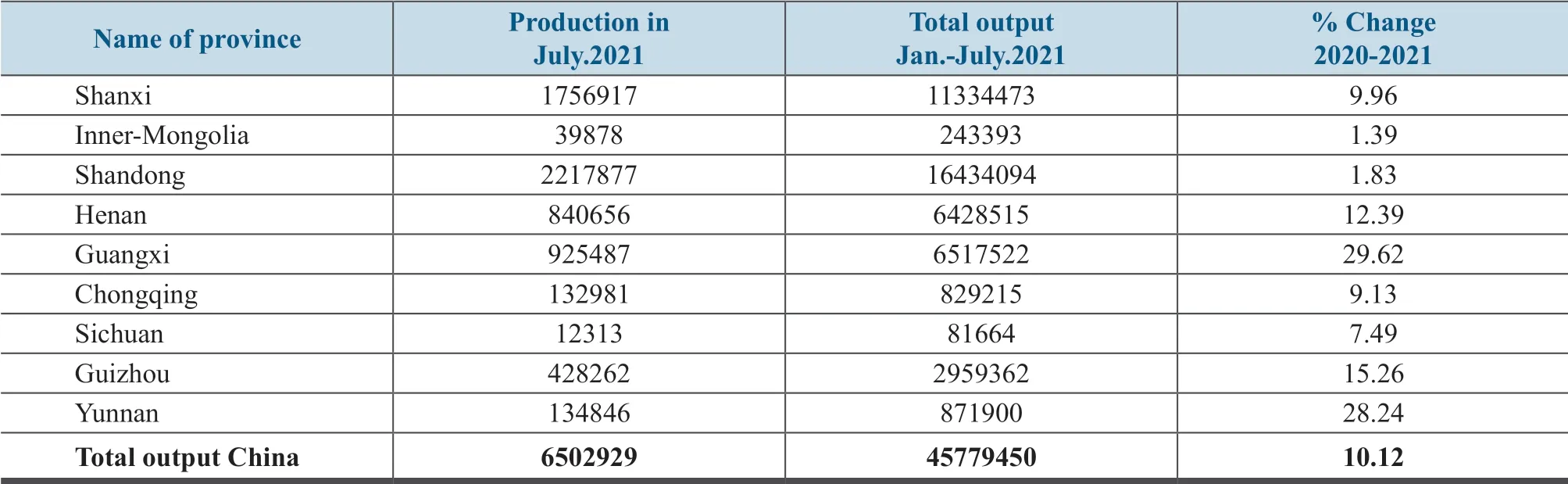

Alumina Production by Province in 2021 Unit:metric ton

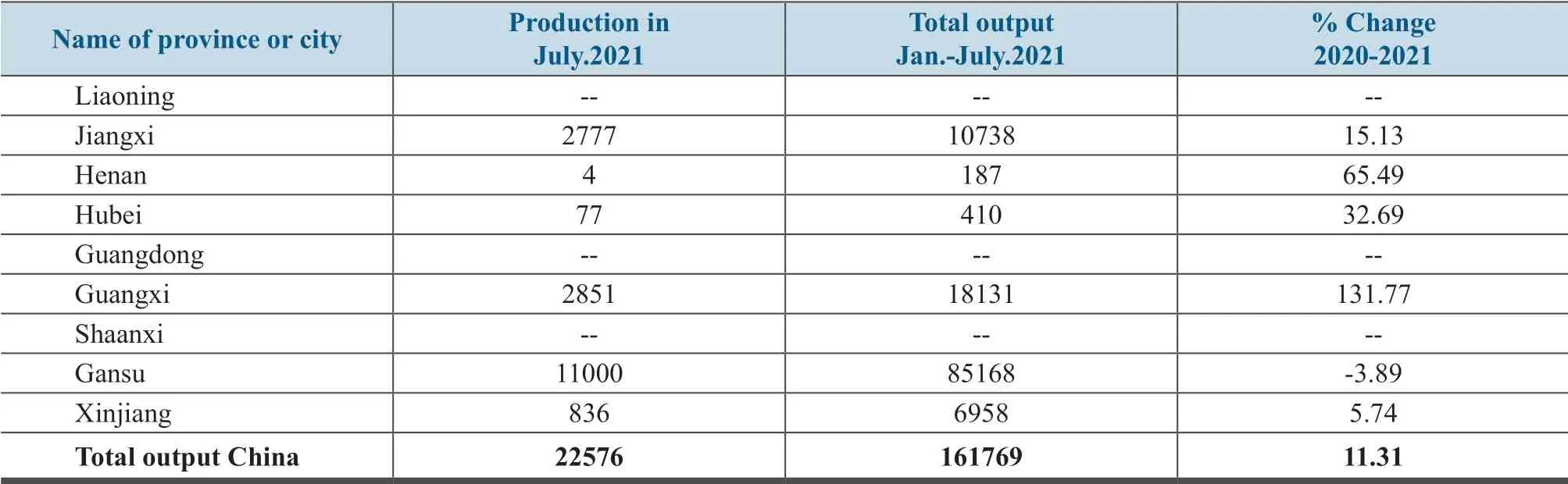

Nickel Production by Province or City in 2021 Unit:metric ton

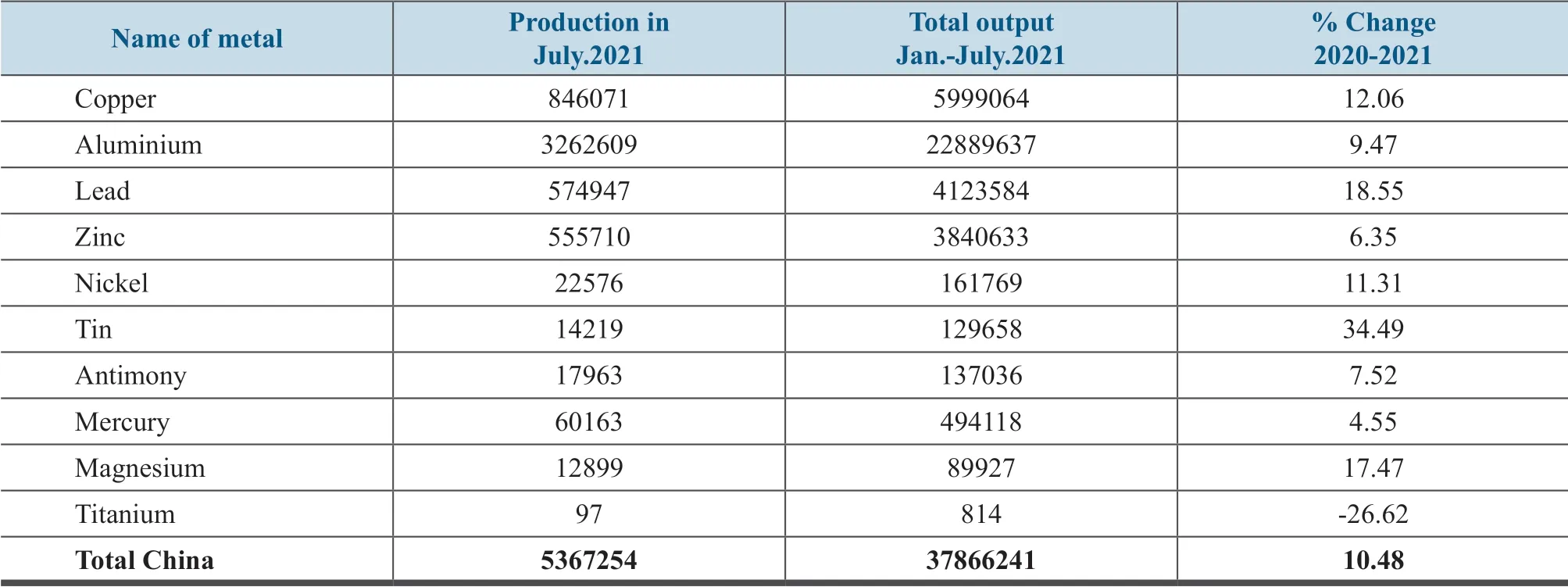

Production of the Ten Major Nonferrous Metals in 2021

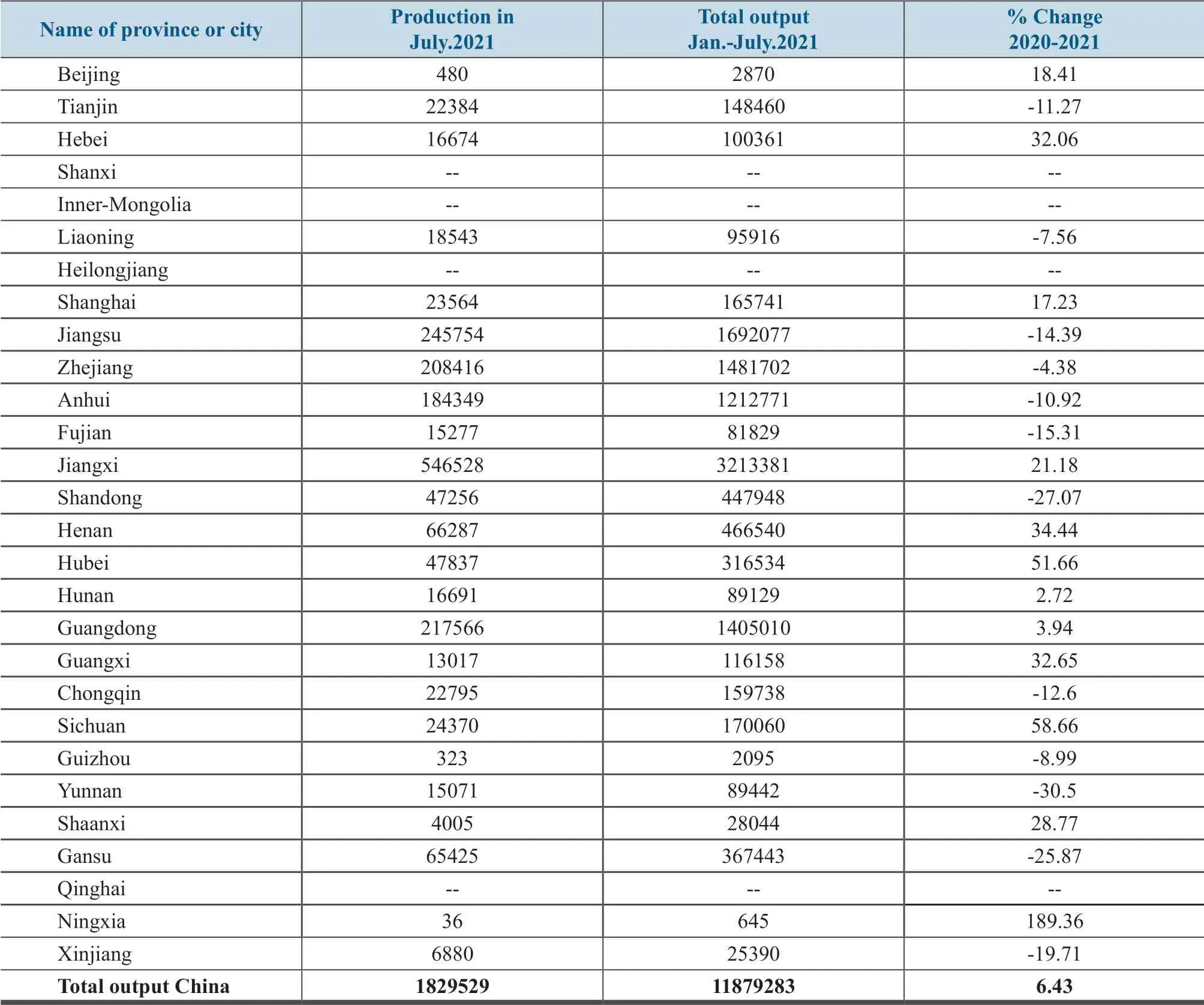

Fabricated Copper Production by Province or City in 2021

Copper Mine Production by Province or City in 2021 Unit:metric ton(metal content)

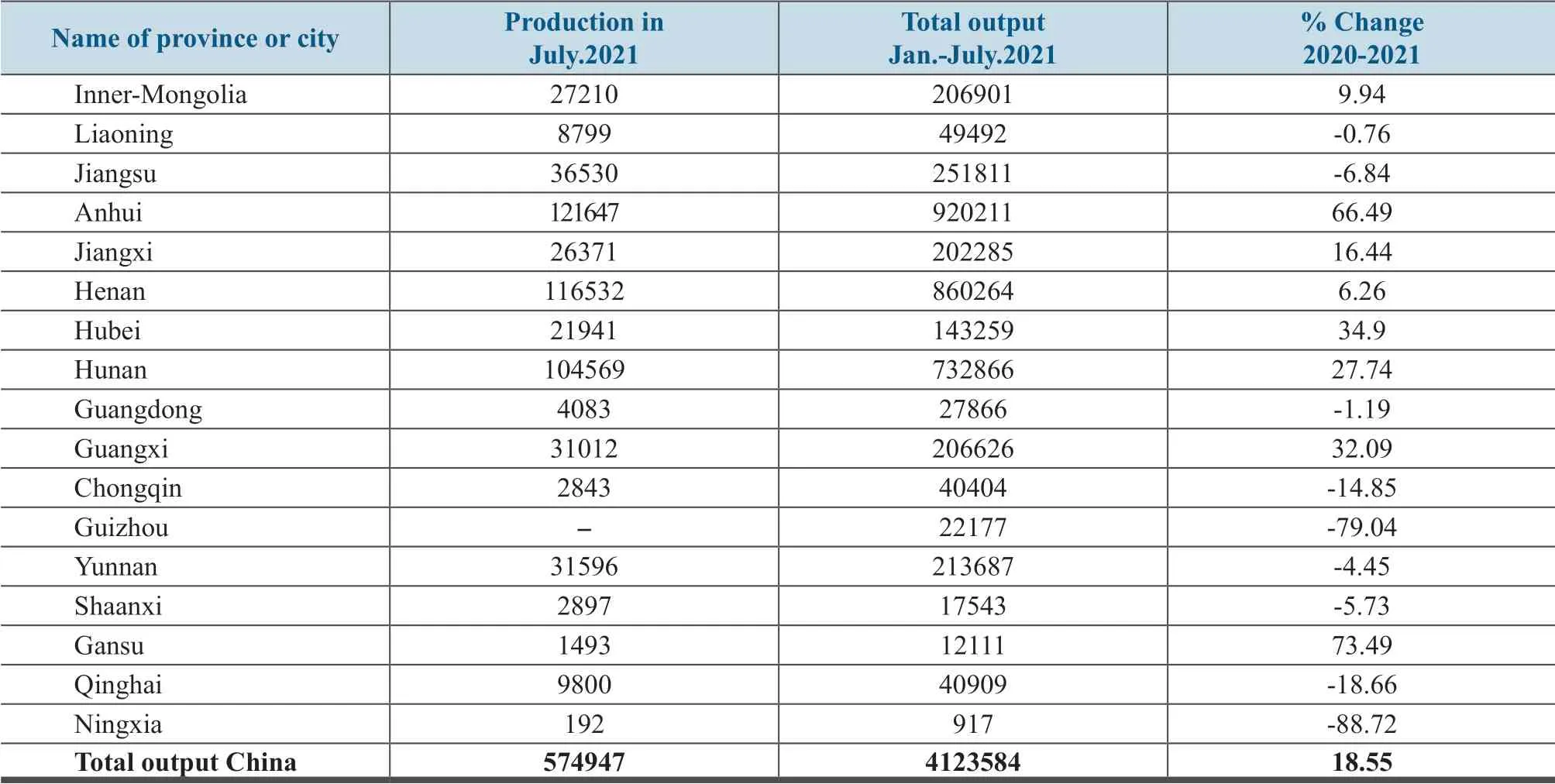

Lead Production by Province or City in 2021 Unit:metric ton

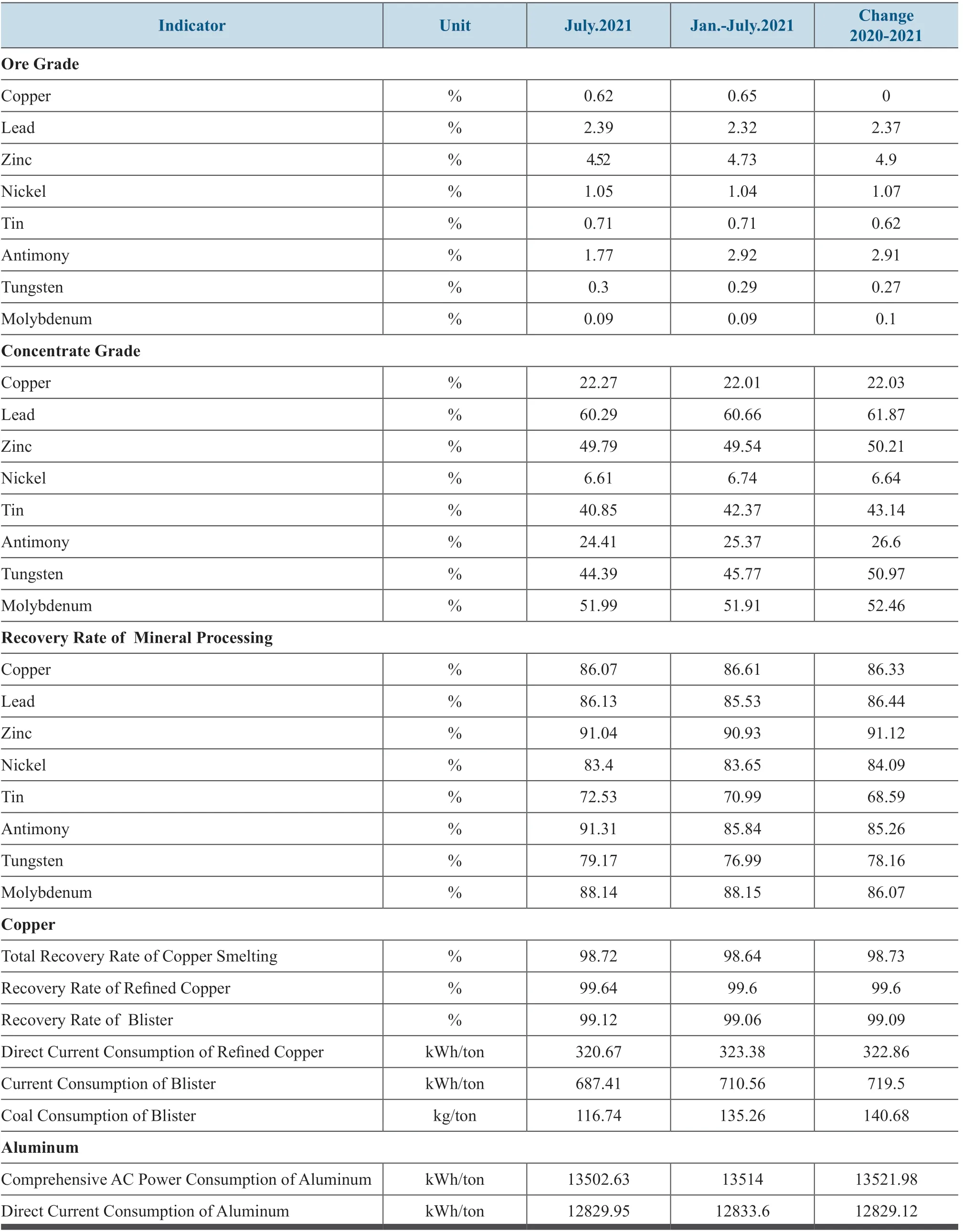

Technical and Economic Indicators of Major Enterprise

Continued from the previous page

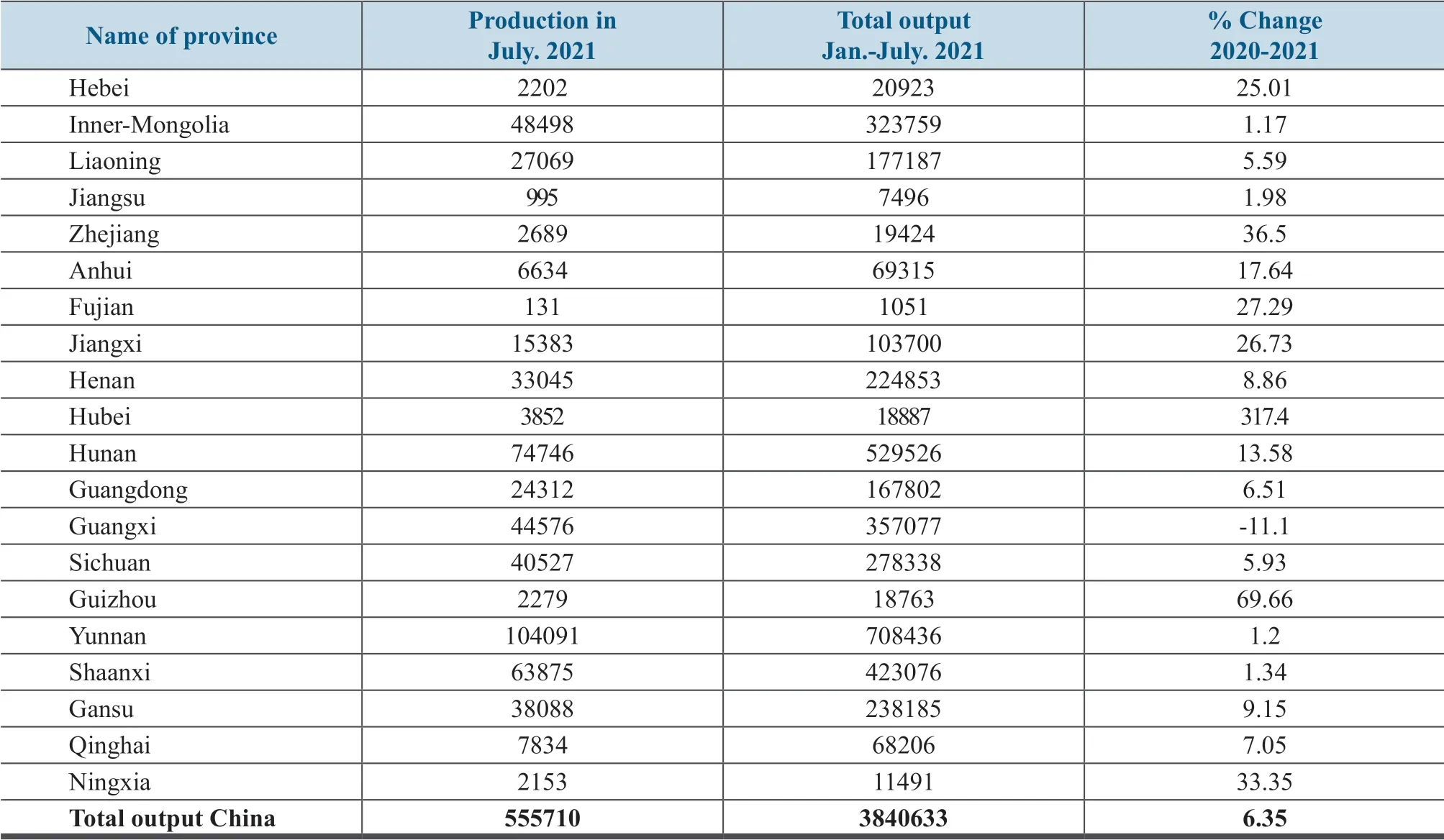

Zinc Production by Province in 2021 Unit:metric ton

杂志排行

China Nonferrous Metals Monthly的其它文章

- In The First Half,A Significant Rise in The Performance of Tongling Nonferrous

- Ministry of Ecological Environment Released the Announcement of Technical Specifications for Pollution Control Over Disposing Used Lithium Ion Power Battery (Pilot)

- China North Rare Earth:Improving the Novel Model in Marketing and Developing into the Wind Vane in the Industry

- MIIT:In The First Half Output of Energy Storage Lithium Ion Battery Nationwide Increased by 260% on A YOY Basis

- Striking Economic Performance Made in Nonferrous Industry in The First Half of The Year