Optimization of Structure of Agricultural Insurance Subsidies: A Multi-task Principal Agent Model

2021-02-18QiHUANG

Qi HUANG

Zhengzhou Central Sub-branch, the People’s Bank of China, Zhengzhou 450040, China

Abstract Optimizing the structure of agricultural insurance subsidies is of great significance to increasing the supply of agricultural insurance and strengthening the effects of agricultural insurance policies. This paper optimized the structure of agricultural insurance subsidies. It decomposed insurance activities into three parts: underwriting, claim settlement, and agricultural services. Next, it incorporated adverse selection risks, moral hazards, agricultural production and operation risks, insurance company’s behavioral decisions and its risk attitudes into the multi-task principal agent analysis framework. Finally, it discussed how the government designs a subsidy mechanism and adjusts the subsidy structure to increase the insurance supply.

Key words Agricultural insurance, Structure of subsidies, Multi-task principal agent theory

1 Introduction

As an effective way of dispersing agricultural risks, Agricultural insurance is a policy guarantee for stabilizing farmers’ income and an agricultural protection method supported by the WTO’s "Green Box Policy". Since the central government of China comprehensively launched the policy-based agricultural insurance pilot in 2007, China’s agricultural insurance has entered a stage of leapfrog development. Agricultural insurance premium subsidies have become an important way for public finance to support agriculture and also an important driver for the rapid development of agricultural insurance. How to increase the efficiency of the use of financial subsidy funds and improve the effect of agricultural insurance financial subsidy policies? This has become a focus of the academic circle and it is the exact significance of this study.

2 Hypotheses of multi-task principal agent model

Hypothesis 1:a

= (a

,a

,a

) is the effort vector of the insurance company.a

denotes the underwriting efforts of insurance company, such as designing insurance contracts, promoting agricultural insurance, assessing risks, confirming insurance policies,etc.

;a

denotes the claim settlement efforts of insurance company, such as inquiries about the case, surveys,etc.

;a

denotes the agricultural service efforts of insurance company, such as agricultural insurance, agricultural technologies,etc.

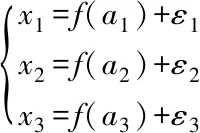

The government cannot directly observe the efforts of insurance company, but can only observe the results of the efforts of insurance company:x

=f

(a

)+ε

(1)

f

(a

) is a strictly increasing concave function,ε

~N

(0,σ

) represents the exogenous uncertainty, and 3 information quantitiesx

were observed in this paper, expressed as:

(2)

To simplify the calculation, letf

(a

)=a

, thenx

=a

+ε

,x

=a

+ε

, andx

=a

+ε

.

u

(y

)=-e

-, whereρ

represents a measure of absolute risk aversion andy

denotes the actual money income. Then the certainty equivalent incomeCE

of the insurance company’s satisfies:Eu

(y

)=u

(CE

)(3)

K

, and part of the premium income needs to be paid to the government as a tax. The tax rate isr

, that is, the government tax for agricultural insurance isK

×r

.3 Design of agricultural insurance subsidy mechanism

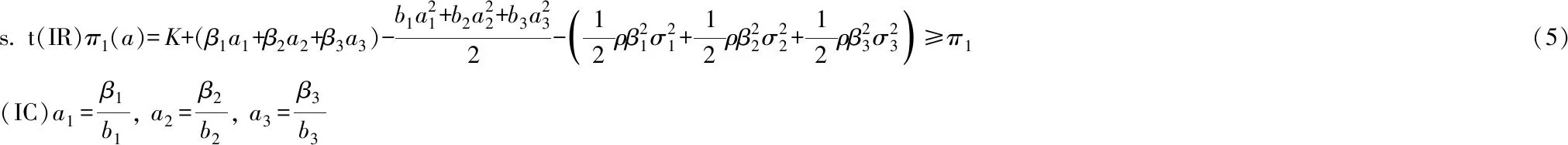

The model of agricultural insurance subsidy mechanism is as follows:

Max:Eπ

=K

×r

+(ua

+va

+wa

)-(β

a

+β

a

+β

a

)(4)

(6)

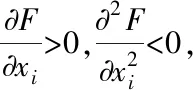

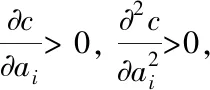

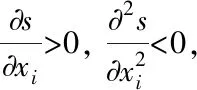

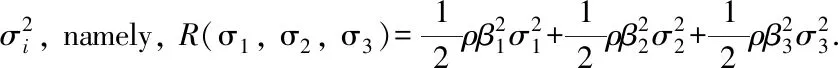

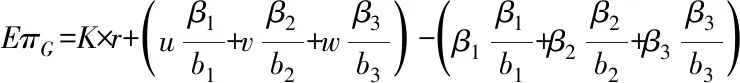

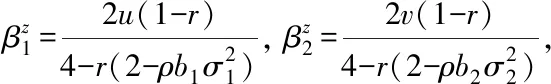

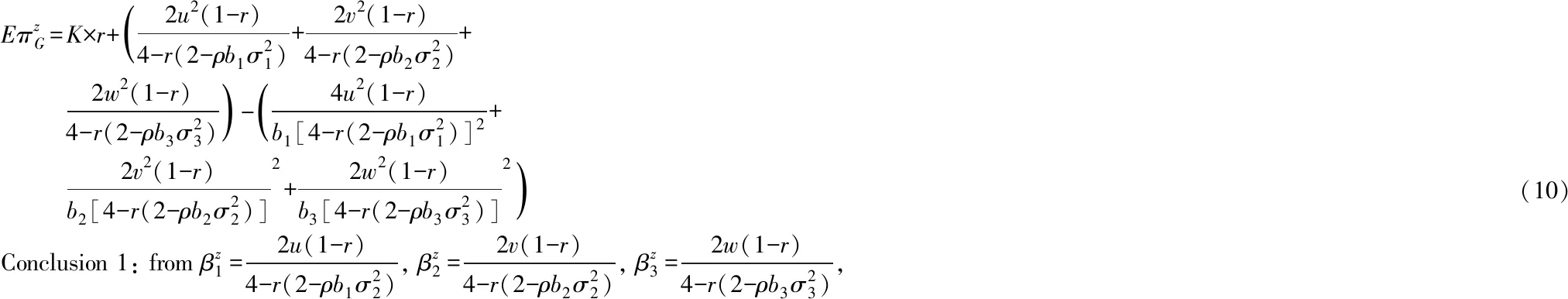

Substituting the participation constraint condition formula (5) and the incentive compatibility condition formula (6) into the target function formula (4), we can get the government’s expected income as:

(7)

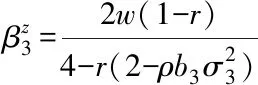

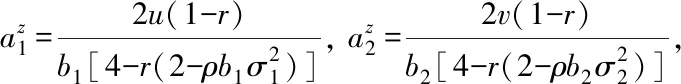

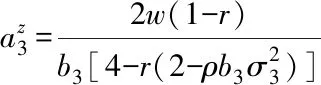

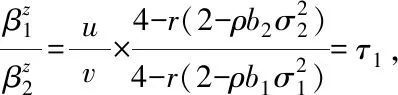

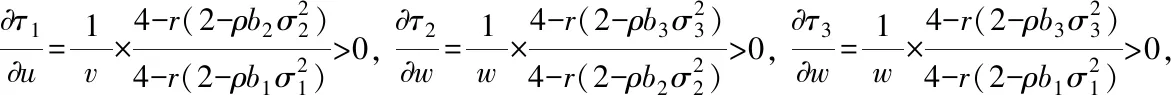

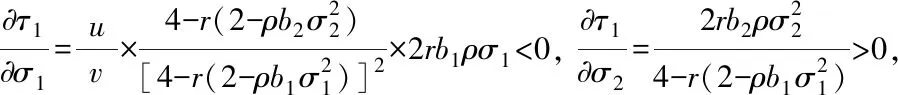

Separately calculating the derivatives of in formula (7), we can obtain the optimal incentive intensity and optimal effort level in the case of information asymmetry:

(8)

(9)

The expected income of the government is:

etc.

Therefore, to improve and optimize the structure of agricultural insurance financial subsidies, it is feasible to decompose agricultural insurance subsidies into three parts: underwriting, claim settlement, and agricultural services. Making clear the subsidy incentive intensityβ

,β

,β

of each part can improve the implementation effect of agricultural insurance policy.

4 Research conclusions

Through the above analysis, it can be known that the government can optimize the subsidy structure of agricultural insurance through the following measures:

(i) The contribution rate of the insurance companies’ efforts to the implementation of agricultural insurance policies. The efforts of insurance companies to operate agricultural insurance are invisible, but the results of their efforts can be quantified. It is recommended to establish an evaluation system for underwriting effort indicators to evaluate the design of insurance contracts, promote the efficiency of agricultural insurance,etc.

Besides, it is necessary to establish an evaluation system for claim settlement effort indicators, including whether to insure the reinsurance, whether to inquire about the case, the number of cases reported,etc.

Also, it is recommended to construct an evaluation system of agricultural service indicators, such as agricultural insurance, production and operation training times, number of participants, expenses, and so on. Furthermore, it is necessary to compare the relative contribution rates of the three efforts, and give more incentives to projects with a large contribution rate and enhance the implementation effect of agricultural insurance policies.(ii) Insurance companies assume the adverse selection risks, moral hazards, and agricultural production and operation risks. By assessing the risks of insurance companies, the government can use financial subsidy rates as a medium to send signals to insurance companies, so as to stimulate insurance companies to take more measures to minimize risks and give play to the "signal sending" mechanism and the "signal screening" mechanism.

杂志排行

Asian Agricultural Research的其它文章

- Effects of Fermented Nano Chinese Herbal Medicines Replacing Antibiotics on Production Performance and Carcass Quality of Growing-Finishing Pigs

- Research on the Curriculum Construction by Promoting Teaching Using Competition Based on Bloom’s Taxonomy of Educational Objectives

- Screening of New High Quality and High Yield Sweet Potato Varieties in Zaozhuang of Shandong Province

- Agricultural Water Resources Utilization and Management under Agricultural Safety Aim Based on Fuzzy Neural Network Algorithm

- Analysis on Development Potential and Development Measures of Nanchong Ecotourism

- Distribution of Value-added Income of Collective Construction Land Entering the Market Based on the Subject Input Contribution and TOPSIS