Wine Consumer behavior in Hong Kong

2020-12-28刘思佳

刘思佳

1、Introduction

Production of wine is both art and science, it is a cooperation of natures creativity and techniques. However, for most of wine merchants and consumers, wine production is also regarding as a business, which is developing globally. Nowadays, wine industry became one of the most globalized industries in the world while wine has been traditionally consumed in Europe. Comparing to the past, the European market is declining in terms of consumption. During the period from 1970 to 1999, in “old world” countries as Spain, France and Italy, the per capita consumption has decreased 40 to 50%, meanwhile, the per capita wine consumption in the United States, one of the “new world” country, has almost doubled (Figure 1). According to researches, European wine consumption per capita has decreased from 53 liters in the period of 1991 to 1995 to 44 liters in 2009 in average (USDA, 2011). The European Union therefore decided to expand wine export so as to maintain the consumption level. The main export destinations are several developed countries like the United States, Canada and Japan as well as the BRIC economies referring to Brazil, Russia, India and China.

Figure 1: Changes in total consumption of wine by country during the period of 1970-1999

Emerging wine markets are the proof of globalization of wine industry. The increasing amount of markets brings the need for examinations, especially, the need to understand consumers behavior. In order to be profitable and successful in the modern markets, a wine marketer must be aware of a reliable understanding of the intrinsic and extrinsic factors underlying wine purchase motivations (Linda et al, 2002). Knowledge for the emerging markets and consumers is beneficial not only for domestic professionals to make decisions on what wines to import and sell, but also for worldwide marketers to better target new consumers.

The influences of globalization in the wine industry are particularly evident in Asia. The volume of wine consumption in Asian countries like Japan, China, Singapore, and South Korea has increased rapidly during the last five years and currently they demonstrate high potential in export markets (Lee, 2009). In 2008, after repealing the alcohol tariffs and excise tax for most alcoholic beverages, Hong Kong has experienced a boom in the alcohol industry, especially in wine trading, it has become the largest wine auction center in the world, moreover, the gate to Asian wine market (Yui-yip, Adolf& David, 2014). Hence it is a significant market to consider for wine producers and traders who seek export opportunities. This paper aims to gain insight into Hong Kong wine market and the consumers behavior in terms of consumption behavior, purchasing behavior, preference and information source.

2、Overview of existing information on the Hong Kong wine industry

2.1 Demand Booms

An increasing awareness of health benefits of wines had been spread throughout Hong Kong in the 1990s, which had brought revolutionary changes to the citys alcohol consumption scene (Speece, Kawahara and So, 1994). Not only wine consumptions increased exponentially, but it also changed the patterns of wine drinking and, fundamentally, alcohol drinking in general. Hong Kongs general taste buds have shifted from spirits consumption, including whisky and brandy to wines instead. It is not unusual to see Hong Kong people enjoying their meals with pairing a glass of wine (Schwartz, 2002), despite the fact that wine prices in Hong Kong are much more expensive that most countries at that time. However, Hong Kong entering the economic boom period since 2000, the wine market had experienced tremendous growth (Dewald, 2003). Wine lovers and collectors had shown great interests towards the finest wines of Bordeaux.

2.2 Taxation change

Taxation of alcoholic products is widely implemented worldwide as a method of funding public health system. The heavy high wine tax had gone through gradual amendments and increased to 80% from 60% from 1994-2000(The Economists, 2010). Hong Kong as capacity of managing a free trade port, the government had made a decision to reduce 50% taxation on beers and wines in order to further strengthen the strategic position. The taxation on beers and wines was further reduced and eventually removed in February 2008 (HKTB, 2015). This revolutionary reform greatly incited the wine business scene in HK in various ways. Professional wine storage warehouses and facilities were erected in order to meet the requirements of the zealous wine collectors. The huge inflow of international investments and talents from all over the world was truly remarkable at the time: wine merchants and companies flooded to HK and have their headquarters set in HK (Debra M, 2013). By the end of the 2000s, HK has arguably become the wine hub of Asia.

2.3 Product diversity & taste change

Accompanied by the influx of international wine ventures, the number and the range of products available to consumers have increasing in last decade. First of all, the total volume of imports has increased greatly. According to the government report, the import of wine reached HK$8.4 billion at the end of 2014, compared to that in 2007 merely HK$1.6 billion. Secondly, there has been a much greater diversity to the range of products coming into Hong Kong. For example, French wine has been the origin and main imports (more than 40% market share) into the HK wine market in the end of 1990s (H.K. Trade Statistics Reports – Nov-Dec 1999). But according to recent statistics, between 2012 and 2014, the total percentage of French wine import has decreased, whereas the percentage share of New World Wines such as Chile and Australia has increased tremendously. Furthermore, the preference for wine of Hong Kong customers has also change gradually from red to white wine, with a ratio about 3 to 1 choosing red wine. Hong Kong as the culinary center in the region, it is popular to has wine pairing with Asian cuisine thus enrich wine sales in restaurants and hotels as wholesales, meanwhile the more full-bodied red wines with fruity characteristics appeal to the Asian palate (Bolcina, 1997).

Firstly, Hong Kong consumer data were collected through questionnaires in a quantitative method. For the purpose of data collection, the researchers employed the online questionnaire designed by Dr. Steve Pratt from The Hong Kong Polytechnic University to obtain the data about Hong Kong wine consumer behaviors. Compared with pen-and-paper surveys, the online questionnaire tends to be more convenient, economic, environmental-friendly and less time-consuming.

Moreover, the online questionnaire allows the researchers to approach potential respondents more easily, which also provides a pressure-free environment. Meanwhile, random sampling was possible and applicable since this study mainly focuses on Hong Kong residents. The online questionnaire included demographic information, consumer preference for wine consumption, purchasing behavior as well as source of information. A total number of twenty-one questionnaires were received and collected for data analysis.

3.2 Qualitative Focus Group

Additionally, in this study, qualitative focus group method is considered practical and appropriate because it facilitates to reveal the consumer behaviors (Liu, F. & Murphy, J., 2007). Focus group is an interview involving the researchers as moderators and six to twelve respondents to discuss the topics introduced by the moderators (Zikmund & Babin, 1997). In this study, the targeted respondents were Hong Kong residents over 20 years old.

A total of twelve participants were invited to join the focus group interview. The participants were categorized into four groups according to age and gender: males under 30 years old (Group A), males over 30 years old (Group B), females under 30 years old (Group C), females over 30 years old (Group B). The researchers adopted 30 years of age was intended to unveil if there is any age difference in wine consumer preference like purchasing behavior, consumption behavior and source of information. The researchers took the role as facilitators to raise questions and to guide discussions (Krueger & Casey, 2014). Each focus group was about 15 to 20 minutes in length during lunch time and dinner time for two days. The facilitators made sure that all the questions were discussed and the participants in the group had equal opportunity to express their viewpoint. four focus group interviews were recorded through pen-and-paper in order to enable the researchers to conduct the analysis. The data were decoded and categorized based on the frequency of answers in the discussions.

4、Findings

4.1 Quantitative method

4.1.1 Wine purchasing behavior

The participants on average purchase 4.79 bottles of wine every month. And the average spending on wine per month is about 1167.86 HKD. The majority of the Hong Kong wine consumers tend to buy wine at liquor stores, followed by supermarkets and restaurants/bars. A very small percentage of participants buy wine through online/mail order. This results showed that Hong Kong wine consumer still prefer to buy wines mostly at liquor stores, only a small percentage will choose to order online or via emails. Hong Kong is a developed place economically and socially, however the e-commerce grew slowly. Consumers seldom order wines online not only because of the higher barrier for free delivery (often purchase over 1000 HKD for free delivery) but also thanks to the fierce competition among retailers and the convenient shopping environment in Hong Kong. In this competitive wine market, consumers are able to compare prices among retailers and tend to purchase onsite.

In terms of Top-3 countries of origin for wine, the participants ranked France as the Top 1 favorite wine region, followed by Italy, New Zealand, Spain, Australia, South Africa and Chile. When it comes to France, the first thing came to peoples mind might be about wine and perfume. French wines have been successfully constructed as the national symbol of France. This survey revealed that the Hong Kong wine consumers still prefer wines old world such as France and Italy than that of new world. However, they are willing to try and accept new world wines since several new world wine regions like New Zealand, Australia, South Africa and Chile.

4.1.2 Information sources

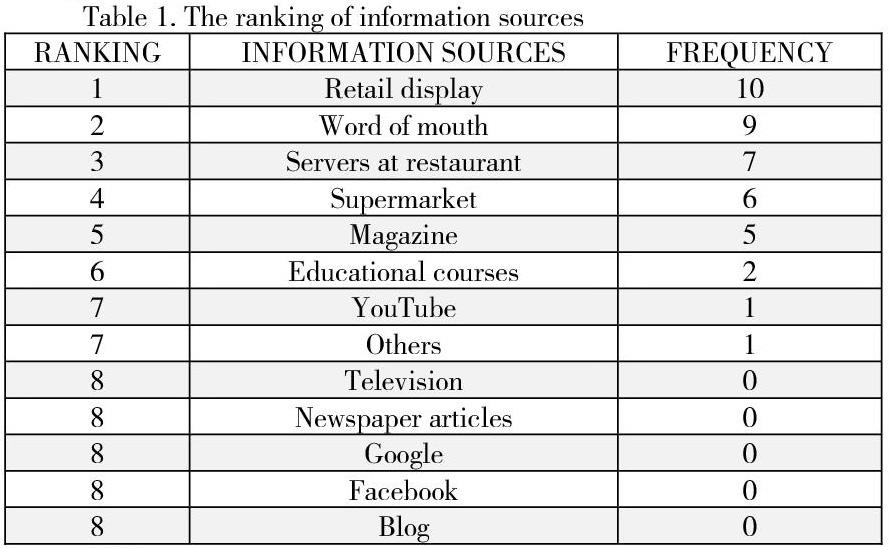

In order to allow marketers to take appropriate promoting strategies, it is necessary for researchers to obtain the information on sources that Hong Kong wine consumers mostly depend on. Hence, the questionnaire included a question about the sources that consumers use to obtain information about wine. The results showed that the retail display, word of mouth/ friends' recommendation are considered to be the most widely-accepted information sources, followed by restaurant sommeliers, supermarkets, magazines and educational courses. However, the Facebook, YouTube, Google and Television were perceived as less reliable sources of wine information. Retail display is the most direct way to present wine information, which is highly effective and more reliable for Hong Kong's wine consumers. However, the modern social networks experienced difficulties in promote wine information in Hong Kong and were less valued by the local wine consumers.

4.2 Focus group

A total of 12 participants were recruited for the interview. The participants were segmented into four groups according to their age and sex. Each group is composed of 5 members. Group A for males between 20 to 30, group B for males over 30, group C for females between 20 to 30 and group D for females over 30. Participants who are over 30 are all have stable jobs, meaning that they have the ability to purchase wine and may have occasions to enjoy wines during their work. On the other side, participants between 20 to 30 are students and unemployed.

Topics were allowed to be explored base on the conversation. The discussion guide includes 5 topics:

Monthly frequency of wine purchasing

Preference of type of wine (e.g. red, white, rose, dry, sweet)

Preference of wines country of origin

Average monthly spending on wine

Source of information

Based on discussions with different groups, it is undeniable that Hong Kong is a developing wine market with increasing number of wine consumers. 16 participants replied that it is easy to get information and to buy wine in Hong Kong, for instance, supermarket, wine shop, online shop. Therefore, unlike in the past, wine became a commodity same as other beverages that have easy access with reasonable price.

The results are concluded as following: for males (Group A and Group B), red wine is more favorable than other type of wine, however, males over 30 have more spending power on wine than males under 30, which is referred by higher frequency and more money used to purchase wine per month. For females (Group C and Group D), Natalia (2013) reported that men and women were discovered to have different wine preferences, perceptions about wine regarding the occasion or motivational factors to consume wine. Unsurprisingly, sparkling wine is preferred rather than red wine regardless the origin. Furthermore, females tend to spend less on wine but when they walk in to wine store, they choose according to the sellers advice.

4.3 Secondary data

In February 2016, Hong Kong Trade Development Council (HKTDC) published a report with the topic of Wine Industry in Hong Kong on its official website. This report overviewed the latest situation of wine industry in Hong Kong including industry features, performance of Hong Kongs wine trade, sales channels, industry trends, provisions of Closer Economic Partnership Arrangement (CEPA), general trade measures affecting wine exports, and product trends.

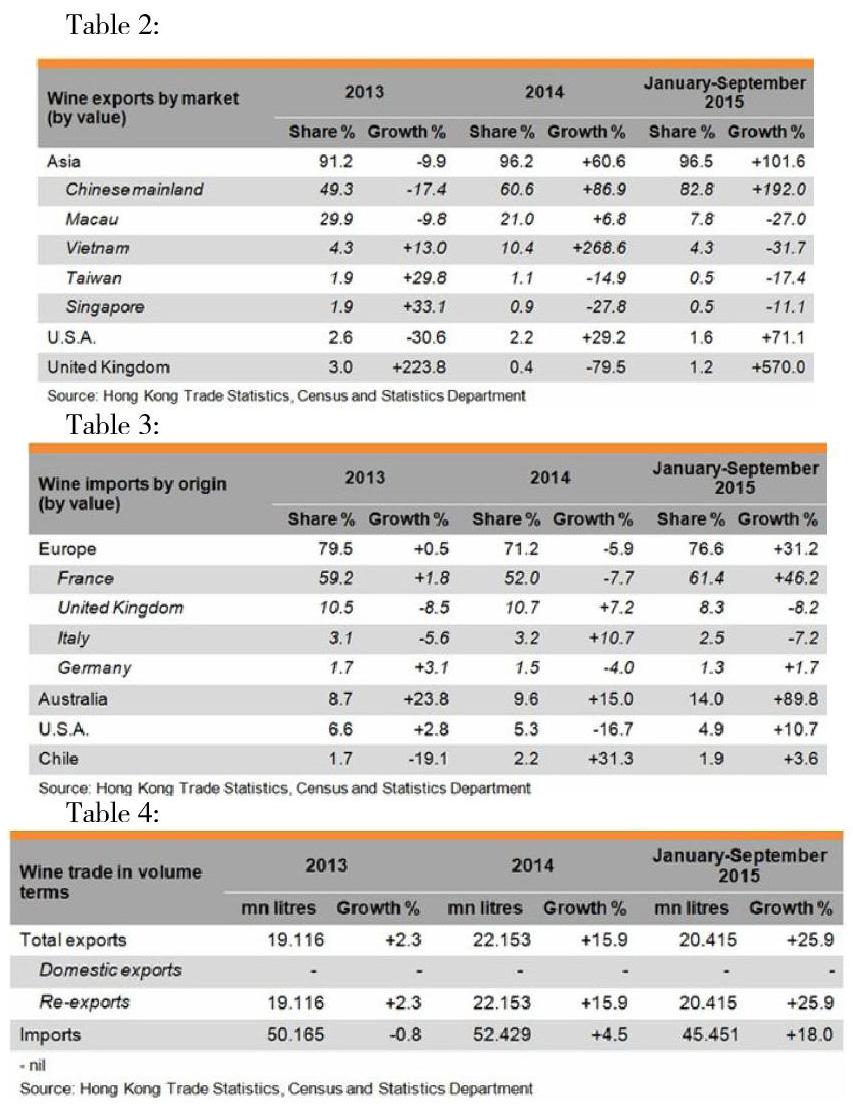

Due to the weather condition in Hong Kong, it is difficult for grapes growing, there is

only a little amount of wine produced here, consequently, the quantity of domestic export is low (Table 4). In fact, all exports of wine are re-exports of imported wines. Chinese mainland and Macau are the two major destinations for wine exports, accounting for nearly 90.6% of the total exports in the first three quarters of 2015.

Besides, wine imports in Hong Kong have grown rapidly since the exemption of import duties in 2008. In the first three quarter of 2015, the wine imports experienced a growth of 18% (Table 4). According to Table 3, a large portion of the imported wines were from European wine regions as France and the UK, yet, another important market share came from new world wine regions like Australia, the US and Chile. To conclude, new world wines start to attract Asian wine consumers while old world wines still occupy the majority of the market share.

Through the research figures, it is clear that consumers in Asia have increasing interest on wine and their demand for wine remains strong. On the one hand, thanks to the rapid growing demand for wine in Asia and deregulation of wine imports, Hong Kongs wine business has sprung up like mushrooms. More and more international wine companies and their specialists have moved to Hong Kong to seek new opportunities. On the other hand, private and public institutions are enlarging their wine courses and developing more complex training system. Institution as AWSEC, offers courses for not only professionals in this filed, but also people who are willing to know how to appreciate wine.

5、Conclusion & Recommendations

This study revealed the wine consumer behaviors including consumption behavior, purchasing behavior, preferences and source of information through a combination of quantitative and qualitative methods. The Hong Kong wine consumers attached great importance to the retail display and word-of-mouth which are their two major ways of obtaining wine information. Similar to other products, perception and preference varies from consumer to consumer. Meanwhile, the researchers also analyzed the current wine market of Hong Kong by the means of secondary data. Old world wines still took the majority among Hong Kong wine consumers, however the new world wines also attracted numerous wine fans in Hong Kong. It can be predicted that the new world wine regions like Australia, New Zealand, US and Chile will continue its rapid growth. In this matured wine market, consumers are willing to try and accept new wine styles, therefore it provides extensive opportunities for some less popular wine regions like Greece, Georgia, etc. to take some market share in Hong Kong.