Effects of Agricultural Insurance on Poverty Alleviation under Uncertain Price of Agricultural Products

2019-08-26JianZHANG1BoyuYANGLinaZHAO

Jian ZHANG1,*, Boyu YANG, Lina ZHAO

1. School of Insurance, Central University of Finance and Economics, Beijing 100081, China; 2. School of Sciences, Hebei University of Technology, Tianjin 300401, China

Abstract Poverty alleviation of the rural poor is the most arduous task in building a moderately prosperous society in all respects in China, and agricultural insurance is an important financial tool for this task. Due to different capital levels, individual farmer will adopt production technology with different efficiency. In the case of uncertain price of agricultural products, this paper establishes a series of multiple equilibrium models based on agricultural risk and agricultural insurance. Under the catastrophe risk, the probability of falling into the poverty trap is calculated, and the effects of agricultural insurance on poverty alleviation are discussed respectively. It is found that agricultural insurance can effectively reduce the probability of falling into the poverty trap for the farmers whose initial capital is greater than a certain critical value. While the government subsidizes the premium of agricultural insurance by a certain proportion, the effect on poverty alleviation will be further improved.

Key words Agricultural insurance, Multiple equilibrium models, Probability of falling into the poverty trap

1 Introduction

Targeted poverty alleviation is the basic strategy for poverty alleviation in China. The Chinese government has issued a series of major poverty alleviation policies and development measures, which explicitly call for lifting all rural poor out of poverty by 2020, taking off the poverty hat from all poverty-stricken counties, addressing overall regional poverty, and building a moderately prosperous society in all respects. The poor in China are mainly concentrated in remote rural areas where natural conditions are harsh and natural disasters occur frequently, and farming and aquaculture are the main industries. "Poverty caused by disasters" and "returning to poverty due to disasters" is frequent, and farmers are vulnerable to natural disasters.

Agricultural insurance has played a positive role in ensuring agricultural production and stabilizing farmers’ income, and has become an important tool for poverty alleviation for the rural poor in China. In particular, since the central government began to subsidize agricultural insurance premiums in China in 2007, it has boosted the development of agricultural insurance and enhanced farmers’ ability to withstand agricultural natural disaster risks. In recent years, the input of subsidies for agricultural insurance premiums has been increasing, the proportion of subsidies for agricultural insurance premiums has been increasing, and the coverage of subsidies for agricultural insurance premiums has been further expanded. In 2017, China provided 17.904 billion yuan in subsidies for agricultural insurance premiums, up 13% year-on-year. In August 2018, the Ministry of Finance, the Ministry of Agriculture and Rural Affairs, and the Banking Regulatory Commission issued a notice informing that the three major food crops of rice, corn and wheat were included in the central financial agricultural insurance premium subsidy catalogue. Agricultural insurance has become an important policy-based financial means of targeted poverty alleviation in China. With the continuous advancement of the targeted poverty alleviation strategy, the remaining poor people in China have deeper poverty and higher poverty alleviation costs. How to play the role of agricultural insurance in poverty alleviation has theoretical and practical significance.

2 Literature review

2.1 Research on poverty alleviation through agricultural insuranceTargeted poverty alleviation by policy-based agricultural insurance has become an important poverty alleviation system in China. Zhang Weietal.[1]proposed that policy-based agricultural insurance poverty alleviation mechanism can solve the poverty caused by natural disasters, and further research found that agricultural insurance poverty alleviation also has obvious multiplier effect and welfare spillover effect. Zhang Yuehuaetal.[2]proposed that policy-based agricultural insurance is essentially a policy supporting agriculture, like other tools supporting agriculture, can improve the welfare of farmers to different degrees. The results of Huang Yuanjietal.[3]showed that the policy agricultural insurance market in Hunan province is generally in an effective state. The number of farmers participating in the insurance, the number of beneficiary households, the determined compensation and the government premium subsidy would significantly influence the effect of agricultural insurance on poverty alleviation. Lin Zhiyong[4]took the local agricultural characteristics of Fuping as the industry support and developed the income insurance of characteristic agricultural industry. PICC used the credit enhancement function of agricultural income insurance to provide risk protection for other financial entities, and promote the poverty alleviation effect of finance in agricultural insurance. Xu Rongetal.[5]conducted an empirical study on the impact of government relief on the agricultural insurance market based on the inter-provincial panel data from 2001 to 2012, which showed that government relief for rural natural disasters had a significant promoting effect on the development of agricultural insurance market. Zhang Weietal.[6]showed that in addition to agricultural insurance subsidies, encourage farmers to increase grain output, but also improving the guarantee level of agricultural insurance and constructing the underwriting mode combining with commercial insurance.

2.2 Development of Chinese agricultural insurance and policy recommendationsThrough the efficiency analysis of agricultural insurance subsidies, Jiang Shengzhongetal.[7]proposed that agricultural insurance financial subsidies are efficient in promoting the development of agricultural insurance market. Hou Linglingetal.[8]showed that agricultural insurance has been developed under the policy promotion, but the agricultural insurance subsidy policy still needs to be improved, and the insurance subsidy has a significant impact on farmers’ purchasing behavior. Zhang Zongjunetal.[9]proposed that premium subsidy ratio should be adjusted according to regional differences, product types, goal orientation and guarantee level, so as to better play the role of agricultural insurance in supporting and benefiting farmers. Wang Zhenjunetal.[10]took the meteorological index insurance of winter wheat in Huan County of Gansu Province as an example to optimize the design scheme, aiming at the problems of low guarantee level and unreasonable premium sharing in China’s policy-based agricultural insurance. Zhang Weietal.[11]proposed that optimizing the insurance structure of agricultural insurance in ethnic areas, designing flexible guarantee level and premium subsidy combination for farmers to choose freely, could bring the leverage effect of agricultural insurance on poverty alleviation into full play. Lu Kaiyuetal.[12]suggested to improve the long-term mechanism of subsidy policy, expand insurance coverage according to different needs, intensify the development of index-type insurance products, and improve farmers’ awareness of insurance participation. Yu Yangetal.[13]proposed that China could learn from the successful experience of the United States, gradually improve the level of agricultural insurance guarantee, implement differentiated proportional subsidies, and optimize agricultural insurance premium subsidy policy in China.

Based on the above research results, we established a multiple equilibrium model containing agricultural risks and agricultural insurance. Considering the impact of agricultural insurance on the probability of farmers falling into poverty in the case of uncertain agricultural product price, we analyzed the effects of agricultural insurance on poverty alleviation.

3 Models and methods

s.tct+kt+1=Qt·f(At,kt)+(1-δ)(kt-mt), ∀t=0, 1, 2, …

(1)

whereβis the discount factor of utility,u(·) is the utility function,ctis the consumption in periodt,ktis the capital level in periodt,k0is the initial capital of the individual,δand is the depreciation factor. Individual consumption in the current period and production input in the next period can only be decided by the current output level and the depreciated capital stock. Individual consumption in the current period and production input decisions in the next period can only be determined by the current output level and the depreciated capital stock. Capital cannot be accumulated by advancing future income.

With reference to Buera[14](2009), we assumed that expected incomef, for an individual in periodtis given by :

(2)

whereαis the level of technology,γL,γHrepresent the output elasticity of capital. The high technology is subjected to fixed costf, such that the technology is not worth using at low amounts of capital.

According to Formula (1) and Formula (2), the Bellman equation for maximizing the farmers’ lifetime utility can be expressed as:

(3)

(4)

Then, we set the relevant parameters according to Formula (3), solved Bellman equation by approximation method, and calculated the probability of poverty of farmers at different asset levels according to Formula (4).

3.2 The model with agricultural insuranceThe farmers choose to purchase agricultural insurance with a guarantee level of B, basing on his wishes and needs, and aiming at maximizing the lifetime utility. Assume that agricultural insurance is priced according to Expected Value Premium Principle. Then the premium is:

mt=Q2(1+θ)(1-p)max{(f(B,kt-mt)-f(At,kt-mt)), 0}

(5)

The maximization problem becomes:

s.tct+kt+1=Qt·max{f(B,kt-mt),f(At,kt-mt)}+(1-δ)(kt-mt), ∀t=0, 1, 2, …

(6)

As farmers purchase agricultural insurance, the assets invested in agricultural production are reduced, but the losses caused by the risks can be partially compensated. When agricultural insurance is included, the Bellman equation is the same as Formula (3), but the constraint becomes to Formula (6). According to Formula (4), the poverty probability of farmers with different assets under agricultural insurance can be calculated. Whether the probability of farmers’ poverty is effectively reduced can measure the effects of agricultural insurance on poverty alleviation.

4 Results and analysis

We assume that the farmers’ asset is between 0 and 25, and agricultural production is endangered by the catastrophe risk once every 20 years. The parameters are set as follows:γL=0.1,γH=0.5,α=1,f=1,p=0.95,A1=1,A2=0.1,β=0.98,δ=0.1,Q1=1,Q2=1.2, the utility function is:u(ct)=lnct.

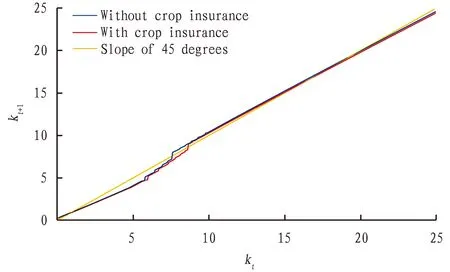

The optimal consumption strategy of farmers with different asset is obtained by solving the Formula (3) with the aid of MATLAB, and then we numerically simulated the dynamic path of the individual inter-temporal assets of the farmer, as shown in Fig.1.

Fig.1 Dynamic path of the individual inter-temporal assets

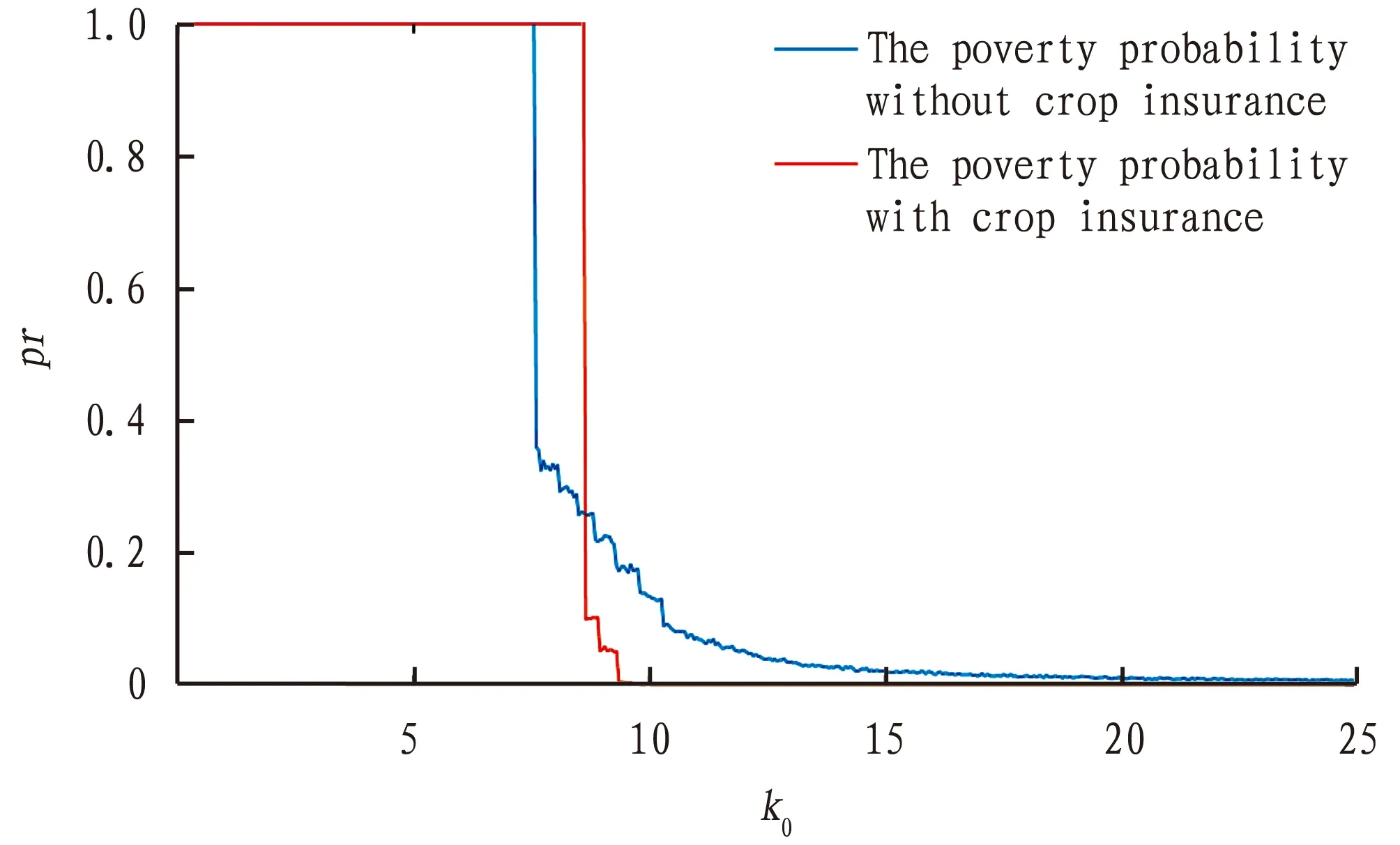

Using the Monte Carlo method, we simulated the asset dynamics asset of individuals with different initial assets in the 50 periods, compared the asset level with the critical value falling into the poverty trap one by one, and calculated if the asset is less than the critical value. We finally calculated the poverty probability with and without the agriculture insurance by repeating the process 10 000 times, as shown in Fig.2.

Fig.2 Poverty probability without and with the agriculture insurance

According to Fig.2, without purchasing agricultural insurance, the poverty probability is 1 when the individual’s initial asset is lower than 7.576 4, that is, the individual will fall into the poverty trap; the probability of the others is less than 1, and decreases as assets increase. The threshold enlarges to 8.622 0 after purchasing agricultural insurance, but the poverty probability of the farmers whose initial asset is above the threshold will drop sharply, and the probability of poverty will reduce to 0 with the increase of the assets.

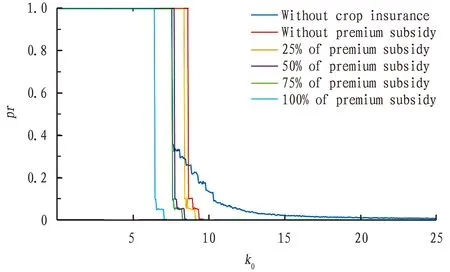

Considering the premium subsidy, we set the proportion of premium subsidies as 25%, 50%, 75%, and 100%. The impact of agricultural insurance under different subsidy ratios on the probability of poverty is drawn in Fig.3.

Fig.3 Probability of poverty with agricultural insurance under different subsidy ratios

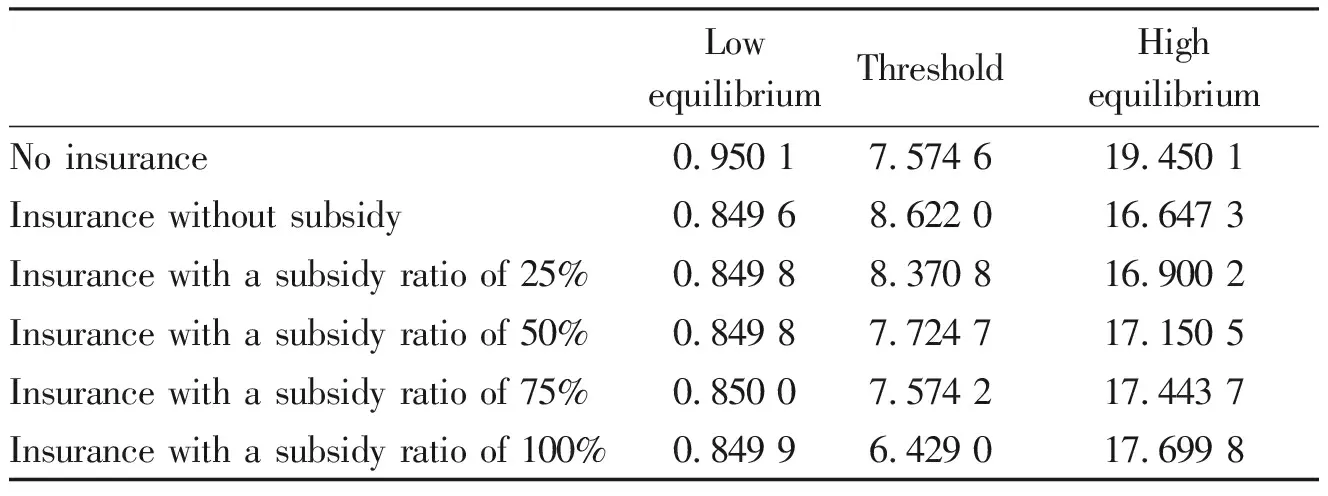

As mentioned above, we can get changes in the threshold and the equilibriums under no insurance, purchase insurance and different premium subsidies, as shown in Table 1.

Table 1 Impact of agricultural insurance on the equilibrium

LowequilibriumThresholdHighequilibriumNo insurance0.950 17.574 619.450 1Insurance without subsidy0.849 68.622 016.647 3Insurance with a subsidy ratio of 25%0.849 88.370 816.900 2Insurance with a subsidy ratio of 50%0.849 87.724 717.150 5Insurance with a subsidy ratio of 75%0.850 07.574 217.443 7Insurance with a subsidy ratio of 100%0.849 96.429 017.699 8

5 Conclusions

In case of the uncertainty of price, we established a multiple equilibrium model based on agricultural risk-insurance, and used numerical simulation to analyze the effects of agricultural insurance on poverty alleviation under the catastrophe risk. we reached following conclusions. (i) Without agricultural insurance, individuals whose asset is lower than the threshold (7.574 6) will definitely fall into the poverty trap, and the probability of poverty is 1. The poverty probability of individuals above the threshold is less than 1, and reduces as the asset increases. (ii) After adding agricultural insurance without premium subsidy, the threshold falling into the poverty trap is higher than that before, and the probability of poverty of the individuals whose initial asset is between 7.522 7 and 8.620 0 rises to 1, reflecting that the poverty becomes worse. This is because the assets invested in agricultural production are reduced for buying insurance, and then the individuals fall into the poverty trap. However, for individuals whose initial assets are higher than the critical value (8.622 0), their probability of falling into poverty trap is significantly reduced, and a certain poverty alleviation effect has been achieved. (iii) There are different effects on the individual’s long-term asset equilibrium level and the probability of poverty, because of the different premium subsidy ratios: 25%, 50%, 75% and 100%. The higher the proportion of premium subsidies, the lower the level of critical assets falling into the poverty trap, that is, fewer individuals fall into the poverty trap, lower probability of poverty of those whose initial assets are above the threshold. And there are some people getting rid of the poverty trap due to the premium subsidies. Agricultural insurance has played a better role in poverty alleviation for the above groups. (iv) For individuals in deep poverty, the poverty alleviation effect is limited by using agricultural insurance alone, and it is necessary to assist them in combination with other ways.

杂志排行

Asian Agricultural Research的其它文章

- Impact of Ningbo Port Logistics on Regional Economic Development of Zhejiang Province

- Current Situation of College Students’ Entrepreneurship and Employment in the Countryside in the Context of Rural Revitalization

- Evaluation of the Degree of Opening to the Outside World in Guizhou Province

- Poverty Alleviation through Employment Promotion in Extreme Poverty-stricken Areas in Western China: A Case Study of Targeted Poverty Alleviation through Employment Promotion in Awang Town, Dongchuan District

- Optimal Method of Extraction Process of Flavonoids from Ginkgo biloba

- The Poverty Alleviation Model for Poor Nationalities in the Mountainous Areas of Western China: A Case Study of “Promotion for the Entire Lisu Nationality” in Naimu Danxia Village Group