Risk Control Strategies for Loan of Commercial Banks to Small Agricultural Enterprises

2019-03-20,

,

Huazhong Agricultural University, Wuhan 430070, China

Abstract In recent years, the deepening of reform has provided larger development space for small agricultural enterprises. Besides, with flexible operation mechanism and sensitive market perception, small agricultural enterprises have also enriched the reform achievements, improved the market structure and promoted economic development. Therefore, attaching great importance to small agricultural enterprises and supporting their healthy development have become the key tasks of each country. However, at the current stage, small agricultural enterprises in China are facing tremendous survival pressure. Because their capital is limited, the capital turnover is difficult. In this situation, financing has become an important means for small agricultural enterprises to revitalize the capital chain, expand the scale, and ensure normal operation. Compared with large and medium sized enterprises, small agricultural enterprises are small in size, imperfect in operation system, and weak in the ability of coping with market risks. Thus, commercial banks take on more risks when lending to small agricultural enterprises. To cater to state policies, commercial banks have to lend to small agricultural enterprises. In this process, it is particularly important for commercial banks to control risks. Taking some commercial banks in Xiangyang City of Hubei Province as an example, this paper analyzed the loan contracts provided by commercial banks for small agricultural enterprises and the investigation of financial status and credit status of loans before and after lending. It is found that commercial banks seldom check the financial statements when checking the operation status of small agricultural enterprises. They just check electricity fees, water fees, and wages, which are real-time and provided by the authority to accurately grasp the operation conditions. It has also been found that commercial banks will ensure that enterprises can possess the capital flow to reduce loan risks through requiring enterprises to set up fund withdraw accounts, and taking accounts receivable of enterprises as pledges.

Key words Small agricultural enterprises, Credit, Risk control

1 Introduction

1.1ResearchbackgroundandsignificanceIn the global range, small agricultural enterprises provide a strong impetus to increase employment, promote economic development, improve market structure, and improve technological innovation with the aid of their advantages of low entrepreneurial costs, high concentration of property rights, and rapid and efficient development. Up to now, most agricultural enterprises in China are small ones. According to relevant statistics, there are more than 20 million small agricultural enterprises in China. Plus those mini enterprises or companies that have no regular business license, the number of small agricultural enterprises is up to 50 million, far larger than that of any country. At present, small agricultural enterprises face bottlenecks in financing difficulties. Therefore, under the background of the introduction of state policies to help small agricultural enterprises, banks and other financial institutions have started to soften the loan threshold and gradually develop credit business for small agricultural enterprises. However, because small agricultural enterprises are mainly individual industrial and commercial entities, they are weak in economic strength, imperfect financial system, and short life cycle. In addition, the credit mechanism of commercial banks to small agricultural enterprises lacks experience, the credit system is not perfect. Especially, with the overall economic depression, small agricultural enterprises have great operation difficulties, and the problem of credit risks of small agricultural enterprises is being exposed. The social practice in recent years shows that under the background of big data, the traceability of transaction information of small agricultural enterprises provides the possibility for banks to change their credit methods. Small agricultural enterprises that are often excluded from the financial system due to mortgages are included to the list of loan targets, but the credit risk will be even greater. The choice of commercial banks depends on risk control. The commercial banks in China needs to establish a complete set of risk evaluation and warning system for small agricultural enterprises. In this study, we are intended to analyze how commercial banks to control risks in providing loan to small agricultural enterprises, so as to sort out and summarize the credit risk control of commercial banks for small agricultural enterprises.

1.2Literaturereview

1.2.1Foreign literature. (i) Performance of foreign small agricultural enterprises: Stigltz and Weis[1]held that the financing difficulties of small agricultural enterprises are due to the fact that some commercial banks do not have the ability to supervise borrowers, and the purpose of interests of borrowers and lenders are different. An empirical analysis of Stigltz and Weis on the merger of two banks in England from 1993 to 1994 proved that the loans received by small enterprises after the bank merger were reduced compared to that before the merger. Based on his own research, Weis stated that financial services for small enterprises are provided mainly by small financial institutions, rather than large state-owned policy banks. Foreign countries have established relatively perfect system for supporting small agricultural enterprises. In addition to direct support of financial institutions, small agricultural enterprises also have indirect financing from other financial institutions or even non-governmental institutions. Steve Beck and Tim Ogden found that the loan of small agricultural enterprises is a new growth point for commercial banks, while the quality of loan is also an essential factor limiting the development of commercial banks[2].

(ii) Mortgage, guarantee and credit risks: limited by the development of credit risk measurement technology, traditional credit risk control is always represented as a static control. In the traditional credit risk control, the most important one is to provide mortgage or guarantee. In the opinion of Whette, in case of information asymmetry, mortgage can reduce the occurrence of ex post moral hazard[3]. Based on the basic model of Stiglitz and Wies, Bester built a mortgage model and put forward an opposite viewpoint: the collateral alleviates the risk of information asymmetry to some extent, but due to the evaluation risk, realization risk, and supervision cost, the collateral itself may become an endogenous variable. Berger and Udell pointed out that the generalized model based on the average number may mislead financial policies due to deviation from the actual situation, and they advocated the combination of specific types of lending contracts to identify the mechanism of credit rationing[4]. With regard to financing guarantees, the models of Boot, Thakor and Udell indicated that due to the use of guarantees, the losses will be greater; to minimize such losses, customers will make effort to comply with contracts, therefore, the guarantee is favorable for reducing the possibility of borrowers’ default risks and speculative behavior.

(iii) Information and credit risk: Berger’s research shows that if banks adopt information technology that is intended to mitigate information asymmetry, then the incidence of loan collateral requirements for small agricultural enterprises will decrease, he stated that with the development of information technology, the innovations in lending technology will reduce the reliance on mortgages. With the advancement of information technology, the credit scoring system was gradually introduced into the commercial field by resident consumption in the 1990s, and research on lending technology has become increasingly rich and extensive[5-7]. The study found that credit scoring can reduce the requirement of loan mortgage. In the opinion of Berger and Udell, the long-term cooperative relationship between banks and enterprises is helpful for increasing the possibility of small enterprises obtaining loans, and can effectively alleviate the requirements of loan interest rates and mortgage collateral. The close relationship between banks and enterprises enables banks to understand the development and operation of enterprises more accurately, increase the possibility of enterprise financing, and enable enterprises to obtain bank loans with lower commercial credit reliance. Thus, banks’ understanding of enterprise information will reduce the credit risk to some extent. However, when studying the impact of relational loan on the quality of Mexican SME loans, Porta, Silanes & Zamarripa found that relational loan made commercial banks’ loan quality worse, and the bad debt rate was 30% higher than non-relational loans.

(iv) Industry chain and credit risk: Thorsten Beck, Asli Demirguc-Kunt, Vojislav Maksimovic studied the relationship between leasing and trade financing methods and small agricultural enterprise financing[8]. Berger studied the practibility of trade finance credit facility. Nobuyoshi Yamori found that most SME financing methods are gradually diversified. Viktoriya Sadlovska studied supply chain finance and found that its appeal lies in its visibility. Petersen Busch, jason Mike Ojala, Jukka Hallikas studied the sources and types of supply chain risks. One of the "micro-enterprise operating capital financing management systems" established by the Canadian government department: build a comprehensive "industry chain" financial framework. For a market, or a supply chain, an industrial chain or even an industry, financing methods such as centralized credit and approval on a selective basis also reflect the importance of supply chain and industrial chain for financing of small agricultural enterprises.

(v) Institutional environment and credit risk: Throsten Beck holds that in developing countries, banks are still the main components of the financial system, and the government plays a leading role in reforming the financial environment, providing regulatory frameworks, and arranging market forces, while government regulation also affects the effect of loan technology. Berger and Udell established an overall analytical framework for SME financing, analyzing the impact of the economic environment, legal environment and industry regulation on financing of small enterprises. Geols and Werner studied "financial liberalization" in Mexico after 1990 and found that implementing this policy and relaxing government regulation, especially interest rate control, can stimulate competition among financial institutions and expand the choice of financing demands. Olafhubler, Lukas Menkhoff & Chodechai Suwanaporn also reached similar conclusions. They found that the positive significance of deregulation, that is, "financial liberalization", for small enterprise financing is to reduce the requirements for interest rates and mortgages, while liberalization also brings more risks to banks. It can be seen that the institutional environment has greatly affected the possibility of small enterprise loans and the risks faced by commercial banks.

1.2.2Domestic literature. (i) Research on the constraints of SME financing: Tian Xiujuan contended that the financial constraints of SMEs belong to insufficient supply. Zhang Weiying used game theory to study the phenomenon of credit deficiency under the condition of information asymmetry. He pointed out that under the condition of weak construction of credit information system, commercial banks can not effectively identify small enterprises with higher credit in the same industry and region, so that they have to treat all small enterprises the same, so that some small enterprises with excellent development prospects also have difficulty in financing from commercial banks. Ma Jiujie and Zhang Jie found that the primary factor for small enterprise financing constraints is the lack of appropriate collateral and complex procedures[10-11]. Lin Yifu put forward the "institutional defect theory", and believed that China’s financial system has certain defects and financial institutions are not complete, which is also the institutional problem of financing difficulties for small agricultural enterprises[12]. Some scholars believe that the reason for the difficulty in financing of small agricultural enterprises is that there are inherent defects in their production and management. Chen Xiaohong[13]pointed out that some small agricultural enterprises are limited in technology and professional skills, and the industries they engage in are low-value-added, low-cost labor-intensive industries with high competition and high operational risks. Under this circumstance, banks are not willing to grant loans to them. There is a corresponding relationship between bank size and enterprise scale. SMEs prefer soft-information-based financing, and close relationship with banks is favorable for SME financing[14-17]. Based on a sample of industry surveys, SMEs are facing low credit constraints in local areas, which proves that relational financing is an approach to solving the problem of credit constraints of SMEs[18].

(ii) Research on credit innovation technology: Zhang Jingfeng studied the risk monitoring of capital flow and found that if banks can track the continuous operation of customers and then reduce the information asymmetry, they are more likely to grant loan to small agricultural enterprises. According to the survey of commercial banks by Shi Gang, "exchanging the bricks (collateral) with speciality" is a new trend of credit of small enterprises. Bao Jinghaietal. believe that it is important to focus on the accounts receivable of small agricultural enterprises, and it is recommended to use commercial bank insurance agents to solve the financing difficulties of SMEs[19].

1.2.3Summary. Credit risk control has been continuously developed, and traditional risk control methods have become more and more perfect, but traditional risk control methods have considerable costs due to the need of manpower and material resources. Recently, with the development of technology, the rise of information technology has exerted a major impact on traditional mortgage-type loans. Compared with ten years ago, small agricultural enterprises could not get loans without real estate. In the present information age, the credit risk control of small agricultural enterprises also presents a diversified trend. There are many ways to obtain loans without collateral, which also saves commercial banks the cost of checking collateral after lending. However, the current research of scholars at home and abroad generally focuses on the relationship between enterprise scale and financing satisfaction. There are no many findings on how small agricultural enterprises can improve their own conditions to meet loan demand.

2 Overview of loan risks of small agricultural enterprises

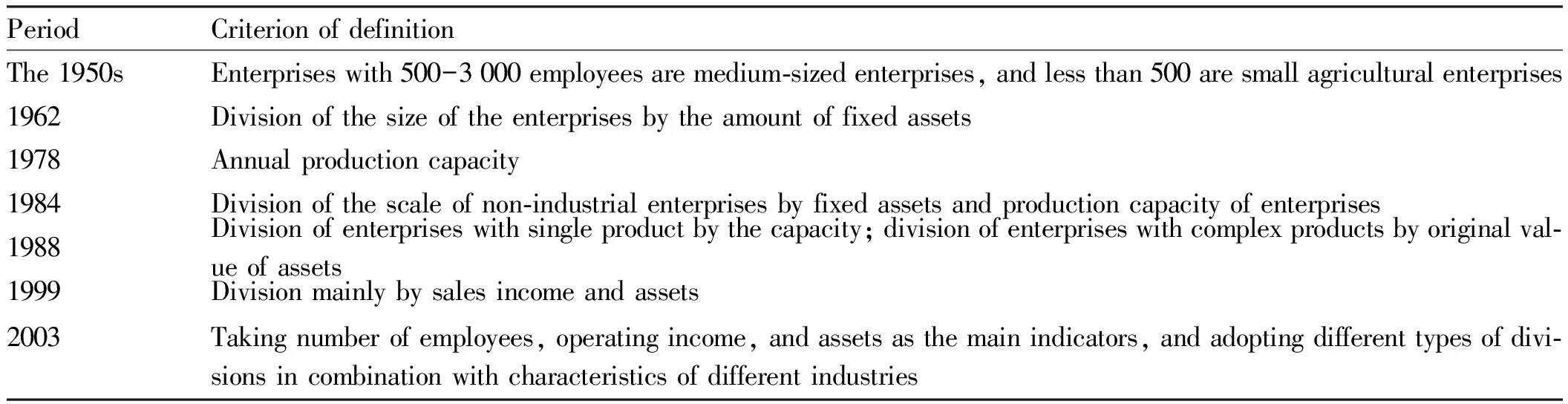

2.1DefinitionofsmallagriculturalenterpriseSmall and micro enterprises are not an absolute concept to a large extent, but relatively to large and medium-sized enterprises. Thus, there is no definite criterion for definition of small agricultural enterprises. At present, small agricultural enterprises refers to small enterprises, micro-enterprises, family-run enterprises, and individual industrial and commercial entities. This concept was proposed by Professor Lang Xianping. At present, China has revised the criteria of SMEs, for seven times, and the detailed definition is listed in Table 1.

Table1HistoryoftheevolutionofChina’sSMEs

PeriodCriterion of definitionThe 1950sEnterprises with 500-3 000 employees are medium-sized enterprises, and less than 500 are small agricultural enterprises1962Division of the size of the enterprises by the amount of fixed assets1978Annual production capacity1984Division of the scale of non-industrial enterprises by fixed assets and production capacity of enterprises1988Division of enterprises with single product by the capacity; division of enterprises with complex products by original val-ue of assets1999Division mainly by sales income and assets2003Taking number of employees, operating income, and assets as the main indicators, and adopting different types of divi-sions in combination with characteristics of different industries

Data source:RegulationsonConstructionProjectsandDivisionCriteriaforLargeandMedium-sizedEnterprises(State Planning Commission, State Construction Commission, Ministry of Finance[1978]No. 234);InterimProvisionsonSMECriteria(Guo Jing Mao Zhong Xiao Qi[2003]No. 143).

2.2Overviewofcreditrisksofsmallagriculturalenterprises

Small agricultural enterprises (mainly including small agricultural, forestry, animal husbandry, fisheries, and other small and micro-enterprises in the agricultural industry in this paper) have the following four characteristics compared to the credit risk of large and medium-sized enterprises. (i) In China, the risk level is usually negatively correlated with the enterprise size. Due to the small scale of the enterprise and the incomplete internal system, the small agricultural enterprises have higher operation risk than the large and medium-sized enterprises and weaker resistance to market changes, which can be clearly seen in the tide of closure of many small agricultural enterprises. (ii) Due to being engaged in labor-intensive industries, small agricultural enterprises are characterized by low science and technology content, and low industrial level. As a result, they are easy to be eliminated by the market. The survival rate of enterprises is lower, which also exacerbates the credit risk of small agricultural enterprises. (iii) It is difficult to provide good guarantees and mortgages for general small agricultural enterprises. For small agricultural enterprises with few fixed assets, the loan amount obtained through using such fixed assets as mortgage can not meet their needs of normal operation and expanding scale to a large extent. Besides, due to possible merger and acquisition, once there is dispute about the ownership of collateral, there will be high risk of ownership This credit risk is difficult to estimate, and it takes more manpower to conduct collateral inspections after lending. (iv) Due to imperfect institution, small agricultural enterprises have low real value of financial indicators as the indicators for pre-lending risk evaluation and post-lending risk control. When commercial banks conduct pre-lending risk evaluation for small agricultural enterprises, it is difficult to accurately understand the operation situation of the enterprise, difficult to make accurate risk estimation, and difficult to find out the repayment ability of the enterprise based on the financial data, so the risk is higher. In summary, compared with large and medium-sized enterprises, small agricultural enterprises are small in scale, have low ability to resist market risks, and have low financial data. It is difficult to accurately find out the operation conditions of enterprises. Commercial banks have taken greater risks and these make small agricultural enterprises have difficulties in obtaining loan and commercial banks are facing many bad debts.

2.3Technicalmeansofriskcontrolforcommercialbanks

The risk control technology mainly refers to the technology used by commercial banks for estimating risks for the small-scale agricultural enterprises of different scales and different credit levels, so as to choose the means and measures to minimize the risk loss. At present, there are four risk control methods in China. (i) Risk aversion: risk aversion means that a commercial bank gives up or terminates a certain business without taking risks, so as to avoid the risks in the business market, that is, neither doing the business, nor taking the risks. However, although this strategy avoids risks, the business is given up, so there is no business income. This method is not active, so it should not be taken as main means of risk control by commercial banks. (ii) Risk diversification: risk diversification refers to diversifying the portfolio of risk assets in order to avoid excessive concentration of risks and minimizing the overall risk level. Nevertheless, in actual practice, commercial banks are often limited by credit management capabilities, operation areas and inspection costs due to decentralization, thus risk diversification strategy is often difficult to implement. (iii) Risk transfer: risk transfer refers to transferring part or all of credit risks and possible losses to other institutions. The most important characteristic of risk transfer is that it changes the ultimate bearer of risk and does not fundamentally eliminate the risk. In China, the forms of risk transfer include: mortgage, professional agency guarantee, and insurance. (iv) Risk compensation: although the first three methods can disperse and transfer some risks to a certain extent, no matter how to avoid and transfer, the credit risks cannot be completely removed, so the bank must establish compensation measures for credit losses. Common methods include use of capital, profit and collateral to make fund compensation.

3 Survey on the status of loan business of small agricultural enterprises by some commercial banks in Xiangyang City

3.1SamplesourcesandtypesWe surveyed the loan situation of in HB Bank and ZGGS Bank for some small agricultural enterprises in Xiangyang City. The source of the materials is the loan information of some small agricultural enterprises with subsidy of Xiangyang Municipal Government in November 2015, of which five were loans from HB Bank, 17 loans from ZGGS, a total of 22 loans, five were credit loans, 17 were non-credit loans (that is, one or a combination of mortgage and guarantee). The borrowing time was the year 2015.

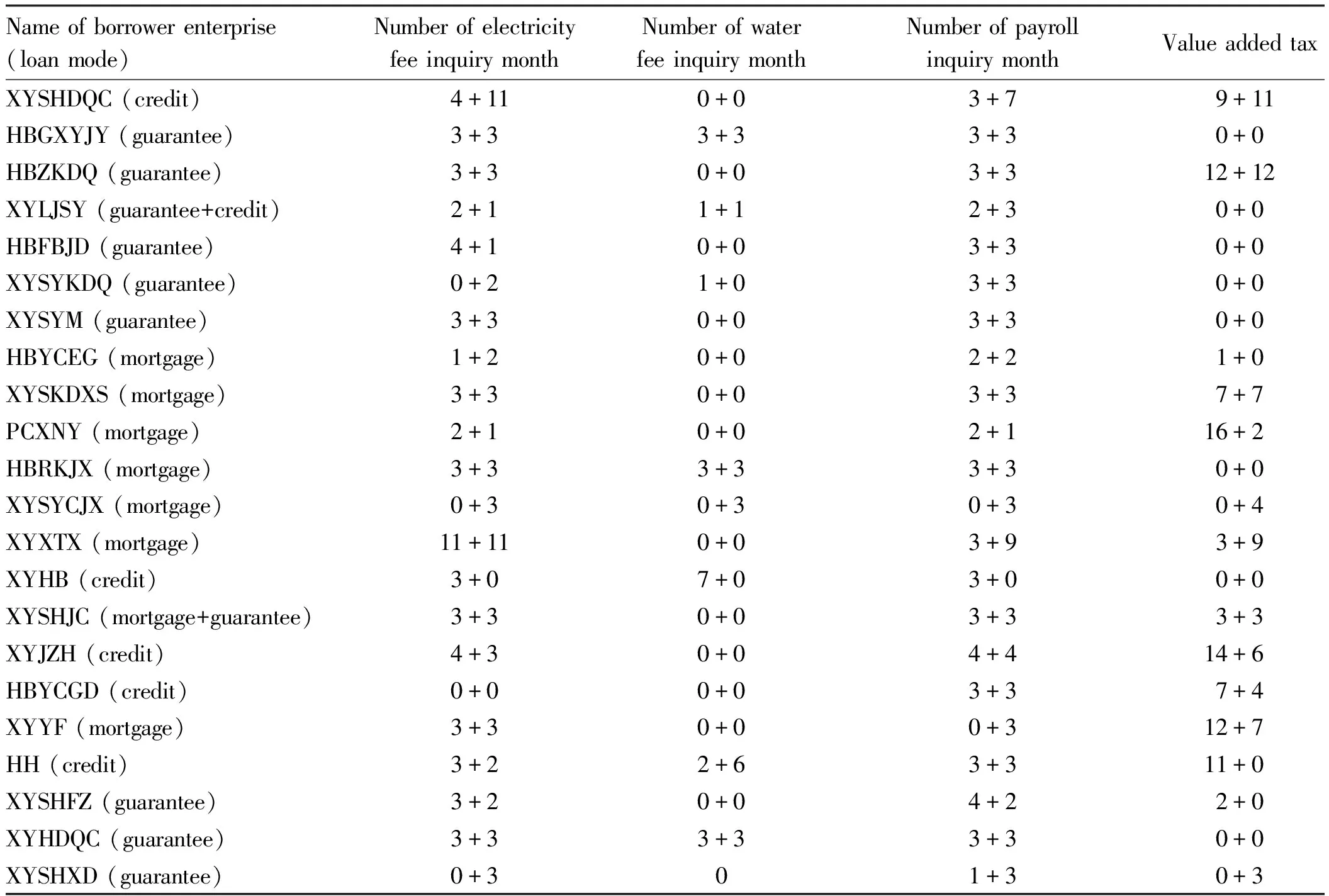

3.2MaterialanalysisThe materials obtained in this study included the contract for the enterprise to apply for a loan, as well as the materials involved in the survey of the commercial banks before and after the loan. Since all loans have two points before and after the loan, is there any difference in the risk control of commercial banks between the pre-lending and post-lending? What measures do commercial banks take to control or even evade risks? Loans are divided into credit and non-credit loans. Are commercial banks taking different measures between the two? Is it the same as previous research: mortgage is not so important for loans of small agricultural enterprises in the current environment? In view of the above problems, we sorted out all the materials before and after the loan, credit and non-credit, some of which are listed in Table 2. Excluding the above information, in the business of this survey, the loan amount was five million yuan, and the repayment period was one year. The interest rates were 30% higher than the one-year loan interest rate issued by the People’s Bank of China. The commercial bank also reviewed the balance sheet, cash flow statement and statement of profit distribution of all borrowing enterprises in November 2015; in the loan contract, certain restrictions were imposed on the behavior of the post-lending enterprise, which is partly risk control.

3.3Analysisofpre-lendingstrategy

3.3.1Materials analysis. From the material obtained, in the pre-lending inspection of 22 businesses, a total of 18 businesses conducted electricity fee inquiry, and there were 15 businesses not less than three months; a total of seven businesses conducted water fee inquiry, and four businesses not less than three months; a total of 21 businesses conducted the payroll inquiry and 16 businesses not less than three months; however, no business conducted the inquiry of financial statement of enterprise. This indicated that due to the imperfect system of small agricultural enterprises and the low authenticity of financial statement data, commercial banks are more willing to believe in the water and electricity fees collected by authorities and the wage records issued by enterprises. The authenticity of these data can be guaranteed. Besides, compared with the lag of financial statements, water and electricity fees and wages can reflect the current financial situation of the borrowing enterprises in real time, so that commercial banks can more accurately grasp the current operation conditions of the borrowing enterprises, thus controlling risks before lending. All enterprises use electricity and pay wages, so most of the businesses in the actual process will query these two indicators, and for enterprises that need a lot of water in the process of production and operation, the water consumption also reflects their operating status, therefore commercial banks also check the water fee. In addition, a total of 12 businesses have inquired about the value-added tax payment record, and 10 businesses not less than three months. It can be seen that commercial banks will consider the integrity of the enterprises when making credit, and paying taxes on time is an integrity operation standard of an enterprise.

Table2Loaninformation

Name of borrower enterprise(loan mode)Number of electricityfee inquiry monthNumber of waterfee inquiry monthNumber of payrollinquiry monthValue added taxLender bankXYSHDQC (credit)4+110+03+79+11ZGGSHBGXYJY (guarantee)3+33+33+30+0ZGGSHBZKDQ (guarantee)3+30+03+312+12ZGGSXYLJSY (guarantee+credit)2+11+12+30+0ZGGSHBFBJD (guarantee)4+10+03+30+0HBXYSYKDQ (guarantee)0+21+03+30+0HBXYSYM (guarantee)3+30+03+30+0HBHBYCEG (mortgage)1+20+02+21+0ZGGSXYSKDXS (mortgage)3+30+03+37+7ZGGSPCXNY (mortgage)2+10+02+116+2ZGGSHBRKJX (mortgage)3+33+33+30+0ZGGSXYSYCJX (mortgage)0+30+30+30+4ZGGSXYXTX (mortgage)11+110+03+93+9ZGGSXYHB (credit)3+07+03+00+0ZGGSXYSHJC (mortgage+guarantee)3+30+03+33+3ZGGSXYJZH (credit)4+30+04+414+6ZGGSHBYCGD (credit)0+00+03+37+4ZGGSXYYF (mortgage)3+30+00+312+7ZGGSHH (credit)3+22+63+311+0ZGGSXYSHFZ (guarantee)3+20+04+22+0HBXYHDQC (guarantee)3+33+33+30+0ZGGSXYSHXD (guarantee)0+301+30+3HB

Note: "x+x" in the table stands for "month checked before loan + month checked after loan".

3.3.2Analysis of contractual provisions. ZGGS Bank clearly stipulates in the loan contract that there has been no major violations in the production and operation in the last year, and the current executives have no major bad records. This provision is pre-lending control. It stipulates the behavior of the borrowing enterprise before the load, reflecting the zero tolerance of commercial banks about the small agricultural enterprises that violate the law and discipline in the process of credit. In addition, it also limits the behavior of enterprise executives. It can be understood that because small agricultural enterprises are small in scale, the owners have more rights than large and medium-sized enterprises. In many cases, even the owner has the final say, the behavior and credit of the owner can replace the behavior and credit of the enterprise to a large extent.

3.3.3Summary of risk control strategies. (i) Risk aversion: In the 22 businesses we surveyed, commercial banks have more or less checked the pre-lending operation of agricultural enterprises. This is a means of investigating the ability of enterprises to repay the loan in the future. The risk can be judged according to the operation of the enterprise found in the pre-lending inspection. If the operation of the enterprise is obviously at a loss, the production capacity is weak, and the operation is poor, the commercial bank will choose not to lend the money to the enterprise. Such measure is essentially a kind of risk aversion. (ii) Risk weakening: the amount of these 22 businesses of this time were all three million yuan. When the enterprises were surveyed after the loan, almost all enterprises thought that five million was too little. This shows that it is not that companies do not want to borrow more, but banks do not want to lend more. For commercial banks, even though small agricultural enterprises are in good operation condition, they are still unwilling to lend more money to enterprises, indicating that banks are unwilling to bear more risks. The essence of such measures is to weaken the risks.

3.4Analysispost-lendingstrategy

3.4.1Materials analysis. From the material obtained, in the post-lending inspection of 22 businesses, a total of 20 businesses conducted electricity fee inquiry, and there were 13 businesses not less than three months; a total of six businesses conducted water fee inquiry, and four businesses not less than three months; a total of 21 businesses conducted the payroll inquiry and 19 businesses not less than three months; however, all businesses conducted the inquiry of financial statement of enterprise only one time. In the materials examined after the loan, it could obtain the same conclusion as before the loan. In other words, the financial statements of small agricultural enterprises are less credible. In order to accurately understand the current status of small agricultural enterprises, commercial banks generally inquire about the electricity fee, water fee and payroll of small agricultural enterprises in individual months, and because such data are real-time, they can also better reflect the current situation of the enterprise to achieve the purpose of controlling risks; compared with that before the loan, the number of inquiries of the above-mentioned fees by commercial banks has not increased or decreased significantly, and has remained basically the same. To a certain extent, it also indicates that commercial banks attach equal importance to the pre-lending and post-lending situations. In addition, a total of 11 businesses have inquired about the value-added tax payment record, and 10 businesses not less than three months. Compared with pre-lending situation, there is no significant difference. It can be seen that the tax record is still an important indicator of honest operation after the loan.

3.4.2Contractual provisions. In the respect of the contract, there is only one article to control risk before the loan, and the post-lending provisions are much more. (i) As to the purpose of borrowing: it specified that the loan can only be used for the purchase of raw materials, and cannot be used for other purposes (ZGGS); if the borrower fails to provide the use record and information of the borrowing funds in time according to the lender’s request, the lender has the right to stop the granting and payment of the borrowing funds (HB). (ii) Repayment ability: the lender has the right to withdraw the loan in advance according to the withdrawal of the borrower’s funds. If the loan term is shortened due to early repayment or the lender’s early recovery of the loan according to the contract, the corresponding interest rate will remain unchanged (ZGGS); if the borrower’s credit status is declining or the profitability of the main business is not strong, the use of borrowing funds is abnormal, and the borrower fails to provide the loan use records and materials in a timely manner at the request of the lender, the lender has the right to stop the granting and payment of the borrowing funds (HB). (iii) In terms of the guarantee risk: if the collateral is damaged, depreciated, in property disputes, seizure, or the mortgagor disposes of the collateral without authorization, or the financial status of the guarantor of the guarantee suffers adverse changes or changes that are not favorable for the loan bonds, the borrower shall promptly notify the lender, and provide other guarantees approved by the lender (ZGGS); with the consent of the lender, the loan under this contract provides a pledge guarantee for the accounts receivable (if the bad debt rate of accounts receivable has increased for two consecutive months, and 5% of the debt has been recovered at the end of the period, resulting in a dispute with the payer or any other third party, if it is unable to repay on time, the lender may recover the the loan immediately) (ZGGS); the lender has the right to assess whether the borrower’s affiliated company, guarantor or guarantor’s affiliated company has contractual issues and whether it affects the borrower and threatens the borrower’s loan safety, and adopts this the measure or measures specified in this contract according to the assessment results (HB); the borrower’s affiliate, guarantor or guarantor’s affiliate has problems, and the borrower needs to provide the lender with new guarantee measures (HB). (iv) In terms of the repayment order: the incentives and bonuses will not be distributed in any form until the principal and other payables are paid off under this contract (ZGGS); the loan repayment has priority (HB). (v) In terms of the account management: the lender has the right to supervise the fund withdrawal account; if the loan is used for the liquidity needs of the borrower’s production and operation turnover, the borrower shall designate a special fund withdrawal account at the lender to collect the corresponding sales income or plan; if the repayment amount is settled in a non-cash manner, the borrower shall ensure that the funds are returned to the account in time after receiving the payment (ZGGS); if the designated fund withdrawal account has large amounts of abnormal capital inflows and outflows, and the borrower cannot provide explanation materials approved by the lender, it will be deemed as the borrower’s breach of the contract (HB).

From the above terms, we found the following characteristics. (i) The purpose of borrowing has been clearly stated at the time of signing the contract. The use of funds in the 22 businesses in this survey is the purchase of raw materials, and the provisions cannot be used for other purposes. Otherwise, it will be deemed as the breach of contract. It can be seen that through specifying the use of funds can prevent enterprises from using this funds for venture capital to obtain benefits, and can reduce the risks borne by the commercial banks. At the same time, in the post-lending supervision, only the payment vouchers of raw materials need to be checked, saving a lot of trouble for checking the funds after lending. (ii) Commercial banks usually require enterprises to pledge the accounts receivable and open the fund withdrawal accounts in the bank, which can enable banks to better understand the operation status of enterprises after lending, and can directly control the funds of enterprises. In the event of breach of the contract or failure to repay, the bank may directly freeze the funds of the enterprise to remove the risk of failure to recover the funds. (iii) Commercial banks have the liquidation right before the dividends and liabilities, which guarantees the priority solvency of the loan and minimizes the risk of bank collection. (iv) Commercial bank will check the collateral and the guarantor after the loan; for collateral, they will check whether its value is consistent with the value when it is guaranteed, whether there is a devaluation, and whether there is change in the ownership. For the guarantor, the commercial bank will check its own economic situation to ensure that the bank can guarantee the second collection in case the borrower fails to repay the loan. The above methods are measures taken by commercial banks for risk of failure to recover funds once the enterprises violate the loan contract.

3.4.3Summary of risk control strategies. (i) Risk transfer: in the 22 businesses in this survey, 17 are non-credit loans, in other words, there is at least one of mortgages or guarantees, and banks will require companies to pledge accounts receivable. The essence of such measuris risk transfer. (ii) Risk aversion: as can be seen from the contract, commercial banks have specified many items that deemed to be breach of contract, such as changing the purpose of borrowing, not returning funds to designated accounts, and so on, and in the event of default, commercial banks have the right to immediately stop the business and recover the loan amount, and the liquidation right of commercial banks is before the dividend distribution and debt repayment. Besides, after the loan, the operation situation of the enterprise is still checked to determine whether the repayment ability of the enterprise has changed. If the enterprise has a poor operation, the commercial bank can also request repayment at any time. For the mortgage business, the commercial bank will also check whether the collateral after the loan has depreciated and whether there is change of the ownership. If such things happen, the enterprises will be required to provide new collateral. In essence, these actions belong to risk aversion. (iii) Risk compensation: the loan interest rate of all 22 businesses of this survey was 30% higher than the one-year loan interest rate issued by the People’s Bank of China. This is an inevitable risk that must be borne by those who cannot control through risk transfer and risk dispersion. Such behavior belongs to risk compensation.

3.5Creditandnon-creditloansA total of five businesses in the 22 businesses involved in this survey belonged to credit loans, and the remaining 17 were non-credit loans. In the non-credit loans, eight businesses belonged to secured loans, six were mortgage loans, and the remaining three were combined loans. In terms of quantity and proportion, in the current loans of small agricultural enterprises, credit loans are still a minority, and most of them are still loans consisting of mortgages and guarantees. This also reflects that the credit system of small agricultural enterprises is still not perfect, and credit, to a large extent, excludes many small agricultural enterprises. However, in non-credit loans, the proportion of mortgages is less than half, which is consistent with the idea of Shi Gang (2010) that mortgage is no longer necessary for future loans, and non-collateral will become a new trend.

4 Conclusions and recommendations

Since the samples are limited in this study, it is difficult to fully and accurately reflect the current situation of the loan of small agricultural enterprises in China. However, according to the establishment of the loan contract and the existing inspections that reflect the risk control strategies of commercial banks, we still can roughly get a general view of the current risk control of small agricultural enterprises in China. (i) Due to the instability of operation of small agricultural enterprises, the credit system of small agricultural enterprises in China is still not perfect, the loan of small agricultural enterprises is still dominated by secured and mortgaged non-credit loans. However, compared to the situation in the past, mortgages are no longer so important for the loan of small agricultural enterprises, and many small agricultural enterprises without fixed asset mortgages can still get a considerable amount of loan. (ii) Because the system of small agricultural enterprises is not standardized, commercial banks do not pay attention to the financial statements of enterprises, but use the water fees, electricity fees and payroll of borrowing enterprises to evaluate their operation situation. As a measure of integrity, tax record is also listed as in indicator of inspection. (iii) Commercial banks usually take corresponding measures to control risks before and after lending. Before the lending, commercial banks will inspect the credit and operation situation of the enterprises, while after the lending, they will examine the capital flow of enterprises. In case of guarantee or mortgage, they will inspect the status of the collateral and the guarantor.

With the advancement of the information technology, the advent of the information age has gradually provided a new way for commercial banks to grant loans to small agricultural enterprises. The new method saves a lot of inspection costs and reduces costs compared with traditional loan methods. It is hope that commercial banks will take advantage of the modern information technology, try new form of credit, and expand banking businesses, so as to promote the development of small agricultural enterprises.

杂志排行

Asian Agricultural Research的其它文章

- Design and Realization of Communication Platform"CDream Creating a Dream"for College Students

- Economic Value Evaluation of Fine Individual Plants ofRibesrubrum Linn.Based on AHP

- Driving Force of China’s Agricultural Exports to Japan

- Causes of Recurrence of RiceChilosuppressalis(Walker)in Longyou County and Prevention and Control Measures

- Effects of Bacterial Manure from Cassava Alcohol Fermentation Mash on Yield and Starch Content of Cassava

- Landscape Space Creation of Red Star·Xintiandi Exhibition Area in Liuzhou