An Analysis of Development Trend of Food Industry in Three Northeastern Provinces of China

2018-03-21,,*

, ,*

1. Northeast Institute of Geography and Agroecology, Chinese Academy of Sciences, Changchun 130102, China; 2. Jilin Agricultural University, Changchun 130000, China

1 Introduction

The food industry includes four kinds of sectors: agro-food processing industry, food manufacturing sector, beverage and refined tea manufacturing sector, tobacco manufacturing sector. Among them, the agro-food processing industry and food manufacturing sector are the industries with a regional advantage in Northeast China. The main business income is an important indicator to reflect the size and profitability of enterprises, and the main business income of agro-food processing industry and food manufacturing sector in the food industry in Northeast China is higher than the national average. It is an important industry with the advantage of regional scale. The main business income of enterprises is 297 million yuan and 255 million yuan, respectively. In the same period, the main business income of enterprises in the two sectors in China is only 256 million yuan and 249 million yuan, respectively. By contrast, the main business income of the beverage and refined tea manufacturing sector, and tobacco manufacturing sector, is below the national average for a long time. In Northeast China, the main business income of the beverage and refined tea manufacturing sector, and tobacco manufacturing sector, is 216 million yuan and 259.2 million yuan, respectively, while in the same period, the main business income of the same industries is 261 million yuan and 700.2 million yuan, respectively. It is worth noting that the tobacco industry is a state-monopoly industry, whose development direction and real-time operation receive the regulation at policy level different from other industries. The main business income of tobacco manufacturing sector is significantly higher than the main business income of other food businesses, and the business profitability is several times that of other industries. However, from the perspective of the northeast region, there are 13 enterprises in the tobacco manufacturing sector, and the business income is only about one-third of the national level, with no competitive advantages.

Since the rejuvenation, the food industry in the three northeastern provinces has shown a booming trend overall. The proportion of food-industry enterprises above designated size to the similar enterprises in the country has increased from 8.53% to 12.9%, and the number of enterprises has increased by 2.85 times. The number of industrial enterprises, enterprise assets and main business income of the food industry in the three northeastern provinces of China account for 12.94%, 10.83% and 13.57% in China, respectively, all more than 10%, so it is one of the regions with significant advantages nationwide. In addition, the proportion of the output value of food industry in Liaoning, Jilin and Heilongjiang provinces to the total industrial output value reaches 11.52%, 18.8% and 27.4%, respectively, and it has become one of the leading industries in these provinces. However, after 2011, the growth rate of total industrial output value of major industries in the food sector was on the decline. In 2013, the growth rate of total industrial output value of agro-food processing industry, food manufacturing sector and beverage and refined tea manufacturing sector, was only 14.6% and 11.1% and 3.9% respectively, 25.2%, 26.3% and 9.6% of the peak in 2008, respectively, reaching the lowest level in nearly a decade. This will inevitably have a negative impact on the entire industry and the entire industrial economy. It is necessary to make an in-depth analysis of its situation, existing problems and development trends, and put forward corresponding recommendations.

2 Development status, spatial distribution and problems about the food industry in Northeast China

2.1Thefoodindustryhasformedapatternofindustrialdevelopmentdominatedbytheagro-foodprocessingindustry

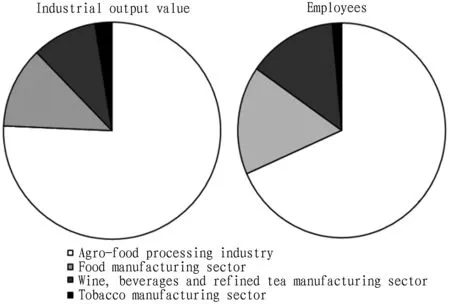

The food industry in northeast China has formed a pattern of industrial development dominated by the agro-food processing industry, supplemented by the food manufacturing industry, beverage and refined tea manufacturing sector, and tobacco manufacturing sector. In 2014, as for the agro-food processing industry, its industrial output value accounted for 75.7%, its assets accounted for 67.44%, its main business income accounted for 76.08%, and the employees accounted for 68.36% in the food industry (Fig.1), thus becoming an important sector leading the food industry in Northeast China.

In addition, as for the national agro-food processing industry, its industrial output value accounted for 58.35%, its assets accounted for 45.56%, its main business income accounted for 58.2%, and the employees accounted for 52.95% in the food industry. The share of various indicators of agro-food processing industry at the national level is smaller than the share of various indicators of agro-food processing industry in the three northeastern provinces of China, indicating that the agro-food processing industry has a significant dominant position in the food industry of Northeast China.

Fig.1TheindustrialoutputvaluestructureandemployeestructureinthefoodindustryofthethreenortheasternprovincesofChina

2.2Theoutputvaluestructureofthefoodindustrywasadjustedtotheregionalpatternof4∶3∶3forLiaoning,JilinandHeilongjiangprovincesThe development of food industry in Liaoning Province still occupies the leading position in Northeast China, but its dominant structure has been broken. The total output value of the food industry in the three northeastern provinces of China is 133.778 billion yuan, and it is 550.561 billion yuan, 420.761 billion yuan and 366.465 billion yuan for Liaoning Province, Jilin Province and Heilongjiang Province, respectively, accounting for 31.45%, 41.15% and 27.39% in the three northeastern provinces, respectively. The proportion of the output value of Liaoning’s food industry in Northeast China decreased by about 5% compared with previous years, and the output value structure of the food industry in Liaoning, Jilin and Heilongjiang is adjusted to the 4∶3∶3 regional pattern.

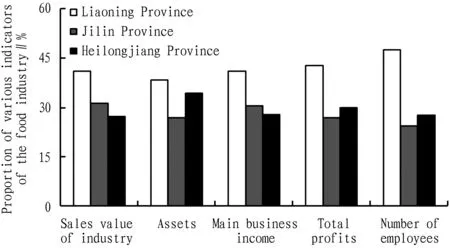

In addition to the 4∶3∶3 pattern of output value structure, the proportion of the food industry assets, main business income and profits in Northeast China is basically the same for Liaoning, Jilin and Heilongjiang provinces, and in Liaoning Province, the proportion of the three indicators is 38.54%, 41.21% and 42.79%, respectively (Fig.2).

Fig.2TheproportionofvariousindicatorsofthefoodindustryinthethreenortheasternprovincesofChina

2.3TheefficiencyofmainprocessingindustriesdeclinedinthethreenortheasternprovincesofChinainthecontextofoverallsmoothoperationofnationalfoodindustryThe overall operation of the food industry is stable while the food industry in Northeast China continues to decline. In 2014, the national food industry’s output value growth rate was 7.33%, and the main business income growth rate was 6.94%, and the growth rate of the two indicators decreased compared with 2013, but the positive growth rate shows that the overall operation of the national food industry is stable, and the main industries are in the normal growth range. Over the same period, the output value growth rate of the food industry and the main business income growth rate in the three northeastern provinces of China are negative, indicating that in the context of resurgence of the industry in the country, there is no synchronous upward trend in the food industry of Northeast China.

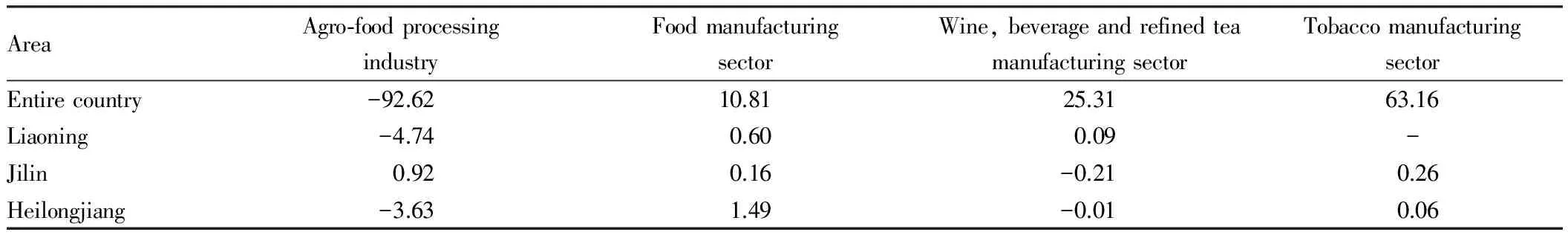

In addition, in terms of the income on investment of the food industry in the three northeastern provinces of China, there is a state of simultaneous loss in the agro-food processing industry across the country, and the three northeastern provinces of China, and the balance is slightly maintained in Jilin Province. The income on investment of food manufacturing sector and tobacco manufacturing sector is in a state of slight equilibrium in the three northeastern provinces of China, while the wine, beverages and refined tea manufacturing sector is in a state of loss, and the overall income on investment is significantly lower than the national average (Table 1).

Table1TheincomeoninvestmentofthefoodindustryinthethreenortheasternprovincesofChinaandtheentirecountry

Unit: 108 yuan

Note: The losses are reported as "-".

3 The new trends, new features and new patterns of the food industry development in the three northeastern provinces of China

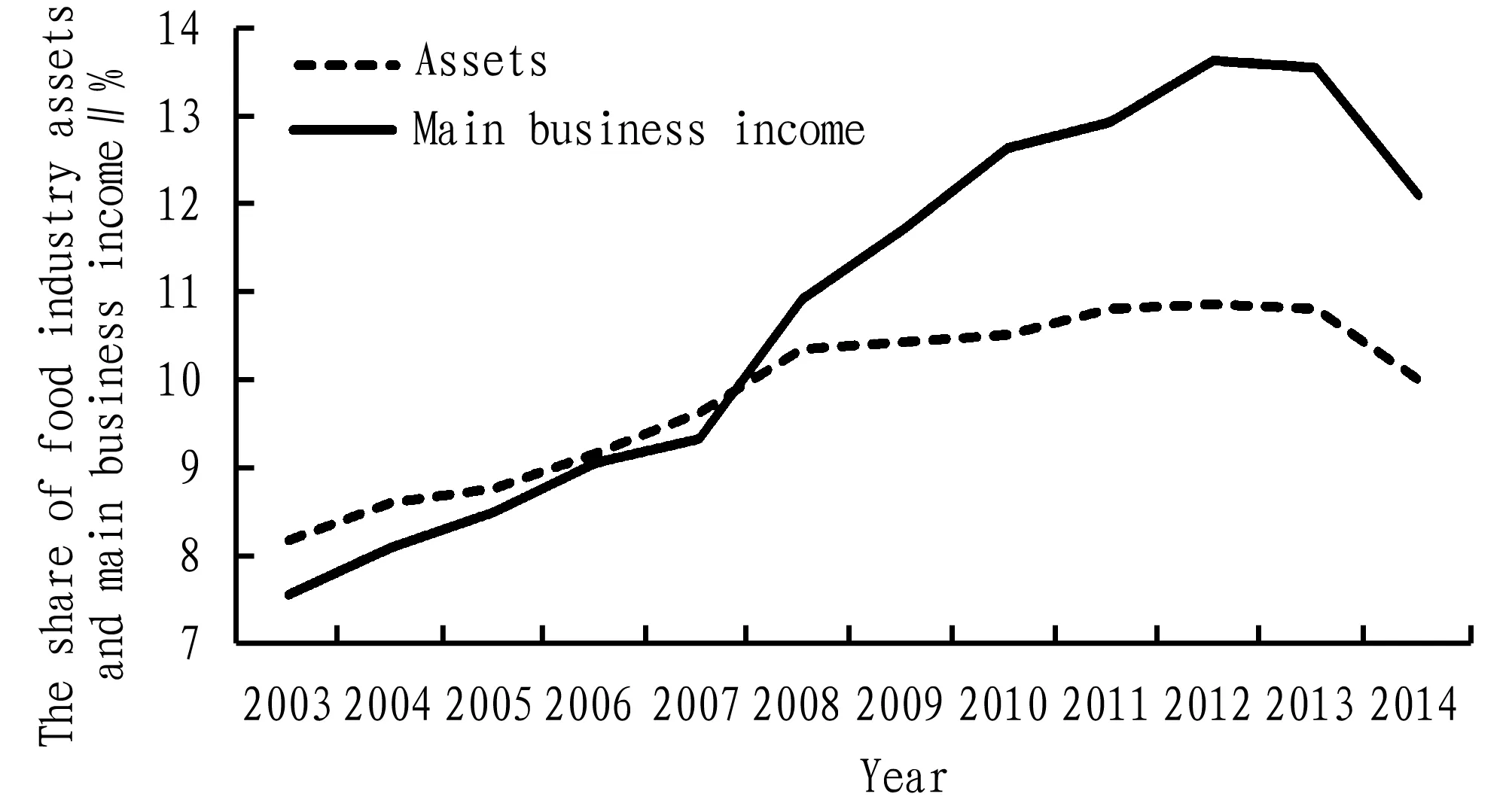

3.1TheshareoftheeconomicbenefitindicatorssignificantlydecreasedSince the rejuvenation, the share of the economic benefit indicators of the food industry in the three northeastern provinces in the economic benefit indicators of the national food industry rose to its highest level in 2012, and then decreased, and the downward trend was even more remarkable in 2014. Data calculation results show that in 2003, the food industry assets and main business income in the three northeastern provinces of China reached 101.785 billion yuan and 93.511 billion yuan, respectively, accounting for 8.18% and 7.57% of the national level, respectively. In 2012, the indicator values reached 562.896 billion yuan and 1.251 592 trillion yuan, and the proportion increased to 10.88% and 13.64%, and then declined for two consecutive years. In 2014, the indicator values reached 671.52 billion yuan and 1.324 158 trillion yuan, and the proportion dropped to 10.0% and 12.1%, down to the level of five years ago (Fig.3).

Among them, the share of main business income indicator value in the national main business income indicator value underwent the fastest increase, and it was still larger than the proportion of assets in the past two years. This shows that for a long time, the business sales of the food industry in the three northeastern provinces of China have been greatly increased and the market share has been expanded. However, the downward trend in the recent two consecutive years needs to be given enough attention.

Fig.3ThechangesintheshareoffoodindustryassetsandmainbusinessincomeinthethreenortheasternprovincesofChinaduring2003-2014

3.2TheoperatingefficiencyoftheleadingindustriesdeclinesandtheshareintheoutputvalueofmanufacturingsectorsimultaneouslydeclinedinthethreeprovincesThe agro-food processing industry is the leading industry in the food industry of Northeast China. The number of enterprises, scale, output value and profitability showed a high level of development during 2007-2010, but the overall profitability in the past two years dropped significantly.

(i) The period before 2011 is the rising period of agro-food processing industry development in Northeast China. Except for 2009 when the growth rate of the number of employees was lower than the national average, the indicator values of number of enterprises, main business income, total profit and number of employees were all above the national average in the same period, and the growth rate of most indicators was 50% higher than the national average in the same period.

(ii) 2011 is an important turning point worth noting for the development of agro-food processing industry. The growth rate of total industrial output value of this industry was 10.2 and 7.0 percentage points lower than in the previous year in Liaoning Province and Heilongjiang Province, respectively. The growth rate of total industrial output value of this industry in Jilin Province experienced a significant decline in 2012.

(iii) In 2013, the growth rate of total output value of agro-food processing industry in Liaoning, Jilin and Heilongjiang provinces was 8.37%, 13.4% and 28.6%, respectively, down by 19.1, 12.5 and 1.5 percentage points respectively, compared with the previous year, and there was a total reduction of 13.0 percentage points in the three northeastern provinces.

(iv) In 2014, the output value, total profits, value added tax and number of employees showed a downward trend in the agro-food processing industry in the three northeastern provinces of China, the values of various indicators decreased by 4.06%, 22.49%, 38.82% and 2.29%, respectively, over the previous year, and the development situation of the food industry as the leading industry is quite grim.

3.3Thegrowthrateofnationalcapitalintheindustrialpaid-upcapitalwashighestandthecollectiveandindividualcapitalwithdrawalwasobviousIn 2014, the paid-up capital of the food industry in the three northeastern provinces of China decreased by 8.885 billion yuan over the previous year, with a substantial decrease in Jilin Province and an increase in Liaoning and Heilongjiang provinces. Over the same period, the composition of capital also underwent significant changes. Except for the increase of national capital in all provinces, other types of capital declined in different provinces.

The national capital was significantly increased, thus becoming the key to supporting the composition of the paid-up capital in the food industry in Northeast China. In 2014, the national capital in the paid-up capital of the food industry in Northeast China became the third largest capital after the corporate capital and individual capital. The considerable intervention of national capital indicates that the national government departments or agencies on behalf of the state to invest, use the capital formed by the national capital investment to offer financial support for the development of the food industry in Northeast China. At the same time, it also indicates that the status of national capital is in the ascendant in the basic property rights of enterprises, and the distribution of profits or dividends.

The withdrawal of collective capital and individual capital was obvious, especially for the collective capital. In 2014, the collective capital and individual capital in the three northeastern provinces of China decreased by 18.686 billion yuan and 9.622 billion yuan, respectively, over the previous year (Table 2). Except for the collective capital and individual capital, other kinds of capital showed an overall upward trend, and the withdrawal of collective capital and individual capital demonstrated that the decreasing profitability of the food industry enterprises dealt a huge blow to the small-scale capital.

Table2Thechangesinthepaid-upcapitalcompositionofthefoodindustryinthethreenortheasternprovincesofChinain2014comparedwiththepreviousyear

Unit: 108 yuan

3.4BoththeindustrialproductionandsalesrateandtheexportdeliveryvaluedeclinedThe production and sales rate of the food industry in Northeast China decreased, particularly obvious in Liaoning and Jilin provinces. In 2014, the production and sales rate of the food industry in the three northeastern provinces of China was 97.6%, lower than the overall level of 98.5% in the previous year, indicating that in 2014, the proportion of the quantity of the food industry products sold to the total quantity of industrial products available for sale decreased in the three northeastern provinces of China over the previous year, and the connection between production and sales was slightly poor, indicating that the degree to which products met the needs of the social market became smaller, which was a poor signal fed back by the market.

The export delivery value decreased, and the food industry products were mainly for sale in domestic market. In 2014, the export delivery value of the food industry was 56.559 billion yuan in the three northeastern provinces of China, decreasing by 14.897 billion yuan over the previous year, and the share in the national export delivery value of the food industry fell by 2.94 percentage points. There was the most significant decline in the export delivery value of agro-food processing industry and food manufacturing sector in Northeast China, with the largest drop in Liaoning Province. In 2014, the export delivery value of agro-food processing industry and food manufacturing sector in Liaoning Province was 41.293 billion yuan and 3.725 billion yuan, respectively, decreasing by 11.656 and 1.999 billion yuan, respectively, over the previous year, indicating that the quantity of the food industry products to enter the international market showed a downward trend, highlighting the necessity of "going out" ideas to alleviate the situation of sluggish food industry development (Table 3).

Table3ThechangesintheexportdeliveryvalueofthefoodindustryinthethreenortheasternprovincesofChinain2014comparedwiththepreviousyear

Unit: 108 yuan

Note: "-" in the table means that the export delivery value is not marked in the statistical yearbook.

4 Recommendations

4.1Increasingthepolicysupporttotheagriculturalprocessingindustry,acceleratingtheimprovementofnationalfoodpurchasingandstoragepolicyandfocusingonthefinancialsupportOn the one hand, it is necessary to place emphasis on financial support. There is a need to increase the central and local fiscal support to expand the scale of primary processing in the origin of agricultural products, and clarify the proportion and application range of agriculture-related funds for the processing industry support; increase the loan support of banks and other financial institutions to the agricultural product processing enterprises, and offer preferential policies for the processing enterprises to build the breeding sheep base, purchase agricultural raw materials, construct the cold chain logistics and engage in other business activities; expand the input tax deduction pilot range, and expand the preferential initial processing income tax range.

On the other hand, it is necessary to improve the relevant policies[1-5]. According to the domestic grain supply and demand situation and the price trend, it is necessary to scientifically determine the grain storage amount, to ensure reasonable food circulation while ensuring the national food security; strengthen the management of local grain reserves, perfect the regulatory system of local grain reserves, improve the application level of new technology of grain storage, and adjust the variety structure, to ensure real quantity, good quality and storage security.

4.2EstablishingthestatusoftheenterprisesasmarketplayersandinvestmententitiesProperly dealing with the relationship between the government and the market is the core of economic system reform, and the most important thing is to clarify the relationship between government and enterprises. Except for the projects involving the national security and public interest projects, the enterprises should be free to make decisions, and the government should create a fair and orderly development environment for the enterprises. At a time when the entire industry is in a sluggish and declining trend, the government needs to clearly define its own position, make the supporting policies based on guidance, and give the enterprises independent power and learning ability to adapt to the market.

In the choice of support object, it is necessary to take the leading industry, medium-sized and small enterprises and micro-enterprises into full consideration, and transfer the elimination right to the market. In the financing process of businesses, the government should reduce or quit the direct operation or administrative intervention on the specific guarantee business, put the focus of government’s guarantee business supervision on the guarantee institutions’ market access, guarantee operation mechanism, guarantee procedures, and charging standards regulation and management, and ensure the market-oriented operation of the credit guarantee institutions for the medium-sized and small enterprises.

4.3Promotingtheprocessofindustrialagglomerationandimprovingthecorecompetitivenessofthecompetitiveindustry

Relying on the advantages of agricultural production in the region, taking the agro-product processing industry park as the carrier, it is necessary to extend and expand the industrial chain, integrate the related enterprises and upstream and downstream products, take the industrial agglomeration area as a platform to promote the centralized distribution of enterprises, and accelerate the fostering of agricultural product processing industrial clusters, to achieve greater scale and higher level development[6-7]. Based on the regional characteristics of agricultural production in the three northeastern provinces of China, combined with the current state of development of the agro-food processing industry, it is necessary to promote the process of agglomeration of advantageous industries with the province as a unit, and make the key industrial enterprises with high market acceptance achieve the expansion of business scale through the joint reorganization, brand expansion and cross-regional (provincial) production, and to some extent reduce the logistics costs of the entire industry.

In Liaoning Province, it is necessary to focus on promoting the development of aquatic product processing, meat product processing, feed processing and food processing. In Jilin Province, it is necessary to focus on the development of meat processing and food processing, and extend the industrial chain of cattle, sheep and poultry. In Heilongjiang Province, it is necessary to focus on the development of grain processing and vegetable oil processing, eliminate the excess capacity that does not meet the market demand through the process of agglomeration of agro-food processing industry, and enhance the market competitiveness of the entire industry.

4.4Exploringtheappropriatemodeofstablerawmaterialchainoffoodprocessingindustryinthemainproducingareas

It is necessary to deepen and optimize the relationship between the food processing enterprises and agricultural producers, and promote the enterprises to form a community of interests and cooperation with major grain growers, agricultural cooperatives, specialized cooperative organizations and other new types of agricultural production and operation entities in a wider range and at a deeper level. It is necessary to actively launch, explore and promote the new cooperation model between the leading enterprises or companies and the new entities, give the legal norms to the new model to truly create a partnership rather than simple raw material acquisition, accelerate the agricultural industrialization process, stabilize and improve the agro-food processing industry chain[8-12].

There is a need to encourage the enterprises to build the cross-regional raw material base in the main producing areas, encourage the processing enterprises to construct the plant or foster the clusters of related industries in the origin. By enhancing the cooperation between agricultural enterprises, we can improve the level of coordination between the food processing industry needs and agricultural product industrial raw material base construction, enhance the agricultural standardization and specialization, while addressing the insufficient total supply of some raw materials, poor balanced supply capacity and other problems restricting the industrial development and upgrading of product quality.

4.5Optimizingtheenterprisestructure,cultivatingtheindustryleaderandenhancingtheproductvalueFaced with the current situation of relatively small number of large enterprises in the food processing industry in Northeast China, low brand awareness of the products and the difficulty in enhancing the value-added of the products, optimizing the structure of the enterprises, focusing on brand promotion and enhancing the brand value is the most important task.

It is necessary to take actions that suit local circumstances and foster the industry leaders, guide the leading enterprises to integrate resource elements[13]through mergers, restructurings, joint ventures and alliances, and develop them into large-scale, group-based and highly competitive leading enterprises, while focusing on the development of the small and medium-sized backbone enterprises in the late agricultural industrialization area, placing equal emphasis on the development of large enterprises, small and medium-sized enterprises and micro-enterprises, and maintaining the appropriate ratio. There is a need to increase the number of leading enterprises in the agro-processing industry by 5% according to the existing number, perfect the development framework of small

and medium-sized enterprises and micro-enterprises as non-leading enterprises, attach great importance to the brand effect of the finished products in the food processing industry, carry out the brand promotion and create the brand value[14].

[1] ZHANG YJ. Study on the tax policy of agricultural products processing enterprises[D]. Hohhot: Inner Mongulia University of Finance and Economics,2015. (in Chinese).

[2] LIU XZ, WANG SG, ZHANG K,etal. Analysis and recommendations of the production and circulation of grain in China at the angle of supply-side reform[J]. Geography and Geo-Information Science, 2016, 32(6): 1-6. (in Chinese).

[3] JIANG HP, LU L. Prominent problems of present food policy and policy suggestions[J]. Food and Nutrition in China, 2015, 21(3): 5-7. (in Chinese).

[4] YUAN CB, XUE JL. The food policy of the developed countries and their reference to our country[J]. Agricultural Economy, 2012(3):11-13. (in Chinese).

[5] ZHAO YX. The goal and key task of China’s grain policy optimization[J]. Economic Review, 2016(9):78-83. (in Chinese).

[6] LI BM, WANG GM. To improve the competitiveness of China’s food processing industry[J]. Economic Review, 2012,(1):101-104. (in Chinese).

[7] LI JX. Measurement of industrial agglomeration of China’s food industry[J]. Rural Economy and Science-Technology,2014,25(5):120-121, 111. (in Chinese).

[8] YU DF. The research of leading enterprises’ strategy in agricultural industrialization of China[D]. Qingdao: Ocean University of China,2012. (in Chinese).

[9] JIANG CY. On the development of agricultural producer services[J]. Problems of Agricultural Economy, 2016,37(5):8-15, 110. (in Chinese).

[10] CAI HL. The organization form of agricultural industrialization and its innovation path[J]. Chinese Rural Economy, 2013(11):4-11. (in Chinese).

[11] CHENG DN. The comparison and choice of the industrial chain integration model of China’s agriculture[J]. Economist, 2012(8): 52-57. (in Chinese).

[12] LIAO ZJ, GUO XM. The logic and direction of evolution of China’s agricultural operation organization system: An analysis framework of industrial chain integration[J]. Chinese Rural Economy, 2015(2): 13-21. (in Chinese).

[13] WANG H. Research on the financial support policy of leading enterprises in agricultural industrialization[D]. Changsha: Hunan Agricultural University,2014. (in Chinese).

[14] ZHANG KC. WANG XY. Analysis on China’s agricultural products brand construction[J]. Problems of Agricultural Economy,2009(2):22-24. (in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- System Factors for Land Corruption in China

- Value Appeal of Harmonious Moral Life of Chinese College Students

- Interaction between Hosts and Guests of Rural Tourism in Northeast China Based on Symbolic Interaction Theory

- Rules for Access of Foreign Capitals to Agricultural Field in Countries along the "Belt and Road"

- Promoting Cotton Green Production in Shandong through Accelerating Simplified Cultivation Technique

- Comprehensive Evaluation of Main Traits of Sugarcane Germplasm Resources with High Sucrose Content