Taking a Fast Track

2017-11-28ByWangJun

By+Wang+Jun

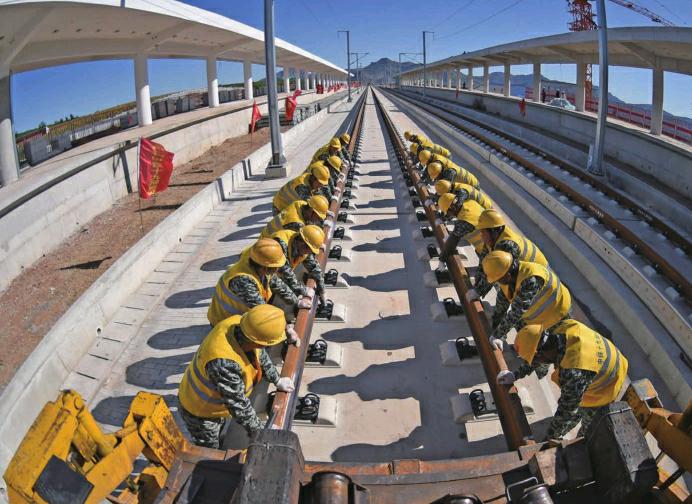

An investment agreement for the public-private partnership (PPP) project of the Hangzhou-Shaoxing-Taizhou highspeed railway was inked on September 11 in Hangzhou, east Chinas Zhejiang Province. The project is invested by a consortium of eight privately owned enterprises led by Shanghai-based Fosun International, which owns a 51-percent stake. State-owned China Railway, Zhejiang Communications Investment Group and the local government hold the rest.

The 269-km Hangzhou-ShaoxingTaizhou high-speed railway project is estimated to cost 44.89 billion yuan ($6.76 billion). Construction will take four years. “It would be impossible for such a huge investment to only rely on government funds. So the provincial government requires the introduction of private capital into the fi eld of infrastructure,” said Xu Xing, Deputy Director of the Zhejiang Provincial Commission of Development and Reform.

Zhejiang invests nearly 1 trillion yuan($150.6 billion) in infrastructure each year, of which 100 billion yuan ($15.06 billion) is in transportation. Xu said Zhejiang is adopting the PPP model mainly because Zhejiangs private economy is very powerful, and if successful, the model will greatly benefi t Chinas railway development.

Governments role

In December 2015, the National Development and Reform Commission approved eight demonstration railway projects involving private investment, one of which is the Hangzhou-Shaoxing-Taizhou high-speed railway. “We will try to establish a demonstration model for PPP in four aspects: administrative approval, investment and fi nancing, returns, and management,” said Li Xuezhong, Director of the Zhejiang Provincial Commission of Development and Reform. According to him, private investors were selected through competitive dialogues, and in the preliminary stage of the project, the government held several rounds of dialogues and conducted investigations to find out private investors concerns and expectations about participating in such railway projects.

To ensure fair competition, the provincial government formulated guidelines on the competitive dialogues. The consortium led by Fosun International was finally selected as the winning candidate. These innovative measures demonstrated how to intensify railway investment and financing reform and attracted private investment to the sector, said Hou Wenyu, head of the Shanghai Railway Bureau, to which the HangzhouShaoxing-Taizhou railway is affi liated.endprint

Directly benefiting from the railway, the Taizhou Municipal Government is also actively facilitating the project. “For a local government, our biggest wish is to build this railway as soon as possible,” said Yan Shiping, Director of the Taizhou Municipal Commission of Development and Reform. He believes after introducing private investment, the local government need only provide a small amount of funding to start an infrastructure project that needs huge investment.

The high-speed railway project has encouraged many private investors to seek opportunities in Taizhou, and the local gov- ernment is determined to further open up to the private sector. “We have formulated guidelines on encouraging private investment in PPP projects, requiring the adoption of the PPP model in all qualifying infrastructure and public service projects and that private investors should hold stakes of at least 50 percent,” said Yan.

Private participation

“In the first few versions of [such] plans, private investors were only allowed to be minority shareholders. [Then in] June 2016, the Zhejiang Provincial Government proposed that private investors could be majority shareholders, which was a very important breakthrough,” said Wen Xiaodong, chief executive offi cer of Shanghai Sunvision Equity Investment and Management Co. Ltd. As a PPP investment platform, Sunvision is one of the eight consortium members responsible for implementing the Hangzhou-ShaoxingTaizhou high-speed railway.

Why have the local governments and the railway agencies decided to allow private investors to be majority shareholders? Guo Guangchang, Chairman of Fosun International, said private companies have advantages which are highly valued by government. “PPP projects will not only diversify the organizational structure and development patterns of the railway sector, but also explore a model for building public utilities with commercial methods. Private capital will make resource allocation more effi cient and ultimately benefit clients and the public,”said Guo.

“Returns on investment in high-speed railway projects may not be high, but for Sunvision and other professional PPP investment platforms, high-speed railways are a large investment product with long-term, stable returns. Private investors will not miss a profi t and will actively participate in railway development,” Wen said.

New pattern

There have been previous cases of private capital participating in railway development, but few were successful.endprint