Female directors and real activities manipulation: Evidence from China

2017-07-18JinhuiLuoYuangaoXiangZeyueHuang

Jin-hui Luo,Yuangao Xiang,Zeyue Huang

School of Management,Xiamen University,China

Female directors and real activities manipulation: Evidence from China

Jin-hui Luo*,Yuangao Xiang,Zeyue Huang

School of Management,Xiamen University,China

ARTICLE INFO

Article history:

Accepted 14 December 2016

Available online22February2017

JEL classi fi cation:

G32

G34

J70

M41

Female director

Gender diversity

Earnings management

Real activities manipulation

Corporate governance

Unlike previous studies that focus on accrual-based earnings management,this study analyzes real activities manipulation and investigates whether female directors on boards of directors(BoDs)af f ect managers’real activities manipulation.Using a large sample of 11,831 f i rm-year observations from Chinese listed companies from the 2000 to 2011 period,we f i nd that higher female participation on BoDs is associated with lower levels of real activities manipulation,and that this negative relationship is stronger when female directors have higher ownership.These results hold for a battery of robustness checks. Overall,our f i ndings indicate that board gender diversity may serve as a substitute mechanism for corporate governance to curb real activities manipulation and thus provide interested stakeholders with higher quality earnings reports.

Ⓒ2017 Sun Yat-sen University.Production and hosting by Elsevier B.V.This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

1.Introduction

In recent years,board gender diversity has drawn considerable attention worldwide,especially after the 2008 economic crisis(Sun et al.,2015;Terjesen et al.,2009).Despite the rapid increase in female participation in business in the last decade(Rose,2007;Srinidhi et al.,2011),female directors are still underrepresented on corporate boards.Some European countries(e.g.,Sweden,Norway and Spain)now impose legal requirements on corporations to allocate board seats to women.For example,Spain introduced legislation requiring a 40%threshold for female board representation by the end of 2015.In this context,the economic bene fi ts of female directors must be determined(Gul et al.,2011).If board gender diversity was known to increase fi rm value, fi rms would be willing to accept female directors on their boards even without legislation.The purpose of this study was to explore the role of female directors in curbing managers’real activities manipulation.

Managers have professional responsibilities and ethical obligations to report high quality earnings to outside stakeholders,such as investors and regulators(Krishnan and Parsons,2008).However,self-serving managers all over the world are inclined to manipulate earnings to beat/meet benchmarks(Burgstahler and Dichev,1997;DeGeorge et al.,1999;Liu and Lu,2007).Generally,there are two earnings management strategies:accrual-based and real activities earnings manipulation(Cohen et al.,2008;Cohen and Zarowin,2010; Zang,2012).Prior studies of the ef f ect of female directors focus on accrual-based earnings management and produce mixed results(Fields et al.,2001;Srinidhi et al.,2011;Sun et al.,2011).We argue that analyzing only one earnings management strategy fails to capture the overall ef f ect of board gender diversity.In particular,as managers use the two earnings management strategies as substitutes for each other(Achleitner et al.,2014; Cohen et al.,2008;Cohen and Zarowin,2010;Zang,2012),a focus on accrual-based earnings management can be expected to lead to inconclusive results.Furthermore,in emerging economies such as China,where investors have a relatively low demand for high quality earnings and f i rms face low litigation risks(Allen et al.,2005;Chen et al.,2008;Liu and Tian,2012),it is less costly for f i rms to manipulate accruals(Kuo et al.,2014).Thus,in emerging economies,female directors may play a more important role in curbing real activities manipulation.Finally,unlike accrual-based earnings management,which is achieved by exercising discretion over accruals in light of accounting principles,real activities manipulation is achieved by altering the timing and scale of operations,investments or f i nancing transactions,which have real adverse economic consequences on a f i rm’s long-term prof i tability and growth(Achleitner et al.,2014;Bereskin et al.,2014; Cohen and Zarowin,2010;Gunny,2010;Kim and Sohn,2013;Zang,2012).Given this fundamental dif f erence,we predict that female directors,who are characterized by a lower tolerance of opportunism,less overconf i dence and greater risk aversion,and as better monitors(Adams and Ferreira,2009;Barber and Odean, 2001;Gul et al.,2011;Hillman et al.,2007;Krishnan and Parsons,2008;Srinidhi et al.,2011;Sunde´n and Surette,1998),may play a stronger role than male directors in curbing managers’real activities manipulation. However,few studies examine the potential ef f ect of female directors on real activities manipulation.

Studies of corporate governance must focus on not only how an individual mechanism works,but also how the interaction of dif f erent mechanisms mitigates agency problems(Kim and Lu,2011).That is,understanding how board gender diversity interacts with other mechanisms to curb real activities manipulation is also an important issue.On the one hand,the role of female directors largely depends on their personal characteristics,which may change under certain conditions,as all human beings,regardless of gender,are inevitably emotional and more or less opportunistic.In other words,the ef f ectiveness of female directors in curbing managers’real activities manipulation may be unstable.Therefore,it is important for f i rms to design f i rmlevel mechanisms that formalize and even enhance the role of female directors.On the other hand,stakeholders have long been interested in mechanisms that can mitigate earnings manipulation and improve earnings quality(Krishnan and Parsons,2008).Thus,it is meaningful to know whether the role of board gender diversity is unique and irreplaceable.If the role of female directors is unique,stakeholders should voluntarily push fi rms to increase female board representation,as fi rms would otherwise depend on traditional mechanisms rather than a gender-diverse board.However,to date,little is known about the interactions between board gender diversity and other governance mechanisms.

To fi ll these knowledge gaps,we develop a conceptual model of the links between female participation on boards of directors(BoDs)and real activities manipulation.As ownership structure is one of the most cited in fl uences on agency problems(Shleifer and Vishny,1997),we further examine the moderating e ff ect of stock ownership on the association between female participation on BoDs and real activities manipulation.We test this model in the context of China because it is the largest emerging economy in the world,and despite its severe earnings management(Kuo et al.,2014;Liu and Lu,2007;Qi et al.,2014),little is known about real activities manipulation there.In general,there is limited evidence from emerging economies on whether BoDs are able to discipline managers’earnings management.Hence,a focus on Chinese fi rms allows us to extend the boundaries of existing knowledge on the antecedents of real activities manipulation.Moreover,the social status of women in China is assumed to be relatively high due to the policy of gender equality that has beenimplemented by the Communist Party of China since its founding in 1949(Leung,2003;Peng et al.,2009). Therefore,China provides a good setting for examining the potential e ff ects of gender diversity on corporate behavior and decision making.

Using a large sample of 11,831 fi rm-year observations from Chinese A-share listed fi rms for the 2000-2011 period,we fi nd that when a fi rm has a critical mass of women serving on its BoD,i.e.,at least 3 women or a high ratio of women on BoD,its managers engage in less real activities manipulation.In addition,we fi nd that the negative relation is more pronounced when female directors hold higher ownership,indicating that stock ownership may enhance the role of female directors in curbing real activities manipulation.To further verify our fi ndings,we undertake a battery of robustness checks.First,we split the role of female directors from that of female CEOs/chairmen by introducing female CEOs/chairmen as a control variable in the regressions,and fi nd that female CEOs/chairmen have no signi fi cant relation with real activities manipulation;more importantly,our results are robust to this test.Second,we di ff erentiate the governance e ff ects of inside and outside female directors and fi nd that although our results are valid for both,the e ff ects are stronger for inside directors.Third,as fi rms with less real activities manipulation may be more likely to appoint women to serve on BoDs,we use the Heckman two-stage selection model and the propensity score matching(PSM)approach to address the issue of endogenous selection,and our fi ndings still hold.Fourth,given the unique context of Chinese listed fi rms’two-tier boards,i.e.,a BoD and a supervisory board,we examine the association between female participation on two-tier boards and real activities manipulation and arrive at similar fi ndings.Fifth, as China’s split share structure reform occurred during our sample period,we explore the e ff ect of the reform on the role of female directors and get consistent and signif i cant f i ndings only in the subsample after the reform.Sixth,we examine the association of female participation on BoDs for each category of real activities manipulation,i.e.,sales manipulation,overproduction and discretionary fees manipulation.The results indicate that female participation on BoDs curbs managers’real earnings management mainly through reducing sales manipulation and overproduction.Finally,as several studies have documented a trade-of fbetween accrual-based and real activities earnings management(Achleitner et al.,2014;Cohen et al.,2008;Cohen and Zarowin,2010;Zang,2012),we also examine the role of female directors in curbing accrual-based earnings management and rerun the regressions by adding the level of accrual-based earnings management as a control variable.The results suggest that female directors have no relation with accrual-based earnings management,while our f i ndings still hold after controlling for the potential trade-of f between two kinds of earnings management.

This study makes several contributions to the literature.First,we extend the literature on female directors by showing that female participation on BoDs can help to curb managers’real activities manipulation.Female directors have received increasing research attention all over the world(Adams and Ferreira,2009;Bear et al., 2010;Chen et al.,2016;Fields et al.,2001;Gul et al.,2011;Jia and Zhang,2012,2013;Jin et al.,2014;Srinidhi et al.,2011;Sun et al.,2015;Terjesen et al.,2009).To our knowledge,we are among the f i rst to examine whether female directors may discipline managers who are engaging in real activities manipulation.Specif ically,this study f i nds evidence that female directors can ef f ectively curb real activities manipulation but not accrual-based earnings management.

Second,we contribute to the growing literature on real activities manipulation in the area of earnings management.Real activities manipulation is detrimental to a f i rm’s long-term growth and competitive advantages (Achleitner et al.,2014;Bereskin et al.,2014;Cohen and Zarowin,2010;Gunny,2010;Kim and Sohn,2013; Zang,2012).In particular,scholars argue that real activities manipulation is largely opaque to outside stakeholders and less easy to be detected than accrual-based strategies of earnings management(Ge and Kim,2014; Graham et al.,2005;Zang,2012).However,we have limited knowledge of the mechanisms for solving this agency problem.In this study,we f i nd evidence showing that board gender diversity is an ef f ective mechanism for alleviating real activities manipulation.

Finally,we not only examine how female directorships work,but also explore how female directors may interact with other governance mechanisms to curb managers’real activities manipulation.More precisely, this study f i nds that female directors’ownership enhances their role in curbing real activities manipulation. In this way,our study helps to deepen our understanding of the role of female directors.In addition,these results have important practical implications for f i rms and regulators.In particular,they suggest that f i rms can make full use of the role of female directors by implementing stock-based compensation schemes.

2.Literature review and hypotheses development

2.1.Literature review

To examine the role of female directors in curbing real activities manipulation,we bring together two different strands of research.

First,this study builds on studies of board gender diversity.Although gender dif f erences have been widely discussed in the psychology,sociology and economics f i elds,scholars have only begun to link gender diversity to corporate behavior and outcomes in the past two decades(Terjesen et al.,2009).Scholars initially explored the association between board gender diversity and f i rm performance,but the results of these early studies are inconclusive.For example,some studies f i nd that board gender diversity is benef i cial to f i rm performance(e.g., Campbell and Mı´nguez-Vera,2008;Erhardt et al.,2003),some fail to get a signif i cant f i nding(e.g.,Carter et al.,2010;Rose,2007)and others conclude that board gender diversity is detrimental to f i rm outcomes (e.g.,Adams and Ferreira,2009;Haslam et al.,2010).Particularly,Joecks et al.(2013)document a U-shaped relationship between board gender diversity and f i rm performance,indicating that a critical mass of female directors achieves the best performance.Thus,the economic ef f ect of board gender diversity is an ongoing debate.

As f i rm performance is a complex function of many factors,more recent research has largely examined the role of board gender diversity in specif i c types of corporate behavior.For instance,studies document that female directors can improve corporate social performance and particularly increase corporate philanthropy (e.g.,Bear et al.,2010;Jia and Zhang,2011,2012,2013;Post et al.,2011;Williams,2003),which is consistent with the common view that women care more about others and think more highly of social responsibility than men.Apart from this,as women have long been viewed as more risk averse than men(Barber and Odean, 2001;Byrnes et al.,1999;Sunde´n and Surette,1998),scholars have examined the role of female directors in shaping corporate risk-taking behavior.They f i nd that f i rms with higher female director participation have lower leverage,invest less in R&D,achieve lower investment efficiency and make fewer takeover defenses (Adams and Ferreira,2009;Chen et al.,2016;Jin et al.,2014).In addition,more gender-diverse boards are found to play a better monitoring role by promoting higher board attendance,joining more monitoring committees and demanding greater accountability for managers’poor performance(Adams and Ferreira,2009; Hillman et al.,2007),indicating that female directors are better and more active monitors.

However,evidence on the ef f ect of board gender diversity on corporate accounting decision making is limited and the results are mixed.1Likewise,evidence for the ef f ect of gender diversity among top executives on corporate accounting decision making is also mixed.For instance,whereas Krishnan and Parsons(2008)show that earnings quality is positively associated with gender diversity in senior management,Ye et al.(2010)f i nd insignif i cant dif f erences in the discretionary accruals of f i rms with female and male top executives in China.For example,Gul et al.(2011)f i nd that female directors are associated with higher earnings quality.Similarly,Srinidhi et al.(2011)document that female directors can improve the informativeness of stock prices by disclosing more f i rm-specif i c information and stimulating the collection of private information.However,Sun et al.(2011)fail to identify an association between female directors on audit committees and the extent of accrual-based earnings management.Given these limited and inconclusive results,the role of female directors in corporate accounting decision making is still an open question and requires more research.

Second,our study builds on research on real earnings management.Generally,managers have two dif f erent strategies for managing f i rms’earnings:accrual-based and real activities earnings management(Cohen et al., 2008;Cohen and Zarowin,2010;Ge and Kim,2014;Zang,2012).Unlike the accrual-based strategy,which does not harm corporate daily operations or have real outcomes,real activities strategies are detrimental to a f i rm’s growth and competitive advantages due to their long-term ef f ects on sales manipulation,overproduction and abnormal reduction of discretionary expenses(Cohen et al.,2008;Graham et al.,2005; Roychowdhury,2006;Zang,2012).For example,Zhang et al.(2008)document that meager-prof i t enterprises in China engage in real activities manipulation to avoid losses.Gunny(2010)f i nds that real activities manipulation is positively associated with f i rms merely meeting earnings benchmarks,and that such manipulationadversely a ff ects subsequent performance.Similarly,Francis et al.(2011)show that insiders use real activities to hide bad information,which results in a higher risk of future stock price crash.Taking a step further, Bereskin et al.(2014)and Lian et al.(2014)document that managing real earnings by cutting R&D expenses signi fi cantly reduces the number of subsequent innovations and their technological importance and novelty.In addition,Kim and Sohn(2013)and Ge and Kim(2014) fi nd that outside investors and bondholders require a higher risk premium for real activities manipulation.That is,focal fi rms su ff er a higher cost of capital caused by real activities manipulation.

As real activities manipulation results in adverse economic consequences,it is a critical and striking issue to understand how to alleviate this opportunistic behavior,particularly after the survey by Graham et al.(2005) demonstrated that real activities management is a common practice.Roychowdhury(2006) fi nds that sophisticated institutional investors are able to curtail real activities manipulation.Similarly,Wongsunwai(2013) fi nds that IPO fi rms backed by higher quality venture capitalists experience lower real activities manipulation. Moreover,recent studies have found evidence indicating that media coverage and Big 4 auditors are e ff ective external governance mechanisms for alleviating real earnings management(e.g.,Qi et al.,2014;Zhu et al., 2015).Despite this progress,few studies examine the e ff ectiveness of internal governance mechanisms.One exception is a study by Ge and Kim(2014),who fi nd that real earnings management increases with better board governance and decreases with higher takeover protection,indicating that tough board monitoring may enhance managerial incentives for real earnings management while takeover protection may reduce it. In essence,scholars have reached a consensus that as real activities manipulation is opaque to outside stakeholders and thus largely not subject to external monitoring scrutiny(Ge and Kim,2014;Graham et al.,2005; Zang,2012),internal governance mechanisms should play a stronger role.However,there is limited evidence to support this consensus.

Therefore,in this study,we investigate the in fl uence of board gender diversity on real activities manipulation.

2.2.Hypothesis development

Previous studies have identif i ed three reasons why board gender diversity engenders less real activities manipulation.Although these reasons may also be applicable to accrual-based earnings management/quality (Gul et al.,2011;Srinidhi et al.,2011),we argue that they are more powerful and persuasive in explaining the mechanisms through which female directors af f ect real activities earnings management.We outline the three mechanisms as follows.

First,female participation on BoDs optimizes the board structure and improves boards’abilities and ef f ectiveness in monitoring managers’real activities manipulation.Generally speaking,a board with diverse expertise will have a broader scope of action and exhibit more perspectives in making board decisions(Srinidhi et al.,2011).Accordingly,female participation on BoDs brings dif f erent experiences that enrich board discussions and thus improves the quality of board decisions(Hillman et al.,2007).Specif i cally,studies of organization theory suggest that female participation facilitates the discussion of tough issues and promotes board communications(Clarke,2005;Huse and Solberg,2006;Joy,2008).In addition,Adams and Ferreira(2009) fi nd that a more gender-diverse board is associated with higher board attendance by both male and female directors and more demands for accountability for managers’poor performance.Therefore,female participation improves a board’s monitoring abilities and e ff ectiveness.As real earnings management is largely nested in normal operation activities and thus difficult to detect(Ge and Kim,2014;Graham et al.,2005;Zang, 2012),detecting it requires great diligence and energy from boards.In this sense,female participation helps boards to achieve this difficult task.

Second,as they are better at monitoring,female directors are better at curbing managers’real activities manipulation.As Adams and Ferreira(2009) fi nd,relative to male directors,female directors have better board attendance records and are more likely to join monitoring committees such as the audit,nominating and corporate governance committees.In other words,female directors provide better oversight of managers’opportunistic behavior(Adams and Ferreira,2009;Hillman et al.,2007).Furthermore,studies suggest that female directors tend to behave and think more independently than their male counterparts(Adams et al.,2010;Carter et al.,2003),which is crucial for ef f ective monitoring(Srinidhi et al.,2011).Therefore,female directors as monitors can help boards to better detect real earnings management.

Finally,female directors may exhibit less tolerance for managers’real activities manipulation and require a higher earnings quality from managers.Many studies provide evidence that women are usually more risk averse,less overconf i dent and less tolerant of opportunistic behavior than men.For example, Bernardi and Arnold(1997)f i nd that women,on average,score higher than men on a moral development measure in public accounting f i rms,suggesting that women are more sensitive to unethical opportunistic issues.Likewise,Sunde´n and Surette(1998)examine gender dif f erences in the allocation of assets in retirement savings plans and f i nd that women are less likely than men to invest in stocks and other risky assets. Furthermore,Barber and Odean(2001)f i nd that women,on average,hold securities for a longer period than men,indicating that women are less overconf i dent in their abilities and thus trade less frequently. Therefore,as real activities manipulation is unethical and risky and has profound adverse economic consequences(Achleitner et al.,2014;Bereskin et al.,2014;Cohen and Zarowin,2010;Gunny,2010;Zang, 2012),female directors,because of their general ethical dif f erences from men,are more likely to reject real activities manipulation.

In summary,as female directors are more risk averse,less tolerant of opportunistic behavior and more active and better monitors than male directors,they can improve boards’total monitoring abilities and ef f ectiveness.Thus,we predict that f i rms with gender-diverse boards experience less real activities manipulation. Therefore,we put forward the f i rst testable hypothesis.

Hypothesis 1.Firms with gender-diverse boards engage in less real activities manipulation.

To ensure that female directors create economic benef i ts,it is important to understand how to make full use of their gender-specif i c dif f erences.In this study,we argue that stock ownership is one of the best mechanisms for enhancing and formalizing the role of female directors in curbing real activities manipulation.As classic economics and agency theory suggest,all human beings are rational and self-interested economic beings with their own utility functions(Berle and Means,1932;Jensen and Meckling,1976).In particular,as organizational roles may override traditional gender roles,female directors may have values and needs more similar to the males in their organizations than to females who are not part of their organizations(Shawver and Clements,2015).That is,female directors are also rational and self-interested actors.As stock ownership aligns the interests of female directors with other stakeholders,female directors with high ownership are more likely to have a stronger monitoring role in curbing managers’real activities manipulation.Furthermore,stock ownership,specif i cally getting returns based on future long-term performance,induces female directors to pursue a f i rm’s long-term growth and value(Kim and Lu,2011).In this regard,as real activities manipulation involves operating actions that deviate from normal business practices(e.g.,sales manipulation,overproduction,cutting discretionary expenses)and harm f i rms’competitive advantages and long-term value(Achleitner et al.,2014;Bereskin et al.,2014;Cohen and Zarowin,2010;Ge and Kim,2014;Gunny,2010;Zang,2012), female directors with high ownership have stronger incentives to monitor managers’opportunistic activities. In short,stock ownership reinforces the role of female directors in detecting real activities manipulation. Therefore,we put forward the second testable hypothesis.

Hypothesis 2.Stock ownership enhances the negative association between board gender diversity and real activities manipulation.

3.Research design

3.1.Sample and data

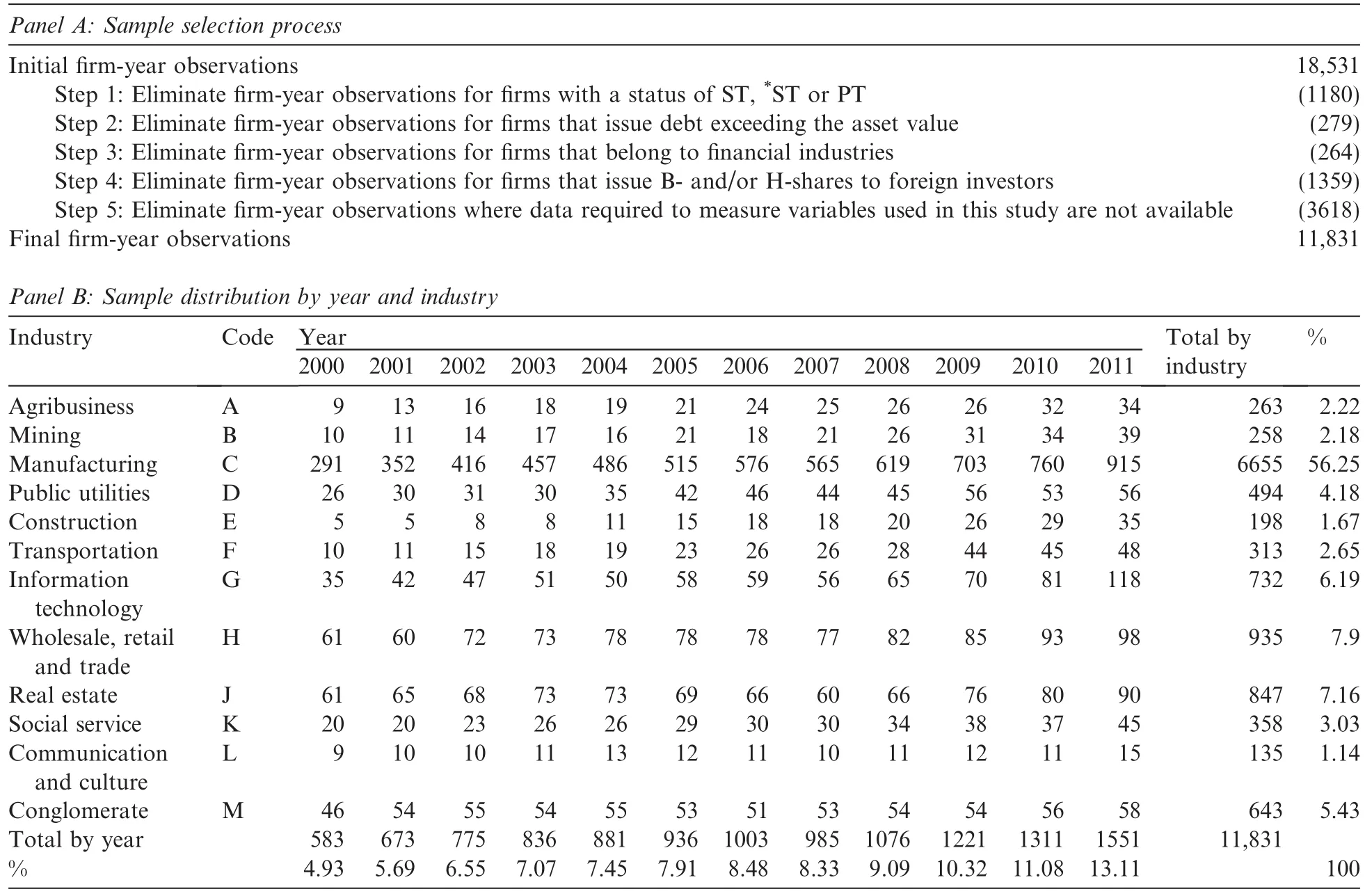

The initial sample includes all of the f i rms listed on both the Shanghai and Shenzhen Stock Exchanges in the 2000-2011 period.Panel A of Table 1 details the sample selection process.After collecting the full sample of 18,531 f i rm-year observations,we screen the target sample using the following step-by-step criteria:(1)remove 1180 f i rm-years for f i rms that have a transaction status of special treatment(ST),suspension from trading(*ST)or particular transfer(PT);(2)remove 279 f i rm-years for f i rms that issue debt exceeding the asset value;(3)remove 264 f i rm-years for f i rms belonging to f i nancial industries;(4)remove 1359 f i rm-years for fi rms that issue B-and/or H-shares to foreign investors;and(5)remove 3618 fi rm-years with missing data for measured variables.Our fi nal sample includes 1680 unique fi rms and 11,831 fi rm-year observations.Panel B of Table 1 reports our sample distribution by year and industry.We obtain the data from the China Stock Market&Accounting Research(CSMAR)database,which is designed and developed by Shenzhen GTA Information Technology Company,a major provider of Chinese data.

Table 1Sample selection and distribution.

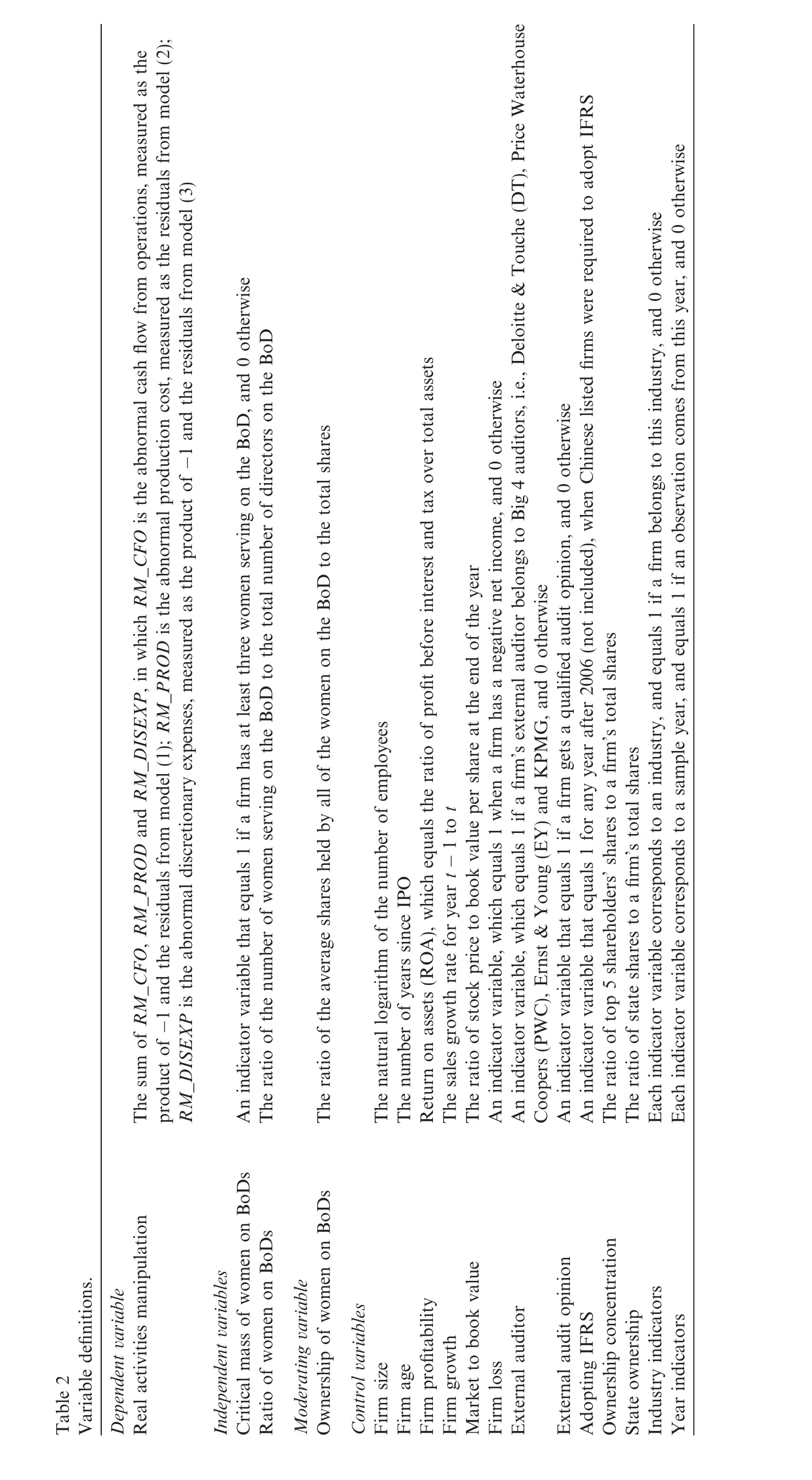

3.2.Measures

3.2.1.Dependent variables

To capture real activities manipulation,we follow Roychowdhury(2006)and Cohen and Zarowin(2010)to estimate an aggregate measure based on abnormal levels of cash f l ows from operations(RM_CFO),discretionary expenditures(RM_DISEXP)and production costs(RM_PROD).For every f i rm-year,we measure RM_CFO,RM_DISEXP and RM_PROD as the dif f erences between actual values and the normal levels calculated using the estimated coefficient from cross-sectional regressions for each industry and year,as given in Eqs.(1)-(3),respectively.where CFOi,tis the net cash f l ow from the operations of f i rm i for year t;DISEXPi,tis the sum of sales expenses and administrative expenses of f i rm i for year t2In China,listed companies are not required to disclose their advertising expenditures and R&D expenditures separately;these expenditures are included in sales expenditures and administrative expenditures,respectively,in the f i scal reports.Therefore,the data for corporate advertising expenditures and R&D expenditures have many missing values.As an alternative,we measure discretionary expenditures as the sum of sales expenditures and administrative expenditures.;PRODi,tis the sum of the cost of goods sold and the change in inventories of f i rm i for year t;Ai,t-1is the total assets of f i rm i at the end of year t-1; Si,tis the sales of f i rm i for year t;DSi,tis the change in the sales of f i rm i between year t and year t-1; and DSi,t-1is the change in the sales of f i rm i between year t-1 and year t-2.

Then,we use RM_CFO,RM_DISEXP and RM_PROD variables as proxies for real activities manipulation.At given sales levels,f i rms that manage earnings upward are likely to have one or all of the following:unusually low cash f l ow from operations,low discretionary expenses and/or high production costs.Therefore,we use Eq.(4)to aggregately measure the extent of real activities manipulation(RM).

In additional tests,we also use RM_CFO,RM_DISEXP and RM_PROD as direct measures of real activities manipulation.

3.2.2.Independent variables

Following previous studies(e.g.,Adams and Ferreira,2009;Jia and Zhang,2013;Torchia et al.,2011; Williams,2003),we introduce two independent variables,critical mass of women on BoDs and ratio of women on BoDs,to measure female participation on a BoD.Specif i cally,the critical mass of women on BoDs variable is a dummy variable,which equals 1 if a f i rm has at least three women serving on BoDs,and 0 otherwise.The ratio of women on BoDs variable is the proportion of female directors on a BoD.According to critical mass theory,a majority may often dismiss or devalue the opinions of a minority in the boardroom(Westphal and Milton,2000).A relatively low level of female participation on BoDs is unlikely to have a signif i cant ef f ect on corporate decision making(Joecks et al.,2013;Post et al.,2011;Rose,2007;Torchia et al.,2011).Therefore, both of our two independent variables may be needed to fully capture the potential ef f ect of female directors on real activities manipulation.

3.2.3.Moderating variable

To test H2,we construct a moderating variable,i.e.,ownership of women on BoDs,which is measured as the ratio of the average shares held by women on BoDs to total shares.

3.2.4.Control variables

Following Sun et al.(2011)and Qi et al.(2014),we include a number of control variables that are widely known to af f ect real activities manipulation.Firm size is measured as the natural logarithm of the number of employees.Firm age equals the number of years since IPO.Firm prof i tability is proxied by return on assets (ROA),which equals the ratio of prof i t before interest and tax over total assets.Firm growth is measured as the sales growth rate from year t-1 to year t.Market to book value is measured as the ratio of stock price to book value per share at the end of the year.Firm loss is a dummy coded 1 if a f i rm has a negative net income,and 0 otherwise.External auditor is a dummy coded 1 if a f i rm is audited by Big 4 auditors,and 0 otherwise.External audit opinion is a dummy coded 1 if a f i rm gets a qualif i ed audit opinion,and 0 otherwise. Adopting IFRS is a dummy coded 1 after 2006(not included),when China started to require listed f i rms to adopt IFRS,and 0 otherwise.Ownership concentration is measured as the ratio of top f i ve shareholders’shares to a f i rm’s total shares.State ownership is measured as the ratio of state shares to a f i rm’s total shares.In addition,we generate industry and year indicators to control for industry and time ef f ects.The def i nitions of all of the variables are listed in Table 2.

3.3.The model

We conduct OLS regressions to test our hypotheses,where standard errors are corrected using the Huber-White procedure.To control for potential endogeneity between female directors and real activities manipulation,we use lagged values of the independent and control variables.Multicollinearity appears insignif i cant because the average variance inf l ation factor(VIF)for each regression model is much less than the cutof fpoint of 10(Neter et al.,1990).We also center the interaction variables to further avoid the problem of multicollinearity.Finally,we winsorize the top and bottom 1%of each continuous variable to control the inf l uence of some outliers.

4.Results

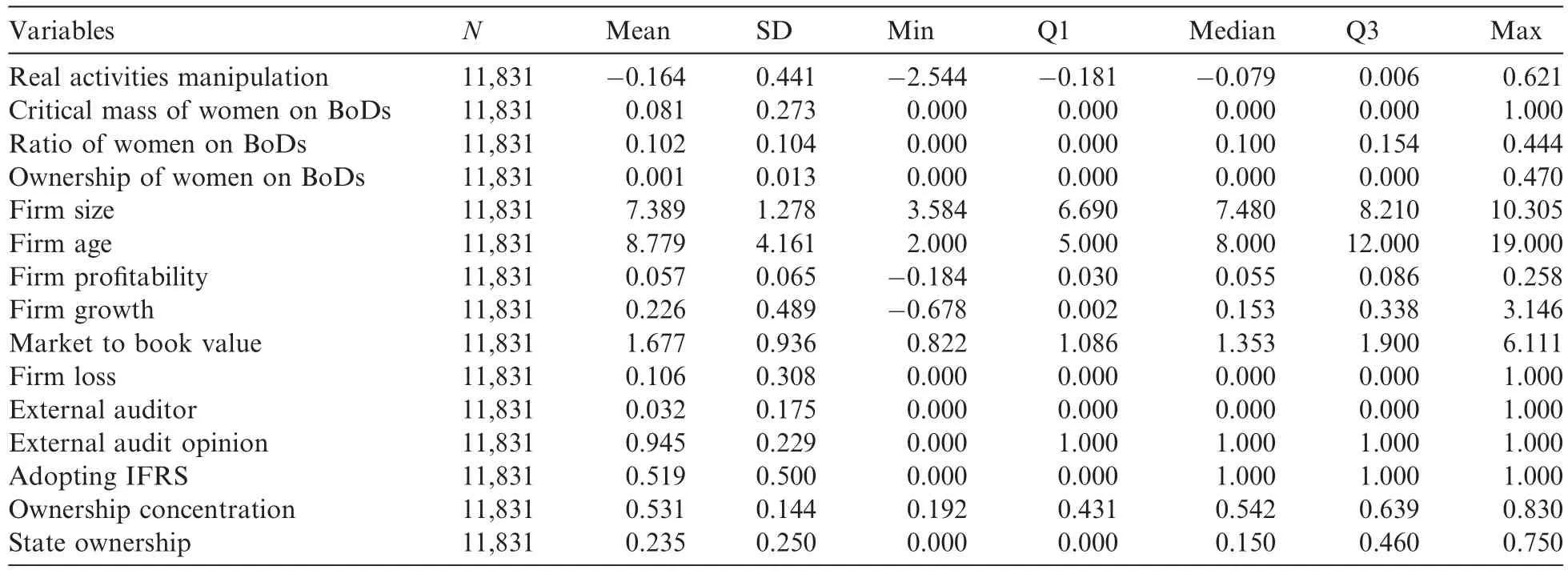

Table 3 reports the descriptive statistics for the main variables used in this study.In the whole sample,8.1% of the f i rms have at least three female directors and the average ratio of female directors to total directors on BoDs is 10.2%,which is close to the 10.1%reported in a study by Sun et al.(2015)for a Chinese sample and higher than the 8.9%reported in Hong Kong and the 8.5%reported in the U.S.,but lower than the 11.7%in the U.K.(Adams and Ferreira,2009;Sun et al.,2015).This result suggests that although female directors are still underrepresented throughout the world,China has made great strides in increasing female participation on BoDs.However,on average,female directors own a mere 0.1%of f i rms’stocks,ref l ecting China’s severe restrictions on stock-based compensation systems.In addition,3.2%of f i rms use Big 4 auditors(i.e.,DT, PWC,EY and KPMG),suggesting a low market share.

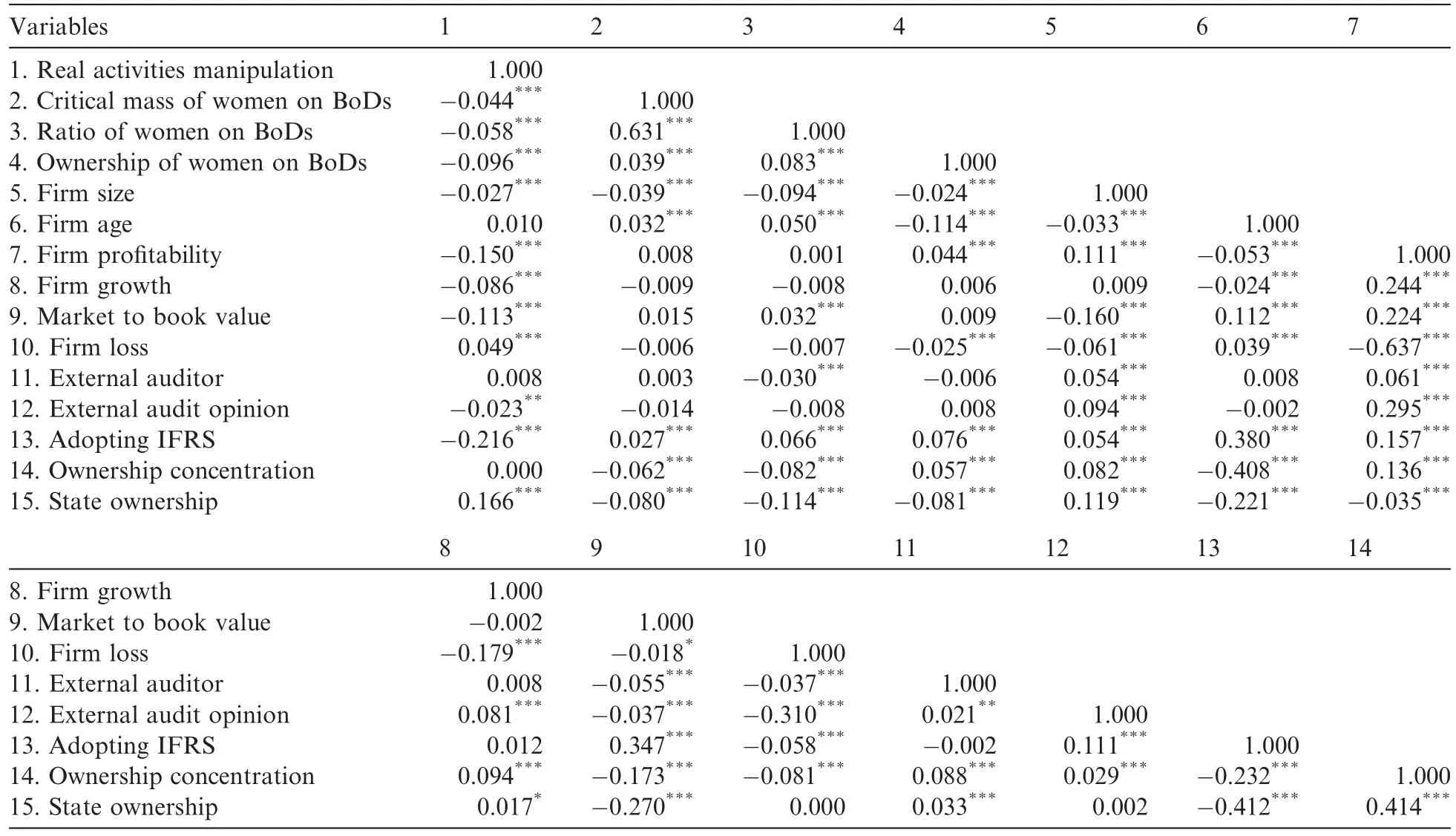

Table 4 displays the Pearson’s correlation coefficients of the variables included in the regression models. Our two measures of female participation on BoDs,critical mass of women on BoDs and ratio of women on BoDs,are highly correlated(r=0.631,p<0.01).As expected,both measures are signif i cantly and negatively related to real activities manipulation(r=-0.044,p<0.01;r=-0.058,p<0.01),preliminarily supporting Hypothesis 1 that female directors are able to curb managers’real activities manipulation.We also f i nd a signif i cant and negative correlation between female director ownership and real activities manipulation (r=-0.096,p<0.01),which corroborates our argument that stock ownership may inherently motivate female directors to play a stronger role in supervising managers’earnings manipulation through real activities. In addition,almost all of the correlation coefficients for the remaining variables are less than 0.5,implying that including these variables in the regression models would create only a weak problem of multicollinearity.

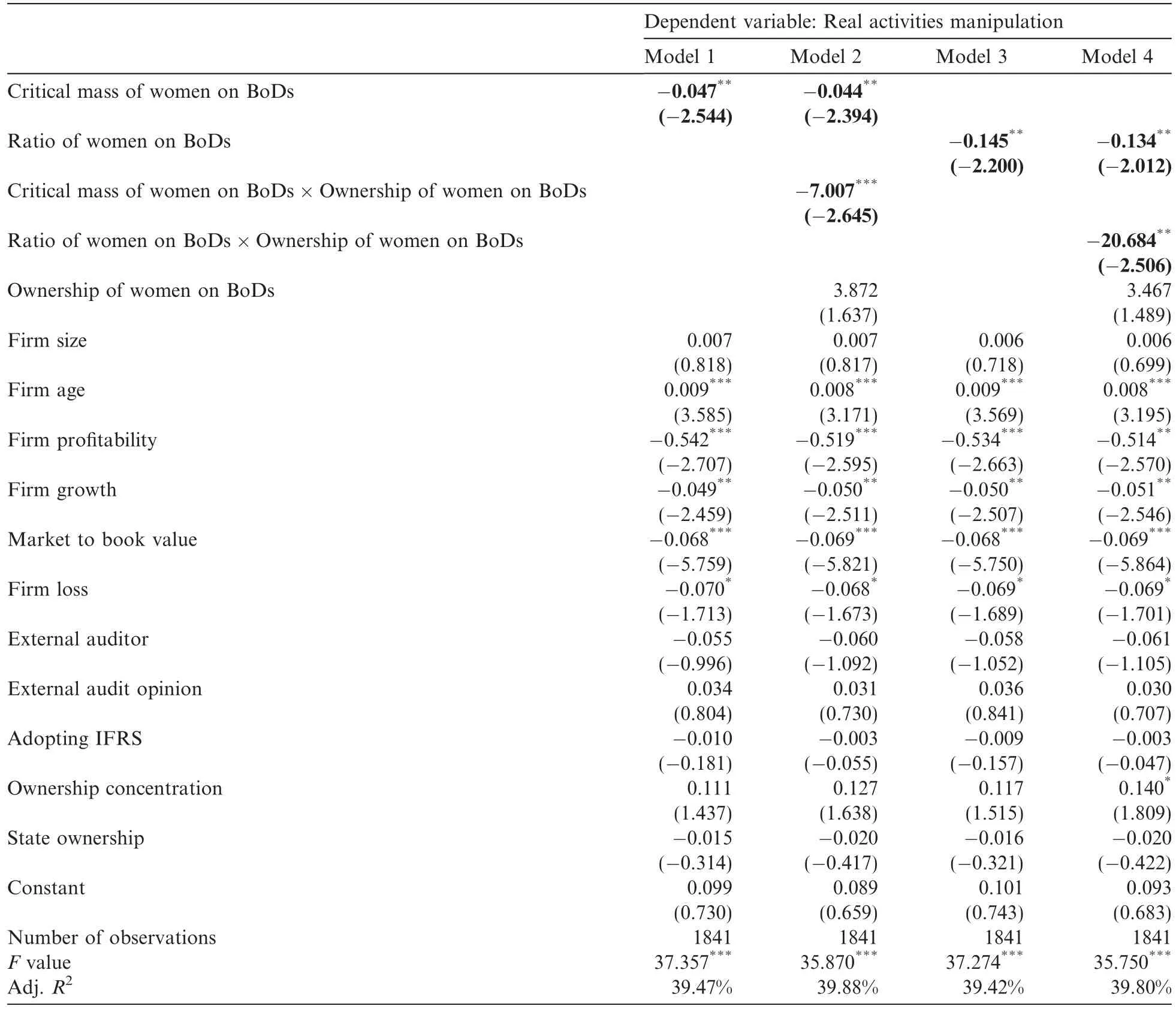

Table 5 shows the results of the OLS regression analyses.Hypothesis 1 predicts that female participation on BoDs,measured by critical mass of women on BoDs and ratio of women on BoDs,has a negative relationshipwith real earnings manipulation.As Table 5 shows,the variable critical mass of women on BoDs has a significant and negative regression coefficient(Model 1:β=-0.021,p<0.10).Similarly,ratio of women on BoDs has a signif i cant and negative regression coefficient(Model 3:β=-0.069,p<0.05).Thus,Hypothesis 1 is supported.

Table 3Descriptive statistics.

Table 4Pearson’s correlation matrix(N=11,831).

Hypothesis 2 concerns the moderating ef f ect of ownership of women on BoDs.As shown in Table 5,the coefficients on both interactions,i.e.,critical mass of women on BoDs×ownership of women on BoDs and ratio of women on BoDs×ownership of women on BoDs,are signif i cantly negative(Model 2: β=-1.573,p<0.05;Model 4:β=-9.487,p<0.01).These results suggest that female directors’ownership intensif i es the negative association between female participation on BoDs and real activities manipulation, supporting Hypothesis 2.

5.Robustness checks

5.1.Tests for splitting the role of female directors from female CEOs/chairmen

As CEOs have overall responsibility for most corporate business decisions(Francis et al.,2013)and previous research suggests that the individual features of CEOs may shape corporate decision making and outcomes(Bertrand and Schoar,2003;Cai et al.,2012),one may argue that if a f i rm has a female CEO or chairman,the role of female directors on BoDs is limited.Furthermore,a female CEO/chairman may be naturally prone to appoint female directors to the BoDs.To mitigate this concern,we re-examine the association between female directors and real activities manipulation by controlling for the presence of female CEOs/chairmen.Specif i cally,female CEOs are captured by a dummy variable,denoted by female CEO,which equals 1 if a f i rm has a female CEO/chairman,and 0 otherwise.3In China,board chairmen are usually legal representatives of listed companies and take overall responsibility for corporate decision making.In other words,chairmen in China act more like CEOs in Western economies such as U.S and U.K.Table 6 presents the empirical results.

Table 5Relationship between women on BoDs and real activities manipulation and the moderating ef f ect of ownership of women on BoDs.

As shown in Table 6,after controlling for female CEOs,the regression results are qualitatively similar to those in Table 5.Specif i cally,female participation on BoDs,as measured by both critical mass of women on BoDs and ratio of women on BoDs,still has a negative relationship with real activities manipulation.In addition,female directors’ownership still signif i cantly moderates the association between female participation on BoDs and real activities manipulation.Female CEOs are found to have no signif i cant relationship with realactivities manipulation,perhaps because the role of femaleness in curbing earnings management is not strong enough to dominate the pressure to beat/meet performance benchmarks that CEOs/chairmen face.In summary,the presence of female CEOs/chairmen does not change our main results in Table 5 and our two hypotheses are still supported.

Table 6Additional test for separating the role of female directors from the ef f ect of female CEOs/chairmen.

5.2.Tests for dif f erentiating the ef f ects between inside and outside female directors

This study considers both inside and outside female directors.It is commonly accepted that outside directors(e.g.,independent directors in China),who are independent of f i rm management and have incentives todevelop and maintain their reputations as experts,may play a stronger monitoring role than inside directors (Fama and Jensen,1983;Jiang et al.,2016).However,inside directors are usually dual-posted by f i rm managers and thus are more likely to side with f i rm management on major decisions.Therefore,it is unclear whether inside female directors have dif f erent ef f ects on real activities management from outside female directors.To deal with this concern,we try to dif f erentiate the governance ef f ects of inside and outside female directors by separating the two kinds of directors and rerunning the regressions.The results are shown in Table 7.

As Table 7 shows,both inside and outside female directors are able to help f i rms curb real earnings management(Model 1:β=-0.129,p<0.01;Model 3:β=-0.341,p<0.01).To some extent,as there are more inside female directors on the board,inside female directors are found to play a stronger role than outside female directors(Model 4:β=-0.027,p<0.10;Model 6:β=0.086,p>0.10).Moreover,stock ownership is found to enhance the role of inside female directors in curbing real activities manipulation(Model 2: β=-8.338,p<0.01;Model 5:β=-10.251,p<0.01).4As outside independent directors in China are not allowed to hold stock ownership in the f i rms they serve,we are unable to investigate the moderating ef f ect of stock ownership on the role of outside female directors.In sum,our f i ndings are robust for both inside and outside female directors,but stronger for inside female directors.

5.3.Tests for endogeneity concerns using the Heckman selection model and PSM approach

A major concern is that this study’s f i ndings may be subject to a potential self-selection bias problem.That is,f i rms with less real activities manipulation may be more likely to appoint females to serve on their BoDs.To address this potential endogenous selection,we conduct a Heckman two-stage selection model.In the f i rst stage,we run the Probit regression model to predict female participation on BoDs,using female CEO as the instrumental variable and other control variables in Table 5.Then,we generate the inverse Mills ratio after the Probit choice regression.5In particular,when using the continuous variable,i.e.,ratio of women on BoDs,to measure female participation on BoDs,we construct a dummy variable,denoted by high ratio of women on BoDs,that equals 1 if a f i rm-year’s ratio of women on BoDs is no less than the median ratio of women on BoDs in the full sample and 0 otherwise,for the sake of running a Probit choice regression in the f i rst stage.In the second stage,we add the inverse Mills ratio to the OLS regression models in Table 5 to control for any endogeneity in the choice of female directors.

The results of the Heckman two-stage selection model,given in Table 8,show that the variable inverse Mills ratio has insignif i cant coefficients in all of the OLS regression models(i.e.,Models 2-3 and Models 5-6)that take real activities manipulation as the dependent variable,indicating that the self-selection problem is weak. More importantly,the results are consistent with the main f i ndings given in Table 5.This suggests that female participation on BoDs curbs real activities manipulation,which disproves the hypothesis that f i rms with less real activities manipulation are more prone to appoint female directors.In addition,the coefficient of the instrumental variable in the f i rst-stage model,female CEO,is positive and signif i cant(Model 1:β=0.772, p<0.01;Model 4:β=1.272,p<0.01),indicating that f i rms with a female chairman/CEO are more likely to appoint females to their BoDs.

In our sample,only 8.1%of the f i rms have a critical mass of female directors on their BoDs,indicating that female directors may not be randomly distributed in f i rms.Therefore,to make causal interpretations of the results,we apply the PSM approach to structure the non-experimental data to look like experimental data.Specif i cally,we take f i rms with a critical mass of female directors as our experimental sample and apply the PSM approach to construct a control sample consisting of f i rms with highly similar characteristics but without a critical mass of female directors.Then,we estimate the causal ef f ects of female directors on real activities manipulation by comparing the two groups in the sample.For our matching process,we follow Francis et al.(2013)and run a logistic regression of critical mass of women on BoDs on f i rm size,f i rm leverage and the industry and year indicators.Then,we use the propensity scores obtained from the logistic regression and perform an one-to-one nearest neighbor match without replacement.After that,we rerun our regressions in the new sample.As Table 9 shows,the results are highly consistent with those in Table 5, indicating the insignif i cance of the endogeneity problem and providing additional support for our hypotheses.

Table 7Additional test for dif f erentiating the ef f ects between inside and outside female directors.

5.4.Tests for the ef f ects of women on two-tier boards

China does not use the Anglo-Saxon unitary board model;publically listed f i rms are required by the Company Law to operate a two-tier board system(e.g.,a BoD and a supervisory board)(Firth et al.,2007;Xiao et al.,2004).According to China’s Company Law,a BoD is a f i rm’s decision-making unit and the supervisory board serves largely as a monitoring mechanism(Jia and Zhang,2011).Accordingly,one concern may emergeabout our f i ndings:does female participation in the supervisory board matter to real activities manipulation? To address this concern,we generate two new variables to capture female participation on two-tier boards, i.e.,critical mass of women on two-tier boards and ratio of women on two-tier boards.More precisely,the variable critical mass of women on two-tier boards is a dummy variable that equals 1 if a f i rm has at least threewomen serving on two-tier boards,and 0 otherwise;the variable ratio of women on two-tier boards is calculated as the ratio of women serving on two-tier boards.We then rerun the regression analyses using these two new variables as independent variables.

Table 8Additional test for the self-selection problem using the Heckman two-stage selection model.

Table 9Additional test for the endogeneity concern using the PSM approach.

Table 10 presents the results for the ef f ects of women on two-tier boards.The variable critical mass of women on two-tier boards in Models 1-2 consistently has negative coefficients at the 5%signif i cance level;ratio of women on two-tier boards in Models 3-4 consistently has negative coefficients at the 5%signif i cance level at least.For the moderating ef f ect of ownership of women on two-tier boards,the interaction term has signif i cant and negative coefficients(Model 2:β=-1.437,p<0.05;Model 4:β=-11.438,p<0.01).These results sug-gest that both Hypotheses 1 and 2 are still supported when we focus on female participation on two-tier boards.In summary,our main f i ndings are robust when extended from women on BoDs to women on two-tier boards.

Table 10Additional test for the ef f ects of women on two-tier boards on real activities manipulation and other determinations.

5.5.Tests for the ef f ects of the split share structure reform

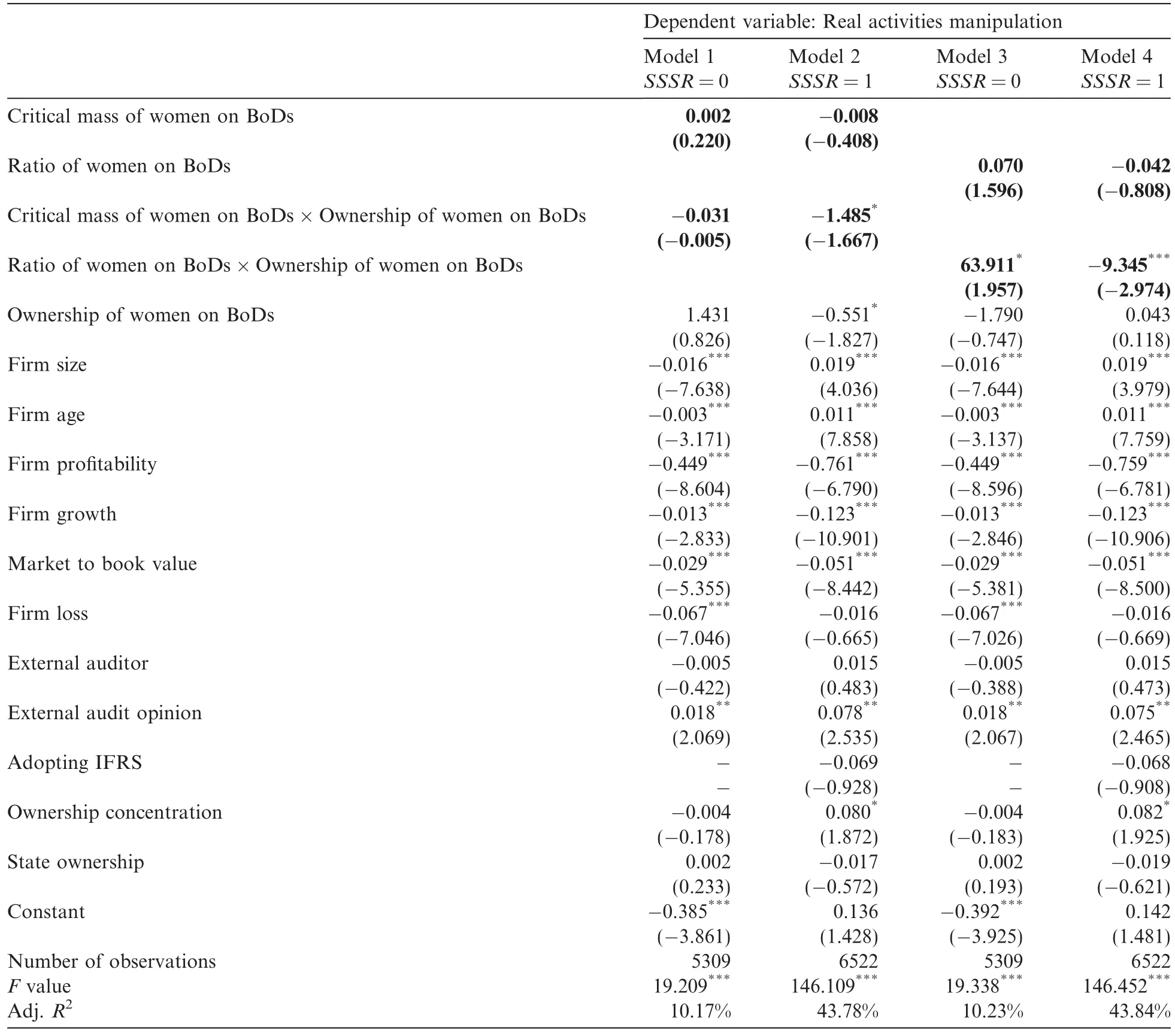

The split share structure reform has fundamentally changed large shareholders’incentives and improved corporate governance in China(Kuo et al.,2014;Liu and Tian,2012).We take advantage of the reform’soccurrence during our sample period and explore whether it af f ected the role of female directors in curbing real activities manipulation.The results are shown in Table 11.

Table 11Additional test for the ef f ect of the split share structure reform.

As Table 11 displays,in the subsample before the reform,our main variables of interest do not have signif i cant coefficients or coefficients with the expected signs.However,in the subsample after the reform,consistent with our expectations,both critical mass of women on BoDs and ratio of women on BoDs have negative coefficients.More importantly,their interactions with ownership of women on BoDs have signif i cant and negative coefficients(Model 2:β=-1.485,p<0.10;Model 4:β=-9.345,p<0.01),thereby providing support for our hypotheses.Thus,our main insights are limited to f i rm-year observations after the split share structurereform,perhaps because the reform creates an incentive alignment ef f ect that induces large shareholders and BoDs to actively monitor managers’real activities manipulation.Another reason may be that f i rms shifted their use of earnings management methods from accruals to real activities after the reform(Kuo et al., 2014),and the increase in real activities manipulation made the role of female directors more obvious.

5.6.Separate tests using the three subindices of real activities manipulation

In this study,following Roychowdhury’s(2006)model,we use the three kinds of real activities earnings management,i.e.,sales manipulation(RM_CFO),overproduction(RM_PROD)and discretionary fees manipulation(RM_DISEXP),to construct a comprehensive index of real activities manipulation.To further test the e ff ect of female participation on BoDs on real earnings management and to shed light on the specifi c mechanisms of this process,we examine the association of female participation on BoDs for each category of real activities manipulation.In particular,as RM_CFO and RM_DISEXP are a pair of inverse indexes that ref l ect the extent of real activities manipulation,we change the value of RM_CFO and RM_DISEXP by multiplying it by-1 for the sake of explanatory convenience.Table 12 presents the regression results.

As Table 12 shows,although the signif i cance level is low,both critical mass of women on BoDs and ratio of women on BoDs have a negative relation with each category of real activities manipulation,i.e.,RM_CFO, RM_PROD and RM_DISEXP,consistent with our prediction in Hypothesis 1.More importantly,when taking RM_CFO as the dependent variable,the interactions,i.e.,critical mass of women on BoDs×ownership of women on BoDs and ratio of women on BoDs×ownership of women on BoDs,have signi fi cant negative coeffi cients(Model 1:β=-0.467,p<0.05;Model 2:β=-1.880,p<0.05).Similarly,when taking RM_PROD as the dependent variable,the interactions,i.e.,critical mass of women on BoDs×ownership of women on BoDs and ratio of women on BoDs×ownership of women on BoDs,also have negative coefficients(Model 3: β=-0.696,p>0.10;Model 4:β=-7.140,p<0.01).However,when taking RM_DISEXP as the dependent variable,the interactions,i.e.,critical mass of women on BoDs×ownership of women on BoDs and ratio of women on BoDs×ownership of women on BoDs,do not have signif i cant and consistent coefficients(Model 5:β=-0.140,p>0.10;Model 6:β=0.001,p>0.10).

In summary,these results indicate that the role of female participation on BoDs in curbing real earnings management is mainly exercised by reducing sales manipulation and overproduction rather than through by reducing discretionary expenditures,6Our additional tests show that the degree of overproduction and sales manipulation signif i cantly increases from year t to year t+1 and then signif i cantly decreases from year t+1 to year t+2 in f i rms with a critical mass of female directors.That is,overproduction and sales manipulation do not persist over time,and there is a within-f i rm reversal of real activities manipulation.However,our further tests f i nd that the cross-sectional variation of real activities manipulation persists in years t+1 and t+2.Therefore,the within-f i rm reversal does not af f ect our main f i ndings.perhaps because f i rms with gender-diverse boards tend to invest less in R&D projects(Adams and Ferreira,2009;Chen et al.,2016;Jin et al.,2014).As a result,in f i rms with female directors,there is relatively limited space for managers to manipulate earnings by reducing discretionary expenditures such as R&D investment,so the role of female directors may over time become weak in curbing this kind of real activities manipulation.

5.7.Tests for the ef f ects of women on BoDs on accrual-based earnings manipulation

Several previous studies focus on the role of female directors/executives in curbing accrual-based earnings management and improving earnings quality(e.g.,Krishnan and Parsons,2008;Srinidhi et al.,2011;Sun et al.,2011;Ye et al.,2010).Most are conducted in the U.S.context,and it is unclear whether female board participation would af f ect accrual-based earnings manipulation in China.To address this concern,we f i rst estimate the extent of accrual-based earnings manipulation based on a cross-sectional version of the modif i ed Jones(1991)model by DeFond and Jiambalvo(1994),and then regress accrual-based earnings manipulation on female participation on BoDs.The regression results,given in Table 13,show that neither of the proxy variables for female participation on BoDs,i.e.,critical mass of women on BoDs or ratio of women on BoDs,has a signif i cant coefficient(Model 1:β=0.003,p>0.10;Model 3:β=0.003,p>0.10).Moreover,the interactions between female directors’ownership and female participation on BoDs also have insignif i cant coefficients.These results suggest that female directors do not help to curb accrual-based earning management in China,perhaps because it is less costly for f i rms to manipulate accruals in China due to relatively low demand for high quality earnings and low litigation risks(Allen et al.,2005;Liu and Tian,2012;Kuo et al.,2014).

Table 12Additional tests for three subindices of real activities manipulation.

Zang(2012)documents that managers use real activities manipulation and accrual-based earnings management as substitutes for each other in managing earnings.This suggests another potential explanation for the results:the reduction in real activities manipulation may be the result of an increase in accrual-based earnings management rather than an increase in female board participation.We investigate this possibility by includingaccrual-based earnings manipulation as a control variable when regressing real activities manipulation on female participation on BoDs.The regression results,given in Table 14,show that after controlling for the potential trade-of fbetween real activities and accrual-based earnings management,the results are highly consistent with our main f i nding given in Table 5,suggesting that the negative association between real activities manipulation and female participation on BoDs does not depend on the extent of accrual-based earnings management.In addition,Table 14 shows that the variable accrual-based earnings manipulation has a signif i cant and negative relationship with real activities manipulation in all of the regression models,indicating a trade-of f between two kinds of earnings management in the context of China and thus extending the boundary of Zang’s(2012) fi ndings.

6.Summary and conclusions

This study investigates the role of female directors in curbing managers’real activities manipulation.Using a large sample of Chinese listed f i rms from the 2000 to 2011 period,we f i nd that female participation on BoDs, as measured by the critical mass of female directors and the ratio of female directors,is associated with less real activities manipulation.Furthermore,this negative association is more pronounced when female directors have a higher ownership stake.These results hold for a battery of robustness checks.Overall,our f i ndingsdemonstrate that female directors help boards to curb real activities manipulation ef f ectively,and stock ownership can enhance this ef f ect.

Our study contributes to several strands of research.First,it contributes to the board gender diversity literature by showing that f i rms with a gender-diverse board exhibit less real activities manipulation.Previous studies of the consequences of female directors focus on accrual-based earnings management/quality and draw inconclusive results(Gul et al.,2011;Srinidhi et al.,2011;Sun et al.,2011).To our knowledge,our study is one of the few,if not the f i rst,to examine the role of female directors in curbing real activities manipulation.Second,our study contributes to the literature on real activities manipulation by showing that a gender-diverse board can ef f ectively alleviate real activities manipulation.As current research largely examines the ef f ectiveness of external mechanisms(Qi et al.,2014;Roychowdhury,2006;Zhu et al.,2015),we expand the scarce literature testing the role of internal governance mechanisms in curbing real activities manipulation,which is to a large extent opaque to outside stakeholders and thus more subject to internal monitoring scrutiny (Ge and Kim,2014;Graham et al.,2005;Zang,2012).Furthermore,responding to Kim and Lu’s(2011)call for more in-depth work on the interactive ef f ects of dif f erent governance mechanisms on mitigating agency problems,our study contributes to the corporate governance literature by showing the interactive ef f ect between board gender diversity and stock ownership schemes.

As real activities manipulation,although detrimental to a f i rm’s long-term growth,is a common practice among managers trying to meet short-term earnings targets,our f i ndings are of great interest to shareholders and regulators.Our results indicate that shareholders can curb costly real earnings manipulation by increasing female participation on BoDs and implementing stock-based compensation systems.Our study is limited to Chinese f i rms,which have relatively weak corporate governance and underdeveloped institutions.Therefore, there may be limits to the generalizability of our f i ndings.Future research should test our arguments and conclusions in diverse contexts.The measurement of real activities manipulation is concrete but incomplete due to potential measurement errors.Scholars should develop a better measure to fully capture the exact extent of real activities manipulation.Finally,our knowledge of the interactive ef f ects between dif f erent governance mechanisms is still limited.More in-depth research is needed to gain a better understanding of corporate governance.

Acknowledgments

We acknowledge f i nancial support from the National Natural Science Foundation of China(Grant Nos. 71202061,71572160 and 71672197),Program for New Century Excellent Talents in University of Fujian Province(2015),and Program for Cultivating Outstanding Young Research Talents in University of Fujian Province(2015),and would also like to thank Xingqiang Du for his constructive suggestions and help.All remaining errors are our own.

Achleitner,A.-K.,Gu¨nther,N.,Kaserer,C.,Siciliano,G.,2014.Real earnings management and accrual-based earnings management in family f i rms.Eur.Account.Rev.23(3),431-461.

Adams,R.B.,Ferreira,D.,2009.Women in the boardroom and their impact on governance and performance.J.Financ.Econ.94(2), 291-309.

Adams,R.,Gray,S.,Nowland,J.,2010.Is there a business case for female directors?Evidence from the market reaction to all new director appointments.Working Paper.The City University of Hong Kong.

Allen,F.,Qian,J.,Qian,M.,2005.Law,f i nance,and economic growth in China.J.Financ.Econ.77(1),57-116.

Barber,B.M.,Odean,T.,2001.Boys will be boys:gender,overconf i dence,and common stock investment.Quart.J.Econ.116(1),261-292.

Bear,S.,Rahman,N.,Post,C.,2010.The impact of board diversity and gender composition on corporate social responsibility and f i rm reputation.J.Bus.Ethics 97(2),207-221.

Bereskin,F.L.,Hsu,P.,Rotenberg,W.,2014.The real ef f ects of earnings management:Evidence from innovation.Working Paper No. 2459693.Rotman School of Management.

Berle,A.,Means,G.,1932.The Modem Corporation and Private Property.Harcourt,New York.

Bernardi,R.A.,Arnold,D.F.,1997.An examination of moral development within public accounting by gender,staf flevel,and f i rm. Contemp.Account.Res.14(4),653-668.

Bertrand,M.,Schoar,A.,2003.Managing with style:the e ff ect of managers on fi rm policies.Quart.J.Econ.118(4),1169-1208.

Burgstahler,D.,Dichev,I.,1997.Earnings management to avoid earnings decreases and losses.J.Account.Econ.24(1),99-126.

Byrnes,J.P.,Miller,D.C.,Schafer,W.D.,1999.Gender di ff erences in risk-taking:a meta-analysis.Psychol.Bull.125(3),367-383.

Cai,D.,Luo,J.,Wan,D.,2012.Family CEOs:Do they bene fi t fi rm performance in China.Asia Paci fi c J.Manage.29(4),923-947.

Campbell,A.,M´ınguez-Vera,A.,2008.Gender diversity in the boardroom and fi rm fi nancial performance.J.Bus.Ethics 83(3),435-451.

Carter,D.A.,Simkins,B.J.,Simpson,W.G.,2003.Corporate governance,board diversity,and fi rm value.Financial Rev.38(1),33-53.

Carter,D.A.,D’Souza,F.,Simkins,B.J.,Simpson,W.G.,2010.The gender and ethnic diversity of US boards and board committees and fi rm fi nancial performance.Corp.Govern.:Int.Rev.18(5),396-414.

Chen,G.,Firth,M.,Xin,Y.,Xu,L.,2008.Control transfer,privatization,and corporate performance:efficiency gains in China’s listed companies.J.Financ.Quant.Anal.43(1),161-190.

Chen,S.,Ni,X.,Tong,J.Y.,2016.Gender diversity in the boardroom and risk management:a case of R&D investment.J.Bus.Ethics 136 (3),599-621.

Clarke,C.J.,2005.The XX factor in the boardroom:why women make better directors.Directors Monthly(August),12-14.

Cohen,D.A.,Dey,A.,Lys,T.Z.,2008.Real and accrual-based earnings management in the pre-and post-sarbanes-oxley periods. Account.Rev.83(3),757-787.

Cohen,D.A.,Zarowin,P.,2010.Accrual-based and real earnings management activities around seasoned equity of f erings.J.Account. Econ.50(1),2-19.

DeFond,M.L.,Jiambalvo,J.,1994.Debt covenant violation and manipulation of accruals.J.Account.Econ.17(1-2),145-176.

DeGeorge,F.,Patel,J.,Zeckhauser,R.J.,1999.Earnings management to exceed thresholds.J.Bus.72(1),1-33.

Erhardt,N.L.,Werbel,J.D.,Shrander,C.B.,2003.Board of director diversity and f i rm f i nancial performance.Corp.Govern.:Int.Rev.11 (2),102-111.

Fama,E.F.,Jensen,M.C.,1983.Separation of ownership and control.J.Law Econ.26(2),301-325.

Fields,T.,Lyz,T.,Vincent,L.,2001.Empirical research on accounting choice.J.Account.Econ.31(1-3),255-308.

Firth,M.,Fung,P.M.P.,Rui,O.R.,2007.Ownership,two-tier board structure,and the informativeness of earning—evidence from China. J.Account.Public Policy 26(4),463-496.

Francis,B.,Hasan,I.,Li,L.,2011.Firms’real earnings management and subsequent stock price crash risk.Working Paper.Rensselaer Polytechnic Institute.

Francis,B.,Hasan,I.,Wu,Q.,2013.The impact of CFO gender on bank loan contracting.J.Account.,Audit.Finance 28(1),53-78.

Ge,W.,Kim,J.-B.,2014.Real earnings management and the cost of new corporate bonds.J.Bus.Res.67(4),641-647.

Graham,J.,Harvey,C.,Rajgopal,S.,2005.The economic implications of corporate f i nancial reporting.J.Account.Econ.40(1-3),3-73.

Gul,F.A.,Srinidhi,B.,Ng,A.C.,2011.Does board gender diversity improve the informativeness of stock prices?J.Account.Econ.51(3), 314-338.

Gunny,K.A.,2010.The relation between earnings management using real activities manipulation and future performance:evidence from meeting earnings benchmarks.Contemp.Account.Res.27(3),855-888.

Haslam,S.A.,Ryan,M.K.,Kulich,C.,Trojanowski,G.,Atkins,C.,2010.Investing with prejudice:the relationship between women’s presence on company boards and objective and subjective measures of company performance.Br.J.Manage.21(2),484-497.

Hillman,A.J.,Shropshire,C.,Cannella Jr.,A.A.,2007.Organizational predictors of women on corporate boards.Acad.Manage.J.50 (4),941-952.

Huse,M.,Solberg,A.,2006.Gender related boardroom dynamics:how women make and can make contributions on corporate boards. Women Manage.Rev.21(2),113-130.

Jensen,M.C.,Meckling,W.H.,1976.Theory of the f i rm:managerial behavior,agency costs and ownership structure.J.Financ.Econ.3 (4),305-360.

Jia,M.,Zhang,Z.,2011.Agency costs and corporate philanthropic disaster response:the moderating role of women on two-tier boards—evidence from People’s Republic of China.Int.J.Human Resour.Manage.22(9),2011-2031.

Jia,M.,Zhang,Z.,2012.Women on boards of directors and corporate philanthropic disaster response.China J.Account.Res.5(1),83-99.

Jia,M.,Zhang,Z.,2013.Critical mass of women on BoDs,multiple identities,and corporate philanthropic disaster response:evidence from privately owned Chinese f i rms.J.Bus.Ethics 118(2),303-317.

Jiang,W.,Wan,H.,Zhao,S.,2016.Reputation concerns of independent directors:evidence from individual director voting.Rev.Financ. Stud.29(3),655-696.

Jin,Z.,Song,S.,Yang,X.,2014.The role of female directors in corporate investment in China.China J.Account.Stud.2(4),323-344.

Joecks,J.,Pull,K.,Vetter,K.,2013.Gender diversity in the boardroom and f i rm performance:what exactly constitutes a‘‘critical mass”? J.Bus.Ethics 118(1),61-72.

Jones,J.J.,1991.Earnings management during import relief investigation.J.Account.Res.29(2),193-228.

Joy,L.,2008.Women board directors in the United States:an eleven year retrospective.In:Vinnicombe,S.,Singh,V.,Burke,R.J., Bilimoria,D.,Huse,M.(Eds.),Women on Corporate Boards of Directors.Edward Elgar,Northampton,MA,pp.15-23.

Kim,E.H.,Lu,Y.,2011.CEO ownership,external governance,and risk-taking.J.Financ.Econ.102(2),272-292.

Kim,J.-B.,Sohn,B.C.,2013.Real earnings management and costs of capital.J.Account.Public Policy 32(6),518-543.

Krishnan,G.V.,Parsons,L.M.,2008.Getting to the bottom line:an exploration of gender and earnings quality.J.Bus.Ethics 78(1-2), 65-76.

Kuo,J.-M.,Ning,L.,Song,X.,2014.The real and accrual-based earnings management behaviors:evidence from the split share structure reform in China.Int.J.Account.49(1),101-136.

Leung,A.S.M.,2003.Feminism in transition:Chinese culture,ideology and the development of the women’s movement in China.Asia Pacif i c J.Manage.20(3),359-374.

Lian,Q.,Wang,Q.,Xu,Z.,2014.Ef f ects of real earnings management:Evidence from Patents.Working Paper.Louisiana Tech University.

Liu,Q.,Lu,Z.J.,2007.Corporate governance and earnings management in the Chinese listed companies:a tunneling perspective.J.Corp. Finance 13(5),881-906.

Liu,Q.,Tian,G.,2012.Controlling shareholder,expropriations and f i rm’s leverage decision:evidence from Chinese non-tradable share reform.J.Corp.Finance 18(4),782-803.

Neter,J.,Wasserman,W.,Kutner,M.H.,1990.Applied Linear Statistical Models:Regression,Analysis of Variance,and Experimental Design.Irwin,Homewood,IL.

Peng,K.Z.,Ngo,H.,Shi,J.,Wong,C.,2009.Gender dif f erences in the work commitment of Chinese workers:an investigation of two alternative explanations.J.World Bus.44(3),323-335.

Post,C.,Rahman,N.,Rubow,E.,2011.Green governance:boards of directors’composition and environmental corporate social responsibility.Bus.Soc.50(1),189-223.

Qi,B.,Yang,R.,Tian,G.,2014.Can media deter management from manipulating earnings?Evidence from China.Rev.Quant.Financ. Acc.42(3),571-597.

Rose,C.,2007.Does female board representation inf l uence f i rm performance?The Danish evidence.Corp.Govern.:Int.Rev.15(2),404-413.

Roychowdhury,S.,2006.Earnings management through real activities manipulation.J.Account.Econ.42(3),335-370.

Shawver,T.J.,Clements,L.H.,2015.Are there gender dif f erences when professional accountants evaluate moral intensity for earnings management?J.Bus.Ethics 131(3),557-566.

Shleifer,A.,Vishny,R.,1997.A survey of corporate governance.J.Finance 52(2),737-783.

Srinidhi,B.,Gul,F.A.,Tsui,J.,2011.Female directors and earnings quality.Contemp.Account.Res.28(5),1610-1644.

Sun,J.,Liu,G.,Lan,G.,2011.Does female directorship on independent audit committees constrain earnings management?J.Bus.Ethics 99(3),369-382.

Sun,S.L.,Zhu,J.,Ye,K.,2015.Board openness during an economic crisis.J.Bus.Ethics 129(2),363-377.

Sunde´n,A.E.,Surette,B.J.,1998.Gender dif f erences in the allocation of assets in retirement savings plans.Am.Econ.Rev.88(2),207-211.

Terjesen,S.,Sealy,R.,Singh,V.,2009.Women directors on corporate boards:a review and research agenda.Corp.Govern.:Int.Rev.17 (3),320-337.

Torchia,M.,Calabro`,A.,Huse,M.,2011.Women directors on corporate boards:from tokenism to critical mass.J.Bus.Ethics 102(2), 299-317.

Westphal,J.D.,Milton,P.L.,2000.How experience and network ties af f ect the inf l uence of demographic minorities on corporate boards. Admin.Sci.Quart.45(2),366-398.

Williams,R.J.,2003.Women on corporate boards of directors and their inf l uence on corporate philanthropy.J.Bus.Ethics 42(1),1-10.

Wongsunwai,W.,2013.The ef f ect of external monitoring on accrual-based and real earnings management:evidence from venture-backed initial public of f erings.Contemp.Account.Res.30(1),296-324.

Xiao,J.Z.,Dahya,J.,Lin,Z.,2004.A grounded theory exposition of the role of the supervisory board in China.Br.J.Manage.15(1),39-55.

Ye,K.,Zhang,R.,Rezaee,Z.,2010.Does top executive gender diversity a ff ect earnings quality?A large sample analysis of Chinese listed fi rms.Adv.Account.,Incorp.Adv.Int.Account.26(1),47-54.

Zang,A.Y.,2012.Evidence on the trade-o ffbetween real activities manipulation and accrual-based earnings management.Account.Rev. 87(2),675-703.

Zhang,J.,Li,B.,Liu,D.,2008.Real activities manipulation on earnings management:a loss-avoidance based empirical evidence.J.Appl. Stat.Manage.27(5),918-927(In Chinese).

Zhu,T.,Lu,M.,Shan,Y.,Zhang,Y.,2015.Accrual-based and real activity earnings management at the back door:evidence from Chinese reverse mergers.Paci fi c-Basin Finance J.35(A),317-339.

23 December 2015

*Corresponding author at:School of Management,Xiamen University,No.422,Siming South Road,Xiamen,Fujian 361005,PR China.

E-mail addresses:jinhuiluo@xmu.edu.cn(J.-h.Luo),xiangyuangao@hotmail.com(Y.Xiang),vickyhuangzy@163.com(Z.Huang).

http://dx.doi.org/10.1016/j.cjar.2016.12.004

1755-3091/Ⓒ2017 Sun Yat-sen University.Production and hosting by Elsevier B.V.

This is an open access article under the CC BY-NC-ND license(http://creativecommons.org/licenses/by-nc-nd/4.0/).

杂志排行

China Journal of Accounting Research的其它文章

- Banking deregulation and corporate tax avoidance

- Geographical relationships and CEO compensation contracts

- Peer ef f ects in decision-making:Evidence from corporate investment

- Thornyroses:Themotivationsandeconomic consequences of holding equity stakes in f i nancial institutions for China’s listed nonf i nancial f i rms