Efforts for Chinese Chips to Catch Up

2016-09-26ByTanXingyu

By Tan Xingyu

Efforts for Chinese Chips to Catch Up

By Tan Xingyu

On Jan 29, 2016, the Strategy Analytics released its 2015 global and Chinese smart mobile phone market reports. the performance of China-made mobile phones Huawei and Xiaomi was outstanding. In the Chinese market, Xiaomi continued to rank first, with shipment of 67.5 million phones, and a market share of 15.4 percent, an increase of 17 percent over 2014. Huawei showed even greater growth momentum, with shipments surging 51 percent to 62.2 million and its market share rising to 14.2 percent.

Despite Xiaomi's excellent performance, its founder Lei Jun still feels great pressure in the face of Huawei's powerful efforts to catch up. Some analysts believe one reason for Huawei's breakthrough in the fierce Chinese mobile phone market is its adoption of the HiSilicon chip it developed independently that has not only further reduced the phone price but also enhanced its capability to compete with international chip manufacturers such as the Qualcomm and the Media Tek. Lei Jun indicated that Xiaomi will further strengthen the research and development on chips to achieveself-production of chips as soon as possible.

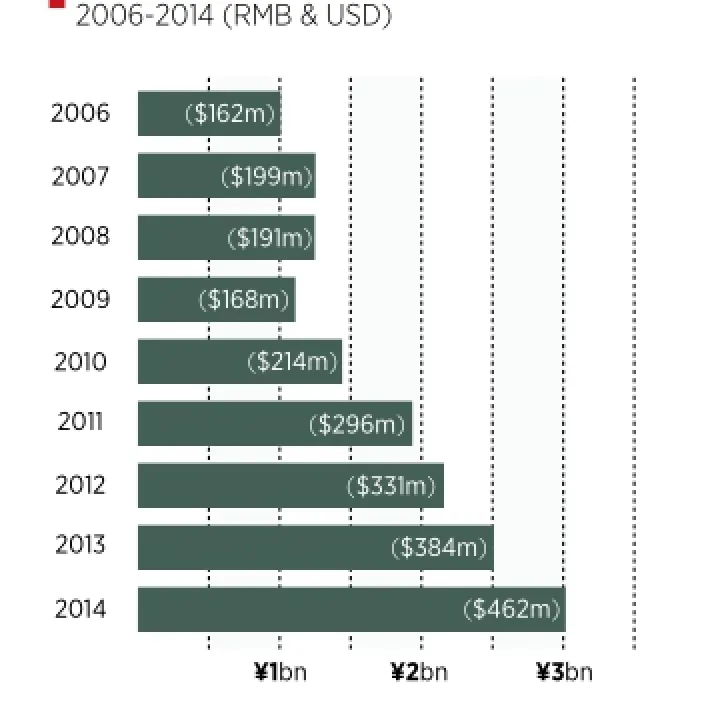

Chinese microchip industry sales

The chip is not only the heart of a mobile phone but also the most important nerve center of the information industry, being indispensable to the PC, server or mobile terminal. In view of that, China's State Council issued the Outline for Promoting the Development of the National Integrated Circuit Industry in June 2014, requiring speeded-up efforts to catch up with and surpass other countries and achieve huge development of the Chinese IC industry.

In response, capital from various sources has entered the chip industry and Chinese chip companies have embarked on a wave of expansion.

Efforts to Keep Buying

Among the numerous buyers, the Tsinghua Unigroup is the most representative.

In 2013, Unigroup spent $1.8 billion acquiring the Spreadtrum Communications listed in the US, and then another $910 million on the RDA Microelectronics. In 2014,it sold 20 percent of the shares of the two acquired companies to Intel for 9 billion yuan ($1.37 billion). In May 2015, Unigroup purchased a 51 percent shareholding in the H3C Technologies for $2.5 billion. Less than half a year later, it bought 15 percent of Western Digital for $3.8 billion, becoming its largest single shareholder. At the end of 2015, Unigroup Chairman Zhao Weiguo went to Taiwan where he showed great interest in the MediaTek, Taiwan Semiconductor Manufacturing (TSMC) and other major chip enterprises.

Unigroup is not a special case. there are also many Chinese enterprises trying to become world-class chip giants via acquisitions.

In 2014, Shanghai Pudong Science and Technology Investment invested $693 million to acquire the Montage Technology, listed in the US, and, together with the Hua Capital Management,bid $1.67 billion for the OmniVision, a camera supplier for Apple last October.

In early January 2016, there was news that the US Marvell Technology Group is considering selling the controlling rights to its wireless chip business. China's Leadcore Technology and Shanghai Pudong Science and Technology Investment showed interest in joining the bidding process.

In addition, the Changjiang Electronics Technology, a chip packaging company,spent $780 million to gain a controlling stake in the STATS ChipPAC, a peer enterprise in Singapore in 2014. the JAC Capital Management purchased part of the NXP Semiconductors in the Netherlands, specialized in producing chips for mobile phone base stations. A consortium led by the China Resources also bid $2.5 billion for the US Fairchild Semiconductor.

According to incomplete statistics,since 2013, Chinese enterprises such as the JAC Capital Management, the Hua Capital Management and the Tsinghua Unigroup have spent a total of $15 billion to complete 10 international acquisitions.

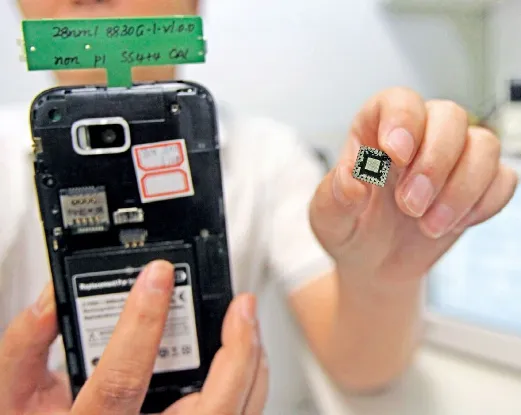

On June 29, 2014, the Spreadtrum Communications (Tianjin) Company launched the mobile phone chip SC883XG, which adopts advanced 28nm technology. The product is expected to help mobile phone manufacturers develop cost-effective solutions for medium- and high-end mobile phones

Meanwhile, several foreign chip giants have accelerated their participation in the market.

In June 2015, the Semiconductor Manufacturing International Corporation(SMIC), Huawei Technologies, the Interuniversity Microelectronics Centre(IMEC) and Qualcomm jointly invested in the establishment of the SMIC Advanced Technology Research & Development Corp.

In October 2015, Intel announced plans for investment of $5.5 billion in Dalian in Northeast China to transform a local factory into a memory chip manufacturer. In December 2015, the chip production king TSMC revealed its intention to build a $3 billion chip production plant in Nanjing. Tsinghua University, Intel and the Montage Technology (Shanghai) recently signed an agreement in Beijing for joint development of a new generic CPU to meet market demand.

A Long Way to Go

The large acquisition and investment cooperation activity have aroused keen interest in China's chip industry as to whether such huge investment by Chinese enterprises is sufficient to shake the existing global industrial structure.

In 2015, McKinsey & Company issued a report entitled “New World Under Construction: China and Semiconductors”,which identified three reasons for the increasing importance of the Chinese chip market: First, the government is actively attempting to reshape the domestic semiconductor market and assist local companies in becoming national champions. Second,Chinese consumers and companies are becoming increasingly important to the growth of the global semiconductor market. Third,Chinese capital - from both government and private sources - is actively pursuing merger,acquisition, investment, and partnership opportunities worldwide.

The report also pointed out that Chinese enterprises have made total outbound investment of over $15 billion. However, that amount accounted for less than 10 percent of total acquisitions in the global chip industry in 2015. To provide context, the report also revealed that the capital expenditures and R&D spending of the IC companies in the world added up to $80 billion, 20 times as much as that of Chinese local enterprises.

Take the wafer foundry aspect as an example. The Made in China 2025 strategic plan set a goal “for the self-sufficiency rate of the IC industry to reach 70 percent by 2025”. However, SMIC, the largest wafer foundry in China, ranks fifth in the world but its revenue is less than 10 percent of the world's largest corporate entity.

Since the smart phone market is nearly saturated and the boom has receded, the chip sales volume has been shrinking in recent years. According to the latest data released by the Semiconductor Industry Association in November 2015, global semiconductor sales value in the third quarter of 2015 was $85.2 billion, down 2.8 percent year on year.

The IC Insights also released a list of the world's top 10 chip design companies and total sales value in 2015. The total revenue of the chip design companies worldwide in 2015 was calculated to be $58.92 billion, a decline of 5 percent from 2014.

These data mean that the global chip industry is undergoing a change from being a high to a low profit one. Unless a complete ecosystem from chip to sothware is established,the round of acquisitions by Chinese chip enterprises will end up producing a deficit.

Besides the significance and risks of the acquisitions, it can't be ignored that although the activity has greatly promoted China's chip industry, the core technologies of chips are still in the hands of Intel, Qualcomm,IBM, AMD and other American companies.

Though Huawei, Xiaomi, ZTE and other domestic mobile phone manufacturers have pledged to increase their investment in research and development of chip design, for now, numerous mobile phone chip makers have found out that they still have to buy the chip frame from Qualcomm and ARM.

A research report shows that Chinese chip enterprises are still small, scattered and weak. the total revenue of 500 Chinese chip design enterprises is only 60-70 percent of that of Qualcomm, and the R&D investment of China's chip manufacturing industry less than one-sixth of that of Intel.

The report concluded by saying: “We should clearly see that Chinese chip enterprises still lag far behind and can't realize a qualitative leap only through acquisitions. It is necessary to get down to the basic research work and vigorously foster the industrial ecology.”