China Nonferrous Metals Monthly

2016-04-21

China Nonferrous Metals Monthly

中国有色月刊

For SubscribersFebruary2016

Overall Analysis of Key Mineral Resources Trends in 2015

In 2015,the global economy continued to remain in deep transition adjustment period,demand for major mining products is sluggish,meanwhile in combination with fluctuations in the financial market,“ore prices”fell steadily,mining situation continued to deteriorate.Under the New Normal,structural adjustment of Chinese economy made further progress,basic demand of major mining products is preliminarily in position,besides prices stayed at bottom level,the“money-picking”age of mining investment has ended,investors’interest and confidence toward mining investment will gradually evaporate,mining industry development enters a new stage of“reshuffling”.

Mining financial market was plunged into recession,investment enthusiasm vanished completely.According to SNL data,in 2015 global non-fuel solid mineral prospecting budget was USD9.2 billion,down by 18% on Y-o-Y basis,recording decline for three consecutive 3 years;oil and gas prospecting investment budget dropped from the peak value of USD 100 billion in 2014 to USD 70 billion in 2015,down by 30% on Y-o-Y basis,there were 150 postponed or mothballed oil and gas projects worldwide;the same goes for iron ore,in 2015 Australia’s exploitation investment for Q1-Q3 was only USD 820 million,equivalent to 57.5% of the same period in the previous year.

With weakening short-term demand and midterm structural adjustment,the economy faced increasing downward pressure.Currently,mounting downward pressure of economy and rising deflation risk co-exist side by side in China,declining enterprise performance encountered slowdown of financial income,which developed rather complicated situation.In the short term,external demand is obviously inadequate,investment decelerated sharply,real estate market continued adjustment,plus industrial enterprise de-stocking factors,which directly restrained expansion of resource consumption scale.From the mid term perspective,currently the pressure of economic growth shift-changing and the anguish of structural adjustment intertwined,growth of emerging industry can hardly make up for the impact of declining traditional industry,the supporting effect of element investment is weakened,requirement of structural upgrading increased,defusing earlier surplus capacity and strengthening eco environment protection etc will all affect economic growth speed,it is expected the whole year GDP growth rate is only 6.9%.

Basic demand for major mining products is preliminarily in place,production scale approached peak value.Firstly,peak values of coal demand and output both arrived earlier.Owing to eco civilized construction,rapid development of clean energy such as hydraulic and nuclear power and execution of coal-to-gas project,along with significant drop in coal prices,coal consumption and output peak value arrived earlier than expected.From January to November,nationwide raw coal output was 3.37 billion tonnes,down by 3.7% on Y-o-Y basis;import coal was 186 million tonnes,down by 29.4% on Y-o-Y basis;public coal stock has topped 300 million tonnes for 47 consecutive months.In synchronization with the continual all-round decline of raw coalproduction,supply and sales,price downward pressure continued,the contradiction of coal oversupply can hardly be improved.Secondly,China’s infrastructure construction is steadily improving,in traditional fields crude steel demand is basically in place,iron ore consumption intensity weakens,market competition entered balanced stage.from January to November,nationwide iron ore crude ore output was 1.25 billion tonnes,down by 9.7% on Y-o-Y basis;import iron ore was 857 million tonnes,up by 1.3% on Y-o-Y basis;monthly stock of port iron ore was basically kept above 80 million tonnes.In the future,not only domestic downstream steelusing sectors have limited fueling effect for iron ore demand,especially against the background of continual output expansion by four global major low-cost mines,it strengthened the trend of iron ore supply surplus,while entering the stage of balanced competition with domestic high cost mines.Thirdly,basic demand of major nonferrous metals minerals slowed down in growth;meanwhile,with the accumulation and release of secondary resources,and the prospect of closing down some heavily polluting mines or mines disregarding environmental pollution due to environmental issue,output of key nonferrous metals minerals will gradually decline.From January to October,nationwide metal outputs of copper concentrate,lead concentrate,zinc concentrate,and nickel concentrate were respectively 1.44 million tonnes,1.97 million tonnes,3.98 million tonnes,and 76000 tonnes,down by 5.5%,9.7%,9.2%,and 1.0% respectively on Y-o-Y basis,aluminum oxide output was 47.35 million tonnes,up by 10.6% on Y-o-Y basis;from January to November,nationwide physical quantity of import copper concentrate,aluminum ore sand,lead concentrate,zinc concentrate,and nickel concentrate were respectively 11.84 million tonnes,48.99 million tonnes,1.58 million tonnes,2.79 million tonnes,and 33.43 million tonnes,up by 10.8%,47.2%,down by 3.6%,up by 48.4%,and down by 26.1% respectively on Y-o-Y basis.Fourthly,outputs of major non-metal mining products declined.From January to November,fluorite output was 3.50 million tonnes,down by 6.1% on Y-o-Y basis,natural flake graphite output was 550,000 tonnes,down by 15.4% on Y-o-Y basis,talcum output was 1.80 million tonnes,down by 18.2% on Y-o-Y basis,gypsum raw ore output was 42.60 million tonnes,down by 9.0% on Y-o-Y basis.Fifthly,as premium energy sources,production,supply and sales of oil and gas continued to expand across the board.From January to November,nationwide crude oil and natural gas outputs were respectively 196 million tonnes,and 119 billion cubic meters,up by 2.0% and 3.3% respectively on Y-o-Y basis;import volumes were respectively 312 million tonnes,and 54.4 billion cubic meters,up by 8.7% and 4.7% respectively on Y-o-Y basis.

Financial indicators of mining companies continued to deteriorate,basically depriving them of financing ability.In the first half of the year,although stock market prosperity promoted rapid growth in financial service industry,it did not reverse the downward trend of industrial development,especially the“stock market disaster”in mid June resulted in falling prices of major mining products.Wherein,coal and iron ore prices basically have comprehensively dropped below cost line,dragging down January~October industrial profit by 62.1% and 43.2% respectively on Y-o-Y basis;prices of main nonferrous metals products such as copper,aluminum,lead,zinc also approached or dropped below domestic enterprises’ cost line,January~October profits of major nonferrous metals mines declined by 26.5% on Y-o-Y basis;in the aftermath of sharply falling global oil price,in the first three quarters the operating income of CNPC,Sinopec,and CNOOC dropped respectively by 25.6%,27.4% and 33.4% compared with the same period last year.In summary,compared with 2011,in 2015 China’s mining assets shrank by nearly 2/5,4/5 of mine enterprises were unable to cover expense with income,some mines failed to pay salary to workers normally or postponed payment by several months.

Sharp decrease in business performance basically deprived mining companies of financing ability.At present,although IPO has re-started,the Shanghai Stock Exchange Resource Stock Index is still in“halved”status in comparison with the highest point this year,stock prices of mining companies fell sharply,wherein the earnings per share of a considerable number of listed companies in coal,iron &steel,nonferrous metals industries are in loss or near-loss status;especially coal and iron &steel industry,in the first three quarters the percentage of loss among listed companies exceeds 50%.

Mining market becomes increasingly deserted,fixed asset investment of the mining industry continued to diminish.According to statistics,currently nationwide valid exploration right and registration area dropped by 6% and 10% respectively on Y-o-Y basis,valid mining right and registered area dropped by 11% and 1% respectively on Y-o-Y basis.From January to November,in particular transfer of exploration right through prior application method dropped by 32.6% on Y-o-Y basis;transfer of exploration right through public bidding,auction and listing dropped by 16.8% on Y-o-Y basis.Meanwhile,the transfer instances of exploration right and mining right also declined obviously,in 2015 transfer of exploration right dropped by 15.8% on Y-o-Y basis,transfer of mining right dropped by 20.8% on Y-o-Y basis.Keeping synchronized step with the“recession”in mining right market,fixed asset investment of mining industry continued to drop.From January to November,fixed asset investment of nationwide mining industry was 1152.1 billion yuan,down by 8.7% on Y-o-Y basis;wherein,for coal and ferrous metal mining and dressing industries,their nationwide investments in fixed assets were respectively only 359.9 billion yuan and 127.7 billion yuan,down by 16.1% and 19.9% respectively on Y-o-Y basis.

As China’s economic development enters the New Normal,it still has powerful and stable demand for major mining products.The economic development of developed countries all experienced the transition process from fast speed growth to mid and low speed growth,such as the US and Germany,and in the end the economic growth rate stays below 4%,only after that will the size of resource demand become stabilized.Although Chinese economy now still has around 7% growth rate,ultimately it still needs to make transition to the 3%~4% growth range.Therefore,in the next decade,China is still the powerhouse of global economic development,to support the development and stability of China,a country with such economic volume on par with global leading countries,it still has powerful and stable demand for traditional staple mineral resources,and can still provide solid support in economic fundamentals to the development of global mining industry.On the other hand,the world today is germinating a new round of industrial revolution,hi-tech industry and strategic emerging industries are making rapid development,the demand for new energy and new material minerals will continue rapid growth,which will provide major opportunity for developing the prospecting of emerging mineral resources.

Prices of major mining products will remain at bottom level,at least in the short term it is difficult to see any rebound trend.In the short term,The rising of prices of mining products depends on absorption speed and ability of surplus capacity,in the long term it depends on economic development speed and resource guarantee degree.In the past decade,although Chinese economy achieved rapid development,at the same time it also caused blind expansion of capacity in coal,iron &steel and nonferrous metals metallurgical industry.Although major domestic metallurgical enterprises announced production cut programs,these production cut programs lagged far behind the surplus capacity being supplied,so that the future absorption of surplus capacity will be a long and arduous task.The complexity degree and slow progress of the process for surplus capacity absorption determines that prices ofmajor mining products will hardly have chances of momentous rise,for some ore varieties,such as copper and nickel,in the short term their prices still have room for downward decline.

Investors’ interest and confidence in mining investment gradually evaporated,M&A among large mining companies constitutes the main theme of mining development.Rapid development of Chinese economy brought global mining prosperity and growth of wealth,but fast drop of mining prices also make people re-recognize the essence of mining industry.In 2015 the mining market was steeped in the atmosphere of tragedy and decisiveness,mining companies basically were trapped in all-round loss,1/2 private mining enterprises were trapped by bank loans and high-interestrate loans,mine owners sought hideaways everywhere to elope from creditors,1/4 mines were abandoned,resulting in loss of investor wealth and lack of confidence;meanwhile,with economical development and deepening of reform,mine labor usage and environmental costs will further increase,besides compared with other investment products,mining investment is characterized by big risk,long cycle,and low short-term proceeds,which dampens investor enthusiasm for mining investment.

On the other hand,currently many small and medium sized mines in China are all facing shutdown crisis,selling assets“at discount”and bankruptcy &restructuring offer their final solutions,but this cannot fundamentally solve intrinsic problems of the current mining industry development.In the future,as consumption structure and space utilization structure of Chinese resources undergo significant changes,M&A and restructuring among large mining companies constitute the main theme of mining development.Judging from existing condition,the asset market value of almost all mining companies has shrunken significantly,liability ratio increased greatly,weaknesses in asset structure etc have surfaced,driven by the state government’s capacity substitution policy,in cooperation with the need to substantially reduce surplus capacity,M&A and restructuring among large mining companies are inevitable.

The financing difficulty of mining industry continued to increase,seeking securitization by mine enterprises provides an effective way to set up connection with the capital market.Mining is a capital-intensive industry,and needs capital support to ensure continual development and expansion.As prices of mining products continued to fall,mining companies’ profit-earning ability is deteriorating,it is becoming increasingly difficult to maintain positive cash flow,some enterprises experienced downturn in credit rating,resulting in widespread early withdrawal of bank loan,and triggering capital chain rupture.Although enterprise raised funds from different sources,it increased financing cost,currently many state-owned backbone enterprises are no longer able to pay interest with profit,the existence status of mines are worrisome.Asset securitization of mining companies is an effective option for mining industry development,it can guarantee mining companies to possess relatively healthy cash flow.

Mining policy adjustment entered active period,external cooperation faced new opportunities.Against the weak market background,many resource-type countries one after another adjusted mining policies,in the hope of hitting targets of obtaining more interest from resource development or protecting local environment and improving employment.For developed countries such as Canada and Australia,policies tend to give benefit to mining companies,in the hope of seeking“survival”through mining companies to save national economy;the Indian government has strong intention to introduce investment into mining industry,and put forward concepts of mutual progress and joint development;Kazakhstan’s resource allocation serves official diplomacy;Japanese government is very willing to make investmentin Africa,but enterprises are not willing to cooperate,which eased the frontal competition pressure in the African market.Russian mining policy serves economic poverty relief,the entire mining industry is highly open to China,there are signs that even some strategic mining sectors are open.

Adjust mineral resource prospecting &exploitation structure,guarantee security of mineral resources.In order to meet the future powerful and stable needs for traditional bulk mineral resources and the demand for new energy and new material minerals,it is required to systematically adjust prospecting &exploitation structure of mineral resources:Firstly,strengthen mineral prospecting of conventional oil and gas,and new energy resources such as coal bed methane,shale gas,and uranium,along with new materials such as heavy rare earth,Germanium,Indium,Gallium,and graphite,steadily support prospecting of short-supplied minerals such as copper,nickel and traditional advantageous minerals such as tin and antimony etc,moderately carry out mineral prospecting of manganese,aluminum,lead,zinc,and phosphorus,restrict mineral prospecting of coal,molybdenum,sulfur etc.Secondly,based on development speed of clean energy,rationally adjust the basic position of coal in China’s energy sources,and by propelling revolution of coal resource development &utilization methods,promote coal resource to make transition from relatively extensive development to safe,eco-friendly,intelligent,and efficient development.Thirdly,improve national iron ore strategic guarantee system,avoid excessive impact from overseas low-price ore on domestic iron mines,strive to stabilize rational development scale in China.

Support the development of high-quality mines,promote construction of new type mines through transition &upgrading.Firstly,for mine capacity lacking competitiveness,quicken the pace of setting up and improving mine exit mechanism,study basic conditions for mine closedown and exit,exit model,exit passageway,and exit supporting policies,guarantee unobstructed and smooth exit passageway.Secondly,accelerate innovation of mineral resource management system,establish resource utilization efficiency evaluation system,and allocate resources based on resource utilization efficiency condition,support the development of premium mines.Thirdly,link up resource tax rate to mine resource condition,and regularly evaluate mine tax rate grades,enhance mines’ initiative to rationally utilize resources.Fourthly,intensify efforts to support scientific &technological innovation,popularize advanced mining,oredressing and integrated utilization technologies,encourage mines to introduce high and new technologies to implement technology equipment upgrading,speed up transition &upgrading of traditional mining,promote efficient utilization of resources and construction of new mines.

Wage five battles of annihilation,i.e.“Three Removings(Removing capacity,Removing stock,Removing leverage),One Cutting(Cutting cost),One Making up for(Deficiency)”,promote mining recovery with no delay.Firstly,removing capacity,which mainly depends on routes of legitimate bankruptcy,financial subsidy,M&A and restructuring,controlling newly added capacity etc,clean up and rectify already closed-down or soon-to-be-closed-down capacity of high cost mines,shut down rule-breaking and inferior capacity,encourage enterprises to voluntarily verify and reduce capacity,by strengthening supply-side management,comprehensively defuse surplus capacity.Secondly,removing stock,actively cope with high stock situation of primary products.Thirdly,removing leverage,it is required to handle credit default problems according to law,intensify efforts in debt swap,actively prevent risks.Fourthly,cutting cost,help enterprises lower cost,including reducing system-based trading cost,enterprise tax burden,financial cost,electricity price,and logistics cost etc,dish out“a series of combined policies”.Fifthly,making up for deficiency,encourage mining financialinnovation,improve mining financing platform,propel construction of mining capital market,completely make up for deficiency in mining financing difficulty.

Actively cope with the challenge posed by TPP Agreement,plan China’s mining deployment from global perspective.Trans-Pacific Partnership Agreement(TPP)enables the strength of resource powers including US,Canada,and Australia in dominating the global mining pattern to be more powerful,although in the near future it will not affect overseas supply of China’s mining products,from long perspective,TPP Agreement will affect export of China’s industrial products,further affect demand trend of China’s mineral resources,and will impose negative impact on China’s mining industry.To address the global mining reform possibly caused by TPP Agreement,it is required to depart from global perspective when planning China’s mining deployment.Firstly,change the ways of utilizing overseas resources,promote China’s industrial shift toward countries along the“One Belt One Road”route and capacity cooperation,accomplish the change from simple resource development to capacity cooperation and from controlling resources to controlling industrial development.Secondly,unfold mining deployment by revolving around key mineral resource supplying countries around the world,ensure China’s resource supply security,in the future countries like Brazil,Chile,Peru,South Africa and the Democratic Republic of Congo,Zambia will play increasingly important role in global resource supply,it is imperative to make early deployments in these countries,encourage“Walking out”enterprises to join forces,create“Walking out”alliance of mining enterprises Thirdly,revolving around resources needed for the development of national strategic emerging industries,study and formulate“Checklist of national key minerals”,guide state-owned enterprises and private enterprises to engage in related prospecting &exploitation and trade activities,enhance China’s guarantee ability for key minerals.Fourthly,grasp the buyer market opportunity period,centering on pricing right,actively take part in and even dominate structural adjustment in global energy resource governance.

Sternly prevent continual capacity expansion of non-metal mining industry in structural adjustment.Currently,although China’s iron &steel and nonferrous metals mining industries almost are all trapped in loss condition,nonmetal mining(e.g.graphite)industry still has certain profit space.Since capital has intrinsic desire to go after profit,for this reason some iron &steel and nonferrous metals industrial capital switched to investing in non-metal mining industry in structural adjustment,which directly drives forward continual capacity expansion of non-metal mining industry.Up till now,certain iron ore capital has switched to Liaoning for making investment in the construction of a 100,000 t/a graphite product factory,some individual large molybdenum group companies also are organizing early stage survey and argumentation for 200,000 t/a graphite mining investment.If no effort is made to prevent them from penetrating into graphite mining sector,for the graphite market whose original total demand is 500,000 tonnes~600,000 tonnes,capacity surplus will further aggravate.For this reason,it is necessary to sternly prevent other mining capitals from penetrating into non-metal mining sectors such as graphite in the structural adjustment.

Nonferrous Metals Industry Sustained 23% Loss in 2015,95% of Profit Came From Private Enterprises

In 2015,bulk commodity prices fell sharply,but compared to whole-industry loss status of iron &steel and coal industries,nonferrous metals industry is relatively optimistic in terms of operation condition.Wen Xianjun,Vice President of China Nonferrous Metals Industry Association,said at the Bulk Commodity Market Summit Forum on December 20 that from January to October 2015,among 8651nonferrous metals industry enterprises above designated size,1965 sustained loss,the loss percentage is 23%,5.5 percentage points higher than last year;loss amount is 41.3 billion yuan,up by 27.7% on Y-o-Y basis.

It is worth noting that 90% of the industry profit came from private enterprises.In the first 10 months this year,state-owned enterprises recorded a loss of 1.5 billion yuan,the profit of the same period last year was 7.3 billion yuan;private enterprise recorded profit of 104.7 billion yuan,accounting for 94.6% of the whole industry.Judging from asset,assets of private enterprises accounted for over 60%,those of state-owned enterprises accounted for less than 40%.In the income aspect,income of stateowned enterprises accounted for 32% of the industry,income of private enterprises accounted for 61.8%.it can be inferred that the operation efficiency of private enterprises is considerably higher than that of state-owned enterprises.

While upstream mining and smelting steps are experiencing shrinking profit,processing profit bucked the trend to record growth.Judging by different steps,while profits of ore mining &dressing and smelting steps respectively dropped by 26.5% and 37.7%,profit at processing step increased by 6.8% on Y-o-Y basis,profit amount reached 80.3 billion yuan,accounting for 72.6% of the whole.Viewed from the whole industry,in the first 10 months this year nonferrous metals industry recorded total profit of 110.6 billion yuan,down by 7.4% on Y-o-Y basis.Wherein aluminum industry recorded the highest profit share of up to 38.4%,followed by copper,lead and zinc.

The Relation Between Copper Tube Demand and Air Conditioner Production Is Stable

According to monitoring data of heating and ventilation related industrial departments,from January to October 2015,China’s total output of household air conditioners was 93,173,500 sets,up by 8.27% on Y-o-Y basis,from the data we will find it easy to infer:Owing to stable macro environment and healthy development,this year the air conditioner industry experienced overall rebound and recovery,and recorded certain growth compared to the same period last year.

The supply and demand relation of heating &ventilation and air conditioner industry has obvious synchronization feature,in particular the upstream and downstream industrial relation is more prominent.As a result,this year China’s copper tube demand volume maintained comparatively stable corresponding relation with air conditioner output,it can therefore be inferred that the development of air conditioner market directly determines the demand condition of air conditioner copper tube.According to incomplete statistics,by October 2015,total domestic sales of air conditioner copper tube was about 326,000 tonnes,it is expected that whole year domestic demand of air conditioner copper tube industry is about 380,000 tonnes,if this data can be fulfilled,it will mean that the total domestic sales of air conditioner copper tube will grow by about 7% on Y-o-Y basis.

After discussing the market trend of air conditioner copper tube,let’s turn to enterprises on the supplier side.Currently,air conditioner copper tube supply enterprises are mainly distributed among large air conditioner copper tube manufacturers like Jinlong,Hailiang,Albetter,and Luvata etc.According to statistics,Jinlong and Albetter combine to account for about 70% of the domestic air conditioner copper tube market,wherein Jinlong’s domestic sales ranks top,Albetter this year recorded obvious growth in domestic sales.

Overall speaking,the sales of air conditioner copper tube in 2015 recorded significant growth over that in 2014,we also look forward to seeing the sales of air conditioner copper tube will scale a new height.

Competition of central air conditioner copper tube in the Chinese market is relatively mature,as industry competition continued to intensify,big brand enterprises in the industry continued to grow,the industry is expected to evolve toward oligopoly direction.

Some small and medium sized manufacturers of air conditioner copper tube are striving to catch up,many refrigeration equipment manufacturers have also joined the ranks of air conditioner copper tube manufacturers.Since 2012,with the expansion of market share by frontline brands,some small brands were forced to exit the market,price war of low-end products no longer suited the trend of market development;competition strategies such as improving product quality,focusing on developing new products,and developing mid to high-end models to lift price have become key measures for condenser/evaporator manufacturers to win the market,and guarantee profit.At present,competition of central air conditioner copper tube industry has returned from pure price competition to overall competition covering brand,technology,quality,scale,and management.

At present,the technology standard of air conditioner connection tube industry is comparatively mature,technology development is mainly manifested in expansion of product technique structure and product functions as well as substitution of product materials.Technology competition of domestic air conditioner connection tube enterprises is mainly concentrated on frontline brands,however,since China’s production technology is still at the stage of following European and American enterprise in core technology aspect such as design &development of new material/new technique products and automated production,overall speaking there is lack of innovation,only that different manufacturers have certain technology advantages in different fields.In future development,if domestic air conditioner &refrigeration copper tube enterprises want to truly become international manufacturers,technology competition must develop toward core technology and high technology directions.

Amer Offered Cooperation to Propel Transition &Upgrading of Chenzhou Nonferrous Metals Industry

On January 8,Chenzhou Municipal People’s Government formally signed framework agreement for strategic cooperation with Shenzhen Amer Group.After the agreementsigning ceremony,representatives from both sides including Wu Guanyi,Vice Chairman of the Board of Amer Group and President of Global Resource Committee,and Qu Hai,Deputy Secretary of CPC Municipal Committee and Mayor,together received interview from the media.

Chenzhou is the hometown of China’s nonferrous metals,after making efforts through“Mine Rectification”,“Resource Integration”,and“Nonferrous Metals Five One Strategic System”construction,nonferrous metals industry becomes the first industrial cluster topping 100 billion yuan in Chenzhou.However,up till now its resource advantage has not yet truly developed into industrial advantage,in the face of the market,“selling ore”and“selling ingots”are destined to make it a slave of others.

Wu Guanyi said,Chenzhou’s current resource advantages are scattered,Chenzhou’s nonferrous metals resources are like pearls scattered in a river bed,though each pearl has no big value,the mission of Amer Group is to pick up these pearls one by one,string them up,and turn them into pearl necklaces,in this way its value and gold content would be vastly different.

According to contents of the signed framework agreement for strategic cooperation,Amer Group will register with exclusive investmentto set up company in Chenzhou Hi-tech Zone,construct Chenzhou precious and rare metal industrial supply chain system project.This project takes root in the construction of supply chain system for nonferrous metals industry,and provides platform support to integration,transition &upgrading of Chenzhou’s nonferrous metals industrial resources.The project involves a total investment of 1.5 billion yuan,after completion it can fulfill annual turnover of over 15 billion yuan,and annual tax revenue of over 300 million yuan.

In addition,Amer Group will also build Global Mineral Resource Trading Center and Mineral &Gem Industrial Park Project in Chenzhou Hitech Zone.The Global Mineral Resource Trading Center Project is committed to building international mineral resource trading center,financial service center,and trade settlement center,aiming to push forward Chenzhou’s convention &exhibition economic development;the Mineral &Gem Industrial Park mainly focuses on invigorating precious metal(such as gold and silver)processing trading and mineral &gem &jade processing trade,planning to develop 100 billion yuan grade industrial cluster conglomeration scale in around 5 years time.

Qu Hai pointed out that through cooperation with Amer Group,it is expected to expand and strengthen Chenzhou’s nonferrous metals deep intensive processing,gem industry,convention &exhibition industry and global resource trading.We must take advantage of this cooperation,intensify efforts in business invitation and investment attraction,propel extensive external economic cooperation,cultivate new growth points,and push forward Chenzhou economy to get off to a good start in the“Thirteenth Five Year Plan”period.

600,000 t/a High-Precision Aluminum Project of Yulian Group was Completed

On January 11,Yulian Group 600,000t/a highprecision aluminum project was completed and launched into production,and entered production stage.It has been learned that,the production launching of this project signaled that Yulian Group became China’s first aluminum alloy new material enterprise group with complete industrial chain in coal power aluminum deep processing in the true sense.

Since 2008,Yulian Group began to plan industrial transition &upgrading,and phased out all outdated capacity,suspended expansion of electrolytic aluminum scale,continually improved industrial chain,increased investment in technological innovation,went all out to propel traditional industry to transition and develop toward deep processing,new material,and high-grade,precision and advanced fields.In the Top 100 Henan Enterprise 2015,Yulian Group ranked 16th,with 23.262 billion yuan of operating income.

The high-precision aluminum project of this enterprise is a milestone project signaling transition &upgrading of the current aluminum industry in Henan Province and even China.The key equipment introduced aluminum processing production lines from German SMS Siemag and Siemens,up till now this project’s smelting and casting production line,1+4 hot rolling production line,cold rolling production line have finished commissioning,and will all reach design capacity in 2016.

It has been learned that in 2015,Yulian Group sold nearly 200,000 tonnes of high-precision aluminum products.In order to promote transition of Yulian Group,the state government and Henan Province both offered corresponding policy support:Giving big user directly purchased power new model to Linfeng Aluminum &Power,a subsidiary of Zhongfu Industrial Co.,Ltd,the electricity usage cost was greatly reduced.

Up till now,financial institutions like Industry and Commercial Bank of China,China Construction Bank,and Agricultural Bank ofChina have changed the industrial label of Zhongfu Industrial co.,Ltd,a subsidiary of Yulian Group,from“electrolytic aluminum industry”to“nonferrous metals manufacture industry”,signaling in the future the company is no longer a“Two High One Surplus”(high pollution,high energy consumption and capacity surplus)enterprise,instead it is now a deep processing,high-precision aluminum,and new material enterprise.

After the high-precision aluminum project reaches design capacity,it will become Yulian Energy’s new profit growth points,after Linfeng Aluminum &Power implemented direct purchase electricity price cut,it can save 180 million yuan of electricity fee throughout the whole year,after capacity increase &upgrading of power generation business,it can add extra 54 million yuan of profit.In 2016,Yulian Group plans to manufacture 700,000 tonnes of aluminum products,existing primary aluminum will all be subject to local conversion as raw material for aluminum deep intensive processing products,thus accomplishing the transition to an aluminum deep intensive processing enterprise.

Refined Copper Production by Province or City in 2015 Unit:metric ton

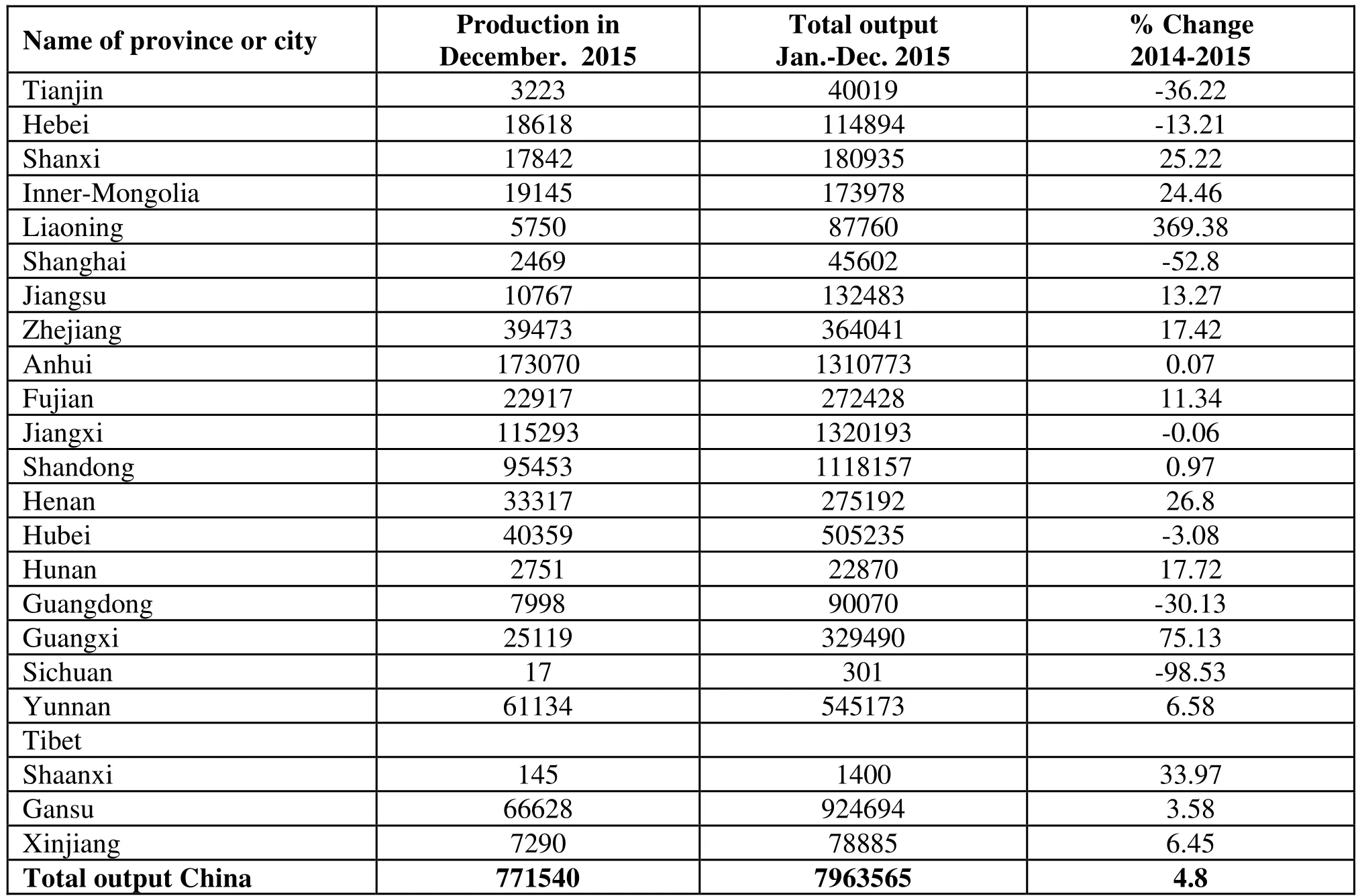

Tin Production by Province or City in 2015 Unit:metric ton

Aluminium Production by Province or City in 2015 Unit:metric ton

Alumina Production by Province in 2015 Unit:metric ton

Lead Production by Province or City in 2015 Unit:metric ton

Magnesium Production by Province in 2015 Unit:metric ton

Nickel Production by Province or City in 2015 Unit:metric ton

Production of the Ten Major Nonferrous Metals in 2015 Unit:metric ton

Fabricated Copper Production by Province or City in 2015 Unit:metric ton

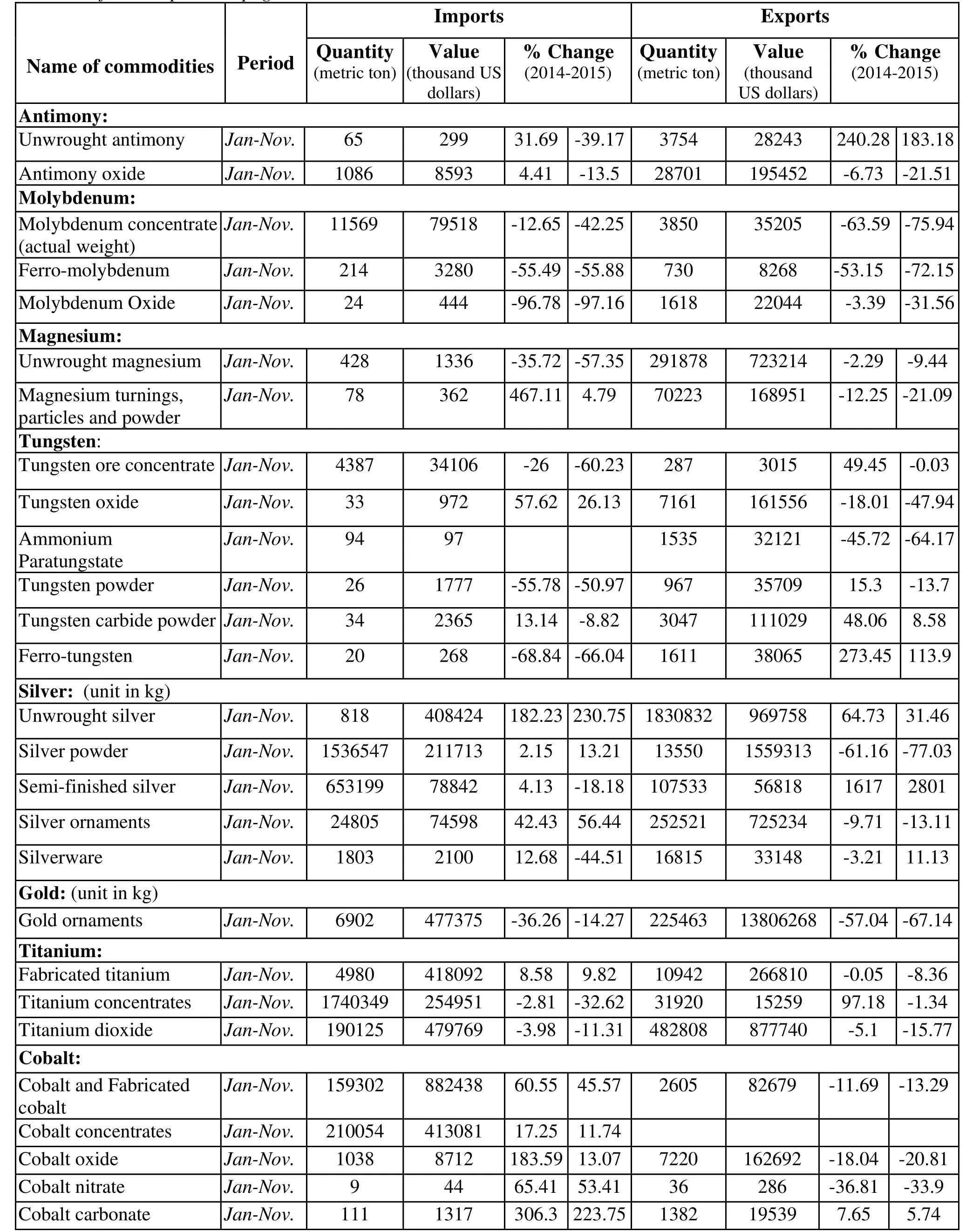

China’s Major Non-ferrous Metals Imports &Exports(End of November.2015)

Continued from the previous page

Zinc Production by Province in 2015 Unit:metric ton