Refueling China’s Econ

2016-03-22ByDengYaqing

By+Deng+Yaqing

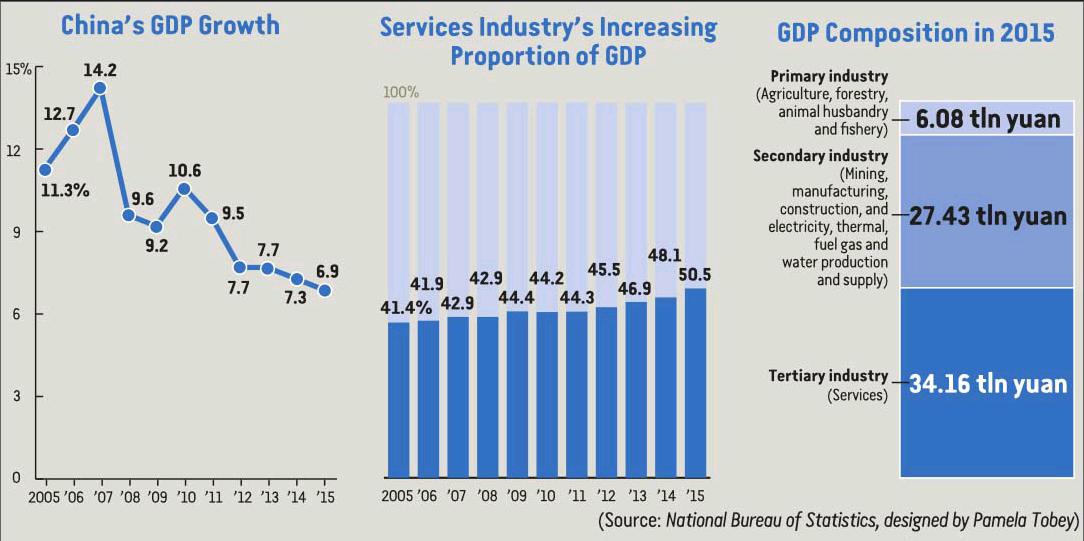

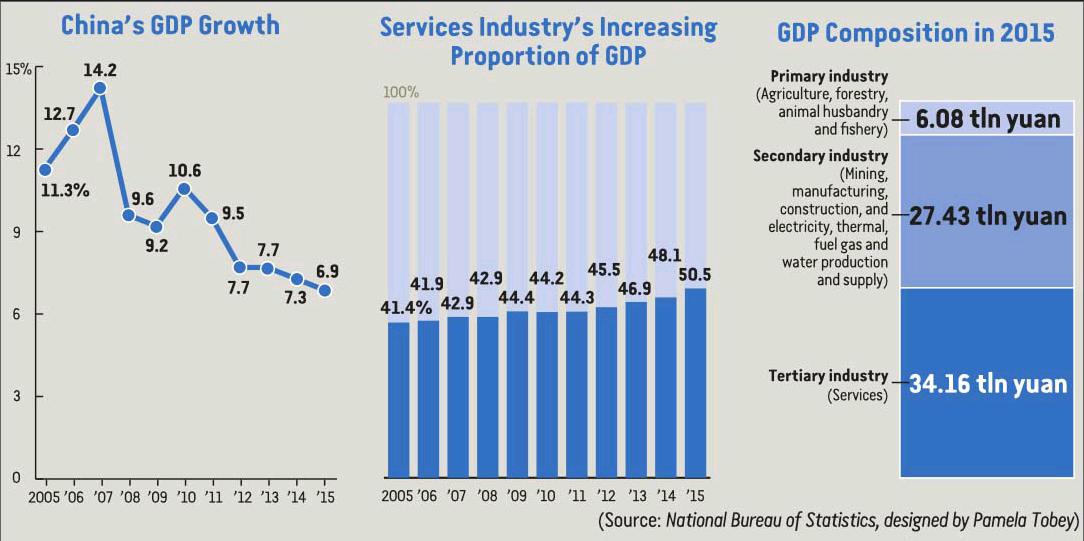

After falling below 7 percent in the third quarter of 2015, economic growth in the worlds largest developing country stumbled once more to 6.8 percent in the fourth quarter, dragging annual expansion in 2015 down to 6.9 percent, the slowest pace within 25 years.

“Economic growth is still within a reasonable range in 2015, with its structure further optimized, transformation and upgrading accelerated, new growth drivers strengthened and peoples livelihoods improved,”said Wang Baoan, Commissioner of the National Bureau of Statistics (NBS). Wang also recognized that China still faces troublesome challenges such as a complicated external environment, ongoing domestic structural reform and so on.

Yao Jingyuan, a research fellow at the Counselors Office of the State Council, argued that the 6.9-percent growth is a hardearned achievement, as opposed to the 2.4-percent growth recorded by the global economy, of which, 25 percent was contributed by China.

“Its still in line with the official target of around 7 percent for the year,” said Yao, stressing that what really matters is to ensure that the economic fundamentals, structural changes, transformation of growth patterns and growth quality are all positive. Yao claimed that significant progress had been made on those fronts last year.

Highlights

A structural change to the economys growth engine is underway, as indicated by the value-added output of the service industry, which accounted for 50.5 percent of the total. The figure marked a year-onyear increase of 2.4 percentage points, and was 10 percentage points higher than that of the manufacturing industry, according to statistics from the NBS.

“In the future, economic growth will be more dependent on the service industry,” said Pan Jiancheng, Deputy Director of the China Economic Monitoring & Analysis Center. Pan suggested that the trend should be properly encouraged, and that beneficial interactions should be established between the service and manufacturing industries.

For one thing, the expansion of the service industry is a prerequisite for economic structural upgrading. For another, its in line with the law of economic growth—the proportion of the service industry always rises remarkably throughout mid- and post-industrialization, according to Wang.

Consumption contributed 66.4 percent to economic growth, 15.4 percentage points higher than that in 2014, reflecting strong support from the domestic market for the countrys economy.

Meanwhile, per-capita disposable income surged 7.4 percent in real terms, outpacing GDP growth, with that of rural and urban residents going up by 7.5 percent and 6.6 percent, respectively.

Since Chinas economy is still within reasonable range, employment figures turned out to be satisfactory while the cost of labor has been rising steadily. People witnessed a rapid increase of property incomes and the minimum wage standards in many regions were elevated, which worked in tandem to give a leg up to the growth of resident income, said Zhu Baoliang, Director of the Forecast Department of the State Information Center.

Aside from that, the rapidly expanding service industry absorbed a larger workforce, but at the same time, the working-age population is dwindling, which combined to stabilize employment, said Zhu.

In addition, Chinas Gini coefficient, an index measuring the gap between the rich and poor stood at 0.462 in 2015, according to the NBS. A coefficient of “zero” represents perfect equality—conversely, scoring a “one” depicts complete inequality. That marked the seventh year in a row of drops.

The consecutive decrease indicated that reform measures targeted at optimizing income distribution have taken effect, said Li Shi, President of the China Institute for Income Distribution at Beijing Normal University, adding that the narrowed gap is also partly attributed to the current economic slowdown.

As the labor shortage continues to decrease, and wages for ordinary workers keep going up, the income gap will be further narrowed in the future, Zhu noted.

Industrial enterprises value-added output was up 6.1 percent in 2015, a slower pace than the 8.3 percent registered in 2014, according to the NBS. “Slowing industrial growth will undoubtedly affect Chinas economy. However, such a phenomenon is quite normal against the context of structural adjustments and the implementation of the innovation-driven strategy,” said Wang. For example, the dramatic slowdown of high energy consuming industries is a requisite to the solution of resource and environmental problems. An economic slowdown would also make green development viable, and precipitate the upgrading of the industrial structure.

In stark contrast to that, the value-added output of the hi-tech industry soared 10.2 percent, 4.1 percentage points faster than the growth of total industrial value-added output, accounting for 11.8 percent of the total.

It was a reflection of the robust development of emerging industries, new industrial patterns, and business models, signifying the gushing vitality of the market, claimed Wang. For instance, online sales of physical commodities surged 31.6 percent last year, far exceeding the overall growth of retail sales of consumer goods.

Beyond that, energy consumption per unit of GDP was reduced by 5.6 percent, justifying the nations efforts and input in promoting green and sustainable development and breaking the bottleneck of resources and environment.

Heading for stable growth

In part because Chinas economy is embroiled in a complicated and constantly changing situation, there is a possibility of its slowing down even further amidst the supply-side structural reform. Even so, the chances are that stable growth will be maintained in 2016, said Wang.

Cai Zhizhou, a professor from the School of Economics at the Peking University, argued that the quality of economic growth is improving, and the economic structure is being adjusted. Though the situation is tough, existing problems are gradually being ironed out, and the economy is likely to maintain a steady pace of growth.

As Chinas economy keeps expanding, population dividend wanes, and structural re-form is pressed on, it comes as no surprise to shift from a high gear to a slower gear, stated Zeng Gang, Director of Institute of Finance and Banking at the Chinese Academy of Social Sciences.

Exports and imports totaled 24.58 trillion yuan ($3.74 trillion) in 2015, down 7 percent year-on-year, casting a gloomy light on the economys external factors. Nonetheless, Chinas export model is still upgrading, and the nations growth potential lies primarily in its domestic consumption, said Cai.

Micro-control policies and reform measures that have been adopted will continue to play a role in stabilizing growth, said Zhang Liqun, a research fellow from the Development Research Center of the State Council, pointing out that robust consumption, a recovering housing market and possible rebound of investment spurred by the reform on investment and financing system will facilitate stable growth in days to come.

Structural reform

What does supply-side structural reform actually entail, and how will it bolster the Chinese economy? Strategically, the econ- omy should continue growing at a proper pace and with adequate momentum while simultaneously ensuring stability. Tactically, the efforts undertaken by the government need to be divided in five ways: cutting excessive industrial capacity, lowering financing cost for companies, destocking housing inventories, financial de-leveraging and improving weak links to increase effective supply.

To complete the five tasks, efforts need to be made in linking the supply side with the demand side, accurately identify, predict and eliminate risks, innovate and improve policy instruments available, said Zeng Peiyan, Chairman of China Center for International Economic Exchanges.

A regulation mode balancing effective supply with effective demand should be established to get rid of structural surplus as well as the shortage of high-quality products with value-added. The cost of labor, capital, land, energy and logistics should all be lowered to provide momentum, and an environment conducive to supplyside structural reform. Also, investment in infrastructure should be diverted to human capital, innovative research and develop- ment, said Zeng Peiyan.

To promote the quality and efficiency of economic growth, the supply-side reform should be pushed forward to boost innovation and total factor productivity, shift dependence from factor input to scientific and technological progress and improvement of labor quality. Additionally, demandside reform such as household registration reform should be advanced to expand domestic consumption and encourage spending, said Zhuang Jian, senior economist from Asian Development Bank (China).

Economist Liu Shijin believes that a core problem faced by supply-side structural reform is to smooth the flow, reorganization and optimization of economic factors. Therefore, the misallocation of those factors resources should be corrected to enhance the quality and efficiency of the whole supply system.

“Given that overcapacity in the iron and coal industries is the most severe and many state-owned enterprises are involved, the next step should be further deepening state-owned enterprise reform,” said Liu.