The TPP and the Chinese Economy

2016-01-19ByXIANGANBO

By+XIANG+ANBO

THE Trans-Pacific Partnership (TPP), with its ambitious core objective of trade liberalization characterized by comprehensively advanced standards in all areas, has polarized international attention. Upon conclusion of negotiations, the TPP becomes the worlds largest free trade zone, and so considerably influences the current restructuring of international trade rules and reforms to global economic governance. It moreover has direct impact on China.

TPP Affects World Economy

TPP negotiations embrace almost all issues pertaining to 21st-century major international trade rules. Its members include the U.S. and Japan, the worlds largest and third-largest economies. The combined population of all 12 TPP countries totals 800 million. Taken as a whole, it generates a total GDP of US $3 billion, or 40 percent of the global total, and accounts for 50 percent of world trade and 30 percent of global ODI. The TPPs huge economic volume and open, expansive, advanced mode of regional integration will have significant and far-reaching influence on both Asia-Pacific economic cooperation and the entire global economic pattern.

At the regional level, the TPP is conducive to promoting in-depth development of economic and trade relations among member states, and also economic cooperation and integration in the Asia-Pacific region. At the global level, the TPP agreement will greatly influence the restructuring of current international trade rules and the reform of global economic governance. More importantly, it will exert economic checks on the governments of its member states, so invigorating the private sector and hastening the achievement of a flattened, multi-polarized and liberalized world.

It must be remembered, however, that the TPP is a regional trade agreement applicable specifically to the Asia- Pacific. Therefore, it must also deal and form relationships with other influential free trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) and the Free Trade Agreement of the Asia-Pacific (FTAAP).

Negative Impact on China

Negative consequences of Chinas exclusion from the TPP undoubtedly exist.

Firstly, diversion of trade and investment by virtue of the TPP will have certain negative impact on the Chinese economy; it will affect Chinas foreign trade, and its advanced standards will also send shockwaves through the current trade system and rules. On the other hand, this will propel further opening-up of Chinas various markets. However, the TPPs Rule of Origin will squeeze Chinas export market and shrink its FDI, thus inflicting harm on Chinas economy. Relevant studies show that, generally speaking, the TPP will be detrimental to Chinas mainland, bearing in mind that the majority of Chinas businesses have yet to complete their restructuring and upgrading, as well as to Taiwan and Hong Kong.endprint

The results of the Peoples Bank of China research teams model stimulation imply that unless China joins the“Greater TPP” (a future TPP agreement among 16 member states, including China, South Korea, Thailand, and Indonesia), it will lose 2.2 percent of its GDP. Should there be a transitional TPP period of four years, the annual opportunity cost will be slightly above 0.5 percent of GDP. The conclusions of a similar research model by another group of economists headed by Peter A. Petri imply that if China were to join the TPP, by the year 2025 the global income would grow by US $1.46 trillion, of which China would generate US $891 billion – about 60 percent.

Second, the TPP will affect Chinas position in the regional economy. The core of Chinas regional economic cooperation strategy lies in its peripheral areas. The TPP will probably affect the East Asian integration progress, of which China is a part, and delay Chinas implementation of its FTA strategy. This will, to a certain extent, influence trade between China and other East Asian economies. There is also a risk that it will bog down the Asian regional economic cooperation effort with the “10+X” at its core.

Endurable Pressure

In the short term the TPPs pressure on China is bearable.

This is due to the TPPs intrinsic flaws, and to the size and global influence of Chinas economy, although the agreement will at the outset likely exert pressure on the countrys economy.

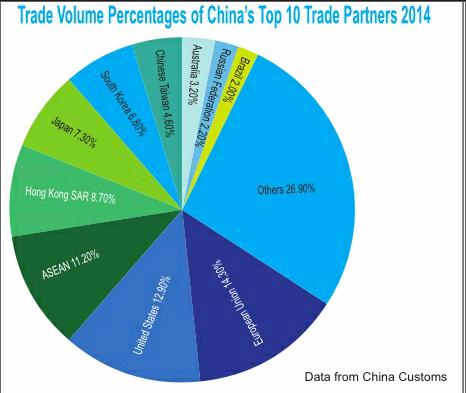

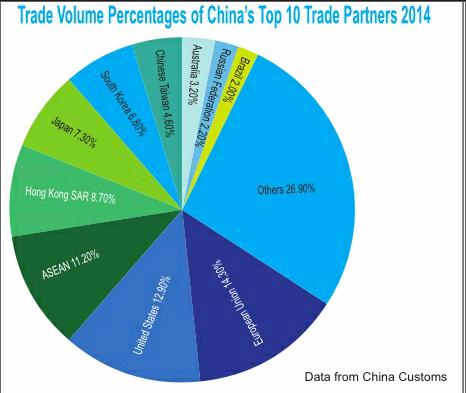

First of all, the barely nascent TPP is far from achieving its objectives. There are different voices from member states within it, while objections resound outside from the countries it undermines. Second, an incomplete industrial system, especially without Chinas participation as regards labor-intensive products, will make it difficult for the TPP to meet its trade demands. Third, China is proactively developing bilateral and multilateral free trade both with the TPP countries and other major economies. The overlapping contents of Chinas bilateral and multilateral agreements with TPP countries mean that it can, by indirect trade through an indirect country, partially alleviate pressure brought to bear by the TPP. Finally, among Chinas top 10 trade partners, the EU, South Korea, Hong Kong SAR, and other non-TPP emerging markets constitute a large proportion.

In a nutshell, the TPP is a set of trade rules within the free trade system. Although it presents China with challenges, it is not necessarily an insurmountable obstacle on Chinas development path. As the worlds secondlargest economy, China will not be excluded from the global free trade system. The country needs to remain calm, adapt to changes, and improve its economic governance, management, and trade rules. The TPP could thus be helpful to Chinas restructuring and transformation of its growth model.endprint

Adapt to Change

China needs to adapt to changes that the TPP has brought about, and use it to deepen reform and expand opening-up.

Joining the TPP would effectively expand Chinas exports. An early entry would also give it the upper hand as regards setting the rules. Under the current political and economic framework, however, China can hardly meet the advanced TPP standards in such areas as labor rules, environmental protection, IPR, and SOEs. For these reasons, rather than that the TPP poses any real threat, now is not the best time for China to join. China should nevertheless make proactive preparations for its TPP entry, and adapt to the array of changes the agreement has created. The TPP rules in fact accord with Chinas efforts towards economic restructuring, transformation of its growth model, and deepened reform. By adapting, China can in turn further its reform and opening-up through the TPP.

Domestic demand has always been a main force behind Chinas economic growth. In 2014 the countrys total retail sales of consumer goods grew by 12.0 percent year-onyear, and domestic consumption contributed 51.2 percent to GDP growth. Domestic policy dictates that expanding domestic demand is the fundamental solution to overcoming the TPPs negative impact, and that China changes its long entrenched export-driven growth model.

China should also accelerate its talks on bilateral free trade agreements, on implementation of the Belt and Road Initiative, and on the building of the free trade zone, all of which will offset the negative impact of the TPP. As to regional interaction, China should promote cooperation with Japan and South Korea, and facilitate talks on the China-S. Korea/China-Japan-S. Korea free trade zones. In the meantime, China should uphold the“10+X” as a basis for East Asian joint action, bring into play the effectiveness of regional teamwork, and promote comprehensive economic cooperation between China and the ASEAN free trade zone, as well as across East Asia. The country must deepen substantive and functional cooperation in various fields, and ensure there is no interruption of East Asias integration process.

More attention should also be paid to Americas “Pivot to Asia” strategy. In this regard, China should strengthen communication and dialogue with the U.S. on regional cooperation and enhance policy transparency, seek consensus, and manage differences.endprint