Pig Price Fluctuations and Forecasting Model Based on Information Platform

2016-01-12

Jiyang College of Zhejiang A&F University, Zhuji 311800, China

1 Introduction

Pig breeding industry as the largest livestock industry has an important position in the national economy. Pig has a direct impact on pig price and even CPI. It also directly affects people’s daily life, and even the healthy running of the overall macroeconomy. Therefore, pig demand forecast becomes particularly important. Pig industry has developed rapidly, and the changes in pig price are the focus of attention, so the price fluctuations in pig market have become a hot spot of scholars’ studies. Since the purchase of pig by state quota was canceled, the purchase and sale market was opened and multi-channel management was implemented in 1985, the pig price has presented obvious cyclical fluctuations under the market law, greatly affecting farmers’ enthusiasm for production and restricting the development of the pig industry. The current studies on pig price are mainly focused on the price relationship between pigs and other agricultural products, pig production cycle, and pig inflation. Based on the information released by Bureau of Statistics and Bureau of Agriculture, analyzing cyclical fluctuations in pig price and the influencing factors, and establishing price forecasting model, is an important measure to achieve sustained and stable development of the pig industry. At first, this paper reviews the cyclical fluctuations in pig prices, and analyzes the main factors affecting fluctuations, then uses relational analysis, time series analysis and multiple regression model for empirical analysis of each factor to identify the influence of the factors and establish price forecasting model, and finally establish forecasting model information platform.

2 Cyclical fluctuations in China’s pig price

From 1990 and 2015, the pork price in China’s market showed an overall upward trend, and there were great price fluctuations in 1995 and 2007. From 1990 to 1994, the total output of pork exhibited an upward trend, lowering the pork price in market, and oriented by price, the farmers raised fewer pigs. In 1995, China’s pork production showed a clear downward trend. The reduction of pork production led to a rise in pork price. In 1996, China’s pig production rebounded, and reached the raising level in 1994. Driven by this passion for farming, China’s pig production gradually increased from 1996 to 1999. In 2000, it began to gradually decrease, and continued into 2006. Due to weak pig production for many years, the pork market price started to rise. In 2007, China’s pork production gradually rose, and continued into 2011. In 2013, the overheated pig development situation was contained, but generally speaking, pork production was still on the rise. Fluctuations appeared during 2006-2008, and then there was an upward trend. On the whole, China’s pork production is stable, but in a handful of years, there were great fluctuations in pork production. The fluctuation was largest from 1994 to 1995, reaching more than 30%, and the fluctuation was large in 1993 and 2006, but it was controlled at 10% to 30%.

3 The factors affecting pig price

(i) Income level. When the income level rises, the high-income groups will have a low demand for pork, followed by the middle-income groups. For the low-income groups, they have a huge consumer demand for pork, and the income elasticity of demand is greater than 0. (ii) Substitute price. The beef, pork and mutton price changes greatly affect pork price changes. When beef and mutton prices rise, people will be more inclined to buy pork, which also makes the price of pork increase. (iii) Plagues and natural disasters. Due to the impact of plagues and natural disasters, people dare not buy pork, which can greatly reduce the price of pork. Plagues not only affect the demand for pigs, but also profoundly affect the supply of live pigs. The "SARS" in 2003 completely reduced the supply of pork; the Streptococcosis suis in Sichuan Province in 2005 eroded farmers’ confidence in pig production; the pig high fever which happened in many regions during the summer of 2006 led to a large number of dead pigs, further reducing the number of raisers. (iv) Input price. The changes in maize and soybean prices play the main role. Maize and soybeans are the main foodstuff for pigs, and when the maize and soybeans are reduced, pig price will also be reduced. (v) Piglet price. Piglet price primarily affects production costs accounting for about 30% of total pig breeding costs, so piglet price fluctuations will lead to pork price changes. However, the piglets have a four-month fattening period, so relative to piglet price, there is a lag in the current pig price. By the relational analysis of pig price and the piglet price with 4-month lag, 3-month lag and 2-month lag, and current piglet price, it can be found that the correlation coefficient between pig price and current piglet price is highest, which means that their mutual influence is largest. (vi) Labor costs. As rural migrant workers increase and pig raisers decrease, working outside hometown reduces the leisure time, thereby increasing labor cost for raising pig and leading to pig price increase. (vii) Expected pig price. The pig in market price is "economic man". If people are optimistic about the expected pig price and find it profitable, pig raisers will increase, thereby reducing pig price. The decreasing pig price reduces the profit of pig raisers, thereby changing the pig expectation.

4 Empirical analysis

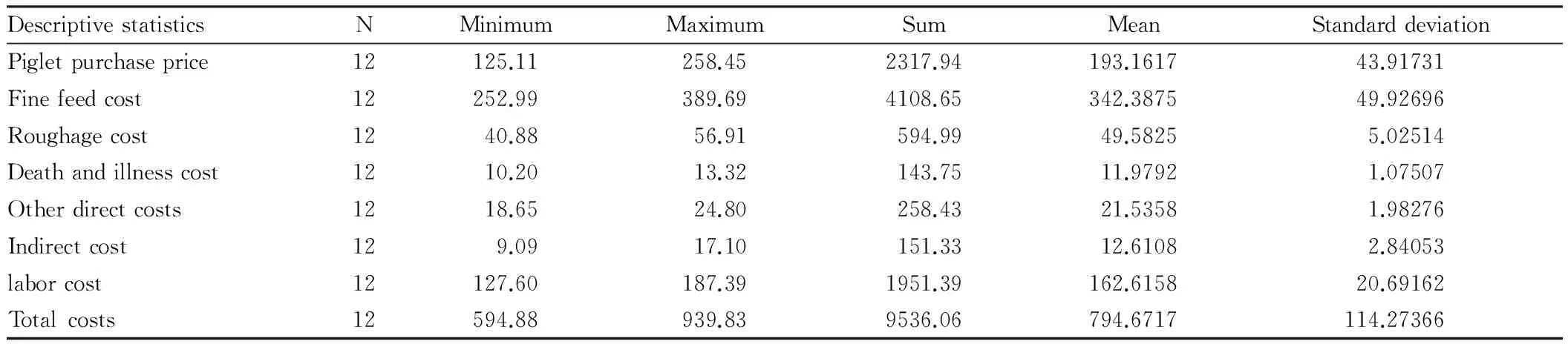

4.1AnalysisofthefactorsaffectingproductioncostsAfter descriptive statistics analysis, fine feed cost occupies the largest share in the total pig production costs (Table 1). The correlation coefficient between fine feed cost and total costs is highest, reaching 97.8%, that is, fine feed cost has a significant impact on the fluctuating total pig production costs. Now we focus on analyzing the impact mechanism of fine feed. The main fine feed for pig is maize, so the maize price directly affects pig price. Therefore, we are looking for a model between pig production benefit and maize cost for analysis. For simplicity of the study, the pig price includes maize price and fixed input price. LetAbe pig product,emaize input factor and k fixed price input factor, we get:

A=G(e,k)

(1)

Based on the profit maximization principle of pig producers, assuming thatHis pig producers’ benefit, andare pig pricePaandPbmaize input factor price, respectively, we get:

Hmax=PaA-Pbe

(2)

According to utility theory and production theory in microeconomics, we get:

(3)

By using Equation (3), the optimal function of maize input factor is as follows:

(4)

By putting Equation (4) into Equation (2), we can get pig operators’ best return:

(5)

From Equation (5), it is found that the pig operators’ best return is the function of ratio of maize input price to pig input price, and subject to the constraints of other inputs. In recent years, with gradually increased use of maize in industry and human diet, the maize price has increased, thereby increasing the pig production costs.

Table1Descriptivestatisticsaboutthefactorsaffectingproductioncosts

DescriptivestatisticsNMinimumMaximumSumMeanStandarddeviationPigletpurchaseprice12125.11258.452317.94193.161743.91731Finefeedcost12252.99389.694108.65342.387549.92696Roughagecost1240.8856.91594.9949.58255.02514Deathandillnesscost1210.2013.32143.7511.97921.07507Otherdirectcosts1218.6524.80258.4321.53581.98276Indirectcost129.0917.10151.3312.61082.84053laborcost12127.60187.391951.39162.615820.69162Totalcosts12594.88939.839536.06794.6717114.27366

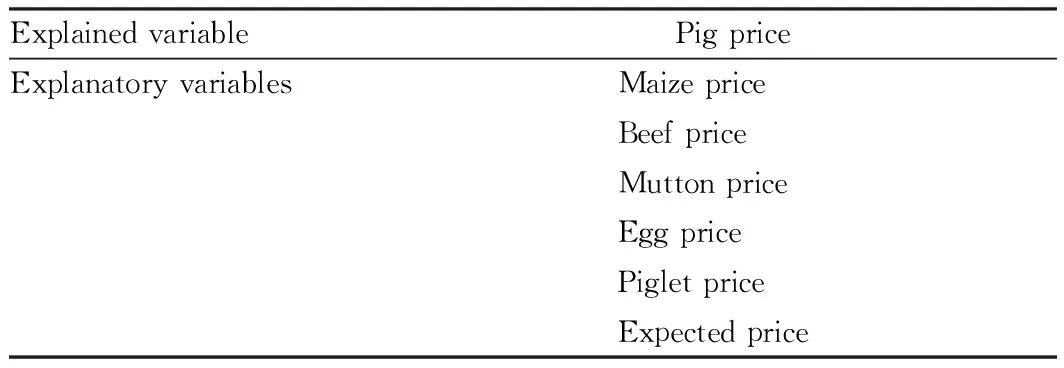

4.2RegressionanalysisofpigpriceIn this paper, we mainly use the national average pig price data during 2001-2015 for analysis. The pig demand factors and supply factors affect the pig price fluctuations. According to the characteristics of pig industry, the factors affecting pig price are divided into two categories. (i) Feed price and expected price. The data about the two are selected. (ii) Substitute price. We choose maize price, beef price, mutton price and egg price for a series of relational analyses. We use the piglet price in different years to reflect the adult sow changes, and use the maize price in different years to reflect the feed price changes. Maize price, beef price, mutton price and egg price can reflect the substitute changes (Table 2). The specific form of model is as follows:

y=a+b1x1+b2x2+b3x3+b4x4+b5x5+b6x6+z

whereyis pig price;ais the constant term;xi(i=1~6) represents maize price, beef price, mutton price, egg price, piglet price and expected price, respectively;zis the random disturbance term.

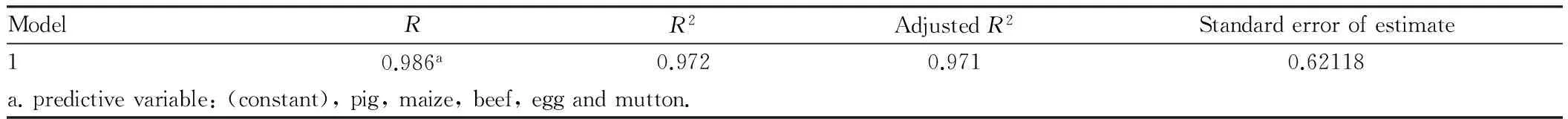

Referring to the relevant literature, it is found that the correlation coefficient of expected price is generally 0.16-0.20, and here it is set to 0.18. By the variance analysis of regression model, it is found thatFvalue is 967.279 and significance probability is 0.000, less than 1%, indicating that the data are relevant (Table 3). WhenR2is closer to 1, the goodness of fit of regression model will get better.R2is 0.986, indicating that the above factors can explain 98.6% of pig price changes, so these factors can basically explain the pig price changes. By substituting the coefficients in B column of non-standardized regression coefficients in Table 4 into the above formula, we get the forecasting equation:

Table2Explanatoryvariablesofpigprice

ExplainedvariablePigpriceExplanatoryvariablesMaizepriceBeefpriceMuttonpriceEggpricePigletpriceExpectedprice

Table3Modelsummary

ModelRR2AdjustedR2Standarderrorofestimate10.986a0.9720.9710.62118a.predictivevariable:(constant),pig,maize,beef,eggandmutton.

Table4Regressionanalysis

CoefficientaModelNon-standardizedcoefficientBStandarderrorStandardizedcoefficientTrialversiontSig.1(constant)-0.5250.370-1.4190.158Maize-1.0480.543-0.119-1.9290.056Beef0.0150.0390.0370.3950.693Mutton0.0400.0370.1091.0840.280Egg0.8600.1330.3746.4640.000Pig0.3180.0140.62322.6490.000a.dependentvariable:pig.

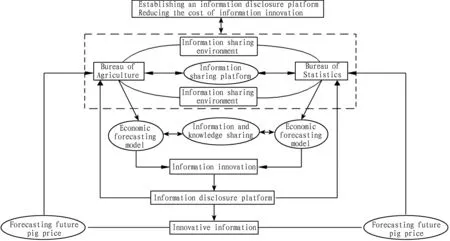

5 Model importing

The economic forecasting model for pig price fluctuations is imported into the information platform of Bureau of Agriculture or Bureau of Statistics, and the information sharing platform is established, as shown in Fig. 1.

Fig.1Informationsharingplatformregardingeconomicforecastingmodelforpigprice

6 Conclusions and policy recommendations

6.1ConclusionsThis paper makes a statistical analysis of the influence of price fluctuation in the pork market on China’s pork production, and finds that China’s pork production shows a general trend of fluctuations due to the impact of price factors. (i) The five variables finally determined have a great impact on pig price, and the confidence level is high, so it can be concluded that China’s pig price fluctuations are largely caused by these factors. (ii) The partial regression coefficient of each influencing factor determines the influence of this independent variable on the dependent variable (pig price). The greater the absolute value of coefficient, the greater the weight, the higher the degree of influence of this factor on pig price. (iii) Among all partial regression coefficients, the corresponding coefficient in egg price reaches a maximum, much higher than the parameter values of other variables. This shows that production costs have the greatest impact on pig price, and for each additional unit of egg price, pig price will increase by 0.86 units in theory. (iv) The regression coefficient of maize price is -1.048, the only one negative value. It is easy to imagine that many farmers predict that the pork price will rise, accumulate a lot of maize and expand the scale of breeding. After the pigs are ready for slaughter, there is oversupply, resulting in pig price decline.

6.2PolicyrecommendationsBased on pig price fluctuations, it is necessary to increase efforts to support pig production, and play the role of market mechanisms and government regulation in promoting breeding pattern change and improving large-scale and intensive breeding; establish a sound early warning system and improve risk prevention capacity; improve pig industrial chain management, establish pig disease prevention system, and build a good pig production system and regulatory system to realize pig brand management.

[1] ZHANG C, LUO Q, YU ML. Economic explanations on fluctuation of pig price in China [J]. Chinese Agricultural Science Bulletin, 2013, 29(17): 1-6. (in Chinese).

[2] ENGEL B, LAMBOOIJ E, BUIST WG,etal. Lean meat prediction with HGP, CGM and CSB-Image-Meater, with prediction accuracy evaluated for different proportions of gilts, boars and castrated boars in the pig population[J]. Meat Science, 2012,90: 338-344.

[3] THOLEN E, BAULAIN U, HENNING MD,etal. Comparison of different methods to assess the composition of pig bellies in progeny testing [J]. Journal of Animal Science, 2003, 81(5):1177-1184.

[4] HAO M, CHEN R, FU XH. Effect of pig price volatility on Sichuan pig farmers’ behavioral response in China [J]. Journal of Agricultural Science, 2014, 6(4):55-67.

[5] LIU X. Thinking on the abnormal fluctuations of the price of live pigs [C]. Haikou: Chinese Pig Industry Development Conference,2006-08. (in Chinese).

[6] LV J, QI Y. Economic analysis on the cyclical fluctuations of price in the pig market [J]. Problems of Agricultural Economy, 2007,28(7):89-92.(in Chinese).

[7] QI Y, LV J, SONG LX. Economic analysis of fluctuations in the price of live pigs [J]. Chinese Journal of Animal Science,2007,43(2):31-35.(in Chinese).

[8] NING YL, QIAO J. Influence of price fluctuation and cause of swine industry in China [J]. Chinese Journal of Animal Science, 2010: 46(2): 52-56. (in Chinese).

[9] LV J, QI Y. Economic analysis on the cyclical fluctuations of price in the pig market [J]. Problems of Agricultural Economy,2007, 28(7): 89-92. (in Chinese).

[10] LIANG G. Factors affecting the price fluctuation of live pigs in China [J]. Contemporary Animal Husbandry, 2011(1): 1-2. (in Chinese).

[11] ZHOU FM, LIAO Y. Evaluation on the the price fluctuation of live pigs in China and its regulatory policies [J]. Hunan Social Sciences, 2012(1): 156-160. (in Chinese).

[12] QI Y, SONG LX. An empirical analysis on the live hog price fluctuation influencing factor——Take Liaoning Province as example [J]. Chinese Journal of Animal Science, 2009(8): 1-4. (in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Empirical Study on the Relationship between Organizational Flexibility and Performance of Agricultural Enterprise

- Correlation between Employment Quality and Skill Training of Land-expropriated Farmers

- A Study on Spatial Distribution of Commercial Housing Prices in Xiangtan City

- Design and Experiment of Fluid Dynamic Ultrasonic Water Aerator

- The Relation between Age Structure of Population and Resident Consumption Based on Endogenous Growth Theory

- Effect of Different Pretreatments on Explosion Puffing Drying of Hami Melon at Modified Temperature and Pressure in Xinjiang