Empirical Analysis on Financial Development, Urbanization, and Urban and Rural Resident Income in Jiangsu Province

2016-01-12,

,

1. College of Finance, Nanjing Agricultural University, Nanjing 210095, China; 2. Jiangsu Research Center for Rural Financial Development, Nanjing 210095, China

1 Introduction

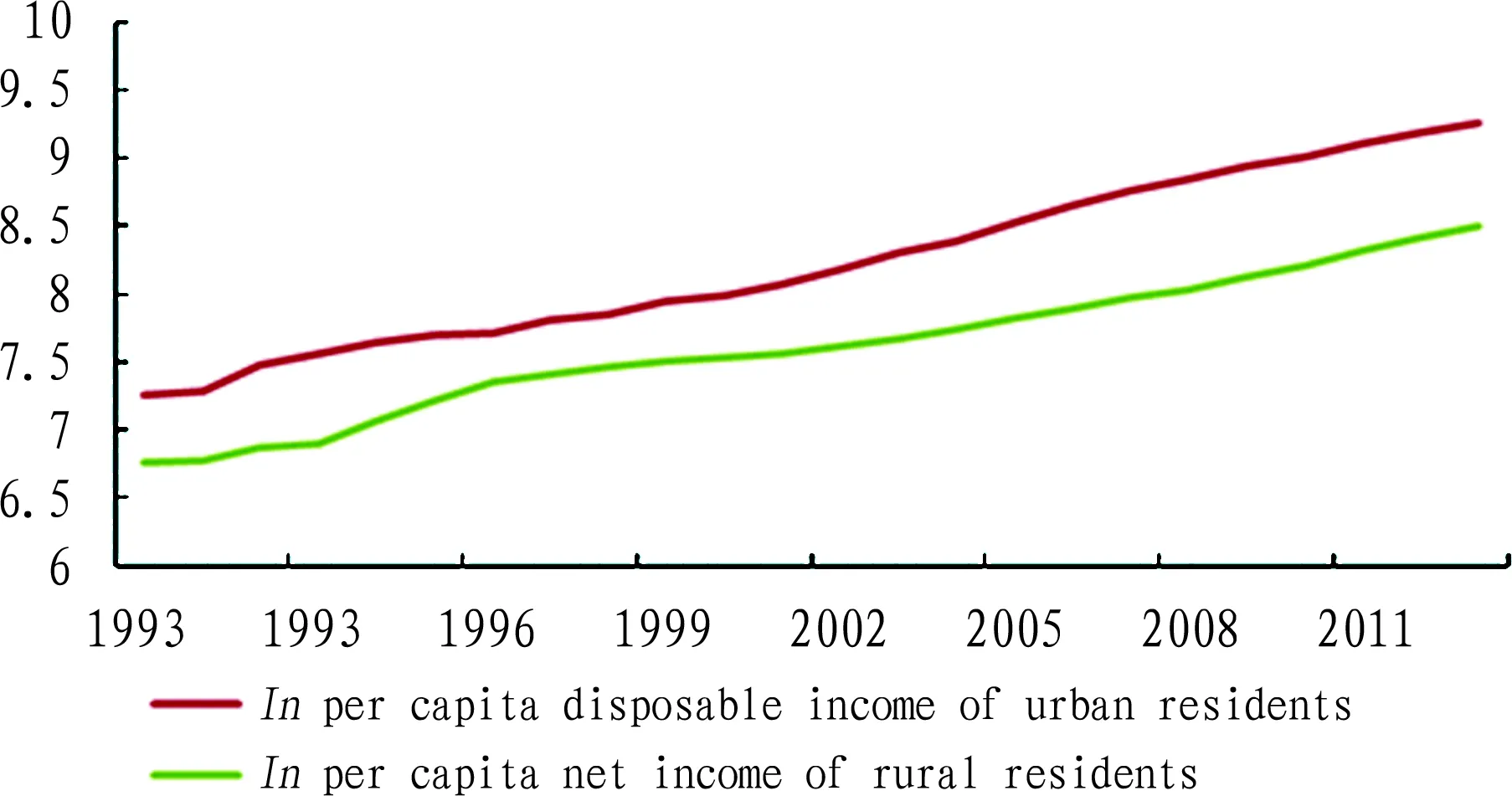

With acceleration of the modernization process, urban and rural resident income of Jiangsu Province constantly increases. The per capita disposable income of urban residents grew from 1464 yuan in 1990 to 32538 yuan in 2013. Excluding the price factor, the average annual growth rate reached 9.12%. In comparison, the per capita net income of rural residents grew from 884 yuan to 13598 yuan, and the average annual growth rate was 7.88%. However, due to implementation of urban-biased policies for a long time, the urban and rural income gap is gradually widening. In Jiangsu Province, the ratio of urban and rural resident income rose from 1.66:1 in 1990 to 2.39:1 in 2013. How to constantly increase urban and rural resident income and narrow their income gap has become a top concern of the government of Jiangsu Province. According toOpinionsofJiangsuProvincialPartycommitteeandPeople’sGovernmentaboutthePlanofDoublingResidentIncome, it set forth requirement of doubling actual income of residents in the whole province by 2017. In fact, however, estimated at the average annual growth rate of residents in 2010-2013, there is still a long way to reach such goal. In other words, it is difficult to realize income doubling of the urban and rural residents in Jiangsu Province. For the issue of urban and rural resident income, both foreign and domestic scholars have made extensive studies, and have found that the urban and rural resident income gap is mainly influenced by heavy industry priority development strategy, urban and rural separated administration system, urbanization, household registration system, and financial development[1-3]. At present, the urbanization rate of Jiangsu Province is up to 64.1%, and it has entered an important stage of raising quality, optimization structure, and making improvement. All stages of urbanization development are dependent on financial support, especially at the later stage of urbanization development, both infrastructure improvement and environmental control generate financial demands. In recent years, the overall strength of financial industry in Jiangsu Province is gradually growing, and the financial system with banks, securities and insurance as main parts is gradually improving, and financial market scale is constantly expanding. Nevertheless, due to implementation of urban-biased policies for a long time, rural financial efficiency remains at a relatively low level, so the financial development may restrict increase of rural resident income. On the basis of this, using the time series data of Jiangsu Province in 1990-2013, we made empirical analysis on the relationship between financial development, urbanization and urban and rural resident income and the income gap in Jiangsu Province, to provide theoretical support and empirical basis for promoting urban and rural resident income growth and narrowing the income gap in the process of urbanization and financial development of Jiangsu Province.

2 Theoretical analysis and literature review

Financial development interacts with urbanization. Financial development can satisfy financial demands in the process of urbanization, to promote urbanization process, while urbanization provides opportunity for financial development. However, excessive attention to urban development but belittling rural development will lead to unbalance in urban and rural finance. For a long term, urban and rural financial development is not balanced in China. Rural financial institutions are few, funds are not oriented towards agriculture, and there is problem of financial repression. Financial development exerts effect on urban and rural income gap mainly through the threshold effect, poverty reduction effect, and disequilibrium effect[4]. At the early stage of financial development, financial resources are biased towards urban areas, financial service threshold is high, it is difficult for poor people to enjoy financial services, so the poverty reduction effect is little, accordingly financial development widens the urban and rural income gap. After financial development becomes relatively mature, the general preference of financial services increases, and financial service efficiency grows, the radiation effect of urban development will be manifested, and the poverty reduction effect of financial development is greater than the sum of threshold effect and disequilibrium effect. Therefore, financial development in this period is helpful for narrowing the urban and rural income gap. The above theoretical analysis indicates that there is nonlinear relation between financial development and urban and rural resident income and the income gap. Both domestic and foreign empirical studies prove the above analysis results: Greenwood and Javanovic[5]used the endogenous growth model and found that the relation between urban and rural income gap and financial development submits "inverse U shape" curve relation; Qiao Haishuetal.[6]and Hu Zongyietal.[7]proved similar relation using the county level data. Besides, Clarketal.[8]based on empirical analysis of global data, found that financial development is negatively correlated with income gap, financial development will significantly reduce the income gap; Becketal.[9]studied and found that the promotion function of financial development to income of poor people is greater, and they stressed poverty reduction effect of financial development. However, on the basis of the data since the reform and opening-up, using different empirical methods, Ye Zhiqiangetal.[10]and Wang Xiuhuaetal.[11]proved that financial development is positively correlated with urban and rural income gap.

With flow of production elements including labor, urbanization will exert a great influence on urban and rural resident income and the income gap. For rural residents, the increase in urbanization level promotes flow of rural labor to urban high wage industries. Besides, migrant work income may be invested by farmers to agricultural sectors, and migrant workers who obtain higher capital and higher technology level may finally return to rural areas, so it will further raise the level of rural resident income; for urban residents, since urbanization promotes rural labor to flow to urban labor market, labor supply increases, the equilibrium wage will decline. Thus, theoretically, promotion of urbanization will exert a positive influence on urban and rural income gap. However, Cai Fang[2]stated that the proposition "migration can narrow the urban and rural or regional gap" holds true but it is not unconditional. He summarized conditions as follows: structural changes reflecting transfer of agricultural labor to non-agricultural sectors, mainly the pulling force of receiving area, changes in the distribution pattern of total urban and rural output, free flow without institutional restriction. If any one condition is not satisfied, the labor flow will not narrow the urban and rural income gap. At present, there are following factors which may offset the active role of urbanization to the income and the income gap. (i) Change in population structure. In rural residents, those with greater initial wealth, higher human capital, and younger age are more probable to move to urban areas, which will lead to rural labor aging and becoming womanlike and having relatively low income. (ii) Urban biased policies. Because financial expenditure, investment and finance are more biased towards urban areas[12], urban infrastructure and public service system will be more perfect and financial development level will be higher, then rural capitals and talents will flow to urban areas, and the urban and rural income gap will further be widened. (iii) Household registration system. The household registration system limits free flow of labor, and leads to significant difference in labor and social security, employment policies and services between urban and rural labor, and it is hard for rural labor to realize permanent flow. In sum, the influence of urbanization on urban and rural resident income and the income gap is not certain. In empirical studies, Song Yuanliangetal.[13], based on the data at national level and using vector auto-regression (VAR) model, found there exists long-term positive correlation between urbanization and rural resident income. Lu Mingetal.[14]analyzed provincial panel data in 1987-2001 and found that urbanization plays a significant role in narrowing the urban and rural income gap. Later, many studies reached similar conclusions. However, Cheng Kaimingetal.[12]adopted time series data of 1978-2004 and found urbanization widens the urban and rural income gap. Besides, Cao Yuetal.[15]found the relation between urbanization and urban and rural resident income gap has significantly regional difference, the increase of urbanization level of East China, South China and Central China widens the urban and rural income gap in these regions.

In sum, we can come up with following implications: (i) increase of urban and rural resident income is influenced by many factors and there is still no unanimous conclusion for the influence of financial development and urbanization on urban and rural resident income and the income gap; (ii) most studies focus on the relation between financial development or urbanization and urban and rural resident income, while few studies touch upon dynamic relation between three aspects; (iii) difference in financial development and urbanization level between regions is a reason for difference in conclusion of empirical studies. Existing literature conclusions may not be effectively extended, thus we take Jiangsu Province as an example to make an empirical study.

3 Research methods, selection of variables and data source

3.1ResearchmethodTo avoid spurious regression of the model, we firstly used ADF unit root test method to test stationarity of variables, and differentiated nonstationary variables to make them become stationary time series. If variables are integrated, we will conduct co-integration test for relevant variables to determine long-term equilibrium relationship between variables. On the basis of existence of co-integration relation, we will conduct Granger Causality Test to further test the causal relation between variables.

3.2Selectionofvariables

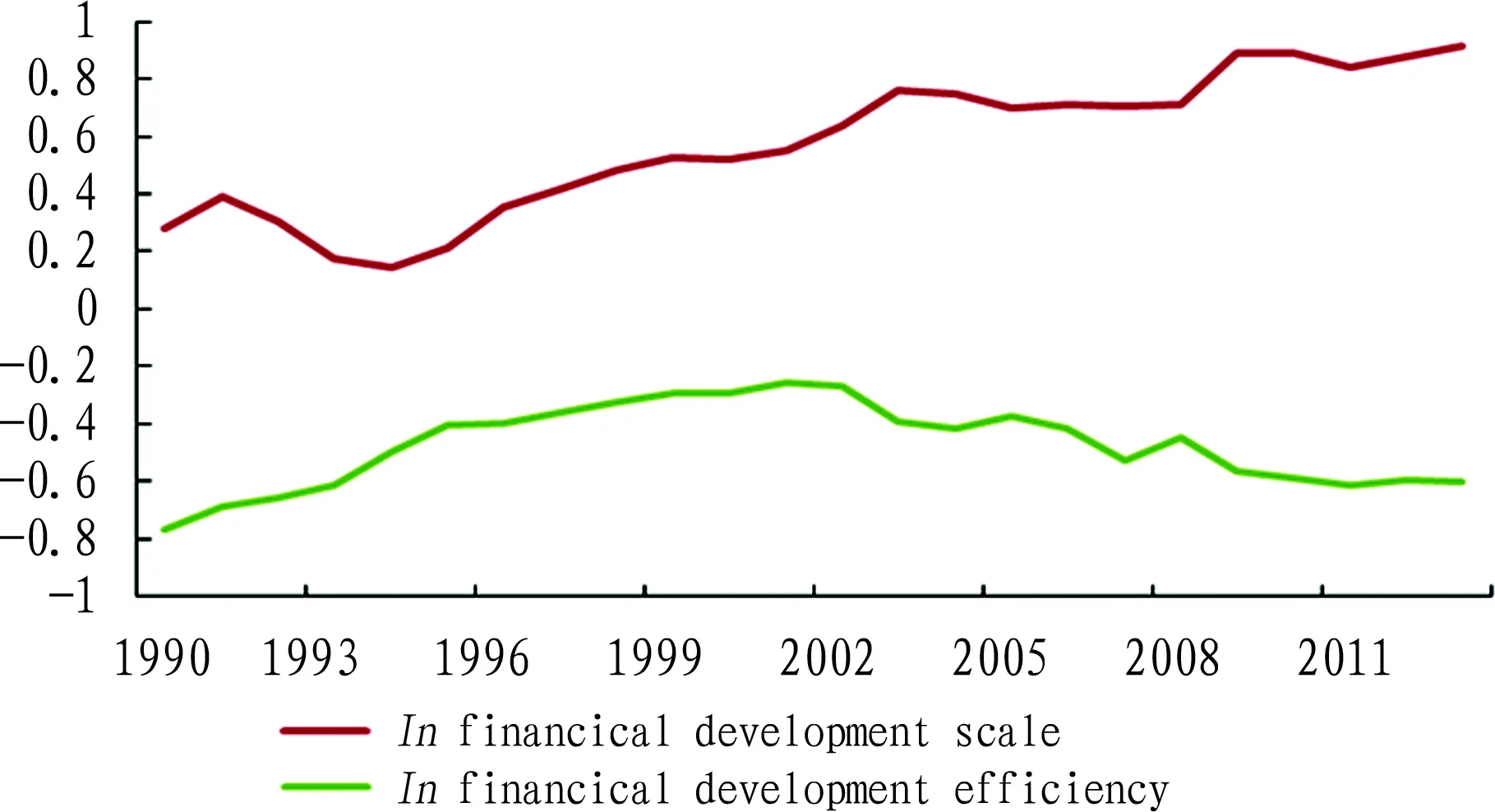

3.2.1Financial development. Considering data availability, we selected the financial development scale (FD) and financial development efficiency (FE) to measure the financial development level. We took the ratio of balance of deposits and loans of financial institutions in Jiangsu Province to nominal GDP of Jiangsu Province as theFDindicator, and took the ratio of balance of deposits of urban and rural residents in Jiangsu Province to balance of loans of financial institutions in Jiangsu Province as theFEindicator.

3.2.2Urbanization. With reference to customary algorithm of urbanization rate in existing researches, we used the population urbanization rate to measure the urbanization rate (URB) of Jiangsu Province. The algorithm is to calculate the ratio of urban population to total population.

3.2.3Urban and rural resident income. In this study, we used the per capita disposable income of urban residents (CI) in Jiangsu Province to measure the urban resident income level, and selected per capita net income of farmers (NI) in Jiangsu Province to measure the rural resident income level, and used resident CPI to balance the income.

3.2.4Urban and rural income gap. In this study, we selected Theil index (TI) to measure the urban and rural income gap.TIis calculated by formula (1):

(1)

whereTItdenotesTIin periodt;p1tandp2tdenote total income of urban and rural residents of Jiangsu Province in periodt(the product of per capita income multiplied by population);ptdenotes total income of urban and rural residents of Jiangsu Province in periodt;z1tandz2tdenote population of urban and rural areas of Jiangsu Province in periodt, andztdenotes total population of urban and rural areas of Jiangsu Province in periodt.

3.3DatasourceData in this study were selected fromStatisticalYearbookofJiangsuProvince(1991-2014), and sample spacing was the year 1990-2013. To avoid violent fluctuation and heteroscedasticity of data, we took logarithm of all variables.

4 Empirical test and analysis

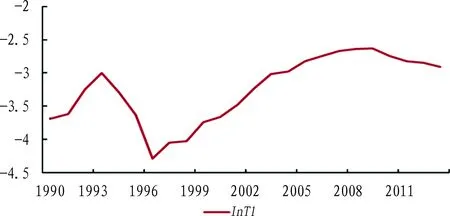

4.1Variationinfinancialdevelopment,urbanization,urbanandruralresidentincomeandincomegapinJiangsuProvinceFrom Fig. 1 and Fig. 3, it can be seen that both urban and rural resident income and financial development scale of Jiangsu Province take on a rising trend and the synergetic relation is good, but the variation trend of urban and rural resident income is not completely consistent with that of financial development efficiency. From Fig. 1 and Fig. 4, it can be seen that there exists synergetic relation between urbanization rate and urban and rural resident income of Jiangsu Province. Fig. 2 indicates that the fluctuation in urban and rural income gap is high in Jiangsu Province. Combined with Fig. 3 and Fig. 4, we found that the synergetic relation is not significant between financial development, urbanization rate and urban and rural income gap in Jiangsu Province. In addition, variation trends in Fig. 3 and Fig. 4 indicate show that there possibly exists synergetic relation between financial development and urbanization rate of Jiangsu Province.

Fig.1VariationinurbanandruralincomeofJiangsuProvincein1990-2013(logarithmcalculated)

Fig.2VariationinurbanandruralincomegapofJiangsuProvincein1990-2013(logarithmcalculated)

Fig.3VariationinfinancialdevelopmentofJiangsuProvincein1990-2013(logarithmcalculated)

Fig.4VariationinurbanizationrateofJiangsuProvincein1990-2013(logarithmcalculated)

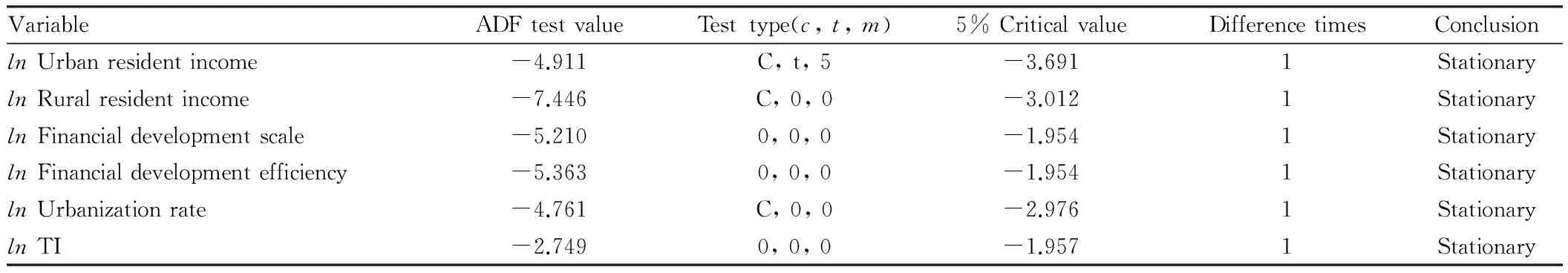

4.2UnitroottestWe used ADF unit root test method to test the data stationarity, and determined the optimal lag order by Akaike’s information criterion (AIC).

Table1ADFtestresultsofvariables

VariableADFtestvalueTesttype(c,t,m)5%CriticalvalueDifferencetimesConclusionlnUrbanresidentincome-4.911C,t,5-3.6911StationarylnRuralresidentincome-7.446C,0,0-3.0121StationarylnFinancialdevelopmentscale-5.2100,0,0-1.9541StationarylnFinancialdevelopmentefficiency-5.3630,0,0-1.9541StationarylnUrbanizationrate-4.761C,0,0-2.9761StationarylnTI-2.7490,0,0-1.9571Stationary

Note: in test type (c, t, m),cdenotes intercept,tdenotes trend, andmdenotes lag order.

From Table 1, it can be known that after first order difference of variables, every variable is stationary time series and submits to I(1) process.

4.3Co-integrationtestAll the above variables are first order integrated, so we could carry out Johansen co-integration test. Before test, we firstly built VAR model, and selected the optimal lag order for the model according to Schwarz criterion (SC). The co-integration test results were listed in Table 2 to Table 5.

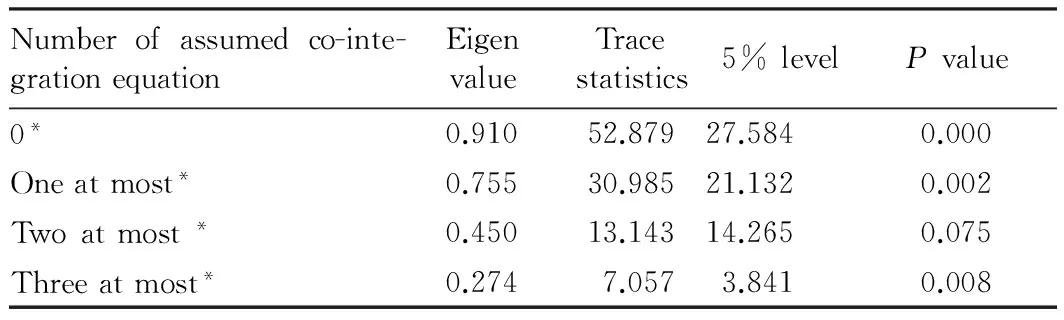

4.3.1Financial development, urbanization, and per capital disposable income of urban residents.

Table2Co-integrationtestresultsofpercapitaldisposableincomeofurbanresidents,financialdevelopment,andurbanization

Numberofassumedco-inte-grationequationEigenvalueTracestatistics5%levelPvalue0*0.91052.87927.5840.000Oneatmost*0.75530.98521.1320.002Twoatmost*0.45013.14314.2650.075Threeatmost*0.2747.0573.8410.008

Note:*means it rejects original hypothesis at 5% significance level, the same in following tables.

From Table 2, it can be known that there exists co-integration relation between financial development, urbanization and urban resident income, and the co-integration equation is as follows:

lnCI=1.16lnFD + 1.01lnFE+0.81lnURB

(0.253) (0.127)(0.161)

Table3Co-integrationtestresultsofpercapitaldisposableincomeofruralresidents,financialdevelopment,andurbanization

Numberofassumedco-inte-grationequationEigenvalueTracestatistics5%levelPvalue0*0.82937.04827.5840.002Oneatmost*0.76730.58021.1320.002Twoatmost*0.56517.48414.2650.015Threeatmost*0.0060.1213.8410.728

Values in parentheses refer to approximate standard deviation. From the co-integration equation, we can see that in 1990-2013, the financial development and urbanization of Jiangsu Province promote increase of the per capita disposable income of urban residents. The elasticity of per capita disposable income of urban residents on financial development scale, financial development efficiency and urbanization rate is 1.16, 1.01, and 0.81 respectively.

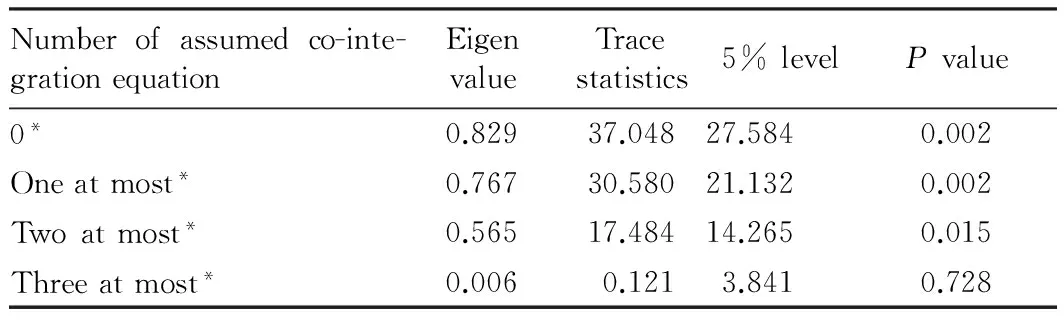

4.3.2Financial development, urbanization, and per capital disposable income of rural residents.

From Table 3, it can be known that there exists co-integration relation between financial development, urbanization and rural resident income, and the co-integration equation is as follows:

lnNI =0.47lnFD + 0.40lnFE + 2.11lnURB

(0.601)(0.229)(0.436)

The co-integration equation indicates that in the sample spacing, the elasticity of per capita net income of farmers on financial development scale, financial development efficiency and urbanization rate is 0.47, 0.40, and 2.11 respectively, and there is positive correlation between financial development scale, financial development efficiency, urbanization rate, and per capital net income of farmers.

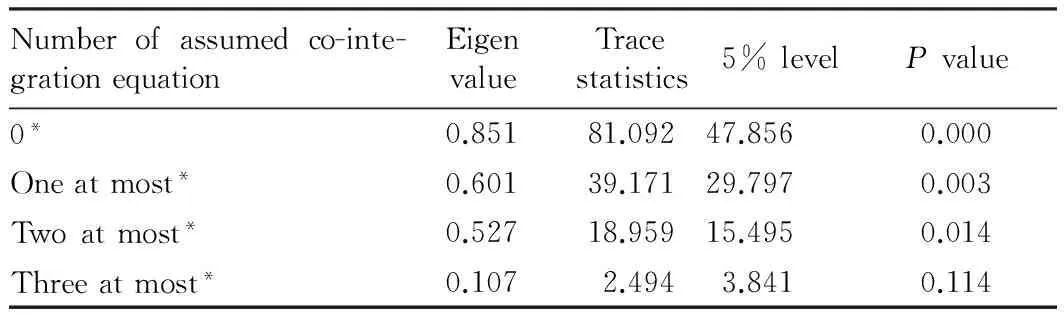

4.3.3Financial development, urbanization rate and urban and rural income gap.

Table4Co-integrationtestresultsofurbanandruralincomegapandfinancialdevelopment,andurbanization

Numberofassumedco-inte-grationequationEigenvalueTracestatistics5%levelPvalue0*0.85181.09247.8560.000Oneatmost*0.60139.17129.7970.003Twoatmost*0.52718.95915.4950.014Threeatmost*0.1072.4943.8410.114

From Table 4, it can be known that there exists co-integration relation between financial development, urbanization and Theil Index, and the co-integration equation is as follows:

lnTI =-5.51lnFD + 7.60lnFE + 4.43lnURB

(2.543)(1.209)(1.618)

The co-integration equation indicates that when financial development scale rises about 1%, the urban and rural income gap measured by TI will shrink about 5.51%; when financial development efficiency and urbanization rate increase about 1%, the urban and rural income gap will expand about 7.60% and 4.43% respectively. This reveals that the expansion of financial development scale will narrow the urban and rural income gap, while the increase in financial development efficiency and urbanization rate will widen the urban and rural income gap.

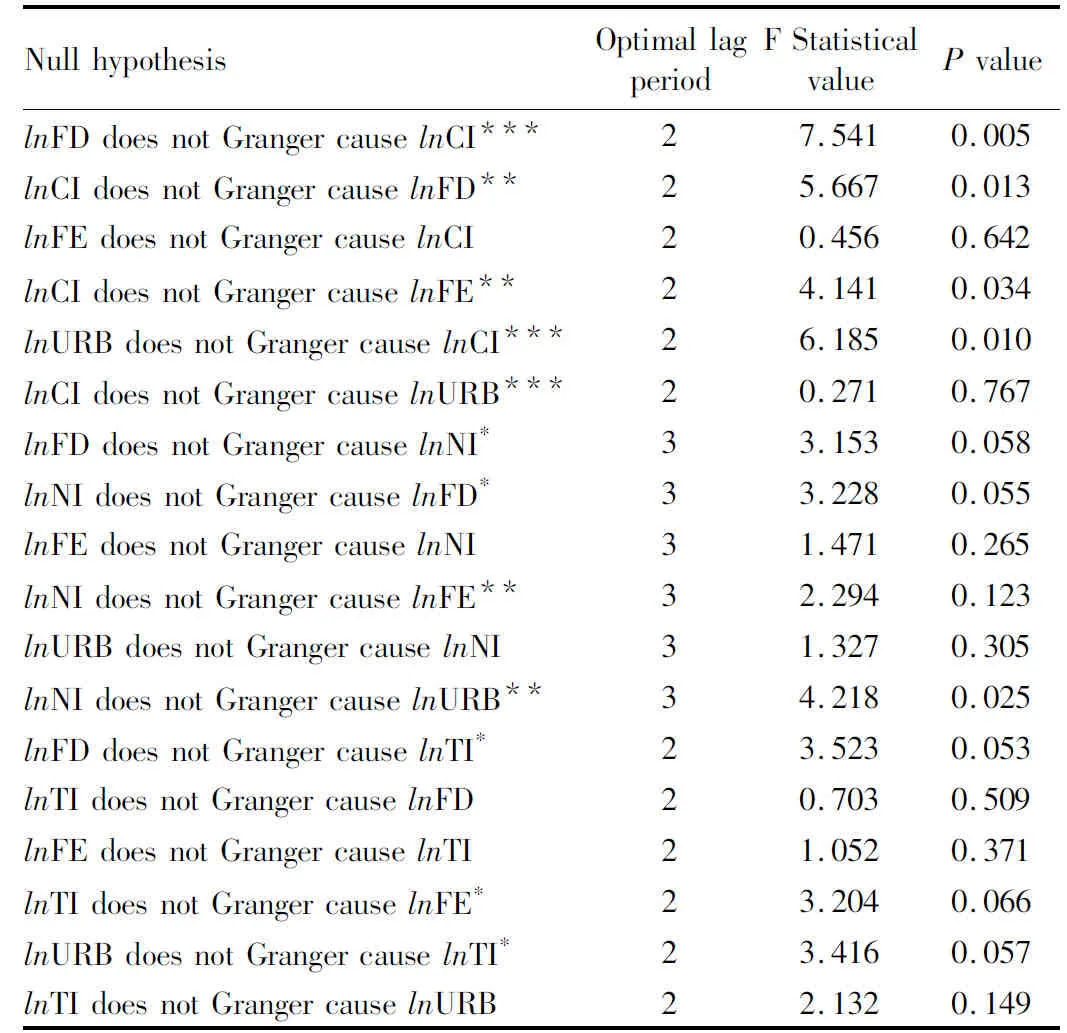

4.4GrangercausalitytestIn this study, we carried out Grainger causality test to determine if the co-integration between variables constitutes causality and what kind is the causality. Detailed results are listed in Table 5.

Table5Grangercausalitytestofvariables

NullhypothesisOptimallagperiodFStatisticalvaluePvaluelnFDdoesnotGrangercauselnCI***27.5410.005lnCIdoesnotGrangercauselnFD**25.6670.013lnFEdoesnotGrangercauselnCI20.4560.642lnCIdoesnotGrangercauselnFE**24.1410.034lnURBdoesnotGrangercauselnCI***26.1850.010lnCIdoesnotGrangercauselnURB***20.2710.767lnFDdoesnotGrangercauselnNI*33.1530.058lnNIdoesnotGrangercauselnFD*33.2280.055lnFEdoesnotGrangercauselnNI31.4710.265lnNIdoesnotGrangercauselnFE**32.2940.123lnURBdoesnotGrangercauselnNI31.3270.305lnNIdoesnotGrangercauselnURB**34.2180.025lnFDdoesnotGrangercauselnTI*23.5230.053lnTIdoesnotGrangercauselnFD20.7030.509lnFEdoesnotGrangercauselnTI21.0520.371lnTIdoesnotGrangercauselnFE*23.2040.066lnURBdoesnotGrangercauselnTI*23.4160.057lnTIdoesnotGrangercauselnURB22.1320.149

Note:*,**, and***signify 10%, 5% and 1% significance level respectively.

From Table 5, it can be known that at 1% significance level, financial development scale Granger causes per capital disposable income of urban residents, and urbanization rate also Granger causes per capital disposable income of urban residents; at 5% significance level, per capital disposable income of urban residents Granger causes financial development scale and financial development efficiency, and per capita net income of rural residents Granger causes financial development efficiency and urbanization rate; at 10% significance level, there exists two-way causality between financial development scale and per capita net income of rural residents; financial development scale Granger causes urban and rural income gap, and there exists one-way causality between urban and rural income gap and financial development efficiency, and between urbanization rate and urban and rural income gap.

4.5Furtheranalysisoftestresults(i) Financial development scale and financial development efficiency increase urban and rural resident income. There exists negative correlation between financial development scale and urban and rural income gap, and there exists positive correlation between financial development efficiency and urban and rural income gap. Financial development scale Granger causes per capita disposable income of urban residents, and per capita disposable income of urban residents Granger causes financial development scale and financial development efficiency. There exists two-way causality between financial development scale and per capita net income of rural residents, per capita net income of rural residents Granger causes financial development efficiency. Financial development scale Granger causes urban and rural income gap, and there exists one-way causality between urban and rural income gap and financial development efficiency. Reasons are as follows.

At present, financial development scale of Jiangsu Province remains in the right side of "inverse U shape" curve, namely, the later period of financial development scale, and poverty reduction effect of financial development scale should be greater than the sum of the threshold effect and disequilibrium effect. In recent years, Jiangsu provincial government asks financial institutions to extend to rural areas, then the number of rural small loan companies and township banks gradually rises and agricultural loan also gradually increases. For small loan companies, the Finance Service Office of Jiangsu Province demands that the total amount of small loan should account for at least 70% of the entire loan amount, and the percentage of loan granted by rural small loan companies farmers, agricultural, and rural areas to the entire loan should be not lower than 70%, and the loan amount with period longer than 3 months should take up at least 70% of the entire loan. These policies and requirements are favorable for increase in rural resident loan. Besides, Jiangsu provincial government reasonably adjusts the loan rate of small loan companies to reduce financing costs of rural enterprises. In addition, the reform of rural credit cooperatives is further deepening and the preparatory work for construction of rural commercial banks is basically completed. The development of rural financial institutions reduces threshold of financial services for rural residents and reduces the disequilibrium degree of urban and rural financial scale, favorable for solving problems of rural residents in difficult and expensive financing, thus increasing rural resident income and narrowing urban and rural income gap. The increase in rural resident income can attract financial institutions to settle down in rural areas and expand financial development scale of Jiangsu Province. With the widening of urban and rural income gap, Jiangsu provincial government cares more about balanced development of finance. Therefore, both Granger cause financial development scale. Furthermore, special urban and rural dual economic structure in China renders financial institutions more willing to invest in those urban sectors with higher return rate, and the total loan amount of financial institutions gradually increases but the agricultural loan still takes up a relatively low portion. With increase in financial efficiency, more funds flow to urban areas. Urban residents will obtain more financing opportunities, then it is able to increase fund utilization efficiency and realize income increase. However, there is still problem of financial repression in rural areas, so it is difficult for rural areas to catch development opportunities offered by economic growth, channels for increasing rural resident income are limited, and substantial growth of income is difficult.

(ii) Urbanization promotes increases in urban and rural resident income, but it widens the urban and rural income gap. Urbanization Granger causes per capita disposable income of urban residents, but does not Granger cause per capita net income of farmers, and there exists one-way causality between urbanization rate and urban and rural income gap. Possible reasons are as follows. Firstly, positive effect generated from labor flow is limited. The population urbanization rate of Jiangsu Province is high and labor flow scale is large, but positive effect of labor flow is weakened by such factors as abnormal distribution pattern of urban and rural resident income and household registration system. Cai Fang[2]stated that if there exists relatively balanced development relation between three industries, and labor flow tends to change the pattern of urban and rural resident income distribution, their comparative labor productivity should be close to 1. Through calculation, the comparative labor productivity of primary industry in Jiangsu Province rose from 0.28 in 2000 to 0.30 in 2013; in the same period, the comparative labor productivity of secondary industry dropped from 1.71 to 1.15, and that of tertiary industry changed from 1.34 to 1.21, showing the comparative labor productivity of primary industry much lower than that of secondary and tertiary industries. Besides, it indicates that employment volume of primary industry is relatively high and urbanization level is to be further improved. Secondly, urban-biased policies are implemented. In the process of urbanization, there exists obvious urban-biased tendency in resource allocation of Jiangsu Province. To solve the loading ability of urban areas in the process of population urbanization, government provides large funds to support urban infrastructure construction, public service supply, which deteriorates imbalance in allocation of economic and social resources between urban and rural areas. Urban-biased policies promote urban infrastructure and public service system more perfect and financial development degree much higher, which is helpful for increasing urban resident income; however, rural funds and talents flow to urban areas, rural infrastructure becomes weaker, which restricts increase in rural resident income and accordingly widens urban and rural income gap.

5 Conclusions and policy recommendations

5.1Conclusions(i) Financial development scale of Jiangsu Province remains in the right side of "inverse U shape" curve, namely, the later period of financial development. Expansion of financial development scale and increase in financial development efficiency promote increase in urban and rural resident income. However, due to existence of rural financial repression, financial loans flow to urban sectors with high return, and urban and rural gap is constantly widening. (ii) Currently, the urbanization of Jiangsu Province becomes steady, and the increase in urbanization level practically increases urban and rural resident income. However, due to imbalanced development of three industries, in addition to urban-biased allocation of resources, urbanization development widens urban and rural income gap.

5.2Policyrecommendations(i) Further increasing the percentage of agricultural loan and improving rural financial market. Jiangsu provincial government should energetically develop rural finance and increase the number of rural financial institutions, such as rural commercial banks, township banks, and small loan companies. At the same time of expanding rural financial scale, it is recommended to greatly increase rural financial development efficiency, guide back flow of rural funds, increase percentage of agricultural loan, and provide financial support for Jiangsu Province firstly realizing agricultural modernization. (ii) Jiangsu Province should transform traditional extensive urbanization development mode, change the focus on urbanization development rate to urbanization development quality, promote connotative development of urbanization, orderly promote citizenship of permanent resident population, solve problems of migrant workers’ social security, housing, and children education, increase investment in urban and rural infrastructure and public services, optimize urban and rural spatial pattern, and promote balanced urban and rural development and narrow the urban and rural income gap.

[1] LIN YF, LIU MX. On the convergence and income distribution of economic growth in China[J]. The Journal of World Economy, 2003(8): 3-14. (in Chinese).

[2] CAI F. Analysis on the institutional barrier of the flow of surplus rural labor force[J]. Economics Information, 2005(1): 35-39. (in Chinese).

[3] YAO YJ. On the financial development, urbanization and urban-rural income inequality[J].China Rural Survey,2005(2):2-8.(in Chinese).

[4] ZHANG LJ, ZHAN Y. The analysis of three major effects of financial development on the urban-rural income gap[J].The Journal of Quantitative & Technical Economics, 2006(12):73-81.(in Chinese).

[5] GREENWOOD J, JOVANOVIC B. Financial development, growth, and the distribution of income[J]. Journal of Political Economy, 1990, 98(5):1076-1107.

[6] QIAO HS, CHEN L. The inverted U-shaped relationship between financial development and urban-rural income gap in China[J].Chinese Rural Economy,2009(7):68-85.(in Chinese).

[7] HU ZY, LIU YW. Research of the Kuznets effect of financial non-balanced development and urban-rural income distribution ——The analysis based on the county-level cross-section data in China[J]. Statistical Research, 2010, 27(5):25-31.(in Chinese).

[8] CLARKE G, XU LX, ZOU HF. Finance and income inequality: Test of alternative theories[N].World Bank Policy Research Working Paper, 2003(2984).

[9] BECK T, DEMIRGUE KA, LEVINE R. Finance, inequality, and poverty : Cross-country evidence[N]. NB ER Working Paper, 2004(10979).

[10] YE ZQ, CHEN XD, ZHANG SM. Do financial development can reduce urban-rural income gap[J]. Journal of Financial Research, 2011(2): 42-56. (in Chinese).

[11]WANG XH, ZIU ZX. The impact mechanism and empirical research of the rural financial development on the urban-rural income gap in China[J]. Economics Information,2011(2):71-75.(in Chinese).

[12] CHENG KM, LI JC. Analysis of mechanism and dynamic econometric relationships between urban bias, urbanization and urban-rural inequality[J]. The Journal of Quantitative & Technical Economics, 2007(7):116-125.(in Chinese).

[13] SONG YL, XIAO WD. An analysis of dynamic econometric relationship between development of urbanization and income growth of rural residents in China[J]. The Journal of Quantitative & Technical Economics, 2005(9):30-39.(in Chinese).

[14] LU M, CHEN Z. The economic policy of urbanization and urban bias and the gap between urban and rural income[J]. Economic Research Journal, 2004(6): 50-58. (in Chinese).

[15] CAO Y, CHEN XH, MA YR. Urbanization, urban-rural income gap and economic growth——An empirical research based on provincial panel data in China[J]. Statistical Research, 2010, 27(3): 29-36. (in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Farmer’s Perception on Supply-Demand Matching of New Variety and Its Influence Factors

- Vegetation Coverage Changes in the West Qinling Region from 2000 to 2010: A Case Study of Longnan City

- A Study of Estimation Model for the Chlorophyll Content of Wheat Leaf Based on Hyperspectral Imaging

- A Study of Virtual Museum Simulation Platform Based on 2.5D Architectural Modeling Technology

- The Value Insistence of the Cultural Production in the Big Data Era

- Sino-Australian Agricultural Product Trade Development in the Context of the Belt and Road Initiative