Influence of Strategy Selection of Dairy Enterprises on Performance

2016-01-11,,

, ,

College of Economics and Management, Huazhong Agricultural University, Wuhan 430070, China

1 Introduction

With constant increase in national income, dairy products have been reduced from high end consumer goods to large scale goods, and popularization of dairy products is also expanding, the dairy industry is rapidly growing. In 1949 - 2013, the output of China’s dairy products increased from 217000 t to 35.31 million t, with the average annual growth up to 114.1%, per capita consumption of dairy products increased from 0.45 kg to 36 kg, up to 80 times. The development of dairy industry also alleviates employment pressure and promotes national economic development. According to statistics, except in 2008, profit of dairy enterprises suffered from negative growth due to incident of Sanlu Milk Powder, employment people, total output value, profit and total assets of dairy products of domestic dairy enterprises were constantly growing in 2000-2013. Besides, the development of the dairy industry also promotes the development of animal husbandry and feed industry and other related industries, the proportion of the milk cow breeding industry in animal husbandry continues to increase, by 2010, the proportion had reached 5.38%. The incident of Sanlu Milk Powder weakens confidence of consumers in domestic dairy products. On the one hand, trust crisis of consumers creates impact on domestic dairy products. On the other hand, weak confidence of consumers in domestic dairy products leads to pour in of foreign dairy products, so the domestic dairy enterprises are confronted with huge market pressure. In view of domestic and foreign situations, dairy enterprises have great difficulty in survival.

2 Literature review and research hypotheses

2.1StrategyselectionEnterprise growth can be divided into integration and diversification in strategy. The integration can be divided into horizontal strategy (horizontal integration) and vertical strategy (vertical integration). Enterprises select strategies to realize expansion, and increase quantity of resources they possess and control, so as to increase resource utilization efficiency and strengthen profitability and competitiveness of enterprises.

Xiong Huaping (2006) stated that vertical relation of enterprises is the connection of raw material purchase, production, and sales and related product support in the whole process of final product, and such relation can be connected through different combinations of property rights and contracts. In the process of enterprise operation, although related interest groups have strong cooperation motivation, there are still threats of opportunism, and vertical strategies reduce uncertainty of enterprises terminating transactions at will and evading fluctuation of product price. Liu Shan (2005) enterprises implementing vertical strategies can guarantee sufficient supply when there is shortage of products. From the perspective of market, vertical strategies can raise access barrier of industry. For dairy industry, He Yucheng (2003) stated that such vertical organization relation is established through rational decision. Enterprises reach their purpose through controlling the optimum milk source, taking up favorable geographical position, and attracting consumers through brand effect. The price negotiation of upstream and downstream of dairy industry compresses enterprise profit. Through vertical strategies, it can increase operation efficiency, so as to make enterprise obtain more profits.

Huang Zhenfeng (2011) put forward horizontal strategies are to expand production scale, consolidate market position, reduce costs, enhance enterprise strength, raise competitive edge, and cooperate with other enterprises in the same industry. In this way, it enhances enterprise strength and alliance with other enterprises. Yu Anping (2003) stated that adopting horizontal strategy can effectively realize scale economy and obtain scale and benefit.

Zhao Feng (2012) stated that diversification is a strategy selection of enterprise expansion. Through study of influence of diversified strategy on technical ability of enterprises, Liu Hongwei (2015) held that diversified strategy is an operating strategy for enterprises entering two or more related or non-relevant product fields or seeking development. Wu Xiaobo (2011) stated that diversification can help enterprises apply these resources and ability to new business, increase operation benefits, and guarantee long-term survival and development of enterprises. Diversified strategy of enterprise is a kind of operation strategy and growth method for increasing market or industrial differentiated products or industries in existing operating state. It is able to take full use of internal advantage of enterprises to effectively evade operation risks.

As intermediate link of dairy industry chain, the dairy product processing industry plays a great role in promoting development of the entire industry. Due to influence of upstream and downstream price negotiation ability, profit of dairy product enterprises is compressed. For dairy product market, large enterprises become big competitors of other existing enterprises. Although the access barrier is high and the risk is high, as long as there is profit, it will attract potential competitors to enter dairy industry to share enterprise profit. Besides, due to influence of substitute products and food safety, the consumption inclination of consumers towards dairy products also declines. To change such situation, dairy products must make adjustment of strategy selection.

2.2PerformanceassessmentEnterprise performance refers to benefit and performance obtained by enterprises in certain period[9]. Some foreign scholars consider that enterprise performance is organizational effectiveness[10]. Enterprise performance assessment indicator system is quantitative management of enterprise,i.e. assessment of operating quantity. Chen Gongrong and Zeng Jun (2005) stated that after entry to the 1980s, on the basis of pure financial indicator, non financial indicators have received more and more attention, so the enterprise performance assessment has developed to organic combination of financial and non-financial indicators. In fact, compared with financial indicators, non-financial indicators are difficult to calculate in quantity. Therefore, the selection of performance indicators should still be placed in financial indicators. Sale amount, net profit, and market share can visually reflect situation of enterprise operating activities. Thus, we take these three indicators as indicators for performance assessment.

Performance can reflect effect and benefits of enterprise operation, while enterprise operating activities will be carried out on the basis of decisions made by management of enterprises. These decisions include strategy selection. Strategy selection can influence enterprise performance and the effect of strategy selection can be reflected through performance.

2.3HypothesesRaw material price of dairy products directly influences economic benefits of dairy enterprises. He Yuchengetal(2010) compared purchase price of raw material milk and sales price of dairy products in 1998-2007 and stated that purchase price of raw material milk is a decisive factor for performance of dairy product enterprises. Therefore, enterprises adopt horizontal strategy to expand production scale to seek scale economy. Through vertical strategy, enterprises can establish dairy source bases, reduce costs, and directly provide high quality and low cost raw milk to improve enterprise performance. In this situation, we put forward the first hypothesis:

H1: Dairy enterprises adopting vertical strategy have higher performance than those adopting horizontal strategy

Single business operation can make enterprises focus on businesses they are good at, but such strategy will lead to excessive concentration of enterprise resources and not fully effectively used and even idle due to surplus, which is not favorable for decentralizing operating risk of enterprises. Business diversification can decentralize enterprise specialization degree through touching upon two or more fields, such strategy measure can reduce enterprise risks in certain degree. Therefore, we believe that diversified operation of dairy enterprises can promote increase of enterprise performance compared with single business operation. In this situation, we come up with hypothesis 2 and hypothesis 3:

H2: Dairy enterprises adopting diversified strategy have higher performance than those adopting vertical strategy

H3: Dairy enterprises adopting diversified strategy have higher performance than those adopting horizontal strategy

3 Variable selection and data statistical analysis

3.1DatasourceWe selected data of 115 dairy enterprises from 27 provinces, autonomous regions, and municipalities directly under the central government to make following empirical study. For listed companies, we only select headquarter as research object, the affiliated companies are not studied. The main business income, operation income, sales amount, net profit, and market share of listed companies were selected from annual report, related data of non-listed companies came from Dairy Association of China, and industrial data came from Dairy Yearbook of China and China’s Dairy Statistical Data.

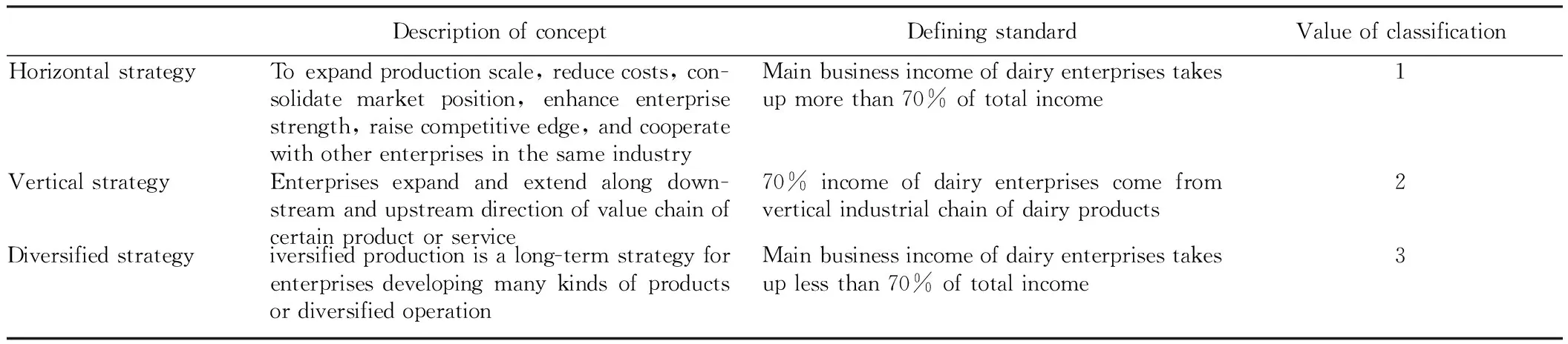

3.2StrategyselectionStrategy selection of dairy enterprises can be judged from the percentage of main business income to total income (Rumel, 1975; Caves, 1980; Li Dabingetal, 2010). According to Supplementary Notice on Several Matters about Issuing Stocks by China Securities Regulatory Commission in 1998, the percentage of main business income (a certain business) should be not lower than 70%. Selection and classification of major independent variables of strategy selection are listed in Table 1.

As for strategy selection, among all selected sample enterprises, most dairy enterprises (85 enterprises) adopt vertical strategy through extension of industrial chain, accounting for 73.9% of total samples. Only 16 dairy enterprises adopt horizontal strategy to expand enterprise scale through merging, acquisition and strategic alliance, accounting for 13.9% of total samples. Only 14 dairy enterprises adopt diversified strategy to carry out inter-industry businesses, accounting for 12.2% of total samples.

Table1Descriptionofstrategyselectionofenterprises

DescriptionofconceptDefiningstandardValueofclassificationHorizontalstrategyToexpandproductionscale,reducecosts,con-solidatemarketposition,enhanceenterprisestrength,raisecompetitiveedge,andcooperatewithotherenterprisesinthesameindustryMainbusinessincomeofdairyenterprisestakesupmorethan70%oftotalincome1VerticalstrategyEnterprisesexpandandextendalongdown-streamandupstreamdirectionofvaluechainofcertainproductorservice70%incomeofdairyenterprisescomefromverticalindustrialchainofdairyproducts2Diversifiedstrategyiversifiedproductionisalong-termstrategyforenterprisesdevelopingmanykindsofproductsordiversifiedoperationMainbusinessincomeofdairyenterprisestakesuplessthan70%oftotalincome3

Table2Statisticsofstrategyselectionof115dairyenterprises

ScopeFrequencyPercentage//%Strategyselec-tionHorizontalstrategy1613.9%Verticalstrategy8573.9%Diversifiedstrategy1412.2%

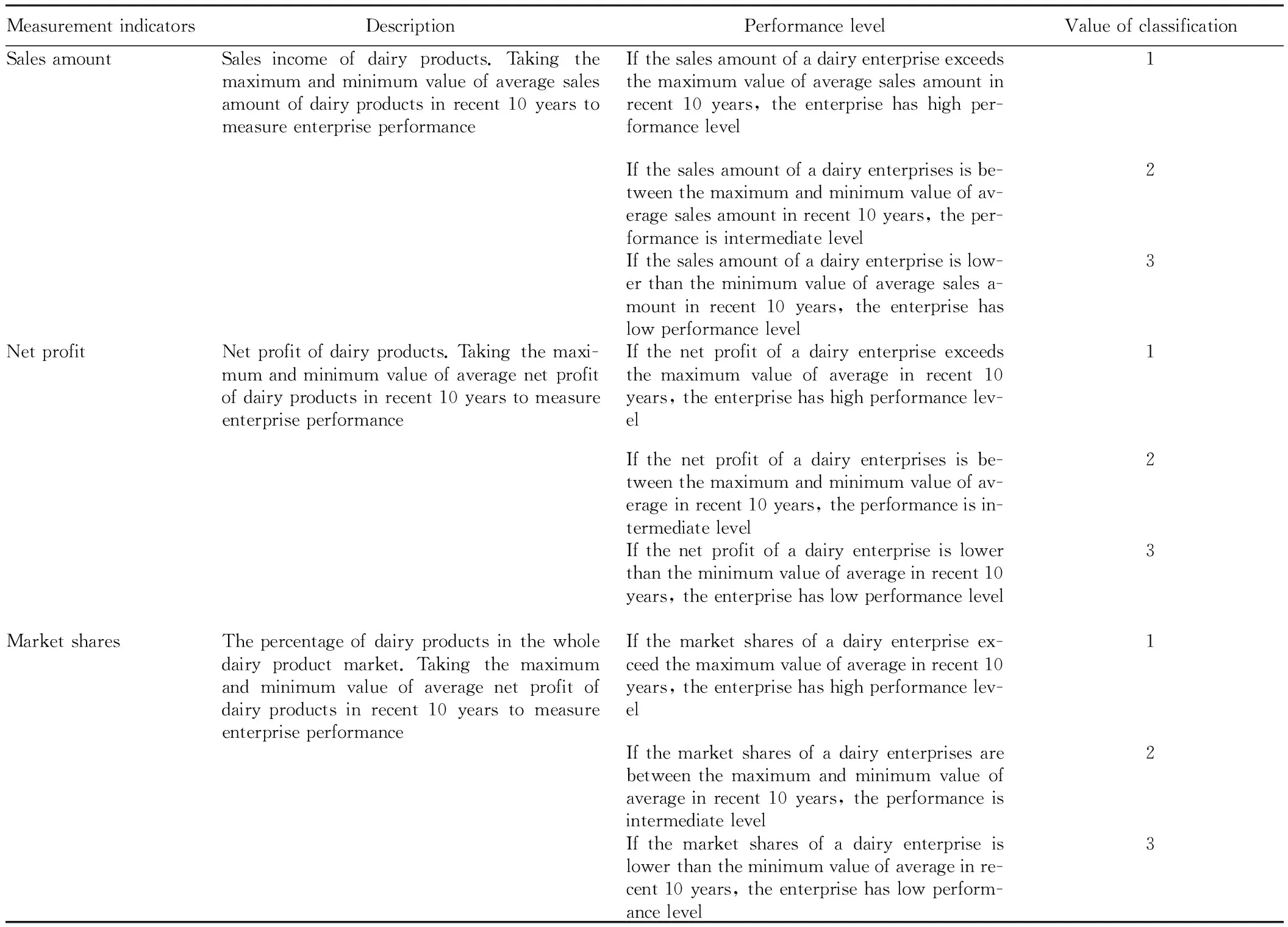

3.3PerformancemeasurementindicatorsIn this study, performance measurement indicators include sales amount (S), net profit (NP), and market shares (MS). Sales amount, net profit and market shares are dependent variables, and their description and classification values are listed in Table 3.

Table3Descriptionofperformancemeasurementindicators

MeasurementindicatorsDescriptionPerformancelevelValueofclassificationSalesamountSalesincomeofdairyproducts.Takingthemaximumandminimumvalueofaveragesalesamountofdairyproductsinrecent10yearstomeasureenterpriseperformanceIfthesalesamountofadairyenterpriseexceedsthemaximumvalueofaveragesalesamountinrecent10years,theenterprisehashighper-formancelevel1Ifthesalesamountofadairyenterprisesisbe-tweenthemaximumandminimumvalueofav-eragesalesamountinrecent10years,theper-formanceisintermediatelevel2Ifthesalesamountofadairyenterpriseislow-erthantheminimumvalueofaveragesalesa-mountinrecent10years,theenterprisehaslowperformancelevel3NetprofitNetprofitofdairyproducts.Takingthemaxi-mumandminimumvalueofaveragenetprofitofdairyproductsinrecent10yearstomeasureenterpriseperformanceIfthenetprofitofadairyenterpriseexceedsthemaximumvalueofaverageinrecent10years,theenterprisehashighperformancelev-el1Ifthenetprofitofadairyenterprisesisbe-tweenthemaximumandminimumvalueofav-erageinrecent10years,theperformanceisin-termediatelevel2Ifthenetprofitofadairyenterpriseislowerthantheminimumvalueofaverageinrecent10years,theenterprisehaslowperformancelevel3MarketsharesThepercentageofdairyproductsinthewholedairyproductmarket.Takingthemaximumandminimumvalueofaveragenetprofitofdairyproductsinrecent10yearstomeasureenterpriseperformanceIfthemarketsharesofadairyenterpriseex-ceedthemaximumvalueofaverageinrecent10years,theenterprisehashighperformancelev-el1Ifthemarketsharesofadairyenterprisesarebetweenthemaximumandminimumvalueofaverageinrecent10years,theperformanceisintermediatelevel2Ifthemarketsharesofadairyenterpriseislowerthantheminimumvalueofaverageinre-cent10years,theenterprisehaslowperform-ancelevel3

As for income of dairy enterprises (Table 4), only 32 dairy enterprises have sales amount higher than the maximum average in recent 10 years, while 40 dairy enterprises have sales amount lower than the minimum average value, showing that the proportion is relatively even. As for net profit, about half enterprises have net profit lower than the minimum value of average in recent years, and only 20.9% enterprises have net profit higher than the maximum value of average in recent years. For the market shares, market shares of dairy enterprises have relatively low average value. In recent 10 years, the maximum average is only 23‰, and only 19.1% dairy enterprises reach this value, while 64.3% dairy enterprises have market shares lower than 12‰.

Table4Statisticsofsalesamount,netprofitandmarketsharesof115dairyenterprisesinrecent10years

RangeFrequencyPercentageSalesamountHigherthanthemaximumaveragevalue(240.05millionyuan)inrecent10years3227.8%Betweenthemaximumandminimumaveragevalue(62.65millionyuanto240.05millionyuan)inrecent10years4337.4%Lowerthantheminimumaveragevalue(62.65millionyuan)inrecent10years4034.8%NetprofitHigherthanthemaximumaveragevalue(22.57millionyuan)inrecent10years2420.9%Betweenthemaximumandminimumaveragevalue(3.95millionyuanto22.57millionyuan)inrecent10years3328.7%Lowerthantheminimumaveragevalue(3.95millionyuan)inrecent10years5850.4%MarketsharesHigherthanthemaximumaveragevalue(0.23%)inrecent10years2219.1%Betweenthemaximumandminimumaveragevalue(0.12%-0.23%)inrecent10years1916.5%Lowerthantheminimumaveragevalue(0.12%)inrecent10years7464.3%

4 Building of test model and data analysis

4.1ModelbuildingDescription of related variables is given in Table 5.

Table5Descriptionofrelatedvariablesinthemodel

SymbolDescriptionTypeD1D1=1denoteshorizontalstrategy;D1=0denotesotherstrategiesIndependentvariable(dummyvariable)D2D3=1denotesverticalstrategy;D2=0denotesotherstrategiesIndependentvariable(dummyvariable)D3D3=1denotesinternalfinancingmode;D3=0denotesexternalfinancingmodeIndependentvariable(dummyvariable)SaleSalesamountDependentvariableMSMarketsharesDependentvariableNPNetprofitDependentvariable

(i) Setting of test model for H1:

To test H1, we built following test model:

Sale=β0+β1D1+β2D2+β3D3+ε

If β2-β1>0, it accepts H1, indicating that dairy enterprises adopting vertical strategy have higher performance than those adopting horizontal strategy; if β2-β1≤0, it rejects H1, and the original hypothesis does not hold true.

(ii) Setting of test model for H2:

To test H2, we built following test model:

Sale=β0+β1D1+β2D2+β3D3+ε

If β2=0, it accepts H2, indicating that dairy enterprises adopting diversified strategy have higher performance than those adopting vertical strategy; if β2≠0, it rejects H2, and the original hypothesis does not hold true.

(iii) Setting of test model for H3:

To test H3, we built following test model:

Sale=β0+β1D1+β2D2+β3D3+ε

If β1=0, it accepts H3, indicating that dairy enterprises adopting diversified strategy have higher performance than those adopting horizontal strategy; ifβ1≠0, it rejects H3, and the original hypothesis does not hold true.

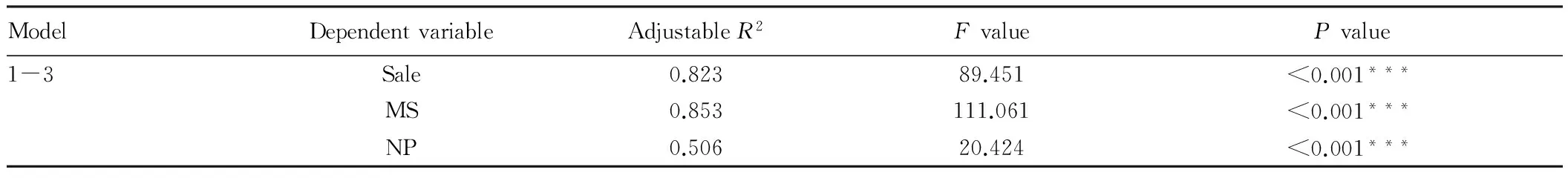

4.2DataregressionresultsIn this study, we selected Sale, MS, and NP three indicators to measure the performance. Substitute these three dependent variables to 3 hypotheses and make analysis, the analysis results are listed in Table 6.

Table6Analysisofmodelregressionresults

ModelDependentvariableAdjustableR2FvaluePvalue1-3Sale0.82389.451<0.001***MS0.853111.061<0.001***NP0.50620.424<0.001***

Since test models of H1-H3 are similar, the adjustableR2,Fvalue andPvalue of entire model are similar, we combined models 1-3 in Table 6. The three models have excellent goodness of fitting with R2higher than 0.5. ThePvalue of all test models is lower than 0.001, reaching the significance level of 0.01, indicating that all test models of three hypotheses pass the significance test. Sample data adopt cross-section data, it is easy for regression models to have multicollinearity, and thus test models need judgment of multicollinearity. In this study, we use the tolerance and variance inflation factor (VIF) to judge whether there is multicollinearity between independent variables.

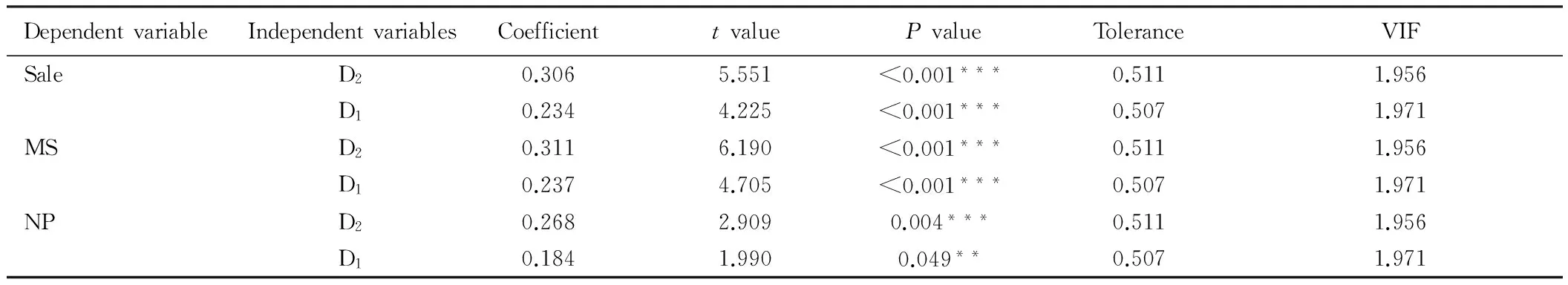

The data processing results of H1 test model are indicated in Table 7, the tolerance of independent variable D1and D2> 0.5, VIF is smaller than 2, indicating there exists no multicollinearity between independent variable D1and D2. β2and β1are positive, and P value is smaller than 0.05, passing the significance test, indicating independent variable D1and D2have positive influence on dependent variable Sale, MS, and NP, namely, both horizontal and vertical strategies have positive promotion on performance of dairy enterprises. Data analysis results indicate β2-β1>0, so H1 passes the test, namely, dairy enterprises adopting vertical strategy have higher performance than those adopting horizontal strategy.

Table7DataanalysisresultsofH1models

DependentvariableIndependentvariablesCoefficienttvaluePvalueToleranceVIFSaleD20.3065.551<0.001***0.5111.956D10.2344.225<0.001***0.5071.971MSD20.3116.190<0.001***0.5111.956D10.2374.705<0.001***0.5071.971NPD20.2682.9090.004***0.5111.956D10.1841.9900.049**0.5071.971

The data processing results of H2 test model are listed in Table 8, the tolerance of independent variable D2is 0.511, and VIF is 1.956, one is relatively high and the other is relatively low, indicating there exists no multicollinearity between independent variable D2and other independent variables. β2>0, and P value is smaller than 0.05, passing the significance test, so it rejects H2, the original hypothesis does not hold true, in other words, dairy enterprises adopting vertical strategy have higher performance than those adopting diversified strategy.

Table8DataanalysisresultsofH2models

DependentvariableIndependentvariablesCoefficienttvaluePvalueToleranceVIFSaleD20.3065.551<0.001***0.5111.956MSD20.3116.190<0.001***0.5111.956NPD20.2682.9090.004***0.5111.956

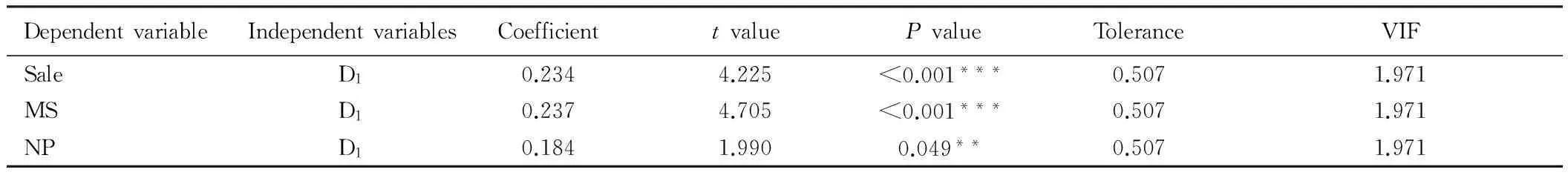

The data processing results of H3 test model are listed in Table 9, the tolerance of independent variable D1 is 0.507, and VIF is 1.971, one is relatively high and the other is relatively low, indicating there exists no multicollinearity between independent variable D1 and other independent variables. Β1>0, and P value is smaller than 0.05, passing the significance test, so it rejects H3, the original hypothesis does not hold true, in other words, dairy enterprises adopting horizontal strategy have higher performance than those adopting diversified strategy.

Table9DataanalysisresultsofH3models

DependentvariableIndependentvariablesCoefficienttvaluePvalueToleranceVIFSaleD10.2344.225<0.001***0.5071.971MSD10.2374.705<0.001***0.5071.971NPD10.1841.9900.049**0.5071.971

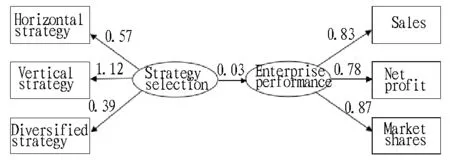

4.3PathanalysisofinfluenceofstrategyselectionofdiaryenterprisesonperformanceIn this study, we took enterprise performance and characteristics of strategy selection as latent variables. Enterprise performance, as latent variables, can be measured using explicit indicators sales amount, net profit and market share, and strategy selection can be measured using explicit indicators horizontal strategy, vertical strategy, and diversified strategy. Generally, every observation variable will be influenced from measurement error in different degrees, so each observation error has an error variable.

Using Amos software, we substituted related data of 115 dairy enterprises explicit indicators into the model to conduct calculation and analysis. From the perspective of model adaptation, the model operation results indicate that GFI is 0.888, close to 1, and RMR = 0.049, lower than 0.05, indicating that established model path graph has excellent goodness of fitting with actual data. As for the path coefficient, all path coefficients in the model pass the significance test of 0.05. The empirical analysis of established path is illustrated in Fig. 1.

Fig.1 Path analysis results

From Fig. 1, we can know that all path coefficients of explicit variables and latent variables are greater than 0, indicating that the selected indicator variables can explain latent variables, and path coefficients of latent variables to indicator variable are positive, namely, the influence of indicator variables on latent variables are positive influence. The analysis of latent variables indicates that the path "strategy selection → enterprise performance" shows strategy selection of dairy enterprises can directly influence enterprise performance and the path coefficient is 0.03, so this influence is positive.

5 Conclusions and recommendations

5.1ConclusionsFrom the direction of industrial chain, major restriction of economic benefits of dairy enterprises lies in price of upstream raw materials. Establishing milk source base not only can reduce production costs, but also ensure dairy safety from the root. Compared with using horizontal strategy to pursue scale economy and reduce costs, adopting vertical strategy can better increase the profit and obtain trust and purchase tendency of consumers. Therefore, using vertical strategy is better than horizontal strategy. From the perspective of business diversification, single business pursues specialized production, such diary enterprises can put enterprise resources and energy into core main business, to make business realize specialization and differentiation to obtain higher trust of consumers. If enterprises adopt diversified strategy, they will adopt diversified strategy and take time, make effort, and materials and financial resources to explore businesses they are not good at. Besides, they will compete with top enterprises doing related businesses, which will lead to risks of unsmooth fund operation, breakage of capital chain, and even bankruptcy. Thus, adopting diversified strategy is not better than adopting horizontal and vertical strategies.

5.2RecommendationsResearch conclusions indicate that the optimum strategy for diary enterprises is vertical strategy, followed by horizontal strategy, and the last is diversified strategy. Adopting vertical strategy to expand upstream and downstream of industrial chain needs huge investment, large dairy enterprises have funds and ability to implement such strategy, but small and medi-um sized enterprises do not have such ability to implement such strategy, so they have to adopt horizontal strategies, such as expansion of product production scale, product types, and market shares.

Facing impact of foreign products to dairy product market, product differentiation and innovation can increase types of dairy enterprises, so dairy products can adopt horizontal strategies to realize expansion of product types through product differentiation and innovation. Imported milk at domestic market does not show differentiation and products are limited to whole milk and skimmed milk. In this situation, domestic dairy enterprises can segment product functions, consumer groups and consumption occasions according to demands of consumers.

[1] XIONG HP, JIIN WX. Development stratagem of domestic construction enterprises based on vertical integration [J]. Construction Economy, 2006(288):50-53.(in Chinese).

[2] LIU S. Research on advantage and disadvantage of vertical integrated strategic [J].Value Engineering, 2005, 24(5):64-66.(in Chinese).

[3] HE YC, LI CG. Study on the vertical organizational relationship between raw milk production and dairy processing in China [J]. Rural Economy, 2003(6):6-8.(in Chinese).

[4] JIANG ZF. Analysis on the performance of the horizontal integration of middle- and small-sized enterprises [J]. China Water Transport, 2011, 11(1):53-55.(in Chinese).

[5] YU AP, ZHANG J. The change of marketing patterns from longitudinal integration to transverse one [J]. China Economist, 2003(2):8-9.(in Chinese).

[6] ZHAO F, WANG TN, ZHANG L. An empirical study on the effect of diversification strategy on firm performance [J]. China Soft Science, 2012(11):111-122.(in Chinese).

[7] LIU HW, HE ML. The influence of diversification strategy on the the enterprise’s technical capacities [J]. Soft Science, 2015, 29(8):61-65.(in Chinese).

[8] WU XB, ZHOU HJ. The relationship of international expansion and firm performance in diversified firms [J]. Studies in Science of Science, 2011, 29(9):1331-1341.(in Chinese).

[9] LUO HX. Corporate governance, efficiency of investment and financial performance financial performance and their relations [D]. Jilin: Jilin University, 2014.(in Chinese).

[10] Venkatraman N, Ramanujam V. Measurement of business performance in strategy research: A comparison of approaches [J]. Academy of management review, 1986, 11(4): 801-814.

[11] CHEN GR, ZENG J. The evolution of principal part of performance evaluation and its impact [J]. Accounting Research, 2005(4):65-68.(in Chinese).

[12] HE YC, ZHENG N, ZENG NY. Analysis on the performance characteristics of dairy enterprises in China [J]. China Price,2010: 6. (in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Cotton’s Water Demand and Water-Saving Benefits under Drip Irrigation with Plastic Film Mulch

- Technological Innovation Characteristics and Capacity Enhancement Ways for the Agricultural Science and Technology Enterprises in Beijing City

- A Study of Current Land Use in the Urban Area of Ma’anshan City

- Survey and Evaluation of Reserve Arable Land Resources in Xinjiang’s Makit County

- Fruit Production Distribution and Adjustment Strategies under the Constraint of Grain Security

- The Influencing Factors and Inter-Group Differences for Urban Residents’ Behavior of Consuming Edible Vegetable Oil