A Crowded Marketplace

2015-05-22ByWangJun

By+Wang+Jun

As soon as he got the newly revised gov- ernment work report released on March 15, Yang Zezhu leafed eagerly through to Page 16 and found to his excitement that“carrying out trials of equity crowdfunding” had been incorporated into the section on financial reform, following suggestions from Yang and several other deputies to the 12th National Peoples Congress (NPC).

In 2014, Yang, an NPC deputy and Chairman of Changjiang Securities Co. Ltd., conducted a survey examining financing options for micro and small businesses as well as startups, and found that under the current regulatory system, it was difficult for such ventures to secure bank loans. In most of the companies surveyed, financing costs accounted for up to a whopping 30 percent of their total operational costs.

Gao Dekang, another NPC deputy and Chairman of Bosideng International Holdings Ltd., said a major obstacle for micro and small businesses is financing, but that the innovation of crowdfunding enables companies to access a method of raising capital simpler and more convenient than those offered by traditional financial channels. Crowdfunding also reduces the risk level for micro and small businesses because they are not required to compensate investors if they go to the wall.

Fan Yun, Chairperson of Shanghai Fushen State Assets Evaluation Co. Ltd. and also a deputy to the 12th NPC, said the incorpora- tion of equity crowdfunding into this years government work report indicates the financing method is now an officially recognized part of the capital market and that the Central Government is consequently likely to formulate new measures and policies to ensure its sound development.

On March 12, the State Council issued guidelines to carry out trials for equity crowdfunding so that this novel financing method may be harnessed to better serve emerging entrepreneurship and innovation.

Crowdfunding is the practice of funding a project or venture through soliciting monetary contributions from a large number of people, typically via the Internet. Equity crowdfunding is a mechanism that enables broad groups of investors to fund startup companies and small businesses in return for equity.

The worlds first crowdfunding platform, Kickstarter, was set up in the United States in 2009. The World Bank projected that by 2025, the size of the global crowdfunding market might reach as much as $300 billion.

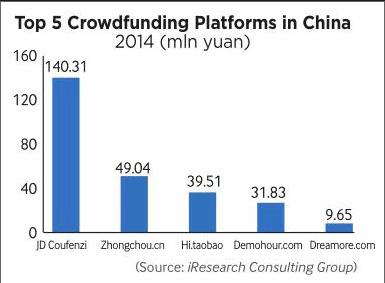

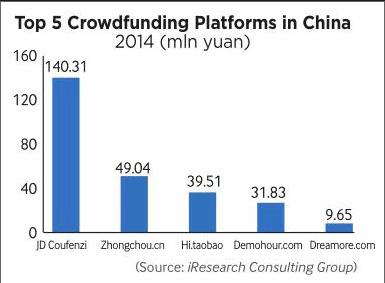

According to a recent survey by iResearch Consulting Group, the size of Chinas equity crowdfunding market reached 440 million yuan ($71.66 million) in 2014 and the number of crowdfunding platforms in normal operation totaled 110 by December 2014. Most of the platforms are based in Beijing, Shanghai, Guangdong, Zhejiang and other eastern coastal provinces.

Chinas top five equity crowdfunding platforms had a total financing volume of 270 million yuan ($43.97 million), accounting for 60.8 percent of the countrys total crowdfunding revenue in 2014, according to iResearch.

Management is vital

Ruan Xiaoqin, an analyst from Shenwan Hongyuan Securities Co. Ltd., said as laws and regulations improve, both the market size of equity crowdfunding and the number of equity crowdfunding platforms will continue to grow.

“Crowdfunding will be widely employed in film and TV production, creative design, technology, the production of healthcare remedies,real estate investment, research funds, and raising money for tuition fees and travel expenses,”said Ruan. “Equity crowdfunding has already been put to good use in the culture and real estate sectors.”

“Take Angelcrunch [Chinas largest crowdfunding platform for angel investors] for example. In 2014, it was used in industries as diverse as local life services, mobile social networks, advertising and education,”she said.

However, only 10 percent of equity crowdfunding projects go on to succeed at present. Ruan said post-investment management will be of paramount importance for platforms to remain competitive.

Equity crowdfunding factors in equity in return on investment; therefore the returns depend on the actual operations of a project. Post-investment management will emphasize operational management, disclosure of financial information and the disposal of the related assets of a project.

Business innovation

As an Internet-based private placement business, equity crowdfunding will bring new opportunities for securities companies.

Song Rui, an analyst from Huarong Securities Co. Ltd., said that in the future, securities companies will glean profits from equity crowdfunding in three distinct ways: by establishing equity crowdfunding projects to obtain revenues from management fees; using crowdfunding to gain access to new sales channels for the over-the-counter securities products; and employing the service to headhunt promising startup companies.

Ruan said that with equity crowdfunding, securities companies can get involved in businesses such as securities underwriting, investment consultancy and asset management. Securities firms can also connect equity crowdfunding with the pledging of stock rights thereby making full use of their overall advantages.

“Currently, securities companies are most likely to participate in equity crowdfunding through stock ownership,” she said.

According to the draft administrative measures for private equity crowdfunding released by the Securities Association of China in December 2014, securities companies now enjoy a generous five-day period in which to file for record to the association after participating in a private equity crowdfunding project.

“As more equity crowdfunding platforms are now open to securities firms, the government can allow them to get involved in innovation-based enterprises as early as possible,” Song said. “By establishing long-term cooperation with such enterprises, securities firms can provide better full-service businesses, such as public offerings or refinancing, and offer comprehensive options for companies in terms of investment and financing.”

“The opening up of equity crowdfunding platforms to securities companies can also nurture awareness of the Internet, and the manifold opportunities the online realm offers to securities companies,” Song added.