Study on the Improvement of Performance of Global Supply Chain Based on Quantity Flexibility Revenue Sharing Contract

2015-02-06

School of Management and Economics,University of Electronic Science and Technology of China,Chengdu 610054,China

1 Introduction

As the globalization process takes shape,more and more enterprises incorporate the global supply chain into their strategic planning.Since the global supply chain always consists of firms from different countries,exchange rate risk is an important uncertain factor in the global supply chain.The movements of exchange ratesmay lead to significant changes in firms'performance.For example,the high volatility of the euro and possible appreciation of the Chinese Yuan have posed significant risks tomany companies in 2010[1].Therefore,many companies and scholars put a premium on the management of exchange rate risk.In fact,the demand risk also hasa huge impacton firms'performance.For instance,with an unexpected demand decline,Cisco Systems Inc.wrote off$2.25 billion excess inventory in 2001[2].In order to maximize the performance of the global supply chain,the key issue is tomanage these two risks at the same time.This paper considers a two-echelon decentralized global supply chain affected by the exchange rate risk and the demand risk at the same time.Spengler pointsout that the doublemarginalization effectarisesbecause the unintegrated downstream firm doesnot take the upstream firm'smarginal profit into account when output is increased[3].Due to the influence of the demand risk,the downstream firm's marginal profit and the upstream firm'smarginal profit are hardly to be the same.So the demand risk leads to inefficiency in the performance of supply chain.The demand risk is not the only reason for the inefficiency caused by double marginalization effect;other uncertain factorswill also exacerbate the inefficiency caused by the doublemarginalization effect[4].For this reason,in order to consider the demand risk,we consider a newsvendormodelwith the constant sale price based on Cachon's study[5],and discuss how to eliminate this inefficiency by the contract design.Indeed,different contracts are used to coordinate the supply chain,and the relevant studies vary.For example,the quantity flexibility contract is a commonly used coordinatingmethod[6].By the quantity flexibility contract,the supplier allows the retailer to return certain percentage of its leftover.The demand risk is allocated among the node-enterprisesby the returnmechanism.So the supply chain can be coordinated with the quantity flexibility contract.The revenue sharing contract is also a commonly used coordinatingmethod[7].By the revenue sharing contract,the supplier gives the supplier a percentage of its revenue,to transfer part of the demand risk to the supplier.So the revenue sharing contract can also coordinate the supply chain.Therefore,we consider these two contracts first,and discuss how to eliminate the demand risk in the global supply chain.Many studies demonstrate that the quantity flexibility contract and the revenue sharing contract can coordinate the supply chain[8-11],but few of them focus on the difference between these two transfer payments.Both the quantity flexibility contract and the revenue sharing contract require the transfer payments at the end of sales season.With the quantity flexibility contract,the transfer payment is from the upstream node-enterprise to the downstream node-enterprise;with the revenue sharing contract,the transfer payment is from the downstream node-enterprise to the upstream node-enterprise.In the non-multinational supply chain,the quantity flexibility contract and the revenue sharing contract can achieve the same result,which is the supply chain coordination[5].The difference between these two transfer paymentswill not affect the performance of the supply chain.In the global supply chain,the situation is totally different.The exchange rate fluctuation will influence these two transfer payments differently,thereby affecting the performance of the global supply chain.For example,with the quantity flexibility contract,the appreciation of the supplier's currency means the reduction of the supplier's return cost;but with the revenue sharing contract,the appreciation of the supplier's currency means the reduction of the supplier's revenue sharing income.Therefore,how tomanage the exchange rate risk in the global supply chain becomesan important issue.The operational hedging and the financial hedging arewidely used methods in managing the exchange rate risk[12].Operational hedging is defined as the firm's ability to anticipate and respond to changes in development andmarket conditions flexibly by means of the firm's operations design[13].With the operational hedging,firms can design a hedging portfoliowith different operational strategies,or different exchange rates,to manage the exchange rate risk.Financial hedging is defined as the use of foreign currency derivatives including forward and futures contracts,swaps and options[14].With the financialhedging,firms canmanage the exchange rate risk by these foreign currency derivatives.Since these two hedgingmethods are effective inmanaging the exchange rate risk,mostof the global supply chain studiesare based on these twomethods.Though these two hedgingmethods are effective in managing the exchange rate risk,some firms can not adopt these twomethods.For example,it ishard to use the operational hedging in a decentralized global supply chain with only one exchange rate available and it is not always guaranteed to obtain the appropriate foreign currency derivatives from the local bank or the local financialmarket[15].Grey etal.pointout that the supply chain contract is similar to some financial tools[16].Some scholars have already focused on the issue ofmanaging the exchange rate risk based on contracts.For example,the risk sharing contract is an effectiveway tomanage the exchange rate risk.Liand Kouvelis manage the uncertain purchase costwith risk sharing contract,and point out that the uncertainty of the purchase cost can be caused by the exchange rate fluctuation[17].Based on Li and Kouvelis'study,Kim and Park investigate the difference between the risk sharing contract and the financial hedging,and design a combined contract tomanage the exchange rate risk[15].But these exchange ratemanagement researches have not considered the demand risk management at the same time.As we mentioned before,the exchange rate risk will affect the quantity flexibility contract and the revenue sharing contract differently.So,is it possible to design a hedgingmechanism with these two contracts?Based on this realization,this paper considers a two-echelon decartelized global supply chain with a retailer and a supplier from different countries.By studying the influence ofexchange rate risk on the transfer payments,we discuss the difference between the quantity flexibility contract and the revenue sharing contract in the global supply chain environment.Hence,by designing a hedging strategy with the quantity flexibilitymechanism and the revenue sharingmechanism,wemanage the demand risk and the exchange rate risk at the same time.

2 M odel assum ptions and notations

We considera two-echelon decentralized globalsupply chain,constituted by a retailer who resides in Country 1 and a supplier in Country 2.In thissupply chain,there isonly one kind of seasonal product.At the beginning of the sales season,the retailer and the supplier conclude the contract.After signing the contract,the supplier delivers the product to the retailer.Then the retailer sells it in themarket located in Country 1.In thisglobal supply chain,since the retailer and the supplier reside in different countries,their objectives are tomaximize the expected profit denominated in their own currency.No matter which contract is analyzed,their expected profits are all denominated in their own currency.

Let x denote the exchange rate the retailer realized,namely the price of one unit Country 2's currency in the Country 1's currency.Therefore,the exchange rate supplier realized is 1/x,namely the price of one unit Country 1's currency in the Country 2's currency.At the beginning of the sales season,the value of x is x0.Due to the exchange rate fluctuation,both the retailer and the supplier do not know what the exact value of x will be at the end of sales season.So the retailer and the supplier forecast x jointly.Based on the forecasts,at the end of the sales season,The fluctuation range of x satisfies x∈[A,B].The density of x will be g(·);the distribution of x willbe G(·).Let X1denote the expected exchange rate the retailer realized,and X2denote the expected exchange rate the supplier realized.Hence,X1and X2can bewritten as follows:

In order to focus on the exchange rate fluctuation instead of the tendency of exchange rate changes,here we assume that X1=x0.In global supply chain,since there are exchange rate fluctuations between node-enterprises,different settlement currency means different risk-taker.Normally,firms use the widely recognized currency to settle the payment.In the revenue sharing contract,retailer is required to give a percentage of its revenue to the supplier,and this partof revenue is directly from themarket located in the Currency 1.So,the exchange rate risk is always on the supplier no matter which currency is used to settle the revenue shares.Hence,in our research,wemainly focus on the situation that the exchange rate risk is on the supplier.

Let D denote the demand,with the fluctuation range of D∈[0,Q].The density of D is f(·),and the distribution of D is F(·).Based on Lariviere and Porteus's research[18],herewe assume that F(·)satisfy IGFR condition.Also,we assume the demand risk and the exchange rate risk are independent.In order to demonstrate how the exchange rate fluctuation affects the contract,we do not consider the salvage and inventory in ourmodel.The sale price p isa constant price denominated in the currency of Country 1,and the product cost c is a constant cost denominated in the currency of Country 2.We consider a newsvendor model here,namely the order decision in light of the uncertain demand for a seasonal product[19].For simplicity,based on Cachon's study[5],let S(·)denote the expected sale number.Then,for any order quantity qa,S(qa)can be demonstrated as follow:

Firstwe consider the centralized decision-making model as the benchmark case.In the centralized decision-making model,since the exchange rate at the beginning of sales season is known,the optimal order quantity of this global supply chain will be equivalent nomatter which currency is used to settle the payment.LetΠdenote the total expected profit denominated in the Country 1's currency.Then,Πcan be written as follows:

where q0is the order quantity of the centralized decision-making model.It is easy to know that the optimal order quantity q*0satisfies:

In the decentralized decision-makingmodel with the wholesale price contract,the supplierwill announce thewholesale price w first;then the retailerwill decided the order quantity q based on the realization of w.Since the exchange rate at the beginning of the sales season is known,in order to avoid the exchange rate risk,supplier will settle the purchase payment immediately after signed the contract.Let E(Πr)denote the expected profits of the retailer,E(Πs)denote the expected profits of the supplier.The node-enterprises'expected profits can be written as follows,respectively:

Based on Equation 5,we can get Proposition 1.In the following part,we analyze how the exchange rate fluctuation affects this global supply chain.

Proposition 1 In the decentralized decision-makingmodel with thewholesale price contract,the optimal order quantityq*can be derived as follows.

In Proposition 1,¯F(q*)=1-F(q*).Proposition 1 and Equation 4 show that because of the doublemarginalization effect raised by the demand risk,the wholesale price contract can not coordinate this global supply chain.

3 Quantity flexibility contract

Section 2 shows that,the demand risk will also affect the global supply chain.In order tomaximize the performance of global supply chain,it is important to manage the demand risk first.We consider that the node-enterprises conclude a quantity flexibility contract in this supply chain.With the quantity flexibility contract,the retailer charges wqper unit purchased but gives the retailer a full refund on the firstδunits returned.The supplier will announce wqandδfirst.Then the retailer will decided the order quantity qqbased on the realization of wqandδ.Let E(Πrq)denote the expected profit of the retailer and E(Πsq)denote the expected profit of the supplier.Then E(Πrq)and E(Πsq)can be written as follows:

where wqx0is thewholesale price the retailer realized.In order to insure the retailer can get wqx0per unit returned,the supplier's expected cost per unit returned is wqΓ.ΓsatisfiesΓ=X2x0.We will discuss the value ofΓin Proposition 2.

Proposition 2 For any givenx,is always larger than 1.

Proposition 2 shows that,though there is a reciprocal relation between the exchange rate the retailer realized and the exchange rate the supplier realized;there is not a reciprocal relation between the expected exchange rate the retailer realized and the expected exchange rate the supplier realized.Proposition 2 indicates that,the exchange rate fluctuation will increase the supplier's return cost,to affect the performance of the global supply chain.

Proposition 3W ith the quantity flexibility contract,the optimal order quantity can be derived as follows.

Based on Proposition 3,we can obtain the following corollary.

Corollary 1 W ith the quantity flexibility contract,the optimal order quantityq*qis lower than the optimal order quantity of the centralized decision-making model.

Proposition 3 and its corollary indicate that the quantity flexibility contract can manage the demand risk,but the product return at the end of sales season will be influenced by the exchange rate fluctuation.

4 Revenue sharing contract

We consider that the node-enterprises conclude a revenue sharing contract in this supply chain.With the revenue sharing contract,the retailer charges wrper unit purchased and the retailer gives the supplier 1-λof its revenue.The retailer will announce its own revenue share fractionλfirst.Then the supplierwill announce the wholesale price wrand the retailerwill decided the order quantity qrbased on the realization of wr.Let E(Πrr)denote the expected profit of the retailer and E(Πsr)denote the expected profit of the supplier.Then E(Πrr)and E(Πsr)can bewritten as follows:

In Equation 7,the sale revenue is denominated in the Country1's currency,the supplierwillexchange the revenue shares into Country 2's currency after receive it.With one unit Country 1's currency,the supplier is expected to get X2unitof Country 2's currency.Based on Equation 7,we can obtain the Proposition 4.

Proposition 4W ith the revenue sharing contract,the optimal expected profits of both node-enterprises can bew ritten as follows,respectively.

In Proposition 4,Πr=pS(qr)-cqrx0;

Then the optimal expected profits of both node-enterprises can be written as follows,respectively:

Equation 8 shows that the exchange rate fluctuation will increase the supplier's expected profit.In order tomaximize its own profit,the supplier will transfer parts of the extra income caused by the exchange rate fluctuation to the retailer,to spur the retailer to increase the order quantity.It is important to note that,the centralized expected profit only affected by the demand risk,but the decentralized expected profit not only affected by the demand risk,it also affected by the exchange rate risk.Therefore,these two kinds of expected profitwith the same values are not equivalent.We can notdraw the conclusion that the performance ofglobal supply chain with revenue-sharing contract is better than the centralized performance.

5 The quantity-flexibility-revenue-sharing contract

So far,we have discussed two widely used contracts separately.Since the transfer payments at the end of the sales season are different,the exchange rate fluctuation affects these two contracts differently.The exchange rate fluctuation increases the supplier's expected profit with the revenue sharing contract while decrease the supplier'sexpected profitwith the quantity flexibility contract.Based on this realization,can we build a hedging with these two contracts,hence to eliminate the exchange rate risk?We consider that the node-enterprises conclude a combined contract in this supply chain.With this combined contract,the retailer charges wcper unit purchased,butgives the retailer a full refund on the first δcunits returned.And the retailer also gives the supplier 1-λcpercentage of its revenue.Let E(Πrc)denote the expected profit of the retailer and E(Πsc)denote the expected profitof the supplier.Then E(Πrc)and E(Πsc)can be written as follows:

Base on Equation 9,we can obtain Proposition 5.

Proposition 5W ith this combined contract,the retailer's revenue shareλcshould satisfy:

Proposition 5 shows that the revenue sharingmechanism will lead to a drop in the retailer's expected profit.If the retailer gives tomuch revenue to the supplier,the retailermay suffer a deficit.This happens because the wholesale price is not only decided by the fraction of revenue shares;it also depends on the product return.

Proposition 6W ith this combined contract,the optimalorder quantityq*ccan be derived as follows.

Based on Proposition 6,we can obtain the following proposition.

Proposition 7 Ifλc+Ωc=1,the optimal order quantity w ith this combined contract equals to the centralized order quantity.

Proposition 7 shows thatby designing a hedging strategy with these different transfer payments,this combined contractmanages the demand risk and the exchange rate risk at the same time.It is important to note that,this combined contract can eliminate the exchange rate risk if the sales volume happens to be the expected sales quantity.In other circumstances,it can only decrease the exchange rate risk,but not the elimination.This happens because our study is based on the expected profits.The demand risk will lead to the volatility of sales volume,hence to change the transfer payments at the end of the sales season.And it will decrease the efficiency of the hedging.

6 Numerical analysis

This section analyzeshow the exchange rate risk affects the quantity flexibility contract,the revenue sharing contract and the performance of global supply chain.This numerical analysis ismade on the basis of Matlab7.0.

6.1 Exchange rate fluctuationIn order to illustrate the impacts of the exchange rate fluctuation,we first consider the relation between the expected exchange rate the retailer realized and the expected exchange rate the supplier realized.We generate series of exchange rates with the same expected value and different fluctuation ranges for 100 times.In each time,we generate 1000 exchange rates randomly,and calculate the expected exchange rates.Let x denote the exchange rate the retailer realized,namely the price of one unit Country 2's currency in the Country 1's currency.Therefore,the exchange rate supplier realized is 1/x,namely the price of one unit Country 1's currency in the Country 2's currency.x satisfies x∈unif[1-r,1+r],with the expected values of 1.In which,r stands for the fluctuation range,and changes from 0 to 0.3 with an interval of0.003.

In Fig.1,Fig.2 and Fig.3,X axis indicates different fluctuation ranges,and Y axis indicates different series of the exchange rate risks.Figure 1 and Figure 2 shows that,both the expected exchange rate the retailer realized and the expected exchange rate the supplier realized increase volatility as the fluctuation range of x increases.Intuitively,there is a reciprocal relation between the expected exchange rate retailer realized the expected exchange rate supplier realized.Since the value of E[x]is1,the value of E[x]E[1/x]should also be 1.But as Figure 3 illustrates,the value of E[x]E[1/x]increases in the fluctuation range of x.Therefore,this phenomenonmay lead to a bias in the exchange rate evaluation,hence to cause the inefficiency in the global supply chain.Besides,Fig.1,Fig.2 and Fig.3 show that,the product of expected exchange rates is relatively constant compare to the expected exchange rates.

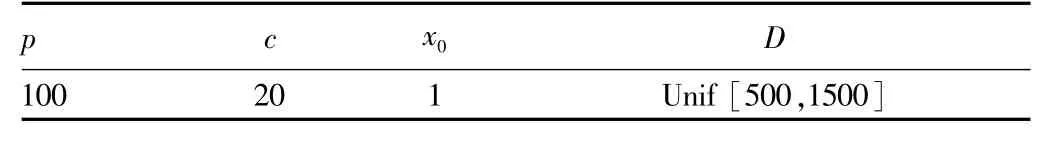

6.2 Optimal order quantity with different contractsHere we discuss how the exchange rate fluctuation affects the exchange rate risk.We also generate a series of exchange rates with the same expected value and different fluctuation ranges.x satisfies x∈unfi[1-r,1+r],with the expected values of 1.In which,r stands for the fluctuation range,and changes from 0 to0.3 with an interval of 0.003.The others parameters are assigned below:

Table 1 Parameters assignment

With these Parameters,we discuss three contracts,the quantity flexibility contract,the revenue sharing contract and the combined contract.Note that,the global supply chain'sexpected profit can be allocated with all of these three contracts;and the total expected profit of the global supply chain is hard to evaluate since the node-enterprises use a different currency.Therefore,we use the optimal order quantity as the index to evaluate the global supply chain's performance.

In Fig.1,X axis indicates different fluctuation ranges,and Y axis indicates the return percentages.Fig.1 shows that the quantity flexibility contract is influenced by the exchange rate fluc-tuation.The optimal order quantity decreases in the fluctuation and the return percentage.The quantity flexibility contract will lose efficiency if the exchange rate fluctuates dramatically.In Fig.2,X axis indicates different fluctuation ranges,and Y axis indicates the revenue shares.Fig.2 shows that the revenue sharing contract is influenced by the exchange rate fluctuation.The optimal order quantity will exceeds the centralized order quantity,since the supplier will transfer part of extra profit to the retailer.In Fig.3,X axis indicatesdifferent fluctuation ranges,and Y axis indicates the revenue shares.With this combined contract,the return percentage can be derived from the equationλc+Ωc=1.Fig.3 shows thatwith this combined contract,the exchange rate risk and the demand risk can bemanaged at the same time,and the optimalorder quantity isexactly the centralized order quantity.

7 Conclusions

In the global supply chain,the exchange rate fluctuation isan important uncertainty factor.We considered the quantity flexibility contract and the revenue sharing contract in a decentralized global supply chain,analyzed the impacts of exchange rate fluctuation on the quantity flexibility contract and the revenue sharing contract.Based on our research,we can draw the following conclusion.Though both the quantity flexibility contract and the revenue sharing contract can diminish the demand risk,the differences in transfer payments lead to a differentperformance in the global supply chain.The exchange rate risk increases the supplier'sexpected profit with the revenue sharing contract while decrease the supplier's expected profit with the quantity flexibility contract.With the combined contract,the demand risk and the exchange rate risk can bemanaged at the same time.Hence to let the optimal order quantity equal to the centralized order quantity.So far,there have been few studies focusing on the coordinating contracts in the global supply chain,and the coordinating studies are even rarer.In the future research,there are several interesting extensions.First,in the global supply chain,most of the existing literature only concerned one kind of risk.In order tomaximize the performance of global supply chain,how tomanage different risks simultaneously is a crucial issue.How to evaluate the total profit of the global supply chain is also an important question.Since node-enterprises often use different currencies,an appropriate evaluation of global supply chain's total profit is the precondition for the global supply chain coordination.

[1]LIU Z,NAGURNEY A.Supply chain outsourcing under exchange rate risk and competition[J].Omega,2011,39(5):539-549.

[2]LAIG,DEBO LG,SYCARA K.Sharing inventory risk in supply chain:The implication of financial constraint[J].Omega,2009,37(4):811-825.

[3]SPENGLER JJ.Vertical integration and antitrust policy[J].The Journal of Political Economy,1950:347-352.

[4]HEESEHS.Inventory record inaccuracy,doublemarginalization,and RFID adoption[J].Production and OperationsManagement,2007,16(5):542-553.

[5]CACHON GP.Supply chain coordination with contracts[J].Handbooks in Operations Research and Management Science,2003(11):227-339.

[6]TSAY AA,LOVEJOY WS.Quantity flexibility contracts and supply chain performance[J].Manufacturing&Service OperationsManagement,1999,1(2):89-111.

[7]MORTIMER JH.The effects of revenue-sharing contracts on welfare in vertically-separated markets:Evidence from the video rental industry[J].2002.

[8]TSAY AA.The quantity flexibility contract and supplier-customer incentives[J].Management Science,1999,45(10):1339-1358.

[9]CHAN FTS,CHAN HK.A simulation study with quantity flexibility in a supply chain subjected to uncertainties[J].International Journalof Computer Integrated Manufacturing,2006,19(2):148-160.

[10]CACHONGP,LARIVIEREMA.Supply chain coordination with revenue-sharing contracts:strengths and limitations[J].Management Science,2005,51(1):30-44.

[11]ALLAYANNISG,IHRIG J,WESTON JP.Exchange-rate hedging:Financial versus operational strategies[J].American Economic Review,2001:391-395.

[12]ERZURUMLU SS,DAVIES J,JOGLEKAR N.Operations design to enhance Arpae funding for transformational clean technology start-ups[J].Frontiers of Entrepreneurship Research,2012,32(3):2.

[13]GLEASON K,KIM YS,MATHUR I.The operational and financial hedging strategies of US high technology firms[J].Documento De Trabajo,Florida Atlantic University,2005.

[14]KIM KK,PARK KS.Transferring and sharing exchange-rate risk in a risk-averse supply chain of amultinational firm[J].European Journal of Operational Research,2014,237(2):634-648.

[15]GREYW,OLAVSON T,SHID.The role of e-marketplaces in relationship-based supply chains:A survey[J].IBM Systems Journal,2005,44(1):109-123.

[16]LICL,KOUVELISP.Flexible and risk-sharing supply contracts under price uncertainty[J].Management Science,1999,45(10):1378-1398.

[17]LARIVIEREMA,PORTEUSEL.Selling to the newsvendor:An analysis of price-only contracts[J].Manufacturing&Service OperationsManagement,2001,3(4):293-305.

[18]CHOI T.Quick response in fashion supply chains with dual information updating[J].Journal of Industrial and Management Optimization,2006,2(3):255.

杂志排行

Asian Agricultural Research的其它文章

- Forecasting of the Egg Price Based on EEMD

- On Modern Fruit Production in Japan

- Supply Chain Optimized Strategies in the Mode of External Financing

- Financial Support for Rural Cooperative Economy in China Based on Grey Correlation Analysis

- A Study on the Driving Factors of Food Production in Huang-Huai-Hai Plain Based on Path Analysis

- An Analysis of the Consumer Demand Structure of Rural Residents in Chongqing City in the Context of New Urbanization