A BLOCKBUSTER BUSINESS

2015-02-05ByJiJing

By+Ji+Jing

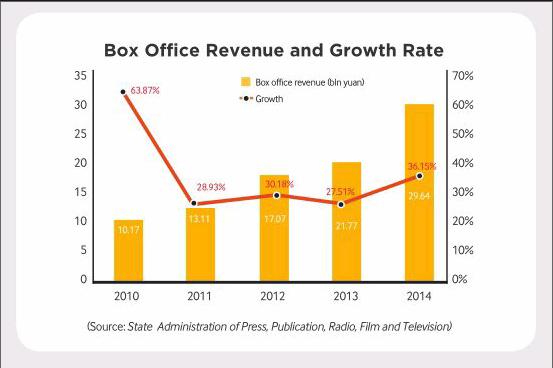

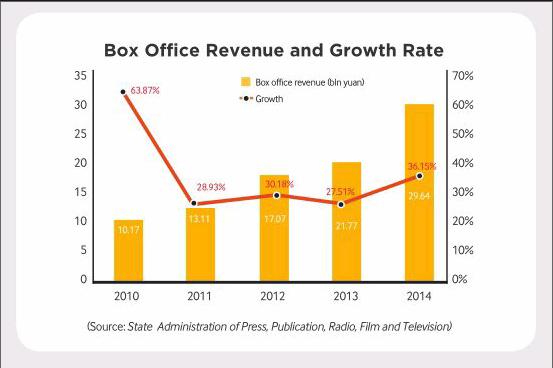

The Chinese film industry once again experienced a boom last year. According to a report released by the State Administration of Press, Publication, Radio, Film and Television on January 5, Chinas box office revenue in 2014 reached 29.6 billion yuan($4.77 billion), growing 36 percent. Although this sum fell short of the preset target of 30 billion yuan ($4.83 billion) , it more than sufficed to raise a few eyebrows in the international film community, as global box office revenue registered only 4-percent year-on-year growth. In North America, box office numbers actually declined by 6 percent, according to the 2014-15 Chinese Film Industry Report published by EntGroup Consulting, a domestic film industry research firm.

It has taken a paltry four years for Chinas box office revenue to grow from 10 billion yuan ($1.61 billion) in 2010 to nearly 30 billion yuan in 2014. In 2012, China became the worlds second largest film market, the largest being North America.

The report also pointed out that China has of late functioned as the driving engine for global box office growth. Worldwide box office takings in 2014 amounted to $37.5 billion, with that of the United States accounting for 27 percent and that of China constituting 13 percent. Of the $1.6-billion increase of the global box office in 2014 against the previous year, box office takings in the Middle Kingdom contributed 75 percent.

Additionally, the number of tickets sold reached 830 million, 1,015 new cinemas opened and 5,397 screens were added to existing establishments. As of January 5, there had been altogether 23,600 screens across the country.

A booming market

Looking back on Chinas vibrant film market in 2014, several tendencies become apparent.

The competitive edge of domestic films against their imported counterparts has sharpened. The box office revenue of homemade films surpassed that of imported ones. The 308 domestic films released in theaters last year raked in 16.16 billion yuan ($2.6 billion), accounting for 54.51 percent of the total box office revenue and the 80 imported ones grossed 13.48 billion yuan ($2.17 billion). Among the 20 highest-earning films, Chinese productions occupied half of the spots. “The Chinese film industry has gone through a period of rapid adjustment following the signing of a film agreement with the United States in 2012. As a result, China has been able to register a world-leading growth rate, even in the face of competition from Hollywood blockbusters such as Transformers: Age of Extinction (Transformers 4),” said Hou Tao, vice President of EntGroup Consulting.

According to the 2012 agreement, Hollywood film imports would increase from 20 to 34 per year. The additional 14 movies were mostly in 3D or IMAx formats. The United States currently takes 25 percent of box office revenues drawn from its film exports to China, a sharp increase from the original 13 percent.

Eighteen of the top 30 films by box office in the United States last year were imported into China and another two of the top 30, The Hunger Games: Mockingjay and The Hobbit: The Battle of the Five Armies, will hit screens later this year. Those 18 films, together with Frozen and The Hobbit: The Desolation of Smaug, took in $1.5 billion in China, accounting for 32 percent of the countrys total box office revenue. In the meantime, the top 20 domestic films in terms of box office generated $1.6 billion, amounting to 33 percent of the total box office revenue, indicating the growth of the box office didnt merely rely on imported movies but upon the improvement of the domestic film industry as well.

With an eye to the opportunities present in the gigantic Chinese market, many foreign film companies are now seeking cooperation with China. The Hollywood science-fiction action film Transformers: Age of Extinction was co-produced by Paramount Pictures, the China Movie Channel and Jiaflix Enterprises. Some of its scenes were shot in the three Chinese cities of Beijing, Chongqing and Hong Kong, and the film included a number of Chinese actors and actresses in order to appeal to local audiences. Actress Li Bingbing, for instance, was among the films top-billed stars.

The movie, which is the fourth installment of the Transformers franchise, raked in 1.98 billion yuan ($319 million), surpassing previous records for both domestic and foreign movies to become Chinas highestgrossing film ever.

By the end of 2014, 10 countries had signed film co-production agreements with China, such as the United Kingdom, South Korea and Singapore.

An xiaofen, President of Desen International Media Co. Ltd., a Beijing-based company specialized in local feature film pro- duction and distribution, said there are three ways for foreign movies to enter the Chinese market. First, film producers may apply for their films inclusion in the yearly quota of 34 imported films, through which they can claim a 25-percent share of the box office sales. Second, domestic distribution companies purchase the rights to show a foreign film. Under these circumstances, foreign producers will have zero share in the box office. Third, Chinese and foreign producers coproduce a film, in which case foreign producers are entitled to a 43-percent share of the box office revenue.

In addition to foreign producers, domestic Internet companies such as Baidu Inc., Alibaba Group Holding Ltd. and Tencent Holdings Ltd., also announced plans to invest in the movie business in 2014.

According to Tianto Info Consulting, Internet companies are likely to reshape the whole film industry. They will be able to take into greater consideration the audienceswants and needs, as they possess data on audiences purchasing and search preferences. In addition, they may expand film distribution channels by making use of the Internet, especially the mobile Internet.

“Every mobile phone can function as a miniature silver screen. The profit film distributors receive from mobile streaming apps will become more stable and lasting. At the same time, the boom in apps of this kind will enable movies with narrower appeal, such as art-house titles, to reach audiences,” said Liu Shuyao, founder and CEO of 100 Tv, a video portal exclusively designed for mobile devices.

Wider variety

The tastes of Chinese film audiences are also becoming decidedly more varied. Predictably, romances, comedies and action movies occupied nearly 70 percent of the box office revenue for domestic films last year. However, thrillers, martial arts films and fantasy movies also expe-

rienced upticks in popularity.

There is widespread agreement that the biggest deficit in the film market last year was the lack of homegrown blockbusters and science fiction films, said Chen Xuguang, Director of the Institute of Film, Television and Theatre of Peking University.

As a result, blockbusters and sci-fi epics from the United States registered huge success. For example, Christopher Nolans sci-fi Interstellar garnered acclaim from critics and audiences alike and also achieved commercial success, grossing 751 million yuan ($120.93 million).

“The lack of domestically produced science fiction movies has given opportunities for even mediocre movies inhabiting such genres from the United States to grab a share of Chinas film market. Some speculate that the Chinese screenwriters are not steeped in the tradition of scientific and rational thinking necessary to create good science fiction. Maybe we could focus on fantasies temporarily in the place of science fiction, as the two genres are very close to each other in terms of conventions,” Chen added.

Movies specifically targeting at the youth market thrived in 2014, as represented by Beijing Love Story, My Old Classmate, Fleet of Time and Tiny Times 3.0, all of which reaped over 400 million yuan($64.41 million) in box office receipts.

“Teen movies, which often center on love stories, have managed to successfully relate to young audiences,” said Chen.

Take the third installment of the Tiny Times series for example. Audiences aged below 19 accounted for 41 percent of the movies takings while those aged between 20 and 29 accounted for 28 percent. young audiences have become the main consumers of youth movies, and also constitute the majority of the Chinese movie-going public. According to the EntGroup report, customers aged between 19 and 30 have accounted for over one half of moviegoers in the past two years. College graduates account for approximately 80 percent of current audiences.

As young moviegoers are frequent Internet users, online social networking platforms such as Weibo and WeChat have become important means for film promotion. Films hotly discussed on these platforms in advance of their release often achieve high box office numbers.

Several notable directors came out with new productions in 2014. However, many of them fell short of commercial expectations, arguably owing to an inability to adapt and cater to the market. For example, both John Woos The Crossing and Jiang Wens Gone With the Bullets, which hit screens in December, flopped at the box office. Meanwhile, Dearest and The Taking of Tiger Mountain 3D, respectively directed by Peter Chan and Hark Tsui, curried favor with audiences and performed well commercially.

“The two movies were the highlights of last year. They have reached a balance between demands of the commercial mainstream, the directors personal aspirations and the audiences interest,” said Suo yabin, a professor at the Communications University of China.

He criticized Jiang for paying insufficient attention to the market and overemphasizing his personal ideals to the detriment of audience enjoyment in his most recent movie.

In addition to famous directors, people from other professions such as writers and actors also tried their hand at filmmaking last year. Two young best-selling authors Guo Jingming and Han Han both made their directorial debuts. Their Tiny Times 3.0 and The Continent earned 522 million yuan ($84.05 million) and 629 million yuan ($101.28 million) apiece respectively during the summer vacation period. Actor Deng Chaos The Breakup Guru took in 666 million yuan ($107.24 million) and actor Chen Jianbins A Fool won him Best Actor and Best New Director at the 51st Golden Horse Awards in Taiwan, one of the largest events in the Chinese-language film industrys calendar.

“First-time directors often depend on carrying over their established fanbase from other entertainment areas to prop up the box office. Such a model of success is impossible to replicate by others. In the meantime, inadequate narrative ability will hinder them from making further progress,” said Chen Xuguang.

Challenges

In spite of the outstanding performance of the film industry last year, industry insiders and experts harbor concerns about the future.

“The Chinese film industry should not be unduly distracted by the revelry arising from recent box office success and pay more attention to improving quality,” said Rao Shuguang, Chairman of the China Film Association.

“Only by improving the quality of films can the film industry realize sustainable and healthy growth,” Rao added.

Rao said the film industry still has many shortcomings, such as being overly recreational in focus and possessing a lack of artistic creativity and imagination.

Suo said the lack of quality content has become an increasingly serious problem for Chinese films. Many films seem more like the directors own personal tract or monologue rather than constituting an attempt to communicate with the audience. Some use sophisticated methods of promotion to“trick” audiences into the theater but failed to deliver a well crafted, high-quality piece of entertainment thereafter.

“If Hollywood is granted unlimited access to the market in 2017, when China and the United States will hold their next meeting on movie quotas, domestic films will be greatly impacted,” said Suo.

It is widely believed that the quota will be further increased or that the market will even be completely opened to U.S. movies.

The report by EntGroup also pointed out that the Chinese film industry has a lot room for improvement in spite of its recent rapid growth. For example, the area of film-related merchandizing, encompassing products such as T-shirts, action figures and video games, is underdeveloped. Merchandise occupies only a small proportion of revenue from films, and lacks variety and adequate sales channels. Whats more, most of the audiences are predominantly urban young people aged between 19 and 40. Middle-aged and senior citizens, children, and people from rural areas, meanwhile, are underrepresented and seldom go to the movies. It appears on the whole that if the Chinese movie industry is to further thrive, it will have to spread its wings in terms of improving quality, merchandizing and embracing a wider audience base.