Price Conduction Mechanism of China's W heat Industry Chain Based on VECM

2015-02-02HaiyanZHU

Haiyan ZHU,

1.College of Economics and Management,China Agricultural University,Beijing 100083,China;2.School of Economics and Management,Qingdao Agricultural University,Qingdao 266109,China

1 Introduction

Wheat is an essential grain crop of China.Its industry chain includes the whole process of upstream and downstream closely related to wheat production,including production,circulation and sales sections.The structure of its industry chain is shown as Fig.1.Participant subjects mainly include wheat producers,purchasers,wheat flour processing enterprises,feed processing enterprises,industrial processing enterprises,and sellers.At present,about70%wheat is used for grain ration(calculated according to the consolidated balance sheet of China National Grain and Oils Information Center).Flour is primary product of wheat processing and also raw material of subsequent flour products,so flour production is an essential stage in the wheat industry chain.In this study,we take flour price as downstream product price of the wheat industry chain.

Since January 2000,the price of wheat and flour fluctuated and the rising trend is significant.Fluctuation of wheat and flour price not only influences stable income of farmers,but also influences profits of flour processing enterprises,and concerns sound and stable development of China's wheat industry.More important,the industry chain price conduction mechanism is an essential indicator for evaluating market efficiency.When a certain impact is acted on the conduction process,the price will be adjusted accordingly.As a result,it will lead to redistribution of benefits and welfare of members in the whole product supply chain.Study on price conduction mechanism of wheat and flour price can provide certain reference for making proper policies for China's wheat industry and for flour processing enterprises making proper decisions.

Domestic and foreign scholars have made extensive researches on vertical conduction of agricultural product price fluctuation.Agricultural products they researches mainly include livestock products[7,8,15], poultry and egg products[12], grain products[2,17],dairy products[10],fishes[3],and vegetable[9,13].Research methods include error correction model(ECM)[6]and asymmetrical threshold error correction model(ATECM)[4,16].However,there are few researches about vertical conduction of price of China's wheat industry chain,and the existing researches are mainly integration of wheat and flour market[13]and conduction of domestic and foreign price.

In view of this situation,the objective of this study is to test whether there is nonlinear relationship between wheat price and flour price in a long term,analyze short-term dynamic conduction effect of China's wheat price and flour price through building the VECM and impulse response function,and to provide certain theoretical reference for wheat industry formulating industry policies and flour processing enterprises making proper decisions.

2 Data selection and relevant tests

2.1 Data selectionSince this study focuses on the conduction between wheat price and flour price of the whole country,the wheat price(PWW)adopted the monthly average price of white wheat reported by each price reporting station,and the flour price(PFL)adopted the monthly average price of special flour grade 1 reported by each price reporting station.(In China,wheat flour can be divided into grade flour,high and low gluten flour,and special purpose flour.)The data were selected from the Grain and Oil Wholesale Market Price Collection System of China Grain Website and Sinogra in Price Monitoring System.And the data were supplied by 61 price reporting stations in Anhui,Beijing,Fujian,Gansu,Guangdong,Hebei,Henan,Hubei,Jilin,Jiangsu,Shandong,Shanxi,Shaanxi,Tianjin,and Xinjiang.The cal-culation method adopted simple arithmetic mean.

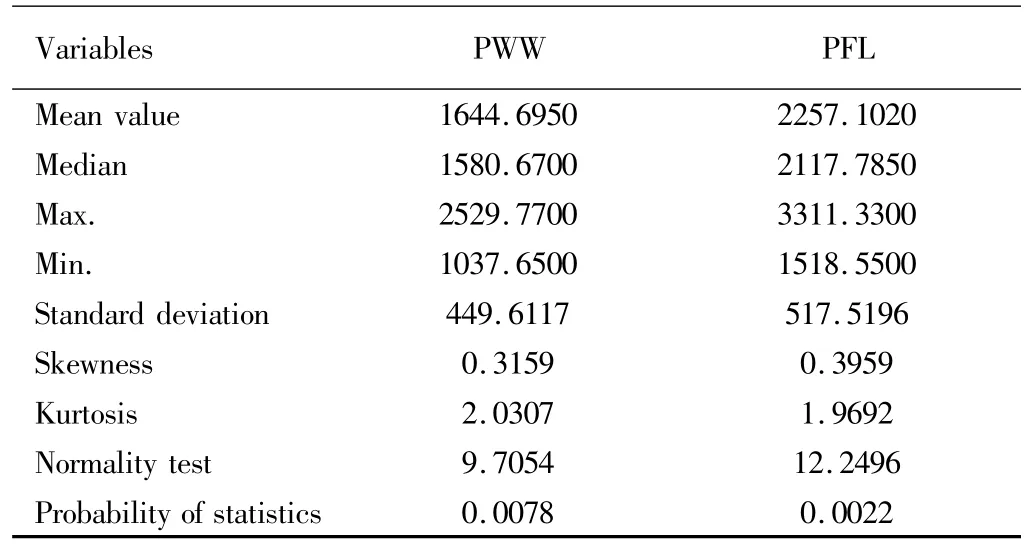

Fig.2 is the variation trend of wheat and flour price during January 2000 and June2014.Fig.2 shows that the variation trend of wheat and flour price is basically consistent,i.e.rising with fluctuation.From Table 1,we can see that the variation coefficient(standard deviation divided by average value)of wheat price and flour price is0.27 and 0.23 respectively,and the fluctuation amplitude is basically same.The correlation coefficient of price series is0.984,indicating highly positive correlation.

2.2 Data testTo eliminate possible heteroscedastic variance in time series data,we first took natural logarithm for two price variables.lnPWW and lnPFL respectively denote natural logarithm ofwheat price and flour price.

Table 1 Basic statistics of wheat price and flour price

2.2.1 Unit root test.If conducting econometric analysis directly for non-stationary time series,it is easy to have the problem of spurious regression.Therefore,it is required to take stationary test firstly.In this study,we adopted ADF test.According to Akaike's Information Criterion(AIC)and the Schwartz Criterion(SC),we determined the specific lag order and carried out stationary test of variables lnPWW and lnPFL(as listed in Table 2).Test results indicated that ADF test value of lnPWW and lnPFL at5%significance level is higher than the critical value,so both price series are non-stationary;with first order difference,ADF test value is lower than the critical value,indicating both price series are I(1)series.

Table 2 Stationary test of variables

2.2.2 Co-integration test.If two or more non-stationary economic variables have stationary linear combination,co-integration relationship will exist in these variables.From Table 1,it can be known that both variables are first order single co-integration variable.Since only the single co-integration variable in the same order can be tested for co-integration,we carried out co-integration relationship test for wheat price and flour price.

In this study,we used Johansen Maximum Likelihood Ratio(LR)to conduct co-integration test for wheat price and flour price,so as to judge whether there is a long-term equilibrium relationship between them.Before the Johansen co-integration test,it is required to firstly determine optimum lag order of the VARmodel.Multi-criteria determination method,i.e.LR testing statistics,final prediction error(FPE),AIC,SC and HQ information criteria,was used to judge the two price series,to determine the optimum lag order.From comparison,we finally determined that the optimum lag order of the VAR model is4.Thus,the lag order of Johansen test is 3.According to data characteristics of two price variables,we adopted test type that variables have linear trend and co-integration equation only has intercept,we obtained test results as listed in Table 3.Table 3 indicates that when the original hypothesis has no co-integration relationship,in other words,both calculated values of trace test and maximum Eigenvalue test are higher than critical value at5%significance level;in the original hypothesis of at most 1 co-integration vector,both calculated values of trace test and maximum Eigenvalue test are lower than critical value at5%significance level.Thus,there exists co-integration relationship and only one co-integration between wheat price and flour price,indicating there is long-term equilibrium relationship between wheat price and flour price.

Table 3 Johansen co-integration of wheat price and flour price

The expression formula of normalized co-integration equation is as follows:

whereECMtis error correction,and the data within brackets is standard deviation.

2.2.3 Non-linear co-integration test Johansen co-integration test indicated that there is long-term stable equilibrium relationship between wheat price and flour price.If the linear error correction model is directly obtained,it may neglect discontinuation and asymmetry of system adjustment.Thus,we tested if there is threshold co-integration relationship between wheat price and flour price with the aid of Matlab program designed by Hansen&Seo(2002).Since different lag period will influence statistical results,we selected lag period of1,2 and 3 to conduct the threshold co-integration test,and the results are as shown in Table3.When the lag period is1,the statistical value of Sup LM is 13.18,lower than the critical value at 5%significance level,the corresponding P value is0.06,in other words,it reject snon-linear model hypothesis;when the lag period is 2,the ECM coefficient fails to pass Wald statistical test at5%significance level;when the lag period is 3,the statistical value of Sup LM is 28.95,higher than 5%critical value of fixed regression,and the corresponding P value is 0.045,in other words,it accepts linear model hypothesis.Therefore,there is no threshold effect but linear adjustment relationship between wheat price and flour price,and it is able to analyze short-term dynamic adjustment with the aid of linear error correction model.

3 Model building and result analysis

3.1 The VECM and estimation resultsThe Granger representation theorem states that if a set of non-stationary variables are co-integrated then they can be characterized as generated by an error correction mechanism.According to this theorem,co-integrated variables have long-term equilibrium relationship in a long term;in a short term,it may deviate from equilibrium,and their short-term non-equilibrium relationship can be expressed with the VECM(advantages of the VECM:use of first-order difference eliminates possible trend factor of variables,avoids spurious regression,and also eliminates possible multicollinearity;introduction of error correction item guarantees that information of variable level value not neglected).In this study,taking monthly data of wheat price and flour price in January 2000 to June 2014 as samples,we built the VECM and analyzed short-term dynamic relationship between wheat price and flour price with the aid of Eviews 6.0 software.The VECM is as follows:

where γ,α,and μ are parameters to be estimated,kdenotes number of lag period,andeitrefers to independently and identically distributed random error items with 0 mean value and constant variance.ECMt-1is error correction item,i.e.non-equilibrium degree oft-1 period.The coefficient α reflects the response to deviation of price int-1 period from the long-term equilibrium relationship.If the absolute value of this value is closer to 1,the speed of correcting deviation will be higher;if the absolute value of this value is closer to0,the correction speed will be lower.The parameter μ reflects characteristics of short-term dynamic adjustment.

According to AIC and SC,the optimum lag order of the VECM is 2,we selected variables with linear trend and co-integration equation with only intercept item,and estimation results of the VECM are listed in Table 4.

Table 4 Estimation results of the VECM for wheat price and flour price

In the flour price short-term fluctuation(ΔlnPFL)equation,the error correction coefficient is negative and significant at 1%significance level,indicating that after deviating from the equilibrium state,the flour price can adjust the error correction item,to return to the equilibrium state at the adjustment speed of 14.49%.At the same time,the fluctuation of flour price at the present period is significantly influenced by wheat price fluctuation at the first lag period and flour price fluctuation at the second lag period.The influence of wheat price fluctuation at the first lag period is positive,while the influence of flour price at the second lag period is negative,and the influence of wheat price fluctuation is higher than the influence of flour price fluctuation.

In short-term fluctuation(ΔlnPWW)equation of wheat price,the error correction coefficient is negative(-0.0049)but fails to pass the significance test,indicating that the speed of returning to equilibrium state after deviating from the equilibrium state is slow.In addition,the wheat price fluctuation at the first lag period and the flour price fluctuation at the first lag period significantly influence the wheat price fluctuation at the present period,and the influence of wheat price fluctuation is higher than the influence of flour price fluctuation.

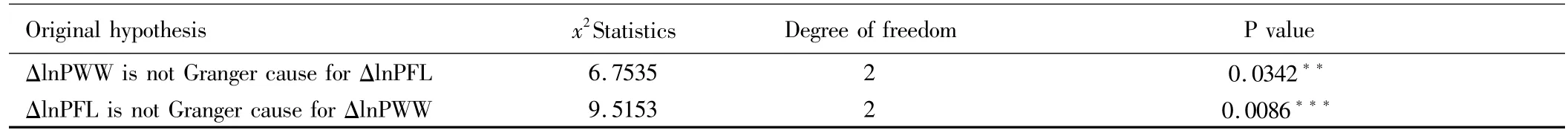

3.2 Granger causality testWith introduction of VAR,the co-integrated vector can be expanded into VECM,thus the VECM belongs to VAR model.Granger causality test is based on VAR model,so it is able to test long-term and short-term Granger causality according to significance ofαandμ.From Table 4,it can be known that the error correction coefficientα1of ΔlnPFL equation is significant at 1%significance level,while the error correction coefficient α2of ΔlnPWW equation is not significant.This reflects that the wheat price is Granger cause of change of the flour price,while the flour price is not Granger cause of change of the wheat price.Short-term Granger causality reflected statistical significance of μ in Table 5 indicates that the wheat price and flour price has mutual Granger causality in short term.

Since variables in the error correction mode are stationary time series variables,we tested the Granger causality between the wheat price and the flour price based on the VECM.The test results are listed in Table 5.From Table 5,we can see the wheat price and flour price has mutual Granger causality in short term.This is consistent with the statistical significance ofμ reflected in the VECM.

Table 5 VEC based Granger causality test of the wheat price and the flour price

3.3 Analysis of the impulse response functionThe impulse response function(IRF)is used to analyze dynamic influence on system when the VAR model is under certain impact.Specifically,it describes influence of applying a standard deviation impact in the random error of a certain endogenous variable on present value and future value of all endogenous variables[11].Based on the VEC mode,we used the impulse response function to analyze dynamic response path of mutual impact between the wheat price and the flour price(setting the impact period as10).

Fig.3 and Fig.4 is an impulse response function for a standard deviation impact of wheat price and flour price respectively.In Fig.3,when the flour price exerts a standard deviation impact,the wheat price generate a positive response in the second period,later,the response degree declines and is close to 0;the flour price makes decreasing positive response for consecutive 10 period.In Fig.4,when the wheat price exerts a standard deviation impact,the flour price exerts a positive response in the second period,later,the response degree is increasing;the wheat price makes positive response in the first period,the response degree rises in the second and third period,and then keeps stable trend.

In sum,changes of the wheat price will bring great and sustained impact to wheat market and flour market.It means that the wheat market lacks rapid adjustment mechanism and the price impact may bring sustained effect.

4 Conclusions and policy recommendations

In order to study the conduction effect between downstream and upstream price of the wheat industry chain,we analyzed monthly data of wheat price and flour price in January 2000 to June 2014 with the aid of VECM,and studied the characteristics of the price conduction mechanism.In a long term,there is a linear equilibrium relationship between wheat price and flour price.In a short term,the wheat price and flour price have Granger causality relationship.When the price deviates from equilibrium state,the flour price can be adjusted and regressed to equilibrium state,but the speed of wheat price regressing to equilibrium state is slow.Finally,the pulse response function analysis indicates that fluctuation of the wheat price can bring huge and sustained impact to wheat and flour market.

Based on the above conclusions,full consideration should be given to price conduction characteristics of the wheat price industry chain when relevant departments making wheat industry policies and flour processing enterprises making decisions.Firstly,when making wheat industry policies,apart from guaranteeing farmers' benefits,relevant departments should consider development of downstream flour processing enterprises.China launched the price subsidy pilot projects for soybeans in northeast and Inner Mongolia and cotton in Xinjiang.The objective of this policy is to bring into full play decisive role of market in resource allocation in the precondition of safeguarding benefits of farmers,to promote coordinated development of upstream and downstream industries.Therefore,the reform direction of China's grain price formation mechanism is also the target price policy.Besides,at the same time of ensuring the wheat yield,government should also take proper measures to expand planting area of fine seed,to provide stable and high quality wheat for downstream processing enterprises.Secondly,when making production and operation decisions,flour processing enterprises should consider price conduction characteristics of wheat price and flour price,make forecast for the flour price based on the fluctuation of wheat price,so as to determine change of production scale.Thirdly,in line with problems of repetitive construction,low technological level and backward management of flour processing enterprises,China should optimize the merger and reorganization and adjust product structure promptly,to strengthen ability of responding to impact of fluctuation of wheat price.

[1]Bakucs L.Z.,Frerto I.,Price transmission on the Hungarian milk market[R].Paper presented at the12th European Association of Agricultural Economics(EAAE)Congress,Ghent,Belgium,2008.

[2]Bernhard B.,von Cramon-Taubadel S.,Sergiy Z.,The impact of market and policy instability on price transmission between wheat and flour in Ukraine[J].European Review of Agricultural Economics,2009,36(2):203-230.

[3]Buguk C.,Hudson D.,Hanson T.R.,et al.,Price volatility spillover in agricultural markets:an examination of US catfish markets[J].Journal of Agricultural and Resource Economics,2003(28):86-99.

[4]Goodwin B.K,Harper,D.C.,Price transmission,threshold behavior,and asymmetric adjustment in the U.S.pork sector[J].Journal of Agricultural and Applied Economics,2000,32(3):543-553.

[5]Rezitis A.N.,Reziti I.,Threshold cointegration in the Greek milk market[J].Journal of International Food&Agribusiness Marketing,2011(23):231-246.

[6]Von Cramon-Taubadel S.Estimating asymmetric price transmission with theerror correction representation:an application to the German pork market[J].European Review of Agricultural Economics,1998(25):1-18.

[7]DONGXX,XUSW,LIZM,etal.Study on price vertical conduction mechanism of Chinese broiler industry——An empirical study on FDL model[J].Journal of Agrotechnical Economics,2011(3):21-30.(in Chinese).

[8]HE ZW,WANG C,LIU F.Study on price vertical conduction mechanism of pig production and marketing system in China[J].Journal of Agrotechnical Economics,2012(8):38-45.(in Chinese).

[9]HU HP,LICG.The join of vertical price transmission and vertical market of agricultural products[J].Problems of Agricultural Economy,2010(1):10-17.(in Chinese).

[10]HUA JG.Study on price vertical conduction mechanism in dairy industry chain based on SVARmodel[J].Journal of Henan Agricultural University,2013,47(4):492-497.(in Chinese).

[11]LIZN,YE AZ.Advanced applied econometrics[M].Beijing:Tsinghua University Press,2012.(in Chinese).

[12]LIZM,XU SW,DONG XX,et al.The short-term market price transmission mechanism of egg industry chain in China[J].Scientia Agricultura Sinica,2010,43(23):4951-4962.(in Chinese).

[13]WANG N,SIW,WANG XQ.Study on the integration of wheat procurement market and flour retail market in North China[J].Problems of Agricultural Economy,2008(6):33-37.(in Chinese).

[14]WU S,MU YY.Studies on vertical transmission relationship of vegetable prices in China[J].China Vegetables,2013,1(18):11-18.(in Chinese).

[15]SINX,TANXY.Study on amplification effect of agricultural productprice[J].China Rural Survey,2000(1):52-57.(in Chinese).

[16]YANG CY,XU XY.Study on price transmission asymmetry of Chinese pork[J].Journal of Agrotechnical Economics,2011(9):58-64.(in Chinese).

[17]ZHANG LY,ZHANG XC.Mechanism of price transmission and regulation in the agricultural chain of China[J].Economic Theory and Business Management,2011(1):104-112.(in Chinese).

杂志排行

Asian Agricultural Research的其它文章

- Integration of Medical Care and Endowment:A New Exploration of Endowment Mode in the Context of Population Aging

- The Distribution of Benefits for Players in Agricultural Industrial Chain

- On the Development and Maintenance of Cigarettes Exported to North Korea

- Study of the Factors Influencing Entrepreneurial Farmers' Formal Financial Credit Demand and Credit Constraints in Sichuan and Chongqing

- The Research on the Construction of Monitoring and Evaluation System for the Operation of Marine Economy in Liaoning Province

- Wetland Purification Pattern for Surface Runoff Pollution of Coastal Highway in Liaoning Province